From the Desk of Deborah Weinswig

Amazon Shopping List: Books, DVDs, Clothing, Groceries…and Prescription Medications?

Amazon, since its founding, has steadily expanded its product portfolio from just books initially to a massive assortment of goods. In the last couple of years, the company has experimented with offering clothing and food. In terms of clothing, Amazon initially offered third-party apparel before launching a handful of private-label apparel brands last year. As of early August, the company owned 19 private-label brands and had applied for more than 800 trademarks. Just this week, Amazon branched into private-label sportswear and furniture. In food, the company launched AmazonFresh in 2007 and then greatly expanded its food offering through its $13.6 billion acquisition of Whole Foods Market at the end of August this year.

Now, the buzz is that Amazon is looking to sell prescription pharmaceuticals, which is sending shock waves through several industries. Rumors of an Amazon entry into the prescription medication space have been circulating for some time, and on October 27, the St. Louis Post-Dispatch reported that Amazon has received approval for wholesale pharmacy licenses in at least 12 states: Alabama, Arizona, Connecticut, Idaho, Louisiana, Michigan, Nevada, New Hampshire, New Jersey, North Dakota, Oregon and Tennessee. The thinking is that Amazon could use its enormous e-commerce and distribution network to disrupt prescription drug distribution on both the wholesale and retail levels. There is already intense competition at the retail level, and Amazon could use its scale to negotiate better drug prices with pharmaceutical companies. Moreover, the company’s recent acquisition of Whole Foods gives it a widespread physical store network through which it could sell prescriptions.

Consumers could likely benefit, not just from lower prescription drug prices, but also through expanded convenience and time savings. For most consumers, a trip to the pharmacy involves waiting for a physician to write out a prescription on paper (although some prescriptions are transmitted electronically to the pharmacy) and then driving to a pharmacy, where the consumer is given the option of sitting and waiting for the pharmacist to fill the prescription or taking time out of the day later to return to the pharmacy to pick it up. The one major recent technological advance in prescription preparation is an automated system that enables a local pharmacy to call a patient and leave a voicemail message when the patient’s prescription is ready.

Fear of Amazon’s potential move into the prescription space is already causing disruption in the healthcare industry, as characterized by drugstore giant CVS Health’s recent $66 billion offer to acquire health insurance company Aetna. The deal would enhance CVS’s ability to compete against Amazon by locking in members for its pharmacy benefit management division, and the larger entity would also have stronger negotiating power with drugmakers. The combined company would be able to provide a seamless end-to-end healthcare services offering to customers and benefit from the ability to share data between business segments. It is possible that CVS’s offer will ignite a wave of merger activity across the healthcare industry as other insurance companies look at the proposed merger and seek to pair up with drugstores.

Amazon’s entry into prescription drugs is not a done deal, though, and there are risks and challenges to entering the market. Although Amazon already possesses 12 state pharmacy licenses, it would still need to acquire another 38 if it wants to cover the whole country. In addition, there are numerous complicated regulatory issues involved with dispensing medication, and Amazon needs to learn and comply with these. It is also possible that there is a political angle involved with gaining pharmacy licenses.

Whole Foods is an interesting variable in this equation. Would Amazon add retail pharmacies or pickup windows to its 400-plus Whole Foods locations? Amazon is still digesting the stores it acquired, and they have not yet been wholly “Amazonized,” so the company’s intentions on this front remain unclear.

Amazon’s initial testing of the pharmacy services waters leads us to imagine what the future could be like—a future in which obtaining or refilling a prescription could be as easy as buying a Kindle e-book with our smartphone already is. But just the specter of Amazon entering the market has prompted a defensive merger offer, so the ultimate outcome will surely prove to be interesting.

