FROM THE DESK OF DEBORAH WEINSWIG

Amazon’s Warehouses Are Going Vertical

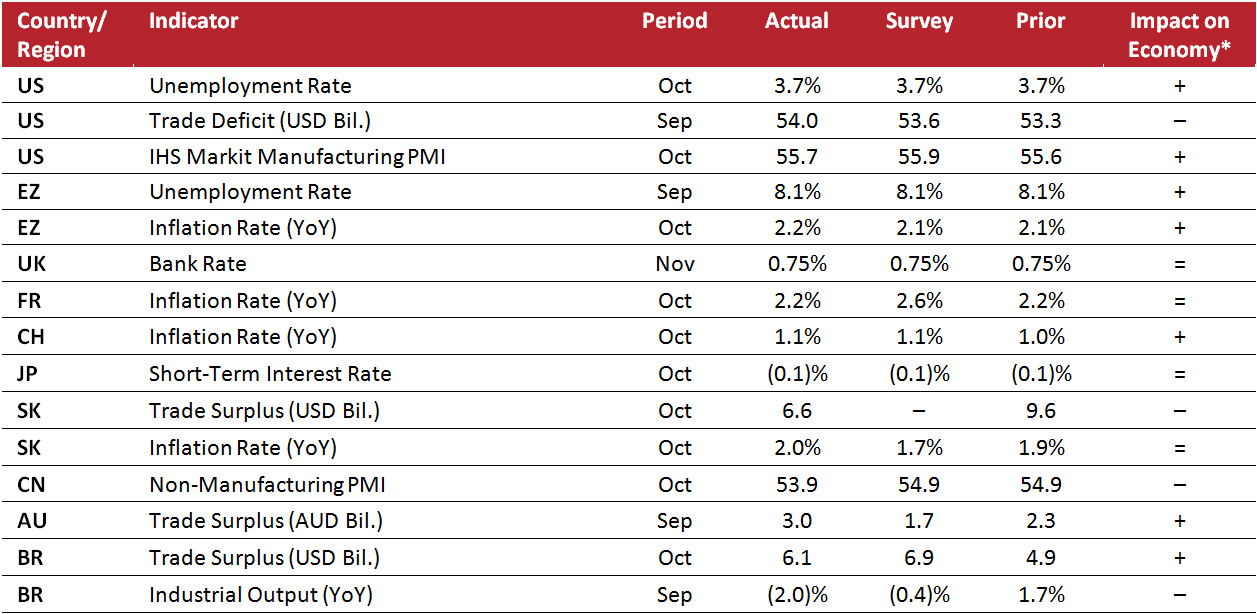

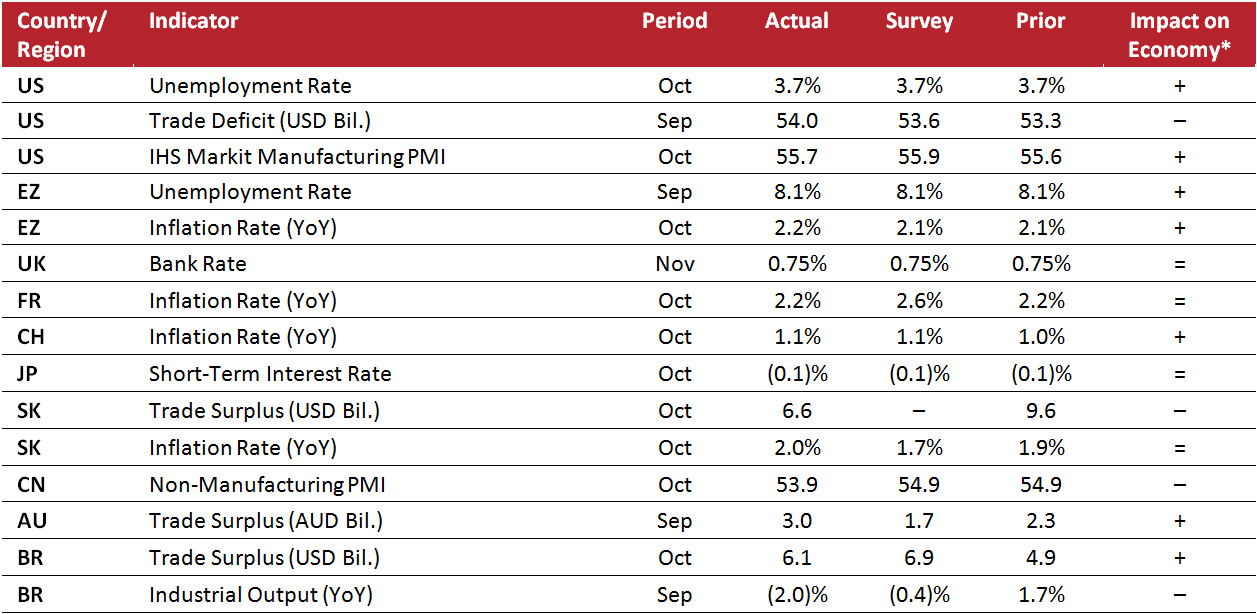

Amazon piqued investors’ interest anew recently when CFO Brian Olsavsky stated on the company’s third-quarter conference call that Amazon is planning to increase its warehouse square footage by just 15% in 2018, following two consecutive years of roughly 30% growth. Historically, this expansion has been driven by faster growth in units Fulfilled by Amazon than in paid units. In Amazon’s financial reports, which combine the square footage of fulfillment and data centers, the company reported that such facilities occupied nearly 200 million square feet of space at the end of 2017. Amazon’s actual square footage for 2015, 2016 and 2017 and its estimated square footage for 2018 are illustrated in the figure below.

Source: Company reports/Coresight Research estimate

Source: Company reports/Coresight Research estimate

When an analyst participating on the conference call questioned this apparently sudden slowdown in expansion, Olsavsky clarified that the 15% figure was comparable to prior expansion rates, since warehouse dynamics are changing, i.e., Amazon is growing its warehouses vertically rather than horizontally. Many of Amazon’s future fulfillment centers will be four stories tall, according to construction plans filed for centers in Minnesota, North Carolina, California and Wisconsin.

Olsavsky said that Amazon was debating whether it should describe warehouse capacity in cubic feet rather than in square feet in the future. He further commented that Amazon’s data centers—both those used by Amazon Web Services (AWS) and those used by Amazon’s consumer services, AWS’s largest customer—have become more efficient and, so, require less space.

