FROM THE DESK OF DEBORAH WEINSWIG

Retailers Stand Ready to Pick Up Billions if Sears Liquidates

In seeking bankruptcy protection this week, Sears Holdings outlined plans to continue operating with a smaller network of profitable stores. Many commentators do not share the company’s confidence, and there is a common expectation that it will be liquidated in the near future. In this week’s note, we look at which rivals could gain should the Sears chain close completely.

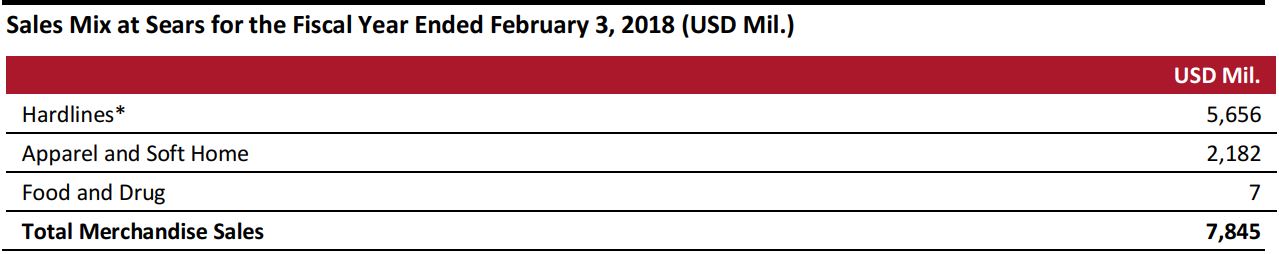

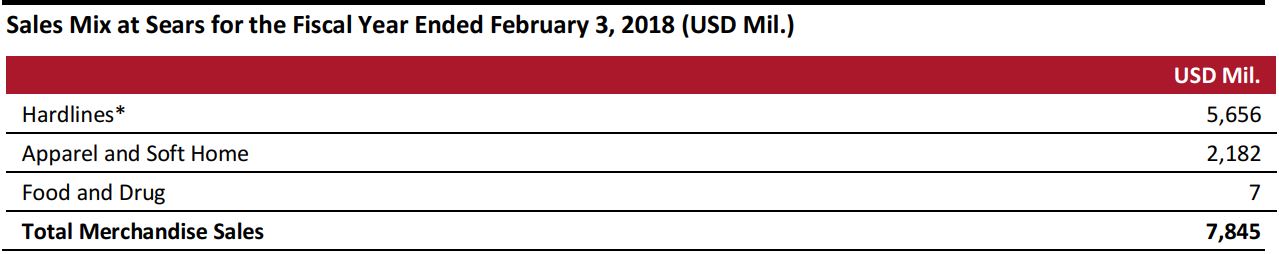

Sears Holdings’ revenues have been falling fast, but the company still turned over a substantial $16.7 billion in the year ended February 3, 2018. That figure fell to $14.3 billion on a trailing-12-month basis for the period ended August 4, 2018, according to S&P Capital IQ. In the year ended February, the Sears banner accounted for $11.1 billion of total revenues (Kmart accounted for the rest). Merchandise accounted for $7.8 billion of those Sears banner sales, with the remainder coming from services and other sales. The table below shows Sears’ merchandise sales breakdown.

*Home appliances, consumer electronics, lawn and garden, tools and hardware, automotive parts, household goods, toys, housewares, and sporting goods

Source: Company reports

*Home appliances, consumer electronics, lawn and garden, tools and hardware, automotive parts, household goods, toys, housewares, and sporting goods

Source: Company reports

Mass Merchandisers

Should the Sears chain close for good, low-price, mass-market chains such as Walmart and Target are positioned to mop up the greatest share of the company’s apparel sales. Our own data on apparel cross-shopping show that Walmart is the top alternative destination for Sears apparel shoppers while Target is in third place. The strength of Walmart and Target in this scenario is relatively unsurprising: Walmart is America’s leading apparel retailer

in terms of total clothing and footwear sales and our own data indicate that Walmart and Target are the most-shopped retailers for apparel among the general population. These retailers would stand to gain in nonapparel categories such as appliances, electronics, household goods and toys, too, and they are also among the best placed to capture sales from Kmart, if that chain were to close.

