FROM THE DESK OF DEBORAH WEINSWIG

Is Amazon Really America’s #1 Apparel Retailer?

Last week, the Coresight Research team in London visited Amazon’s latest brick-and-mortar venture—a pop-up fashion store on the city’s Baker Street. The temporary store was open from Tuesday, October 23, to Saturday, October 27, and offered a highly edited selection of branded and private-label clothing. Although the pop-up likely engaged relatively few shoppers and generated only nominal sales, the resultant coverage of Amazon’s push into fashion by the media and, yes, analysts, provided abundant value for the company.

Amazon Fashion’s London pop-up store

Source: Coresight Research

Amazon Fashion’s London pop-up store

Source: Coresight Research

In the US, the company receives similarly extensive coverage. Barely a week goes by without our US team spotting a news story mentioning that Amazon already is, or is on the verge of becoming, America’s top seller of apparel. This year, Morgan Stanley and Wells Fargo both estimated that Amazon will reach that milestone in 2018, and Cowen and Company previously estimated that Amazon would achieve the status of US market leader in 2017.

According to estimates by Euromonitor International, Amazon.com generated total US apparel and footwear sales of $24.6 billion in 2017, with sales made by third-party merchants accounting for 81% of the total and sales made by Amazon itself for just 19%, or a relatively modest $4.7 billion. Walmart’s estimated apparel sales totaled $24 billion in 2017, so if Euromonitor’s $24.6 billion figure for Amazon is accurate, that means Amazon is already America’s biggest apparel and footwear

seller (but,because of those third-party sales, not its biggest apparel and footwear

retailer).

However, the truth is that no analyst or research firm can truly gauge Amazon’s scale in apparel. One reason for this lack of clarity is that estimates for apparel sales tend to depend on establishing a figure for Amazon’s total sales (or gross merchandise volume)—and there is no definite figure for those, either.

So, what

do we know about Amazon Fashion in the US?

- Our own consumer survey shows that Amazon is the second-most-shopped retailer for clothing and footwear in the US, level with Target. We do not claim, however, that Amazon is the second-biggest retailer in the category because that depends as much on average transaction value and frequency of shopping at a retailer as it does on shopper numbers.

- Amazon Fashion remains heavily reliant on third-party merchants. In February, we found that just 13.7% of clothing products on the site were offered for sale by Amazon itself (first-party sales), while 86.3% were listed by third-party merchants. (We will publish an update to this research with revisions to these numbers very soon.)

- Our 13.7% figure for first-party listings on Amazon Fashion is even lower than the 19% estimated by Euromonitor. So, while Amazon may be a major destination for buying clothing and footwear, our figures confirm that it is not a top apparel retailer in its own right.

- Apparel dominates Amazon’s private labels. The company offers almost 5,000 private-label products in fashion, according to further research we undertook in June. In fact, clothing and footwear account for almost three-quarters of the 6,825 products we identified across 74 Amazon private labels. Womenswear brand Lark & Ro is Amazon’s biggest apparel private label, with 578 products.

So, is Amazon America’s #1 retailer of apparel? If we focus only on what Amazon sells in its own right, the answer is almost certainly no. If we consider third-party sales, the answer is maybe—although nobody knows for sure how much apparel Amazon.com transacts. This uncertainty aside, it is clear from our own research that Amazon is in the top tier of fashion retailers by number of shoppers and that third-party listings continue to drive its fashion sales.

