From the Desk of Deborah Weinswig

The Intelligent Voice Appliance Market Is Getting Quite Crowded

In the beginning, there was Siri. The groundbreaking voice assistant only worked with recent-model iPhones, however, and its imperfect voice recognition led it to be the object of many a joke and cartoon. Siri’s wake saw additional assistants from other technology leaders, such as Cortana from Microsoft and the Google Assistant. Then Amazon entered the fray with its Echo device, which runs its Alexa platform, and it became clear to consumers how useful voice assistants could really be.

Users can ask Alexa a multitude of unscripted questions, and Alexa does its best to answer. Its functionality was cleverly designed to be adaptable, and its repertoire has been expanded: Alexa can now control home automation and security devices, order a car from Uber, tell the temperature, set alarms, and perform other tasks. As of July, Alexa had at least 15,000 skills, and the number continues to increase.

At the CES trade show in 2016, Alexa communicated with a Ford vehicle in a demonstration: the goal was for Alexa to turn on the lights in a house when the car approached the house and to tell the car to start itself on a winter’s day while the owner waited, toasty warm, inside the house.

Of course, Alexa can also order items from Amazon, which has led to some unexpected results. For example, one kid vocally wished for a dollhouse while Alexa was listening (but presumably her parents were out of earshot)…and a dollhouse was subsequently delivered to the child’s home. The power to place orders through Alexa has since been tightened up. Recent add-ons to Alexa’s functionality include the ability to make old-fashioned voice calls and an add-on gadget that can scan the user’s wardrobe and make recommendations.

Amazon Echo buyers unwittingly let a Trojan horse enter their dwelling when they unpack an Echo or Dot, as the devices bring with them an “insanely great” catch (to quote the late Steve Jobs). The catch is that Echos require Amazon Prime service for ordering and for a number of services. So, once a consumer has purchased an Echo, he or she will likely be seduced by the convenience of Prime membership and feel compelled to pay the $99 annual Prime membership fee, lest the Echo turn into nothing more than a high-tech paperweight. The usefulness of the Echo helps encourage Prime members to resubscribe, too, and Amazon recently dropped the price of the original Echo and introduced several new form factors in order to offer precisely the size and features the consumer needs. HTC is offering a smartphone enabled with Alexa, and one person even found a way to wire a Dot into his car.

The wild success of Alexa and the Amazon Echo has not gone unnoticed in the consumer electronics industry, which is rife with imitators. The Google Assistant has rematerialized in hardware form, and Samsung is working on its own device. Chinese tech companies such as Alibaba, JD.com, Tencent and Baidu have also joined the fray and are developing their own devices, which can understand Mandarin and various other Chinese dialects. Given that Google remains blocked in China, the Chinese market will likely go to its domestic players.

Even Apple is making a go of it again. The company has been honing and refining Siri’s functionality and it has demonstrated a device called the HomePod that is scheduled to launch later this year. Apple had to offer cutting-edge technology, as it was so late to the game, and the HomePod excels at sound and music quality—in terms of both sound recognition and production—which is fitting, as music is one of Apple’s core businesses. The device will likely appeal primarily to diehard Apple fans due to its high sticker price ($349). Those flush with cash may want to purchase multiple HomePods, as the devices are able to locate each other and offer the optimal sound distribution within a room or rooms.

It is possible that consumer tech is dividing into separate tribes: the Amazon tribe, the Google tribe and the Apple tribe. Each company offers a smartphone, an intelligent voice appliance and content for its devices. Walmart recently announced a partnership with Google that enables Google Assistant users to order from Walmart.com. Apple, though, still lacks a grocery partner.

Amazon has a tremendous first-mover advantage in intelligent voice appliances, backed by its huge e-commerce offerings and content library, so it is Amazon’s game to lose. Still, users have to pay the Prime membership fee to enjoy all its offerings, and there is room for other players, such as Google, to grab some share. Apple is late to the game, but, as always, can leverage its cult following.