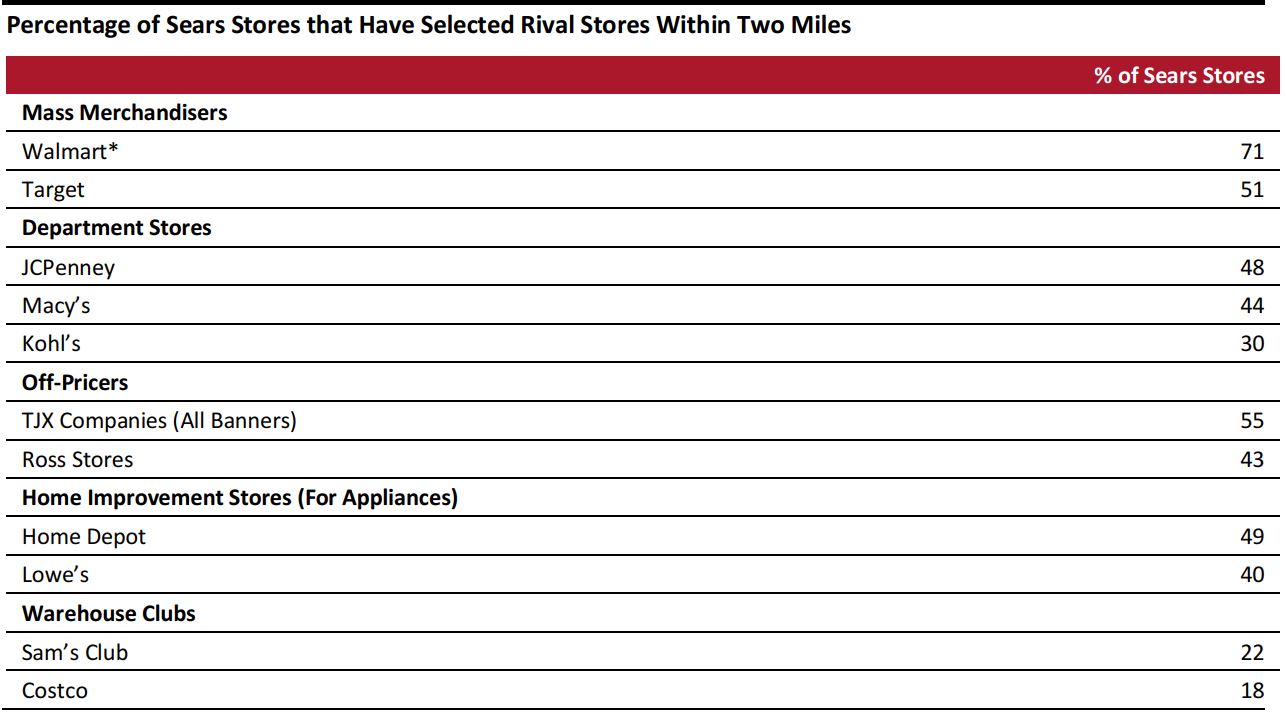

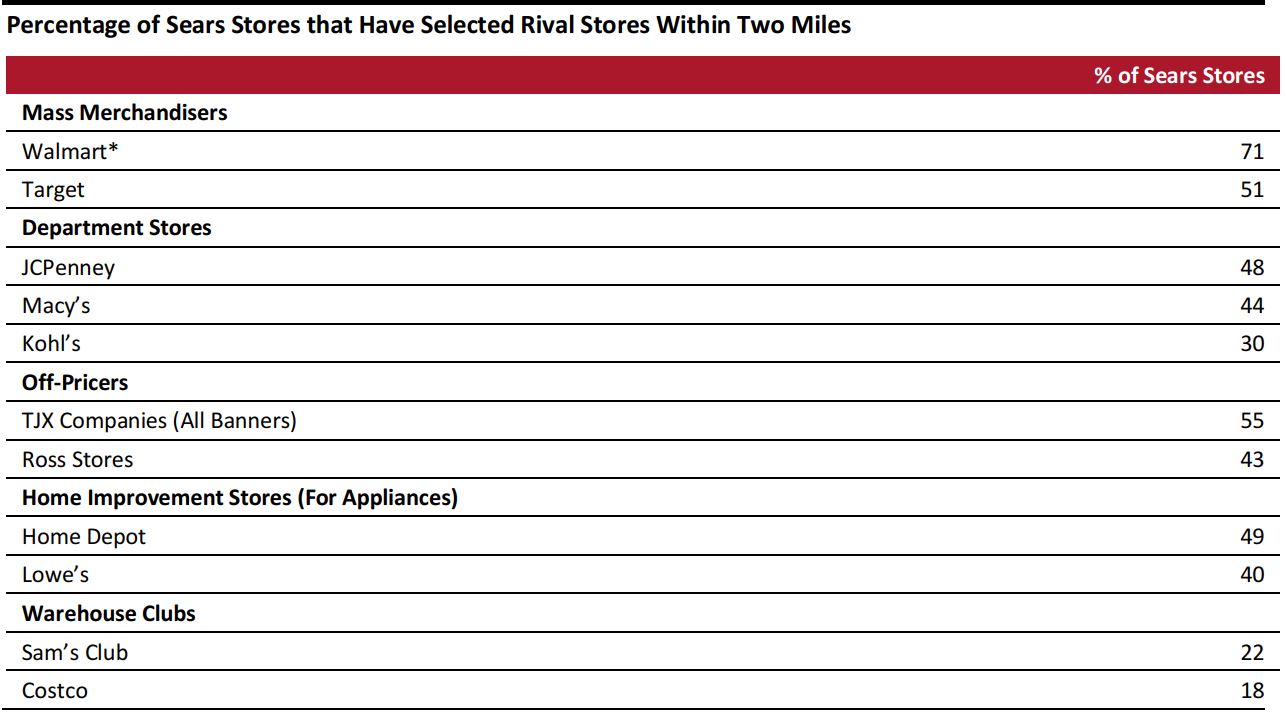

Store-proximity data show a very high overlap between Walmart store locations and Sears stores, as the table at the end of this note details. Target stores overlap with Sears stores to a lesser degree, although the overlap is still high relative to that between Sears and other retailers.

Any boost to Walmart and Target from a Sears closure would come on top of anticipated gains from the closure of Toys“R”Us.

As we have noted previously, our own data show that Walmart and Target are likely to capture the lion’s share of store-based sales that would have gone to Toys“R”Us.

- However, even if Walmart were to capture 10% of Sears’ $7.8 billion in total merchandise sales, that would equate to just a 0.2% uplift in revenues, based on the revenues reported by Walmart US for the year ended January 31.

- Similarly, if Target were to capture 10% of Sears’ merchandise sales, that would equate to just a 1.1% increase in Target’s total sales, based on the company’s reported revenues for the year ended February 3. (These numbers do not factor in any gains that might result from a Kmart closure.)