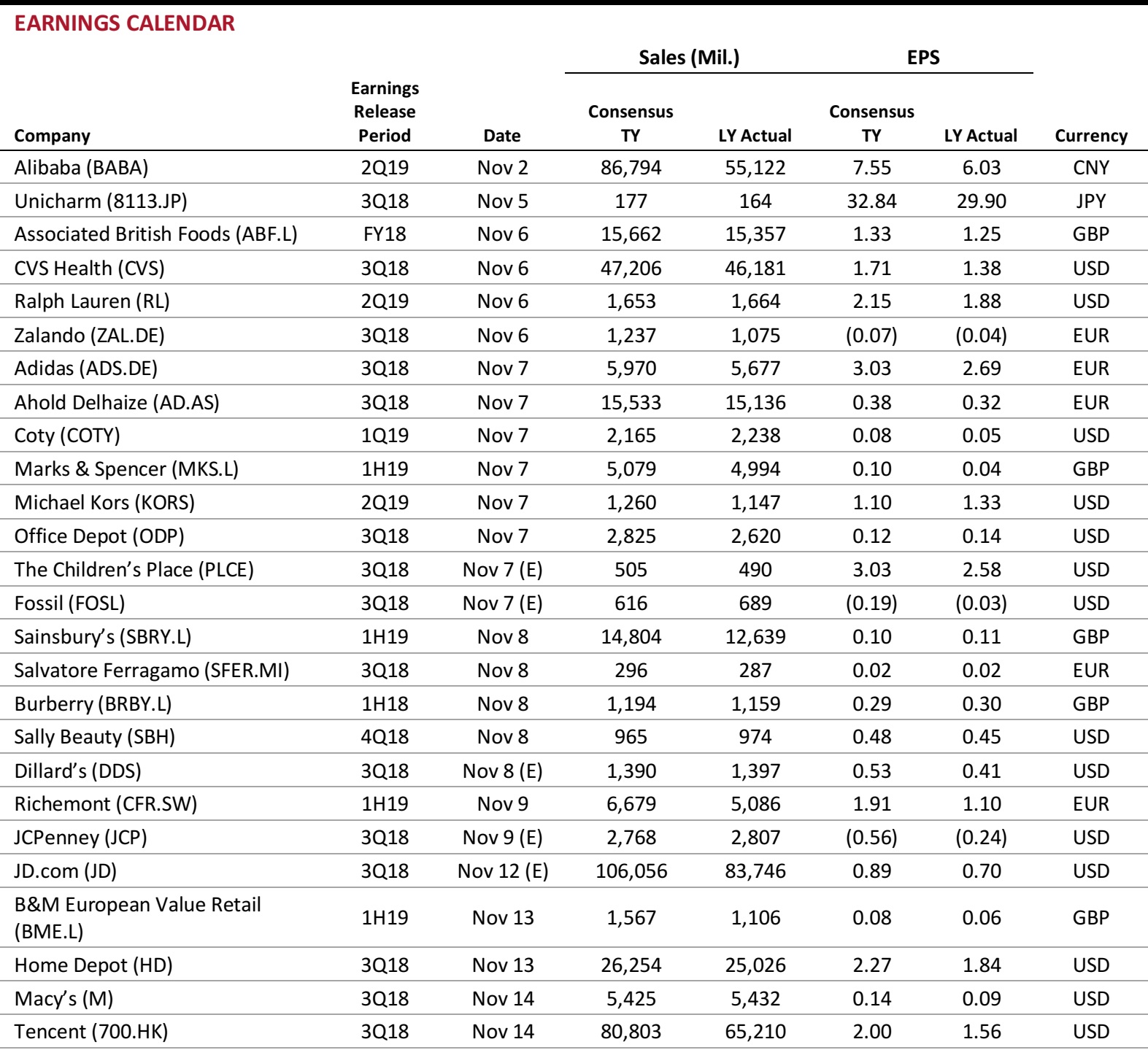

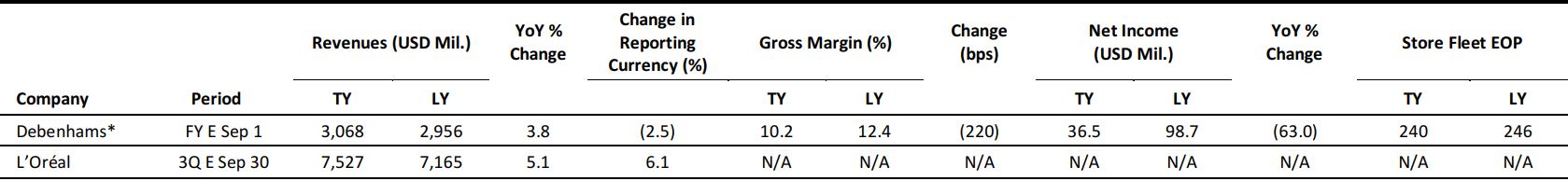

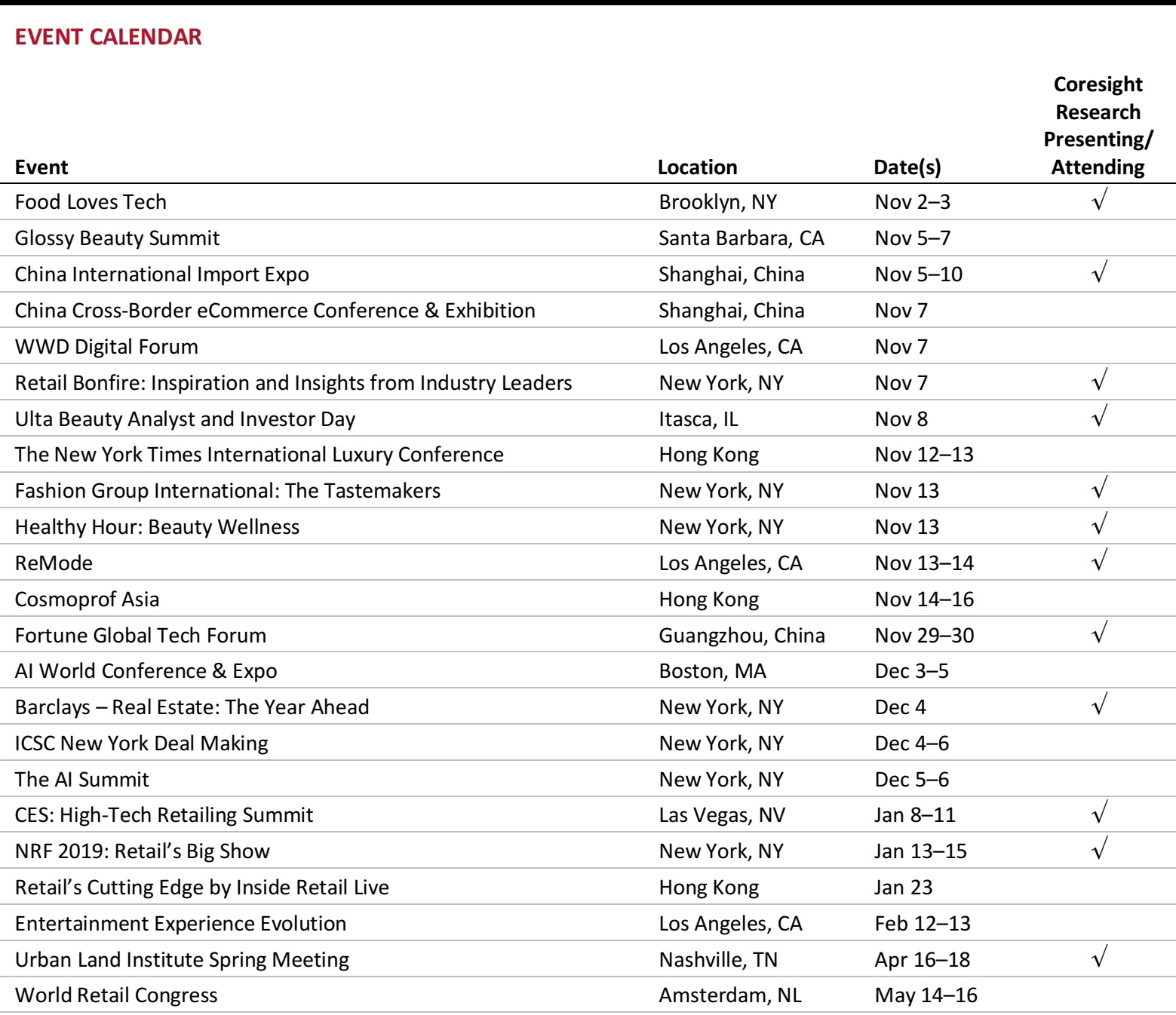

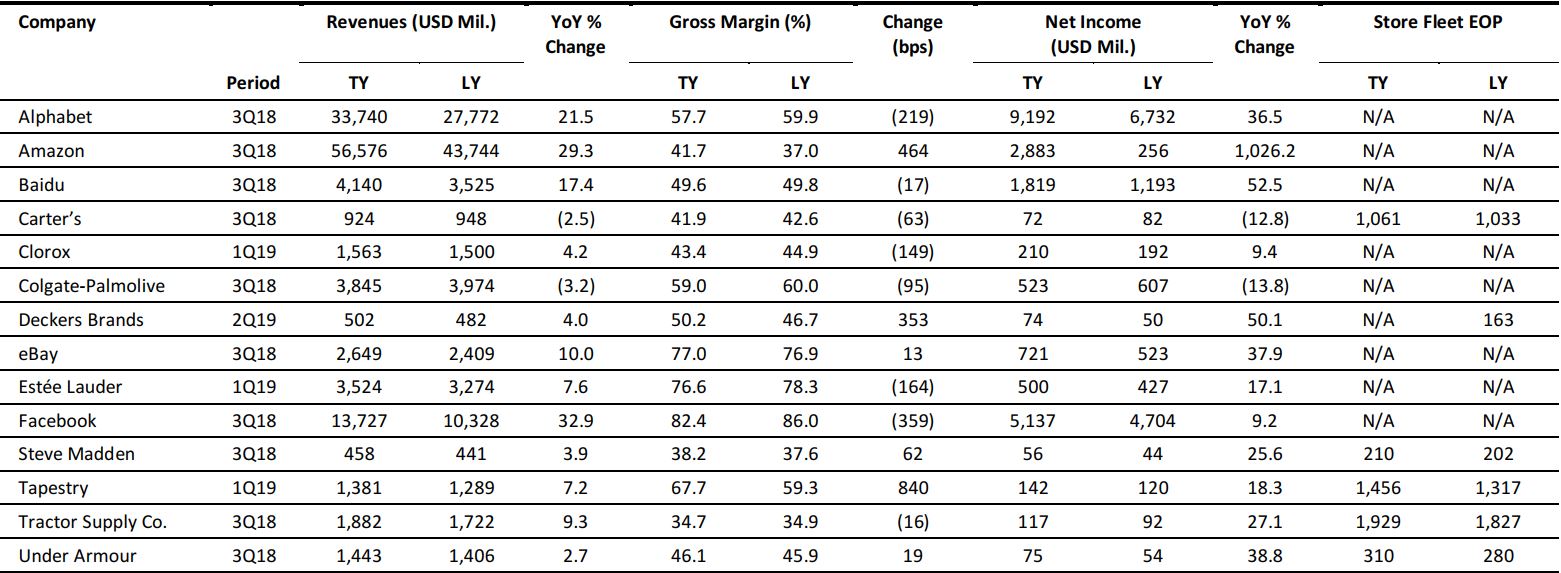

US RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Amazon Launches New Furniture Brand

(October 30) PYMNTS.com

Amazon Launches New Furniture Brand

(October 30) PYMNTS.com

- Amazon has announced the launch of its third private-label furniture brand, Ravenna Home. Described by the company as “classic style made simple” and a “great value,” the new brand has launched with 60 items. Amazon is offering free shipping and free returns within 30 days of delivery on Ravenna Home, as it does on all Amazon furniture brands.

- “We are excited to expand our selection of private-label furniture with the launch of Ravenna Home, our newest line of timeless everyday furniture offered at a great value,” said an Amazon spokesperson.

Walmart, Expecting Best Holiday Season Yet, Wants to Speed Shoppers with New Mobile Checkout

(October 30) CNBC.com

Walmart, Expecting Best Holiday Season Yet, Wants to Speed Shoppers with New Mobile Checkout

(October 30) CNBC.com

- Walmart will be rolling out a “check out with me” option at all of its stores by Black Friday. As soon as this week at some locations, shoppers will find Walmart employees scattered throughout aisles with handheld devices that allow them to scan bulky items such as TVs and furniture to allow customers to pay on the spot and have a receipt emailed to them.

- In addition, Walmart said that its mobile app will include store maps to help shoppers find items faster this holiday season.

Hibbett Sports Agrees to Buy US Fashion Retailer City Gear

(October 30) Retail-Insight-Network.com

Hibbett Sports Agrees to Buy US Fashion Retailer City Gear

(October 30) Retail-Insight-Network.com

- US-based athletics retailer Hibbett Sports has agreed to purchase City Gear for a cash consideration of $88 million. Hibbett will offer an additional $25 million over the next two years based on certain performance-based targets. The deal is subject to customary closing conditions and is expected to be completed by early December.

