Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

Private Label’s Disruption of CPG Prompting Shift to Direct-to-Consumer Sales

Private-label products span a broad variety of categories, ranging from food and household goods to health and beauty products. US private-label CPG sales have accelerated in recent years, increasing from a growth rate of 2.2% in 2015 to 5.8% in 2018, according to IRI. Moreover, US private-label CPG sales by value grew four times faster annually than national brands, as of late 2018, according to IRI.

This higher growth rate of private labels has significant implications for CPG brands, which once had a more cooperative relationship with retailers: These historical partners may have now become competitors through launching their own private-label products.

Private-label CPG brands have generated a high degree of shopper loyalty. More than half (53%) of US shoppers visit a particular retailer specifically to buy its own brands, according to private brand development company Daymon. In addition, 85% of shoppers trust private brands as much as national brands, and 81% purchase them on nearly every shopping trip.

Costco and Kroger have built strong CPG private-label brands. Costco’s Kirkland Signature contributed a significant share of corporate sales in 2018, accounting for 27.5% of total sales, according to company reports. Kroger’s private-label brands accounted for 26.6% of sales by value in the third quarter of 2018.

Kroger, Target and Walmart have also recently launched CPG private-label brands in various new categories:

Target To Power Toys “R” Us’s Online Business

(October 8) Company press release

Target To Power Toys “R” Us’s Online Business

(October 8) Company press release

Walmart Brings One Drop’s Smart Glucose Meter to Stores Nationwide

(October 8) Company press release

Walmart Brings One Drop’s Smart Glucose Meter to Stores Nationwide

(October 8) Company press release

Shiseido Acquires Drunk Elephant

(October 8) WWD.com

Shiseido Acquires Drunk Elephant

(October 8) WWD.com

Adidas To Sell Shoes via Snapchat

(October 7) EnGadget.com

Adidas To Sell Shoes via Snapchat

(October 7) EnGadget.com

Urban Outfitters Teams Up with Myro

(October 7) FashionUnited.com

Urban Outfitters Teams Up with Myro

(October 7) FashionUnited.com

Farfetch Partners with Thrift+

(October 9) ESMMagazine.com

Farfetch Partners with Thrift+

(October 9) ESMMagazine.com

Puma and Karl Lagerfeld To Continue Partnership this Fall

(October 9) RetailGazette.co.uk

Puma and Karl Lagerfeld To Continue Partnership this Fall

(October 9) RetailGazette.co.uk

Made.com Appoints New COO

(October 8) RetailGazette.co.uk

Made.com Appoints New COO

(October 8) RetailGazette.co.uk

Mellby Gård Completed its Public Cash Offer to the Shareholders of KappAhl

(October 7) Company press release

Mellby Gård Completed its Public Cash Offer to the Shareholders of KappAhl

(October 7) Company press release

British Retailers Witness the Worst September on Record

(October 7) BRC.org.uk

British Retailers Witness the Worst September on Record

(October 7) BRC.org.uk

Miniso Opens Its First $2 Format Store in Singapore

(October 9) InsideRetail.Asia

Miniso Opens Its First $2 Format Store in Singapore

(October 9) InsideRetail.Asia

Amazon and Flipkart Record $3 Billion GMV during Shopping Festival in India

(October 8) Ndtv.com

Amazon and Flipkart Record $3 Billion GMV during Shopping Festival in India

(October 8) Ndtv.com

Amazon Expands Its Product Offering in Singapore