Department Stores

Our research suggests that, among the department stores, JCPenney is best placed to capture shopper dollars in the event of a total Sears closure. JCPenney registers disproportionately high apparel cross-shopping rates among Sears shoppers, jumping from the seventh-most-shopped retailer for apparel among the general population to the

second-most-shopped among Sears apparel shoppers. Our consumer data also show that the company’s shopper demographics are similar to Sears’, as measured by age and affluence. Moreover, almost half of Sears stores have a JCPenney store located nearby. Finally, JCPenney has pushed into appliances since 2016, which would support its bid for transferred shopper dollars.

Macy’s would likely gain, too, but to a lesser extent. It is the fourth-most-shopped retailer for apparel among Sears shoppers and approximately 44% of Sears stores have a Macy’s store nearby.

- If JCPenney were to capture 10% of Sears’ $7.8 billion in merchandise sales, that would equate to a sizeable, 6.3% uplift in revenues, based on the sales figures JCPenney reported for the year ended February 3.

- For Macy’s, the same assumption equates to a 3.2% uplift in total revenues (which include Bloomingdale’s and Bluemercury revenues).

Off-Pricers

TJX Companies, whose banners include T.J. Maxx, Marshalls and HomeGoods, shows a relatively high level of store proximity to Sears stores, and the company’s apparel banners fall within the top 10 most-shopped apparel stores among Sears shoppers. However, our data show that TJX and other off-pricers attract a significantly younger average apparel shopper than Sears does, which may limit the proportion of dollars they could capture in the event of a Sears closure.

Home Improvement Retailers and Warehouse Clubs

Home Depot and Lowe’s stand ready to capture some appliance sales in the event of a Sears closure, and 40% or more of Sears stores are located within two miles of one of these rivals’ stores. Home Depot strengthened its appliances offering through a distribution deal with Bosch in August this year.

The major warehouse clubs see a much lower geographical overlap with Sears stores, and this may limit their gains if Sears closes. One caveat is that we expect consumers to be willing to travel further to shop for big-ticket purchases such as appliances or electronics than they would be to shop for everyday apparel.

*Walmart data are for Walmart Supercenter or Walmart Discount Store formats; we have excluded the smaller-format Walmart Neighborhood Market stores from the analysis.

Figures should be viewed as approximate due to Sears’ ongoing store-closure program.

Source: Thinknum/Coresight Research

Source: Company reports/Coresight Research

*Walmart data are for Walmart Supercenter or Walmart Discount Store formats; we have excluded the smaller-format Walmart Neighborhood Market stores from the analysis.

Figures should be viewed as approximate due to Sears’ ongoing store-closure program.

