albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Loyalty Programs Help Retailers Retain Customers and Drive Growth

Today’s abundance of choice is a boon for shoppers, but means retailers face bigger challenges in customer retention than ever before – and the costs are adding up. It costs five to 25 times more to acquire a new customer than to retain an existing one, according to A.T. Kearney. Loyal customers typically spend more and are more likely to promote the brand to occasional customers.

Retailers can gain a larger share of wallet and increase customer retention through well-designed loyalty programs. Global annual spend on loyalty management will total $75 billion by the end of 2019 and continue to grow at low-double-digit rates, according to data analytics company LoyaltyOne. The data loyalty programs deliver give companies customer insight that can enable more effective, personalized marketing and promotions.

There are two main types of retail loyalty programs: proprietary and coalition.

Proprietary programs leverage the company’s core business and seek to build a personal connection with customers. In these programs, retailers have full control of the program’s operation and marketing, in addition to full ownership of customer data, which enables them to create a consistent experience across channels and offer more personalized offers. These programs aim to create an emotional bond with consumers, who are likely to tell others. Examples of this type of loyalty program include Starbucks Rewards, Sephora Beauty Insiders, Family Mart’s membership and Ikea Family.

Coalition programs are consolidated platforms that serve several companies. Examples include frequent-flyer programs and cobranded credit cards. Consumers earn points they can exchange for a variety of rewards. These programs do not require a large investment, since they are not customized. But, companies have limited access to valuable consumer data, find it difficult to differentiate themselves from competitors and may not reap the same customer loyalty benefits. Examples of this type of program include Matas, Star Alliance and Upromise.

But programs elevate the customer experience only if implemented effectively. Here are some best practices:

- Recognition: Retailers should promote the loyalty program both offline and online, with program banners and signage highly visible in the store, and employees trained on the program. Retailers can attract new members by offering a signup bonus or instant reward, in addition to rewards for referrals.

- Registration: Program enrollment should be quick and easy, whether online or offline. Retailers should request only that information absolutely necessary (as requests to provide personal information can lead to abandonment) and inform consumers how they will use that information.

- Rewards and redemption: Retailers need to differentiate their program from competitors’ by offering rewards that resonate with the targeted audience. Program tiers and personalized offers make loyal customers feel more appreciated. Rewards should be reasonably attainable, and members should receive current account information such as a record of purchase history and rewards earned.

More retailers are offering paid membership programs, targeting customers who seek additional benefits. In the US, Amazon Prime members enjoy one-day shipping, Prime Video, Prime Music, Prime Wardrobe and discounts on other services. Alibaba’s Taobao launched 88 VIP to members who have an overall user score that is determined by purchases, interaction and credit rating.

Retailers increasingly seek to differentiate themselves and promote customer loyalty. A well-designed loyalty program can create value for retailers through increasing customer engagement, creating a deeper connection and enabling the collection of consumer data. Shoppers who feel valued are more likely to make return visits and promote the brand to others, creating a virtuous circle that drives loyalty and revenue.

Get more information from the Coresight Research report How Loyalty Programs Help Retailers To Retain Customers and Drive Growth.

US RETAIL & TECH HEADLINES

![]() Under Armour Appoints Patrik Frisk as CEO

Under Armour Appoints Patrik Frisk as CEO

(October 22) Company press release

- Sportswear retailer Under Armour has announced that President and COO Patrik Frisk will become company CEO, replacing Kevin Plank, effective January 1, 2020.

- Plank, founder of Under Armour, will become Executive Chairman and Brand Chief. He served as Chairman and CEO since he founded the company in 1996.

![]() Nike Appoints New CEO

Nike Appoints New CEO

(October 22) Company press release

- Nike has appointed John Donahoe as the company’s new President and CEO, replacing Mark Parker, effective January 13, 2020. Currently, Donahoe is Chairman of PayPal and also serves as President and CEO of cloud computing company ServiceNow.

- Parker, having served as Chairman, President and CEO of Nike since 2016, became Executive Chairman on October 22.

![]() COTY Seeks Sale of its Professional Beauty Division

COTY Seeks Sale of its Professional Beauty Division

(October 21) Company press release

- US beauty company COTY is seeking strategic options for the sale of its professional hair and nail products business. The brands up for sale include Wella, Clairol, Good Hair Day and OPI nail care products. COTY is also looking at selling its operations in Brazil as it shifts focus to its fragrance, cosmetics and skin care businesses.

