DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

Successful Online Migration Strategies: Lessons from Global Electronics and Appliance Retailers The Coresight Research team recently attended Best Buy’s 2019 investor day and we were impressed with a number of the company’s omnichannel-related metrics. Like major peers in other countries, Best Buy has survived the “Amazonification” of the electronics market: electronics and appliance retailers were hit early and hard by the wave of sales migration from stores to online. We examine the strategies of three surviving electronics and appliance giants to glean lessons retailers in other sectors can leverage to survive the slow but steady migration to online shopping. Specifically: Best Buy in the US, Dixons Carphone in the UK (and select other European countries) and Ceconomy, which operates on continental Europe. Lessons from the Last Ones Standing Best Buy, Dixons Carphone and Ceconomy are dominant omnichannel players in electronics and appliance specialist retailing in the US, the UK and Germany, respectively. Each survived major rivals that went to the wall as shoppers switched to e-commerce. In the UK, Dixons Carphone owns the Currys PC World and Carphone Warehouse banners. Ceconomy owns the MediaMarkt and Saturn banners. Omnichannel Excellence First, and perhaps most obviously given the e-commerce challenge, dominant electronics chains invested in omnichannel services, turning their substantial store networks into collection and fulfillment points.- Best Buy: According to statements by management at Best Buy’s recent investor day, 40% of online orders are picked up in store; 80% of collected online orders are ready for pickup in under 30 minutes; and, 93% of online order returns are in-store.

- Dixons Carphone: In the UK, the company offers same-day and next-day delivery, as well as free standard delivery and a one-hour click-and-collect in-store service. Smaller-item orders have a midnight cut-off for next-day delivery. The company also launched an augmented reality app that lets customers see what products will look like in the home.

- Ceconomy: Some 42% of online orders were picked up in stores in the year ended September 2018. The company has been trialing pickup at Smartmile automated collection kiosks. Ceconomy has been overhauling logistics to improve delivery performance, with a new network of national and regional distribution centers. In 2018, the company reported more than half its online sales begin in one of its stores. The company has been growing store numbers but reducing average store size.

US RETAIL & TECH HEADLINES

Barneys Nearing Sale to Saks, Authentic Brands

(October 15) WSJ.com

Barneys Nearing Sale to Saks, Authentic Brands

(October 15) WSJ.com

- US luxury department store Saks Fifth Avenue has teamed up with licensing firm Authentic Brands Group (ABG) to acquire Barneys out of bankruptcy for $270 million. Barneys filed for bankruptcy protection in August, citing an increase in rent as a factor in its decision.

- According to a source cited by the Wall Street Journal, the deal would see Saks open Barneys departments in some of its stores and take over Barneys’ website. ABG will license the Barneys name to Hudson’s Bay Co, the owner of Saks Fifth Avenue, and would also allow Hudson’s Bay to operate Barneys.com.

Walmart Launches “InHome” Grocery Delivery in Three Cities

(October 15) CNBC.com

Walmart Launches “InHome” Grocery Delivery in Three Cities

(October 15) CNBC.com

- Walmart has launched an in-home grocery delivery service called InHome in Kansas City, Missouri; Pittsburgh, Pennsylvania; and, Vero Beach, Florida. Through the InHome membership program, Walmart will deliver inside customers’ homes while they are away, at an introductory price of $19.95 a month.

- Delivery associates will be monitored via wearable cameras and will use a one-time access code to unlock a customer’s door using their InHome app, which integrates with smart-entry technology. Walmart has partnered with technology providers Level Home and Nortek Security & Control for the smart-entry technology.

Gymboree to Relaunch in 2020

(October 15) Company press release

Gymboree to Relaunch in 2020

(October 15) Company press release

- The Children’s Place has announced plans to restart the American kids clothing brand Gymboree in early 2020. It will relaunch the website Gymboree.com, and add Gymboree shops inside 200 of its outlets in the US and Canada.