Source: Thinknum/Coresight Research

Source: Company reports/Coresight Research

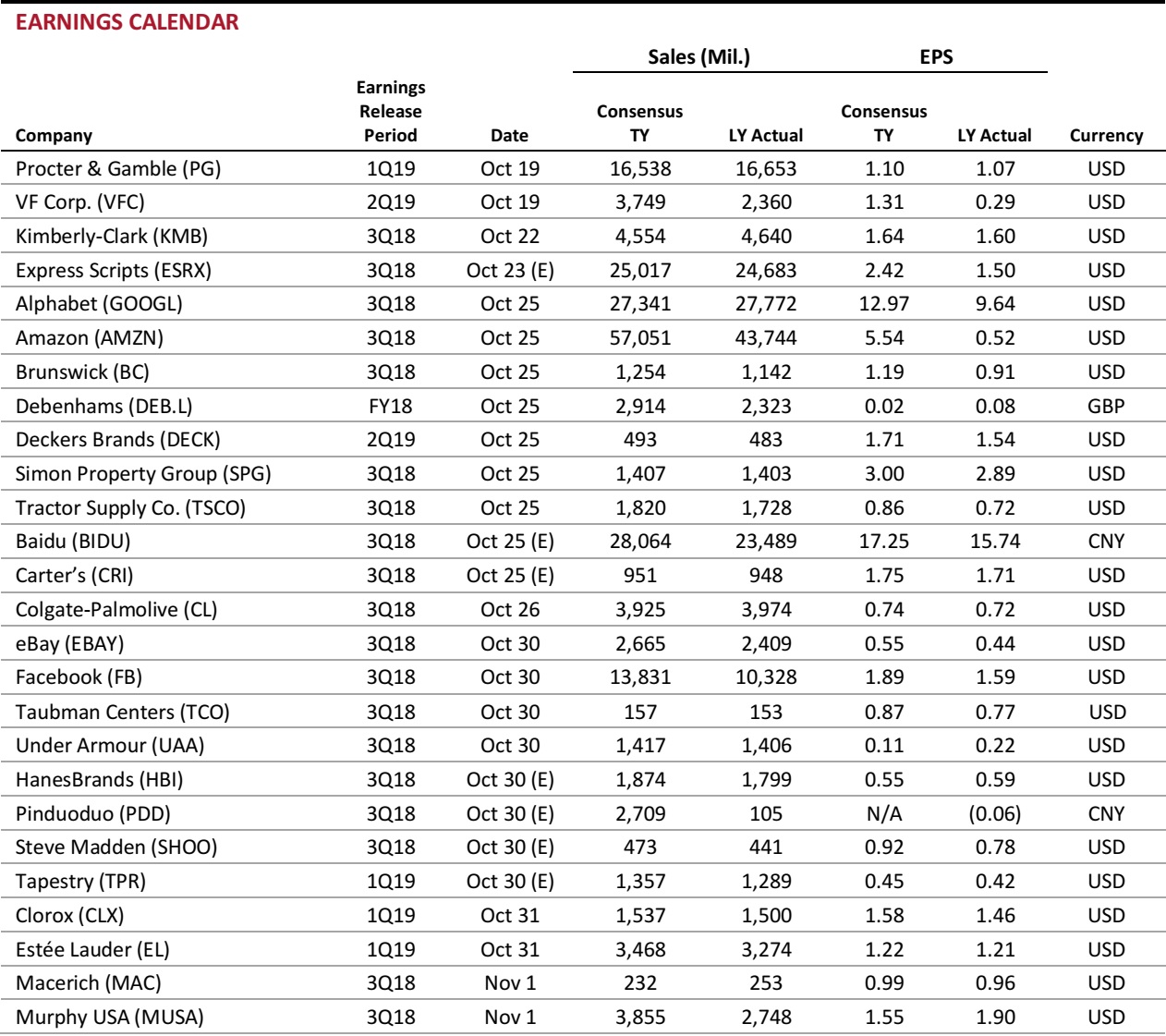

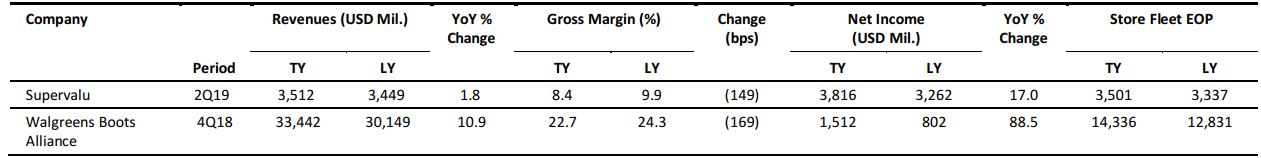

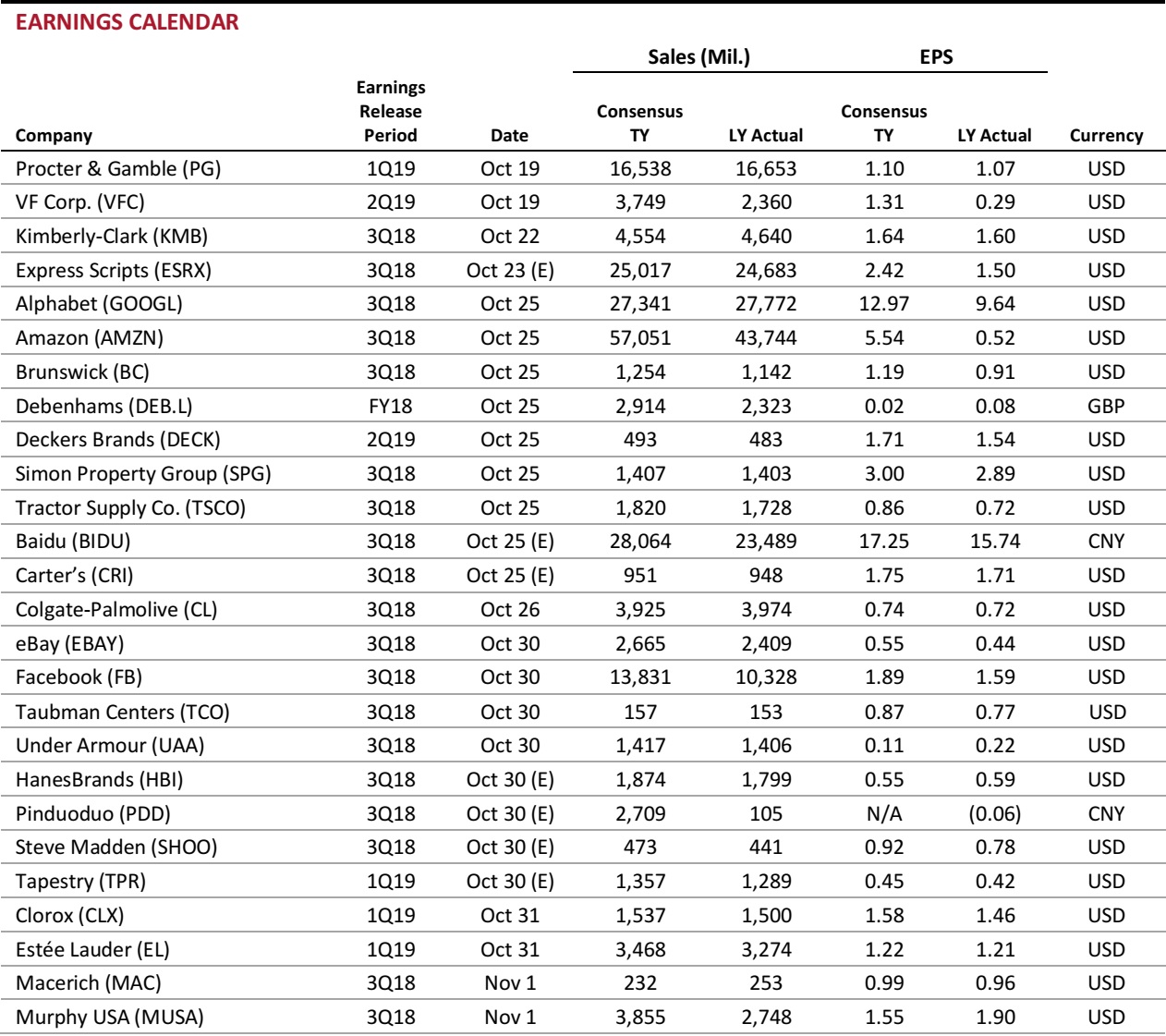

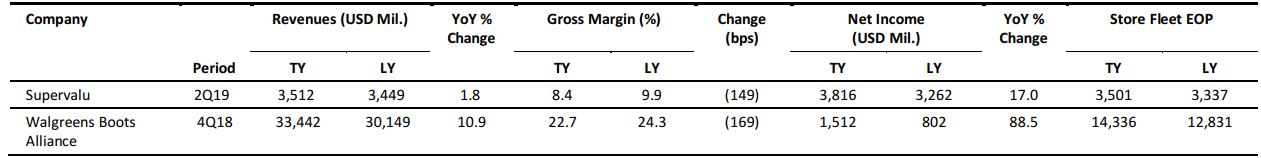

US RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Walmart Lowers Earnings Forecast, Citing Flipkart Acquisition

(October 16) WashingtonPost.com

Walmart Lowers Earnings Forecast, Citing Flipkart Acquisition

(October 16) WashingtonPost.com

- Walmart lowered its earnings predictions for fiscal year 2019, adjusting for the financial impact of its biggest-ever, hard-fought acquisition: Flipkart, an Indian online retailer. But the company’s outlook for 2020 is optimistic.

- The acquisition of Flipkart was a key move as Walmart continues to battle with Amazon.com for share of the e-commerce market. Walmart beat out Amazon in the Flipkart deal, and is predicting a 35% hike in its net e-commerce sales in fiscal year 2020.

Sears Files Just as Things Are Looking Up for US Retail

(October 15) Bloomberg.com

Sears Files Just as Things Are Looking Up for US Retail

(October 15) Bloomberg.com

- A year ago, a Sears bankruptcy would have fit better into the US retail narrative, given the steady decline of shopping malls and foundering chains. Today, with shoppers feeling more free to spend, bankruptcy is a clear sign of individual weakness, not an industry trend.

- Sears Holdings, once a force in US retail so dominant that it could be called the Amazon of the 20th century, has been suffocated by debt and a steady erosion of revenue. While department-store competitors invested in e-commerce and tried new brands and formats, Sears withered.

Walmart Buys Bare Necessities in Latest Digital Acquisition

(October 15) RetailTouchPoints.com

Walmart Buys Bare Necessities in Latest Digital Acquisition

(October 15) RetailTouchPoints.com

- Just a few weeks after Walmart acquired Eloquii, a plus-size fashion retailer, the retail giant has reeled in its next digitally native brand. Walmart has acquired Bare Necessities, an e-commerce intimates and sleepwear retailer, for an undisclosed sum.

- Walmart’s overall acquisition strategy consists of two complementary parts, according to a blog post: acquiring companies that strengthen Walmart.com and Jet.com by enhancing both their category expertise and assortment and acquiring digital brands that are unique and differentiated, offering products and experiences “you can’t find anywhere else.”

How Robots and Drones Will Change Retail Forever

(October 15) WSJ.com

How Robots and Drones Will Change Retail Forever

(October 15) WSJ.com

- Amazon’s distribution center in Baltimore is a massive fulfillment machine, where Kiva robots that resemble oversize Roombas topped with IKEA shelving can carry up to 750 pounds of goods in their 40-odd cubbies.

- Amazon’s robots signal a sea change in how the things we buy will be aggregated, stored and delivered. Autonomous warehouses will merge with autonomous manufacturing and delivery to form a fully automated supply chain.

Walmart Plans to Battle Amazon in Video Streaming

(October 15) Bloomberg.com

Walmart Plans to Battle Amazon in Video Streaming

(October 15) Bloomberg.com

- Walmart is looking to create an online store that would sell other companies’ video services, according to people familiar with the talks, opening up a new front in its fight with Amazon.com.

- Walmart, the world’s largest retailer has approached several media companies about reselling their streaming services. The idea would be to let customers of Walmart’s video service, Vudu, pay for additional services such as HBO Now, Showtime or Starz.

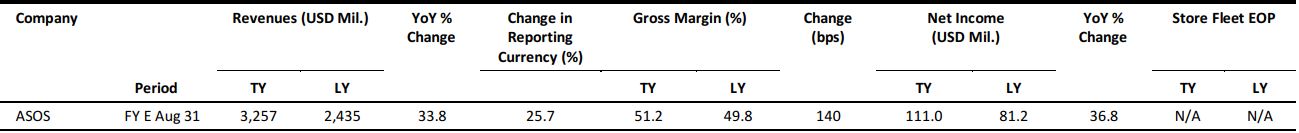

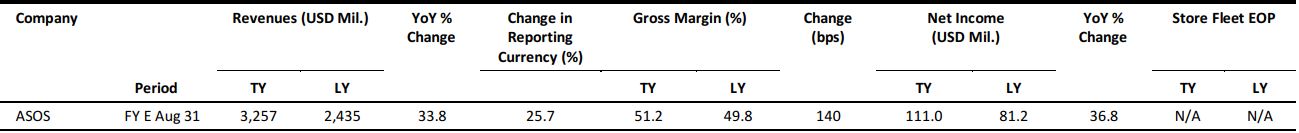

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

Amazon Fashion to Open Its First European Pop-Up Store in London

(October 15) Standard.co.uk

Amazon Fashion to Open Its First European Pop-Up Store in London

(October 15) Standard.co.uk

- Amazon’s first European pop-up store will open in London’s Baker Street for five days, until October 27. The 3,000-square-foot space will showcase Amazon Fashion’s Find, Truth & Fable and Meraki private labels, in addition to international brands.

- The pop-up will highlight a different theme each day and offer live performances by various artists. Customers will be able to buy products in the store as well as through the Amazon app.

Lidl Debuts in Serbia with 16 New Stores

(October 11) Fruitnet.com

Lidl Debuts in Serbia with 16 New Stores

(October 11) Fruitnet.com

- German supermarket chain Lidl has entered the Serbian market by opening 16 new stores across 12 Serbian cities.

- The stores will offer around 1,500 products, including Lidl brands, and more than 350 products will be sourced from domestic producers.

Claire’s UK Considers Store Closures

(October 15) TheGuardian.com

Claire’s UK Considers Store Closures

(October 15) TheGuardian.com

- American accessories retailer Claire’s is believed to be in talks with restructuring firms regarding its UK operations. The company might consider a company voluntary arrangement (CVA), which could involve the closure of its underperforming stores.

- Claire’s has more than 350 stores in the UK and hundreds of jobs could be at risk if the company proceeds with a CVA.

Thread Raises $22 Million in Series B Funding

(October 15) UKTech.news

Thread Raises $22 Million in Series B Funding

(October 15) UKTech.news

- Thread, which provides personalized styling services for men, has raised $22 million in its latest funding round, led by Balderton Capital, Beringea, Forward Partners and H&M’s investment arm.

- The latest round takes the company’s total funding to over $40 million. Thread will use the recently raised funds to expand its artificial intelligence team and grow the brand.

Shop Direct Announces Plans to Shut Seven Stores Across the UK

(October 8) RetailGazette.co.uk

Shop Direct Announces Plans to Shut Seven Stores Across the UK

(October 8) RetailGazette.co.uk

- British multibrand retailer Shop Direct is believed to have launched a proposal to shut its Littlewoods clearance business.

- The proposal reportedly includes closing its clearance centers, its Bargain Crazy website and a fulfillment center in Bolton. This could potentially wipe out 143 jobs, including those of the company’s head office team.

ASIA RETAIL & TECH HEADLINES

Honestbee Launches Dining and Retail Concept Store

(October 16) BusinessTimes.com.sg

Honestbee Launches Dining and Retail Concept Store

(October 16) BusinessTimes.com.sg

- Online grocery and food delivery company Honestbee opened its own dining and retail concept store, called Habitat, in Queenstown, Singapore, marking its first foray into the brick-and-mortar space.

- The store is spread over 60,000 square feet and also houses an innovation lab for the development of new retail technology solutions.

Alibaba Merges Ele.me and Koubei

(October 15) SCMP.com

Alibaba Merges Ele.me and Koubei

(October 15) SCMP.com

- Alibaba has merged its Ele.me food delivery business and its Koubei food and lifestyle unit in order to ward off competition from Meituan Dianping, a group-buying site for local goods and services. The new entity will be a “local service company” and will expand beyond the food market, according to Alibaba CEO Daniel Zhang.

- The new entity is backed by $3 billion in investment commitments, including funds from Alibaba and SoftBank.

Theory Enters E-Commerce Space in China with Tmall Debut

(October 16) RetailNews.Asia

Theory Enters E-Commerce Space in China with Tmall Debut

(October 16) RetailNews.Asia

- Theory, an American fashion label, has opened its first store on Alibaba’s Tmall e-commerce platform. Theory currently has 33 physical stores across 17 cities in China.

- Theory will work closely with Tmall to leverage consumer insights in order to offer personalized experiences to customers, starting with bonus points, sales benefits and exclusive birthday perks for Theory’s VIP loyalty club members.

JD.com Launches “Green Planet Plan”

(October 12) InsideRetail.Asia

JD.com Launches “Green Planet Plan”

(October 12) InsideRetail.Asia

- China’s JD.com e-commerce platform has launched a clothing collection drive to collect used and unused clothes from customers for recycling or distribution to people in need.

- The program will also allow customers to trade in third-party electronic appliances for recycling. The appliances will be disassembled and used for repairs.

Paytm Mall Triples Its Transactions During Indian Festive Sale

(October 16) RetailNews.Asia

Paytm Mall Triples Its Transactions During Indian Festive Sale

(October 16) RetailNews.Asia

- Alibaba-backed e-commerce site Paytm Mall reported that the number of transactions on its platform tripled during the first four days of the festive sales that began on October 9, driven by sales of mobile phones, laptops and groceries.

- The platform witnessed a 30% increase in its gross merchandise value over the four-day period and has already seen more than 50 million visitors this month, according to Paytm Mall VP Srinivas Mothey.

LATAM RETAIL & TECH HEADLINES

IKEA Plans Expansion into South America

(October 10) Bloomberg.com

IKEA Plans Expansion into South America

(October 10) Bloomberg.com

- Swedish furniture retailer IKEA plans to expand into South America in the coming years and aims to garner 3 million customers in the region by 2025.

- As part of its first foray into South America, IKEA will open nine stores and expand online in Chile, Colombia and Peru over the next decade with Chilean department store chain Falabella as its franchise partner.

Ripley to Introduce Marketplace Feature to Its Peru Website

(October 9) ElComercio.pe

Ripley to Introduce Marketplace Feature to Its Peru Website

(October 9) ElComercio.pe

- Chilean department store retailer Ripley will launch a marketplace feature on its Peruvian website before Christmas this year. This feature will allow sellers from its Chilean site and external vendors from Peru to sell on the site.

- Peru currently accounts for 30% of Ripley’s sales. Director of E-Commerce Carlos Honorato stated that the marketplace feature will allow suppliers access to a wider customer base across both countries.

Brazil Holiday Weekend to Inject R$6.7 Billion into the Economy

(October 12) RioTimesOnline.com

Brazil Holiday Weekend to Inject R$6.7 Billion into the Economy

(October 12) RioTimesOnline.com

- Brazil’s Ministry of Tourism expects the extended holiday weekend of October 11–15 to have injected R$6.7 billion ($1.8 billion) into the economy, thanks to an estimated 3.24 million domestic trips undertaken by consumers in the country.

- The Day of Our Lady Aparecida, Children’s Day and Teacher’s Day were the holidays celebrated during this time and the long weekend was the fourth extended holiday of the year.

E-Commerce Sales Surge in Mexico

(October 11) DineroEnImagen.com

E-Commerce Sales Surge in Mexico

(October 11) DineroEnImagen.com

- E-commerce sales in Mexico grew at an average annual rate of 12.4% in real terms between 2013 and 2016, according to new research from the National Institute of Statistics and Geography (INEGI) in Mexico.

- INEGI measured this value for the first time and stated that the e-commerce sales growth was nearly four times GDP growth during the period. The institute valued e-commerce sales in the country at MXN 803,103 million ($43 billion), representing 4% of GDP in 2016.

Skydrop Raises $4.5 Million After Y Combinator’s Demo Day

(October 15) LatAmList.com

Skydrop Raises $4.5 Million After Y Combinator’s Demo Day

(October 15) LatAmList.com

- After presenting at Y Combinator’s Demo Day in California a few weeks ago, Mexican last-mile delivery startup Skydrop has raised funds of $4.5 million, taking its total funding to $6.5 million. The startup counts FJ Labs, Soma Capital, Sinai Ventures, Y Combinator, Variv Capital and Dynamo Venture Capital among its investors.

- Skydrop aims to provide cost-efficient logistics services to companies of all sizes across Latin America by aggregating similar businesses on its platform.

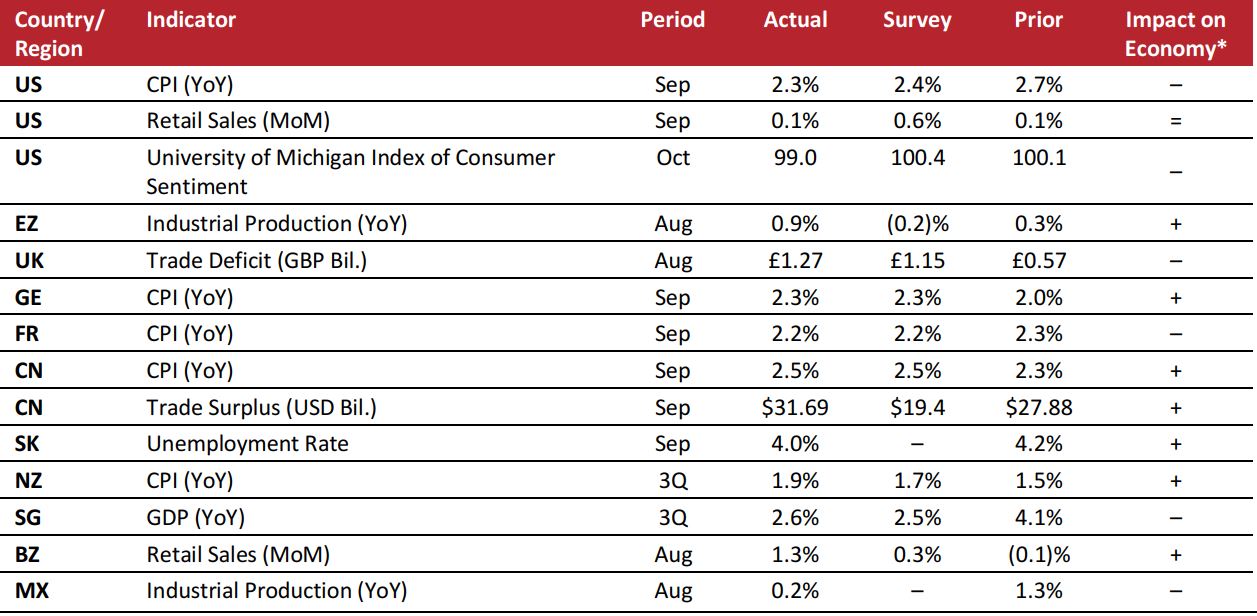

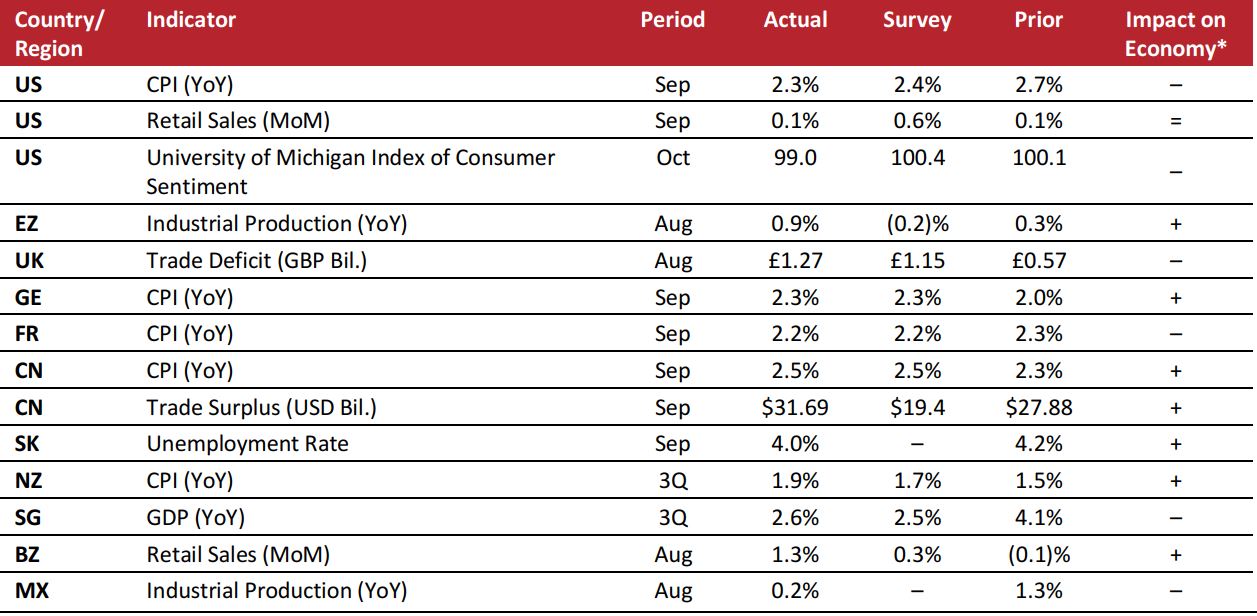

MACRO UPDATE

Key points from global macro indicators released October 10–16, 2018:

- US: The Consumer Price Index (CPI) rose by 2.3% year over year in September, the lowest inflation rate increase seen since February and below the 2.4% consensus estimate. Retail sales grew by 0.1% month over month in September, flat versus August and well below the consensus estimate of 0.6%.

- Europe: In the eurozone, industrial production increased by 0.9% year over year in August, following a 0.3% rise in July and beating the consensus estimate of a 0.2% drop. The UK trade deficit widened by £0.7 billion in August, to £1.27 billion, compared with market expectations of a £1.15 billion gap.

- Asia-Pacific: China’s economy continues to expand, as evidenced by the inflation rate and trade surplus in September. China’s CPI increased by a seven-month high of 2.5% year over year in September, versus a 2.3% increase in the previous month and in line with the consensus estimate. New Zealand’s CPI increased by 1.9% year over year in the third quarter, following a 1.5% increase in the previous quarter.

- Latin America: In August, retail sales in Brazil increased by 1.3% month over month, above the consensus estimate of 0.3%. Industrial production in Mexico increased by 0.2% year over year in August, compared with 1.3% in the previous month.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/University of Michigan/Eurostat/UK Office for National Statistics/Statistisches Bundesamt/INSEE/National Bureau of Statistics of China/China General Administration of Customs/National Statistical Office of South Korea/Statistics New Zealand/Singapore Department of Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/University of Michigan/Eurostat/UK Office for National Statistics/Statistisches Bundesamt/INSEE/National Bureau of Statistics of China/China General Administration of Customs/National Statistical Office of South Korea/Statistics New Zealand/Singapore Department of Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Home appliances, consumer electronics, lawn and garden, tools and hardware, automotive parts, household goods, toys, housewares, and sporting goods

Source: Company reports

*Home appliances, consumer electronics, lawn and garden, tools and hardware, automotive parts, household goods, toys, housewares, and sporting goods

Source: Company reports *Walmart data are for Walmart Supercenter or Walmart Discount Store formats; we have excluded the smaller-format Walmart Neighborhood Market stores from the analysis.

Figures should be viewed as approximate due to Sears’ ongoing store-closure program.

Source: Thinknum/Coresight Research

Source: Company reports/Coresight Research

*Walmart data are for Walmart Supercenter or Walmart Discount Store formats; we have excluded the smaller-format Walmart Neighborhood Market stores from the analysis.

Figures should be viewed as approximate due to Sears’ ongoing store-closure program.

Source: Thinknum/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Lidl Debuts in Serbia with 16 New Stores

(October 11) Fruitnet.com

Lidl Debuts in Serbia with 16 New Stores

(October 11) Fruitnet.com

Shop Direct Announces Plans to Shut Seven Stores Across the UK

(October 8) RetailGazette.co.uk

Shop Direct Announces Plans to Shut Seven Stores Across the UK

(October 8) RetailGazette.co.uk

Honestbee Launches Dining and Retail Concept Store

(October 16) BusinessTimes.com.sg

Honestbee Launches Dining and Retail Concept Store

(October 16) BusinessTimes.com.sg

Alibaba Merges Ele.me and Koubei

(October 15) SCMP.com

Alibaba Merges Ele.me and Koubei

(October 15) SCMP.com

Paytm Mall Triples Its Transactions During Indian Festive Sale

(October 16) RetailNews.Asia

Paytm Mall Triples Its Transactions During Indian Festive Sale

(October 16) RetailNews.Asia

IKEA Plans Expansion into South America

(October 10) Bloomberg.com

IKEA Plans Expansion into South America

(October 10) Bloomberg.com

Brazil Holiday Weekend to Inject R$6.7 Billion into the Economy

(October 12) RioTimesOnline.com

Brazil Holiday Weekend to Inject R$6.7 Billion into the Economy

(October 12) RioTimesOnline.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/University of Michigan/Eurostat/UK Office for National Statistics/Statistisches Bundesamt/INSEE/National Bureau of Statistics of China/China General Administration of Customs/National Statistical Office of South Korea/Statistics New Zealand/Singapore Department of Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/University of Michigan/Eurostat/UK Office for National Statistics/Statistisches Bundesamt/INSEE/National Bureau of Statistics of China/China General Administration of Customs/National Statistical Office of South Korea/Statistics New Zealand/Singapore Department of Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research