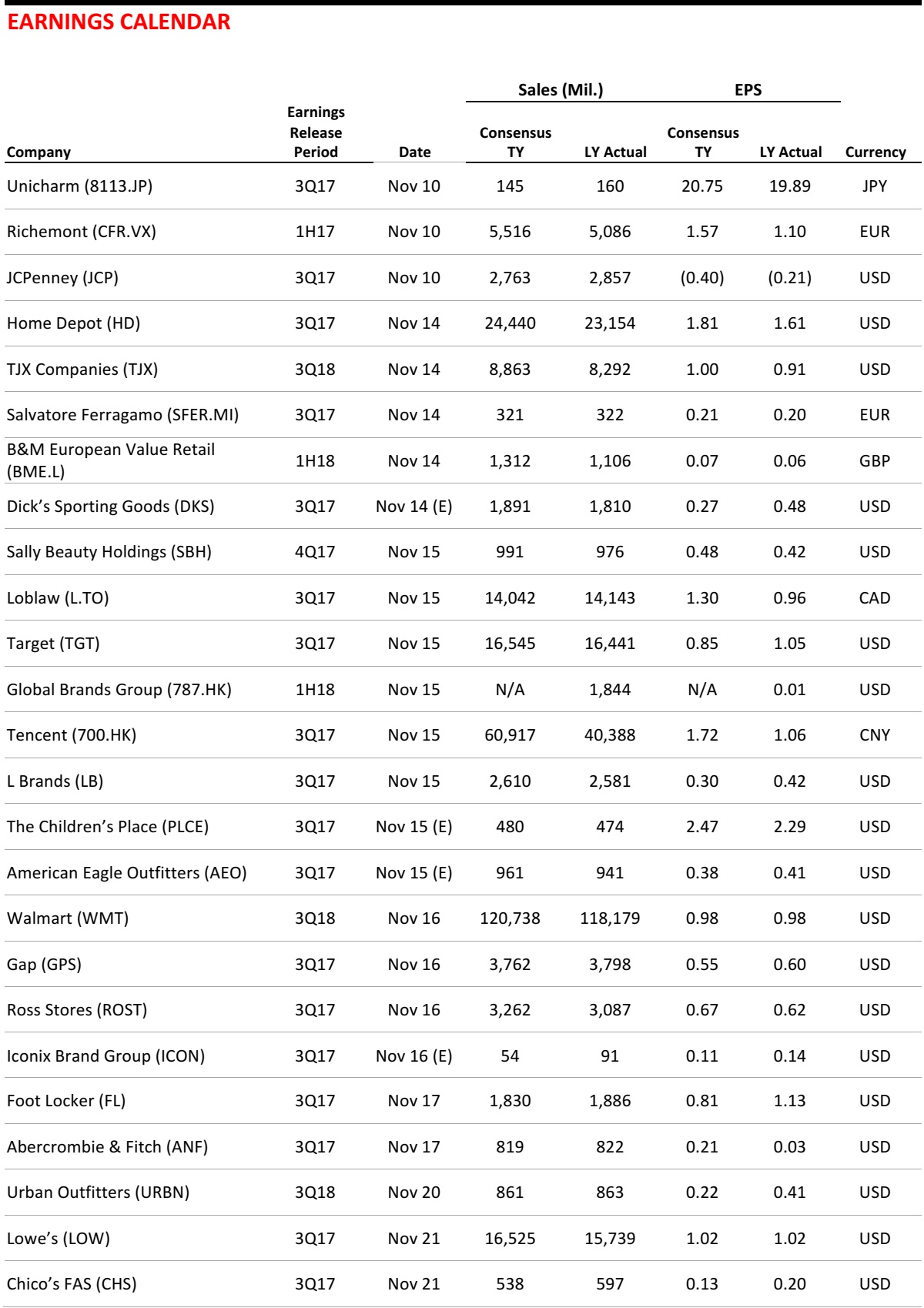

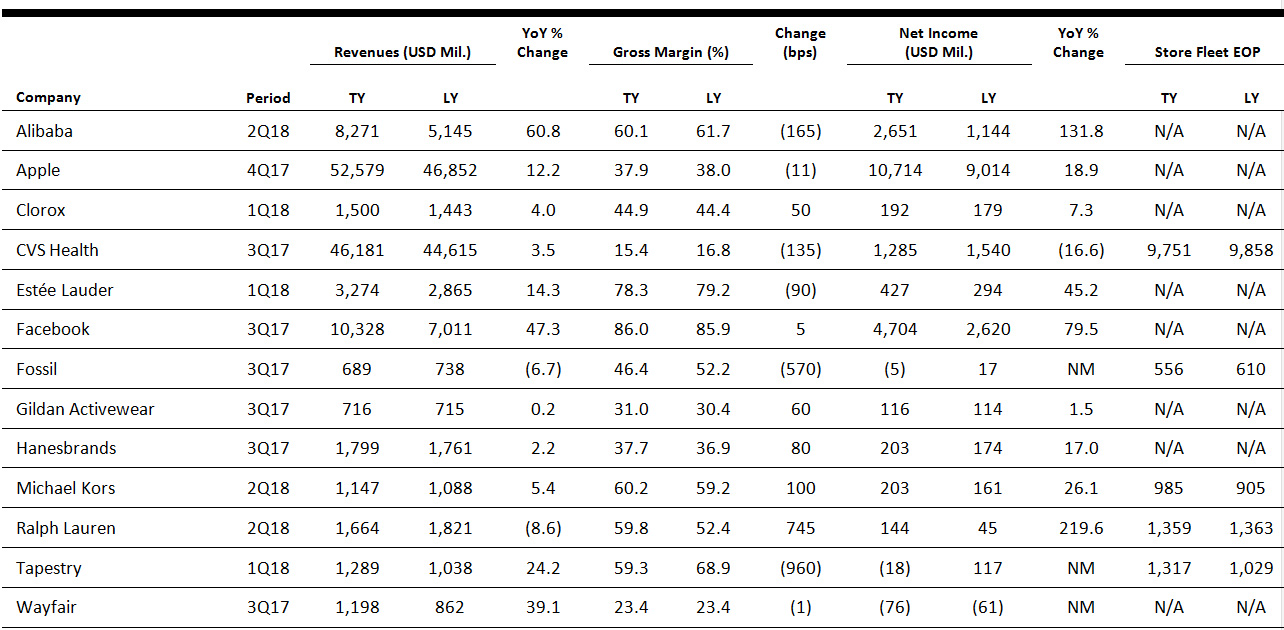

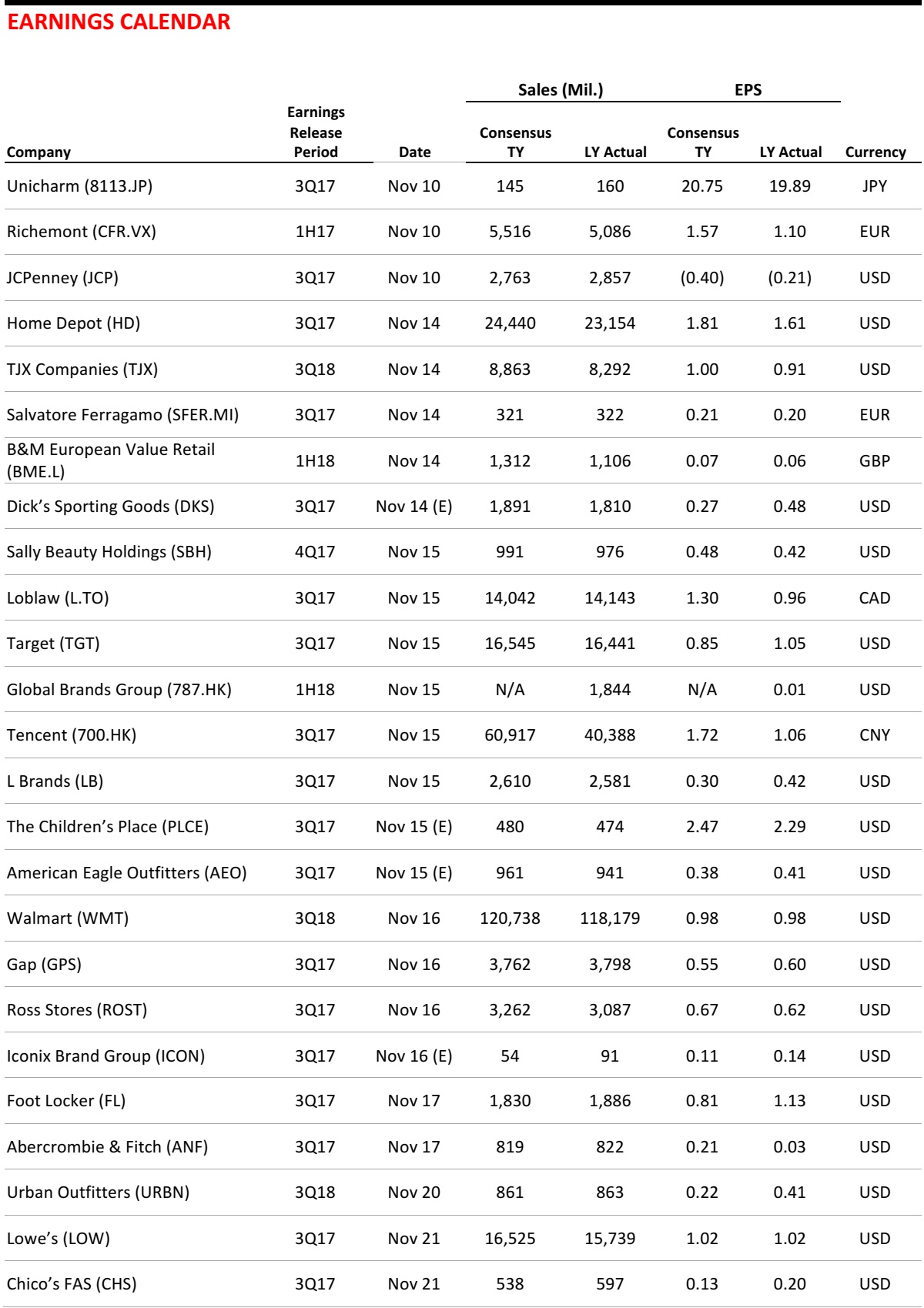

US RETAIL EARNINGS

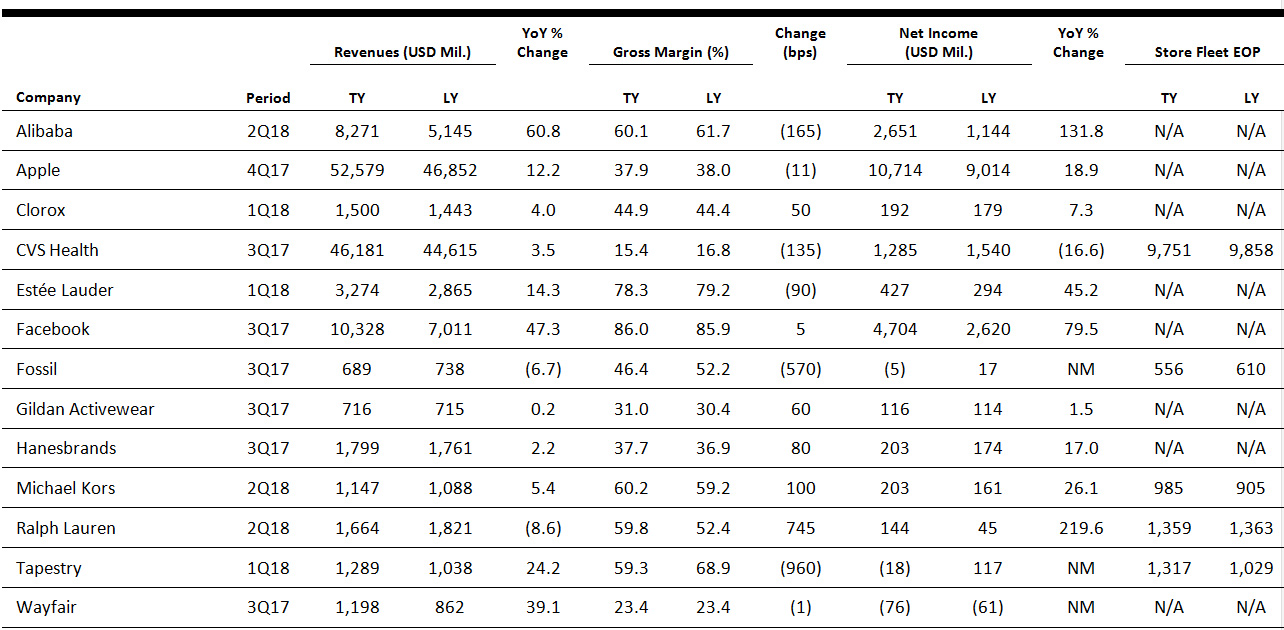

Source: Company reports

US RETAIL & TECH HEADLINES

Weinswig's Weekly November 10 2017  US Retail Bankruptcies in 2017 May Eclipse Financial Crisis Toll

(November 7) TimesofIndia.IndiaTimes.com

US Retail Bankruptcies in 2017 May Eclipse Financial Crisis Toll

(November 7) TimesofIndia.IndiaTimes.com

- The grim retail scene in the US has claimed at least 12 companies so far this year and the toll is expected to rise further. The tally already surpasses last year’s total of nine and is set to eclipse the 20 bankruptcies filed during the 2008 financial crisis, according to consulting firm AlixPartners.

- More than half of the filings this year have come from retailers that were previously bought by private equity firms, according to the firm.

US Department Stores Tap Brakes on Stocking for Holiday Season

(November 7) Reuters.com

US Department Stores Tap Brakes on Stocking for Holiday Season

(November 7) Reuters.com

- This holiday season, retailers are making a list, checking it twice, and then ordering less for US shoppers. With foot traffic at their stores in decline, department stores that normally would have stocked up for the biggest shopping season of the year months ago are still in the process of placing new orders, according to company officials, vendors and consultants.

- The strategy is aimed at avoiding the experience of previous holiday seasons, when large piles of unsold stock led to deep markdowns that eroded profits. But these retailers risk losing sales if supplies run out at a time when many are struggling to keep up with Amazon.com.

Toys“R”Us Won’t Match “Many of the Best Prices” Black Friday Weekend

(November 7) RetailDive.com

Toys“R”Us Won’t Match “Many of the Best Prices” Black Friday Weekend

(November 7) RetailDive.com

- Toys“R”Us on Monday said it will open its doors at 5 p.m. (local time) on Thanksgiving and remain open through 11 p.m. on Black Friday, though its Babies“R”Us stores nationwide will be closed on Thanksgiving, opening at 8 a.m. on Black Friday.

- The retailer also announced a “new and improved Price Match Promise” for toys or baby items advertised at a lower price. Toys“R”Us is limiting its price-matching policy, however, suspending it during the peak Thanksgiving holiday weekend, including on Black Friday.

American Retail Has a Coffee Problem

(November 7) FoxBusiness.com

American Retail Has a Coffee Problem

(November 7) FoxBusiness.com

- America’s coffee market is getting too crowded. Consumers’ hankering for caffeine and quality coffee has fueled a big build-out of cafes in the last five years. There are now nearly 33,000 coffee shops in the US, up 16% from five years ago, according to Mintel.

- The boom in coffee shops is starting to hurt business owners. The troubles facing the coffee business are similar to those plaguing the broader food-retail and restaurant industries, which have an oversupply of retail space and are competing against new food options.

Retailers Cut 8,000 Jobs Before Holidays as US Rebounds from Hurricanes

(November 3) WWD.com

Retailers Cut 8,000 Jobs Before Holidays as US Rebounds from Hurricanes

(November 3) WWD.com

- Retail is continuing to slash jobs, even as employment in the US looks to have quickly bounced back from a string of record hurricanes. Apparel and accessories specialty stores shed 5,800 jobs during October, after cutting 2,500 in September. The two months saw Hurricanes Harvey, Irma and Maria hit various parts of the southern US and its territories.

- Department stores cut 2,300 jobs last month, after losing 2,200 in September, according to new data from the Labor Department.

