FROM THE DESK OF DEBORAH WEINSWIG

Keeping Shopping Energy High in China from Golden Week Through 11/11

Last week, China celebrated its Golden Week holiday, which is anchored by National Day on October 1. While the official holiday runs October 1–5, Chinese authorities, in an effort to promote domestic consumption, have requested that workers work some weekend days before and/or after holidays in order to extend the number of days that employees can take off over holiday periods. In the run-up to Golden Week, workers were asked to work on Saturday and Sunday, September 29–30, in exchange for being off through October 7, thus extending the holiday to seven days.

The Golden Week holiday follows closely on the heels of China’s Mid-Autumn Festival, which fell on Monday, September 24, this year, but was extended to include the prior weekend, for a three-day holiday. To celebrate the holiday, Alibaba ran a Mid-Autumn Festival promotion September 17–24 that featured three Nokia smartphone campaigns.

Many online retailers sprang into action to meet the anticipated surge in consumer demand over the Golden Week holiday period. Alibaba offered a National Day/Golden Week promotion on its Tmall marketplace, running sales on home appliances, furniture, laptops, books and musical instruments. Featured brands included Dyson, Haier, Hisense, Panasonic, Philips, Samsung, Sharp, Sony, TCL and Xiaomi. On Tmall, discounts ranged from 9% off on a Yamaha piano to 72% off on a water purifier from a domestic brand.

The Chinese calendar is bursting with shopping holidays over the remaining months of this year, as shown below.

Selected Chinese Shopping Holidays

Source: Company reports/Coresight Research

The biggest Chinese shopping holiday by far is Singles’ Day, which falls on November 11 (11/11) and was originally created by Chinese college students commiserating with each other over the fact that they were single rather than part of a couple. Last year, the day generated $25.3 billion in gross market value (GMV), a figure more than five times higher than Black Friday’s total. Singles’ Day sales took place in 225 countries and regions in 2017 and sales increased by a stunning 39% from the prior year. To promote its annual Singles’ Day sale, the 11.11 Global Shopping Festival, Alibaba stages a star-studded gala featuring Chinese and international celebrities that is broadcast on Chinese TV networks and Alibaba’s video service. Last year, Nicole Kidman and Pharrell Williams attended.

Alibaba’s massive success in turning a shopping holiday celebrated by single college students into the 11.11 Global Shopping Festival has spurred other companies to create a slew of new e-commerce holidays. These include Amazon Prime Day (in July), the JD.com 6/18 Anniversary Sale and other holidays that fall on auspicious dates in the Chinese calendar, such as 8/8. Similarly, since “nine” sounds like the word for wine or alcohol in Mandarin, e-commerce companies have launched wine sales on 9/9.

With Golden Week behind them, Chinese shoppers can now start to prepare for 11/11. We will soon enter the preheat period, when shoppers learn about 11/11 promotions and begin placing discounted items in their digital shopping carts to purchase on Singles’ Day, when GMV is expected to once again break the previous year’s record.

