From the Desk of Deborah Weinswig

The 2017 Holiday Shopping Season: Approaching the Finish Line

At the time of writing, we are only a couple of days away from stores opening early on Thanksgiving and then welcoming crowds of shoppers over the weekend that includes Black Friday, Small Business Saturday, Super Sunday and the big daddy of them all…Cyber Monday.

Macroeconomic conditions appear to favor a healthy shopping season this year: US unemployment reached a 17-year low of 4.1% in October, and the combination of rising home prices and stock (as well as bitcoin) portfolios is providing a “wealth effect,” leading to healthy consumer sentiment. Mitigating factors, such as higher gas and food prices and a slight downtick in wages, seem to be fairly benign. For example, gas prices, despite being up 11% year to date, are down more than 30% from their relative peak in April 2014.

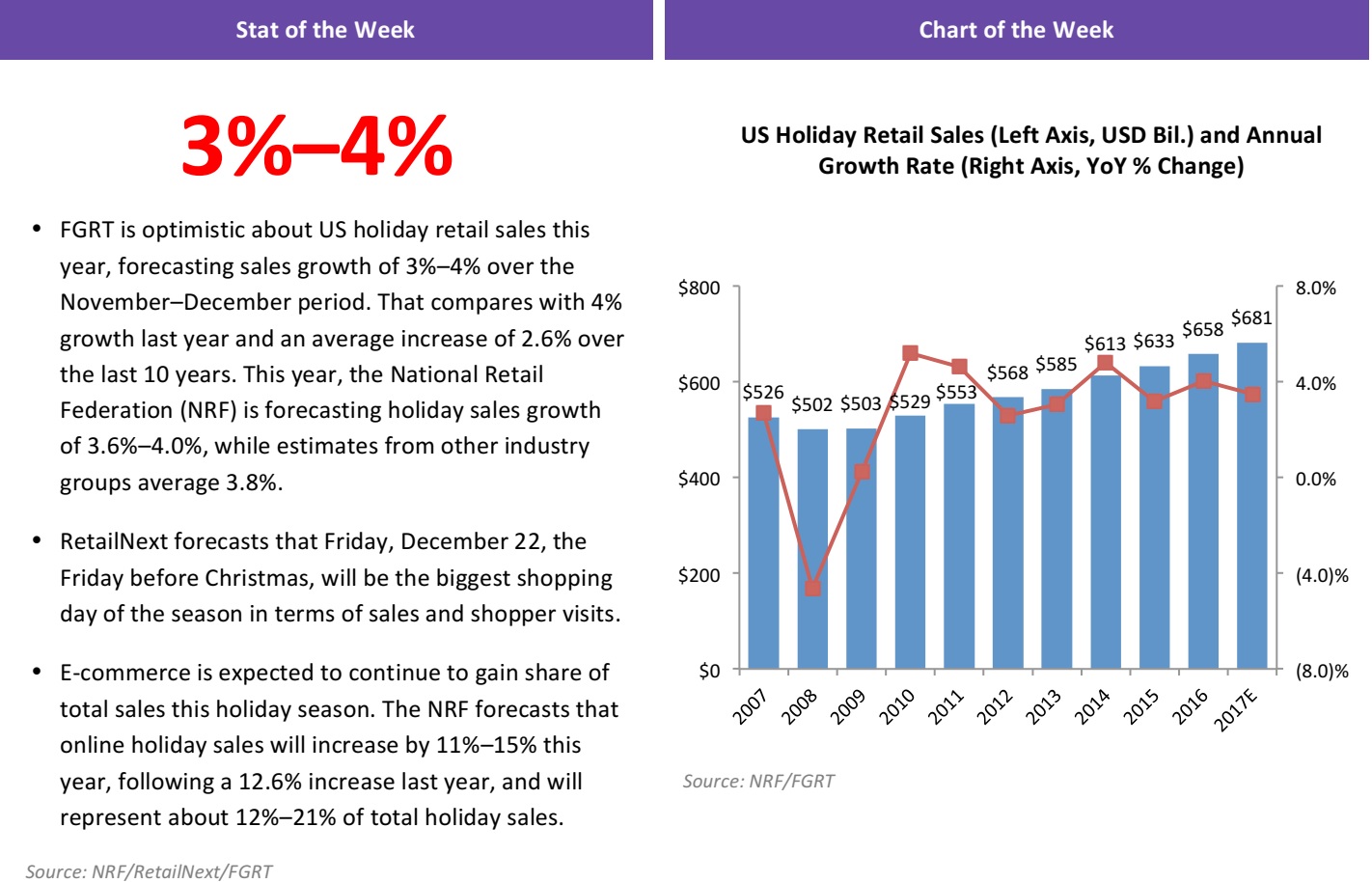

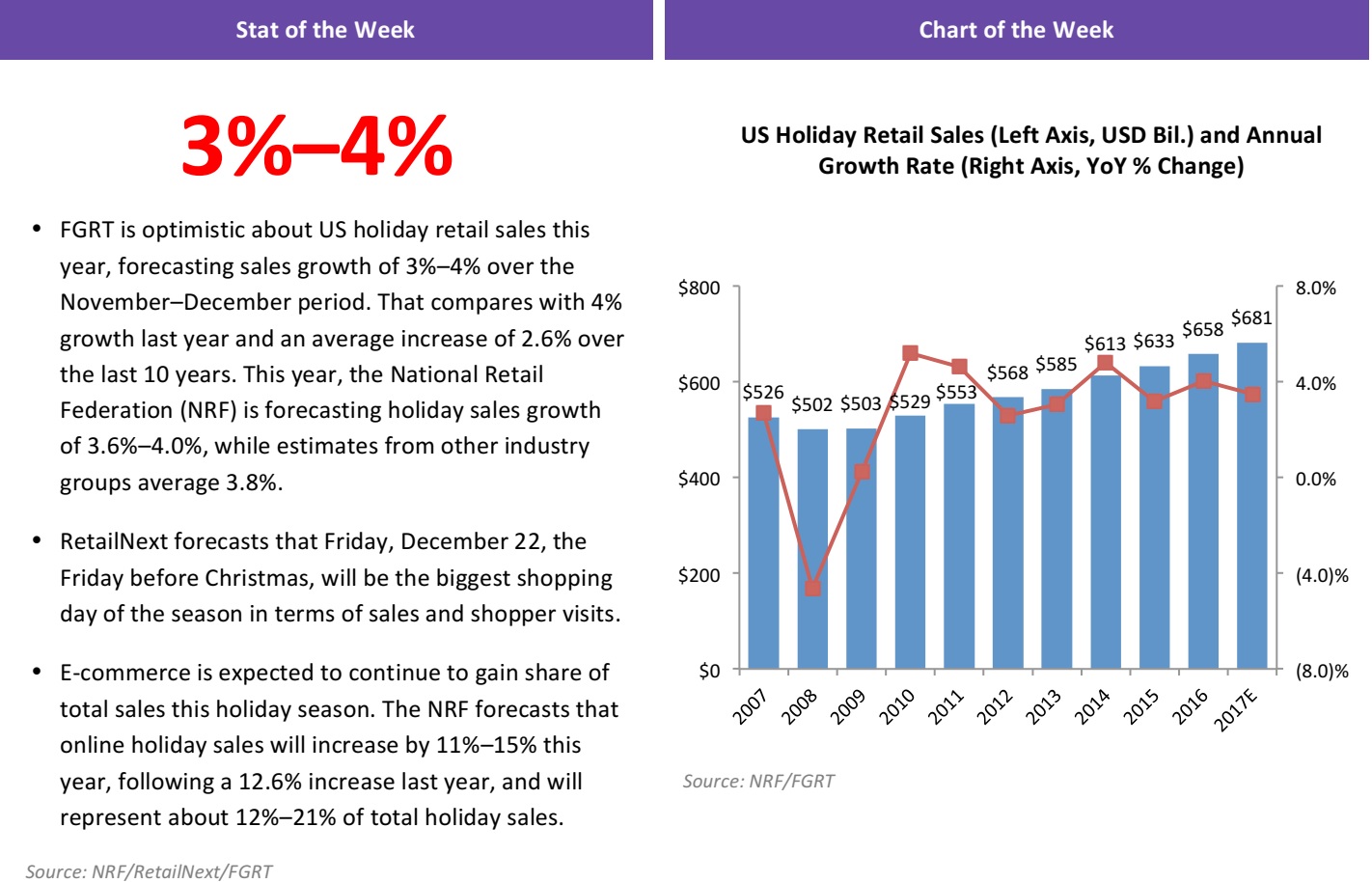

The positive macroeconomic environment led several forecasters to raise their estimates for sales growth this holiday season. The National Retail Federation forecasts holiday sales growth of 3.6%–4.0%, up from 3.6% last year, and other growth forecasts are as high as 4.5%.

This holiday season, we are likely to see a continuation of many of the trends from recent years. For example, the shopping season this year is likely to be highly promotional. In addition, many retailers launched their Black Friday deals early this week, and some even before that, leading some industry watchers to refer to the whole, promotion-filled month as “Black November.”In fact, one could make the claim that the entire year is turning “black.” Savvy shoppers are on the lookout for bargains all year long and, in recent years, newly created shopping holidays such as Christmas in July, Amazon

Prime Day and Singles’ Day have become wildly popular. In an effort not to be eclipsed by Alibaba, which first launched its Singles’ Day shopping festival in 2009, rival JD.com held its own shopping festivals on June 18, August 8 and November 11 this year.

