From the Desk of Deborah Weinswig

Ready for Automated Stores? Join the Queue!

Tired of long checkout lines? Do not worry. We think 2018 could be the year when checkout-less stores go mainstream, thanks to a glut of new technologies that will turn our local shops into something akin to giant vending machines.

Last weekend, we attended Alibaba Group’s Singles’ Day event in Shanghai, and we took the opportunity to tour one of the group’s Hema grocery stores. These stores blend channels as part of Alibaba’s online-to-offline concept: Hema shoppers can use their smartphones to scan bar codes on items in order to learn more about the products. Then, when they check out, they can use the Hema app, which is linked to their Alipay account, to pay. The retailer is now trialing payment by facial recognition. In late September, Alibaba announced that it had opened seven new Hema stores in China.

Almost one year after the first high-tech, checkout-less Amazon Go store launched in trial mode, other retailers are now also offering automated checkout. In recent weeks, we have seen a flurry of announcements from retailers worldwide that are automating the checkout process.

On November 8, Auchan Retail China, part of France’s Auchan Group, announced the rollout of its Auchan Minute stores in China. These unstaffed microstores are just 18 square meters (194 square feet) in size, and they stock only 500 products. Shoppers use the WeChat app to enter the store, then scan the items they want before confirming and paying for them—all with their smartphone. Through a partnership with hardware firm Hisense, Auchan hopes to open “several hundred” such stores in China before the end of this year.

In what may perhaps be termed the “micro-microstore segment,” a fancy vending concept called Bodega launched in September in the US. The company uses artificial intelligence to determine what 100 nonperishable pantry items its customers in a given location will likely want to buy, and then stocks those items in the Bodega boxes. At launch, the company’s cofounder, Paul McDonald, told news website Fast Company that he hopes to ultimately have 100,000 Bodega points in the US.

Elsewhere in grocery, UK supermarket retailer Sainsbury’s launched an app in September that allows shoppers to bypass the checkout line when buying selected items. And, just this week, UK trade website The Grocer reported that Ireland’s Musgrave is set to open a checkout-free convenience store in Cork.

In the pursuit of frictionless shopping, a promising third-party technology looks to be MishiPay. Its “scan, pay and leave” technology allows in-store shoppers to scan bar codes on product labels with their smartphone and pay by card or Apple Pay. Once payment is complete, the RFID security tags attached to the items are deactivated, and shoppers can walk out of the store without setting off alarms. Rivals to MishiPay include the SkipQ app in the UK and QueueHop in the US.

We think that 2018 could shape up to be a year of supersized vending as many more retailers—particularly in the grocery convenience sector—leverage smartphone technology to reduce friction in the in-store shopping experience over the coming months.