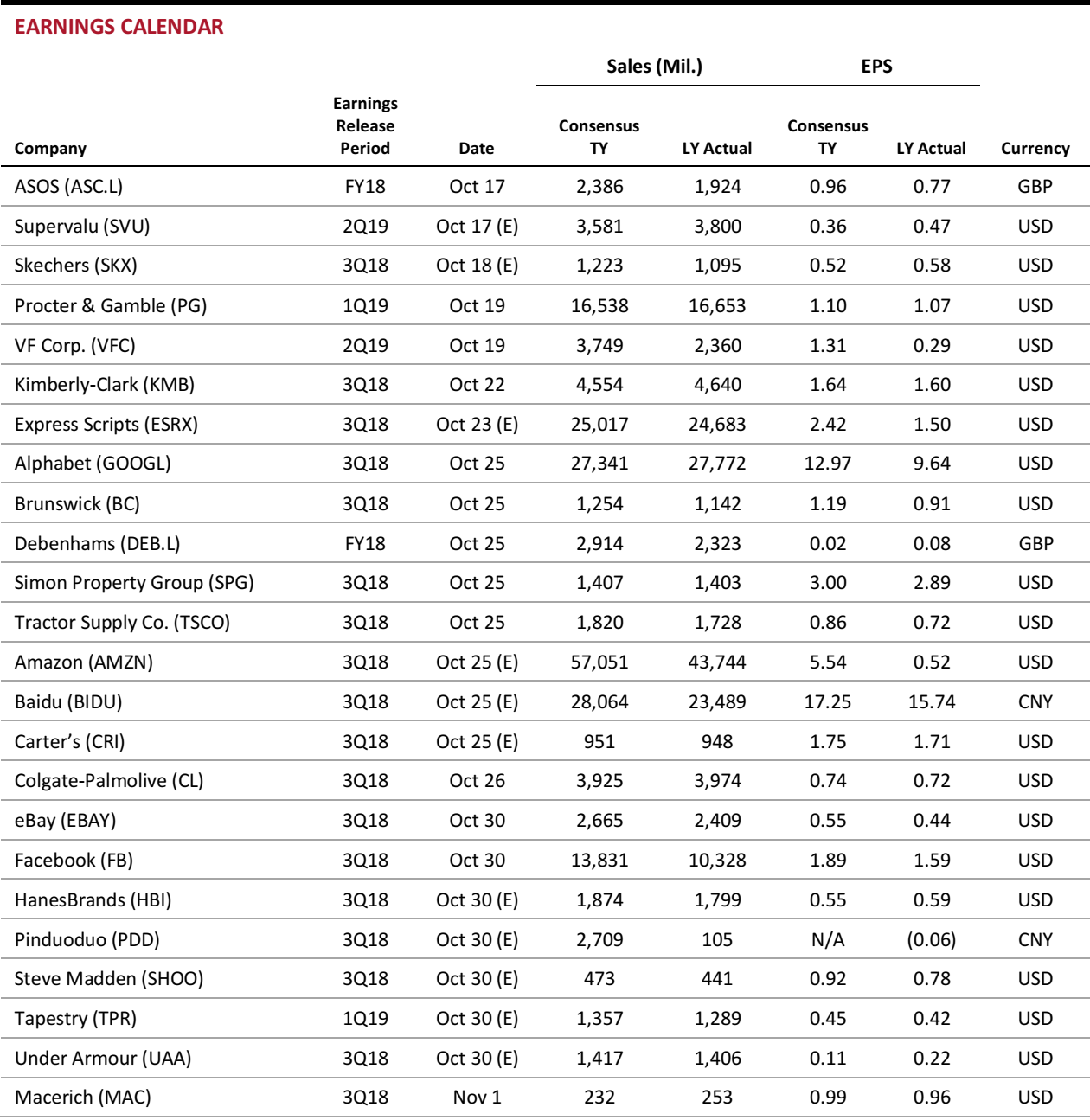

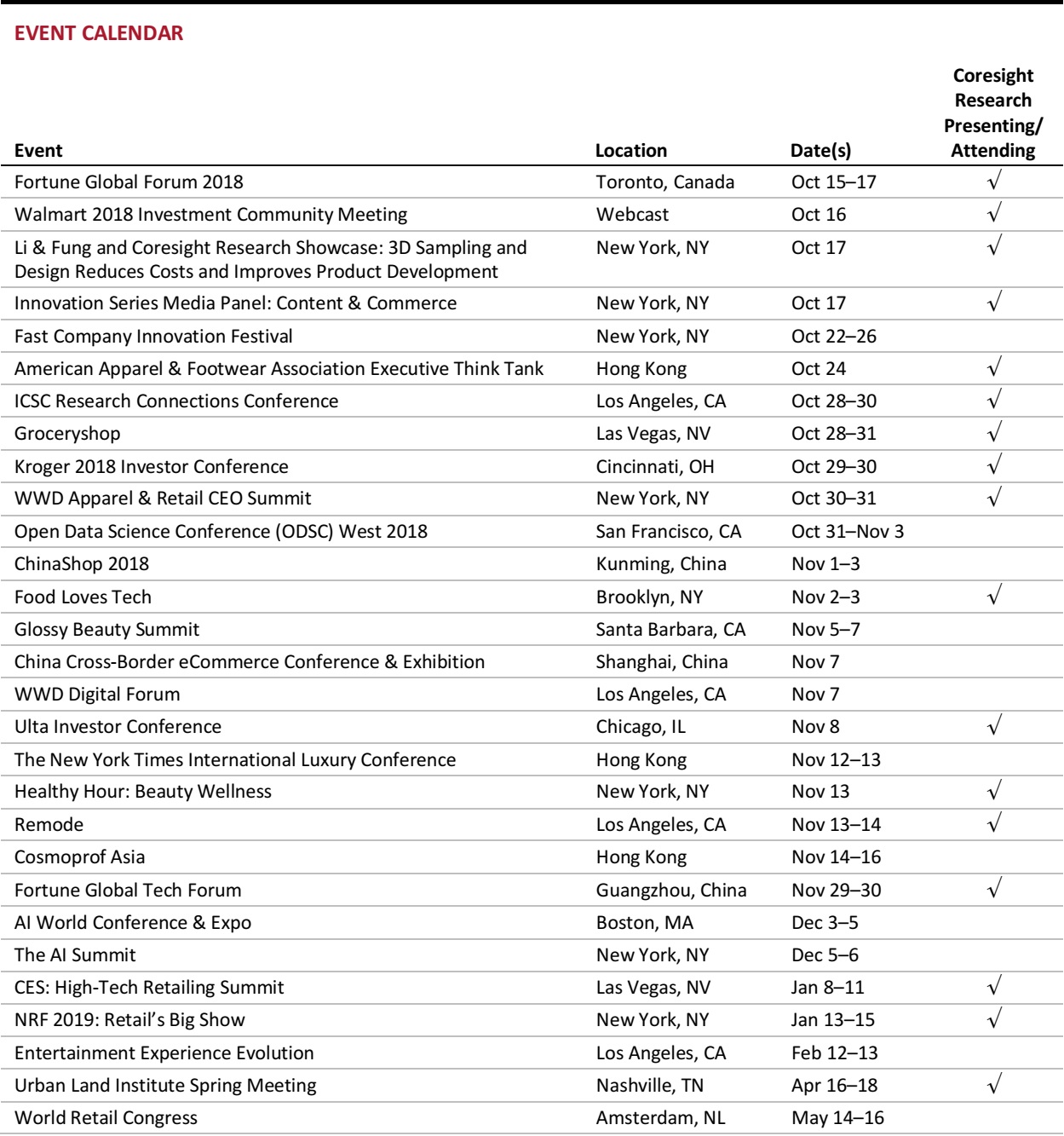

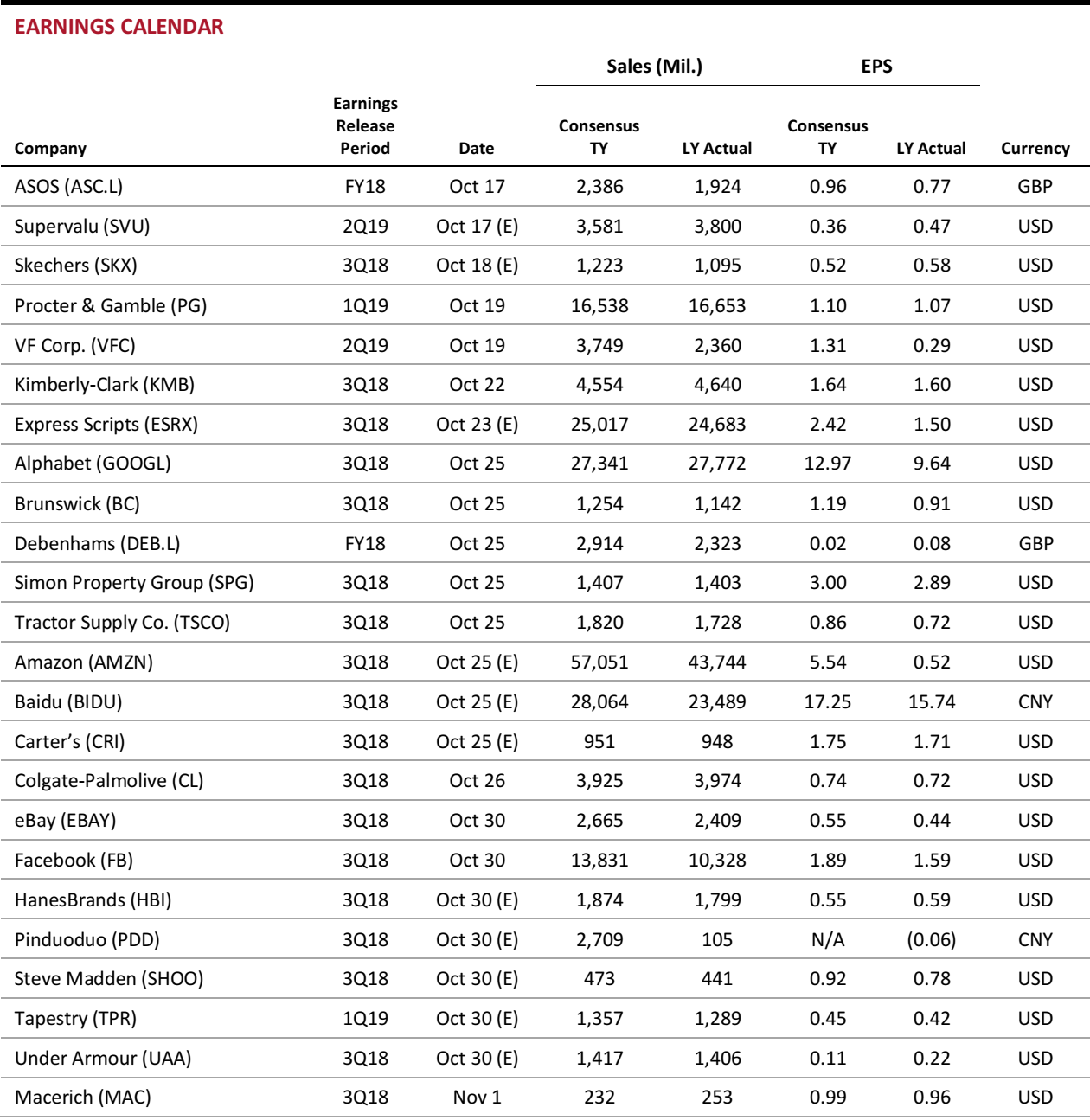

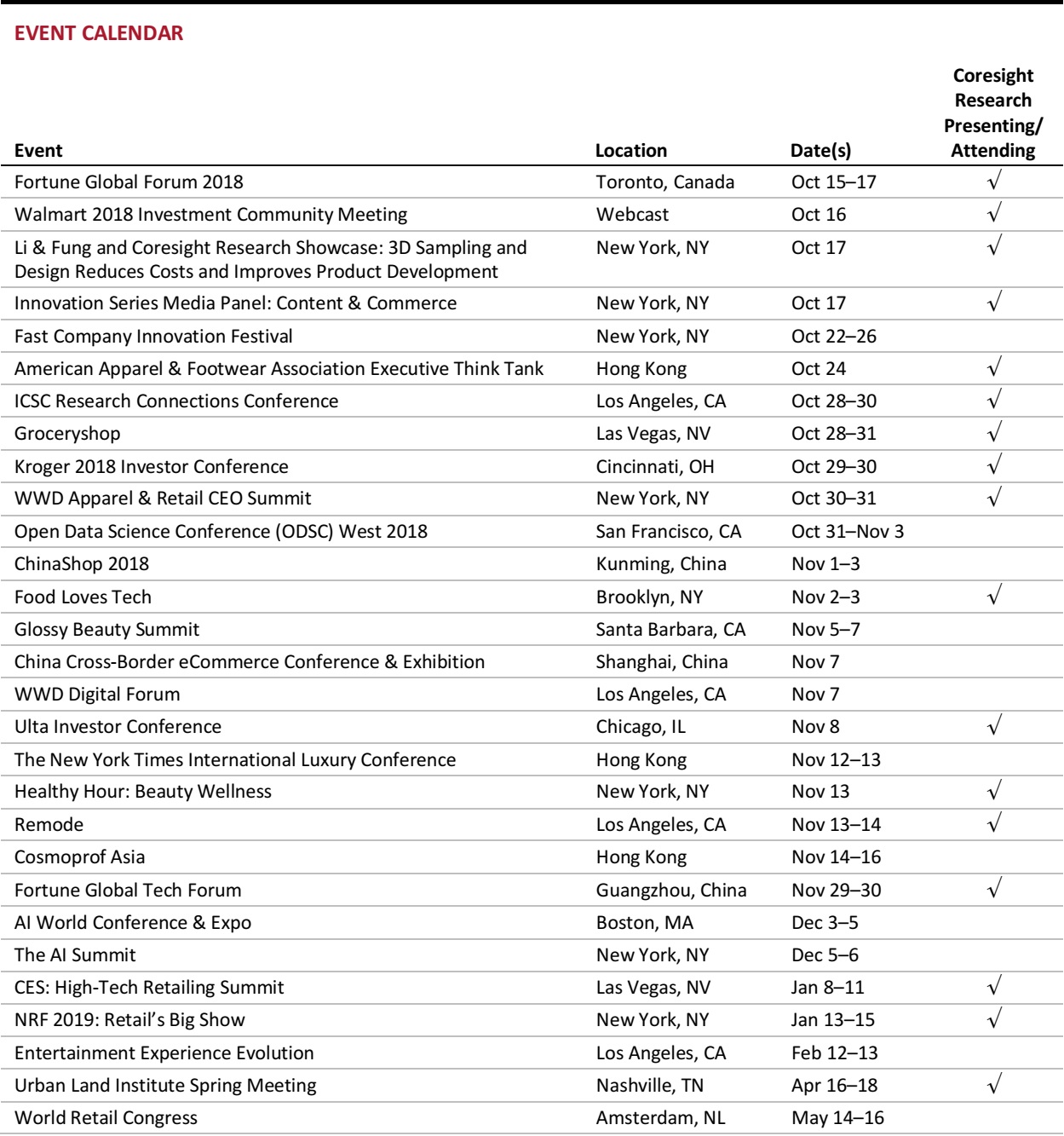

US RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Here’s How Target Plans to Beat Amazon and Walmart in the Shipping Wars This Holiday Season

(October 4) CNBC.com

Here’s How Target Plans to Beat Amazon and Walmart in the Shipping Wars This Holiday Season

(October 4) CNBC.com

- Target has been busy upgrading its supply chain, and this holiday season marks its biggest test yet. Early last year, the retailer said it would pour $7 billion into investments to turn around its business over the next three years.

- There’s a huge opportunity for Target as it competes with rivals like Walmart and Amazon this holiday season. Target’s convenient new options, such as free two-day shipping, curbside pickup and same-day delivery in major metro areas, may make the difference in where a shopper goes to stock up on holiday treats and gifts.

Retailers Rush to Fill Holiday Hole Left by Toys“R”Us

(October 7) WSJ.com

Retailers Rush to Fill Holiday Hole Left by Toys“R”Us

(October 7) WSJ.com

- The collapse of Toys“R”Us has its rivals fighting over billions of dollars in holiday toy sales now up for grabs, and is also likely to make it harder for last-minute shoppers to get their hands on some of the year’s hottest items.

- Walmart, Target and other chains are setting aside more floor space for toys in hundreds of stores. Even Amazon.com is planning to distribute toy catalogs to shoppers visiting its Whole Foods stores, according to toy manufacturers.

US Retail Vacancies Flat at 10.2% in Third Quarter – Reis

(October 2) Reuters.com

US Retail Vacancies Flat at 10.2% in Third Quarter – Reis

(October 2) Reuters.com

- US retail vacancies remained flat at 10.2% in the third quarter, while a number of Sears Holdings and Bon-Ton store closures boosted mall vacancy rates, according to a report from real estate research firm Reis. The mall vacancy rate jumped to 9.1% in the third quarter from 8.3% a year earlier.

- The jump in vacancy does not account for a number of owner-occupied Sears and Bon-Ton stores that also closed. Only 28 of 77 metro areas saw an increase in vacancy in the quarter, according to the report.

Tis the Season…for Holiday Returns

Tis the Season…for Holiday Returns

(October 9) RetailDive.com

- This holiday season is going to bring higher return rates, as more consumers than ever are expected to shop online (e-commerce return rates are double that of brick-and-mortar). Around 13%—or close to $90 billion worth of merchandise—will be heading back to US retailers this holiday season once purchased/gifted/unwrapped.

- A recovery-generating secondary-market solution can enable retailers to eliminate their dependence on a few middlemen or liquidators and set up a dynamic that enables many buyers to push prices up rather than having to negotiate them down.

The Fountains of Retail Sales

(October 8) ChainStoreAge.com

The Fountains of Retail Sales

(October 8) ChainStoreAge.com

- Shopping center owners are working hard to set their centers apart and drive sales with restaurants, entertainment venues and public parks. One effective way to do this is to incorporate thoughtfully designed water features, whether a single large-scale fountain or an interactive show set to lights and music.

- Retailers are willing to pay a premium for space in centers with water entertainment features, as they provide a natural focal point that draws guests in and increases foot traffic with lengths of stay. A study conducted by Macerich found that shoppers spent an average of $25 more per visit at centers with interactive water features.

EUROPE RETAIL & TECH HEADLINES

UK Retail Sales Growth Weakens in September; Nonfood Sales Disappoint

(October 9) BRC press release

UK Retail Sales Growth Weakens in September; Nonfood Sales Disappoint

(October 9) BRC press release

- UK retail sales grew by 0.7% year over year in September, registering their weakest growth since last October, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. The sales growth in September was below the three-month average of 1.2%. Comparable sales declined by 0.2% year over year.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended September, total food sales grew by 3.4% and total nonfood sales fell by 0.6%.

H&M Invests in Klarna to Enhance Omnichannel Payments Service

(October 8) TechCrunch.com

H&M Invests in Klarna to Enhance Omnichannel Payments Service

(October 8) TechCrunch.com

- Swedish fashion retailer H&M has invested $20 million in Klarna, a Swedish payments startup, to help enhance its payment options across its stores and online business. The first phase of the partnership will go live in 2019.

- H&M CEO Karl-Johan Persson said, “We are impressed with what Klarna has achieved to date and now we will work together to elevate the modern shopping experience.”

Lidl Announces the Launch of Pop-Up Webshop Lidl Simpl in Ghent

(October 8) ESMMagazine.com

Lidl Announces the Launch of Pop-Up Webshop Lidl Simpl in Ghent

(October 8) ESMMagazine.com

- German supermarket chain Lidl has announced the launch of a pop-up webshop in Ghent, Belgium. The service will allow customers to order fresh products online, including yogurt, vegetables, fish and meat.

- Cargo Velo, a bicycle courier service, will deliver the orders to customers’ homes. The project is currently running on trial until February 2019, and Lidl expects to extend the service to other Belgian cities.

Waitrose & Partners Launches Innovative Home Delivery Service

(October 5) ESMMagazine.com

Waitrose & Partners Launches Innovative Home Delivery Service

(October 5) ESMMagazine.com

- UK supermarket chain Waitrose & Partners has launched a new grocery home delivery service called “While You’re Away” that allows drivers to enter customers’ homes and put away groceries while the customers are away.

- Waitrose has partnered with lockmaker Yale to provide delivery drivers with access to buyers’ homes through smart locks that create temporary access codes. The whole delivery process is captured on video, on a “chest-cam” worn by the driver, and the video can be accessed by the customer, to guarantee peace of mind. The retailer will test the service with 100 customers in Coulsdon, South London, later this month.

French Connection Confirms Speculation that Business Could Be Sold

(October 8) TheRetailBulletin.com

French Connection Confirms Speculation that Business Could Be Sold

(October 8) TheRetailBulletin.com

- British fashion retailer French Connection stated that the company is considered to be in an offer period. The company issued the statement following press speculation that French Connection founder Stephen Marks is looking to offload his stake in the retailer.