- The proceeds from any future sale will be used to pay off debt and excess cash will be returned to shareholders. The company expects to complete the deals by summer 2020.

CVS Teams Up with UPS to Develop Drone Delivery Service for Prescription Drugs

CVS Teams Up with UPS to Develop Drone Delivery Service for Prescription Drugs

(October 21) Company press release

- US-based delivery service firm United Parcel Service (UPS) has signed an agreement with drugstore retailer CVS Health to establish a drone delivery service for prescription drugs. The initiative will include delivery of both prescription medications and over-the-counter products.

- On September 27, UPS received the first Federal Aviation Administration (FAA) approval to operate a drone delivery service. Also in September, rival Walgreens announced a trial of delivery of nonprescription products by drone.

![]() Destination Maternity Files for Bankruptcy

Destination Maternity Files for Bankruptcy

(October 21) CNBC.com

- US maternity wear retailer Destination Maternity filed for bankruptcy on October 21, saying in the filing it has $260 million in total assets and total debt amounting to $244 million.

- Destination Maternity is working with advisors at law firm Kirkland & Ellis and Berkeley Research Group to find a buyer to avoid liquidation.

![]() Ganni Opens First Stores in the US

Ganni Opens First Stores in the US

(October 21) FootwearNews.com

- Copenhagen-based fashion brand Ganni has opened two new stores in New York and Los Angeles. Previously, the brand was available to US shoppers through its own e-commerce site, as well as through retailers such as Net-a-Porter and Saks Fifth Avenue.

- Ganni inaugurated a 1,600-square-foot store in SoHo, New York on October 18 and an 1,800-square-foot store at West Hollywood in Los Angeles on October 25.

![]() Zilingo to Invest $100 Million to Boost US Operations

Zilingo to Invest $100 Million to Boost US Operations

(October 21) Retail-Insight-Network.com

- Singapore e-commerce platform Zilingo plans to invest $100 million in the US market to expand recently launched operations there. The company will use the money to recruit sales and product teams and to digitalize its apparel sourcing process.

- Earlier this year, Zilingo secured $226 million in a Series D financing round, taking the total funds raised by the company to $308 million.

EUROPE RETAIL AND TECH HEADLINES

![]() Groupe Casino Unveils Strategy to Boost Liquidity and Financial Structure

Groupe Casino Unveils Strategy to Boost Liquidity and Financial Structure

(October 22) Company press release

- French grocery and general-merchandise retailer Groupe Casino plans to expand its credit lines in France and raise new capital for a targeted amount of €1.5 billion ($1.7 billion) to refinance existing debt.

- Groupe Casino stated it aims to set up a new syndicated revolving credit facility, maturing in October 2023, for approximately €2 billion ($2.2 billion). Groupe Casino announced that it has already received commitments from 14 French and international banks for over €1.6 billion ($1.8 billion), subject to the customary conditions.

![]() DESPAR Italia Partners with Gruppo 3A

DESPAR Italia Partners with Gruppo 3A

(October 22) Company press release

- Discount retailer DESPAR Italia has partnered with Italian food retailer Gruppo 3A to expand operations in the Piedmont, Liguria and Valle d'Aosta regions of north-west Italy.

- Effective January 2020, the partnership will see the transformation of Gruppo 3A stores to SPAR stores with the addition of more than 1,600 DESPAR owned brand products.

![]() Ahold Delhaize Appoints Natalie Knight as EVP Finance

Ahold Delhaize Appoints Natalie Knight as EVP Finance

(October 22) Company press release

- Dutch food retailer Ahold Delhaize has appointed Natalie Knight as EVP of Finance and member of the executive committee, effective March 1, 2020. Knight joins Ahold Delhaize from Denmark-based dairy company Arla Foods, where she most recently served as CFO.

- Knight is expected to be nominated by the board to succeed Jeff Carr as CFO and to join the management board during the annual general meeting in April 2020.

![]() Watt Brothers Collapses into Administration

Watt Brothers Collapses into Administration

(October 21) RetailGazetter.co.uk

- Scottish department store chain Watt Brothers has fallen into administration. It has appointed Blair Nimmo and Alistair McAlinden of KPMG as joint administrators to oversee the sale of the business.

- Watt Brothers currently operates 11 stores, and 229 out of 306 staff were made redundant with immediate effect. The retailer’s Glasgow flagship will remain open to run a stock clearance sale.