- Following the transaction, City Gear will become a subsidiary of Hibbett Sporting Goods and will operate from its current headquarters in Memphis, Tennessee. The company’s senior management team will continue to lead the business.

Walmart’s Test Store for New Technology, Sam’s Club Now, Opens Next Week in Dallas

(October 29) TechCrunch.com

Walmart’s Test Store for New Technology, Sam’s Club Now, Opens Next Week in Dallas

(October 29) TechCrunch.com

- Walmart’s warehouse club, Sam’s Club, is preparing to open the doors at a new Dallas-area store that will serve as a test-bed for the latest in retail technology.

- Specifically, the retailer will test out new concepts such as mobile checkout, an Amazon Go–like camera system for inventory management, electronic shelf labels, way finding technology for in-store navigation, augmented reality and artificial intelligence–infused shopping.

Venmo Now Accepted at Shopify Merchants

(October 29) PYMNTS.com

Venmo Now Accepted at Shopify Merchants

(October 29) PYMNTS.com

- Shopify announced that it is adding Venmo as a checkout option for its Shopify Merchants that use PayPal checkout. The company said that to expand its business and reach more consumers, it is always looking at popular checkout options that are resonating with buyers.

- Venmo, which is owned by PayPal, is a mobile digital wallet that lets users split payments with other friends on Venmo or pay friends via the app.