(October 8) TechInAsia

Amazon Expands Its Product Offering in Singapore

(October 8) TechInAsia

Chemist Warehouse Extends Partnership with Tmall

(October 8) Alizila.com

Chemist Warehouse Extends Partnership with Tmall

(October 8) Alizila.com

FamilyMart To Open Its Largest Store, in the Philippines

(October 8) InsideRetail.Asia

FamilyMart To Open Its Largest Store, in the Philippines

(October 8) InsideRetail.Asia

H&M To Launch Festive Collection Across Its Indian Stores

(October 7) Livemint.com

H&M To Launch Festive Collection Across Its Indian Stores

(October 7) Livemint.com

Carter’s Opens Third Store in Argentina

(October 9) FashionNetwork.com

Carter’s Opens Third Store in Argentina

(October 9) FashionNetwork.com

Vivara Sets Its IPO Share Price at R$24

(October 9) Reuters.com

Vivara Sets Its IPO Share Price at R$24

(October 9) Reuters.com

Umbro License Extended in Brazil, Argentina and Paraguay

(October 8) FootwearNews.com

Umbro License Extended in Brazil, Argentina and Paraguay

(October 8) FootwearNews.com

Privalia Celebrates 10 Years in the Brazilian Market

(October 8) FashionNetwork.com

Privalia Celebrates 10 Years in the Brazilian Market

(October 8) FashionNetwork.com

C&A Modas To Raise Up to $540 Million in Brazil IPO

(October 7) Reuters.com

C&A Modas To Raise Up to $540 Million in Brazil IPO

(October 7) Reuters.com

Prada Opens Pop-Up Store in Guadalajara, Mexico

(October 7) America-Retail.com

Prada Opens Pop-Up Store in Guadalajara, Mexico

(October 7) America-Retail.com

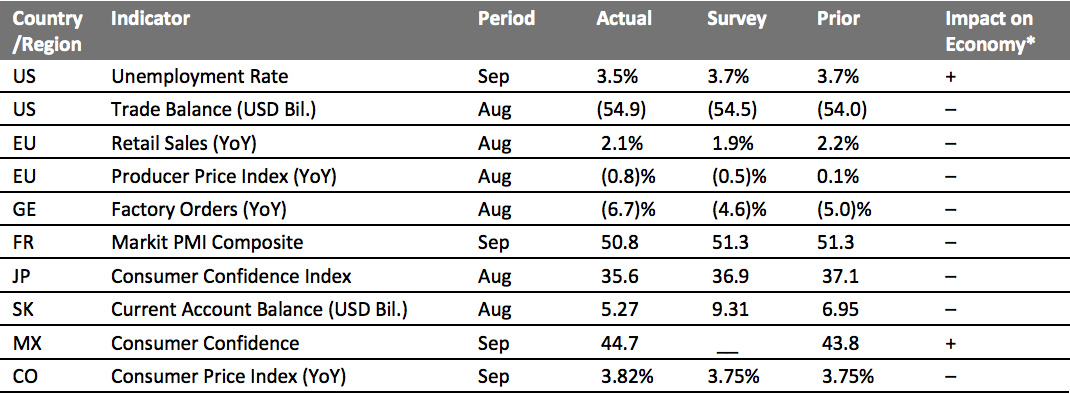

* Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

* Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Bureau of Economic Analysis/Eurostat/Destatis/Markit Economics/Japan Cabinet Office/Bank of Korea/INEGI/DANE/Coresight Research[/caption] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

- Kroger launched a private-label men’s shaving and grooming line called Bromley’s For Men in July 2018, which offers premium razors and blades, shaving accessories and skincare.

- Target launched a low-priced personal care private-label brand called Smartly in October 2018 and launched a food and beverage brand called Good & Gather in September 2019.

- Walmart launched a private-label skincare line called Earth to Skin in August 2019, which includes toners, face cleansers, serums, day creams, eye creams and night creams.

US RETAIL & TECH HEADLINES

Target To Power Toys “R” Us’s Online Business

(October 8) Company press release

Target To Power Toys “R” Us’s Online Business

(October 8) Company press release

- US-based retailer Target has partnered with Tru Kids, the parent company of Toys “R” Us, to power the online business of the toy retailer in the US ahead of the holiday season. The website was relaunched on Tuesday.

- The collaboration allows shoppers to browse toys on ToysRUs.com and complete their order by clicking “Buy Now at Target.com.” Customers can also benefit from free two-day delivery, same-day pickup or curbside service and same-day delivery with Shipt.

Walmart Brings One Drop’s Smart Glucose Meter to Stores Nationwide

(October 8) Company press release

Walmart Brings One Drop’s Smart Glucose Meter to Stores Nationwide

(October 8) Company press release

- Walmart has partnered with New York-based diabetes management platform One Drop to sell One Drop’s wireless glucose meter kit and supplies. The kit will be available at Walmart stores nationwide and Walmart.com.