- The company has appointed Numis Securities as its financial adviser and is reviewing all options, including a potential sale of the business, to deliver the optimal value to its shareholders.

ASIA RETAIL & TECH HEADLINES

Nike Launches House of Innovation in Shanghai

(October 4) EnduranceBusiness.com

Nike Launches House of Innovation in Shanghai

(October 4) EnduranceBusiness.com

- American sportswear retailer Nike has inaugurated its first House of Innovation concept store, in Shanghai. Called “Shanghai 001,” the store offers “a peek behind the curtain of Nike’s biggest innovation moments, matched with personalized and digitally connected shopping journeys.”

- Shanghai 001 is being positioned as the destination for Shanghai-only Nike products and offers customers city-exclusive items and collectibles that will not be available anywhere else.

JD Central Targets a 2020 Launch for Unstaffed Retail Shop in Thailand

(October 8) RetailNews.Asia

JD Central Targets a 2020 Launch for Unstaffed Retail Shop in Thailand

(October 8) RetailNews.Asia

- JD Central, the joint venture between Chinese e-commerce behemoth JD.com and Thailand’s Central Group, has announced its intention to open automated stores, starting with a trial run in 2019 in Bangkok before a 2020 launch.

- JD Central is assessing a location to test an unstaffed store format, according to Vincent Yang, JD Central’s CEO. Customers would enter the store and transact using facial recognition software.

Fave and Grab to Collaborate Across Southeast Asia

(October 8) InsideRetail.sg

Fave and Grab to Collaborate Across Southeast Asia

(October 8) InsideRetail.sg

- Singapore-headquartered O2O service provider Fave and ride-hailing platform Grab have announced a partnership in Southeast Asia that will marry the strengths of Fave’s broad merchant network and FaveDeals platform with Grab’s large user base and growing ecosystem.

- Fave and Grab, through their partnership, are looking to spur the growth of their food delivery and mobile wallet services in Singapore and Malaysia.

Fung Group Partners with French Fashion Retailer Ikks

(October 5) FashionUnited.in

Fung Group Partners with French Fashion Retailer Ikks

(October 5) FashionUnited.in

- French fashion retailer Ikks has marked its entry into Mainland China via a partnership with Fung Kids, a subsidiary of Hong Kong–headquartered conglomerate Fung Group.

- Ikks has opened four stores in Shanghai and Beijing that focus on the brand’s new childrenswear line. The retailer plans to open more stores on both the mainland and in Hong Kong prior to a wider Asian expansion.

Flipkart and Amazon Sale Season Creating Significant Employment in India

(October 8) LiveMint.com

Flipkart and Amazon Sale Season Creating Significant Employment in India

(October 8) LiveMint.com

- E-commerce giants Amazon and Flipkart are generating a significant number of jobs in India in order to cope with the annual sale season. A reported 80,000 people have already been hired directly by the two companies.

- Flipkart’s Big Billion Days sale and Amazon’s Great Indian Festival sale begin October 10. While Flipkart’s sale will continue until October 14, Amazon’s will run a day longer.

LATAM RETAIL & TECH HEADLINES

MercadoLibre Remains the Best Performer in Brazilian E-Commerce

(October 5) ZDNet.com

MercadoLibre Remains the Best Performer in Brazilian E-Commerce

(October 5) ZDNet.com

- MercadoLibre, an Argentine e-commerce company, leads the e-commerce market in Brazil, according to new consumer research by news site Mobile Time and polling firm Opinion Box.

- MercadoLibre was chosen by 37% of survey respondents as their preferred e-commerce destination, surpassing Americanas.com, which was chosen by 32% of respondents.

Argentina Supermarket Sales Down in September

(October 8) America-Retail.com

Argentina Supermarket Sales Down in September

(October 8) America-Retail.com

- Supermarket sales in Argentina fell by 5%–6% year over year in September. The sales slump was reportedly triggered by falling consumer purchasing power and increased prices.

- Sales declined across all product categories, with food and cleaning products registering the largest declines.

Tencent Invests in Brazilian Digital Payments Company Nubank

(October 8) Reuters.com

Tencent Invests in Brazilian Digital Payments Company Nubank

(October 8) Reuters.com

- Tencent announced an investment of $180 million for a minority stake in Nubank, a Brazilian credit card operator and digital payments company. This marks Tencent’s first investment in the Brazilian market.

- Tencent President Martin Lau said that the investment is aimed at helping Nubank “build a full-service personal finance platform.”

Bird to Launch E-Scooter Rentals in Mexico and Brazil

(October 5) Verge.com

Bird to Launch E-Scooter Rentals in Mexico and Brazil

(October 5) Verge.com

- Electric scooter rental service Bird announced that it will launch e-scooters in Mexico, followed by Brazil. Bird will initially launch 100 scooters in Mexico City.