- The Children’s Place acquired the rights associated with both Gymboree and its Crazy 8 brand earlier this year after Gymboree filed for bankruptcy protection in January.

YouTube Expands Access to AR “Try-On” Ad Feature

(October 14) EnGadget.com

YouTube Expands Access to AR “Try-On” Ad Feature

(October 14) EnGadget.com

- YouTube has extended its augmented reality (AR) “Beauty Try-On” feature to all brands on its platform, following its successful launch with selected partners in June 2019. Users can access the feature by tapping on “Masthead” and “TrueView Discovery” ads when browsing YouTube on iOS and Android smartphones.

- The feature allows users to virtually “try on” different shades of makeup and buy products without leaving the app.

Amazon to Offer Free Prime One-Day Shipping on Low-priced Items

(October 14) Vox.com

Amazon to Offer Free Prime One-Day Shipping on Low-priced Items

(October 14) Vox.com

- Amazon will now offer its US Prime members free one-day delivery on items priced below $5.

- Previously, Prime Shoppers had to order at least $25 for free delivery.

EUROPE RETAIL AND TECH HEADLINES

Groupe Casino Concludes Sale Of 31 Outlets

(October 16) Company press release

Groupe Casino Concludes Sale Of 31 Outlets

(October 16) Company press release

- French grocery and general-merchandise retailer Groupe Casino has announced the completion of the sale of 31 hypermarkets and supermarkets to companies associated with US-based private equity firm Apollo Global Management for a deal valued at €465 million ($512.7 million).

- To date, Casino has received €327 million ($360.6 million) for the sale of 30 properties, with an additional €14 million ($15.4 million) to be issued within 12 months of the transfer of another property. Eventually, another asset was removed from the initial scope to be sold to a third party by the end of 2019 under the same conditions.

Next CEO Sells Shares Worth Over £10 Million

(October 15) Reuters.com

Next CEO Sells Shares Worth Over £10 Million

(October 15) Reuters.com

- Simon Wolfson, CEO of British clothing retailer Next, has sold 10% of his shares in the company worth £10.1 million ($12.9 million), according to a stock exchange notification.

- The company stated the share sale was Wolfson’s first transaction in seven years. It also stated Wolfson has no plans to leave the firm and the proceeds from the sale will be used to finance an investment in a private venture outside the retail sector.

- Seán Anglim has resigned from the positions of Finance Director and Joint COO of UK-based home furnishings and fashion retailer Laura Ashley. Anglim has been with the company for more than two decades and is expected to step down by the end of this year.

- At the same time, Laura Ashley announced the promotion of Sagar Mavani as CFO, replacing Anglim. Mavani joined the company as its Group Financial Controller in 2018.

Pingo Doce Opens Its First Checkout-Free Supermarket in Lisbon

(October 14) ESMMagazine.com

Pingo Doce Opens Its First Checkout-Free Supermarket in Lisbon

(October 14) ESMMagazine.com

- Portuguese food retailer Jerónimo Martins has opened its first checkout-free Pingo Doce & Go Lab Store. To enter the store, shoppers scan a smartphone on a QR code reader via the Nova Pingo Doce & Go app.

- Customers purchase an item by scanning its label, which uses NFC contactless technology, to add it to a virtual shopping basket on the app. Customers use the app to pay via credit card linked to the app or at a self-checkout terminal.

Beter Bed has Reached an Agreement on the Sale of Matratzen Concord

(October 14) Company press release

Beter Bed has Reached an Agreement on the Sale of Matratzen Concord

(October 14) Company press release

- Dutch home furnishing retailer Beter Bed has announced that Asian investor Magical Honour intends to buy its German subsidiary Matratzen Concord for €5 million ($5.5 million) in cash, plus an additional amount based on the performance of Matratzen Concord in the first year after completion. The deal is expected to close by 2019 and is subject to regulatory approval.