![]() Burberry Launches its First Video Game

Burberry Launches its First Video Game

(October 21) Company press release

- British luxury fashion house Burberry has launched an online game called B Bounce, the first time the luxury brand has offered a gaming experience on Burberry.com.

- In B Bounce, players control a small deer dressed in one of three of its new collection of puffer jackets. The game is available online or on a giant screen in Burberry’s London flagship store. Players in the UK, the US, Canada, China, Japan and Korea will also have the chance to win a puffer jacket from its new range.

ASIA RETAIL AND TECH HEADLINES

DFS Launches WeChat Facial Recognition Payment Outside China

DFS Launches WeChat Facial Recognition Payment Outside China

(October 23) InsideRetail.HK

- Hong Kong-based travel retailer DFS Group has become the first international retailer to offer WeChat facial-recognition payment outside mainland China. The Group trialed 10 WeChat facial-recognition devices at T Galleria by DFS in Macau, in September.

- DFS plans to enable its WeChat facial-recognition payment at the T Galleria Beauty by DFS in Hong Kong’s Causeway Bay.(Hong Kong and Macau are both Special Administrative Regions of China, with separate legal and financial systems).

![]() Geox Launches X Store Concept in Singapore

Geox Launches X Store Concept in Singapore

(October 22) Rli.uk.com

- Italian apparel and footwear brand Geox opened a new X Store concept in Singapore’s Paragon Shopping Centre. The new concept store combines various elements to showcase contemporary design, sustainability, technology and Italian quality.

- A feature of the store is a digital screen that shows customers product details, current trends and provides a detailed description of patents for each Geox product.

![]() Walmart’s CEO Writes to Indian Prime Minister

Walmart’s CEO Writes to Indian Prime Minister

(October 22) Inc42.com

- Walmart CEO Doug McMillon has written to Indian Prime Minister Narendra Modi asking for an open and stable regulatory system in India for global retailers. The letter states Walmart’s interest in creating jobs in India and sourcing products directly from Indian farmers.

- McMillon also requested the government ease licensing rules and the number of permits required to set up shop in India. He also acknowledged the government concerns about data privacy for Indian citizens.

![]() Alibaba Launches Its 11.11 Global Shopping Festival for 2019

Alibaba Launches Its 11.11 Global Shopping Festival for 2019

(October 21) Alizila.com

- Alibaba marked the start of its 11.11 Global Shopping Festival on October 21 in Harbin, China. The sale event, which culminates on November 11, is expected to see over 200,000 brands participate offering about one million new products on discount.

- Alibaba stated that the focus of the 2019 11.11 Global Shopping Festival is on “new consumption and new business.” Alibaba will showcase products via livestreaming and plans to distribute digital discount vouchers worth over RMB 2 billion ($282 million).

![]() Steve Madden Opens Its First Malaysia Store

Steve Madden Opens Its First Malaysia Store

(October 21) InsideRetail.Asia

- Footwear and accessories brand Steve Madden has entered the Malaysian market with the launch of a store at the Mid Valley Megamall in Kuala Lampur, in partnership with South Asian retail group Valiram.

- The 1,410-square-foot store is designed with the brand’s new design concept called Distilled Urban, using a combination of wood, steel and concreate, and will offer the Steve Madden fall 2019 collection.

SPAR Expands in China

SPAR Expands in China

(October 21) Company press release

- Dutch retailer SPAR has announced plans to open two new stores in Shandong province and three in Guangdong in September and October 2019.

- The five new stores will bring the total number of SPAR supermarkets closer to its target of 400 stores in China.

LATIN AMERICA RETAIL AND TECH HEADLINES

Clèeo Studio Opens Online Store

Clèeo Studio Opens Online Store

(October 23) FashionNetwork.com

- Mexican apparel retailer Clèeo Studio has launched an e-commerce site in Mexico. The online store offers more than 40 brands from Mexico, Latin America, Spain and the US.

- There are 11 categories on the site: accessories, bodies, jackets and coats, sets, skirts, jumpsuits, pants, bags, tops, bathing suits and dresses.

![]() Speedo Launches E-Commerce in Colombia

Speedo Launches E-Commerce in Colombia

(October 22) FashionNetwork.com

- Swimwear brand Speedo launched an online platform in Colombia on October 18.

- Speedo has been in Colombia for over three decades, with 44 stores in 19 cities.

