FROM THE DESK OF DEBORAH WEINSWIG

Flipkart’s Big Billion Days: India’s Homegrown Holiday Shopping Festival

In the US, Cyber Monday is now the biggest shopping day of the year, having first surpassed Black Friday for the honor in 2016. Outside the US, the Singles’ Day shopping festival has become a global phenomenon that extends well beyond China, its country of origin. Alibaba reported total gross merchandise value (GMV) of $25.3 billion for its Singles’ Day sale (the 11.11 Global Shopping Festival) in 2017, more than double the GMV of Black Friday and Cyber Monday combined.

Newer on the scene is Big Billion Days, a shopping holiday created by India’s Flipkart in October 2014. The inaugural shopping event ran for just one day, but demand was so strong that the company’s website crashed, customers canceled orders and some sellers ran out of stock, leading to a public relations disaster and a public apology from the company’s cofounders. Demand was reportedly two and a half times what management had anticipated. Turning a fumble into an opportunity, the company bore down to analyze the bottlenecks, both internal and external, and figure out how to fix them.

The timing of the Big Billion Days sale is intentional, falling within India’s festive season, which includes the nine-day Navaratri festival (which celebrates three Hindu goddesses), Dussehra (which celebrates the victory of good over evil) and Diwali (called “the festival of lights”). This period already has a strong shopping precedent, and Indian markets and shops offer many discounts to celebrants during the season.

The Big Billion Days sale has grown rapidly. In 2014, Flipkart generated about $83 million in GMV over the sale’s 10 hours. This year’s event, which ran October 10–14, is projected to have generated more than $1 billion in GMV, according to the company, and shipments are estimated to have grown from 2 million last year to 3 million this year. The fashion category brings in about half of Flipkart’s regular customers, while general merchandise accounts for 30% and mobile phones the remaining 20%.

As we’ve seen with other shopping festivals, additional retailers have been eager to jump on the Big Billion Days bandwagon. Amazon held the first part of its own sale, the Great Indian Festival, October 10–15 and will run the second part of the sale October 24–28. Total GMV from Flipkart and Amazon is expected to hit $2.5–$3 billion during the 30-day festive period this year, according to an article in Indian daily newspaper

The Economic Times.

India’s e-commerce market is set to grow at a heady 36% between 2018 and 2023, according to research provided by Walmart, and a Boston Consulting Group study suggests that the number of online shoppers in India will grow from 80 million to 300–350 million by 2025, when they will wield $130–$150 billion in total online spending power.

Flipkart is taking steps to ensure that its growth continues. Last year, the company targeted consumers in tier 2 cities to fuel its growth, and this year it plans to add 100 million customers in various geographies. Following a similar roadmap as its Chinese peer Alibaba, Flipkart is offering services such as mobile balance recharging and hotel and transportation booking.

Flipkart’s spectacular growth is likely why Walmart spent $16 billion to acquire a 77% stake in the company (the deal was announced in August 2018). At the time of the acquisition, Flipkart generated $7.5 billion in annual GMV and had 54 million customers. Additional growth drivers include a young population and a high and growing percentage of Internet and mobile device users. In 2017, 30% of the Indian population used smartphones, and that figure is projected to hit 57% in 2020, according to Walmart data.

Flipkart has a growth plan and has received $2 billion of fresh equity funding from Walmart, which stated that an IPO could happen within the next four years. In addition, Flipkart management estimates that the combination of a strong supply chain, warehouse capacity and last-mile delivery structures could take it to $10 billion in GMV. While Flipkart and its Big Billion Days sale are not yet well known outside India, the company’s dramatic growth plans are likely to make it a major topic of discussion in the coming years.