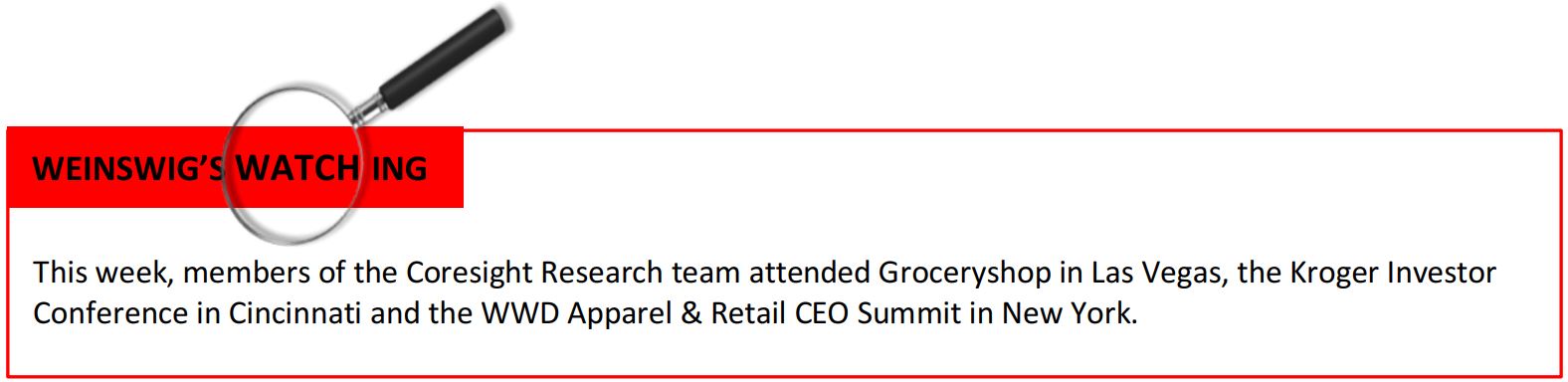

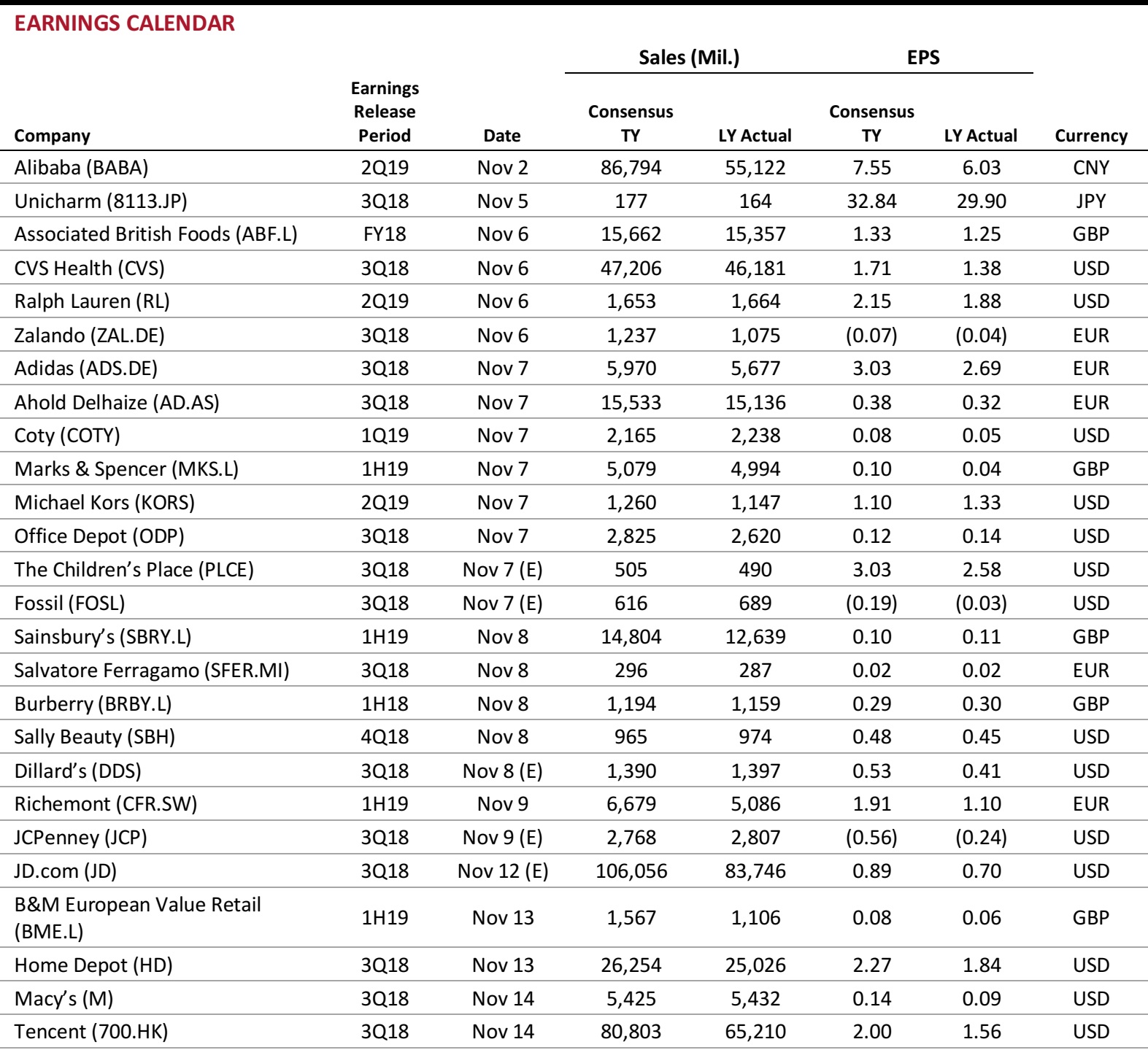

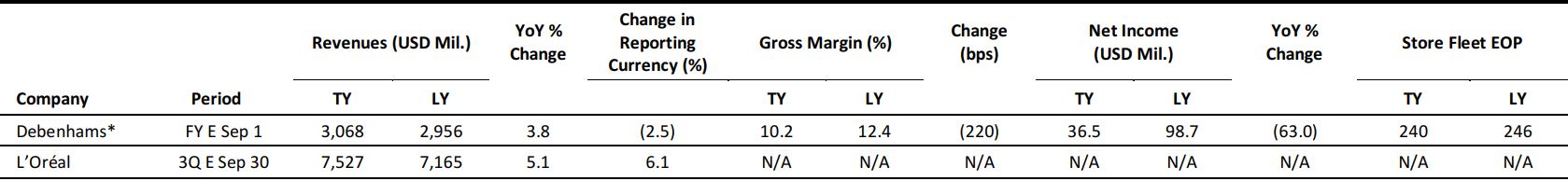

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

Oasis Partners with Sainsbury’s to Open Concessions

(October 25) RetailGazette.co.uk

Oasis Partners with Sainsbury’s to Open Concessions

(October 25) RetailGazette.co.uk

- UK fashion chain Oasis has partnered with Sainsbury’s to open concessions in five of the latter’s supermarkets by next spring. Two concessions will open before Christmas, one in the Sainsbury’s South London location and one in its supermarket near Birmingham.

- Sainsbury’s said that Oasis’s “on-trend fashion ranges” will complement its own fashion clothing brand, Tu, and “help to make [Sainsbury’s] stores leading fashion destinations.”

Metro AG Reports Increase in Like-for-Like Sales in Fiscal Year 2018

(October 25) Company press release

Metro AG Reports Increase in Like-for-Like Sales in Fiscal Year 2018

(October 25) Company press release

- German wholesaler and hypermarket retailer Metro grew its comparable sales by 0.7% year over year in its fiscal 2018 year, ended September 30. Comparable sales were up 1.3% at Metro Wholesale and down 1.7% at hypermarket chain Real. Metro said that it has achieved its sales target for the fiscal year.

- Olaf Koch, Chairman of the company’s Management Board, commented, “In the past financial year, we increased sales in a challenging market environment. In Germany, we reached a significant improvement in like-for-like sales, supported by our [Hotels, Restaurants and Cafés] customers. In Eastern Europe (excluding Russia) and Asia, we continued to grow on a good level.”

ScS Group to Exit House of Fraser Concessions by January 2019

(October 25) Company press release

ScS Group to Exit House of Fraser Concessions by January 2019

(October 25) Company press release

- British furniture and floorings retailer ScS Group is set to exit 27 of its concessions in House of Fraser stores by the end of January 2019 after reporting a 52.5% decline in comparable orders in concessions in the first quarter of its fiscal 2019 year, ended October 20.

- The core ScS business performed well in the quarter, with comparable order intake growth of 4.5%. The company said that it anticipates trading will be in line with its expectations.

Paperchase Profits Fall, Company Plans to Close Some UK Stores

(October 29) RetailGazette.co.uk

Paperchase Profits Fall, Company Plans to Close Some UK Stores

(October 29) RetailGazette.co.uk

- London-based stationery chain Paperchase recorded a statutory pretax loss of £6.3 million ($8 million) in the fiscal year ended February 3, 2018. EBITDA fell to £4.5 million ($5.7 million) from £9 million ($11 million) in the previous fiscal year.

- CEO Duncan Gibson said that the company plans to evolve from a “primarily UK-centric store business to a multichannel, multinational business,” which will involve closing some of the chain’s UK stores.

Monsoon Reports Increase in Website Dwell Time

(October 23) RetailTimes.co.uk

Monsoon Reports Increase in Website Dwell Time

(October 23) RetailTimes.co.uk

- UK fashion retailer Monsoon reported a 29% rise in website dwell time following its launch of shoppable social technology on social media platforms in partnership with marketing technology company Curalate.

- The retailer is also using Curalate’s Fanreel function, which curates customer images posted on social media channels and features them in the #MyMonsoon gallery on the retailer’s website. In addition, Monsoon is testing a technology that can turn any image or video into a virtual pop-up shop and enable customers to shop directly from any social post.