Adobe’s e-commerce sales forecast provides another indication that shoppers are spreading out their buying over the full year. The firm estimates that US e-commerce sales will grow by 13.8% this holiday season. That rate is below the 14.0%–15.5% growth that US e-commerce sales registered from the first through the third quarters of the year, which implies that fewer shoppers are waiting until the end-of-year holidays to make purchases.

Black Friday—once the biggest shopping day of the year, when retailers traditionally made it into the black—has been displaced from its pedestal, at least in terms of online sales, by Cyber Monday. This year, Adobe expects the Monday after Thanksgiving to generate $6.6 billion in online sales, exceeding Black Friday’s $5.0 billion. E-commerce will likely continue to steal share from brick-and-mortar stores and mobile will continue to account for an ever-greater share of e-commerce. In fact, Adobe expects mobile traffic to account for 50% of retail site visits this holiday season for the first time.

The hot toys for holiday 2017 look much like the hot toys of holiday 2016. Based on social media buzz, Adobe expects this year’s top-selling toys to include updated versions of 2016 hits such as Shopkins, Paw Patrol and Hatchimals. Other toys from the past, such as Nerf guns and the Teddy Ruxpin animatronic bear, are also expected to be popular.

Gifts are also increasingly electronic. The Consumer Technology Association (CTA) projects that total US electronics spending will grow by 15% this holiday season and says that holiday sales of electronics and appliances amounted to $22 billion last year, representing 22% of annual sales. Based on social media activity, Adobe expects Apple AirPods, the Sony PlayStation VR, the Oculus VR headset and the Google Home device to be the top consumer electronics gifts this holiday season.

Finally, the calendar and the weather forecast are more favorable for shopping this year. There are 31 days between Thanksgiving and Christmas this year, compared with 30 last year. Also, temperatures were warmer than normal in November and December in many areas last year, so retailers are likely to see a return to more seasonal sales of coats, boots, scarves, hats and gloves this holiday season.

The FGRT team will provide on-the-ground reports from various regions and stores on Black Friday as well as subsequent updates as this year’s holiday shopping season progresses.