Amazon’s recent upward thinking likely stems from its increasing use of robots and automation. Following its acquisition of Kiva Systems in 2012, Amazon has used robots to form the basis of efficient human-machine teams. This year, Amazon boosted the wages of its workers to $15 an hour, yet the company is reportedly planning to hire just 100,000 holiday workers in 2018, down from 120,000 in each of the last two years—and the increased use of automation is likely driving planned seasonal hires lower. Another reason for the company to grow vertically is the tight industrial real estate market: an October report by commercial real estate firm CBRE found that the gap between demand and availability of space for warehouses, distribution centers and other industrial properties has widened for 33 consecutive quarters.

Amazon is not the only retailer deploying automation and robotics. Earlier this year, Walmart expanded its army of Bossa Nova robots to 50. These robots cruise up and down the aisles in stores, scanning shelves to detect out-of-stock items, incorrect prices, and incorrect or missing labels. Bossa Nova claims that its robots are three times faster and twice as accurate as their human counterparts, and the company recently raised $29 million to fund its expansion, taking its total funding to $70 million.

Similarly, Kroger signed an agreement with Ocado in October to leverage Ocado’s Smart Platform technology, which offers online ordering, automated warehouse fulfillment and delivery logistics. Kroger plans to deploy the technology in automated customer fulfillment centers, and will order the first three centers from Ocado by the end of this year and a total of 20 centers over the next three years.

As Amazon moves fulfillment centers closer to its customers, where real estate is at a premium, the company is constructing taller buildings that will leverage more robots and, probably, fewer humans.