- The kit includes a Bluetooth glucose meter, lancing device, carry case, test strips and lancets, along with one year of free access to 24/7 support from One Drop’s certified diabetes coaches. It also includes a mobile app and artificial intelligence-powered insights to provide affordable, effective care to as many people as possible.

Shiseido Acquires Drunk Elephant

(October 8) WWD.com

Shiseido Acquires Drunk Elephant

(October 8) WWD.com

- Japanese beauty group Shiseido has signed a deal to acquire Drunk Elephant, a well-known American “clean” skincare brand, for about $845 million. The acquisition will help Shiseido enter the lucrative clean-beauty market, which promises chemical-free and nontoxic skincare.

- As part of the agreement, Drunk Elephant will operate within Shiseido Americas. In addition, Tiffany Masterson, Founder and Chief Creative Officer of Drunk Elephant, will continue in her role and assume the additional role of President.

Adidas To Sell Shoes via Snapchat

(October 7) EnGadget.com

Adidas To Sell Shoes via Snapchat

(October 7) EnGadget.com

- German sportswear brand Adidas has teamed up with American tech company Snap to launch a product on its social media app Snapchat later this month. Adidas has created an 8-bit game called Baseball's Next Level on Snapchat in partnership with US-based digital agency AvatarLabs, where users can purchase the new 8-bit-themed Adizero or Icon V baseball cleats collection within the game.

- Customers can also play Baseball's Next Level at adidasbaseballsnextlevel.com and buy the exclusive baseball cleats directly from the Adidas website. Each cleat in the Adidas 8-bit collection is priced at $130.

Urban Outfitters Teams Up with Myro

(October 7) FashionUnited.com

Urban Outfitters Teams Up with Myro

(October 7) FashionUnited.com

- Urban Outfitters has partnered with deodorant company Myro to develop two vegan and gender-neutral deodorants, Deco and Punch, in refillable cases. The Deco case comes with a scented pod called Chill Wave, and the Punch variant comes with the Pillow Talk scent.

- The partnership comprises a starter kit costing $10, which includes a refillable case and a scented deodorant pod. The two products will be exclusively available through the retail channels of Urban Outfitters as well as Myro's e-commerce website.

EUROPE RETAIL AND TECH HEADLINES

Farfetch Partners with Thrift+

(October 9) ESMMagazine.com

Farfetch Partners with Thrift+

(October 9) ESMMagazine.com

- Farfetch has partnered with second-hand clothing platform Thrift+ to provide an alternative way for customers to donate unwanted items to charities by offering credits in return that customers can use to shop on the Farfetch website. Consumers can book a free pick-up service or take a bag of unwanted clothes and accessories to a nearby drop-off point.

- Each item is photographed and posted for sale on the Thrift+ website. One third of the proceeds of the sale is given to the customer in the form of Farfetch credits, another third is donated to their preferred charity and the final third goes to Thrift+ to cover costs.

Puma and Karl Lagerfeld To Continue Partnership this Fall

(October 9) RetailGazette.co.uk

Puma and Karl Lagerfeld To Continue Partnership this Fall

(October 9) RetailGazette.co.uk

- German sportswear brand Puma and fashion brand Karl Lagerfeld have agreed to continue their partnership this fall, following the success of their first partnership last year.

- The partnership will offer ready-to-wear footwear and accessories collections for both men and women. The designs will be available both the brands’ websites starting October 10 and in the brands' respective stores and a few other retailers starting October 12.

- Online furniture retailer Made.com has appointed Nicola Thompson as the Chief Operating Officer, which is a new role in the company. She will be responsible for the operations of merchandising, distribution and supply chain, customer service and customer experience functions.

- Thompson has represented ASOS for the past five years, where she was the Global Customer Development Director, responsible for driving the design and implementation of its global commercial strategy.

Mellby Gård Completed its Public Cash Offer to the Shareholders of KappAhl

(October 7) Company press release

Mellby Gård Completed its Public Cash Offer to the Shareholders of KappAhl

(October 7) Company press release

- Investment firm Mellby Gård Holding has announced the completion of the public cash offer made to the shareholders of Swedish apparel retailer KappAhl on July 29, 2019. Mellby Gård offered a price of SEK 20 ($2) per share, which will not be increased.

- The price offered for the KappAhl shares represents a premium of 43% compared to the closing price on Nasdaq Stockholm on July 26, 2019. Mellby Gård will own over 90% shares in KappAhl, after acceptance of the offer.

- UK retail sales fell 1.3% year over year in September, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales decreased 1.7%. The BRC noted that this is the lowest figure for a September, with the fear of a possible no-deal Brexit weighing on customer purchasing decisions.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended September, total food sales grew 1.2% and total nonfood sales were down 1.7%.

ASIA RETAIL AND TECH HEADLINES

- Chinese low-cost retailer Miniso has debuted its $2 store format at its new outlet in the Harbour Front Center shopping mall in Singapore.

- The new format store offers a range of household supplies such as electrical appliances, home appliances and toys, all priced at $2 each.

Amazon and Flipkart Record $3 Billion GMV during Shopping Festival in India

(October 8) Ndtv.com

Amazon and Flipkart Record $3 Billion GMV during Shopping Festival in India

(October 8) Ndtv.com

- Indian e-commerce companies Flipkart and Amazon.in realized a record INR 1,900 billion ($3 billion) of gross merchandise volume (GMV) during their six-day shopping festivals held between September 29 and October 4, according to consulting firm RedSeer.

- Although Flipkart lead the festive sales with 60%-62% GMV, Amazon’s year-over-year GMV growth came in at 22%.

- Amazon has expanded its product offering in Singapore with the launch of Amazon.sg. Previously, customers in Singapore could buy from Amazon only through its Prime app, which had a smaller variety of products.

- Amazon.sg will allow local small and medium-sized businesses to list their products on the site. It will also offer a better selection of international brands along with fast and reliable delivery.

- Australian pharmacy retailer Chemist Warehouse, which launched on Tmall Global in 2015, has extended its partnership with the e-commerce platform for another two years.

- The company also plans to launch a store at Alibaba’s e-commerce platform Lazada to reach customers in Singapore and Malaysia.

- Japanese convenience store FamilyMart will launch its largest store globally in Manila, Philippines. The 4,305 square feet store will be located at the ground floor of the Udenna Towers in Bonifacio Global City.

- GM of FamilyMart Philippines, Bernard Suiza, said, “This is the pivot to food that we are embarking on here in the Philippines—going back to the essence of what konbini is, which is hearty, home-cooked meals.”

- H&M will launch an Indian festive collection at its stores across the country for the first time.

- The new collection—designed by the global team in collaboration with the Indian team—will offer locally inspired Western wear like paisley prints and bright sequined jackets.

LATIN AMERICA RETAIL AND TECH HEADLINES

- US apparel company Carter’s has opened its third store in Argentina at the Alto Rosario shopping center in Sante Fe. Carter's opened its first store in the country in June 2019 in Córdoba and subsequently opened a second store in La Plata in August 2019.

- Carter’s plans to open its next store at Buenos Aires. The company aims to reach seven stores in the Argentine market by 2020.

- Brazilian jewelry retailer Vivara has priced its initial public offering at R$24 ($5.9) per share. The share price was within the range set by the banks advising the company, which was R$21.17 ($5.2) to R$25.40 ($6.2).

- Vivara and its shareholders raised $2.3 billion ($561.7 million) in the IPO. The investment banking units of Itau Unibanco Holding SA, Bank of America, XP Investimentos and JPMorgan Chase & Co managed the offering.

Umbro License Extended in Brazil, Argentina and Paraguay

(October 8) FootwearNews.com

Umbro License Extended in Brazil, Argentina and Paraguay

(October 8) FootwearNews.com

- US brand management company Iconix Brand Group has extended the partnership of UK-based sportswear company Umbro with Latin American sports manufacturing and marketing company Grupo Dass for the next 10 years.

- Under the agreement, Grupo Dass will continue to be the licensed manufacturer and distributer of Umbro’s apparel, footwear and sports equipment in Brazil, Argentina and Paraguay.

- Spanish online fashion retailer Privalia opened a pop-up store in Sao Paulo, operational from October 10 to 13, to celebrate 10 years of its presence in the Brazilian market.

- Many exclusive items, not available on the website and app, have been made available at the pop-up store. Discounts of up to 90% will be running throughout the four-day event along with special performances from musicians and other guests.