ASIA RETAIL & TECH HEADLINES

7-Eleven, Giant, Cold Storage and Guardian Stores in Singapore Set to Accept WeChat Pay

(October 24) VulcanPost.com

7-Eleven, Giant, Cold Storage and Guardian Stores in Singapore Set to Accept WeChat Pay

(October 24) VulcanPost.com

- Singapore’s largest retail group, Dairy Farm Singapore Group, and Singaporean electronic payment service Network for Electronic Transfers have entered into a collaboration with Chinese communication and mobile payment app WeChat to introduce WeChat Pay to retail stores in Singapore.

- WeChat Pay users will be able to use the payment method at more than 600 7-Eleven, Giant, Cold Storage and Guardian stores across the island starting November 1.

Alibaba Collaborates with Swiss Luxury Group Richemont

(October 26) Alizila.com

Alibaba Collaborates with Swiss Luxury Group Richemont

(October 26) Alizila.com

- E-commerce giant Alibaba is set to enter into a joint venture with online luxury retailer Yoox Net-a-Porter, a subsidiary of Swiss luxury group Richemont, to bring Yoox Net-a-Porter’s offerings to China’s online shoppers.

- The joint venture will introduce a mobile app for the Net-a-Porter platform and menswear site Mr Porter and flagship stores for both on Alibaba’s Tmall Luxury Pavilion, which focuses on connecting premier brands with China’s luxury consumers.

JD Introduces Reusable Packaging

(October 29) RetailNews.asia

JD Introduces Reusable Packaging

(October 29) RetailNews.asia

- In an effort to promote sustainable consumption, e-commerce behemoth JD.com has introduced an initiative that gives customers the option to order reusable packaging for small and medium-sized parcels.

- Customers who choose the reusable packaging are credited with JD’s “Jingdou” loyalty points, which can be redeemed to purchase products off the company’s platform. The service was piloted in Beijing, Shanghai, Guangzhou and Shenzhen and will expand to 20 cities by the end of 2018.

South Korean Design Brand Beccos Set to Open 50 Stores in India

(October 25) Businesss-Standard.com

South Korean Design Brand Beccos Set to Open 50 Stores in India

(October 25) Businesss-Standard.com

- South Korean designer brand Beccos announced that it intends to launch 50 stores across India by the middle of 2019.

- The company plans to invest approximately $13.7 million toward its India expansion plans and expects to generate revenues of $27–$34 million from the region in the next fiscal year.

Clarks Singapore Launches New Global Concept Store

(October 24) InsideRetail.asia

Clarks Singapore Launches New Global Concept Store

(October 24) InsideRetail.asia

- Britain-based shoe retailer Clarks opened its first Clarks Pure concept store in Singapore on October 24. The store has been described as “a classic, understated and uncluttered retail space [that] reflects the brand’s history and modern spirit.”

- Located in the Ion Orchard shopping center, the new store is the first of its kind in Southeast Asia and follows successful launches in Manchester and Glasgow in the UK. The only other Clarks Pure store in Asia is in Shanghai.

LATAM RETAIL & TECH HEADLINES

Convenience Store Chain Oxxo Starts Operations in Peru

(October 26) Gestion.pe

Convenience Store Chain Oxxo Starts Operations in Peru

(October 26) Gestion.pe

- Oxxo, a Mexican chain of convenience stores owned by multinational retailer FEMSA, has opened its first store in Peru, in Santiago de Surco, a district of Lima.

- The company said that the store marks the beginning of a new stage in its international growth strategy. Oxxo will compete directly with supermarket chain Tambo+ in Peru.

Falabella Opens New Store in Santiago, Chile

(October 29) America-Retail.com

Falabella Opens New Store in Santiago, Chile

(October 29) America-Retail.com

- Chilean department store chain Falabella has opened a store in Mall Barrio Independencia in the Chilean capital of Santiago. This takes the company’s national store count to 47.

- The new store is spread across approximately 22,000 square feet. The store will offer clothing, footwear, accessories and beauty items, among other products.

Visa Announces Investment in Conductor

(October 25) ZDNet.com

Visa Announces Investment in Conductor

(October 25) ZDNet.com

- After stating earlier in October that it plans to expand investments across fintech companies in Latin America and the Caribbean, Visa has announced an investment in Conductor, a Brazilian digital payments–processing company.

- The partnership involves the development of issuer-focused solutions for tokenizing payments via mobile wallets and improving access to Visa APIs, a set of definitions and protocols used to develop computer programs or software.

Modern Retail in Peru Is One of the Most Attractive Markets for Investment

(October 24) Gestion.pe

Modern Retail in Peru Is One of the Most Attractive Markets for Investment

(October 24) Gestion.pe

- In Peru, the low penetration of modern retail within total retail sales and increased consumer access to digital media have made modern retail a lucrative market for investment, according to research by Spanish banking group BBVA.

- Modern retail in Peru has shown improved performance since the second part of last year due to better labor market conditions and improved consumption financing, according to the study.