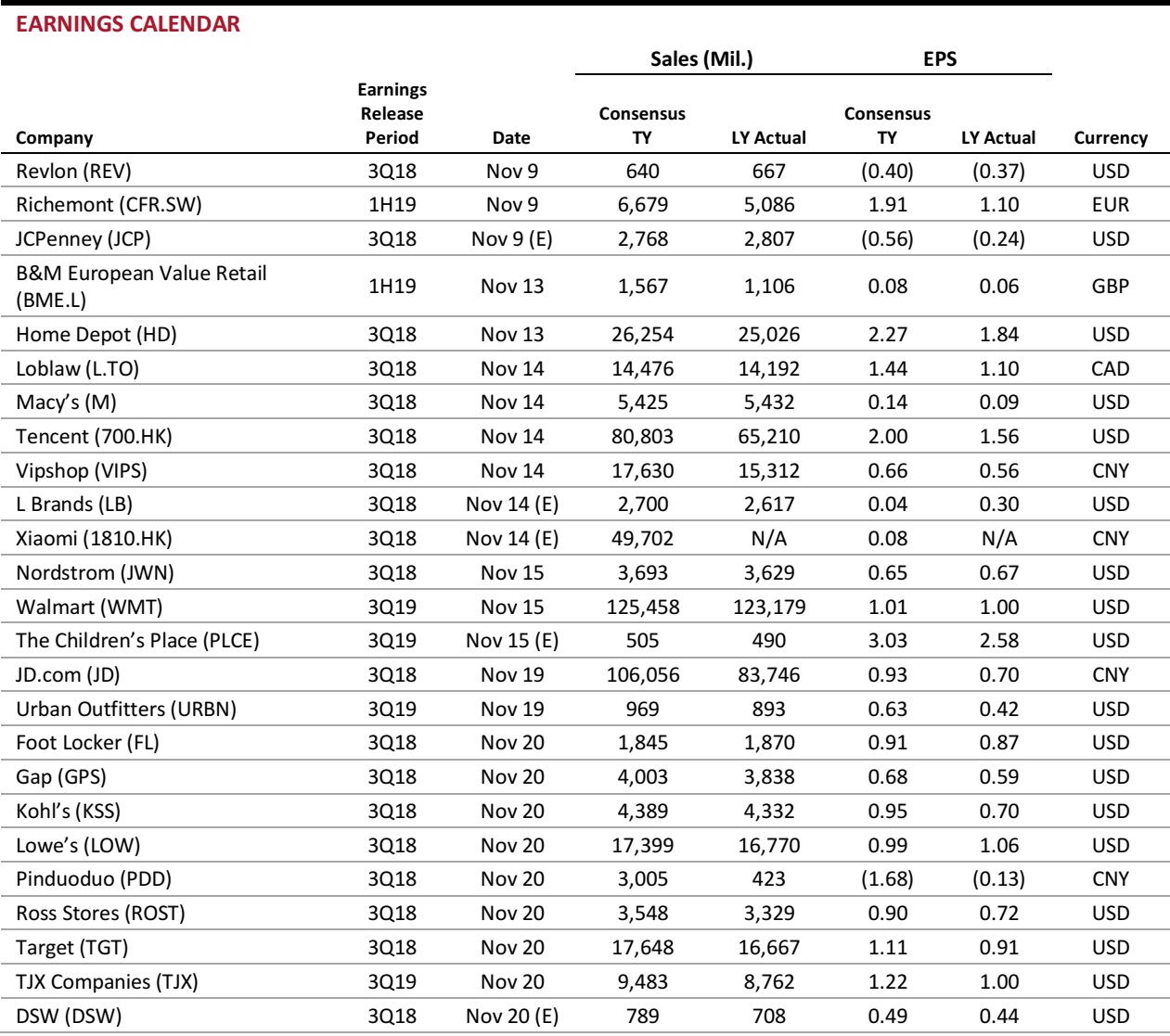

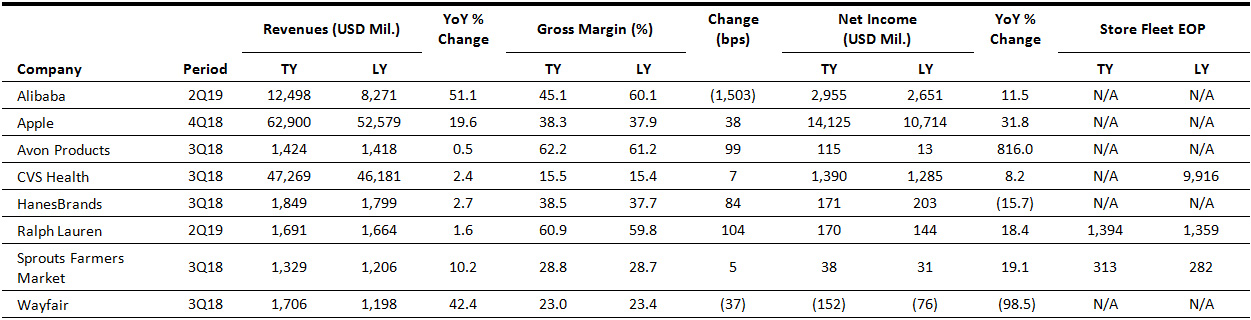

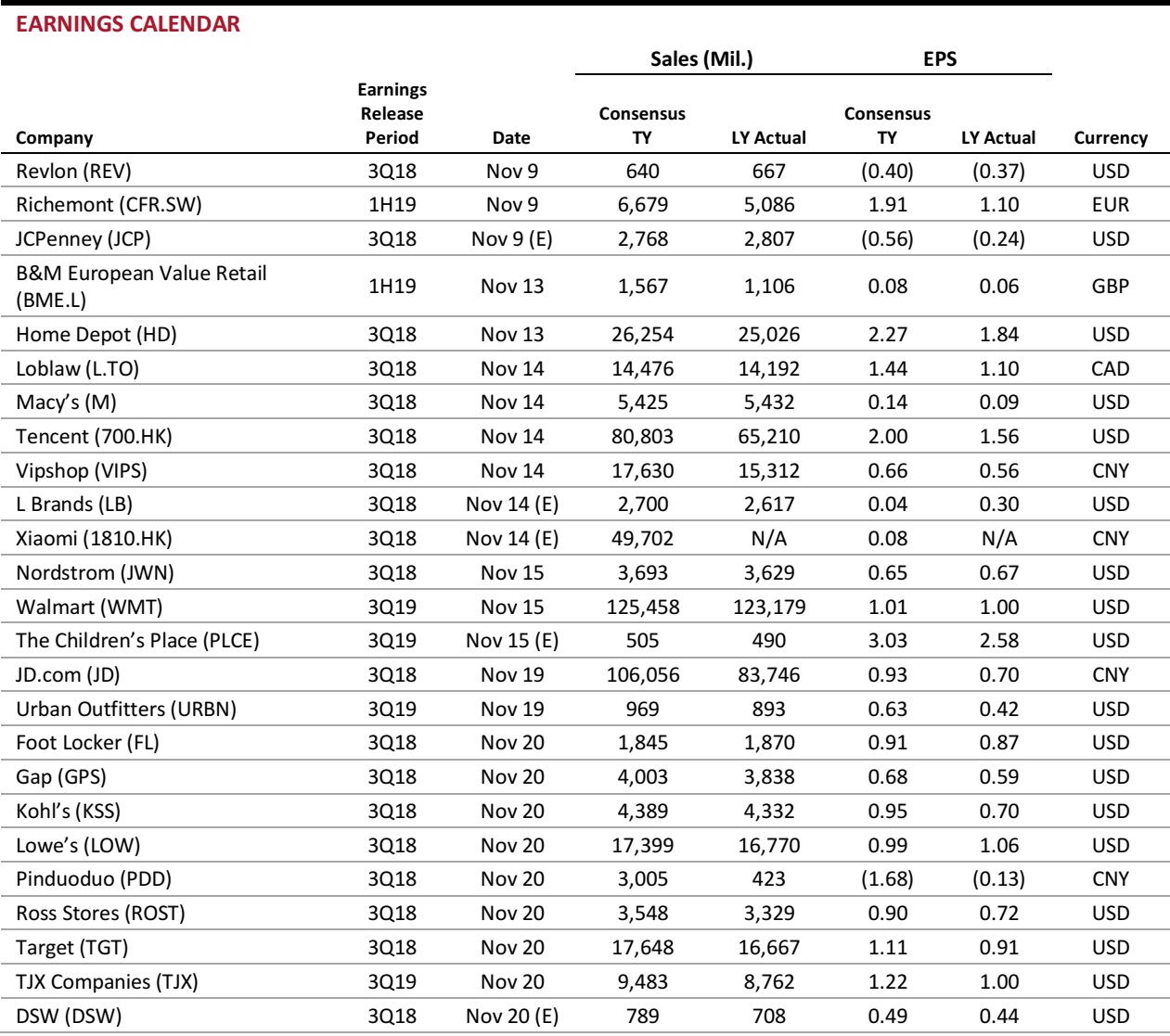

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Walmart Expands Technology Center in Texas

(November 5) AP.com

Walmart Expands Technology Center in Texas

(November 5) AP.com

- Walmart announced plans to expand its technology center in Austin to help associates make better use of digital data and improve operations. Engineers from Walmart and Microsoft will work together in Texas as Walmart seeks more convenient ways for customers to shop.

- Microsoft says about 30 technologists will work in Walmart’s cloud factory, an expansion of its innovation hub, set to open in early 2019. It’s an extension of a strategic partnership announced in July. Team members will focus on migrating Walmart’s thousands of internal business applications to Microsoft Azure.

Sears Lands $60 Million Bid for Home Services Unit

(November 5) RetailDive.com

Sears Lands $60 Million Bid for Home Services Unit

(November 5) RetailDive.com

- Sears has a bidder for its home services business in Service.com, a marketplace for contract and home improvement work. Service.com’s $60 million bid would be subject to higher bids and set the baseline for a Chapter 11 auction, which Sears has asked a court to set for December 13, according to court filings.

- Sears Chairman and former CEO Eddie Lampert, also the company’s majority shareholder, had previously expressed interest in buying the home improvement unit, along with the Kenmore appliance brand, from Sears.

Amazon Offers Free Shipping Without Minimums

(November 5) PYMNTS.com

Amazon Offers Free Shipping Without Minimums

(November 5) PYMNTS.com

- To provide customers with faster and more convenient shipping options, Amazon plans to offer free shipping without minimum purchase on “orders that will arrive in time for the Christmas holiday” beginning November 5.

- The news comes as Target plans to offer free two-day shipping without a minimum order to take on competitors such as Amazon and Walmart. The offering will be available on “hundreds of thousands of items” until December 22.

Kroger Partners with the Remnant of Toys“R”Us

(November 5) RetailDive.com

Kroger Partners with the Remnant of Toys“R”Us

(November 5) RetailDive.com

- Kroger plans to bring exclusive brands from Geoffrey’s Toy Box—which is among the surviving assets of Toys“R”Us following its liquidation in bankruptcy—to almost 600 US Kroger stores in time for the holidays.

- Starting this month, participating stores will have Geoffrey’s Toy Box displays and 35 toys priced from $19.99 to $49.99 from brands that include Animal Zone, Imaginarium, Journey Girls, Edu Science, You & Me and Just Like Home.

Lowe’s Is Closing 51 Stores in the US and Canada

(November 5) CNN.com

Lowe’s Is Closing 51 Stores in the US and Canada

(November 5) CNN.com

- Lowe’s is closing 51 North American stores. The company said that those locations are underperforming and the decision will help the hardware chain focus on its most profitable stores. “The store closures are a necessary step in our strategic reassessment as we focus on building a stronger business,” said CEO Marvin Ellison.

- Earlier this year, Lowe’s gave the reins to Ellison, a home improvement veteran, to turn around the company. He was a top executive at Home Depot for more than a decade, and most recently served as JCPenney’s CEO.

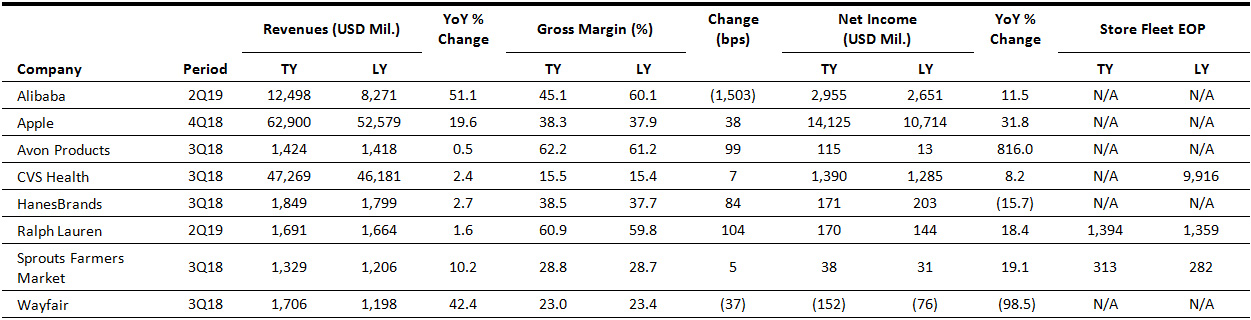

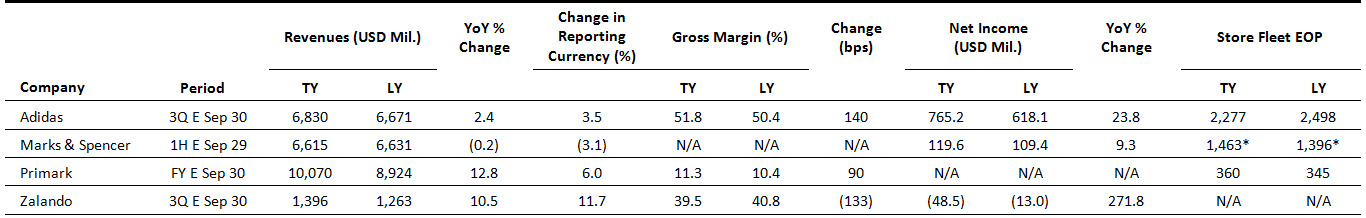

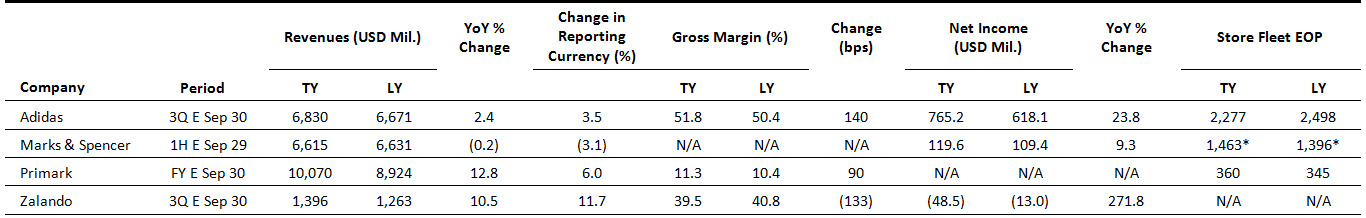

EUROPE RETAIL EARNINGS

*Store numbers are as of the end of fiscal years.

Source: Company reports/Coresight Research

*Store numbers are as of the end of fiscal years.

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

IKEA Plans More Small Stores in the UK

(November 2) BBC.com

IKEA Plans More Small Stores in the UK

(November 2) BBC.com

- Swedish furniture retailer IKEA is set to open more small, city-center-format stores in the UK following the positive response to its first outlet in London.

- The company announced last week that UK revenues for the year ended August 31 increased by 5.9%, to £1.96 billion ($2.55 billion).

UK Government to Work with CMA to Probe Personalized Pricing Practices in Online Retail

(November 5) CMA press release

UK Government to Work with CMA to Probe Personalized Pricing Practices in Online Retail

(November 5) CMA press release

- The UK government has announced that personalized pricing practices in online retail will be investigated following rising concerns that unsuspecting customers are at risk of price discrimination. The government has joined hands with the Competition and Markets Authority (CMA) to this end.

- “UK businesses are leading the way in harnessing the power of new technologies and new ways of doing business, benefiting consumers and helping them save money. But we are clear that companies should not be abusing this technology and customer data to treat consumers, particularly vulnerable ones, unfairly,” said Business Secretary Greg Clark in a statement.

Debenhams’ Struggle Continues as Moody’s Downgrades Company Again

(November 4) DrapersOnline.com

Debenhams’ Struggle Continues as Moody’s Downgrades Company Again

(November 4) DrapersOnline.com

- British department store retailer Debenhams suffered another setback as rating agency Moody’s downgraded the company on two counts. Moody’s based its downgrade on the “aggressive” pricing strategies of rival retailers and the highly challenging market, which it envisages will result in lower-than-expected profits in the period leading up to the Christmas season.

- The downgrade of Debenhams’ corporate family rating from B2 to Caa1 follows another downgrade just two months ago that was due to weaker-than-expected profits. The company registered a statutory loss of £491.5 million ($639.7 million) for the year ended September 1 after recording a profit of £59 million ($76.8 million) in the previous year.

Amazon Announces Plans for Biggest Black Friday

(November 5) Company press release

Amazon Announces Plans for Biggest Black Friday

(November 5) Company press release

- In the UK, e-commerce giant Amazon is preparing for what it expects to be its biggest ever Black Friday sale, which will feature more deals than in previous years across a 10-day period. The details of the deals will be announced closer to the launch date.

- Amazon plans to run a pop-up experience in Shoreditch, London, November 22–25, with doors open for 24 hours on Black Friday itself, which falls on November 23 this year. Online Black Friday deals will begin in the early hours of November 16 and run until midnight on November 25 and will feature “deals of the day” and limited “lightning deals.”

UK Retail Sales Register Marginal Year-over-Year Growth in October

(November 6) BRC.org.uk

UK Retail Sales Register Marginal Year-over-Year Growth in October

(November 6) BRC.org.uk

- Retail sales in the UK grew by 1.3% year over year in October, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales grew by a negligible 0.1% year over year as consumer spending continued to be cautious into the last quarter of the year.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended September, total food sales grew by 2.3% and total nonfood sales edged up 0.1%.

ASIA RETAIL & TECH HEADLINES

Rakuten Partners with Seiyu to Launch Online Grocery Service

(November 5) RetailNews.asia

Rakuten Partners with Seiyu to Launch Online Grocery Service

(November 5) RetailNews.asia

Japanese e-commerce company Rakuten is collaborating with Seiyu, a Walmart-owned group of Japanese supermarkets, shopping centers and department stores, to launch an online grocery service.

Japanese e-commerce company Rakuten is collaborating with Seiyu, a Walmart-owned group of Japanese supermarkets, shopping centers and department stores, to launch an online grocery service.- Around 20,000 products sourced from the Seiyu range, including fresh food, will be available to customers on the site. The service will be available to some 16 Japanese suburbs to begin with and orders will be fulfilled from stores.

Alibaba Unveils China’s Biggest Robotic Warehouse in Preparation for Singles’ Day

Alibaba Unveils China’s Biggest Robotic Warehouse in Preparation for Singles’ Day

(

October 30) TechNode.com

- E-commerce behemoth Alibaba has launched China’s biggest robotic warehouse through its logistics affiliate, Cainiao Network, in anticipation of the expected rush from the Singles’ Day shopping event on November 11.

- The new warehouse is an Internet of Things–powered “robotic smart warehouse” with around 700 automated vehicles that are able to automatically pick up parcels and deliver them to different sections of the warehouse, where they are subsequently picked up for delivery.

JD Partners with Tianjin Air Cargo to Launch Exclusive Freighter Service

(November 5) CargoFacts.com

JD Partners with Tianjin Air Cargo to Launch Exclusive Freighter Service

(November 5) CargoFacts.com

- E-commerce firm JD.com launched a dedicated freighter service on November 6 under its JD Logistics banner in collaboration with Chinese conglomerate HNA Group’s subsidiary carrier, Tianjin Air Cargo. The freighter service will operate round-trip flights six times a week between Tianjin and Guangzhou.

- The launch comes as a significant development for JD.com, which has previously depended on passenger aircraft to move its airfreight. JD.com and HNA Group had entered into a Strategic Cooperation Framework Agreement in March this year, which led to strong speculation regarding further collaboration between the two groups.

Amazon Set to Acquire 9.5% Stake in Future Retail

(November 5) BusinessToday.in

Amazon Set to Acquire 9.5% Stake in Future Retail

(November 5) BusinessToday.in

- In India, Amazon is set to obtain a minority stake in Future Retail next week. The deal is expected to give Amazon access to around a third of the country’s organized food and grocery market via the latter’s Big Bazaar and Nilgiris supermarket chains and other outlets.

- The minority stake acquisition by Amazon’s investment arm is expected to be worth around INR 25 billion ($344 million).

Walmart Plans to Invest $500 Million in Opening 47 B2B Stores in India

(November 1) Inc42.com

Walmart Plans to Invest $500 Million in Opening 47 B2B Stores in India

(November 1) Inc42.com

- Multinational mass merchandiser Walmart is planning a $500 million investment in India, with the aim of reaching a total of 70 B2B cash-and-carry stores by 2022. The retailer currently operates 23 such stores in India, 19 of which have achieved breakeven, according to Krish Iyer, President and CEO of Walmart India.

- Walmart also plans to add to its number of fulfillment centers across the country as it seeks to further grow its presence in India.

LATAM RETAIL & TECH HEADLINES

Mercado Libre Revenues Surge in the Third Quarter

(November 1) Company press release

Mercado Libre Revenues Surge in the Third Quarter

(November 1) Company press release

- Argentina-based e-commerce firm Mercado Libre posted revenue growth of 16.5% as reported and 58.3% at constant currency, to $355 million, in the third quarter ended September.

- Revenues surged by 56%, 68% and 168%, respectively, in the company’s top three markets—Brazil, Argentina and Mexico. Improved gross merchandise volume growth and increased adoption of Mercado Libre’s mobile wallets helped performance in these regions.

EL Palacio de Hierro Grows Third-Quarter Sales by 8.3%

(October 30) Mx.FashionNetwork.com

EL Palacio de Hierro Grows Third-Quarter Sales by 8.3%

(October 30) Mx.FashionNetwork.com

- Mexican premium department store retailer El Palacio de Hierro grew sales by 8.3%, to MXN 7.7 billion ($385 million), in the third quarter ended September. Both profit before tax and net income jumped more than 200% year over year.

- The company attributed its performance to tight control of expenses and other savings strategies implemented during the period.

Liverpool Invests $47 Million to Repair and Reopen Galérias Coapa

(November 2) Modaes.com

Liverpool Invests $47 Million to Repair and Reopen Galérias Coapa

(November 2) Modaes.com

- Mexican retail group Liverpool has invested $47 million to repair its Galérias Coapa shopping mall, which was damaged in the earthquake that struck Mexico in September last year.

- This month, Liverpool reopened the mall, which is located in Mexico’s capital, following repairs. Galérias Coapa sees around 2.1 million visits each month and represents some 3.5% of the total area of Liverpool’s shopping centers.

Oxxo Celebrates 40 Years

(November 5) America-Retail.com

Oxxo Celebrates 40 Years

(November 5) America-Retail.com

- This month, Mexican convenience store chain Oxxo is celebrating its 40th anniversary with attractive deals and offers on its products. The retailer promoted the event across its social media channels with interesting facts about the chain and pictures of number 40–themed coffee and other food available at Oxxo stores.

- Oxxo was established in 1978 and now operates more than 17,400 stores in Mexico, 79 in Chile and 80 in Colombia. It opened its first store in Peru this October.

Saga Falabella Bets on Artificial Intelligence for Christmas Sales This Year

(November 5) America-Retail.com

Saga Falabella Bets on Artificial Intelligence for Christmas Sales This Year

(November 5) America-Retail.com

- Saga Falabella, Falabella’s Peruvian arm, is betting on artificial intelligence to enhance the online shopping experience for its customers during Christmas this year, CEO Alexander Zimmermann told America-Retail.com.

- Zimmermann said that the retailer has already introduced a virtual assistant called Amanda that can help customers with multiple functions such as checking the status of orders placed and searching for products and store locations where they are available.

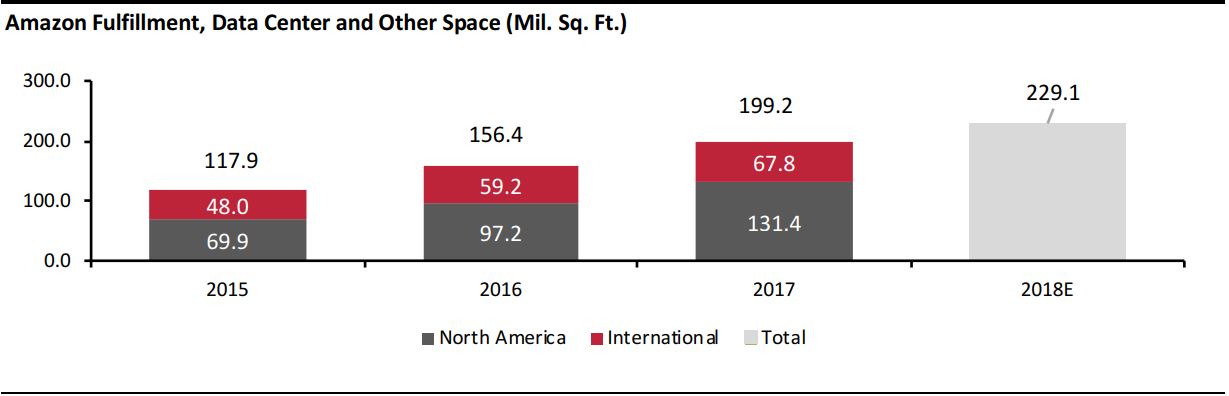

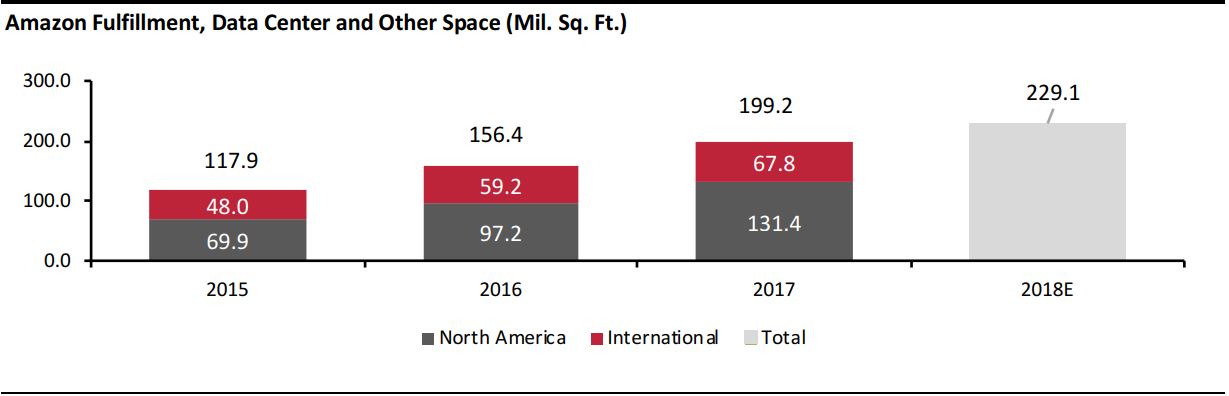

MACRO UPDATE

Key points from global macro indicators released October 31–November 6, 2018:

- US: The US unemployment rate stood at 3.7% in October, unchanged from September and the lowest recorded rate in 49 years. The US trade deficit widened to $54.0 billion in September from $53.3 billion in August and was higher than the consensus estimate of a $53.6 billion gap.

- Europe: The unemployment rate in the eurozone was unchanged at 8.1% in September and was in line with market expectations. The inflation rate in the eurozone stood at 2.2% in October, up from 2.1% in September and slightly above the consensus estimate.

- Asia-Pacific: The Bank of Japan left its key short-term interest rate unchanged at (0.1)% at its October meeting and kept the target for the 10-year Japanese government bond yield at around 0.0%, as had been widely expected. South Korea’s trade surplus narrowed to $6.6 billion in October from $9.6 billion in September.

- Latin America: The trade surplus in Brazil increased to $6.1 billion in October from $4.9 billion in September, but was below market expectations of $6.9 billion. In September, Brazil’s industrial output fell by 2.0% year over year, compared with a revised 1.7% rise in August.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/US Census Bureau/IHS Markit/Eurostat/Bank of England/INSEE (France)/Swiss Federal Statistical Office/Bank of Japan/South Korea Ministry of Trade, Industry and Energy/Statistics Korea/China Federation of Logistics & Purchasing/Australian Bureau of Statistics/Ministério da Indústria, Comércio Exterior e Serviços (Brazil)/Instituto Brasileiro de Geografia e Estatística (Brazil)/Coresight Research

Source: Company reports/Coresight Research estimate

Source: Company reports/Coresight Research estimate

Amazon Offers Free Shipping Without Minimums

(November 5) PYMNTS.com

Amazon Offers Free Shipping Without Minimums

(November 5) PYMNTS.com

*Store numbers are as of the end of fiscal years.

Source: Company reports/Coresight Research

*Store numbers are as of the end of fiscal years.

Source: Company reports/Coresight Research Rakuten Partners with Seiyu to Launch Online Grocery Service

(November 5) RetailNews.asia

Rakuten Partners with Seiyu to Launch Online Grocery Service

(November 5) RetailNews.asia

Japanese e-commerce company Rakuten is collaborating with Seiyu, a Walmart-owned group of Japanese supermarkets, shopping centers and department stores, to launch an online grocery service.

Japanese e-commerce company Rakuten is collaborating with Seiyu, a Walmart-owned group of Japanese supermarkets, shopping centers and department stores, to launch an online grocery service. Amazon Set to Acquire 9.5% Stake in Future Retail

(November 5) BusinessToday.in

Amazon Set to Acquire 9.5% Stake in Future Retail

(November 5) BusinessToday.in

Mercado Libre Revenues Surge in the Third Quarter

(November 1) Company press release

Mercado Libre Revenues Surge in the Third Quarter

(November 1) Company press release

Liverpool Invests $47 Million to Repair and Reopen Galérias Coapa

(November 2) Modaes.com

Liverpool Invests $47 Million to Repair and Reopen Galérias Coapa

(November 2) Modaes.com

Oxxo Celebrates 40 Years

(November 5) America-Retail.com

Oxxo Celebrates 40 Years

(November 5) America-Retail.com