- C&A Modas, the Brazilian unit of Dutch fashion retailer C&A, plans to raise up to R$2.2 billion ($542 million) in an initial public offering in Brazil.

- The funds raised will be used to pay back R$775.2 million ($188.9 million) of intercompany loans and to expand the business.

- Italian luxury fashion company Prada has opened a pop-up store inside the El Palacio de Hierro department store at the Andares shopping center in Guadalajara, Mexico.

- The pop-up store offers items from Prada’s bag collections Galleria, Diagramme, Vela and Monochrome, among other products. The store will be operational until January 8, 2020.

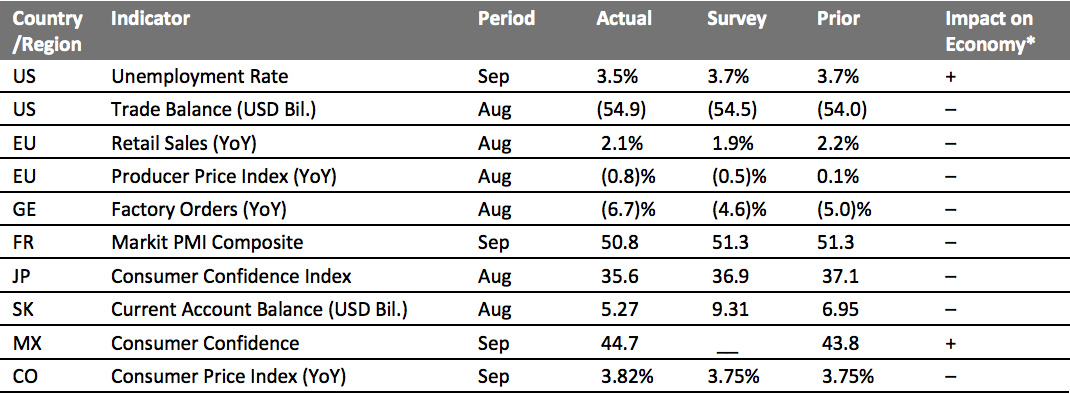

MACRO UPDATE

Key points from global macro indicators released October 2–8, 2019:- US: The unemployment rate was 3.5% in September, marginally lower than the 3.7% in August and below the consensus estimate of 3.7%. Trade deficit was recorded at $54.9 billion in August, widening from the $54 billion deficit in July.

- Europe: In the eurozone, retail sales increased 2.1% year over year in August, slightly lower than the 2.2% increase in July. In Germany, factory orders decreased 6.7% year over year in August, versus the 5% decrease in July.

- Asia: In Japan, the consumer confidence index came in at 35.6 in August, slightly lower than 37.1 in July and below the consensus estimate of 36.9. In South Korea, the current account surplus came in at $5.27 billion.

- Latin America: Mexico’s consumer confidence came in at 44.7 in September, an improvement over 43.8 in the previous month. In Colombia, the consumer price index increased 3.82% year over year in September, versus a 3.75% increase in August and ahead of the consensus estimate of 3.75%.

* Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

* Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Bureau of Labor Statistics/US Bureau of Economic Analysis/Eurostat/Destatis/Markit Economics/Japan Cabinet Office/Bank of Korea/INEGI/DANE/Coresight Research[/caption]

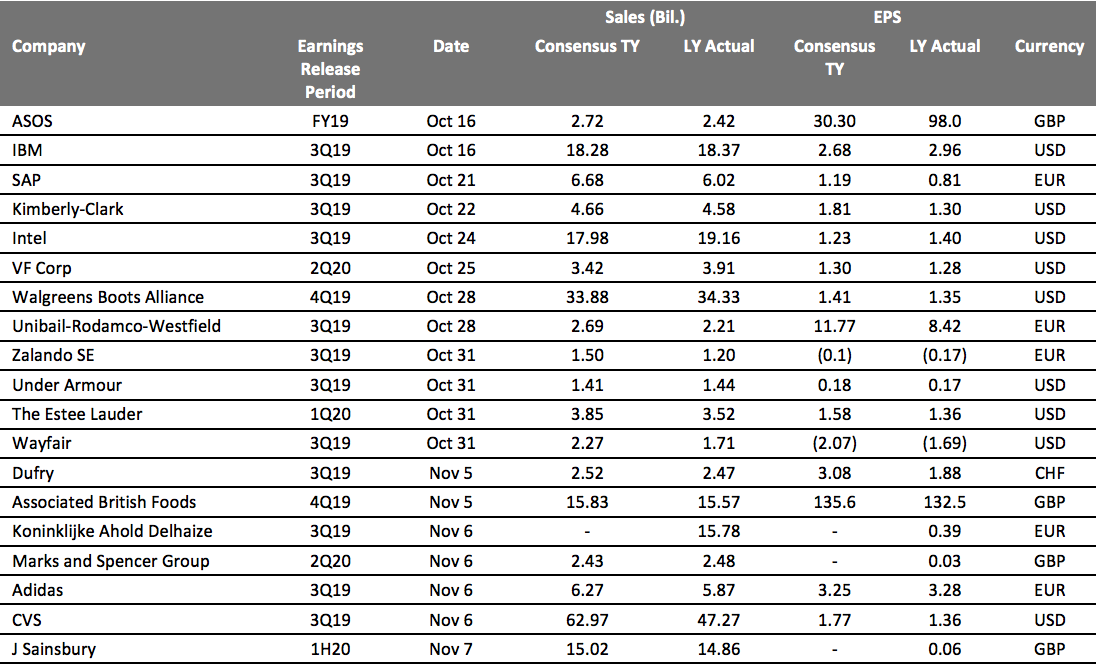

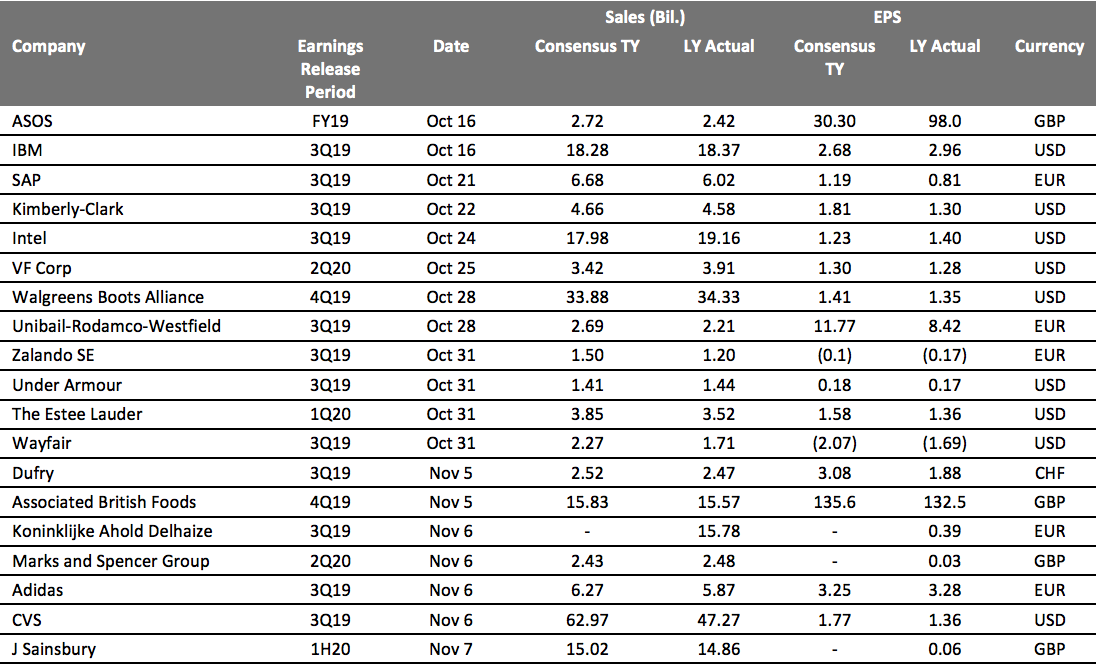

EARNINGS CALENDAR

[caption id="attachment_97884" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

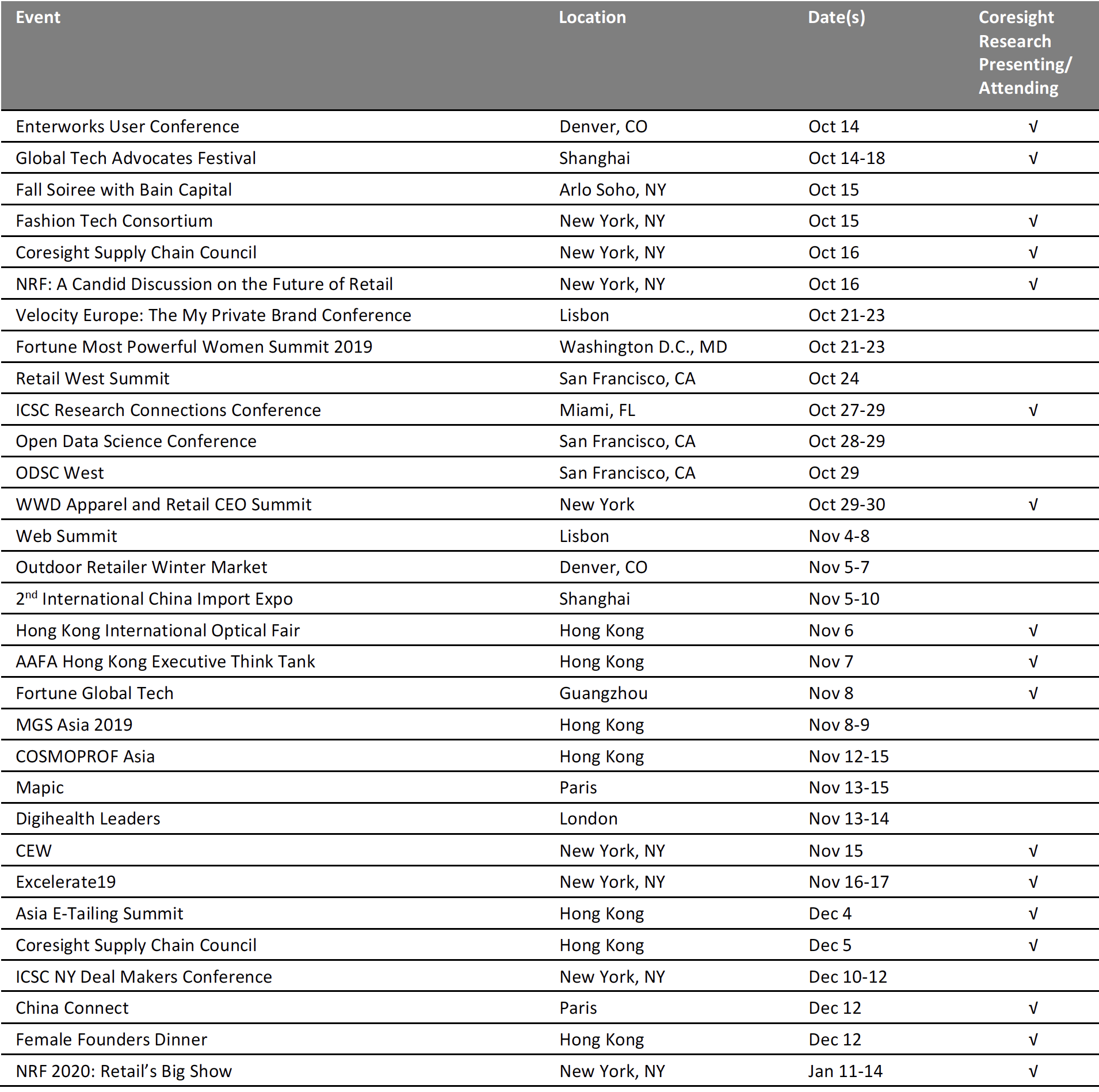

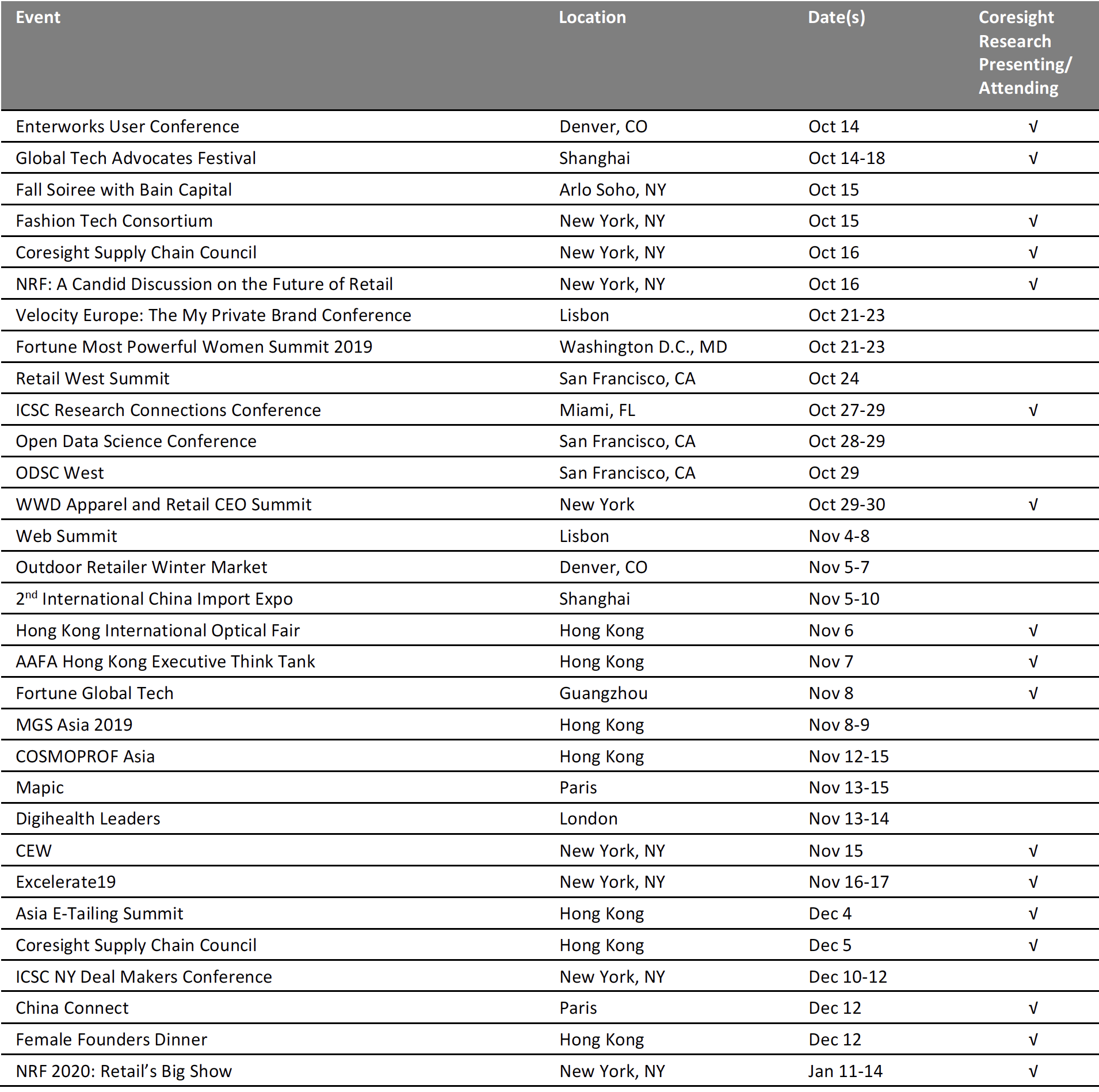

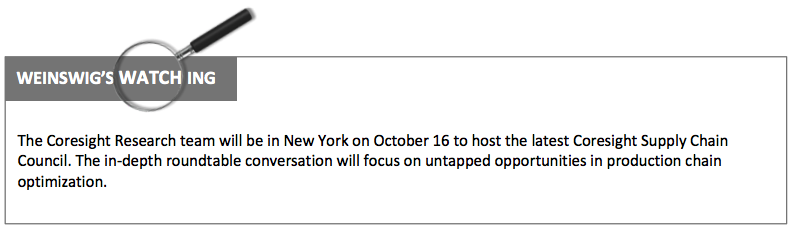

EVENT CALENDAR