- The e-scooter rentals will be available through a mobile application and users will be charged a threshold fee of $1 per ride and an additional $0.15 per minute.

Correios Scales Up Investment in Tech Infrastructure

(October 3) ZDNet.com

Correios Scales Up Investment in Tech Infrastructure

(October 3) ZDNet.com

- Brazilian state–owned postal services operator Correios announced plans to invest $51 million annually in tech infrastructure to improve its brand recognition by e-commerce companies.

- Correios aims to develop an RFID tagging system in collaboration with the Center of Excellence in Advanced Electronic Technology (CEITEC), an organization under the Ministry of Science, Technology and Innovation. It also plans to install 50 sorting machines to automate the parcel-handling process.

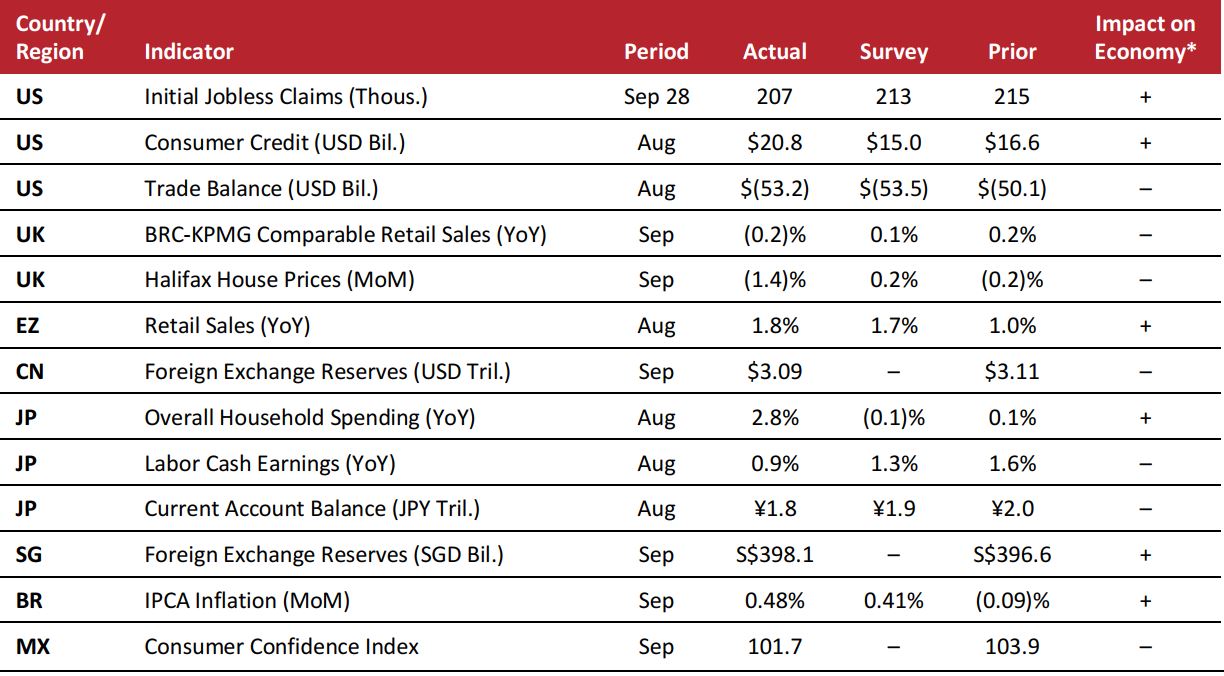

MACRO UPDATE

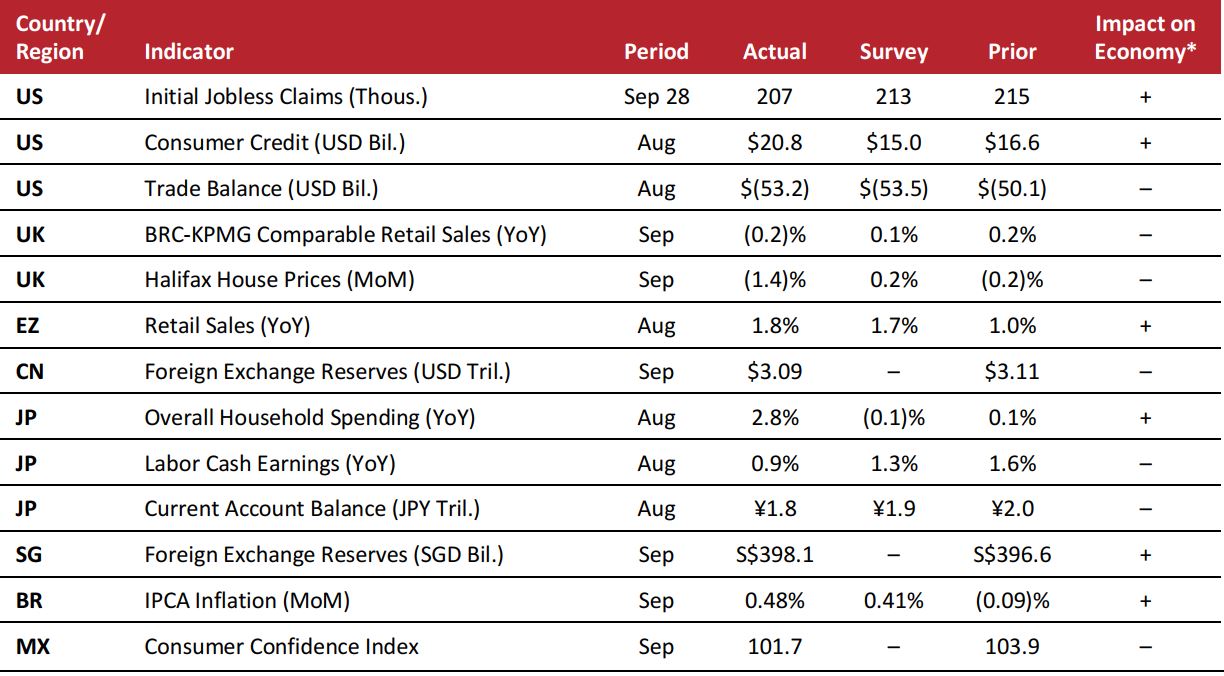

Key points from global macro indicators released October 3–9, 2018:

1) US: In the week ended September 28, initial jobless claims fell to 207,000, which was far below the consensus estimate of 213,000. Consumer credit rose by $20.8 billion in August, well above analysts’ expectations of $15 billion.

2) Europe: In the UK, comparable retail sales declined by 0.2% year over year in September, much below the 0.2% growth seen in August, according to the British Retail Consortium-KPMG Retail Sales Monitor. In the eurozone, retail sales grew by 1.8% year over year in August, compared with a 1.0% increase in July.

3) Asia-Pacific: In China, foreign exchange reserves totaled $3.09 trillion in September, slightly below August’s $3.11 trillion. In Japan, overall household spending grew by 2.8% year over year in August, beating the consensus estimate of a 0.1% decrease.