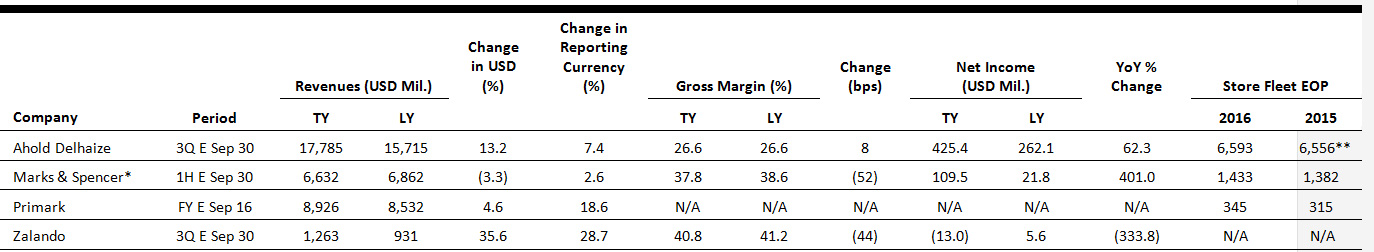

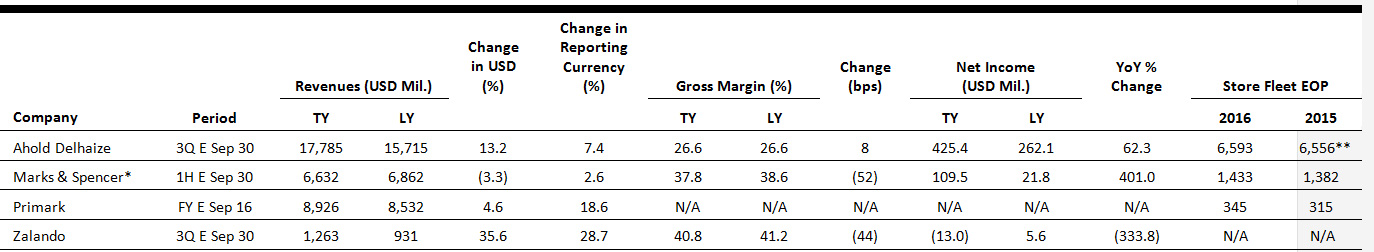

EUROPE RETAIL EARNINGS

*Marks & Spencer gross margin is for UK operations; store numbers are as of closest year-end, due to absence of reported store numbers in latest quarter.

**Store numbers for 2016 are as of year-end, as reported by Ahold Delhaize.

Source: Company reports/FGRT

EUROPE RETAIL & TECH HEADLINES

UK Retail Sales Growth Weighed Down by Nonfood Categories in October

(November 7) BRC press release

UK Retail Sales Growth Weighed Down by Nonfood Categories in October

(November 7) BRC press release

- UK retail sales fell by 1.0% year over year on a comparable basis in October, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Total sales edged up 0.2% during the month, a rate that was well below the three-month and 12-month averages of 1.7% and 1.5%, respectively.

- The BRC provides a food/nonfood split only on a rolling three-month basis. The three-month average sales growth rate was 2.4% for food and (0.4)% for nonfood categories, on a comparable basis. Total food sales rose by 3.7% and total nonfood sales by 0.1% in the three months ended October.

New Look Sales Decline in First Half

(November 7) Company press release

New Look Sales Decline in First Half

(November 7) Company press release

- British fashion chain New Look reported a revenue decline of 4.5%, to £686 million (US$902 million), in the first half of its 2018 fiscal year. Comparable sales of the New Look brand fell by 8.6% and comparable sales in the UK decreased by 8.4%.

- Newly appointed Executive Chairman Alistair McGeorge remarked that “the immediate focus in this period of transition will be to deliver stability” and that New Look will work on reclaiming its position in the UK womenswear market.

Phase Eight and Whistles Owner Acquires Hobbs

(November 7) RetailGazette.co.uk

Phase Eight and Whistles Owner Acquires Hobbs

(November 7) RetailGazette.co.uk

- South African firm The Foschini Group has acquired British women’s fashion retailer Hobbs for an undisclosed sum. The group also owns clothing chains Whistles and Phase Eight.

- In the year ended January 28, 2017, Hobbs achieved sales growth of 9%, reaching £119.5 million (US$156.9 million) in revenues, marking continued growth after a strategic review in 2015 to improve its performance.

Amazon to Open Black Friday Pop-Up in London

(November 6) DrapersOnline.com

Amazon to Open Black Friday Pop-Up in London

(November 6) DrapersOnline.com

- Amazon is set to open a pop-up store in central London later this month. The four-day Home of Black Friday shop will feature products that are part of Amazon’s 10-day Black Friday sale.

- Customers will be invited to participate in workshops and play games to win prizes as well as sample new products. Entry is free and is on a first come, first served basis.

Zalando Adds Personalization Tool for Adidas Shoes on Its Website

(November 6) RetailDetail.eu

Zalando Adds Personalization Tool for Adidas Shoes on Its Website

(November 6) RetailDetail.eu

- Zalando has added a personalization tool to its website that will allow customers to personalize shoes from sports brand Adidas. The tool is called Miadidas and is currently available only to customers in Germany.

- Miadidas allows customers to choose the color and material of their shoes and even add text to the design. Customers can view 3D versions of their customized shoes before finalizing orders, which typically take six weeks for manufacturing and shipping.

ASIA RETAIL & TECH HEADLINES

Paytm Brings Messaging Features to India’s Top Digital Wallet App

(November 3) TechCrunch.com

Paytm Brings Messaging Features to India’s Top Digital Wallet App

(November 3) TechCrunch.com

- Paytm, India’s top digital wallet and payment service, has introduced a chat feature to amp up its appeal in an increasingly competitive market. The new “Inbox” feature, which was first launched in August, is initially available on Android, which accounts for the bulk of Paytm’s claimed 200 million users.

- Paytm, which is backed by Alibaba and SoftBank, among others, is steeling its product with social features to give it an advantage against Indian messaging apps, which are increasingly encroaching on its territory by introducing payment features of their own.

Kaodim Raises $7 Million for Its Home Services Platform in Southeast Asia

(October 31) TechCrunch.com

Kaodim Raises $7 Million for Its Home Services Platform in Southeast Asia

(October 31) TechCrunch.com

- Kaodim, a platform that provides home services for booking and hiring, raised $7 million in a round of funding led by Square Peg Capital, a global fund headquartered in Australia, and an affiliate of private equity fund SIG Asia Investment. This new capital takes Kaodim to $11.5 million raised from investors to date.

- “Our vision is to provide a faster, more dependable way of hiring a broad range of services, from cleaners to personal trainers. Square Peg Capital and SIG’s experience and expertise in investing in marketplaces around the world will help the Kaodim Group achieve this,” Kaodim Group Managing Director Jeffri Cheong said in a statement.

Apple’s Revenues in China Are Growing Again

(November 3) TechCrunch.com

Apple’s Revenues in China Are Growing Again

(November 3) TechCrunch.com

- Apple returned to growth in the key market of China following a challenging couple of years. Analysts already reported that Apple saw shipment growth of 41% in China during the last quarter, but the company’s latest financial report confirmed that revenue was up, too.

- Total sales in Greater China—the region that Apple defines as China, Hong Kong, Singapore and Taiwan—grew by 12% year over year, to $9.8 billion. That figure was up 22% quarter over quarter. The company saw an increase in iPhone sales thanks to the newly released iPhone 8, and CEO Tim Cook told investors in an earnings call that Apple sold a record number of Macs during the quarter.

Uber Rival Grab Crosses 1 Billion Rides in Southeast Asia

(November 7) TechCrunch.com

Uber Rival Grab Crosses 1 Billion Rides in Southeast Asia

(November 7) TechCrunch.com

- Grab, Uber’s fierce rival in Southeast Asia, announced that its service has crossed 1 billion completed rides. The firm hit the milestone on October 26, when 66 concurrent trips from across its seven markets took it into 10-figure territory.

- The company started out in Malaysia in 2012, and today it covers 142 cities across Singapore, Malaysia, Indonesia, Thailand, Vietnam, the Philippines and Myanmar. Its initial service was booking licensed taxis, but it has since expanded to cover Uber-style private hire, carpooling, motorbike taxis and more.

LATAM RETAIL & TECH HEADLINES

Brazil Tries to Reduce Fake News Ahead of Elections

(November 6) ZDNet.com

Brazil Tries to Reduce Fake News Ahead of Elections

(November 6) ZDNet.com

- Brazil is looking to implement rules to reduce the deluge of false stories that could mislead voters. The country’s Superior Electoral Court (TSE) is looking at ways to monitor fake news in next year’s presidential elections and to hold politicians accountable for fraudulent digital campaigns.

- The rules for digital conduct by candidates in the presidential elections of 2018 would be a first in Brazil. There is concern about the impact that fake news may have on voters’ decisions. TSE is looking to update its policies with a new set of guidelines to be released next month.

Bradesco Launches Online Bank as Fintechs Raise Stakes in Brazil

(November 3) ZDNet.com

Bradesco Launches Online Bank as Fintechs Raise Stakes in Brazil

(November 3) ZDNet.com

- Brazilian banking giant Bradesco has launched its own online bank as competition from new market entrants heats up. Online bank Next is hitting the market this week following beta testing of the product over the last few weeks.

- The main audience for the bank will be millennials, to whom Bradesco plans to offer perks from partners such as Uber, Apple and Hotels.com. Partnerships with companies that are familiar to prospective clients are also a way for Bradesco to identify the habits of its customer base and offer relevant products and services.

Brazil Passes Weaker Version of Mobility App Bill

(November 2) ZDNet.com

Brazil Passes Weaker Version of Mobility App Bill

(November 2) ZDNet.com

- The Brazilian Senate approved a watered-down version of a bill to regulate mobility apps such as Uber after much dispute between companies and taxi driver unions. It was decided that drivers working under the mobility apps would not have to meet requirements for special taxi license plates and for several operating documents.

- Uber CEO Dara Khosrowshahi had argued that if the original text of the bill were approved, it would become impossible for Uber to operate in Brazil and would also harm the livelihoods of about 500,000 drivers working for Uber alone, without considering other popular apps such as Spanish tool Cabify and local equivalents.

Amazon Mexico Introduces Cash Payments in Mexico

(November 2) TechNewsObserver.com

Amazon Mexico Introduces Cash Payments in Mexico

(November 2) TechNewsObserver.com

- Online retail giant Amazon has unveiled a service in Mexico that enables shoppers to pay in cash. Shoppers in the country tend to avoid credit cards owing to fear of fraud. Additionally, most shoppers are paid in cash at the places they earn a living.

- Amazon’s cash payment service could help it grab market share from Walmex. The move comes as Walmart and Amazon, as well as others, try to lure more Mexicans into shopping online rather than at the brick-and-mortar outlets that dominate the retail sector in Mexico.

MACRO UPDATE

Key points from global macro indicators released November 1–8, 2017:

- US: In October, the ISM Manufacturing Purchasing Managers’ Index (PMI) ticked down to 58.7; the reading came in below expectations but indicated that the sector remains in an expansionary state. The Non-Manufacturing PMI ticked up to 60.1 in October. Nonfarm payrolls increased by 261,000 in October and the unemployment rate edged down to 4.1%.

- Europe: In the UK, house prices ticked up further in October: Nationwide House Prices edged up by 0.2% month over month and Halifax House Prices increased by 0.3% month over month. In the eurozone, retail sales increased by 0.7% month over month and by 3.7% year over year in September.

- Asia-Pacific: In China, the Caixin Composite and Services PMIs both stayed above 50.0 in October. In Japan, the Nikkei Composite and Services PMIs also stayed above the expansion threshold in October.

- Latin America: In Brazil, industrial production increased by 0.2% month over month and by 2.6% year over year in September; both figures were below consensus estimates. In Mexico, the Markit Manufacturing PMI fell below the expansion threshold in October. The Consumer Confidence Index in Mexico edged down to 88.2 in October.

New Look Sales Decline in First Half

(November 7) Company press release

New Look Sales Decline in First Half

(November 7) Company press release