Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

What We’ve Learned from Amazon’s Physical Stores In recent months, Amazon has opened a number of stores—some permanent, some temporary, some in the US, some in Europe. These ventures, which follow the company’s initial foray into brick-and-mortar through bookshops and its acquisition of Whole Foods Market, confirm Amazon’s incremental progression from Internet pure play to multichannel retailer. Our teams in the US and Europe have visited a number of Amazon’s newest stores, and in this week’s note, we summarize our takeaways from our visits. Amazon 4-star, SoHo, New York: A Diverse Offering Amazon’s permanent 4-star store in New York City’s SoHo neighborhood spans 4,000 square feet and offers a mix of general merchandise that Amazon shoppers have given an average rating of four stars or higher, as well as local top-selling items. The store experience is akin to shopping in a nongrocery convenience store, in that it seems best suited to serving those shopping for gifts or other last-minute purchases. Customers can pay for their items via the Amazon app or at a row of payment tablets. The store showcases some of Amazon’s private-label products, including AmazonBasics items. There appears to be limited integration with the Amazon website: we looked on Amazon.com for a product we had seen in the store and had a hard time finding it on the site. The diversity of the product offering makes it hard to pin down just what Amazon is aiming for with this store—unless it is to gather data on how customers shop in-store. The Amazon website is already a leading destination for books and other general merchandise, and the product range offered in the store does not appear to cater to any specific purpose. [caption id="attachment_85102" align="aligncenter" width="714"] Amazon 4-star, New York City

Amazon 4-star, New York CitySource: Coresight Research[/caption] Amazon Fashion Pop-Up Store, London: Showcasing the Breadth of Amazon’s Apparel Offering Amazon Fashion’s pop-up store on London’s Baker Street was open October 23–27. The location, though central, was off-pitch for a fashion retailer and the store’s short duration meant that only a tiny proportion of London’s shoppers would have been able to visit it while it was open. However, the pop-up did garner Amazon further media coverage of its ongoing incursion into fashion, and special evening events such as yoga sessions and appearances by DJs likely pulled in some shoppers who would not otherwise have visited the store. Unlike some other Amazon pop-ups, the London shop allowed shoppers to buy products on-site and carry them out—although they also had the option of scanning a QR code to find a product on the Amazon app. When we visited, we saw a mix of UK high-street names (such as New Look), private labels (such as FIND) and slightly more premium brands (such as Tommy Hilfiger). So, the store showcased the breadth of Amazon’s fashion offering—even if journalists and analysts might have constituted a bigger proportion of the audience than actual shoppers did. [caption id="attachment_85103" align="aligncenter" width="627"]

Amazon Fashion pop-up store, London

Amazon Fashion pop-up store, LondonSource: Coresight Research[/caption] Amazon Home of Black Friday, London: Experiences Emphasize that Amazon Is Not Just About “Functional Shopping” Amazon’s Home of Black Friday pop-up store was open November 22–25 on Shoreditch High Street in London. This was a much more experiential and entertainment-heavy venue than the Amazon Fashion pop-up we visited a month earlier in London. The Home of Black Friday store was located on the ground floor of a former warehouse and was divided into large rooms that included a bustling cocktail bar, a kitchen/living room, a beauty space and a Christmas tree garden. Visitors could grab a drink, get groomed by a professional hairstylist and play games in the living room. The store also featured prize giveaways, workshops, “VIP” experiences and product sampling. Compared with the other Amazon pop-ups we visited, this store devoted only a limited amount of space to Amazon products, each of which had a QR code that enabled browsers to buy the product via the Amazon app. The pop-up seemed designed to link Amazon with the fun of festivities rather than with the more functional shopping experience presented by the Amazon website. Amazon Loft for Xmas, Milan: Showcasing Smart-Home Products Amazon’s Loft for Xmas pop-up store in Milan ran November 16–26, so it was open well before Black Friday. The main focus of the store was to raise awareness of Amazon products and services and to showcase brands that shoppers can buy on Amazon. Amazon Echo devices, which launched in Italy just this year, featured prominently. However, the store also featured third-party brands such as Disney, Huawei, HP and Sony. Most of the store space was used to display products with QR codes that shoppers could use to buy the items through the Amazon app. Similar to Amazon Fashion’s London pop-up, the Milan pop-up offered some experiential events, such as tutorials and product demonstrations, but these were not a primary focus. Ahead of Black Friday last year, Amazon opened a similar Loft pop-up store in London. [caption id="attachment_85104" align="aligncenter" width="653"]

Amazon Loft for Xmas, Milan

Amazon Loft for Xmas, MilanSource: Coresight Research[/caption] Amazon Go: Recognizing that Stores Are Essential to Cracking the Grocery Market Aside from the acquisition of Whole Foods, Amazon Go automated convenience stores are perhaps Amazon’s best-known move into brick-and-mortar retail. As of mid-November 2018, Amazon operated six Amazon Go stores: one in San Francisco, two in Chicago and three in its hometown of Seattle. Our long-standing view is that it is much more difficult to make Internet pure-play retailing work in the grocery category than it is in nonfood categories, and Amazon’s recent activities appear to support our conclusion. The acquisition of Whole Foods and the launch of Amazon Go stores coincided with Amazon withdrawing its AmazonFresh pure-play operation from some US regions and merging its Prime Now and AmazonFresh operations in the remaining regions. Amazon now appears to be focusing its grocery efforts on a cross-channel proposition.