4) Latin America: Brazil’s IPCA inflation indicator rose by 0.48% in September, compared with a 0.09% decrease the previous month. In Mexico, the Consumer Confidence Index fell to 101.7 in September from 103.9 in August.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Department of Labor/Board of Governors of the Federal Reserve/US Bureau of Economic Analysis/British Retail Consortium-KPMG/Halifax UK/China State Administration of Foreign Exchange/Japan Ministry of Internal Affairs and Communications/Japan Ministry of Health, Labour and Welfare/Ministry of Finance Singapore/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Department of Labor/Board of Governors of the Federal Reserve/US Bureau of Economic Analysis/British Retail Consortium-KPMG/Halifax UK/China State Administration of Foreign Exchange/Japan Ministry of Internal Affairs and Communications/Japan Ministry of Health, Labour and Welfare/Ministry of Finance Singapore/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

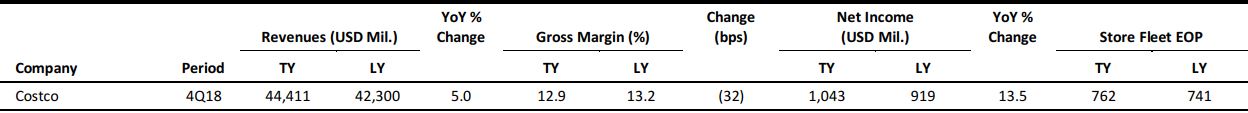

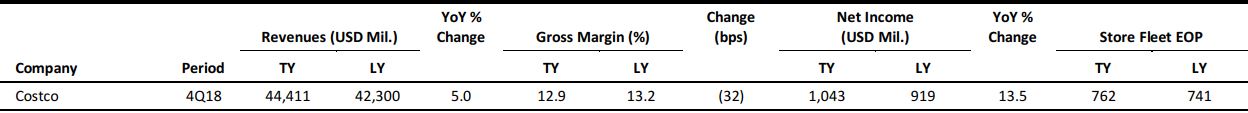

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Department of Labor/Board of Governors of the Federal Reserve/US Bureau of Economic Analysis/British Retail Consortium-KPMG/Halifax UK/China State Administration of Foreign Exchange/Japan Ministry of Internal Affairs and Communications/Japan Ministry of Health, Labour and Welfare/Ministry of Finance Singapore/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Department of Labor/Board of Governors of the Federal Reserve/US Bureau of Economic Analysis/British Retail Consortium-KPMG/Halifax UK/China State Administration of Foreign Exchange/Japan Ministry of Internal Affairs and Communications/Japan Ministry of Health, Labour and Welfare/Ministry of Finance Singapore/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research