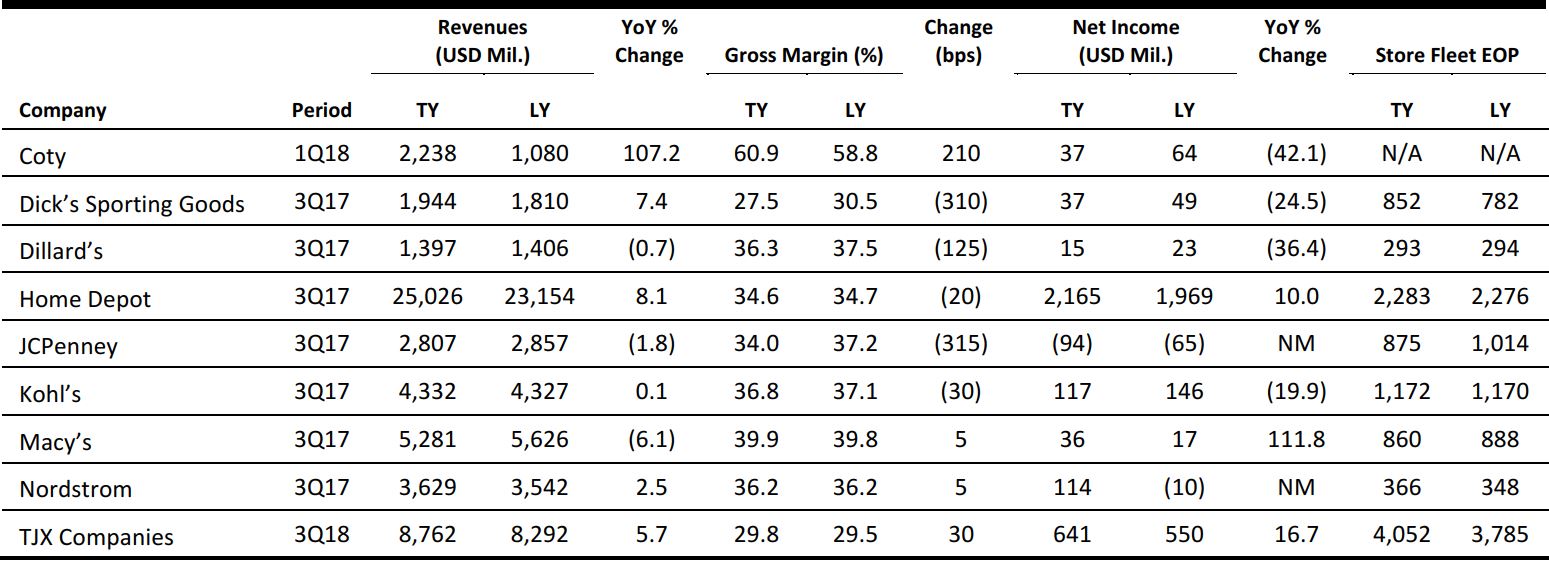

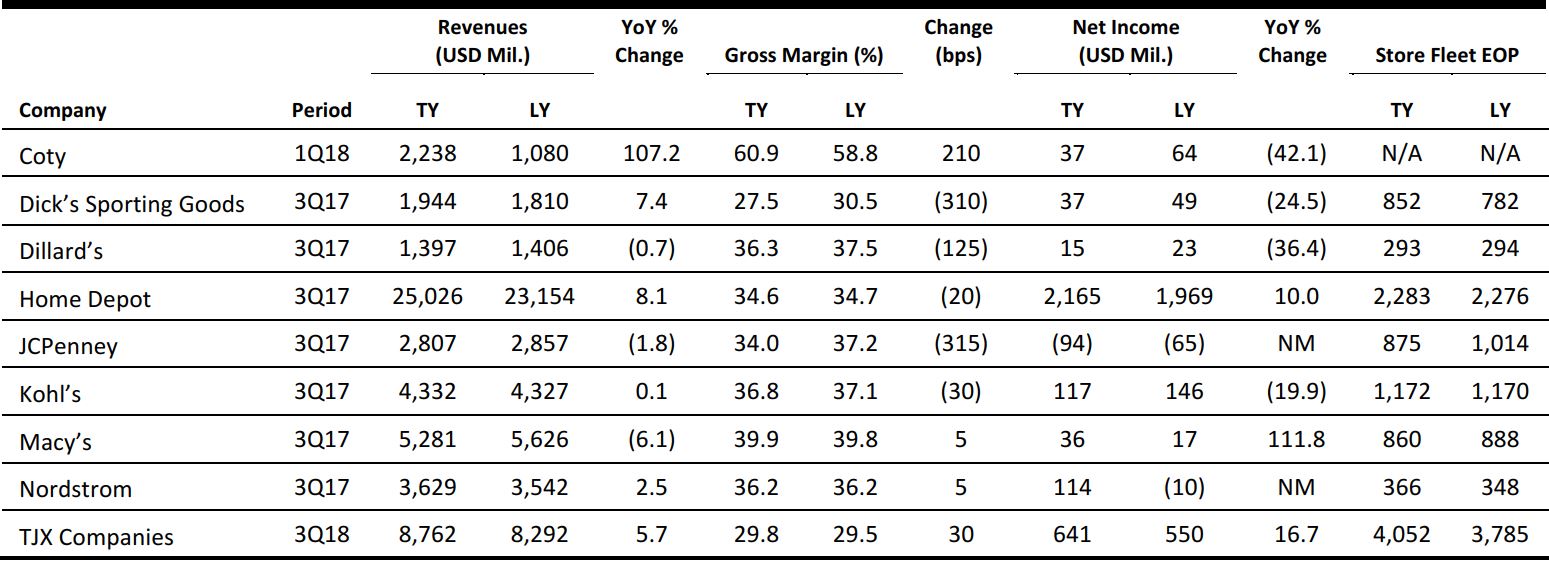

US RETAIL EARNINGS

US RETAIL & TECH HEADLINES

US RETAIL & TECH HEADLINES

Home Depot Is Retail’s Bright Spot as It Courts Younger Shoppers Who Prefer DIY

(November 14) CNBC.com

Home Depot Is Retail’s Bright Spot as It Courts Younger Shoppers Who Prefer DIY

(November 14) CNBC.com

- Home Depot reported an impressive increase in same-store sales, fueled by more shoppers spending on items such as tools, lumber, garden accessories and flooring. Hurricanes Harvey and Irma, along with some US wildfires, also boosted sales of recovery materials.

- Home Depot cited growth among its professional customers, but also noted bright spots with younger shoppers who prefer DIY. When these millennial shoppers become homeowners, they are also spending more for renovations, according to an annual survey from Houzz called Houzz & Home. The study found that the 25–34-year-old age group spent an average of $26,200 in 2016 on home upgrades, up 7% year over year.

Retailers’ Wish Lists Feature Early Holiday Shopping

(November 13) LATimes.com

Retailers’ Wish Lists Feature Early Holiday Shopping

(November 13) LATimes.com

- Walmart, Target and others are already aggressively advertising holiday specials online and in stores to get a jump on the spending spree that remains a key contributor to merchants’ financial health.

- “Black Friday has become black November,” quipped Steve Barr, head of the US retail and consumer sector at accounting and advisory firm PwC, as retailers have rolled out their holiday price cuts well in advance of Black Friday, once the traditional start of holiday buying.

Store Brands Gaining in US Retail Channels

(November 13) PackWorld.com

Store Brands Gaining in US Retail Channels

(November 13) PackWorld.com

- Store brands are gaining market share from the big national brands in America’s fastest-growing retail channels, according to Nielsen. In the 52-week period ended December 24, 2016, private-label dollar volume in the mass merchandise/club/dollar store segment climbed 4.4%, to $49.6 billion, resulting in a 0.5-point market share gain, to 16.6%.

- Although store brands lost market share in the slow-growth supermarket channel—measured at 18.4% dollar share and 22.3% unit share—market shares for retailers’ brands in other outlets saw solid gains at the expense of national brands.

US Retail: 68% of Sales Take Place on Mobile

(November 10) MediaPost.com

US Retail: 68% of Sales Take Place on Mobile

(November 10) MediaPost.com

- Some 30% of US desktop transactions are now preceded by a click on a mobile device, according to data from commerce marketing technology company Criteo. The firm’s Global Commerce Review for the third quarter of 2017 explores the “winding” path shoppers take to purchase and the numerous devices, browsers and apps they use to accomplish the task.

- Globally, advertisers generating transactions on mobile websites and in apps see more than 50% of transactions completed on mobile. In the US, advertisers see 68% of sales taking place on mobile devices. Apps account for 71% of mobile transactions for retailers that invest in both mobile web and in-app campaigns.

2018 Will Be Significantly Worse for Debt-Laden US Retailers

(November 10) Forbes.com

2018 Will Be Significantly Worse for Debt-Laden US Retailers

(November 10) Forbes.com

- Industry-wide headwinds will persist as retail chains sink under the weight of debt in the coming years. Data compiled by Bloomberg suggest that a ballooning load of hard-to-refinance debt held by retailers will doom more chains than anything else will.

- All together, $100 million worth of retail borrowings came due this year. In 2018, the need for refinancing will really kick in for retail, as $1.9 billion in high-yield retail debt will come due next year, according to Fitch Ratings. Many retailers simply will not be able to refinance, meaning more bankruptcies and closures.

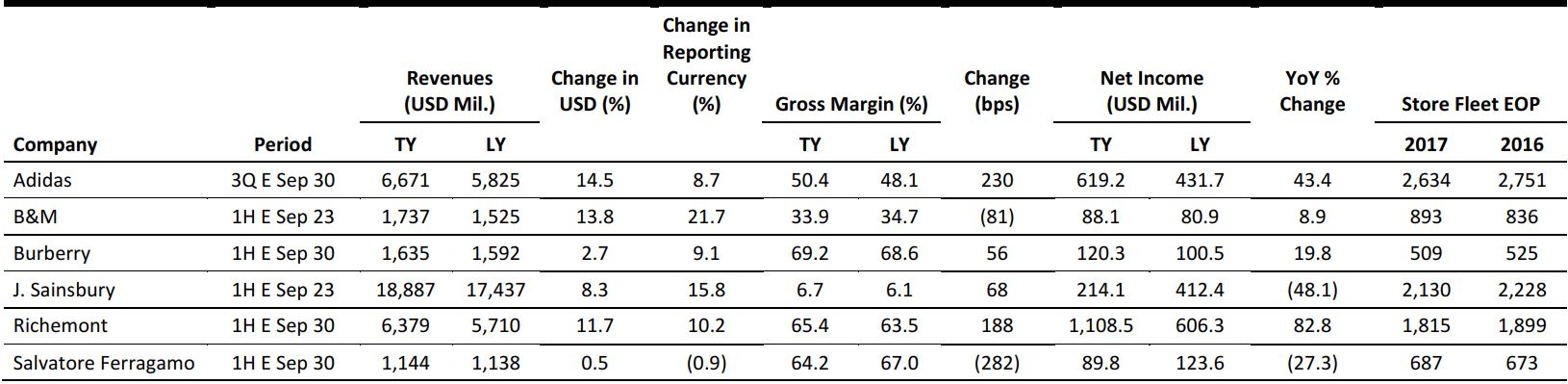

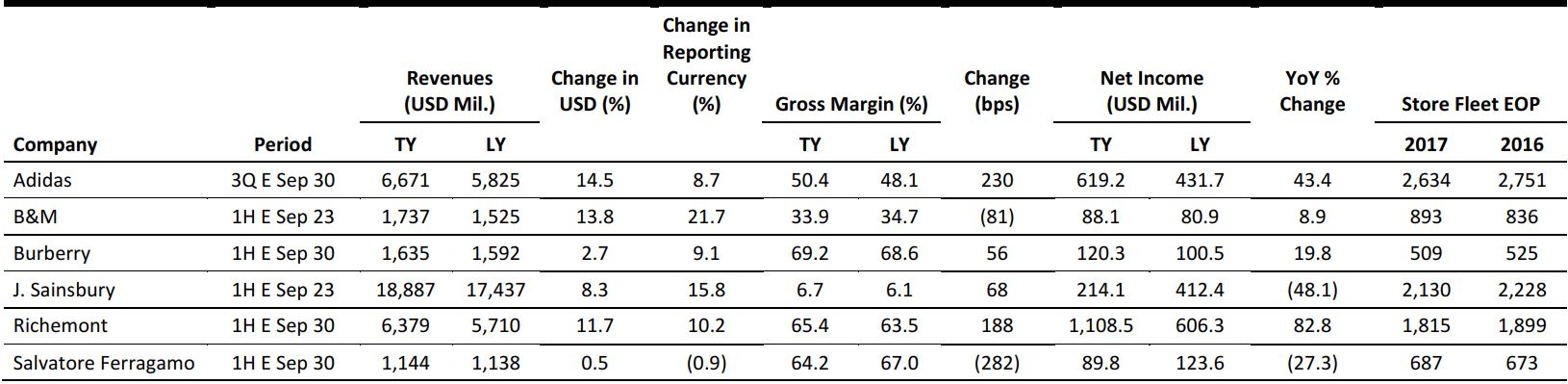

EUROPE RETAIL EARNINGS

Source: Company reports/FGRT

Source: Company reports/FGRT

EUROPE RETAIL & TECH HEADLINES

IKEA Sees Sixth Consecutive Year of Growth in the UK

(November 14) BusinessInsider.com

IKEA Sees Sixth Consecutive Year of Growth in the UK

(November 14) BusinessInsider.com

- Swedish furniture retailer IKEA reported UK sales of £1.8 billion ($2.4 billion) in the year ended August 31, up 5.8% year over year. This was its sixth consecutive year of growth in the UK.

- The depreciation of the pound pushed up the company’s costs by 13.7%, as it imports heavily from abroad. The company said that it increased prices by only 3.6%, while absorbing the remaining costs in order to keep its range affordable. UK CEO Gillian Drakeford said that IKEA will continue expanding to grow its share of the home furnishings market in the country.

B&M’s Sales Jump 21.7% in First Half

(November 14) Company press release

B&M’s Sales Jump 21.7% in First Half

(November 14) Company press release

- British variety retailer B&M European Value Retail reported that sales jumped 21.7% (21% at constant currency), to £1.4 billion ($1.8 billion), in the first half of fiscal 2018. Comparable sales in the UK grew by 7.5% and B&M’s German business, Jawoll, reported growth of 20.2% for the period.

- B&M said that it is on track to open at least 50 new stores in the UK and 11 new stores in Germany this fiscal year.

British Grocery Sales Rise in 12 Weeks Ended November 5

(November 14) Kantar Worldpanel press release

British Grocery Sales Rise in 12 Weeks Ended November 5

(November 14) Kantar Worldpanel press release

- British grocery sales rose by 3.2% in the 12 weeks ended November 5, according to the latest data from consumer insights firm Kantar Worldpanel. Price rises kept “supermarket performance buoyant,” as volume-driven growth was less than 1% in the period, the firm said.

- Sales at Lidl were up 15.1%, making it the UK’s fastest-growing supermarket for the fifth consecutive period. Aldi’s sales rose by 13.1% and Sainsbury’s performed best among the big four domestic grocers, with sales up 2.6%. Sales climbed 2.3% at Tesco, 1.5% at Asda and 2.1% at Morrisons.

Morrisons and Amazon Collaborate to Enable Grocery Shopping by Voice Command

(November 13) InternationalSupermarketNews.com

Morrisons and Amazon Collaborate to Enable Grocery Shopping by Voice Command

(November 13) InternationalSupermarketNews.com

- Amazon has partnered with British grocer Morrisons to enable customers to order groceries by voice command through the online retailer’s artificial intelligence (AI)–powered Echo and Tap devices. Morrisons is the first of the UK’s big four grocers to offer this service to customers.

- The Morrisons “skill,” or app, for Amazon’s AI assistant will let customers add items to and remove items from their basket, check the purchase total, check if the order contains a particular item, check if Morrisons stocks a product, check if the order can be edited and confirm whether the scheduled delivery is on time.

Three Stripes Are Adidas’s Property and Brands Cannot Use Two Stripes, Either

(November 13) RetailDetail.eu

Three Stripes Are Adidas’s Property and Brands Cannot Use Two Stripes, Either

(November 13) RetailDetail.eu

- Swedish fashion chain H&M cannot use two parallel stripes on its sports clothing, as the design very closely resembles Adidas’s three stripes, a court of The Hague has ruled. The dispute can be traced back to 1997, when a court ordered H&M to stop selling a sports collection that featured pants and shirts with two parallel stripes.

- The dispute between the firms, which lasted nearly 20 years, has been settled by a Dutch court ruling that says, “Adidas’s three stripes are a registered trademark with no exceptions allowed.” H&M stopped selling the disputed products in 1997.

ASIA RETAIL & TECH HEADLINES

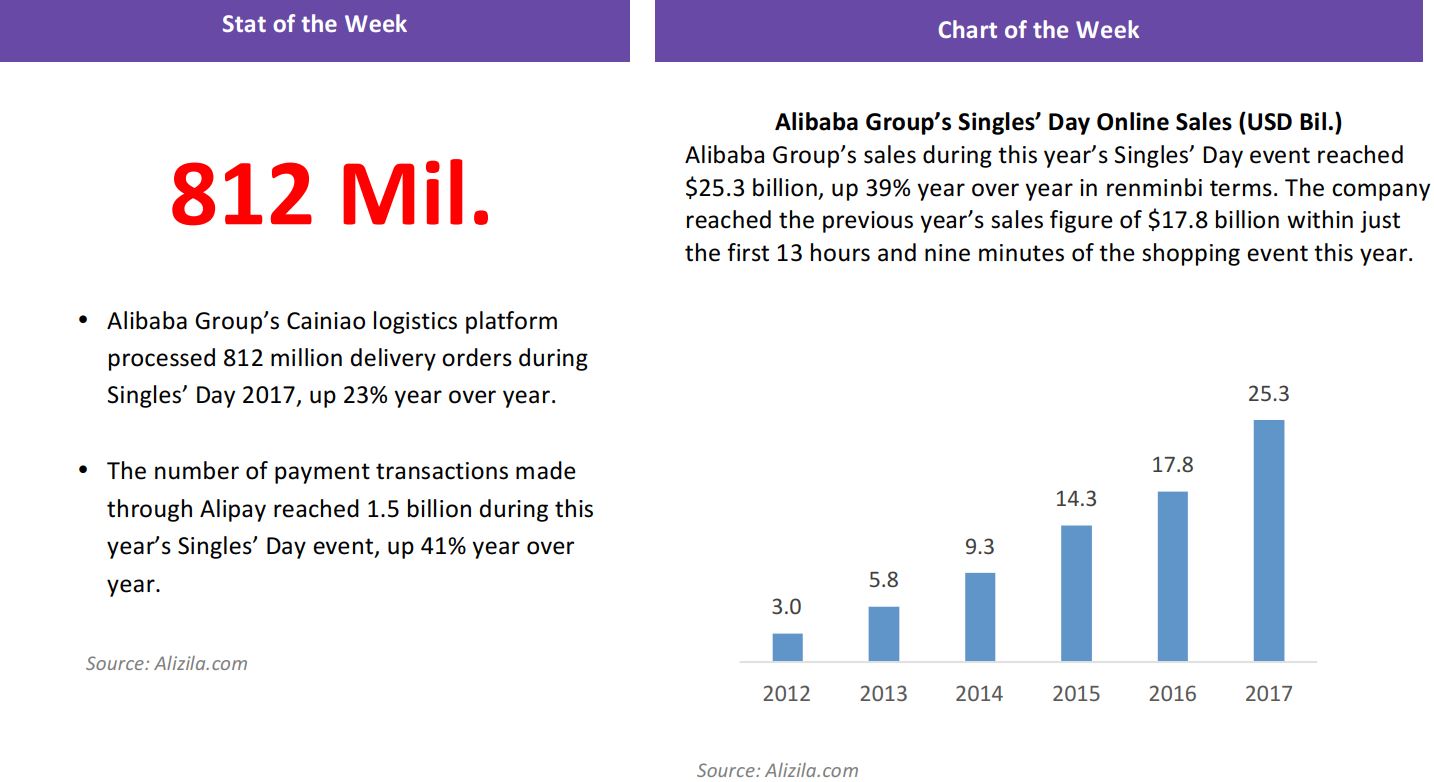

Alibaba Smashes Its Singles’ Day Record Once Again as Sales Cross $25 Billion

(November 12) TechCrunch.com

Alibaba Smashes Its Singles’ Day Record Once Again as Sales Cross $25 Billion

(November 12) TechCrunch.com

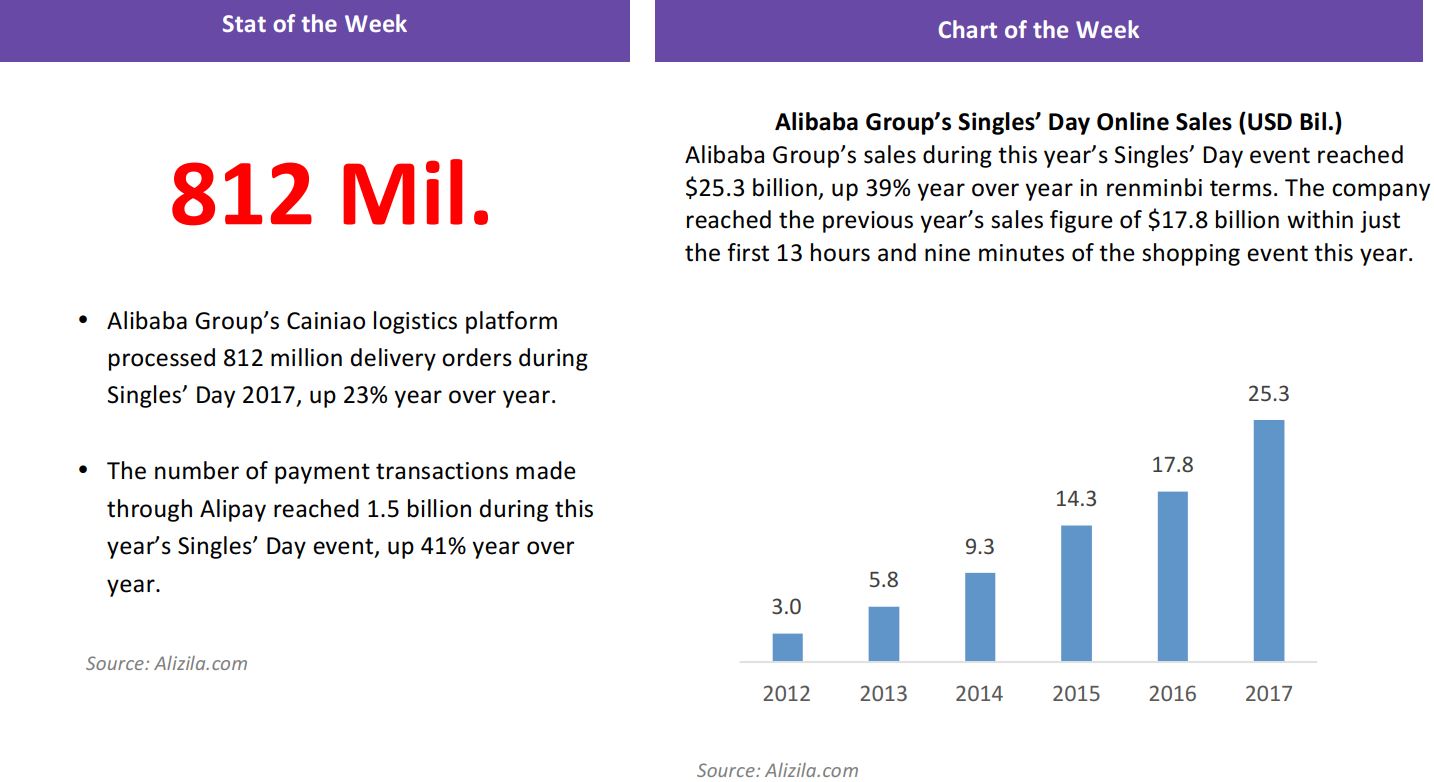

- Alibaba has set another Singles’ Day record after selling more than $25 billion of product during China’s biggest online shopping event. The full number came in at ¥163.8 billion ($25.3 billion) in gross merchandise volume, a 39% increase from last year’s figure. Alibaba handled 1.48 billion transactions during the 24-hour period.

- The holiday began as a promotion for Tmall and was started by current CEO Daniel Zhang, who was then in charge of the business unit, as a way to make single people feel less lonely. It has since blossomed into the world’s largest single shopping date by some margin.

China’s Second-Largest E-Commerce Firm Just Showed Alibaba Has Competition

(November 12) TechCrunch.com

China’s Second-Largest E-Commerce Firm Just Showed Alibaba Has Competition

(November 12) TechCrunch.com

- JD.com, the perennial challenger to Alibaba’s e-commerce empire in China, just revealed its Singles’ Day figures for the first time. While JD.com’s sales were not as high as Alibaba’s ¥163.8 billion ($25.3 billion), the company did process an impressive ¥127.1 billion ($19.14 billion) in gross merchandise volume.

- However, unlike Alibaba, which racked up its huge sales figure in just 24 hours, JD.com’s tally covers November 1–12, which it calls the “Singles’ Day period,” indicating just how dominant Alibaba is. There is no direct comparison, but the figure is a touch above Alibaba’s 2016 Singles’ Day gross merchandise volume.

China’s New Media Firm Bytedance Valued at $20 Billion

(November 10) TechCrunch.com

China’s New Media Firm Bytedance Valued at $20 Billion

(November 10) TechCrunch.com

- Bytedance is valued at $20 billion and its flagship Toutiao news reader app is one of China’s fastest-growing Internet services, with 120 million daily users. The company is in the process of raising a $2 billion funding round, and its revenue for this year is reportedly forecast to hit $2.5 billion.

- Bytedance acquired Musical.ly, a mobile app that is hugely popular among young people in the US, in a deal that could reach $1 billion, to fuel its expansion outside China. The company also invested $50 million in Live.me, a mobile streaming app focused on the US market, and agreed to pay $86.6 million to buy News Republic, a media aggregation service app.

AWS Is Not Exiting China, but Did Sell Physical Assets to Comply with Chinese Law

(November 15) TechCrunch.com

AWS Is Not Exiting China, but Did Sell Physical Assets to Comply with Chinese Law

(November 15) TechCrunch.com

- Amazon has denied reports that it is withdrawing its Amazon Web Services (AWS) business from China, but the firm did admit that it has been forced to sell some physical assets to its local partner. An Amazon spokesperson clarified that the firm remains committed to China, but was forced to offload “certain physical infrastructure assets” in order to comply with Chinese law.

- The US firm appeared to have exited the country after The Wall Street Journal and Reuters reported that Beijing Sinnet, the partner that operates AWS China, had notified investors of its acquisition of the business for ¥2 billion ($300 million).

LATAM RETAIL & TECH HEADLINES

São Paulo Allows Smartphone Use in Classrooms

(November 8) ZDNet.com

São Paulo Allows Smartphone Use in Classrooms

(November 8) ZDNet.com

- Students from schools across the Brazilian state of São Paulo are now able to use their smartphones during class. New state regulations allow using mobile phones for web browsing in classrooms as long as it is for educational purposes. Additionally, São Paulo state governor Geraldo Alckmin pledged to roll out Wi-Fi access to all 5,000 schools across the state.

- According t o the State Department of Education, “Students in elementary and secondary schools will be able to use the [mobile] devices in the classroom, during pedagogic activities and guided by educators, involving them in the language of their time, following technological innovations and awakening creativity in development of new projects.”

Brazilian Banks Lead in Artificial Intelligence Planning

(November 13) ZDNet.com

Brazilian Banks Lead in Artificial Intelligence Planning

(November 13) ZDNet.com

- The number of banks in Brazil that see artificial intelligence (AI) as a strategic priority is higher than in many mature markets, according to recent research. About 30% of local institutions see AI playing an important role in their innovation plans, according to GFT Technologies’ Digital Banking Expert Survey 2017.

- By comparison, 23% of firms in the sector in the UK and Mexico see AI as crucial to their strategy, while only 17% of US banks perceive the technology as an important aspect of their overall plans, the study from the financial services vendor found.

Namaste Expands Brazilian Market and Acquires Leading Vaporizer Retailer

(November 14) Company press release

Namaste Expands Brazilian Market and Acquires Leading Vaporizer Retailer

(November 14) Company press release

- Namaste Technologies announced that it has acquired the domain and customer database of Brazil’s largest vaporizer retailer, VapeBr. There was no cash consideration for the acquisition.

- Based on VapeBr’s 90-day sales history, Namaste expects to add more than C$1 million in additional annual revenue to its current revenue stream. Namaste believes that with the acquisition of VapeBR and the establishment of a local fulfillment center, its Brazilian operations will be profitable immediately.

Brazil Retail Sales Rebound in September as Spending Rises

(November 15) ZDNet.com

Brazil Retail Sales Rebound in September as Spending Rises

(November 15) ZDNet.com

- Brazilian retail sales rebounded in September from an unexpected drop in the prior month as lower unemployment provided a welcome boost to consumer spending. Sales volumes, excluding cars and building materials, rose by 0.5% in September from August after seasonal adjustments, government statistics agency IBGE said.

- The reading exceeded economists’ median forecast in a Reuters poll of a 0.4% increase and bucked a two-month string of underwhelming figures that had stoked concerns over Brazil’s recovery from its worst recession in a century. This suggests that the outlook for a gradual economic pickup remains intact, underpinned by newfound strength in the labor market, low inflation and interest rates bound for all-time lows.

MACRO UPDATE

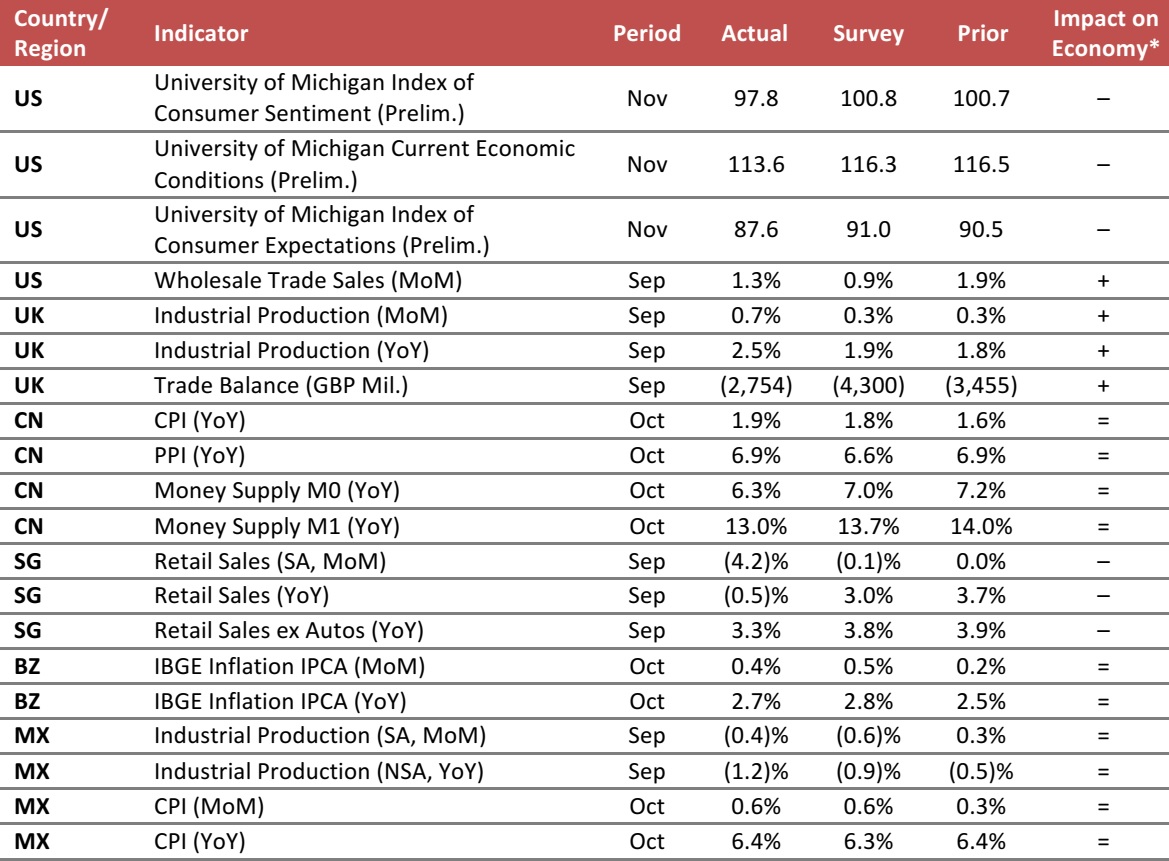

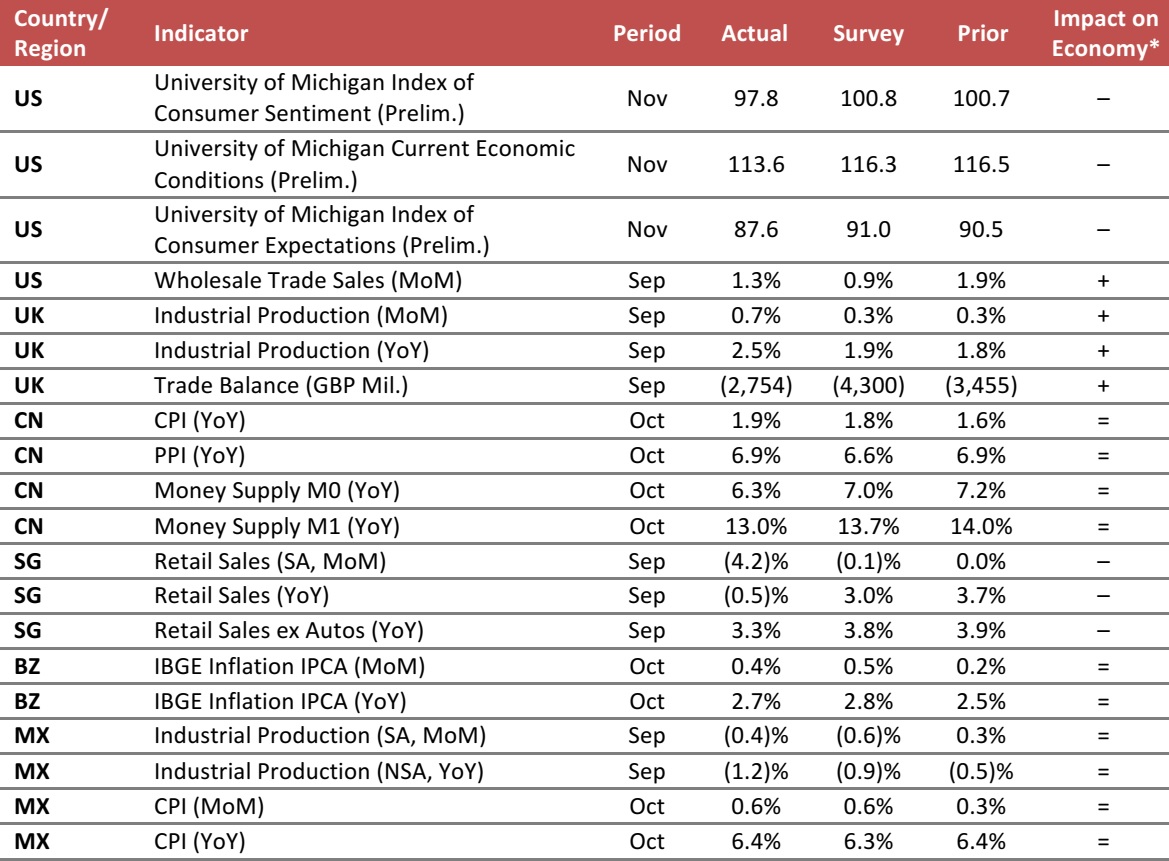

Key points from global macro indicators released November 8–15, 2017:

- US: In November, the University of Michigan Index of Consumer Sentiment ticked down to 97.8, missing the consensus estimate of 100.8. Confidence in both current economic conditions and expectations also deteriorated in November. Wholesale trade sales increased by more than the market had expected in September, rising by 1.3% month over month.

- Europe: In the UK, industrial production increased by 0.7% month over month and by 2.5% year over year in September, exceeding the consensus estimate in both periods. The UK trade deficit decreased to £2.75 billion in September, beating the market’s estimate of £4.3 billion.

- Asia-Pacific: In China, the Consumer Price Index (CPI) rose by 1.9% year over year in October, while the Producer Price Index (PPI) rose by 6.9% year over year. Money supply in China expanded more slowly in October than had been estimated. In Singapore, retail sales were weaker in September than the market had expected, falling by 4.2% month over month and by 0.5% year over year.

- Latin America: In Brazil, inflation increased by 0.4% month over month and by 2.7% year over year in October. In Mexico, industrial production in September dropped by 1.2% year over year; the figure was lower than the consensus estimate.

*FGRT’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: University of Michigan/US Census Bureau/UK Office for National Statistics/National Bureau of Statistics of China/People’s Bank of China/Singapore Department of Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/FGRT

On November 8, Auchan Retail China, part of France’s Auchan Group, announced the rollout of its Auchan Minute stores in China. These unstaffed microstores are just 18 square meters (194 square feet) in size, and they stock only 500 products. Shoppers use the WeChat app to enter the store, then scan the items they want before confirming and paying for them—all with their smartphone. Through a partnership with hardware firm Hisense, Auchan hopes to open “several hundred” such stores in China before the end of this year.

In what may perhaps be termed the “micro-microstore segment,” a fancy vending concept called Bodega launched in September in the US. The company uses artificial intelligence to determine what 100 nonperishable pantry items its customers in a given location will likely want to buy, and then stocks those items in the Bodega boxes. At launch, the company’s cofounder, Paul McDonald, told news website Fast Company that he hopes to ultimately have 100,000 Bodega points in the US.

Elsewhere in grocery, UK supermarket retailer Sainsbury’s launched an app in September that allows shoppers to bypass the checkout line when buying selected items. And, just this week, UK trade website The Grocer reported that Ireland’s Musgrave is set to open a checkout-free convenience store in Cork.

In the pursuit of frictionless shopping, a promising third-party technology looks to be MishiPay. Its “scan, pay and leave” technology allows in-store shoppers to scan bar codes on product labels with their smartphone and pay by card or Apple Pay. Once payment is complete, the RFID security tags attached to the items are deactivated, and shoppers can walk out of the store without setting off alarms. Rivals to MishiPay include the SkipQ app in the UK and QueueHop in the US.

We think that 2018 could shape up to be a year of supersized vending as many more retailers—particularly in the grocery convenience sector—leverage smartphone technology to reduce friction in the in-store shopping experience over the coming months.

On November 8, Auchan Retail China, part of France’s Auchan Group, announced the rollout of its Auchan Minute stores in China. These unstaffed microstores are just 18 square meters (194 square feet) in size, and they stock only 500 products. Shoppers use the WeChat app to enter the store, then scan the items they want before confirming and paying for them—all with their smartphone. Through a partnership with hardware firm Hisense, Auchan hopes to open “several hundred” such stores in China before the end of this year.

In what may perhaps be termed the “micro-microstore segment,” a fancy vending concept called Bodega launched in September in the US. The company uses artificial intelligence to determine what 100 nonperishable pantry items its customers in a given location will likely want to buy, and then stocks those items in the Bodega boxes. At launch, the company’s cofounder, Paul McDonald, told news website Fast Company that he hopes to ultimately have 100,000 Bodega points in the US.

Elsewhere in grocery, UK supermarket retailer Sainsbury’s launched an app in September that allows shoppers to bypass the checkout line when buying selected items. And, just this week, UK trade website The Grocer reported that Ireland’s Musgrave is set to open a checkout-free convenience store in Cork.

In the pursuit of frictionless shopping, a promising third-party technology looks to be MishiPay. Its “scan, pay and leave” technology allows in-store shoppers to scan bar codes on product labels with their smartphone and pay by card or Apple Pay. Once payment is complete, the RFID security tags attached to the items are deactivated, and shoppers can walk out of the store without setting off alarms. Rivals to MishiPay include the SkipQ app in the UK and QueueHop in the US.

We think that 2018 could shape up to be a year of supersized vending as many more retailers—particularly in the grocery convenience sector—leverage smartphone technology to reduce friction in the in-store shopping experience over the coming months.

US RETAIL & TECH HEADLINES

US RETAIL & TECH HEADLINES Source: Company reports/FGRT

Source: Company reports/FGRT Three Stripes Are Adidas’s Property and Brands Cannot Use Two Stripes, Either

(November 13) RetailDetail.eu

Three Stripes Are Adidas’s Property and Brands Cannot Use Two Stripes, Either

(November 13) RetailDetail.eu