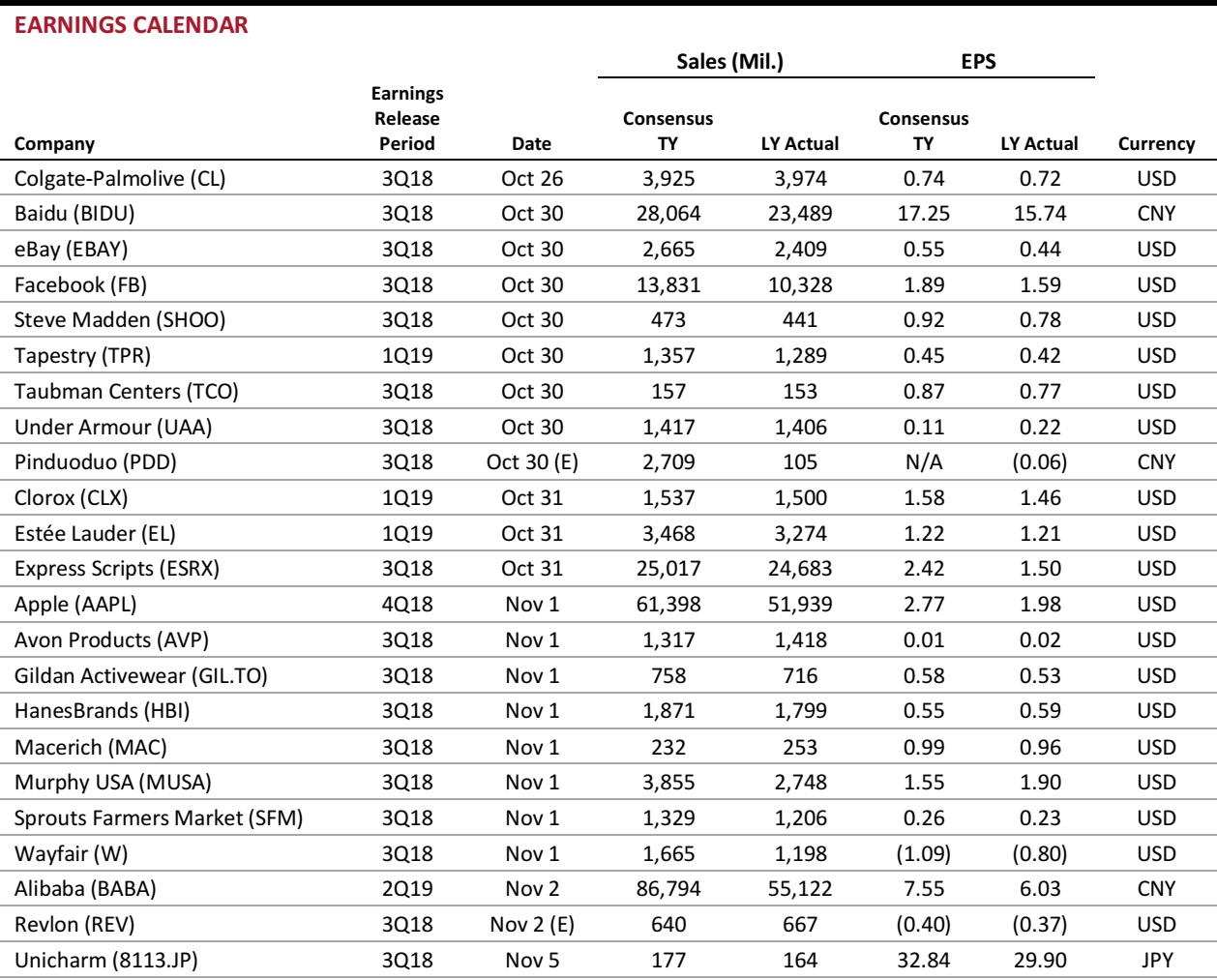

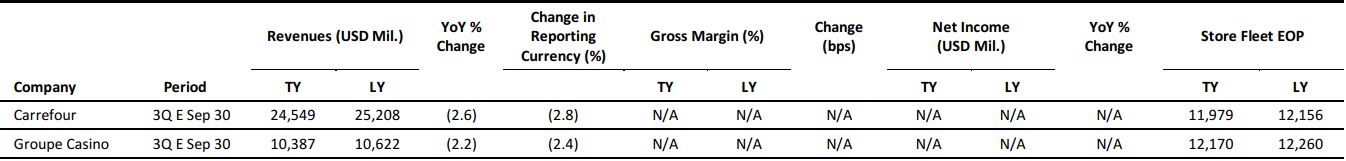

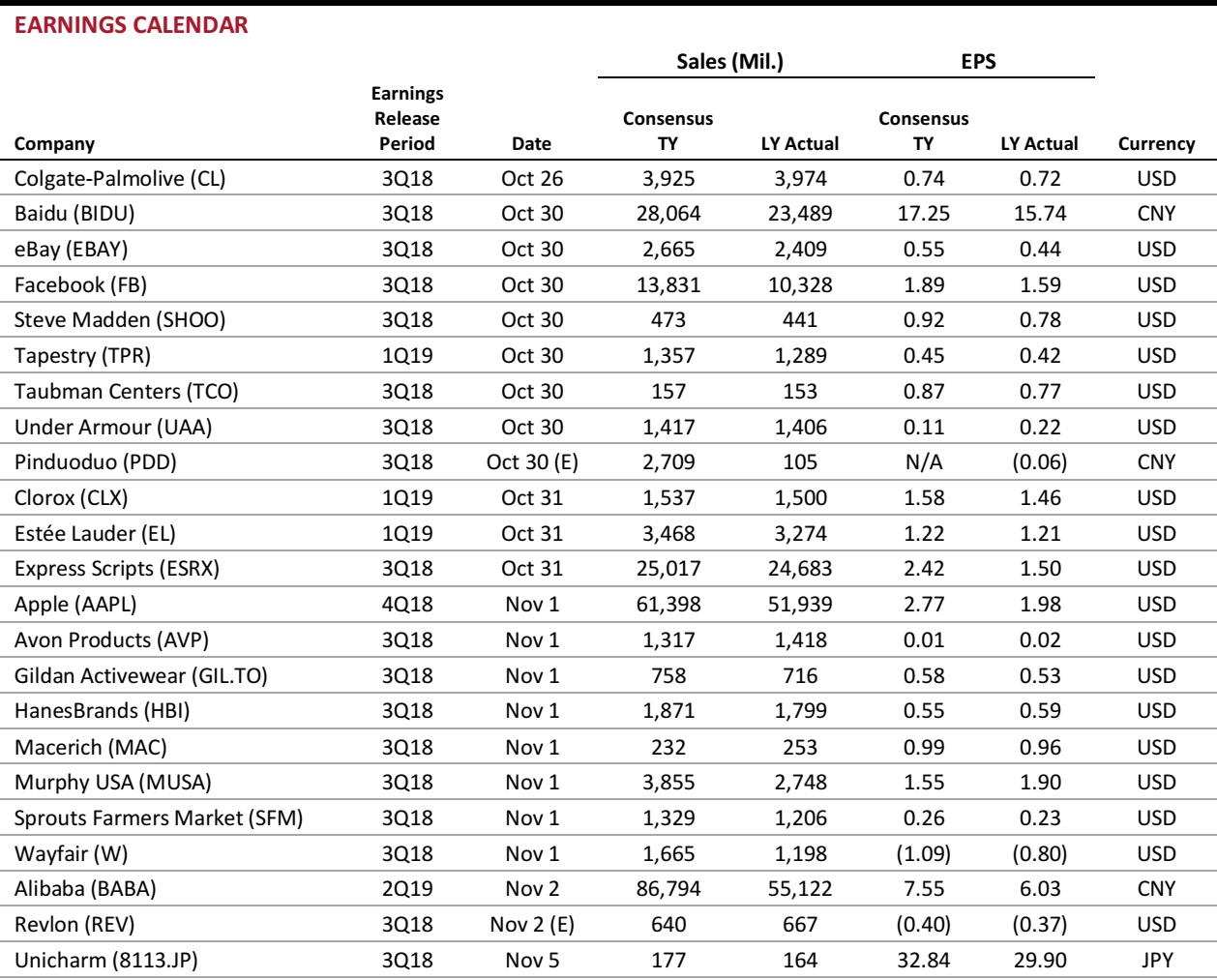

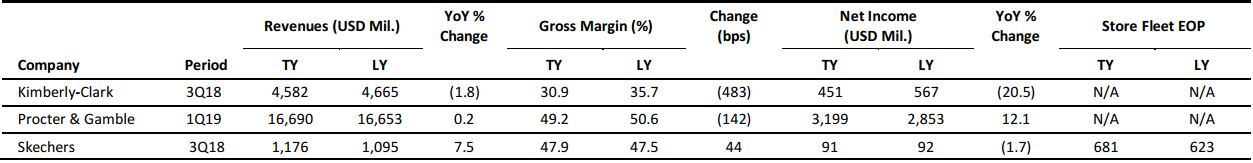

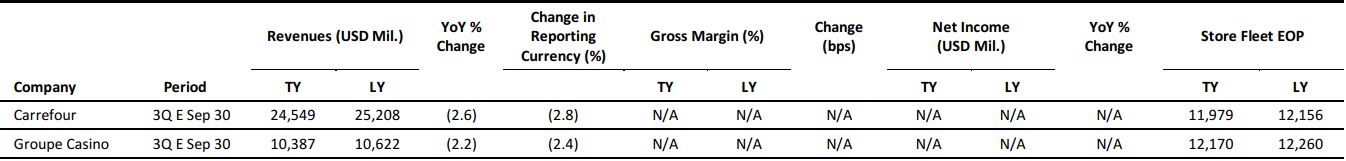

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Hasbro to Reduce Global Workforce

(October 22) RetailDive.com

Hasbro to Reduce Global Workforce

(October 22) RetailDive.com

- Toy maker Hasbro confirmed that it plans layoffs that “will impact a single-digit percentage of our global workforce.” The company has 5,000 employees globally, about half of whom work in the US.

- Executives sought to downplay the importance of the impact of the Toys“R”Us departure, noting that Hasbro’s gaming and entertainment lines, and toys related to those enterprises, are selling well. Last year, sales through Toys“R”Us dominated Hasbro’s third- and fourth-quarter revenue, they said.

Trick or Treat: What Happens to Vacant Big-Box Stores During Halloween Season? Many Turn into Pop-Up Stores

(October 21) BisNow.com

Trick or Treat: What Happens to Vacant Big-Box Stores During Halloween Season? Many Turn into Pop-Up Stores

(October 21) BisNow.com

- Every year—from September to the first week of November—seasonal Halloween stores set up at retail strips nationwide, often taking over vacant big-box stores. According to a principal at commercial real estate services firm Lee & Associates, this is a profitable business model for landlords struggling to fill vacant spaces left behind by Sears, Toys“R”Us and Kmart.

- Though the hedge fund that owns Toys“R”Us has flirted with the idea of bringing back the toy company, for now, the retail spaces that the toy chain once occupied have been vacated.

WeWork, Rent the Runway Partner in Six US Cities

(October 19) RetailDive.com

WeWork, Rent the Runway Partner in Six US Cities

(October 19) RetailDive.com

- Rent the Runway and coworking firm WeWork have launched a partnership that involves various collaborations, starting with a network of drop-offs at 15 WeWork locations.

- WeWork is also hosting Rent the Runway pop-ups at several locations and “spotlighting 10 influential female WeWork members” in a “Women of the Future” campaign featuring fashion photos and commentary. WeWork members will receive discounted Rent the Runway memberships, the company said in a blog post.

Retailers Dreaming of a Green Christmas Without Toys“R”Us

(October 19) RetailDive.com

Retailers Dreaming of a Green Christmas Without Toys“R”Us

(October 19) RetailDive.com

- It’s still an open question whether customers will even notice that Toys“R”Us is missing from the retail landscape this year, much less years into the future. To some degree, the world without Toys“R”Us resembles the world before the category killer came to dominate toys.

- Many analysts and industry observers expect the retailers that played starring roles in the company’s decline and ultimate death—namely Walmart, Amazon and Target—to benefit the most in the new market.

Amazon Store Count Tops 600

(October 17) RetailDive.com

Amazon Store Count Tops 600

(October 17) RetailDive.com

- Amazon runs some 629 physical retail locations. The company’s footprint ballooned after it acquired Whole Foods—those stores alone number 480.

- Amazon now runs quite a diverse physical store operation, according to TJI Research, including six Amazon Go stores, two Amazon 4-Star locations, 18 bookstores, 10 Whole Foods 365 stores, seven coffee shops, 25 Treasure Trucks, 67 pop-ups and 14 “Smart Home Experience” pop-ups (all of them concessions inside Kohl’s stores).

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

New Look Exits China to Focus on UK Operations

(October 18) RetailGazette.co.uk

New Look Exits China to Focus on UK Operations

(October 18) RetailGazette.co.uk

- British fashion retailer New Look has appointed commercial real estate firm CBRE to oversee its departure from China, which includes shutting all its stores in the country. The company has already shut 20 of its 130 stores in China.

- New Look is also thought to be considering an exit from France, Belgium and Poland, after recording losses of £37 million ($48 million) in its international operations in the year ended March 24.

Hamleys’ Owner C.banner Considers Sale

(October 22) ToyWorldMag.co.uk

Hamleys’ Owner C.banner Considers Sale

(October 22) ToyWorldMag.co.uk

- banner is reportedly considering selling British toy retailer Hamleys. The report comes a week after Hamleys announced 2017 losses amounting to £12 million ($15 million).

- banner has hired Vermilion Partners, a corporate finance firm, to carry out discussions with potential buyers, according to Sky News.

BBVA Bank and Anthemis Group to Open a Tech Incubator in London

(October 18) Company press release

BBVA Bank and Anthemis Group to Open a Tech Incubator in London

(October 18) Company press release

- Spanish banking group BBVA has partnered with fintech investment firm Anthemis Group to build an incubator lab in London that will help fintech startups find business opportunities, initiate projects and raise funding.

- Anthemis Group Founder and President Amy Nauiokas said, “BBVA is a perfect partner for Anthemis to align with as we seek to find next-opportunity spaces for early-stage entrepreneurs inside an industry still so ripe for change.”

Lion Capital Sells Hema to Investment Company Ramphastos

(October 18) Reuters.com

Lion Capital Sells Hema to Investment Company Ramphastos

(October 18) Reuters.com

- Dutch retailer Hema announced that Ramphastos Investments, owned by Dutch billionaire Marcel Boekhoorn, will acquire Hema from its current owner, Lion Capital, for an undisclosed amount.

- The company said in a statement that it will be able to focus fully on online growth, international expansion and profitability under its new owner.

Equistone Partners Europe Offers to Acquire Courir

(October 22) Company press release

Equistone Partners Europe Offers to Acquire Courir

(October 22) Company press release

- Investment firm Equistone Partners Europe has offered to acquire French sports specialist Courir for €283 million ($325 million). The acquisition is pending approval by regulatory bodies and is expected to be completed in the first half of 2019.

- Courir runs 278 stores and is owned by Groupe Go Sport, a subsidiary of Groupe Casino’s parent firm, Rallye. This move is part of planned asset disposals from Casino and Rallye to assuage concerns about their financial situation.

ASIA RETAIL & TECH HEADLINES

7-Eleven Stores in Singapore to Become Collection Centers

(October 19) InsideRetail.asia

7-Eleven Stores in Singapore to Become Collection Centers

(October 19) InsideRetail.asia

- Southeast Asian e-commerce company Lazada and last-mile logistics company Ninja Van have partnered with Singapore-based 7-Eleven stores to allow online shoppers to use any of 7-Eleven’s 350 stores on the island as collection centers.

- The service has been launched at 159 7-Eleven stores already, with the rest to follow suit by the end of the year.

Alibaba Launches 11.11 Shopping Festival 2018

(October 19) Alizila.com

Alibaba Launches 11.11 Shopping Festival 2018

(October 19) Alizila.com

- E-commerce behemoth Alibaba Group launched the 11.11 Global Shopping Festival on October 19, and the company expects this year’s event to be the largest ever in both scale and reach.

- “This year marks the 10th anniversary of 11.11. On the back of China’s explosive digital transformation, the festival’s astounding growth over the past decade has powered the steady growth of quality consumption sought by Chinese shoppers. The evolution also showcases the development of the Alibaba ecosystem over time expanding well beyond e-commerce,” said Alibaba Group CEO Daniel Zhang.

Grab Trials On-Demand Package Delivery Service in Singapore

(October 22) VulcanPost.com

Grab Trials On-Demand Package Delivery Service in Singapore

(October 22) VulcanPost.com

- Singapore-headquartered ride-hailing platform Grab announced the launch of a beta trial of GrabExpress, an on-demand, door-to-door delivery and courier service.

- The service will be available starting October 23 and will operate between 8 am and 11 pm daily.

ShopBack Makes Foray into Brick-and-Mortar Cash-Back Programs

(October 20) TechinAsia.com

ShopBack Makes Foray into Brick-and-Mortar Cash-Back Programs

(October 20) TechinAsia.com

- Singapore-headquartered e-commerce services company ShopBack, which specializes in cash-back reward programs, is set to launch a brick-and-mortar cash-back feature called ShopBack Go, according to sources.

- Yole, Tiong Bahru Bakery and Paradise Group are part of around 200 food and beverage businesses that have reportedly signed up with ShopBack Go ahead of its official launch in Singapore in November.

Flipkart and Amazon Announce Record Online Sales in India

(October 22) IndiaRetailing.com

Flipkart and Amazon Announce Record Online Sales in India

(October 22) IndiaRetailing.com

- E-commerce giants Flipkart and Amazon have announced record online sales following the former’s Big Billion Days sale and the latter’s Great Indian Festival, both of which preceded the festive season in India.

- “We made a record-breaking business during the five-day sales festival on October 10–14 in diverse categories, including smartphones, electronic gadgets, home appliances, furniture and fashion,” Flipkart said in a statement on October 18. “We had an overwhelming response to the fifth edition of the fest, with sales in the first 36 hours surpassing the first wave of last year, and exceeded our plans,” said Amazon India, whose sale ran October 10–15.

LATAM RETAIL & TECH HEADLINES

Sears Mexico Shines While US Peer Collapses

(October 21) WWD.com

Sears Mexico Shines While US Peer Collapses

(October 21) WWD.com

- Sears is “doing very well” in Mexico and is on track to reach its 10% sales growth target, according to Ana Maria Baca, e-commerce manager for Sears Mexico. Sales in the country are recovering rapidly after last year’s earthquakes gutted one Sears flagship store and dampened sales.

- The department store chain, owned by billionaire Carlos Slim, bears no relation to the recently bankrupt US retailer; it merely pays a royalty fee to use the name in Mexico.

Victoria’s Secret to Open a New Full-Line Store in Peru

(October 19) LaRepublica.pe

Victoria’s Secret to Open a New Full-Line Store in Peru

(October 19) LaRepublica.pe

- US lingerie specialist Victoria’s Secret is set to open a new full-line store spanning 7,500 square feet in Peru in the first half of 2019. The store will offer lingerie, beauty and accessories from the VS and Pink brands.

- In Latin America, Victoria’s Secret already has a presence in Mexico, Costa Rica and Panama.

SoftBank Invests $100 Million in Brazilian Delivery Startup Loggi

(October 16) Bloomberg.com

SoftBank Invests $100 Million in Brazilian Delivery Startup Loggi

(October 16) Bloomberg.com

- Japan’s SoftBank has invested $100 million through its Vision Fund in Brazilian delivery startup Loggi, which had previously raised $3.3 million from Qualcomm Ventures and Dragoneer Investment Group.

- Loggi’s platform highlights requests to couriers for food and product deliveries in their vicinity and calculates the fee and route as well. Loggi will use the funds to invest in robotics and engineering.

Blue Star Group to Triple Workforce and Increase Store Count to 2,000 by 2024

(October 22) Modaes.com

Blue Star Group to Triple Workforce and Increase Store Count to 2,000 by 2024

(October 22) Modaes.com

- Argentinian fashion accessories company Blue Star Group plans to triple its workforce from 4,500 to 15,000 as part of its expansion strategy plan, called “Plan 2024.”

- The group currently runs 800 stores under its two brands, Isadora and Todomoda, and aims to grow its store count to 2,000 across Argentina, Mexico, Chile and Peru. Blue Star plans to open its first store in Brazil before December this year and to operate 100 stores there by the end of 2019.

El Puerto de Liverpool Grows Profits in Third Quarter

(October 22) Reuters.com

El Puerto de Liverpool Grows Profits in Third Quarter

(October 22) Reuters.com

- Mexican retailer El Puerto de Liverpool grew net profit by 52% in the third quarter, ended September, driven by higher store traffic and transactions at its department store chain. Comparable sales at its Liverpool banner increased by 6.2%, while its clothing chain Suburbia grew comps by 11.7%.

- The company said that it will begin converting its Fábricas de Francia stores to the Liverpool and Suburbia banners next year. It also said that insurance coverage helped the company recover some 94% of the costs incurred due to last year’s earthquake.

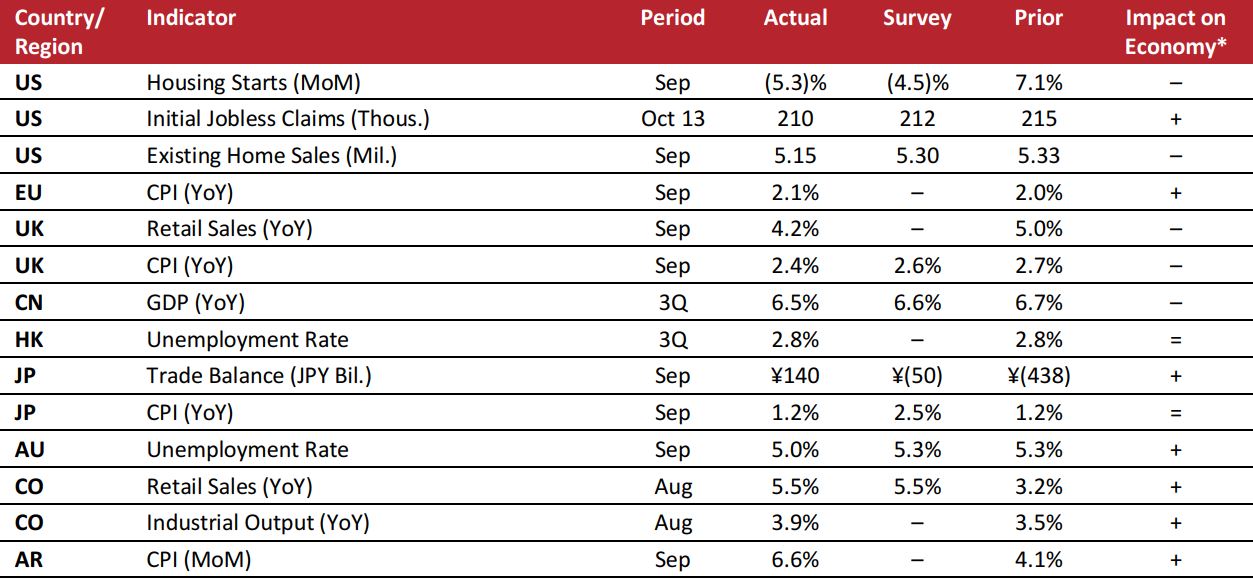

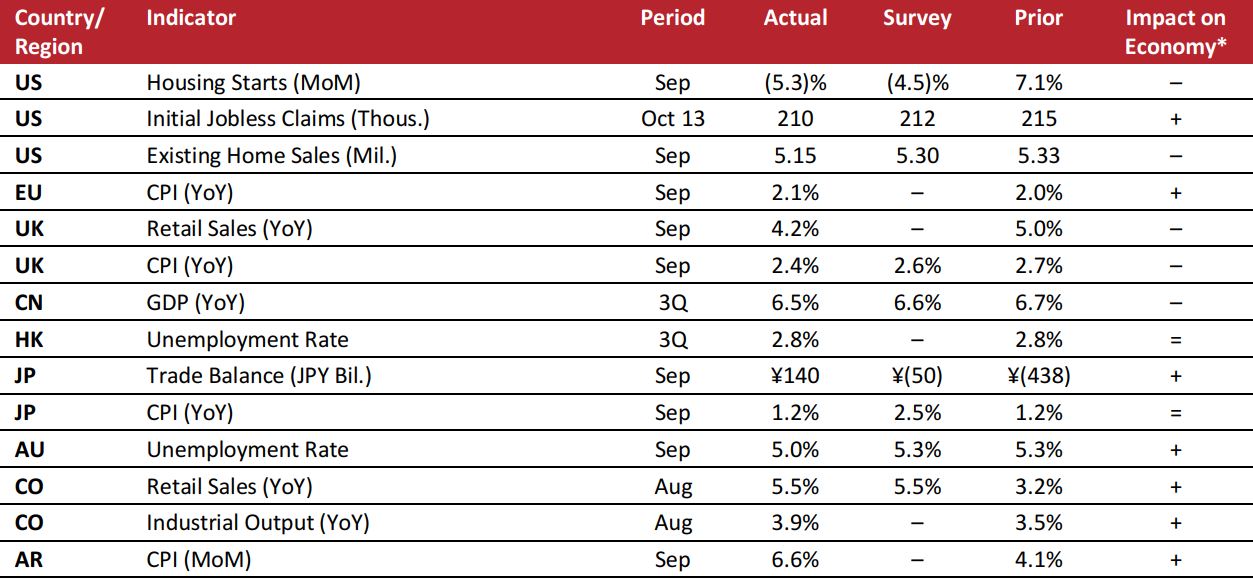

MACRO UPDATE

Key points from global macro indicators released October 17–23, 2018:

- US: Following a 7.1% gain in August, housing starts fell by 5.3% month over month in September, to an annualized 1.2 million. Initial jobless claims decreased by 5,000, to 210,000, in the week ended October 13.

- Europe: The annual inflation rate in the eurozone, as measured by the Harmonized Indices of Consumer Prices, stood at 2.1% in September, slightly above August’s 2.0% level. UK retail sales increased by 4.2% year over year in September, below the 5.0% growth seen in the previous month.

- Asia-Pacific: China’s GDP rose by 6.5% year over year in the third quarter, versus 6.7% in the previous quarter and missing the consensus estimate of 6.6%. The unemployment rate in Hong Kong was 2.8% in the third quarter, unchanged from the previous quarter.

- Latin America: Retail sales in Colombia grew by 5.5% year over year in August, in line with the consensus estimate. In Argentina, the CPI rose by 6.6% month over month in September, compared with 4.1% growth in August.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Department of Labor/National Association of Realtors/Eurostat/UK Office for National Statistics/National Bureau of Statistics of China/Hong Kong Census and Statistics Department/Japan Ministry of Finance/Japan Ministry of Internal Affairs and Communications/Australian Bureau of Statistics/Departamento Administrativo Nacional de Estadística (Colombia)/Instituto Nacional de Estadística y Censosde la República Argentina/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Department of Labor/National Association of Realtors/Eurostat/UK Office for National Statistics/National Bureau of Statistics of China/Hong Kong Census and Statistics Department/Japan Ministry of Finance/Japan Ministry of Internal Affairs and Communications/Australian Bureau of Statistics/Departamento Administrativo Nacional de Estadística (Colombia)/Instituto Nacional de Estadística y Censosde la República Argentina/Coresight Research

Hasbro to Reduce Global Workforce

(October 22) RetailDive.com

Hasbro to Reduce Global Workforce

(October 22) RetailDive.com

WeWork, Rent the Runway Partner in Six US Cities

(October 19) RetailDive.com

WeWork, Rent the Runway Partner in Six US Cities

(October 19) RetailDive.com

Hamleys’ Owner C.banner Considers Sale

(October 22) ToyWorldMag.co.uk

Hamleys’ Owner C.banner Considers Sale

(October 22) ToyWorldMag.co.uk

BBVA Bank and Anthemis Group to Open a Tech Incubator in London

(October 18) Company press release

BBVA Bank and Anthemis Group to Open a Tech Incubator in London

(October 18) Company press release

Lion Capital Sells Hema to Investment Company Ramphastos

(October 18) Reuters.com

Lion Capital Sells Hema to Investment Company Ramphastos

(October 18) Reuters.com

Equistone Partners Europe Offers to Acquire Courir

(October 22) Company press release

Equistone Partners Europe Offers to Acquire Courir

(October 22) Company press release

7-Eleven Stores in Singapore to Become Collection Centers

(October 19) InsideRetail.asia

7-Eleven Stores in Singapore to Become Collection Centers

(October 19) InsideRetail.asia

Alibaba Launches 11.11 Shopping Festival 2018

(October 19) Alizila.com

Alibaba Launches 11.11 Shopping Festival 2018

(October 19) Alizila.com

Grab Trials On-Demand Package Delivery Service in Singapore

(October 22) VulcanPost.com

Grab Trials On-Demand Package Delivery Service in Singapore

(October 22) VulcanPost.com

ShopBack Makes Foray into Brick-and-Mortar Cash-Back Programs

(October 20) TechinAsia.com

ShopBack Makes Foray into Brick-and-Mortar Cash-Back Programs

(October 20) TechinAsia.com

Flipkart and Amazon Announce Record Online Sales in India

(October 22) IndiaRetailing.com

Flipkart and Amazon Announce Record Online Sales in India

(October 22) IndiaRetailing.com

Victoria’s Secret to Open a New Full-Line Store in Peru

(October 19) LaRepublica.pe

Victoria’s Secret to Open a New Full-Line Store in Peru

(October 19) LaRepublica.pe

SoftBank Invests $100 Million in Brazilian Delivery Startup Loggi

(October 16) Bloomberg.com

SoftBank Invests $100 Million in Brazilian Delivery Startup Loggi

(October 16) Bloomberg.com

Blue Star Group to Triple Workforce and Increase Store Count to 2,000 by 2024

(October 22) Modaes.com

Blue Star Group to Triple Workforce and Increase Store Count to 2,000 by 2024

(October 22) Modaes.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Department of Labor/National Association of Realtors/Eurostat/UK Office for National Statistics/National Bureau of Statistics of China/Hong Kong Census and Statistics Department/Japan Ministry of Finance/Japan Ministry of Internal Affairs and Communications/Australian Bureau of Statistics/Departamento Administrativo Nacional de Estadística (Colombia)/Instituto Nacional de Estadística y Censosde la República Argentina/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Department of Labor/National Association of Realtors/Eurostat/UK Office for National Statistics/National Bureau of Statistics of China/Hong Kong Census and Statistics Department/Japan Ministry of Finance/Japan Ministry of Internal Affairs and Communications/Australian Bureau of Statistics/Departamento Administrativo Nacional de Estadística (Colombia)/Instituto Nacional de Estadística y Censosde la República Argentina/Coresight Research