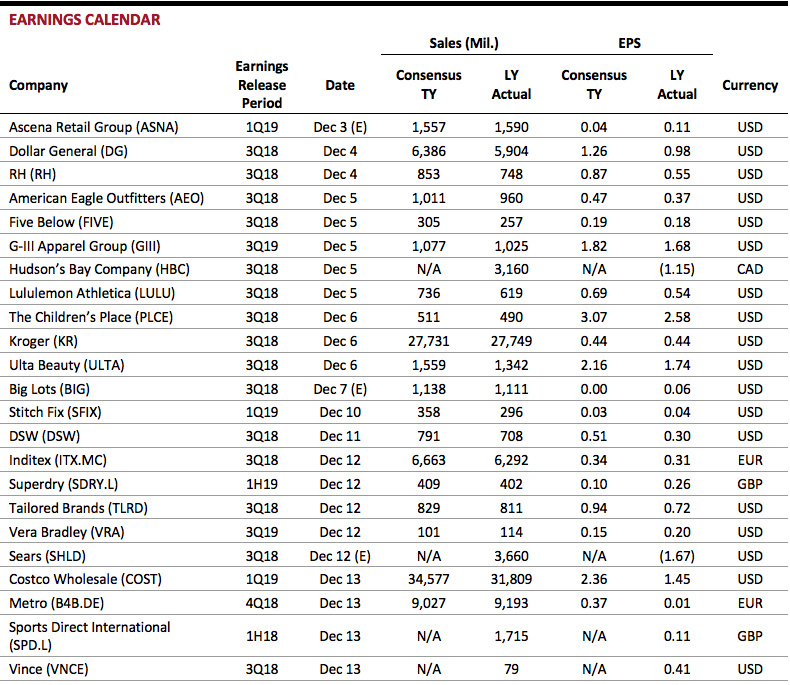

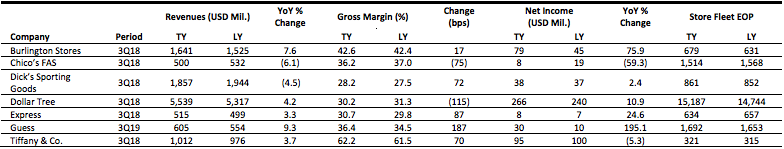

US RETAIL EARNINGS

[caption id="attachment_85106" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

US RETAIL & TECH HEADLINES

- The Thanksgiving Day and Black Friday kickoff of the US holiday shopping season showed the increasing preference for online purchases, as more Americans opted to stay home and use their smartphones and sales and traffic at brick-and-mortar stores declined.

- The weekend also redefined the importance of Black Friday. For the past few years, Black Friday was believed to be waning in importance, but it is now turning into a day when shoppers do not necessarily flock to stores, but spend heavily online.

- Cyber Monday was invented by retailers in the early days of the Internet. It made sense because people had poky dial-up connections at home and faster ones at work. Now, we all shop online and on apps, whenever we want. But that doesn’t stop companies from doubling down on sales on Cyber Monday.

- This year, Cyber Monday is expected to be the largest online shopping day in US history, generating $7.8 billion in sales, an increase of more than 17% from the previous year, according to Adobe Analytics.

Ted Baker Bets on Wholesale with Renewed Nordstrom Partnership

(November 20) Glossy.co

Ted Baker Bets on Wholesale with Renewed Nordstrom Partnership

(November 20) Glossy.co

- At a time when fashion brands are increasingly moving away from wholesale retail and toward a more direct model, Ted Baker is taking the opposite approach: the brand is tying itself even more closely to wholesale retail partner Nordstrom.

- Ted Baker will be one of the key brand partners using a platform called NuOrder that Nordstrom has just partnered with. Brands can upload product catalogs to the NuOrder platform and their retail partners can comment on different products, make suggestions, collaborate, and quickly purchase or repurchase products, making the process more efficient and more collaborative.

- Relying more on automation and gig economy workers isn’t a new cost-saving method for retailers. In fact, retailers have been leveraging part-time, contracted labor to fulfill short-term and seasonal jobs (gigs) for years. What’s different is that today’s workers are increasingly seeking more flexible, nontraditional jobs.

- As the on-demand economy evolves, retailers may find that a smaller, better-compensated core of flex employees are happier in their jobs and perform better. The gig economy also offers significant flexibility to organizations, especially those in the retail industry.

- Kindred makes robots that are purpose-built for the floor of retail fulfillment centers, putting the company in the middle of an interesting business question: Given rising consumer expectations associated with online ordering, can anyone match or beat Amazon when it comes to speed, accuracy and efficiency?

- While industrial robots have worked well on manufacturing floors, they have historically underperformed in e-commerce fulfillment centers, which require systems to handle objects of various shapes and sizes. Kindred’s approach is to allow clients such as Gap to pay based on the robots being able to successfully pick and sort items in a warehouse.

EUROPE RETAIL & TECH HEADLINES

- Some forecasters are predicting that UK shoppers likely spent more than £7 billion ($9 billion) across Black Friday and Cyber Monday. The British Retail Consortium (BRC) said final sales were likely to register some growth over last year, when the UK’s online retailers won the battle for sales on Black Friday.

- “Black Friday and Cyber Monday have become a staple fixture of the calendar year and an important one for many retailers,” a BRC spokesperson told The Guardian.

- German online fashion retailer Zalando recorded around 2 million orders on Black Friday, double what it had recorded for the day last year.

- The company received more than 4,200 orders per minute at peak times, breaking last year’s record of 2,000. Zalando also acquired more than 220,000 new customers and reported that black sneakers were its best-selling product on Black Friday.

- UK grocery chain Co-op has started testing self-driving robots for home delivery service in Milton Keynes. The six-wheeled robots were created by Starship Technologies and have the ability to travel up to two miles while avoiding obstacles.

- Customers can access the service through the Co-op mobile app, which also allows them to remove the groceries from the robot’s compartment. Co-op partnered with Starship Technologies in May this year.

- Luxury fashion group Kering announced plans to develop its own online shopping websites and end its outsourcing joint ventures with third-party e-commerce platforms, including Yoox Net-A-Porter, by 2020.

- Kering brands will still sell through third-party platforms, but the company will take full control of its own online operations. Kering grew its online sales by 80% in its third quarter ended September 30, 2018, and online sales now represent 6% of the company’s total sales.

- Swedish clothing company H&M will open a first-of-its-kind concept store in Hammersmith, London, on December 6.

- The 25,000-square-foot store will offer a “covered courtyard feel” with stone flooring and greenery across three floors connected by a wrought iron staircase. The company will also offer a Repair & Remake service that will allow H&M Club customers to have their garments repaired for free. Shoppers will also be able to have certain H&M items personalized with embroidery for £3 ($4).

ASIA RETAIL & TECH HEADLINES

- Chinese electronics company Xiaomi announced plans to increase its store fleet in India from 500 to 5,000 by the end of 2019.

- Manu Jain, Xiaomi’s Managing Director for India, said, “Offline retail is a huge segment in our country, with nearly 40% of the offline market focused in rural regions, and all of this should increase our offline sales and account for 50% of the company’s revenue by the end of next year.”

Yoox Net-A-Porter Drops Dolce & Gabbana, Following Major Chinese Retailers

(November 22) WWD.com

Yoox Net-A-Porter Drops Dolce & Gabbana, Following Major Chinese Retailers

(November 22) WWD.com

- Major Chinese e-commerce players, including Alibaba, JD, Secoo, Vipshop and NetEase, have pulled products made by Italian luxury company Dolce & Gabbana off their websites over comments posted on one of the designer’s social media accounts that were deemed racist.

- Italian online retailer Yoox Net-A-Porter followed the Chinese companies’ lead and will become the first global retailer to drop Dolce & Gabbana products from its Chinese platforms.

Walmart China Tests Same-Day Grocery Delivery

(November 20) TechCrunch.com

Walmart China Tests Same-Day Grocery Delivery

(November 20) TechCrunch.com

- Walmart China is testing same-day grocery delivery, called Walmart To Go, in its Xiangmihu store. The new service is available through a Mini Program within Chinese messaging app WeChat, and its rollout follows the establishment of a partnership between Walmart and WeChat’s parent company, Tencent, earlier this year.

- Nearly 8,000 products are available through the service and shoppers can receive their orders within one hour. The delivery service is provided by online grocery delivery company Dada-JD Daojia.

- Chinese selfie app maker Meitu and smartphone maker Xiaomi announced a strategic partnership to launch Meitu-branded phones and other smart devices.

- A spokesperson said that, through Xiaomi’s sales network, Meitu’s software products will reach a larger group of customers via smartphones.

- Swedish furniture and home products company IKEA announced that it will open the world’s largest store, at the SM Mall of Asia in the Philippines, in 2020.

- IKEA will invest PHP 7 billion ($134 million) in the 700,000-square-foot store, which will offer 9,000 products and will also have a warehouse, an e-commerce facility and a call center.

LATAM RETAIL & TECH HEADLINES

Falabella Partners with Google to Introduce Google Pay

(November 20) Modaes.com

Falabella Partners with Google to Introduce Google Pay

(November 20) Modaes.com

- Chilean department store chain Falabella has teamed up with Google to introduce the Google Pay digital payment system in Chile.

- Google Pay will be available in Falabella’s department stores as well as in its Tottus supermarkets and Sodimac home improvement stores. Falabella has accelerated its digital expansion since acquiring e-commerce platform Linio last year.

- Chilean retailer Cencosud reported losses of CLP 5,691 million ($8.4 million) in its third quarter ended September 2018. However, the company increased its revenue by 8% at constant currency, driven by home improvement stores in Chile and Colombia as well as by department stores in Peru.

- The company said that it incurred losses due to inflation and exchange rate volatility in Argentina, one of the countries in which it operates.

- FEMSA, the parent company of Mexican convenience store chain Oxxo, estimates that Oxxo’s international openings will grow by 50%. The chain’s international expansion includes locations in Colombia, Chile and Peru.

- Oxxo opened 1,430 new stores last year, bringing its total store count to 17,478 as of the end of its third fiscal quarter.

- Walmart Argentina invested ARS $180 million ($4.6 million) to open its third Changomas store in Moreno.

- The new, 36,600-square-foot store offers a wide range of products across the clothing, home, toys, electronics and bakery categories as well as a self-checkout system. Walmart has also invested in environmentally friendly LED lighting, which will reduce the store’s electricity consumption by 55%.

- Chilean artificial intelligence (AI) company Kauel received $15.8 million in funding to expand its operations in Latin America, Europe and the US.

- Founded in 2007, Kauel has registered more than 50 patents for software, medical devices and electrical devices and has also introduced an AI-driven drone to help monitor assets.

MACRO UPDATE

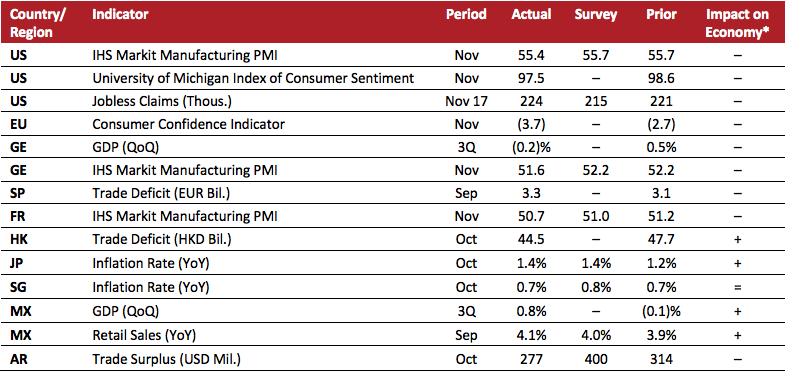

Key points from global macro indicators released November 21–27, 2018:- US: The IHS Markit US Manufacturing Purchasing Managers’ Index (PMI) fell to 55.4 in November from 55.7 in October and was below market consensus of 55.7. The University of Michigan Index of Consumer Sentiment fell to 97.5 in November from 98.6 in October.

- Europe: The Consumer Confidence Indicator in the European Union decreased to (3.7) in November from (2.7) in October. In Germany, GDP fell by 0.2% quarter over quarter in the third quarter, compared with 0.5% growth in the previous quarter.

- Asia-Pacific: The trade deficit in Hong Kong narrowed to HK$44.5 billion in October from HK$47.7 billion in September. Japan’s inflation rate rose by 1.4% year over year in October versus 1.2% in September and was in line with the consensus estimate. It was the highest rate recorded since February, led by a jump in food prices.

- Latin America: In Mexico, GDP expanded by 0.8% quarter over quarter in the third quarter, compared with a 0.1% contraction in the second quarter. Argentina’s trade surplus stood at $277 million in October, down from $314 million in September and below the $400 million consensus estimate.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: IHS Markit/University of Michigan/US Department of Labor/European Commission/Destatis (Germany)/Ministerio de Industria, Comercio y Turismo (Spain)/Census and Statistics Department (Hong Kong)/Ministry of Internal Affairs and Communications (Japan)/Statistics Singapore/Instituto Nacional de Estadística, Geografía e Informática (Mexico)/Instituto Nacional de Estadística y Censos de la República (Argentina)/Coresight Research[/caption]