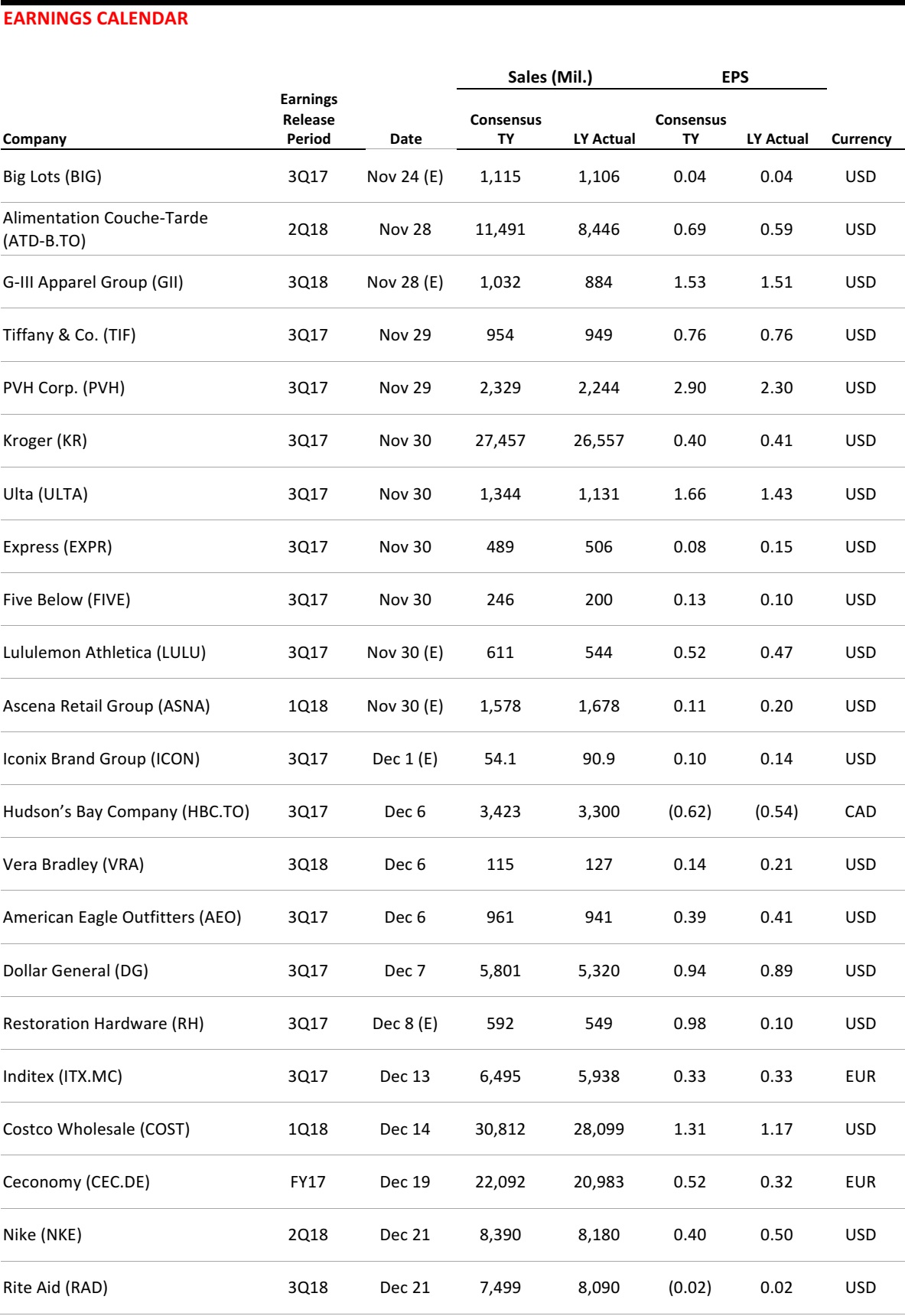

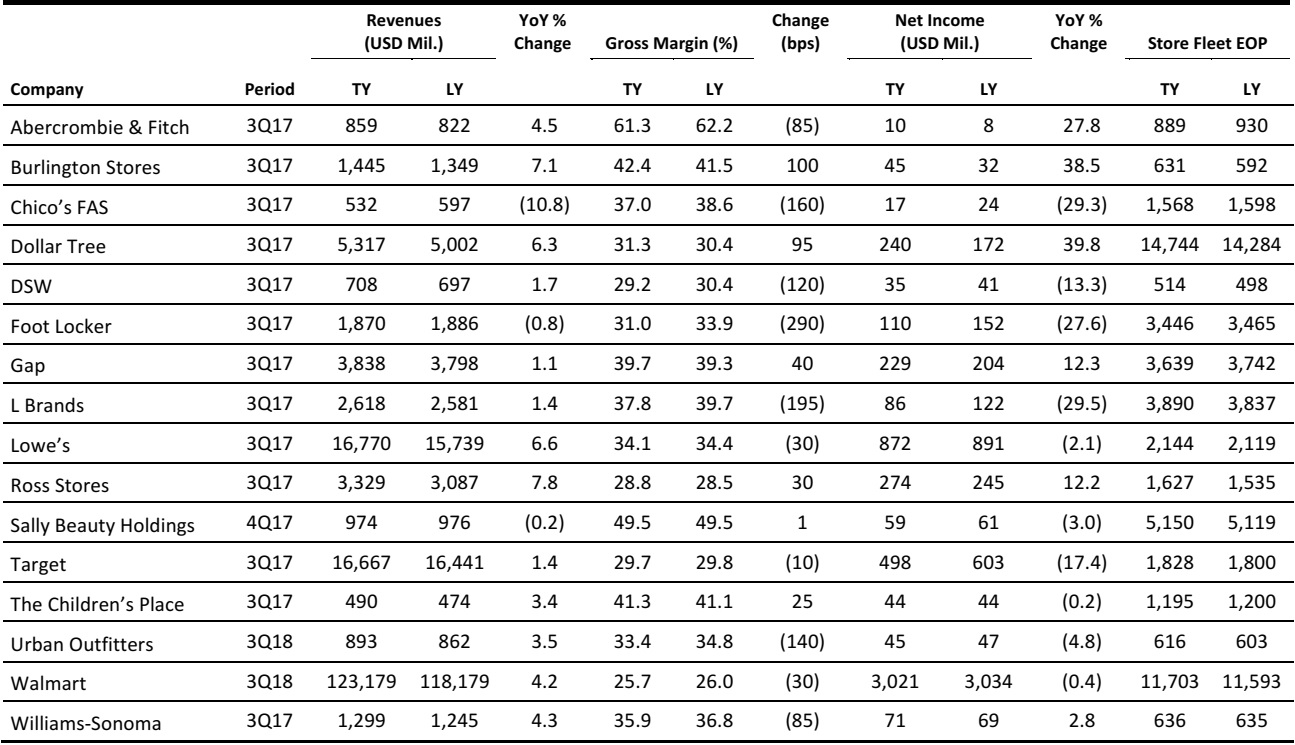

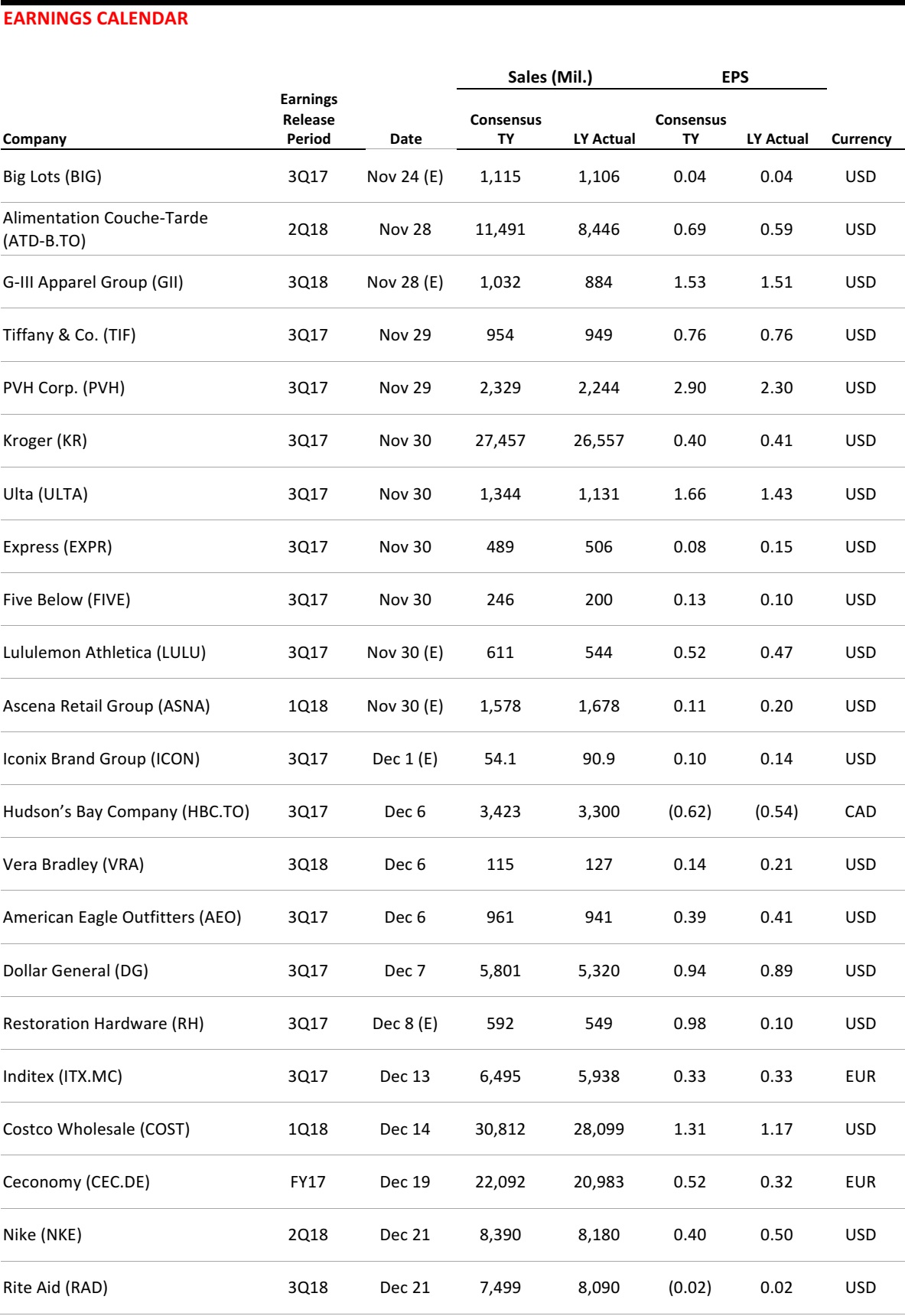

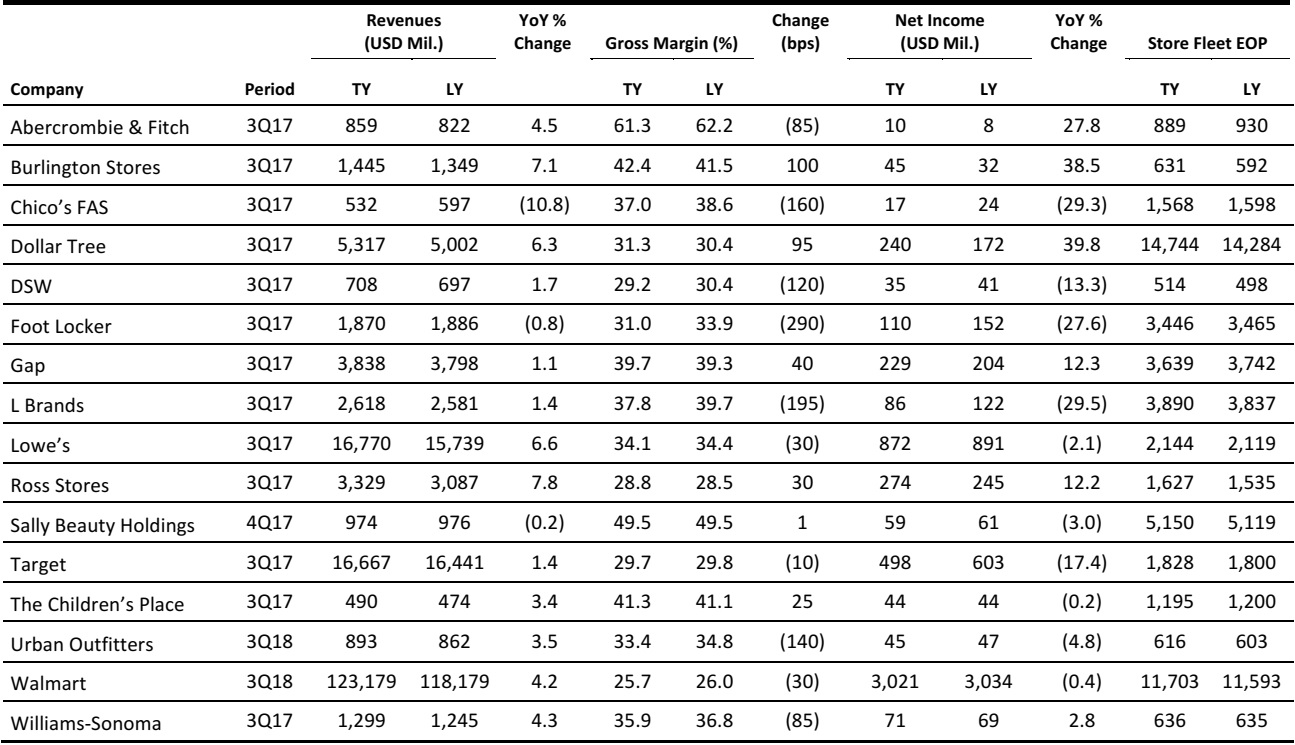

US RETAIL EARNINGS

Source: Company reports/FGRT

Source: Company reports/FGRT

US RETAIL & TECH HEADLINES

Brick-and-Mortar Stores Seek New Ways to Survive “Retail Apocalypse”

(November 20) CBSNews.com

Brick-and-Mortar Stores Seek New Ways to Survive “Retail Apocalypse”

(November 20) CBSNews.com

- Turkey is just one tradition for the Thanksgiving holiday; many stores will open Thursday night for shoppers looking to get a jump on Black Friday sales. Almost 16 million Americans work in retail, an essential part of the US economy, but many stores are struggling against online competition.

- Retailers across the country are looking for ways to lure customers offline and into their stores. Melisa Miller, EVP and President of Card Services at Alliance Data, said that “the brands that are winning have figured that out and are creating unique experiences for the consumer in the store.”

Online Retail Navigates the Cyber Monday Conundrum

(November 20) Bloomberg.com

Online Retail Navigates the Cyber Monday Conundrum

(November 20) Bloomberg.com

- Cyber Monday was officially created back in 2005 as a way to get people into the web’s digital stores. The Internet companies had noticed people were returning to work after the holiday and using their office broadband to go on online shopping binges.

- Then something unexpected happened. Like Frankenstein’s monster, the whole thing got out of control. People waited past the Thanksgiving weekend for the best deals and, on Monday, orders flooded in, websites were strained and warehouses were pushed to the limit. Companies had to gird themselves for a surge that comes only once a year. To protect themselves from the Cyber Monday conundrum, the Internet shopping companies are now busy trying to unwind customer expectations and spread deals throughout the week.