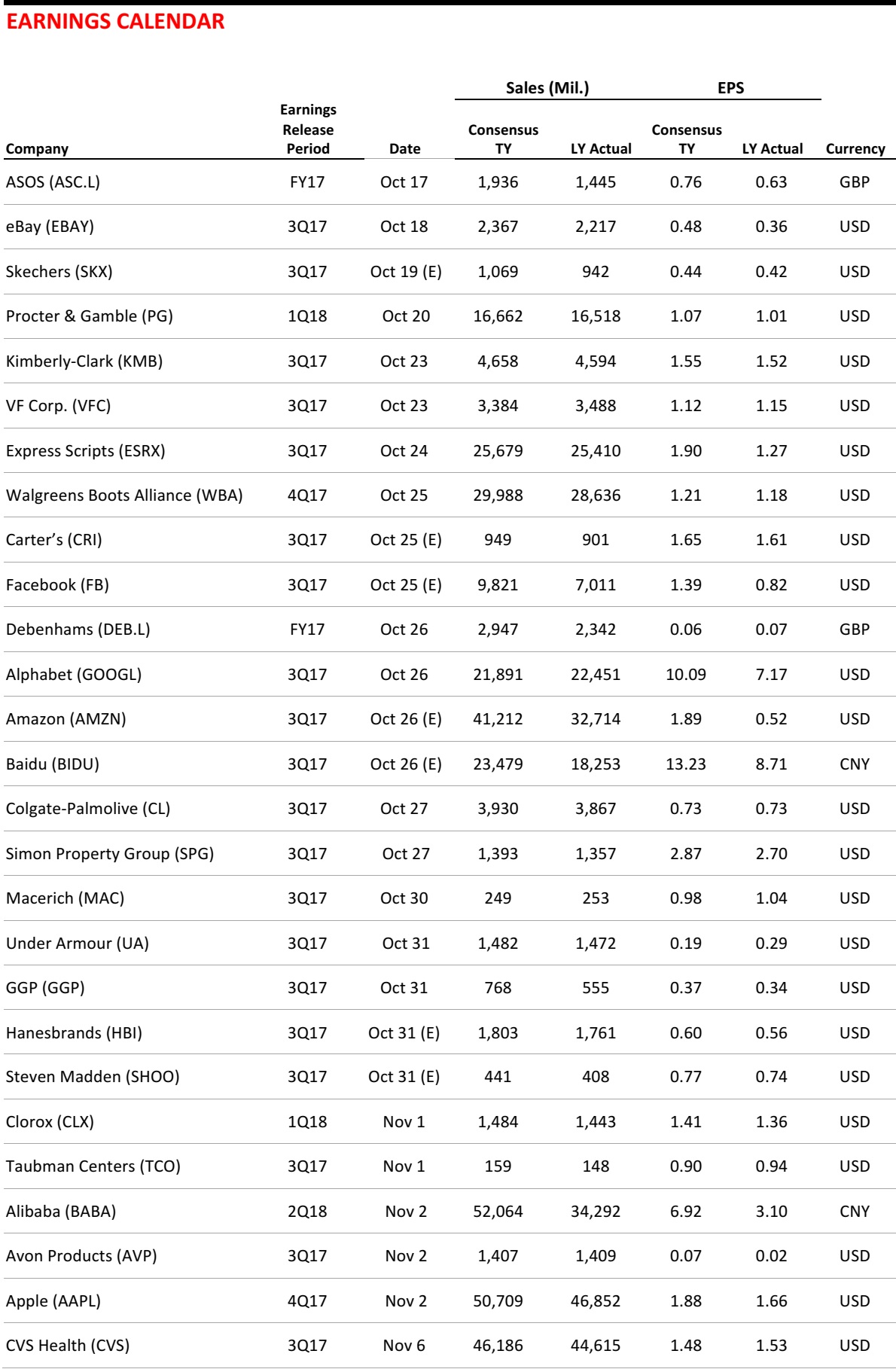

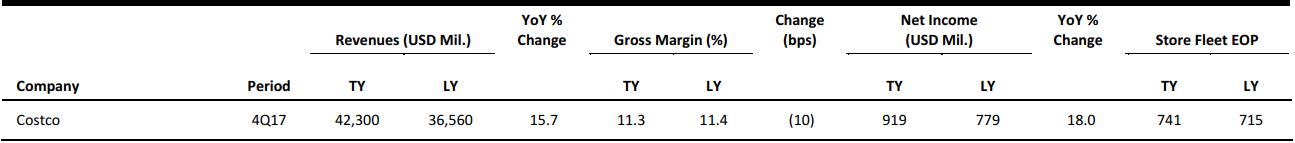

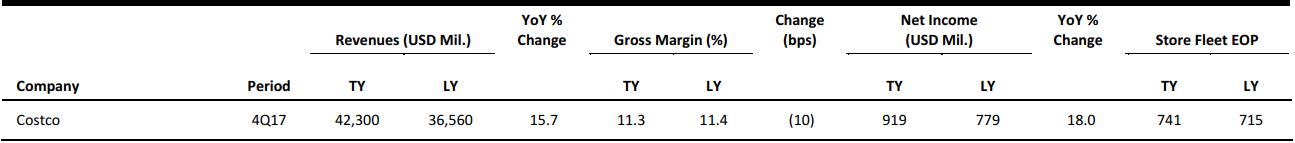

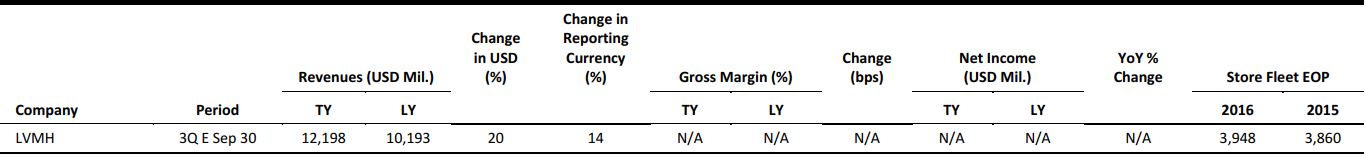

US RETAIL EARNINGS

Source: Company reports

US RETAIL & TECH HEADLINES

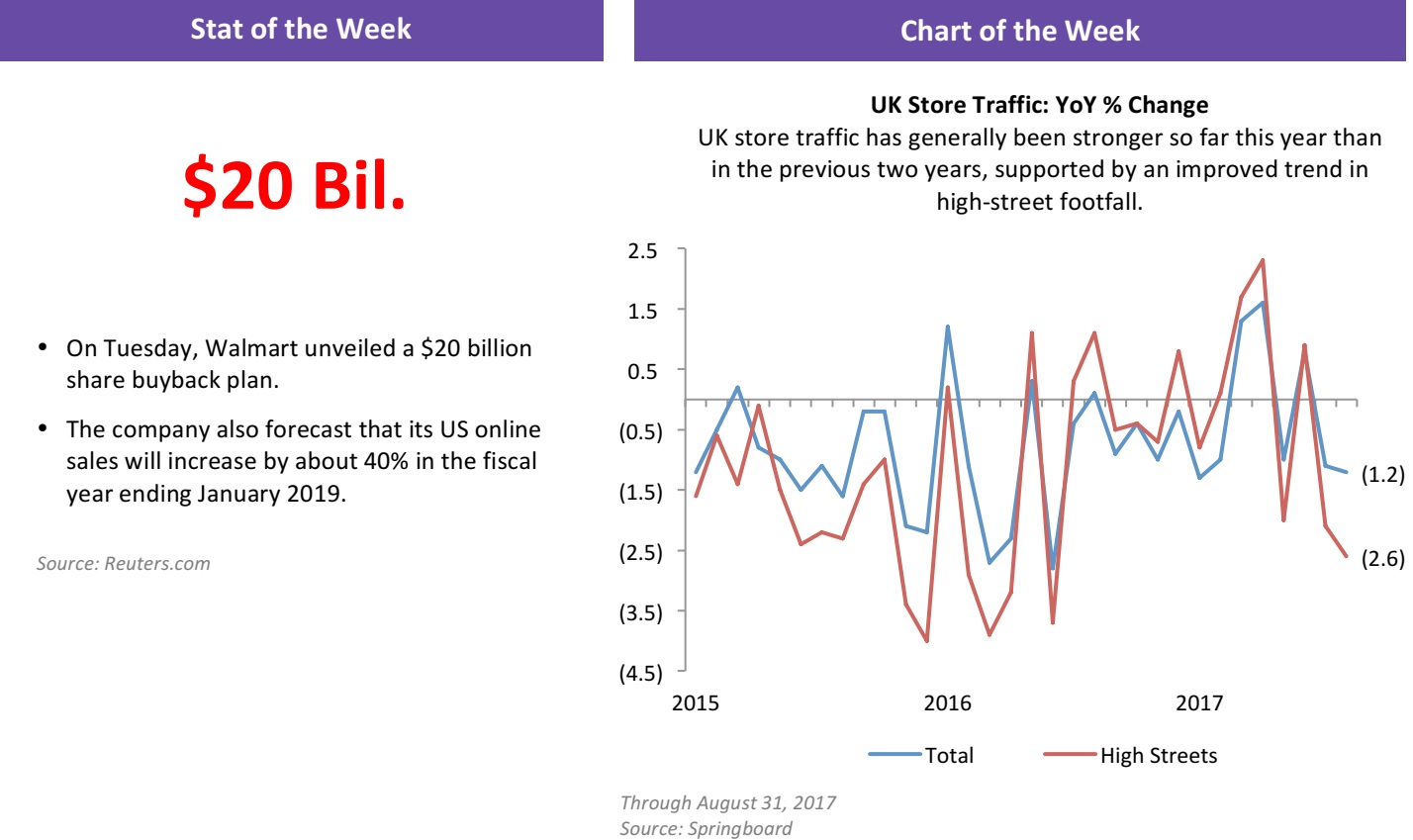

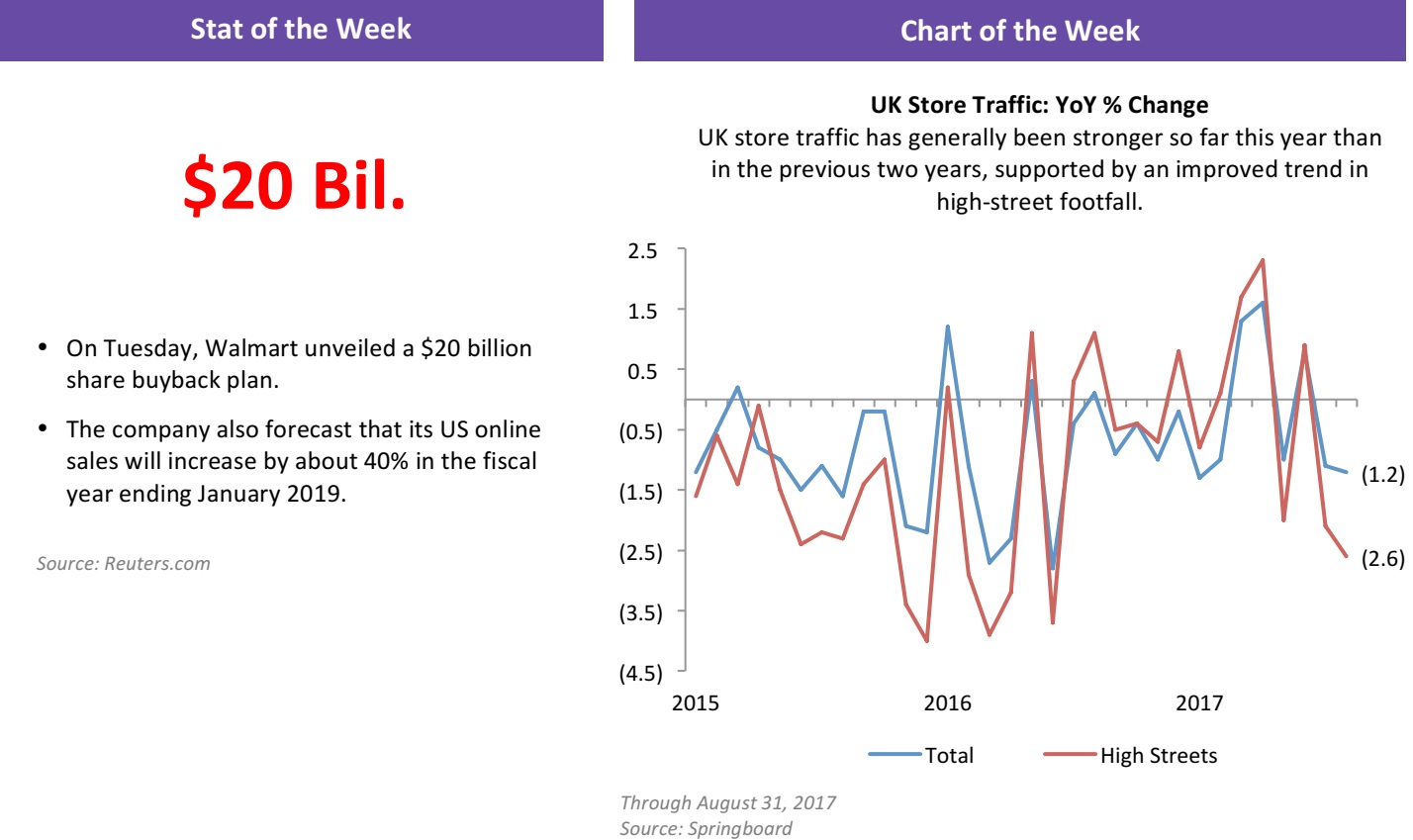

Walmart Sees 40% Online Sales Growth Next Year

(October 10) Reuters.com

Walmart Sees 40% Online Sales Growth Next Year

(October 10) Reuters.com

- Walmart forecast that its US online sales would soar by about 40% in the fiscal year ending January 2019. The company also forecast that overall net sales would rise by at least 3% in the same period and said that it would buy back $20 billion of its shares over the next two years.

- The retailing behemoth reiterated its focus on its e-commerce business at its annual investor meeting in Bentonville, Arkansas. It has started offering free two-day shipping and plans to roughly double the number of locations for shipping online grocery orders and slash its number of physical stores.

Consumers Stay Positive as Gas Prices Drop

(October 10) NACSonline.com

Consumers Stay Positive as Gas Prices Drop

(October 10) NACSonline.com

- Consumers have seen gas prices fall following the temporary supply disruptions caused by Hurricanes Harvey and Irma and they say they are more optimistic about the economy, according to the latest national NACS Consumer Fuels Survey.