![]() Roberto Verino to Expand in the Mexican Market

Roberto Verino to Expand in the Mexican Market

(October 22) FashionNetwork.com

- Spanish fashion company Roberto Verino plans to open four new stores within the next few weeks in Mexico, bringing its total there to 25.

- The new stores will be in the Santa Fe shopping mall in Mexico City, Angelópolis shopping center in Puebla, Punto Valle de Monterrey shopping center in San Pedro Garza García and the Antara shopping center in Mexico City.

![]() Mercado Libre To Add Mass Consumption Category in Argentina

Mercado Libre To Add Mass Consumption Category in Argentina

(October 21) America-Retail.com

- Argentinian online marketplace Mercado Libre will add its “mass consumption” category to its platform in Argentina by early 2020. Mercado Libre’s first Argentinian storage center, which opened in February, will handle logistics for this category.

- The category, which launched in Mexico earlier this year, is a section that sells household, personal care, baby products, non-perishable foods and drinks, among other products.

![]() Under Armour Opens Third Store in Bolivia

Under Armour Opens Third Store in Bolivia

(October 21) FashionNetwork.com

- US sportswear brand Under Armour opened its third store in Bolivia at the Las Brisas shopping center on October 19. Under Armour invested about $150,000 in the new store.

- The company entered Bolivia in the first quarter of 2018 and operates there via a local partner, Fairplay Group.

MACRO ECONOMIC UPDATE

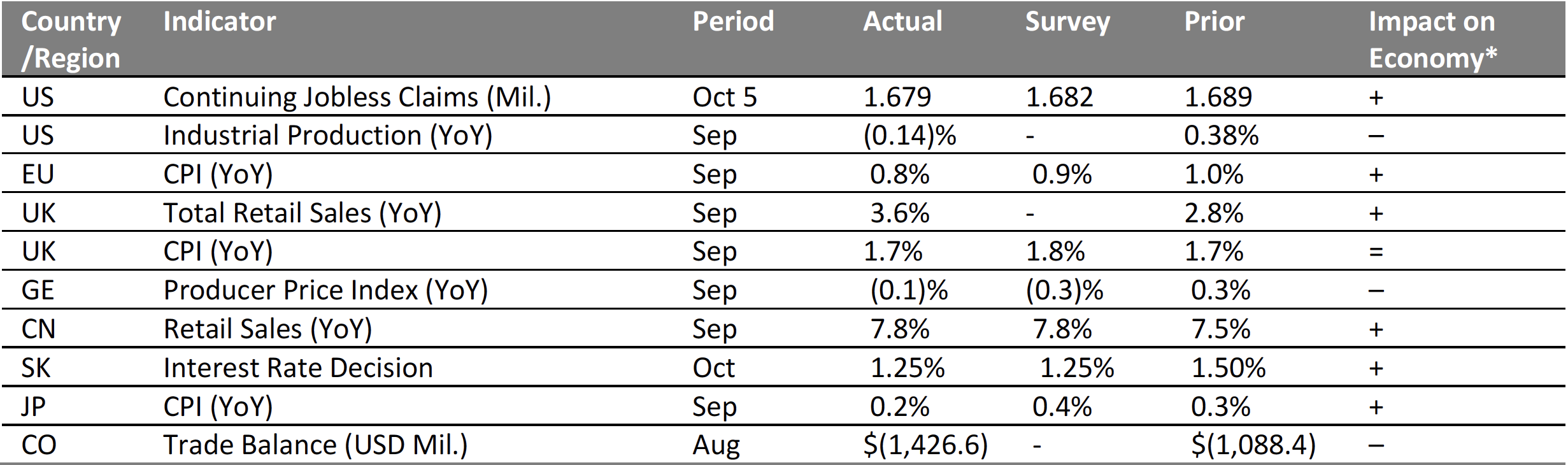

Key points from global macro indicators released October 16–22, 2019:

- US: Continuing jobless claims in the US fell to 1.679 million in the week ended October 5, from 1.689 million in the previous week. Industrial production fell 0.14% year over year in September, versus the 0.38% increase in August.

- Europe: In the eurozone, the Consumer Price Index (CPI) increased 0.8% year over year in September, lower than the 1.0% growth in August and the consensus estimate of 0.9%. In Germany, the producer price index fell 0.1% year over year in September, versus a 0.3% increase in August.