Amazon Flexing Its Muscle on Retail Front, Too

(November 20) Chieftain.com

Amazon Flexing Its Muscle on Retail Front, Too

(November 20) Chieftain.com

- Amazon goes into the holiday season with a newly magnified brick-and-mortar presence. The online retailer now has more than a dozen Amazon Books stores, which also sell toys, electronics and small gifts.

- But the Seattle-based company’s physical stores are a small part of its business, making up just 3% of its total revenue between July and September, even though it bought Whole Foods Market and its 470 stores during that period. The company’s online sales will still dominate.

How Gen Z Is Influencing Retailers’ Acquisition Strategies

(November 20) NRF.com

How Gen Z Is Influencing Retailers’ Acquisition Strategies

(November 20) NRF.com

- Retailers’ marketing and merchandising teams have been thinking about Gen Z for a while now, considering the influencer of the moment, what styles these consumers gravitate to and what social media platforms they are using.

- Gen Z believes that what they purchase and wear must be in line with their individual values—for them, it is not about buying a label or a brand. Research on Gen Z shoppers also consistently shows their affinity for a store experience.

Retailers Experiment with a New Philosophy: Smaller Is Better

(November 17) NYTimes.com

Retailers Experiment with a New Philosophy: Smaller Is Better

(November 17) NYTimes.com

- Brick-and-mortar retail chains, known for sprawling stores that stock a bit of everything, are trying to lift sagging sales using a different strategy: cozier spaces that sell very little of anything. Showrooms are now inspiring mass-market heavyweights.

- This is the antithesis of the standard shopping mall experience, which includes an overwhelming assortment of products, the glazed apathy of part-time store workers and disrobed patrons bellowing from fitting rooms for another size.

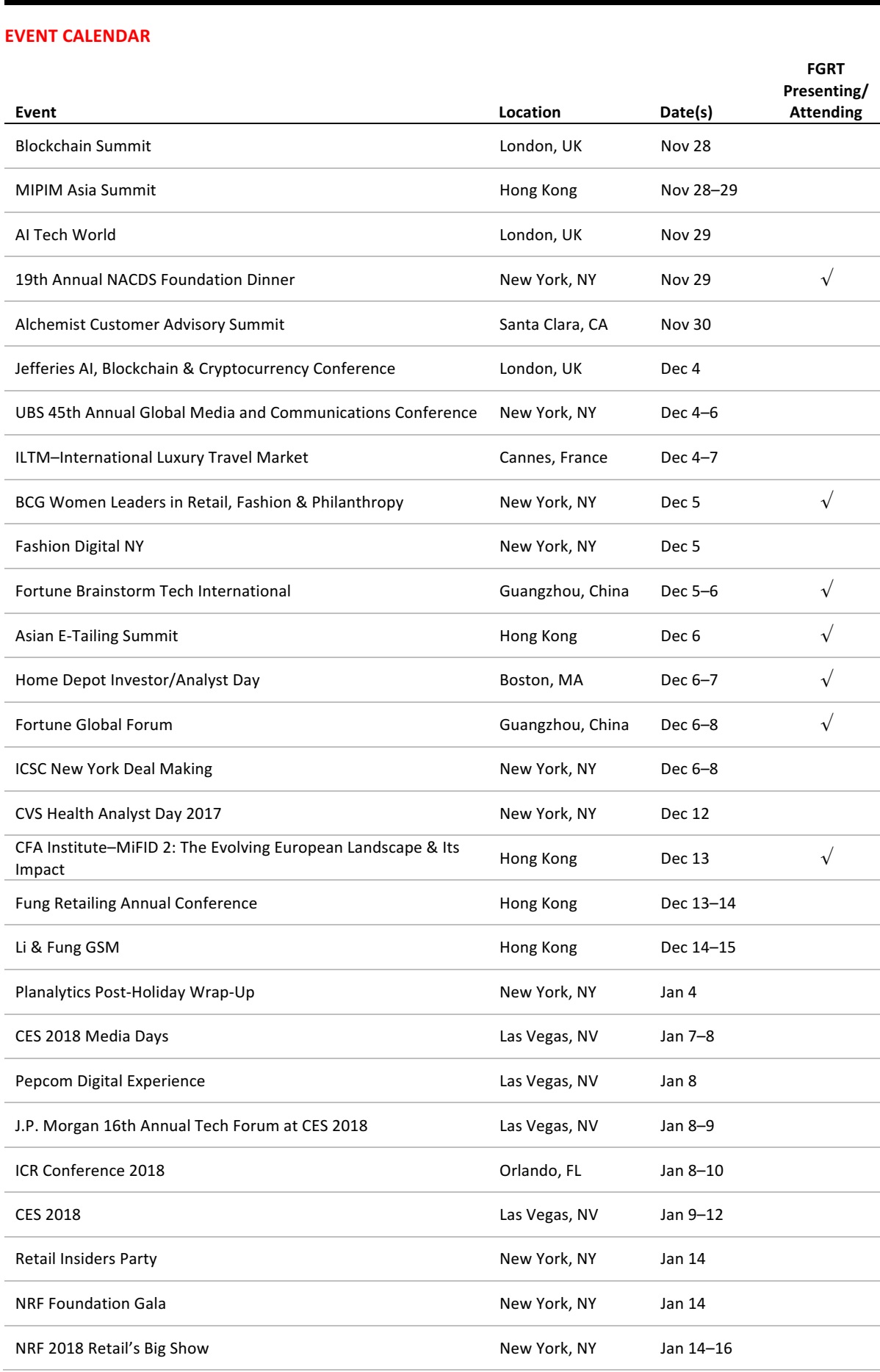

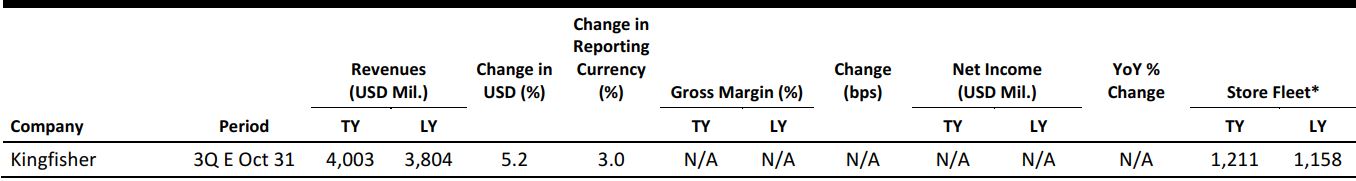

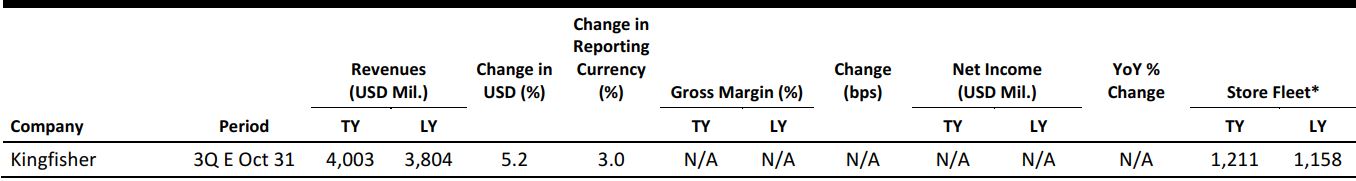

EUROPE RETAIL EARNINGS

*Store numbers are as of the end of the half-year trading periods, as Kingfisher does not report them in quarterly statements.

