From the Desk of Deborah Weinswig

Our Top Digital Retail Trends for the Holiday Season

This holiday season will see digital channels capture more spending, digital devices play a greater role in the shopping process and digital assistants help more shoppers. Here, we share our top trends in digital retailing for this holiday season.

US online grocery sales will surge: Walmart and Kroger are leading the growth of online grocery in the US. Walmart grew its total e-commerce sales (including nongrocery) by 62% in the first half of its fiscal 2018 year and Kroger reported that digital revenues were up fully 126% in its most recent quarter (ended August 12). Over the past year, Walmart and Kroger have more than doubled the number of grocery collection points they operate, fueling their e-commerce growth. Meanwhile, Amazon’s acquisition of Whole Foods Market will likely add further impetus to online grocery growth this holiday season. Amazon sold an estimated $1.6 million of Whole Foods store-brand products in the first month after it took over the chain, according to e-commerce data firm One Click Retail.

Voice commerce will grow share: More consumers will use smart speakers such as the Amazon Echo and Google Home to make purchases this year. Voice commerce will be a fast-growing, though still niche, segment of e-commerce this holiday season. The launch of Apple’s HomePod in December 2017 will add further momentum to the channel. So, too, will retailer tie-ups such as the one Google and Target announced in October: it enables US Google Home owners to shop from Target via their smart speaker.

More retailers will deploy chatbots: Consumers will not only be talking to smart speakers such as Amazon’s Echo while they shop for the holidays, but also having conversations with other forms of automated assistants, most notably online chatbots. Ahead of the 2016 holiday period, major brands and retailers such as Burberry, Sephora and Macy’s were providing customer service through chatbots. We expect more retailers to join them this year.

More gifts will be bought from sellers on marketplace sites: Marketplace sites, which provide forums for third-party sellers, look to be building share of US online sales. Walmart has been growing the number of marketplace sellers and SKUs on its sites very rapidly. In its second-quarter 2018 earnings results (latest), Walmart noted that it now offers more than 67 million SKUs online, up from 15 million one year earlier. Worldwide, third-party sellers now sell slightly more units on Amazon’s site than Amazon itself does. Third-party sellers will therefore benefit from the expected double-digit sales growth at Walmart.com and Amazon.com this holiday season.

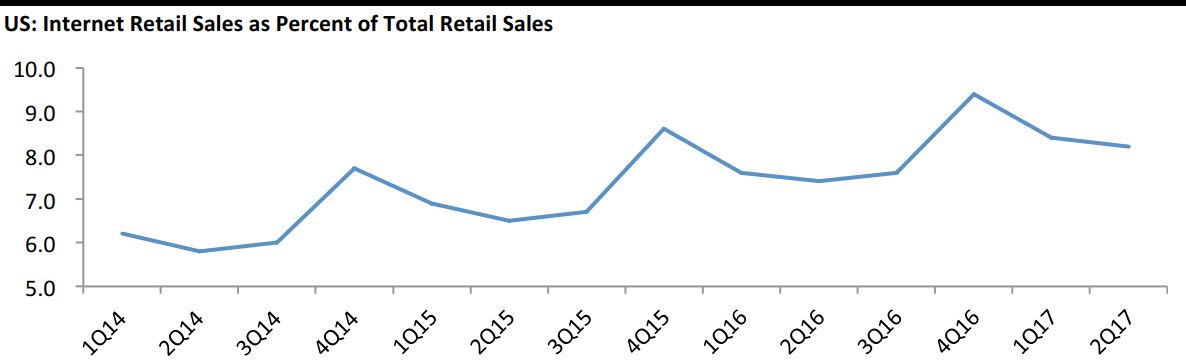

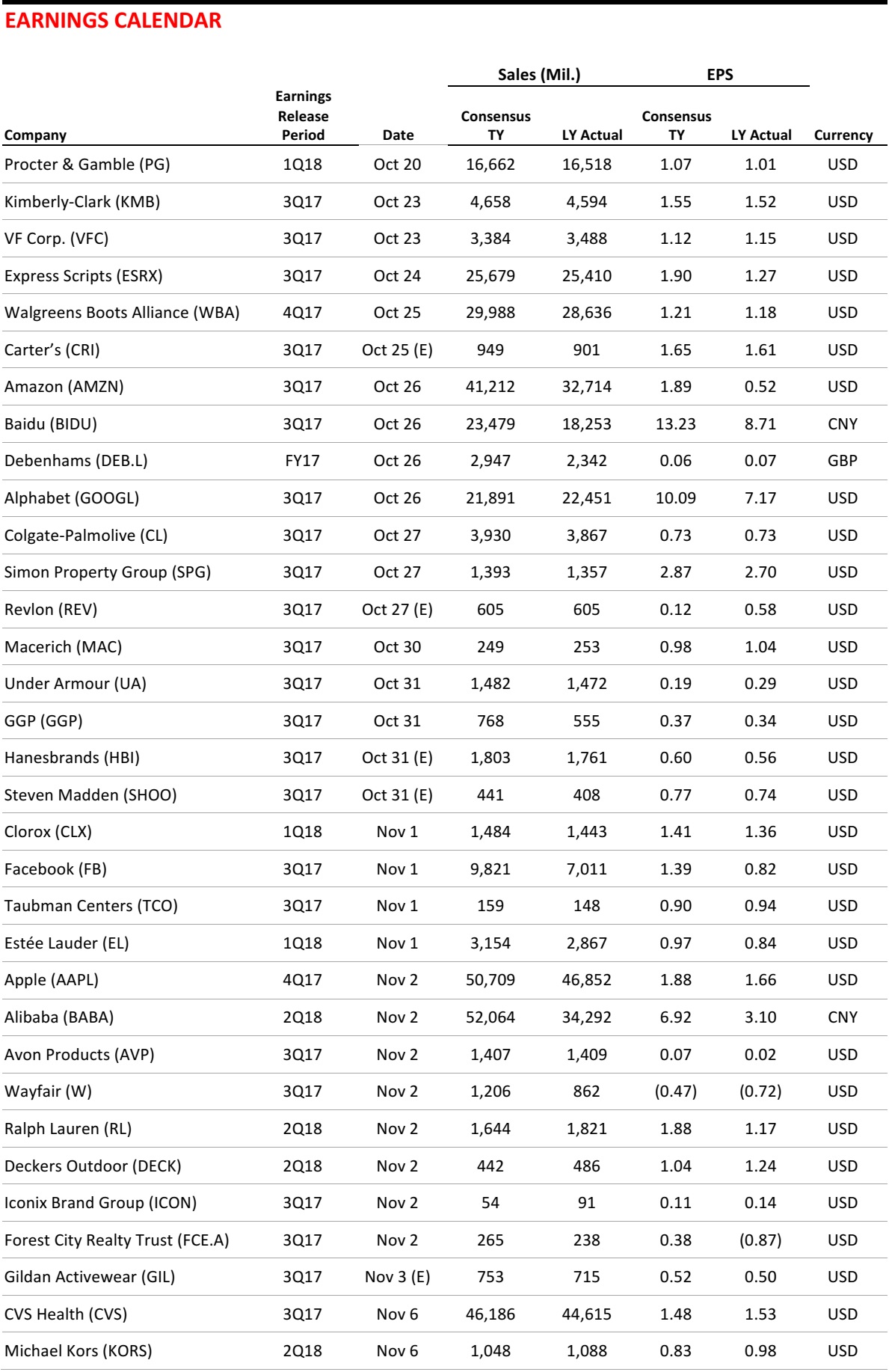

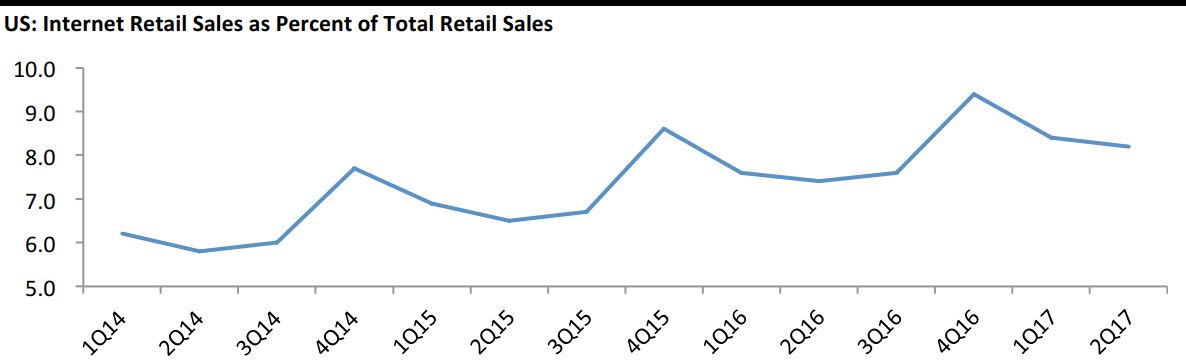

E-commerce will be a more meaningful channel than at other times of the year: E-commerce captures a bigger share of retail sales at holiday time than it does during the rest of the year, as we chart below. Once we strip out noncore retail categories such as automotive retailers and gas stations, we expect e-commerce to account for around 12% of total US retail sales across 2017 as a whole; however, e-commerce penetration rates are likely to be higher for the peak holiday period, and in nonfood categories such as apparel and electronics, e-commerce will capture a

much higher share of sales.

Raw data published by the US Census Bureau; data include motor vehicle and auto parts retailers and are expressed as a share of retail including gas stations.

Source: US Census Bureau

- For more on this subject, keep an eye out for our forthcoming rundown of holiday digital trends, Holiday 2017: US and European Digital Retail Trends.

US RETAIL & TECH HEADLINES

US Online Retail Sales Likely to Surpass $1 Trillion by 2027

(October 17) CNBC.com

US Online Retail Sales Likely to Surpass $1 Trillion by 2027

(October 17) CNBC.com

- As more Americans move away from brick-and-mortar stores, US online retail sales will surpass $1 trillion by 2027, compared with $445 billion this year, according to a forecast by business advisory firm FTI Consulting.

- Online sales will grow at a compound annual rate of 12% through 2020 and at a relatively moderate 9% over the following decade, according to the report released on Tuesday. Purchases made online accounted for 12% of total US retail sales and 50% of total sales growth in the past year, according to the study.

PayPal Rolls Out Venmo Payments to Its US Retailers

(October 17) CNBC.com

PayPal Rolls Out Venmo Payments to Its US Retailers

(October 17) CNBC.com

- Venmo, which has been part of PayPal since 2013, is one of the most popular mobile applications for making person-to-person payments in the US. It processed $8 billion in payments in the second quarter of this year. Now, PayPal is rolling out a new point-of-sale feature for Venmo.

- Venmo users will be able to use their app balance or linked cards and bank account to shop on the mobile sites of almost all merchants that accept payments with PayPal, including retailers such as Foot Locker, Lululemon Athletica and Forever 21.

European Discounters Are Coming for Your Retail Sales, America

(October 16) Bloomberg.com

European Discounters Are Coming for Your Retail Sales, America

(October 16) Bloomberg.com

- As if US brick-and-mortar retailers did not have enough to worry about with Amazon, they now face another threat: European discounters. German grocer Aldi has been in the US for decades, but it is elbowing deeper into the market with a recent pledge to open 900 more stores in the US over five years.

- Its compatriot and rival, Lidl, has just joined Aldi in the US, as has Irish clothing retailer Primark. The latter two have not disrupted US retail too much yet—but if their track records are any guide, they just might.

Nordstrom Family Suspends Attempt to Take US Retailer Private

(October 16) The New York Times

Nordstrom Family Suspends Attempt to Take US Retailer Private

(October 16) The New York Times

- Nordstrom said on Monday that a founding family group had suspended attempts to take the US department store operator private because of difficulties in arranging debt financing for its bid ahead of the key holiday shopping season.

- Nordstrom rival Hudson’s Bay Company, owner of the Saks Fifth Avenue and Lord & Taylor retail chains, has also been exploring going private, Reuters has reported.

US Retail Sales Surge, Driven by Autos and Gasoline Purchases

(October 13) Reuters.com

US Retail Sales Surge, Driven by Autos and Gasoline Purchases

(October 13) Reuters.com

- US retail sales recorded their biggest increase in two and a half years in September, likely because reconstruction and cleanup efforts in areas devastated by Hurricanes Harvey and Irma boosted demand for building materials and motor vehicles.

- The Commerce Department said retail sales jumped 1.6% last month, also buoyed by a surge in receipts at service stations, which reflected higher gasoline prices after Harvey disrupted production at oil refineries along the Gulf Coast. Retail sales increased by 4.4% on an annual basis. Economists polled by Reuters had forecast that retail sales would jump 1.7% in September.

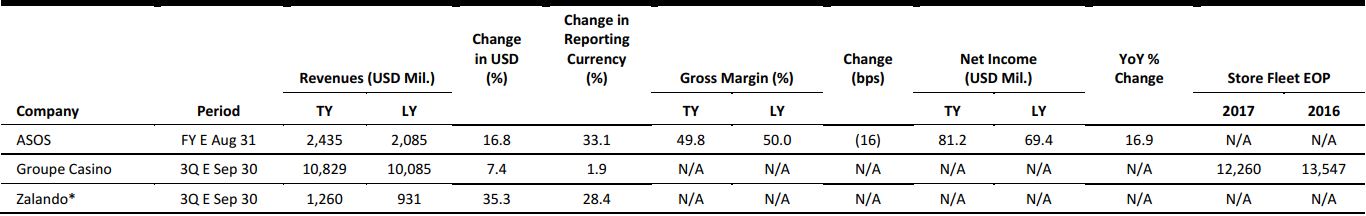

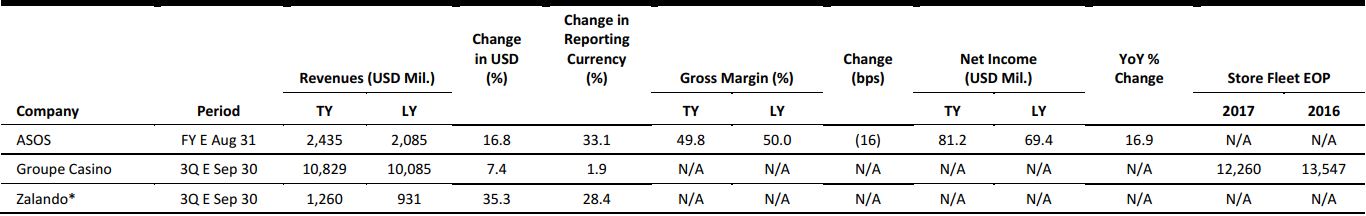

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

UK Retail Footfall Declines by 1.2% in September

(October 16) British Retail Consortium press release

UK Retail Footfall Declines by 1.2% in September

(October 16) British Retail Consortium press release

- Retail footfall in the UK fell by 1.2% year over year in the five weeks ended September 30, 2017, according to the British Retail Consortium-Springboard Footfall and Vacancies Monitor. The decline was the same as in August.

- High-street footfall fell by 2.2% in September, a smaller decrease than August’s 2.6% decline. Footfall in shopping centers dropped by 1.0%, versus a 0.8% fall in August. Retail parks saw footfall grow in September by 1.1%, although the rate was lower than August’s 1.6%.

Harrods Breaks Through £2 Billion Sales Barrier

(October 16) TheTimes.co.uk

Harrods Breaks Through £2 Billion Sales Barrier

(October 16) TheTimes.co.uk

- British luxury retailer Harrods surpassed the £2 billion (US$2.6 billion) mark in annual sales for the first time, representing a jump of 23%, and recorded its eighth consecutive year of rising profits in 2016.

- The retailer’s pretax profit bounced by 38.8%, to £233.2 million (US$307.5 million), and operating profit soared by 42.3%, to £253.3 million (US$334.0 million). Tourists, particularly from China, took advantage of the weakening British pound and boosted trade significantly, the company said.

Carrefour Launches New App for Customers to Deliver Orders to Other Customers

(October 13) RetailDetail.eu

Carrefour Launches New App for Customers to Deliver Orders to Other Customers

(October 13) RetailDetail.eu

- French supermarket giant Carrefour has launched a new app that allows customers to deliver orders to other customers. The app is called Merci Voisin, which is French for “Thanks, neighbor,” and customers who wish to participate need to register on the app.

- Customers who undertake deliveries are paid a small fee for their services. They are also rated after each delivery, so other users in the community know who has a good reputation.

Lidl Working on Opening Largest UK Distribution Center

(October 17) TheRetailBulletin.com

Lidl Working on Opening Largest UK Distribution Center

(October 17) TheRetailBulletin.com

- German grocer Lidl is working on opening its biggest distribution facility in the UK, which will be in Peterborough and will create up to 500 jobs in the area once it opens. Lidl is investing £1.45 billion (US$1.91 billion) between 2017 and 2018 to expand its business in the UK.

- The distribution center is the sixth that Lidl has announced this year. Lidl UK is expected to apply for planning consent for the site soon.

ASIA TECH HEADLINES

Ola Raises $1.1 Billion Led by Tencent to Fuel Battle with Uber in India

(October 10) TechCrunch.com

Ola Raises $1.1 Billion Led by Tencent to Fuel Battle with Uber in India

(October 10) TechCrunch.com

- Ola announced that it has closed $1.1 billion in fresh financing, led by Tencent. The funding round is the largest in the company’s six-year history and its first major raise since November 2015, when it closed $500 million from investors.

- Tencent’s participation is particularly intriguing and further proof that the Chinese giant—valued at more than $300 billion—is upping its game in India through local tech firms that are battling global rivals. Tencent backed Flipkart via a $3 billion funding round this summer. The company also led a critical raise for WhatsApp rival Hike, which valued the Indian upstart at $1 billion, and invested in healthcare firm Practo, which harbors bold international expansion plans.

Logistics on Demand Startup Lalamove Raises $100 Million as It Approaches a $1 Billion Valuation

(October 10) TechCrunch.com

Logistics on Demand Startup Lalamove Raises $100 Million as It Approaches a $1 Billion Valuation

(October 10) TechCrunch.com

- GoGoVan became Hong Kong’s first unicorn in September following a merger deal with China-based 58 Suyun, and now Lalamove—another Hong Kong company specializing in logistics on demand in China and other parts of Asia—has snagged $100 million in new financing at a valuation that is just shy of the $1 billion mark.

- Lalamove Founder and CEO Shing Chow estimates that the logistics market in China alone is worth $1.7 trillion a year, so it is not surprising that Uber was among those to take a look. But the once-bustling field of contenders has whittled itself down over the years as the realities of business have kicked in.

Samsung’s New Connected Tags Monitor Pets or Kids for a Week on a Single Charge

(October 17) TechCrunch.com

Samsung’s New Connected Tags Monitor Pets or Kids for a Week on a Single Charge

(October 17) TechCrunch.com

- Samsung announced Connect Tag, a small Internet-enabled device that tracks location and lasts a week between charges. The offering is similar to existing electronic tagging devices from the likes of Tile, the US startup that pulled in $25 million earlier this year and has picked up nearly $60 million from investors to date.

- Samsung is using a combination GPS, Wi-Fi-based positioning and Cell ID to triangulate a device’s location with accuracy. It also works with Samsung’s SmartThings ecosystem, which means owners could set up a geofence around their house, for example, to trigger lights or switch on the TV automatically when they (and their tag) return home.

Home Improvement Startup Houzz Partners with Indian Media Company Times Bridge

(October 10) TechCrunch.com

Home Improvement Startup Houzz Partners with Indian Media Company Times Bridge

(October 10) TechCrunch.com

- Houzz is expanding its presence in India by partnering with Times Bridge, the investment arm of The Times Group. As a result of the deal, Houzz said its content will be integrated into The Times Group’s online properties, including the Times of India. A Houzz spokesperson said this will be “the authentic Houzz experience” with the full functionality of the platform, which connects users with home remodeling and design professionals.

- Houzz first launched a beta test in India in November of last year, before becoming fully available across the country in January. The company says it now has more than 80,000 active professionals in India. The deal also includes an investment of undisclosed size from Times Bridge. Houzz raised a $400 million round at a $4 billion valuation earlier this year.

LATAM RETAIL & TECH HEADLINES

São Paulo City Readies Own App to Support Taxi Drivers

(October 16) ZDNet.com

São Paulo City Readies Own App to Support Taxi Drivers

(October 16) ZDNet.com

- The city of São Paulo will launch its own mobility application to help taxi drivers compete in the sharing economy. The SPTaxi tool will be available to a limited number of drivers from January 2018. It is the result of a project led by the Department of Transport and Prodam, the city’s information technology company.

- The app is entirely based on a tool launched earlier this year by the city of Rio de Janeiro. The budget to implement it in São Paulo, including customization and local infrastructure, is hoped to be under R$2 million (US$633,000), which is the amount spent by the Rio administration to create the app from scratch.

Private Sector Boosts Innovation Spend in Brazil

(October 11) ZDNet.com

Private Sector Boosts Innovation Spend in Brazil

(October 11) ZDNet.com

- Spending on R&D within the private sector in Brazil has increased despite the economic downturn in recent years, according to a new study. The National Indicators of Science, Technology and Innovation 2017 suggests that private sector investment in R&D in Brazil went from 0.57% of total spend in 2014 to 0.61% the following year.

- That means that investments in innovation by companies grew from R$37.4 billion (US$11.8 billion) in 2014 to R$38.1 billion (US$12 billion) in 2015. Meanwhile, R&D spending in the public sector decreased from 0.67% in 2014 to 0.64% in 2015. Brazil spends more than many other countries do on R&D. Such spending in China accounts for 0.44% of total spending, while it accounts for 0.54% in Japan and 0.48% in the UK.

Shares in Brazil’s GPA Fall as Lower Food Prices Hit Revenue

(October 17) Reuters.com

Shares in Brazil’s GPA Fall as Lower Food Prices Hit Revenue

(October 17) Reuters.com

- Shares in Brazilian food retailer GPA fell to a two-week low on Monday as a bigger-than-expected drop in food prices weighed on the company’s quarterly revenue. GPA reported net revenue of R$10.9 billion (US$3.4 billion) in the third quarter, an 8.1% increase from a year ago.

- Growing market share and the conversion of former hypermarkets boosted net revenue at the company’s Assai cash-and-carry stores by 25.2%. Sales at Assai stores open for at least 12 months, known as same-store sales, grew by 7.7%, while same-store sales in the retailer’s more traditional formats rose by 0.6%, led by recovering volumes in the group’s flagship Pão de Açúcar supermarkets.

Amazon’s Move in Brazil Rattles Some Online Retail Stocks

(October 13) Bloomberg.com

Amazon’s Move in Brazil Rattles Some Online Retail Stocks

(October 13) Bloomberg.com

- The “Amazon effect” on retailers reaches across borders. Shares of several e-commerce companies listed in the US and Brazil are falling on speculation that Amazon may soon expand into the South American country. An earlier report by Bloomberg said that the tech giant is recruiting for a number of positions in Brazil, leading some to believe it has its sights set on Latin America’s largest market.

- The Amazon-led surge in online shopping has been blamed for everything from tepid inflation to a wave of retail bankruptcies in the US. Online trading site MercadoLibre dropped as much as 9% last Thursday—Brazil accounted for 54% of the company’s total revenue in 2016. Magazine Luiza and online sporting goods retailer Netshoes also fell.

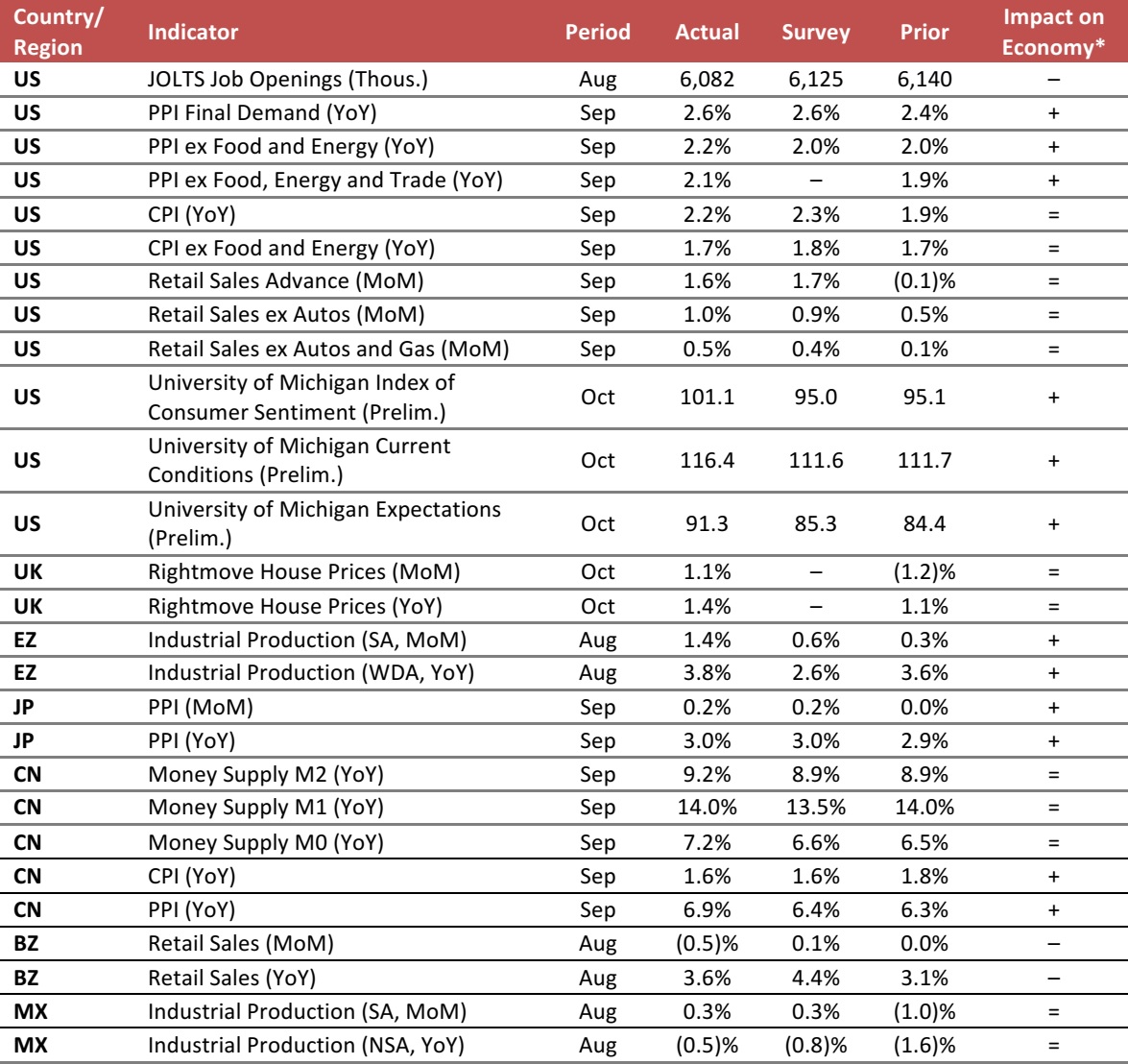

MACRO UPDATE

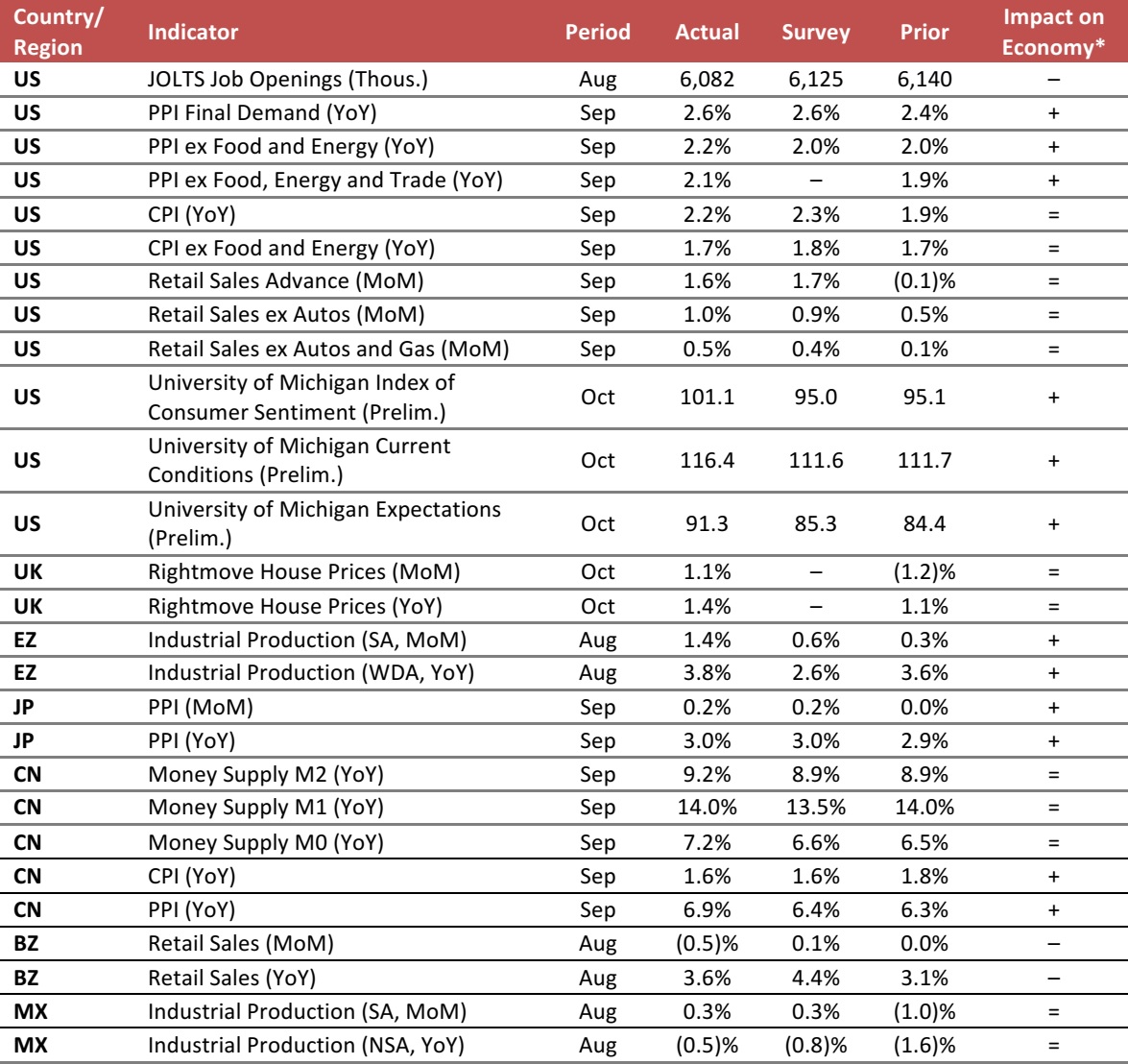

Key points from global macro indicators released October 11–18, 2017:

- US: JOLTS job openings registered at 6,082,000 in August, which was lower than the consensus estimate of 6,125,000. The Producer Price Index (PPI) was up 2.6% year over year in September, in line with the market’s expectation. Retail sales increased by 1.6% month over month in September.

- Europe: In the UK, Rightmove House Prices increased by 1.1% month over month and by 1.4% year over year in October. In the eurozone, industrial production increased by 1.4% month over month and by 3.8% year over year in August, beating the consensus estimate for both periods.

- Asia-Pacific: In Japan, producer prices ticked up by 3.0% year over year in September, in line with the market’s expectation. In China, money supply expanded faster than the market expected in September, while consumer prices moderated upward.

- Latin America: In Brazil, retail sales were weaker than the market expected in August, decreasing by 0.5% month over month. In Mexico, industrial production decreased by 0.5% year over year in August.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/University of Michigan/Rightmove/Eurostat/Bank of Japan/The People’s Bank of China/National Bureau of Statistics of China/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/FGRT

Carrefour Launches New App for Customers to Deliver Orders to Other Customers

(October 13) RetailDetail.eu

Carrefour Launches New App for Customers to Deliver Orders to Other Customers

(October 13) RetailDetail.eu