- The transaction is accompanied by an equity investment of €5 million ($5.5 million), consisting of 2.15 million shares at €2.32 ($2.56) per share. In addition, Magic Honor has committed to invest €15 million ($16.5 million) in Matratzen Concord.

ASIA RETAIL AND TECH HEADLINES

Tokopedia Plans Last Funding Round before IPO

(October 16) TechInAsia.com

Tokopedia Plans Last Funding Round before IPO

(October 16) TechInAsia.com

- Indonesian e-commerce startup Tokopedia is in talks with potential investors for a private funding round ahead of the company’s dual stock market listing.

- Tokopedia secured $1.1 billion in its latest funding round led by SoftBank Vision Fund and existing investor Alibaba Group in December 2018.

Flipkart to Enter Food Retail Business

(October 15) TechCrunch.com

Flipkart to Enter Food Retail Business

(October 15) TechCrunch.com

- Indian e-commerce company Flipkart is entering the food retail business with the launch of a new venture called Flipkart FarmerMart. The company will invest $258 million in the new business.

- Flipkart is already in talks with many small farmers, saying the extended business represents an important part of its efforts to boost Indian agriculture as well as the country’s food processing industry.

Karl Lagerfeld To Debut in India

(October 15) InsideRetail.Asia

Karl Lagerfeld To Debut in India

(October 15) InsideRetail.Asia

- German fashion brand Karl Lagerfeld has partnered with Indian retail conglomerate Future Group’s fast fashion brand Cover Story to enter the Indian market.

- Future Group will sell a limited-edition collection of Karl Lagerfeld’s ready-to-wear fashion and accessories line. The collection will be created in London.

Taubman Asia Appoints New President

(October 14) InsideRetail.Asia

Taubman Asia Appoints New President

(October 14) InsideRetail.Asia

- US real estate investment trust company Taubman Centers has appointed Paul Wright as president for Asia operations. Wright will replace current President Peter Sharp, who has resigned after around three years in the role.

- Wright joined Taubman Asia in 2006. He will relocate to Hong Kong and assume his new role in January 2020.

Metro to Sell Majority Stake in Wumart

(October 13) DealStreetAsia.com

Metro to Sell Majority Stake in Wumart

(October 13) DealStreetAsia.com

- German wholesaler Metro will sell its majority stake in its Chinese operations to local retailer Wumart for an estimated €1 billion ($2.1 billion). The deal is part of Metro’s restructuring plan to simplify its business and focus more on its European cash and carry business.

- Metro will, however, retain a 20% stake in the Metro Wumart China joint venture. The deal is subject to regulatory approvals and is expected to close by the second quarter of next year.

LATIN AMERICA RETAIL AND TECH HEADLINES

Avia to Expand Its Business in Argentina

(October 16) FashionNetwork.com

Avia to Expand Its Business in Argentina

(October 16) FashionNetwork.com

- US footwear and clothing company Avia, which operates in Argentina through its local partner Latin Shoes, plans to invest $1.5 million to increase local production. Currently, domestic production accounts for 25% of the total.

- The company also plans to open its first establishment in Buenos Aires in the first half of 2020 and will expand operations into more cities by 2021.

Vilebrequin Opens Pop Up Store in Brazil

(October 15) FashionNetwork.com

Vilebrequin Opens Pop Up Store in Brazil

(October 15) FashionNetwork.com

- French beachwear brand Vilebrequin opened a popup store at the Iguatemi Ribeirão Preto shopping mall in Brazil from October 17-19.

- Carolina Pajaro, Marketing Manager of the shopping mall said, “Receiving Vilebrequin at the mall is reinforcing our proposal to offer exclusive products from famous brands that are not available in the local and regional markets.”

Google Facilitates Debit Card Payments in Brazil

(October 15) Reuters.com

Google Facilitates Debit Card Payments in Brazil

(October 15) Reuters.com

- Google now allows Google Pay users in Brazil to make payments through debit cards. The company stated it will not charge retailers, card issuers or processors for using the debit card function.