- Americans say that they have seen gas prices fall by 9 cents, to $2.50 per gallon, over the past month, and one in four (24%) expect prices to continue to fall this month, a far higher number than normally expect gas prices to decrease this time of year. In October 2016, only 11% of Americans said that they thought gas prices would decline that month.

US Grocers Count the Pennies as Discounters Wage Price War

(October 9) Financial Times

US Grocers Count the Pennies as Discounters Wage Price War

(October 9) Financial Times

- In Fredericksburg, Virginia, German retailers are trying to beat Walmart at its own game. At stake is the $800 billion US food market. Discount chains Lidl and Aldi are hoping to replicate the success they have enjoyed in Europe and the UK, where their no-frills approach and low prices have helped them capture 12% of the UK market.

- Lidl has been quietly crafting ideas to test US appetites for more than a year, building a prototype store in Fredericksburg before opening its first US store in June—just as Amazon unveiled its $14 billion deal to buy Whole Foods. In Fredericksburg, neighborhood supermarkets are being undercut as grocers battle over penny savings.

Holiday Shopping Expected to Grow, Despite Spate of Storms

(October 9) Houston Chronicle

Holiday Shopping Expected to Grow, Despite Spate of Storms

(October 9) Houston Chronicle

- Shoppers will again divide their time between the store and the screen this year during what is expected to be a robust holiday season bolstered by an increase in consumer confidence, rising wages and low unemployment. But the growth in e-commerce sales is expected to far outpace an overall increase in spending and further fuel competition among traditional retailers and e-commerce players.

- In Houston, economists anticipate a spike in fourth-quarter spending as consumers buy furniture, home goods and building materials in the wake of Hurricane Harvey. Some of that spending is expected to come at the expense of nonessentials such as electronics and luxury goods.

Bankrupt US Retailers Begin to Catch a Break

(October 6) Reuters.com

Bankrupt US Retailers Begin to Catch a Break

(October 6) Reuters.com

- An unexpected helping hand from creditors, landlords and vendors is allowing more US retailers to stay in business following bankruptcy, with most of their stores and employees in the fold. Until this year, most bankrupt retailers, including American Apparel, Sports Authority and The Limited, were dismantled during the bankruptcy process.

- However, several creditors, landlords and vendors now see more value left in some retailers, and they are seizing an opportunity to minimize their own losses in the retail rout.

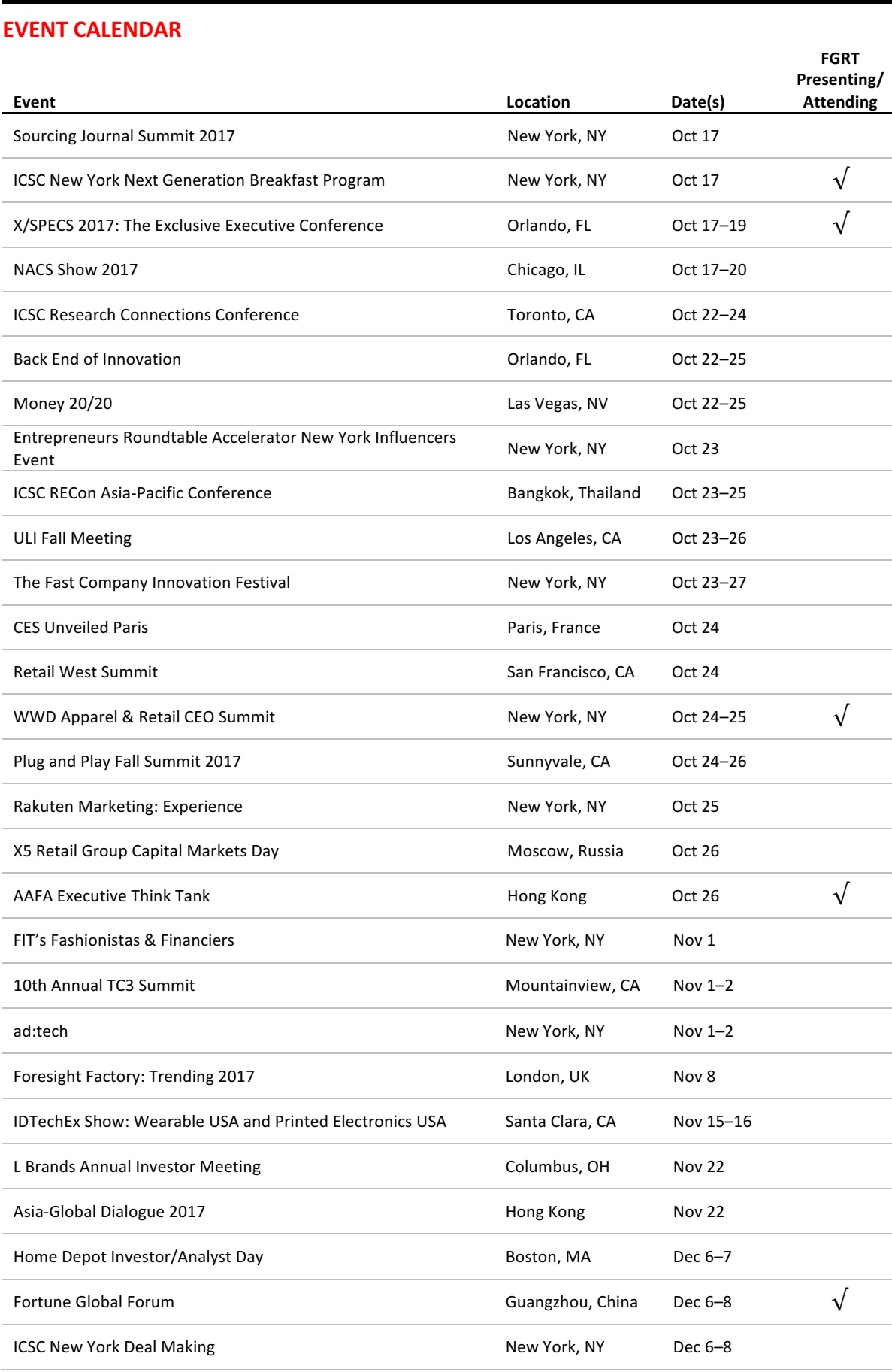

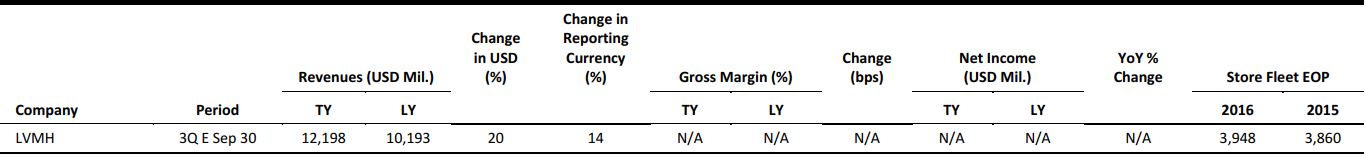

EUROPE RETAIL EARNINGS

Source: Company reports

EUROPE RETAIL HEADLINES

Brits Spend Freely at Retail in September

(October 10) BRC press release

Brits Spend Freely at Retail in September

(October 10) BRC press release

- The British Retail Consortium (BRC) reported that UK retail sales grew by 1.9% year over year on a comparable basis in the four weeks ended September 30. Total retail sales rose by 2.3% during the period.

- The BRC provides a food/nonfood split only on a three-month basis: for the most recent three months, food sales grew by 2.5% on a comparable basis and by 3.5% in total. Sales of nonfood items grew by 0.5% on a comparable basis and by 0.9% in total. Demand for big-ticket items such as furniture and electrical goods was weak. The BRC typically reports much weaker nonfood growth than does the UK Office for National Statistics, which will report its next monthly data on October 19.

Ted Baker Sews Up First-Half Revenue Rise of 14%

(October 10) Company press release

Ted Baker Sews Up First-Half Revenue Rise of 14%

(October 10) Company press release

- For the half-year ended August 12, British fashion retailer Ted Baker reported that group revenue was up 14.0%, pretax profit was up 17.8% and adjusted EPS was up 12.4%. At constant exchange rates, group revenue was up 9.5%.

- In constant currency terms, UK and Europe retail sales rose by 9.1%, while North America retail sales were up 7.8% and Asia retail sales were up 19.6%. The company’s gross margin nudged up by 20 basis points year over year, to 58.9%. The company’s operating margin climbed by 60 basis points year over year, to 8.9%.

IPO on the Menu for Germany’s HelloFresh

(October 10) Financial Times

IPO on the Menu for Germany’s HelloFresh

(October 10) Financial Times

- German meal-kit firm HelloFresh said that it would make a second attempt at an initial public offering, with an aim to raise €250–€350 million (US$295–US$413 million). The money would be used to fund growth initiatives and new business lines.

- HelloFresh was founded in 2011 and planned to float two years ago, but pulled the offering after finding that investors were reluctant to back the company.

Matalan Growth Gathers Pace

(September 28) Bloomberg.com

Matalan Growth Gathers Pace

(September 28) Bloomberg.com

- British middle-ground clothing retailer Matalan reported a 5.9% uplift in revenues in its second fiscal quarter, ended August 26. This marked a sequential acceleration in top-line growth from a 1.3% increase in total revenues in the first quarter. Revenues came in at £260 million (US$343 million) and full-price sales jumped by 19.6%.

- Matalan grew gross profit by 31.4% and operating profit excluding exceptional items by 87.5%. This yielded a gross margin of 11.4% and an operating margin, pre-exceptionals, of 5.8%.

Amazon Scouting for Logistics Partners in France

(October 4) Reuters.com

Amazon Scouting for Logistics Partners in France

(October 4) Reuters.com

- France’s biggest grocery retailer, Leclerc, has announced that Amazon approached it about the possibility of establishing a logistics partnership. “Yes, we have been approached by Amazon,” Leclerc CEO Michel-Edouard Leclerc told Reuters.

- Leclerc’s comments follow reports in French newspaper Le Monde that Amazon had approached various French supermarket operators about setting up distribution deals or making an acquisition in the country. Leclerc is already by far the biggest online grocery retailer in France, according to Kantar Worldpanel data.

ASIA TECH HEADLINES

Tujia, China’s Answer to Airbnb, Got $300 Million in Funding

(October 10) TechCrunch.com

Tujia, China’s Answer to Airbnb, Got $300 Million in Funding

(October 10) TechCrunch.com

- Tujia, China’s biggest Airbnb-esque site, has garnered $300 million in funding, the company announced. The money is technically only for its online offerings, following the earlier detachment of Tujia’s online and offline businesses into separate units. With this latest injection of cash, Tujia’s online wing is valued at $1.5 billion on its own.

- “We see significant growth in China’s online short-term rental market and expect it to reach similar penetration levels of accommodations bookings as in the US and Europe,” said Paul Hudson, founder and CIO at Glade Brook Capital Partners, a new investor in Tujia. Glade Brook has also backed Airbnb and Uber.

Amazon Brings Echo and Alexa to India and Soon Japan, Its First Markets in Asia

(October 4) TechCrunch.com

Amazon Brings Echo and Alexa to India and Soon Japan, Its First Markets in Asia

(October 4) TechCrunch.com

- As the Echo and Alexa devices from Amazon continue to set the pace for voice-based interfaces and home hubs, Amazon is offering them in Asia for the first time. The e-commerce giant announced that Echo and Alexa are now on sale in India, and will be launched in Japan later this year.

- The devices are launching “by invitation.” Would-be users can request them by visiting the specific local sites for the Echo, Echo Plus and Echo Dot. Eligible customers “will receive an introductory discount of 30% off the purchase price of Echo devices and one year of Prime membership.” The devices are due to ship beginning the week of October 30.

LINE Enters AI Game Set to Dominate Asia

(October 10) The Jakarta Post

LINE Enters AI Game Set to Dominate Asia

(October 10) The Jakarta Post

- Japanese multimedia application LINE has recently entered the artificial intelligence (AI) industry and could likely dominate Asia’s virtual assistant market thanks to its primary focus and leverage in the region.

- To compete with current, Western-oriented AI devices such as Apple’s Siri, Google’s Google Assistant and Amazon’s Alexa, LINE developed its own AI system called Clova in about a year and it aims to bring Asia into the AI era, one country at a time.

Temasek’s Vertex Raises $286 Million for Tech Deals in Southeast Asia and India

(October 10) The Straits Times

Temasek’s Vertex Raises $286 Million for Tech Deals in Southeast Asia and India

(October 10) The Straits Times

- Vertex Venture Holdings, the venture capital arm of Temasek, has completed its biggest fundraising for Southeast Asian and Indian technology deals. The Singapore-based firm closed its third Southeast Asian fund at US$210 million (S$286 million), a record in the region that exceeded its target of US$150 million (S$203 million).

- Vertex will use the money for early-stage investments, and it aims to repeat its success with Grab. Vertex was the first institutional backer of the ride-hailing company, which went on to become one of the most valuable technology startups in the region.

LATAM RETAIL & TECH HEADLINES

Unisys Appoints New LatAm Head

(October 5) ZDNet.com

Unisys Appoints New LatAm Head

(October 5) ZDNet.com

- Unisys has appointed Eduardo Almeida to the role of vice president and general manager for the Latin America region. Almeida is charged with boosting the company’s business in the region, which currently represents only 10% of the company’s global revenue.

- “I am very excited to join Unisys, a company with a track record in the region of nearly 100 years. The strategic relationships developed with customers position [Unisys] differently in the IT market, in which data analytics, cloud technologies, managed services and cybersecurity become ever more present,” Almeida said.

Brazilian Government Launches National IoT Strategy

(October 9) ZDNet.com

Brazilian Government Launches National IoT Strategy

(October 9) ZDNet.com

- The Brazilian government has launched a national strategy detailing its policies and action plan for the deployment of Internet of Things (IoT) technologies in the country. The four core verticals are smart cities, healthcare, agribusiness and manufacturing. The plan calls for these policies to be implemented between 2018 and 2022.

- Titled “Internet of Things: An Action Plan for Brazil,” the strategy was launched at the Futurecom conference in São Paulo last week. It was preceded by a study funded by the Brazilian Development Bank and carried out by a consortium led by consulting firm McKinsey & Company.

Carrefour Brasil Opens Online Grocery Shopping in São Paulo

(October 10) Reuters.com

Carrefour Brasil Opens Online Grocery Shopping in São Paulo

(October 10) Reuters.com

- Carrefour Brasil will launch an online grocery shopping and rewards platform in São Paulo this week, executives said, deploying fresh capital to boost its e-commerce presence in a fiercely competitive market.

- The Brazilian unit of French retailer Carrefour, which raised R$5 billion (US$1.6 billion) in a July IPO, will offer the services over a mobile app called Meu Carrefour and will slowly expand beyond an initial 200 neighborhoods in Brazil’s biggest city.

Earthquake-Related Purchases Lift Walmart de Mexico Sales

(October 5) FoxBusiness.com

Earthquake-Related Purchases Lift Walmart de Mexico Sales

(October 5) FoxBusiness.com

- Mexico’s biggest retailer, Walmart de Mexico, reported double-digit sales growth in September, as emergency purchases following a major earthquake offset the impact of temporary store closures.

- Walmex, as the unit is known, said same-store sales in Mexico grew by 10.2% last month, and total sales including stores opened in the past year rose by 12%. There was also a positive calendar effect this year, with one additional Saturday in September.

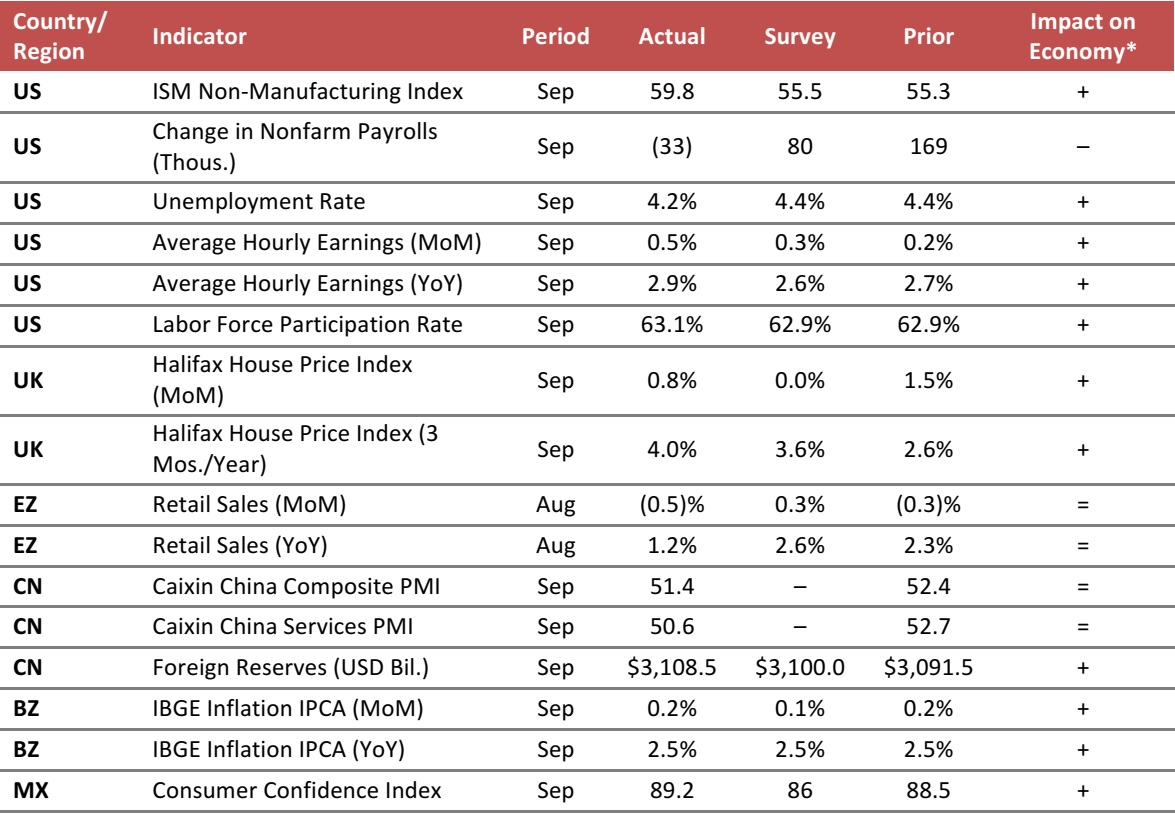

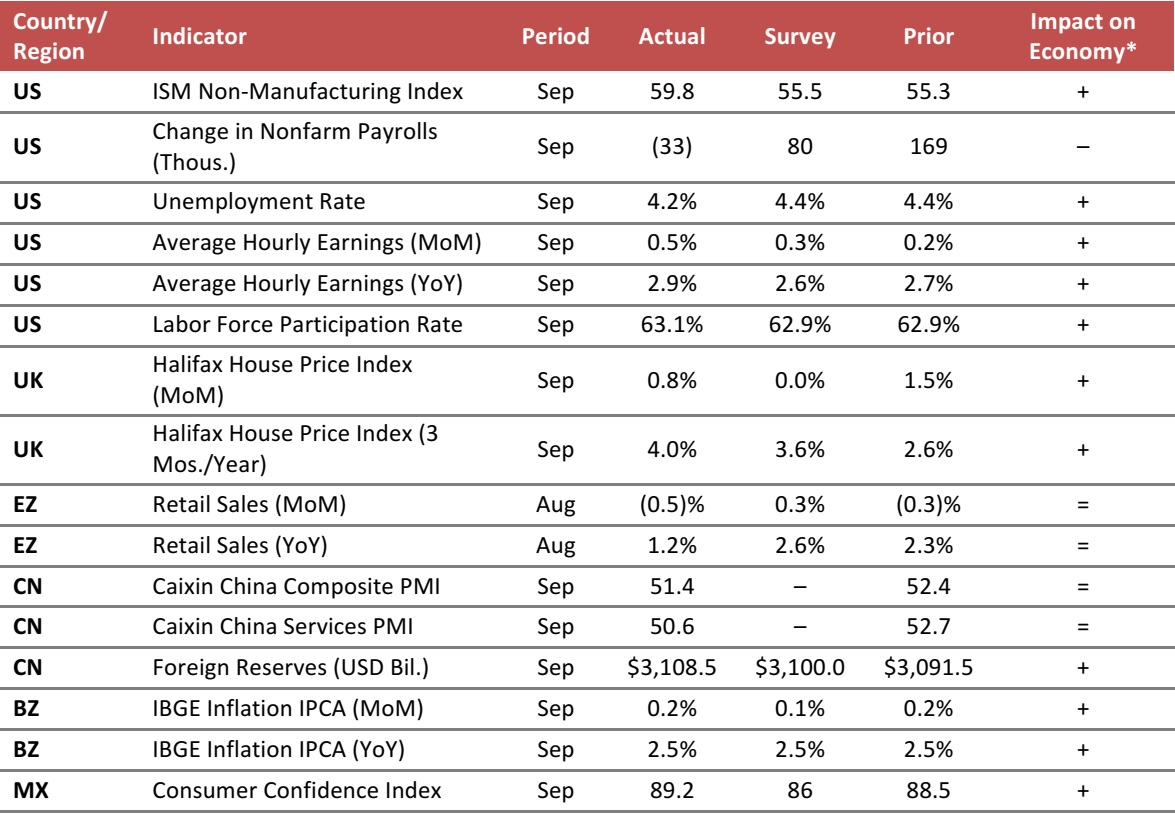

MACRO UPDATE

Key points from global macro indicators released October 4–11, 2017:

- US: The ISM Non-Manufacturing Index registered at 59.8 in September, up from 55.3 in August and ahead of the consensus estimate. Nonfarm payrolls decreased by 33,000 in September, while the unemployment rate dropped to 4.2%.

- Europe: In the UK, the Halifax House Price Index increased by 0.8% month over month in September, above the consensus estimate. In the eurozone, retail sales decreased by 0.5% month over month and increased by 1.2% year over year in August.

- Asia-Pacific: In China, the Caixin Composite Purchasing Managers’ Index (PMI) stood at 51.4 in September, while the Caixin Services PMI ticked down to 50.6. Foreign reserves in China increased to slightly above $3.1 trillion in September.

- Latin America: In Brazil, inflation increased by 0.2% month over month and by 2.5% year over year in September; the year-over-year figure was in line with the consensus estimate. In Mexico, the Consumer Confidence Index reading increased to 89.2 in September.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Institute for Supply Management/US Bureau of Labor Statistics/Bloomberg/Halifax/Eurostat/Markit/The People’s Bank of China/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/FGRT