- Asia Pacific: In China, retail sales increased 7.8% year over year in September, slightly higher than the 7.5% increase in August. In Japan, the CPI increased 0.2% year over year in September, versus a 0.3% increase in August.

- Latin America: Colombia registered a trade deficit of $1.43 billion in August, widening from the $1.09billion deficit registered in July.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Department of Labor/US Federal Reserve/Eurostat/Office for National Statistics/Destatis/National Bureau of Statistics of China/Bank of Korea/Statistics Bureau of Japan/DANE/Coresight Research[/caption]

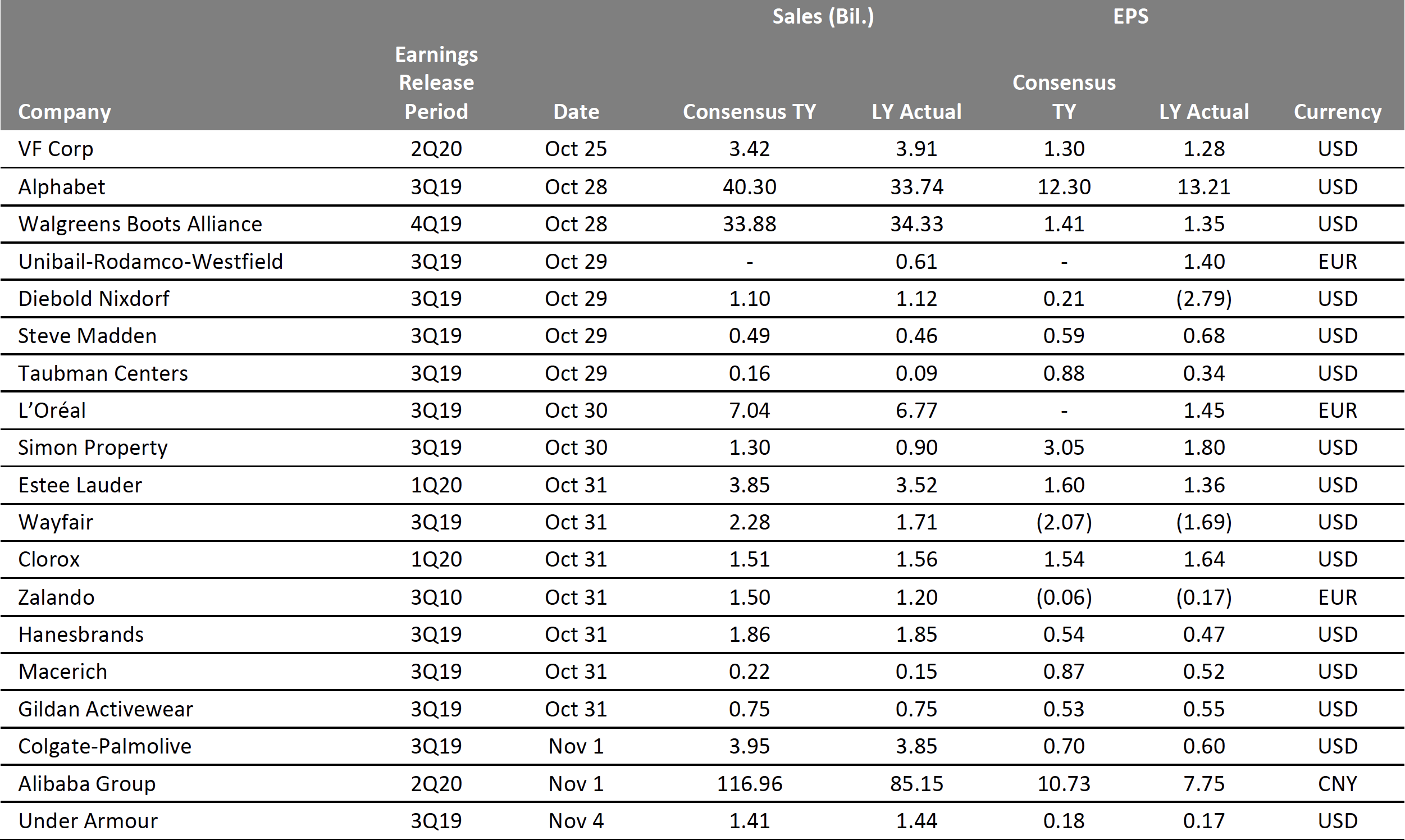

EARNINGS CALENDAR

[caption id="attachment_98566" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR