John Mercer

FROM THE DESK OF DEBORAH WEINSWIG

Three Ways that Singles’ Day Is Evolving

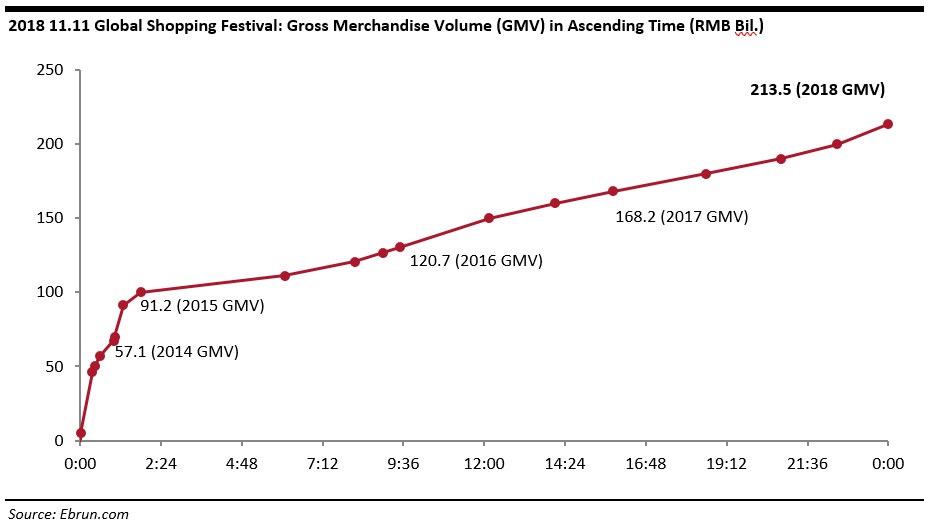

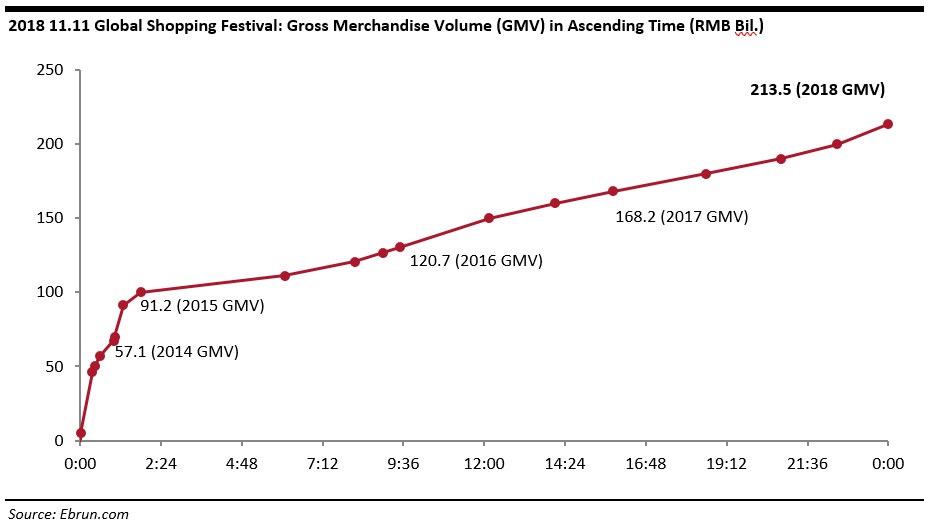

Last weekend, the Coresight Research team was at Alibaba’s Singles’ Day event in Shanghai. There, we watched the live count of Alibaba’s 11.11 Global Shopping Festival sales as they ticked toward the final total of ¥213.5 billion ($30.8 billion). The day’s sales were up 27% year over year and they reached last year’s total before 4 pm local time. In this week’s note, we point to three ways that Alibaba broadened its Singles’ Day reach this year.

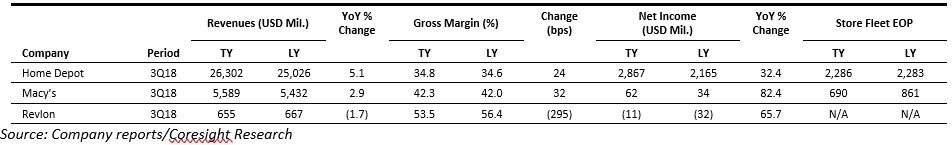

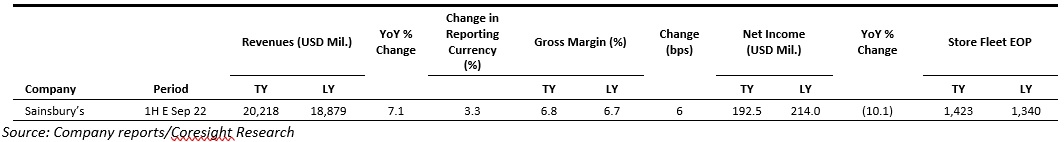

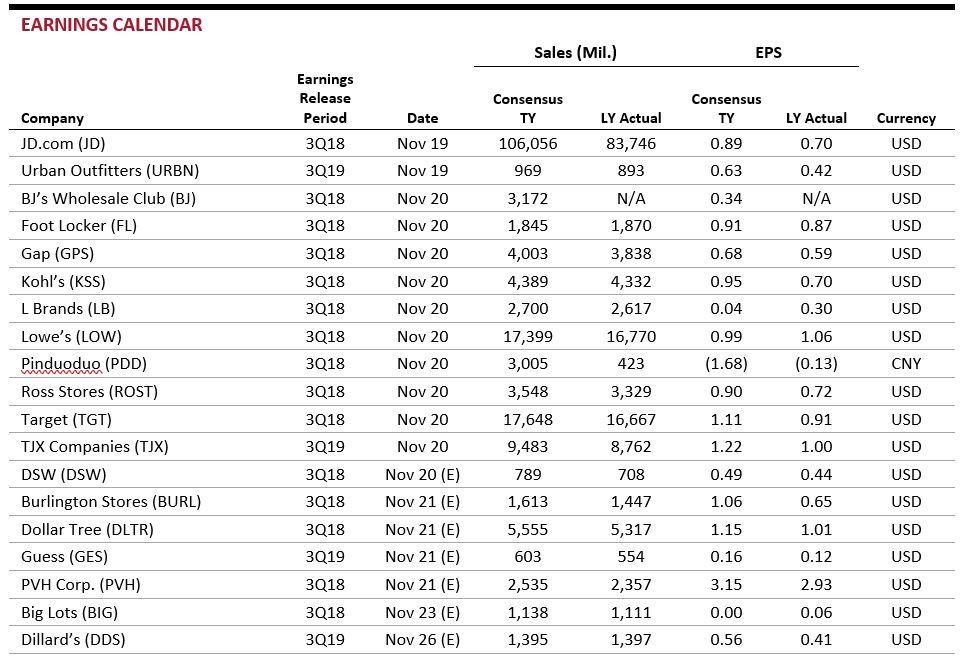

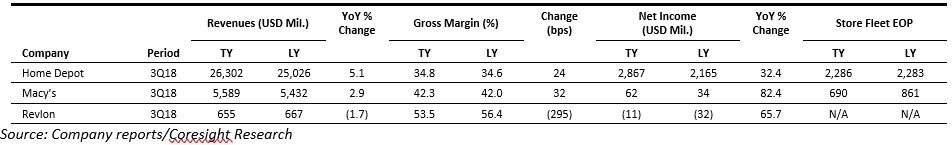

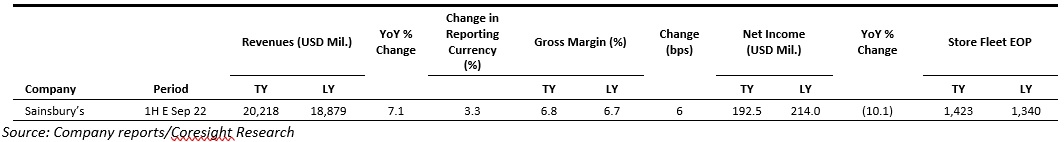

US RETAIL EARNINGS

US RETAIL EARNINGS

US RETAIL & TECH HEADLINES

US RETAIL & TECH HEADLINES

Amazon Chooses New York, Northern Virginia for New Headquarters

(November 13) CrainsDetroit.com

Amazon Chooses New York, Northern Virginia for New Headquarters

(November 13) CrainsDetroit.com

How Neiman Marcus Safeguards Purchases When Sales Surge

(November 12) PYMNTS.com

How Neiman Marcus Safeguards Purchases When Sales Surge

(November 12) PYMNTS.com

NY Gas Prices Continue Decline, US Consumers Saving $100 Million Daily

(November 12) OneidaDispatch.com

NY Gas Prices Continue Decline, US Consumers Saving $100 Million Daily

(November 12) OneidaDispatch.com

10 Years After the Recession, Americans Wake Up to Rising Prices

(November 11) EconomicTimes.IndiaTimes.com

10 Years After the Recession, Americans Wake Up to Rising Prices

(November 11) EconomicTimes.IndiaTimes.com

Consumers Are Spending and It’s Not Just at Walmart and Amazon

Consumers Are Spending and It’s Not Just at Walmart and Amazon

(November 12) CNN.com

(November 12) CNN.com

EUROPE RETAIL & TECH HEADLINES

EUROPE RETAIL & TECH HEADLINES

British Retail Footfall Down 2% in October

(November 12) BRC.org.uk

British Retail Footfall Down 2% in October

(November 12) BRC.org.uk

85,000 Jobs Lost in UK Retail Sector in First Half of This Year

(November 12) RetailGazette.co.uk

85,000 Jobs Lost in UK Retail Sector in First Half of This Year

(November 12) RetailGazette.co.uk

Ahold Delhaize Eyes Robotics to Expand Artificial Intelligence Offerings

(November 9) Company press release

Ahold Delhaize Eyes Robotics to Expand Artificial Intelligence Offerings

(November 9) Company press release

House of Fraser Store Closures Looming as Landlords Reject Rent Proposal

(November 12) RetailGazette.co.uk

House of Fraser Store Closures Looming as Landlords Reject Rent Proposal

(November 12) RetailGazette.co.uk

Karstadt and Galeria Kaufhof Merger Gets Government Approval

Karstadt and Galeria Kaufhof Merger Gets Government Approval

(November 9) Reuters.com

(November 9) Reuters.com

Flipkart Group CEO Binny Bansal Steps Down amid Allegations of Misconduct

Flipkart Group CEO Binny Bansal Steps Down amid Allegations of Misconduct

(November 13) Company press release

(November 13) Company press release

LightInTheBox to Acquire Ezbuy

LightInTheBox to Acquire Ezbuy

(November 10) TechinAsia.com

(November 10) TechinAsia.com

Alibaba and JD.com Register Record Sales on Singles’ Day

Alibaba and JD.com Register Record Sales on Singles’ Day

(November 12) Nasdaq.com

(November 12) Nasdaq.com

Alibaba Enters into Lifestyle Brand Partnership with Fung Retailing

Alibaba Enters into Lifestyle Brand Partnership with Fung Retailing

(November 6) Alizila.com

(November 6) Alizila.com

Japanese Company Signpost to Rival Amazon’s Unstaffed Stores

(November 8) Bloomberg.com

Japanese Company Signpost to Rival Amazon’s Unstaffed Stores

(November 8) Bloomberg.com

September Retail Sales in Singapore Register Modest Growth

(November 13) InsideRetail.asia

September Retail Sales in Singapore Register Modest Growth

(November 13) InsideRetail.asia

Walmex Reports Weak October Sales in Mexico

(November 8) Company press release

Walmex Reports Weak October Sales in Mexico

(November 8) Company press release

Ripley to Offer More than 2,000 Jobs for Christmas Season

(November 9) America-Retail.com

Ripley to Offer More than 2,000 Jobs for Christmas Season

(November 9) America-Retail.com

ProChile Signs a Cooperation Agreement with Chinese Supermarket Chain Suning

ProChile Signs a Cooperation Agreement with Chinese Supermarket Chain Suning

(November 8) America-Retail.com

(November 8) America-Retail.com

Topitop Reopens Store in Lima, Peru

(November 9) Co.FashionNetwork.com

Topitop Reopens Store in Lima, Peru

(November 9) Co.FashionNetwork.com

Mexican Startup Rever Receives $2.25 Million in Funding

(November 7) LatAmList.com

Mexican Startup Rever Receives $2.25 Million in Funding

(November 7) LatAmList.com

- From Online to Offline

- From Imports to Exports

- From Retail to Services

US RETAIL EARNINGS

US RETAIL EARNINGS

US RETAIL & TECH HEADLINES

US RETAIL & TECH HEADLINES

- com said that it will build new offices in the New York City and Arlington, Virginia, areas, ending months of jockeying among potential locations across the country vying for a $5 billion investment that promises 50,000 high-paying jobs over almost two decades.

- Hiring at both locations will begin next year, the company said. Amazon also said it will create more than 5,000 jobs in Nashville at a new operations center.

How Neiman Marcus Safeguards Purchases When Sales Surge

(November 12) PYMNTS.com

How Neiman Marcus Safeguards Purchases When Sales Surge

(November 12) PYMNTS.com

- As the amount of transactions made online increases, many cybercriminals have been targeting online shopping channels. Gift cards have also become an appealing target for fraudsters in recent months. Botnet attacks are especially common in these incidents.

- As cybercriminals adopt more sophisticated attack techniques, retailers must implement new methods to safeguard transactions. Neiman Marcus’s cybersecurity team has made significant efforts to utilize artificial intelligence and machine learning systems, which detect suspicious behaviors or transactions and curb the number of successful cybercrimes.

NY Gas Prices Continue Decline, US Consumers Saving $100 Million Daily

(November 12) OneidaDispatch.com

NY Gas Prices Continue Decline, US Consumers Saving $100 Million Daily

(November 12) OneidaDispatch.com

- Average retail gasoline prices in New York have fallen 3.9 cents per gallon in the past week, averaging $2.90 per gallon on Sunday, November 11. This compares with the national average, which fell 5.9 cents per gallon in the last week, to $2.67.

- The national average has dropped 22.1 cents per gallon during the last month and stands 12.2 cents per gallon higher than this day a year ago.

10 Years After the Recession, Americans Wake Up to Rising Prices

(November 11) EconomicTimes.IndiaTimes.com

10 Years After the Recession, Americans Wake Up to Rising Prices

(November 11) EconomicTimes.IndiaTimes.com

- After years of low, low prices, fed by near-zero interest rates in a convalescing economy, Americans are waking up to costlier consumer living. Everyday household staples such as diapers, toothpaste, shampoo and dishwashing liquid have all started getting more expensive, and the trend is expected to continue early next year.

- For the moment, Americans are willing to pay more, with consumer confidence near record highs, businesses believe. GDP is indeed expanding above trend and wages climbed nicely in October.

- As Black Friday approaches, American consumers, buoyed by a strong economy and rising wages, are ready to spend. That’s good news for dominant retailers such as Walmart and Amazon. But the landscape is much bigger than those two giants.

- The US Census Bureau will soon release retail sales numbers for October and economists are predicting a robust jump of 0.6%. It’s a potential boon for Walmart and numerous other retailers all set to release quarterly results and holiday outlooks later this week. And it could get better.

EUROPE RETAIL & TECH HEADLINES

EUROPE RETAIL & TECH HEADLINES

British Retail Footfall Down 2% in October

(November 12) BRC.org.uk

British Retail Footfall Down 2% in October

(November 12) BRC.org.uk

- British retail footfall fell by 2% in October, according to figures from Springboard and the British Retail Consortium (BRC). Shopping centers and retail parks saw footfall drop by 3.3% and 0.2%, respectively, in October, while high-street footfall slid by 2.3%.

- Northern Ireland was the only region to record growth; footfall rose by 2.7% in the region, and by 4% in both its high streets. High-street footfall in Greater London increased by 0.2%. The East and East Midlands saw the steepest footfall declines, of 6.1% and 4.8%, respectively.

- The UK retail sector shed around 85,000 jobs in the first half of 2018, according to the Office for National Statistics.

- During the first nine months of 2018, around 1,000 retail businesses entered administration, the highest number in five years, according to British newspaper The Observer, while another 26 opted for a company voluntary arrangement process to continue operations.

Ahold Delhaize Eyes Robotics to Expand Artificial Intelligence Offerings

(November 9) Company press release

Ahold Delhaize Eyes Robotics to Expand Artificial Intelligence Offerings

(November 9) Company press release

- Dutch retailer Ahold Delhaize has partnered with Delft University of Technology (TU Delft) to expand its Artificial Intelligence for Retail Lab (AIRLab). The partnership involves a robotics research program and a test site to develop disruptive technologies in retail.

- Director of TU Delft and Supervisor of AIRLab Delft Martijn Wisse said, “At AIRLab Delft, scientists will study how employees can teach their robots to do repetitive tasks or develop methods to optimize the motion and coordination of mobile robots and of delivery vehicles.”

- House of Fraser may see further store closures, as landlords rejected Mike Ashley’s proposal that would see him pay business rates on a few locations while paying performance-based rents on others.

- The company confirmed the closure of its Manchester flagship store Kendals last month in addition to Exeter and Shrewsbury stores that are set to close in early 2019.

- Germany’s antitrust authority has approved the merger of department store chains Karstadt, owned by Austrian real estate company Signa, and Galeria Kaufhof, owned by Hudson’s Bay Company (HBC). The ruling stated that the merger does not threaten competition, as the companies exceeded a combined 25% market share only in a few goods and regions.

- The agreement will provide Signa with a 50.01% stake in the resulting entity, while HBC will acquire a 49.99% stake in it.

- Flipkart Group Cofounder and CEO Binny Bansal has resigned following the conclusion of an investigation by the firm and its parent, Walmart, into a complaint of “serious personal misconduct” against him. The firms say that the investigation did not find evidence to support the complaint, but found “other lapses in judgment” and “a lack of transparency” from Bansal.

- The companies did not name Bansal’s replacement, but have revised the reporting structure. Kalyan Krishnamurthy, CEO of marketplace business Flipkart, and Sameer Nigam, CEO of payments arm PhonePe, will report directly to the board. Ananth Narayanan, CEO of fashion platforms Myntra and Jabong, will report to Krishnamurthy, as the platforms will now be part of Flipkart, albeit operating independently. Previously, all three reported directly to Bansal.

- Chinese online retailer LightInTheBox is set to acquire Singaporean e-commerce platform Ezbuy for approximately $86 million, subject to some closing conditions. Ezbuy, which was formerly known as 65daigou, has more than 3 million customers in Southeast Asia and Pakistan and raised $17.6 million in pre-series C funding in May this year, primarily from Chinese investors.

- “This transaction is part of our larger plan to build our business-to-consumer cross-border e-commerce out to scale globally,” said LightInTheBox CEO Zhiping Qi, citing Ezbuy’s supply chain management as potentially supporting the firm’s emerging markets strategy.

Alibaba and JD.com Register Record Sales on Singles’ Day

Alibaba and JD.com Register Record Sales on Singles’ Day

- E-commerce behemoths Alibaba and JD.com both set new sales records during the Singles’ Day online shopping event. Alibaba declared that it recorded gross merchandise volume of ¥213.5 billion ($30.8 billion) on November 11, 2018, an increase of 27% versus 2017.

- com announced that its transaction volume reached a record ¥159.8 billion ($23 billion) during the November 1–11 period for the Singles’ Day Shopping Festival.

Alibaba Enters into Lifestyle Brand Partnership with Fung Retailing

Alibaba Enters into Lifestyle Brand Partnership with Fung Retailing

- E-commerce giant Alibaba has signed a partnership agreement with Fung Retailing, the retail arm of the Fung Group, whereby the two companies will seek to bring more international lifestyle brands to China to meet growing consumer demand for lifestyle products both online and offline.

- Alibaba and Fung Retailing announced their strategic partnership at a signing ceremony in Shanghai during the China International Import Expo. “We endeavor to help global brands expand their foothold in the China market by fully integrating Alibaba’s strong capabilities in New Retail, big data and technology with Fung Retailing’s unparalleled advantages in brand and supply chain resources,” said Alibaba Group CEO Daniel Zhang.

- Japanese company Signpost is set to rival Amazon in providing a seamless shopping experience through cashier-less stores that are similar to the Amazon Go model. The company has already leveraged its technology and created a kiosk on the platform of a train station in Tokyo.

- Signpost plans to sell its product to Japanese and international convenience stores, supermarkets, and train station kiosks beginning next year. Cameras and artificial intelligence software are used to track merchandise and purchases. Founder Yasushi Kambara calls it the “Super Wonder Register” and believes that the system can be installed in any store.

- In Singapore, retail sales excluding motor vehicles rose by 1.8% year over year in September. On a month-over-month basis, sales registered a marginal 0.1% decline. Total retail sales by value were S$3.6 billion (US$2.6 billion) in September, with online sales constituting 4.9% of the total.

- Sales of watches and jewelry rose by 7.4%, driven partly by higher demand for watches. Several other categories also reported higher sales for the month, including medical goods and toiletries (up 3.3%) and apparel and footwear (up 3%), according to Statistics Singapore.

- Walmex, Walmart’s business in Mexico and Central America, reported total group sales growth of 3.6% in October, with a 4.5% increase in Mexico and a 0.6% decrease in Central America—the weakest monthly result since April this year. Comparable sales grew by 3.0% in Mexico and fell by 2.3% in Central America.

- In October, Walmex opened 11 stores of various formats across Mexico, one discount store in Guatemala, one supermarket in Nicaragua and one convenience store (its “bodega” format) in El Salvador.

- Chilean department store chain Ripley announced that it will hire more than 2,000 seasonal assistants between December 1 and 24 throughout Chile.

- The seasonal assistants will help with customer service, considering the increased flow of shoppers during the holidays.

- The Chilean Export Promotion Bureau, ProChile, has signed a cooperation agreement with Chinese supermarket chain Suning to strengthen the presence of Chilean companies and products in China.

- Jorge O’Ryan Schütz, Director of ProChile, said, “Between January and August of this year, our exports to China totaled $1,779 million, surpassing everything exported in 2017, when shipments reached $1,596 million. Therefore, the goal is to close 2018 with food exports for $2,500 million. And to achieve this, the cooperation agreements that we have signed these days will be key.”

- Peruvian fashion brand Topitop reopened a 4,300-square-foot store in Lima, in the MegaPlaza Independencia shopping center, increasing its store count to 25 in the capital city.

- Topitop has completely renovated its premises to introduce a new image of its brand to Peruvian shoppers.

- Business intelligence startup Rever raised $2.25 million from Sequoia Capital and Zetta Venture Partners, marking Sequoia’s first Mexican investment.

- Sequoia partner Bryan Schreier said, “Mexico has the advantage of being close to the US and it is an industrial country and, as such, it is a great market to test a platform like Rever and then take it to the whole world.”

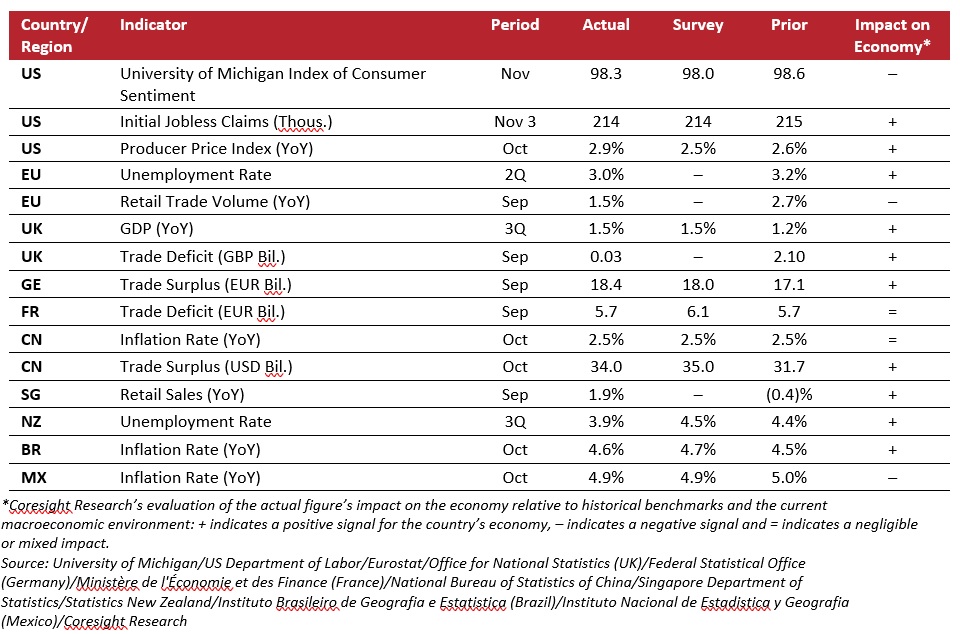

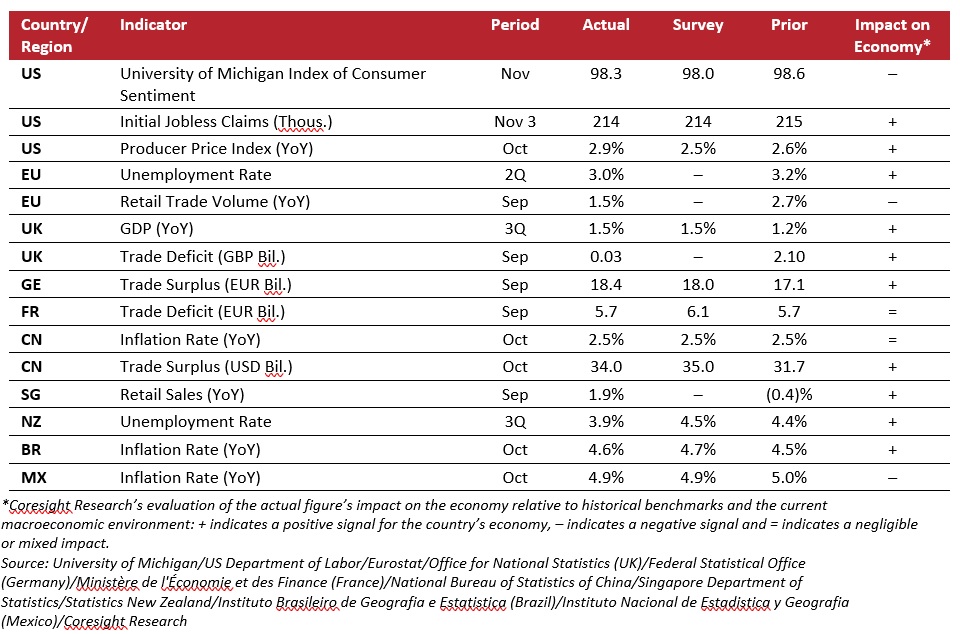

- US: The University of Michigan Index of Consumer Sentiment reading fell to 98.3 in November from 98.6 in October, but was slightly higher than market expectations of 98.0. US jobless claims dropped by 1,000, to 214,000, in the week ended November 3, matching market expectations.

- Europe: The long-term unemployment rate in the European Union decreased to 3.0% in the second quarter of 2018 from 3.2% in the first quarter. UK GDP expanded by 1.5% year over year in the third quarter, up from 1.2% growth in the previous quarter and matching market expectations.

- Asia-Pacific: China’s inflation rate stood at 2.5% year over year in October, unchanged from September and in line with market expectations. New Zealand’s unemployment rate declined to 3.9% in the third quarter from 4.4% in the previous quarter and was below market expectations of 4.5%.

- Latin America: The inflation rate in Brazil rose to 4.6% year over year in October from 4.5% in September and was below market expectations of 4.7%. Mexico’s inflation rate fell to 4.9% year over year in October from 5.0% in September and was in line with the consensus estimate.