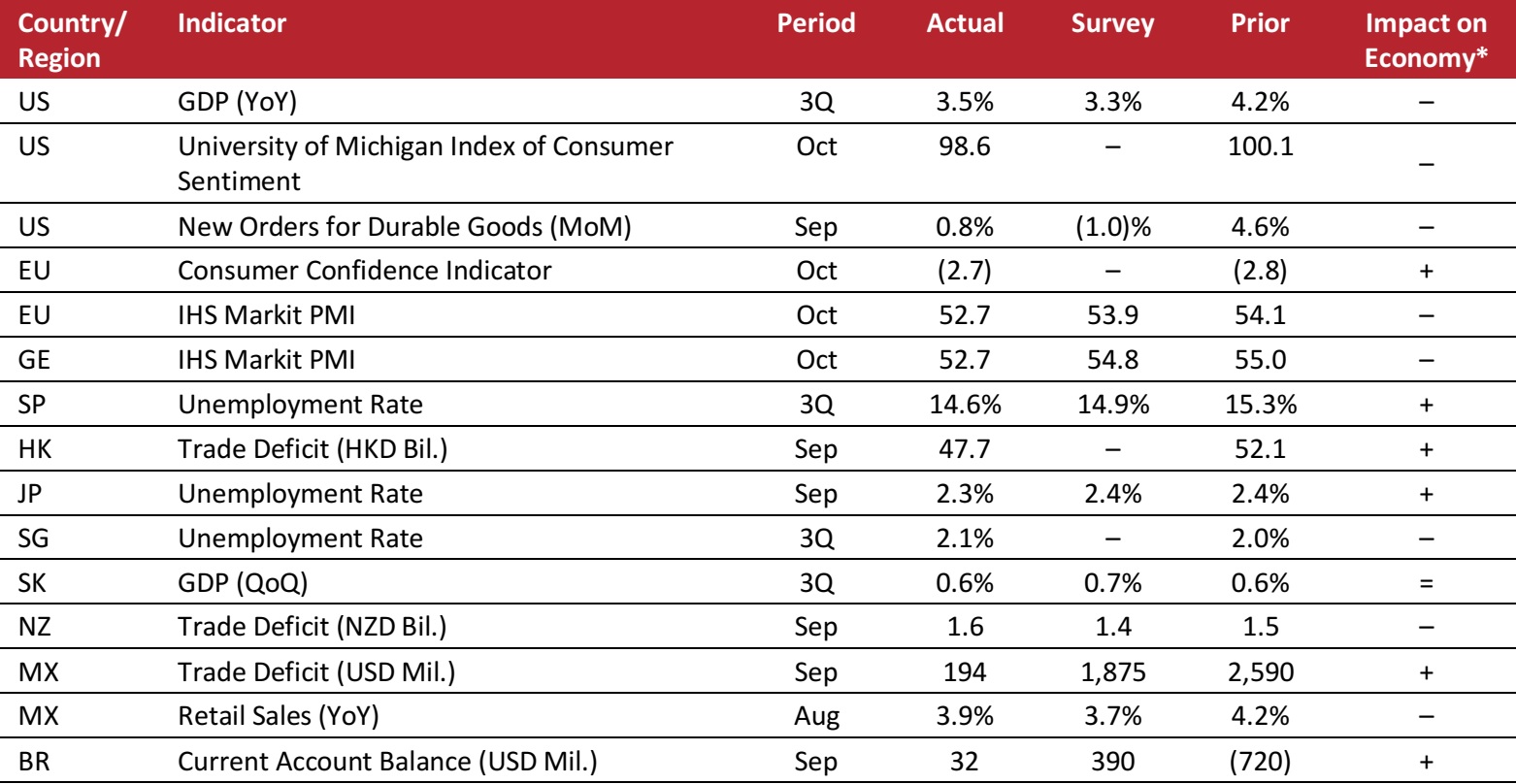

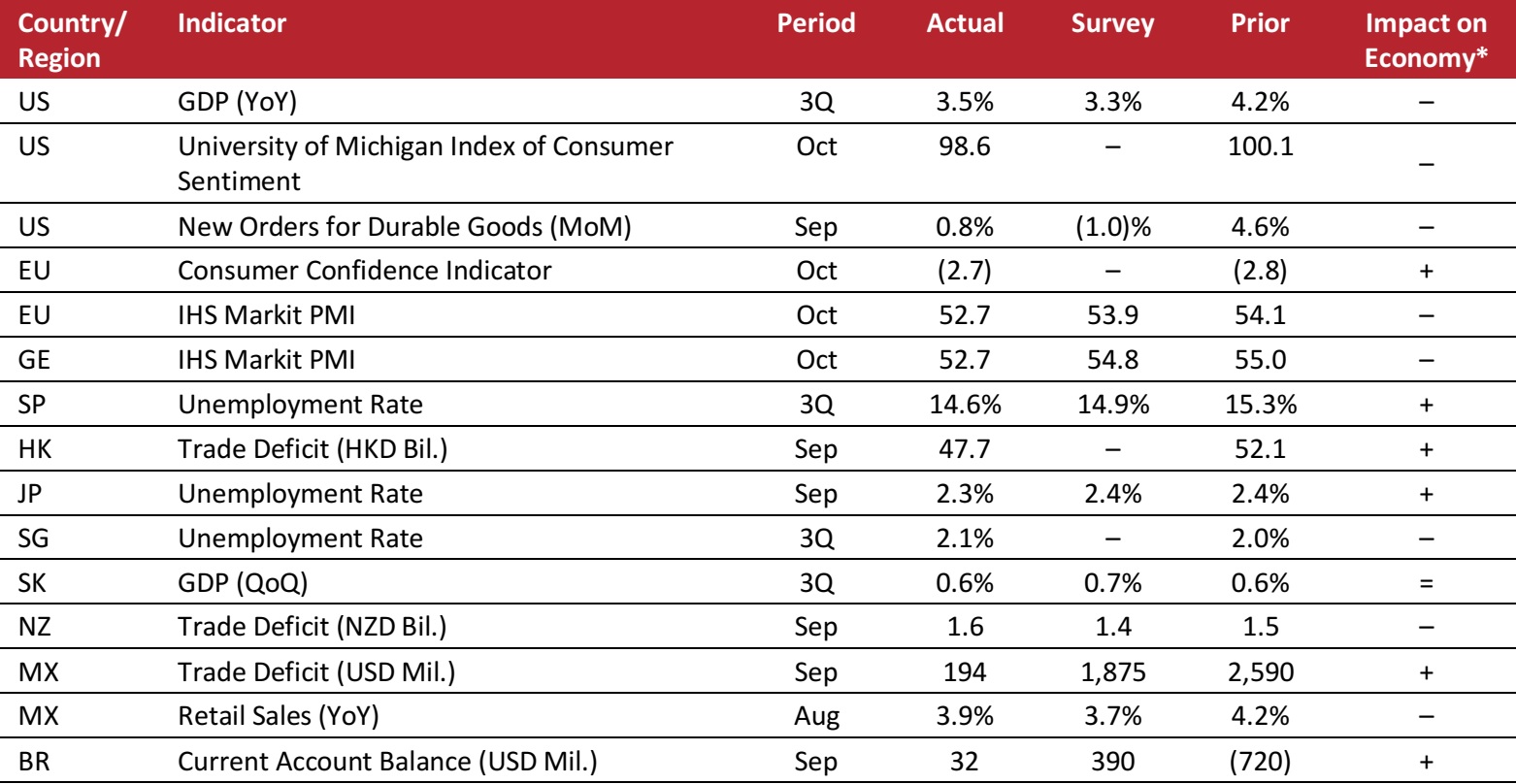

MACRO UPDATE

Key points from global macro indicators released October 24–30, 2018:

- US: In the third quarter, US GDP advanced at an annualized rate of 3.5%, beating the consensus estimate of 3.3% and following 4.2% growth in the previous quarter. The University of Michigan Index of Consumer Sentiment fell to 98.6 in October from 100.1 in September.

- Europe: Consumer confidence in the European Union increased to (2.7) in October from (2.8) in September. The IHS Markit Purchasing Managers’ Index (PMI) for Germany fell to 52.7 in October from 55.0 in September.

- Asia-Pacific: The trade deficit in Hong Kong decreased to HK$47.7 billion in September from HK$52.1 billion in August. In Japan, the unemployment rate fell to 2.3% in September from 2.4% in the previous month and was slightly below the consensus estimate of 2.4%.

- Latin America: The trade deficit in Mexico narrowed to $194 million in September from $2,590 million in August and compared with market consensus of a $1,875 million shortfall. The current account balance in Brazil stood at $32 million in September, compared with a deficit of $720 million in the previous month.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/University of Michigan/US Census Bureau/European Commission/IHS Markit/Eurostat/Hong Kong Census and Statistics Department/Japan Ministry of International Affairs and Communications/Singapore Ministry of Manpower/The Bank of Korea/Statistics New Zealand/Instituto Nacional de Estadística y Geografía/Banco Central do Brasil/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/University of Michigan/US Census Bureau/European Commission/IHS Markit/Eurostat/Hong Kong Census and Statistics Department/Japan Ministry of International Affairs and Communications/Singapore Ministry of Manpower/The Bank of Korea/Statistics New Zealand/Instituto Nacional de Estadística y Geografía/Banco Central do Brasil/Coresight Research

Amazon Fashion’s London pop-up store

Source: Coresight Research

Amazon Fashion’s London pop-up store

Source: Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Oasis Partners with Sainsbury’s to Open Concessions

(October 25) RetailGazette.co.uk

Oasis Partners with Sainsbury’s to Open Concessions

(October 25) RetailGazette.co.uk

Metro AG Reports Increase in Like-for-Like Sales in Fiscal Year 2018

(October 25) Company press release

Metro AG Reports Increase in Like-for-Like Sales in Fiscal Year 2018

(October 25) Company press release

ScS Group to Exit House of Fraser Concessions by January 2019

(October 25) Company press release

ScS Group to Exit House of Fraser Concessions by January 2019

(October 25) Company press release

7-Eleven, Giant, Cold Storage and Guardian Stores in Singapore Set to Accept WeChat Pay

(October 24) VulcanPost.com

7-Eleven, Giant, Cold Storage and Guardian Stores in Singapore Set to Accept WeChat Pay

(October 24) VulcanPost.com

Alibaba Collaborates with Swiss Luxury Group Richemont

(October 26) Alizila.com

Alibaba Collaborates with Swiss Luxury Group Richemont

(October 26) Alizila.com

South Korean Design Brand Beccos Set to Open 50 Stores in India

(October 25) Businesss-Standard.com

South Korean Design Brand Beccos Set to Open 50 Stores in India

(October 25) Businesss-Standard.com

Clarks Singapore Launches New Global Concept Store

(October 24) InsideRetail.asia

Clarks Singapore Launches New Global Concept Store

(October 24) InsideRetail.asia

Visa Announces Investment in Conductor

(October 25) ZDNet.com

Visa Announces Investment in Conductor

(October 25) ZDNet.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/University of Michigan/US Census Bureau/European Commission/IHS Markit/Eurostat/Hong Kong Census and Statistics Department/Japan Ministry of International Affairs and Communications/Singapore Ministry of Manpower/The Bank of Korea/Statistics New Zealand/Instituto Nacional de Estadística y Geografía/Banco Central do Brasil/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/University of Michigan/US Census Bureau/European Commission/IHS Markit/Eurostat/Hong Kong Census and Statistics Department/Japan Ministry of International Affairs and Communications/Singapore Ministry of Manpower/The Bank of Korea/Statistics New Zealand/Instituto Nacional de Estadística y Geografía/Banco Central do Brasil/Coresight Research