- E-commerce platforms and food delivery apps such as Rappi and iFood will now allow customers to pay through Google Pay’s debit card function.

Las Pepas Collaborates with Fila Argentina

(October 13) FashionNetwork.com

Las Pepas Collaborates with Fila Argentina

(October 13) FashionNetwork.com

- Argentinian fashion brand Las Pepas has collaborated with sporting goods company Fila’s Argentine unit to launch a limited-edition collection called “Las Pepas Fila Collab.”

- The collection consists of a range of clothing and footwear priced between ARS 3,990 ($68.7) and ARS 22,990 ($390).

Uber Plans to Acquire Cornershop

(October 11) Company press release

Uber Plans to Acquire Cornershop

(October 11) Company press release

- US ridesharing company Uber plans to acquire a majority stake in Latin American grocery delivery start up Cornershop for an undisclosed amount. The deal is expected to close in 2020, subject to regulatory approval.

- After the acquisition, Cornershop will continue operations under its current management but will report to the board with majority representatives from Uber.

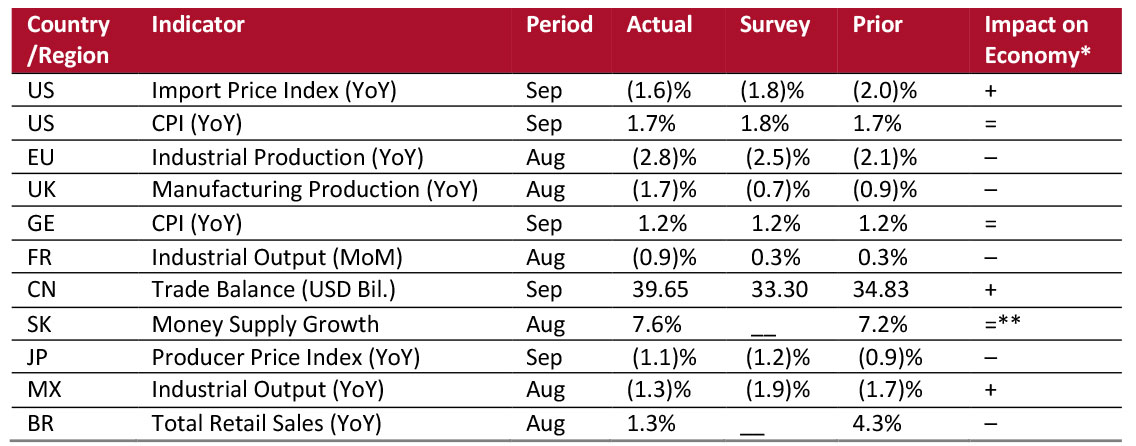

MACRO UPDATE

Key points from global macro indicators released October 9-15, 2019:- US: The Import Price Index fell 1.6% year over year in September, versus a 2% decrease in August. The Consumer Price Index (CPI) climbed 1.7% year over year in September, but unchanged from the previous month.

- Europe: In the eurozone, industrial production fell 2.8% year over year in August, faster than the 2.1% decline in July. In Germany, the CPI grew 1.2% year over year in September, but unchanged from August.

- Asia: China registered a trade surplus of $39.65 billion in September, an improvement over $34.83 billion in the previous month and ahead of the consensus estimate of $33.30 billion. In Japan, the producer price index fell 1.1% year over year in September, versus a 0.9% decrease in August.

- Latin America: Mexico’s industrial output decreased 1.3% year over year in August, versus a 1.7% decrease in July but slower than the consensus estimate of a 1.9% decline. In Brazil, total retail sales increased 1.3% year over year in August, lower than the 4.3% increase in July.

**The impact on the economy cannot be identified as other factors such as aggregate demand and interest rates will also impact the economy even as the money supply increases.