Source: Company reports/FGRT

*Store numbers are as of the end of the half-year trading periods, as Kingfisher does not report them in quarterly statements.

Source: Company reports/FGRT

EUROPE RETAIL & TECH HEADLINES

UK Retail Sales Growth Softens in October

(November 16) ONS press release

UK Retail Sales Growth Softens in October

(November 16) ONS press release

- UK retail sales grew by 2.6% year over year in October, according to the Office for National Statistics. Total growth softened from 4.7% in September, largely due to unusually warm weather in October.

- Grocery stores posted steady sales growth of 1.7% in October, while department stores/mixed-goods retailers saw sales growth improve to 1.4%. Sales at large clothing retailers fell by 3.7% during the month.

Hotel Chocolat Launches New Beauty Line

(November 20) Retail-Week.com

Hotel Chocolat Launches New Beauty Line

(November 20) Retail-Week.com

- Chocolate retailer Hotel Chocolat has partnered with Andrew Gerrie, the firm’s nonexecutive director and the former head of handmade cosmetics brand Lush, to create a new beauty line in the UK.

- The skincare line, which consists of 16 products, is called Rabot 1745. Hotel Chocolat CEO Angus Thirlwell said that the line is “inspired by the wild beauty of our Saint Lucian cacao plantation, with its rich variety of flora and fauna.” Rabot 1745 is now available online and in Hotel Chocolat stores nationwide in the UK.

Regulatory Authority Approves DFS’s Acquisition of Sofology

(November 20) RetailGazette.co.uk

Regulatory Authority Approves DFS’s Acquisition of Sofology

(November 20) RetailGazette.co.uk

- The UK’s Competitions and Markets Authority has approved furniture retailer DFS’s £25 billion ($33 billion) acquisition of rival Sofology. The acquisition will allow DFS to take over Sofology’s chain of 37 stores across the UK.

- DFS first announced plans to acquire Sofology in August this year. The Competitions and Markets Authority subsequently initiated an investigation and called for comments on the deal in October.

Jigsaw Seeking Fast-Track Deal in a Move to Stabilize Its Finances

(November 17) News.sky.com

Jigsaw Seeking Fast-Track Deal in a Move to Stabilize Its Finances

(November 17) News.sky.com

- British womenswear retailer Jigsaw is seeking bids for a potential takeover and has invited offers from The Foschini Group, the owner of Hobbs, Phase Eight and Whistles, as well as from turnaround investors Rcapital and Aurelius Advisers.

- KPMG is supervising the process on behalf of Jigsaw’s controlling shareholder, John Robinson. The company’s pursuit of a new owner comes ahead of an anticipated cash crunch in the run-up to Christmas. Several asset-based lenders have also been approached regarding a refinancing deal.

Bonmarché’s Sales Rise in 1H18

(November 20) Company press release

Bonmarché’s Sales Rise in 1H18

(November 20) Company press release

- British value womenswear retailer Bonmarché reported sales growth of 5.0%, to £97.8 million ($129.6 million), in the first half ended September 30, 2017. Store-only comparable sales grew by 1.6% and online sales jumped 38.6%. Underlying profit before tax surged 70.3%, to £4.2 million ($5.6 million).

- Bonmarché’s relaunch of its denim range with better-quality product and its improvements to its online customer experience both contributed to the progress in performance. The company said that it continues to face “considerable uncertainty as to future market conditions,” but that it expects full-year profit before tax to be in line with the board’s expectations.

Hunkemöller’s Owners Eye Initial Public Offering

(November 16) RetailDetail.eu

Hunkemöller’s Owners Eye Initial Public Offering

(November 16) RetailDetail.eu

- The owners of Dutch lingerie retailer Hunkemöller are preparing for an IPO of the chain, according to Bloomberg. Investment firm The Carlyle Group has reportedly asked Rothschild to prepare for a listing that would value the retailer at around €600 million ($707 million).

- The Carlyle Group bought the 800-store chain from PAI Partners for €440 million ($518 million) in 2016. It has since opened stores in new markets such as Spain and Switzerland.

ASIA RETAIL & TECH HEADLINES

Alibaba Invests $2.9 Billion in Hypermarket Operator Sun Art to Continue Its Offline Retail Push

(November 20) TechCrunch.com

Alibaba Invests $2.9 Billion in Hypermarket Operator Sun Art to Continue Its Offline Retail Push

(November 20) TechCrunch.com

- Chinese e-commerce giant Alibaba is continuing its expansion into offline retail, buying up more than a third of one of China’s most prolific operators of hypermarket stores. Alibaba announced that it has spent HK$22.4 billion (~$2.88 billion) to acquire a 36.16% stake in Sun Art Retail Group, which operates 446 hypermarkets across 224 cities in China.

- The deal will draw inevitable comparisons to Amazon’s acquisition of Whole Foods Market for $13.7 billion this year, but those comparisons would be misplaced. The Whole Foods deal marked a major point for Amazon’s entry into physical retail, but Alibaba’s move into offline retail began years ago, and this is only the largest part of that strategy.

MyRepublic Gets $52 Million as Singapore’s Billion-Dollar IP Fund Makes First Investment

(November 22) TechinAsia.com

MyRepublic Gets $52 Million as Singapore’s Billion-Dollar IP Fund Makes First Investment

(November 22) TechinAsia.com

- Makara Innovation Fund (MIF) has invested $51.8 million in telecom network MyRepublic, marking the fund’s first publicly announced investment. The funding will “supercharge” the development of MyRepublic’s proprietary cloud platform, as well as support its “aggressive” plan to expand its regional footprint and deliver more services, said CEO Malcolm Rodrigues in a statement.

- A partnership between the Intellectual Property Office of Singapore and private equity firm Makara Capital, MIF was launched in April with a S$1 billion raise target. It aims to invest in “high-growth companies with strong [intellectual property] and proven business models.” These include later-stage startups and established businesses from Singapore and elsewhere that demonstrate a “strong pan-Asian growth trajectory.”

Virgin Hyperloop One Lines Up Preliminary Studies in India

(November 16) TechCrunch.com

Virgin Hyperloop One Lines Up Preliminary Studies in India

(November 16) TechCrunch.com

- Virgin Hyperloop One has signed a couple of new memorandums of understanding (MOUs) with Indian government agencies to conduct preliminary studies into hyperloop route construction feasibility. The MOUs mean that Virgin Hyperloop One can now expand its work looking at the feasibility of routes with Andhra Pradesh to cover lines connecting some of India’s largest and fastest-growing cities.

- The purpose is to identify which routes would be most in demand and most utilized, to work out how connecting major urban areas with peripheral communities and commuting locations could benefit the economy overall, and to examine how freight lines could improve the transportation of goods and materials.

Tencent Reportedly Invests $150 Million in Cinema-Ticketing Startup Maoyan

(November 16) TechCrunch.com

Tencent Reportedly Invests $150 Million in Cinema-Ticketing Startup Maoyan

(November 16) TechCrunch.com

- Tencent reportedly invested $150 million in Chinese cinema-ticketing startup Maoyan, which was created this summer from a merger between dominant players Maoyan and Tencent-backed Weiying Technology. Maoyan-Tencent are taking on Alibaba, which operates rival service Tao Piao Piao. The Alibaba unit works closely with sister company Alibaba Pictures, and the combination helped the latter secure a 313% revenue jump in its most recent earnings period.

- The firms are shooting for a slice of a huge market that continues to grow. Box office revenue from Mainland China is reportedly ¥27.3 billion ($4 billion) per year, thanks to 11% annual growth, according to figures from China’s State Administration of Press, Publication, Radio, Film and Television.

LATAM RETAIL & TECH HEADLINES

Brazil Advances in ICT Adoption

(November 17) ZDNet.com

Brazil Advances in ICT Adoption

(November 17) ZDNet.com

- Brazil has made progress in the adoption of information and communication technologies (ICTs), according to a new report from the International Telecommunication Union (ITU). The report analyzed the state of ICT across 176 countries and ranked Brazil 66th overall and 10th in the Americas, behind countries such as Argentina, Chile and Uruguay.

- The ITU report suggests that the competitiveness of the telecom market in Brazil is increasing. It points out that the country is one of the largest telecom markets in the Americas and that there is competition for all services in the country’s major cities.

4G Provision Improves in Brazil

(November 15) ZDNet.com

4G Provision Improves in Brazil

(November 15) ZDNet.com

- Fourth-generation (4G) mobile Internet provision has improved in Brazil over the last year, according to a new study from consulting firm OpenSignal. The country has jumped to the 42nd position in a ranking of 77 countries listed in OpenSignal’s The State of LTE report. A year ago, Brazil ranked 52nd.

- 4G in Brazil has been provided at an average speed of 20.34 megabits per second (Mbps), according to the report. This shows an improvement on the 16 Mbps speed noted in a previous global study on 4G provision that OpenSignal carried out in 2015 and the 19.68 Mbps speed recorded a year ago.

Brazil Sporting Goods Retailer Centauro Files for IPO

(November 17) Reuters.com

Brazil Sporting Goods Retailer Centauro Files for IPO

(November 17) Reuters.com

- Grupo SBF, owner of Centauro, Latin America’s largest retailer of sporting goods, has requested authorization for an IPO from securities industry regulator CVM. Proceeds from the IPO will be used to expand Centauro’s 187-store network, according to the filing.

- SBF hired the investment banking units of Banco Bradesco, BTG Pactual, Itaú Unibanco, Banco do Brasil and Goldman Sachs to manage the issue. The filing did not disclose a range for the pricing of shares or the number of shares to be sold. According to documents filed with the regulator, the retailer had revenue of R$1.3 billion ($397 million) and net income of R$229 million ($70 million) in the first nine months of 2017.

Argentine Company Cañuelas Delays $333 Million IPO at the Last Minute Due to Market Volatility

(November 16) Bloomberg.com

Argentine Company Cañuelas Delays $333 Million IPO at the Last Minute Due to Market Volatility

(November 16) Bloomberg.com

- Argentine agribusiness group Molino Cañuelas is postponing its US and Buenos Aires IPOs because of market volatility. The company postponed its sale of ordinary shares due to recent market volatility in Argentine markets, the company said in a filing to the local regulator.

- Molino Cañuelas faced a tough market window after the Merval Index snapped a five-day slump November 15 from a record high. J.P. Morgan called the slump an “unjustified correction,” as Argentina’s fundamentals remain promising following the successful performance of President Mauricio Macri’s coalition in midterm elections. The drop pushed a technical indicator toward a level that suggests stocks are oversold.

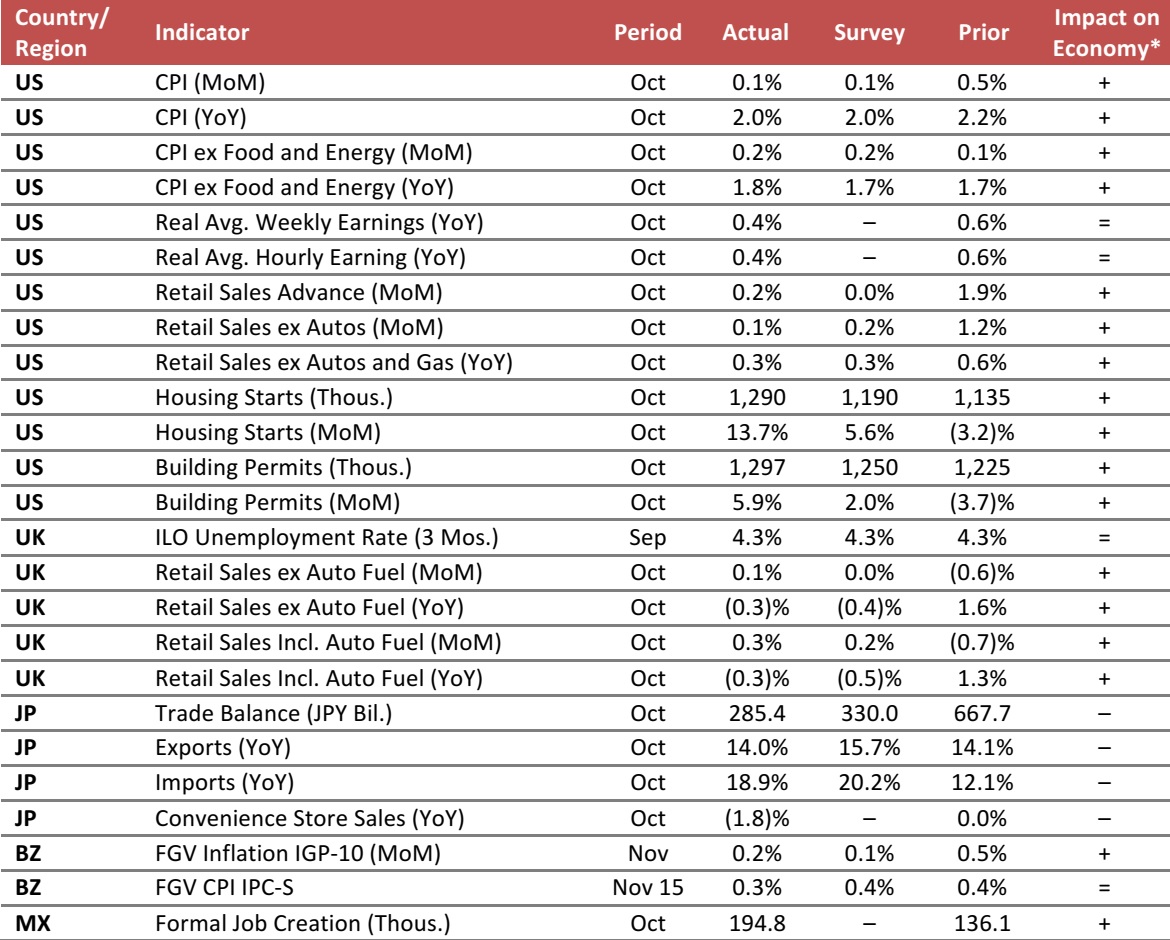

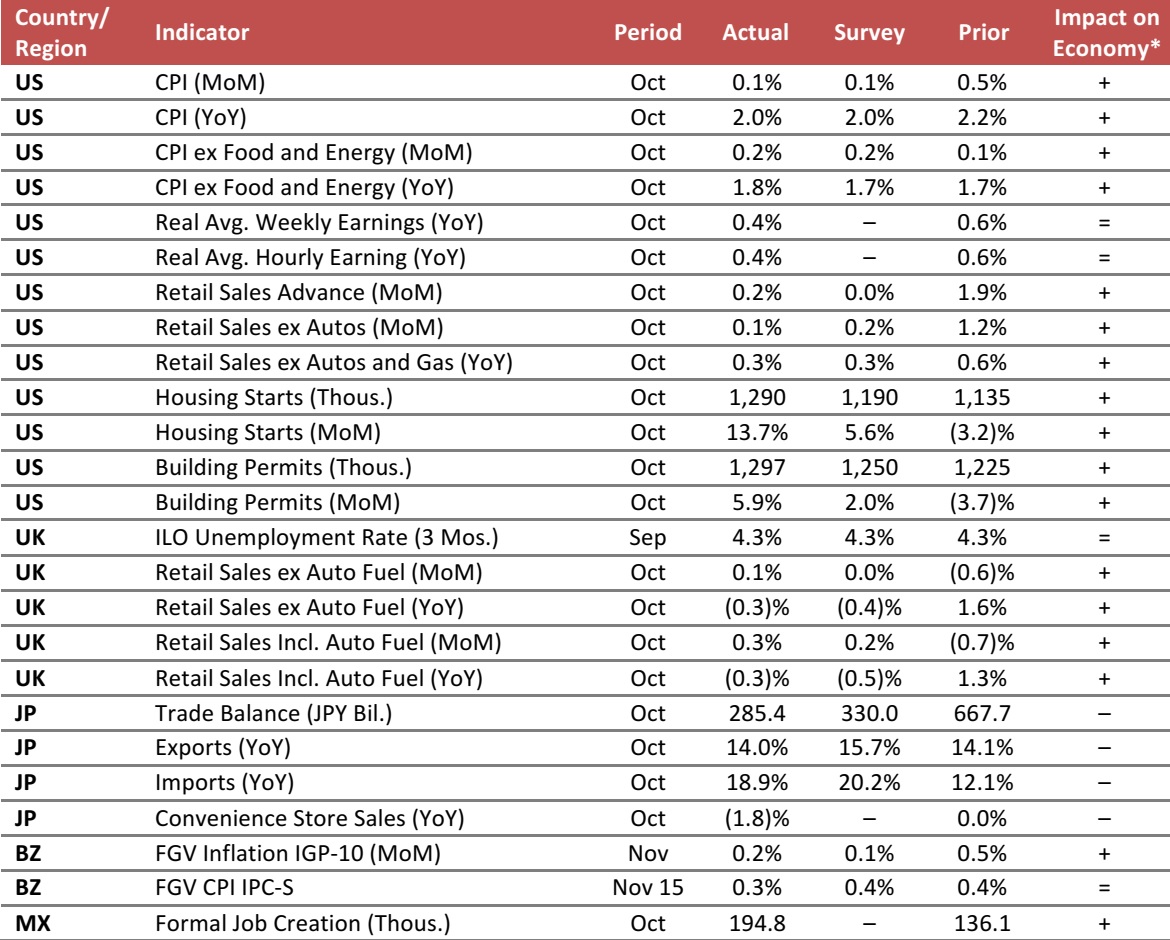

MACRO UPDATE

Key points from global macro indicators released November 15–22, 2017:

- US: The Consumer Price Index (CPI) increased by 0.1% month over month and by 2.0% year over year in October, in line with the consensus estimates. Retail sales increased by 0.2% month over month in October, coming in ahead of the consensus estimate, which called for no change. Housing starts rose significantly in October, growing by 13.7% month over month.

- Europe: In the UK, the unemployment rate was unchanged at 4.3% in September. In October, UK retail sales excluding auto fuel increased by 0.1% month over month and UK retail sales including auto fuel increased by 0.3% month over month.

- Asia-Pacific: In Japan, the trade balance decreased in October to ¥285.4 billion, which was lower than the market’s expectation. Convenience store sales in Japan ticked down by 1.8% year over year in October after registering no change in September.

- Latin America: In Brazil, the IGP-10 inflation index edged up by 0.2% month over month in November; the increase was slightly higher than the consensus estimate. In Mexico, formal job creation in October totaled 194,800, which was higher than the prior month’s 136,100

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Federal Reserve Bank of New York/US Census Bureau/UK Office for National Statistics/Ministry of Finance Japan/Japan Franchise Association/Fundação Getulio Vargas/Instituto Brasileiro de Geografia e Estatística/Secretaría del Trabajo y Previsión Social/Instituto Nacional de Estadística y Geografía/FGRT

Source: Company reports/FGRT

Source: Company reports/FGRT *Store numbers are as of the end of the half-year trading periods, as Kingfisher does not report them in quarterly statements.

Source: Company reports/FGRT

*Store numbers are as of the end of the half-year trading periods, as Kingfisher does not report them in quarterly statements.

Source: Company reports/FGRT Alibaba Invests $2.9 Billion in Hypermarket Operator Sun Art to Continue Its Offline Retail Push

(November 20) TechCrunch.com

Alibaba Invests $2.9 Billion in Hypermarket Operator Sun Art to Continue Its Offline Retail Push

(November 20) TechCrunch.com

Brazil Advances in ICT Adoption

(November 17) ZDNet.com

Brazil Advances in ICT Adoption

(November 17) ZDNet.com