**The impact on the economy cannot be identified as other factors such as aggregate demand and interest rates will also impact the economy even as the money supply increases. *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Department of Labor/US Bureau of Labor Statistics/Eurostat/Office for National Statistics/Destatis/INSEE/National Bureau of Statistics of China/Bank of Korea/Bank of Japan/INEGI/IBGE/Coresight Research [/caption]

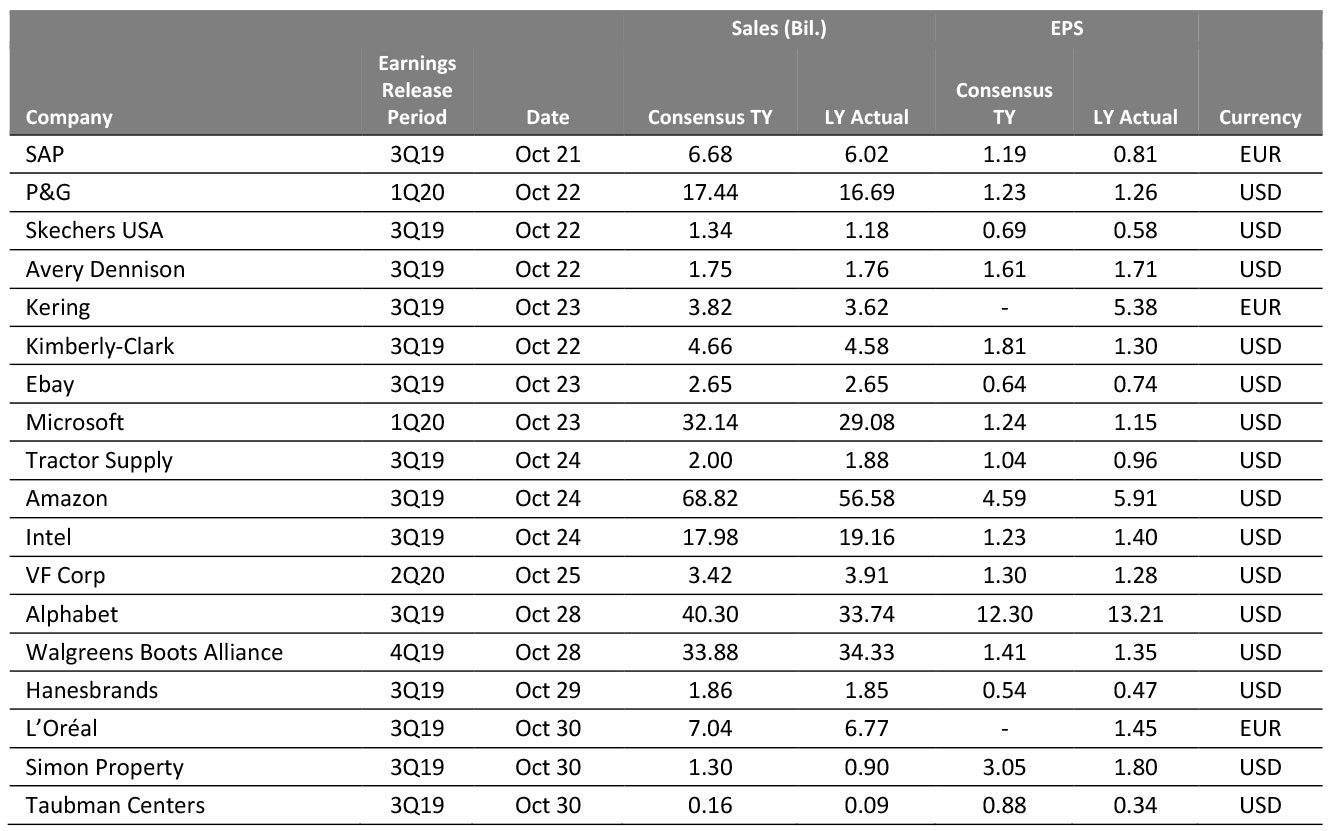

EARNINGS CALENDAR

[caption id="attachment_98248" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR