DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

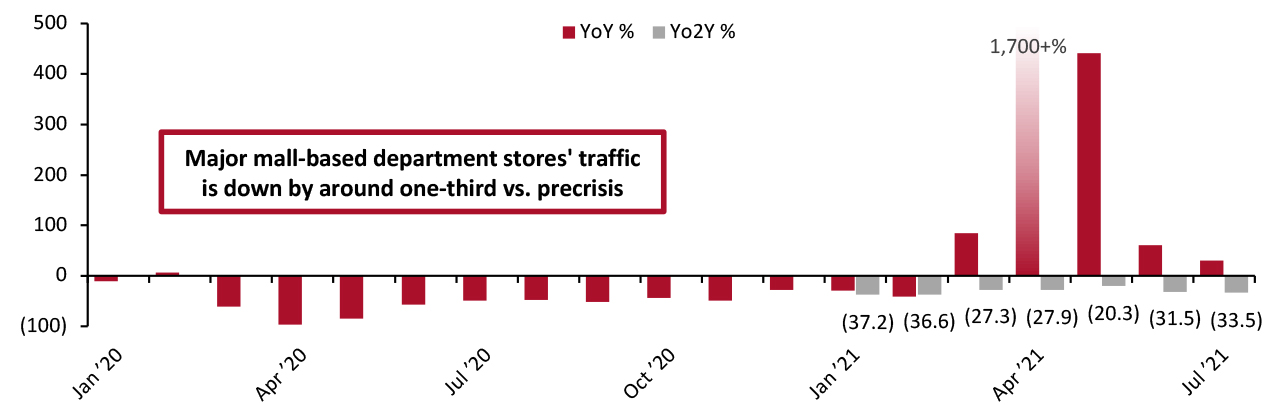

New Clouds on the Horizon for Malls Following a Strong Second Quarter Last week, two major US real estate investment trusts (REITs)—Simon and Macerich—made positive noises as they reported second-quarter results that prompted them to raise full-year earnings guidance. While we summarize those positive results later in this note, we first raise recent data points that suggest renewed near-term challenges for some malls, a trend that would evidently impact not only REITs but the many nonfood retailers based in these shopping centers. Mall Traffic Recovery Appears To Go into Reverse We are seeing indications that recent positive trends in physical store and mall traffic are reversing. Foot-traffic data from location-based-data company Unacast suggest that after a spring recovery, the two-year change in traffic dropped further into the negative in June and July. Amidst a resurgence in Covid-19 cases, renewed consumer caution is not surprising. For Figure 1, we aggregated and analyzed data for two major US mall-based department store chains (as a rough proxy for malls). The year-over-year trend is understandably volatile given what happened in 2020 while the two-year trend shows a steady sequential improvement to May 2021, before weakening. We are seeing substantial variations between states, with the most recent two-year traffic trends being below average in states including California, New York and Tennessee.Figure 1. US Store Traffic: Tracked Visits to Two US Mall-Based Department Store Chains (% Change) [caption id="attachment_131305" align="aligncenter" width="725"]

Source: Unacast/Coresight Research[/caption]

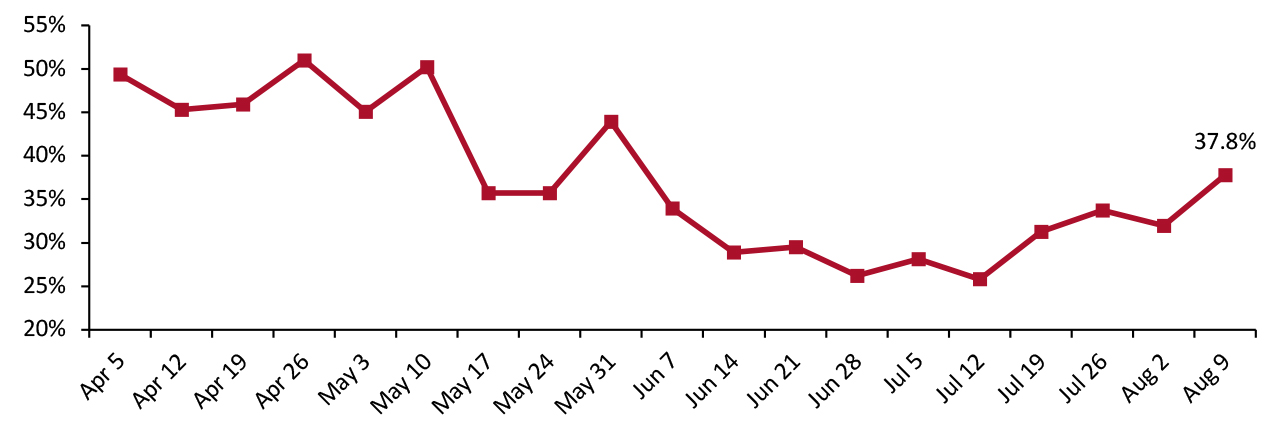

Likewise, Coresight Research’s weekly consumer surveys have recorded a recent uptick in avoidance of shopping centers/malls: Between July 12 and August 19 this year, the proportion of respondents saying that they are avoiding these locations climbed by 12 percentage points. Perhaps understandably, older consumers are the most cautious: as of August 9, 51% of over-60s are avoiding shopping centers/malls versus 29.5% of consumers aged 18–29.

Source: Unacast/Coresight Research[/caption]

Likewise, Coresight Research’s weekly consumer surveys have recorded a recent uptick in avoidance of shopping centers/malls: Between July 12 and August 19 this year, the proportion of respondents saying that they are avoiding these locations climbed by 12 percentage points. Perhaps understandably, older consumers are the most cautious: as of August 9, 51% of over-60s are avoiding shopping centers/malls versus 29.5% of consumers aged 18–29.

Figure 2. US Consumer Survey: Proportion of Respondents That Are Avoiding Shopping Centers/Malls [caption id="attachment_131306" align="aligncenter" width="724"]

Base: US respondents aged 18+

Base: US respondents aged 18+ Source: Coresight Research [/caption] The Opening of a Dollar Store Does Not Offset the Closure of a Department Store These data points follow a recent period of overall real estate buoyancy in the US. Year to date (as of week 32), US store closures are down 28.0% versus last year while store openings are up 48.1% So far this year, closures and openings are almost neck and neck in absolute terms, compared to the clear trend of closures outpacing openings that we saw last year. However, while a rising tide may lift all boats, it may not lift them equally: Year to date, discount stores account for over 40% of openings and these stores are overwhelmingly off-mall. Meanwhile, over 40% of recorded closures are accounted for by apparel and footwear stores—one of the sectors on which the mall offering is traditionally predicated. High-Quality Real Estate Will Always Be in Demand The Delta variant of Covid-19 could result in the second half being more challenging for some retailers than the past quarter’s trends suggest, with greater volatility than a straight-line recovery. The impact of this is likely to be felt most in lower-tier malls, where it will compound challenges from store closures in recent years. It will also amplify the bifurcation in performance between well-invested, higher-quality centers where shoppers still want to spend time (even if the pandemic context means that much of that desire will be in the future rather than right now) and more structurally challenged, lower-tier centers suffering from a negative spiral of limited consumer appeal, store closures and declining shopper traffic. Here are the positive metrics and remarks that two major REITs provided recently:

- Simon Property Group, owner of premium malls and outlet centers, reported that its mall and outlet occupancy at the end of the second quarter stood at 91.8%, an increase of 100 basis points compared to the prior quarter. Chairman, CEO and President David Simon reported: “Through the first six months, we signed 2,500 leases for over 9.5 million square feet. Our team executed leases for 3 million more square feet or over approximately 800 more deals compared to the first six months of 2019.” On the back of this recovery, management raised its guidance for full fiscal year earnings for the second consecutive quarter.

- At Macerich, portfolio occupancy stood at 89.4% at the end of the second quarter, up 90 basis points versus the prior quarter. In the first half, the company signed 488 leases for approximately 1.86 million square feet; management noted that this represents 18% more deals and 34% more square feet than during the same period two years earlier. Management raised earnings guidance, too. CEO and Director Thomas O'Hern told analysts: “We are very optimistic about our business as we move forward to the balance of the year and into 2022. […] The leasing environment is strong and getting better by the month, and we expect significant gains in occupancy.”

US RETAIL AND TECH HEADLINES

Albertsons Companies Appoints Sharon McCollam as President and CFO (August 10) Company press release- Grocery retailer Albertsons Companies has selected Sharon McCollam as its next President and CFO, effective September 7, 2021. McCollam will succeed Bob Diamond, who will remain with Albertsons as an advisor until February 2022 to ensure a smooth transition, before retiring.

- In 2016, McCollam retired from Best Buy, where she served as CFO, Chief Administrative Officer and Executive Vice President. Since retiring from Best Buy, McCollam has served as a member of several corporate boards, including Chewy and Signet Jewelers.

- Sporting goods retailer Fanatics has raised $325 million from new and existing investors, valuing the company at $18 billion. New investors include US celebrity and businessman Jay Z and his entertainment company Roc Nation.

- In early 2021, the company announced its expansion into the Chinese market through a joint venture with private equity firm Hillhouse Capital. Fanatics plans to expand its sales beyond e-commerce to include gaming, media, non-fungible tokens (NFTs) and sports betting.

- Supermarket chain Grocery Outlet reported a sales decline of 3.5% year over year for its second quarter of fiscal 2021, ended July 3, 2021. However, on a two-year basis (versus the corresponding quarter in 2019), the company’s sales increased by 20.2%. The company’s comparable sales also declined year over year, by 9.1%, versus a 17% increase in the same quarter last year, and its adjusted EBITDA decreased by 15.7% year over year.

- Grocery Outlet noted that quarter-to-date comparable store sales for its third quarter of fiscal 2021 are negative at (6.0)%. For the full third quarter, the company expects comps to be in the negative mid-single digits.

- Home-improvement retailer Home Depot has opened its third distribution center in the Baltimore region, Maryland, in the past year. The new openings are part of the company’s 2017 announcement of a $1.2 billion investment in its supply chain network, comprising 150 new facilities nationwide over the next few years.

- The newly opened facility spans 812,000 square feet and features a zero-emission hydrogen fuel cell charging station to power its equipment sustainably. The company noted that the opening will bring faster delivery to customers in the region.

- Apparel e-commerce company Stitch Fix has opened up its “direct buy” offering to non-subscription clients. Launched in late 2019, “direct buy” enables consumers to buy individual items without the styling fee.

- In its third-quarter 2021 earnings call held in June 2021, the company’s management stated that the offering will accelerate Stich Fix’s top-line and client growth and significantly expand the company’s total addressable market.

EUROPE RETAIL AND TECH HEADLINES

Ahold Delhaize Reports Second-Quarter 2021 Results, Raises 2021 EPS Guidance (August 11) Company press release- Dutch grocery retailer Ahold Delhaize has reported a sales increase of 3.0% year over year on a constant currency basis for its second quarter of fiscal 2021, ended July 4, 2021. On a two-year basis, total sales increased by 14.3%. The company’s adjusted operating income declined by 12.2% year over year.

- Ahold Delhaize has also raised its guidance for full-year EPS and operating margins. The company now expects an adjusted operating margin of 4.3%, versus prior guidance of 4.0%, and adjusted EPS growth in the high-teen range relative to 2019, versus prior guidance of low-to-mid-teen growth.

- German supermarket chain Aldi Süd is set to open one store per week in the UK up to Christmas 2021. New stores will be located in Canterbury, Swansea and London, among other locations.

- Aldi expects to create over 2,000 new store jobs in the UK through the openings. In addition to the new roles, Aldi is looking to onboard over 1,000 employees in its UK head office and distribution centers in the coming months.

- Germany-based online food-delivery service Delivery Hero has acquired a 5.1% stake in Deliveroo for £284 million ($392.4 million).

- The acquisition marks the company’s re-entry into the UK market, following its sale of Hungryhouse to Just Eat in 2016. Delivery Hero operates across 50 countries globally and owns the Asia-based food-delivery giant Food Panda.

- The European Union (EU) has set stricter conditions on permissible levels of cadmium and lead content in food products, including baby food, cereals, fish, fruit, meat and vegetables, among others. The move comes as part of the EU’s aim to reduce cancer risks and exposure to carcinogenic content in edible substances.

- The new rules will apply from the end of August.According to the new policy, supermarkets can still sell products that entered the market under old food and safety norms until February 2022.

- Switzerland-based food and retail conglomerate Nestléhas acquired the core brands of health and nutrition company Bountiful Company. These include Nature’s Bounty, Osteo Bi-Flex and Solgar, among others. Additionally, Nestlé will onboard 4,000 Bountiful Company employees.

- NestléHealth Science, the company’s business unit, will lead the operations, sales and production of the acquired brands worldwide. With the closure of the deal, the company noted that Nestlé Health Science has become a global player in the herbals, minerals and supplements business for mass retail.

ASIA RETAIL AND TECH HEADLINES

H&M Collaborates with Indian Designer Sabyasachi (August 9) Company press release- H&M has collaborated with Indian designer label Sabyasachi to launch an apparel and accessories collection for men and women. The collection includes a first-of-its-kind collaboration saree exclusively designed for Indian customers.

- The Sabyasachi x H&M collection launched on August 12 across 11 H&M stores in India and selected stores in 17 other countries. It is also available via Myntra.com and in 48 international markets on HM.com.

- IKEA’s shopping center business Ingka Centres has begun the sale of around 500 flats at its first multipurpose retail and residential development, in Changsha, south-central China.

- Named “Livat Changsha,” the center includes over 380 shops, restaurants, and spaces for entertainment, events and sports, as well as over 500 residential units with communal areas, co-working spaces and gyms. The development is designed to appeal to Changsha’s entrepreneurs and working population. Ingka Centres expects property buyers to begin moving into the space in March 2022.

- MediTrust Health, a Shanghai-based online healthcare payment and pharmacy retail platform, has secured $300 million in Series C funding, led by Boyu Capital, Lilly Asia Ventures and the China International Capital Corporation.

- In March 2021, the company’s Series B funding round raised $154.2 from Ant Group, Shanghai Biomedical Fund, and Sinovation Ventures. Boosted by strong demand for the digitalization of healthcare services in China, the company is reportedly planning an initial public offering (IPO) by the end of 2021.

- Kim Kardashian-owned undergarment and shapewear brand SKIMS has signed a local distribution deal with Australian luxury department store chain David Jones.

- David Jones will stock SKIMS’ high-end loungewear, shapewear and underwear brands in stores and online. It will include the ranges Core Control, Fits Everybody, Seamless Sculpt, Sleep Jersey and Stretch Rib.

- Indian food-delivery platform Swiggy has expanded Instamart, its grocery delivery offering, to five new cities: Chennai, Delhi, Hyderabad, Mumbai and Noida. Instamart claims to offer delivery in 15–30 minutes, upping the ante in the express delivery segment.

- Swiggy first launched Instamart—which employs a dark store model to fulfill rapid deliveries—in Bengaluru and Gurugram in August 2020. In July 2021, the company raised $1.25 billion in its biggest funding round to date, led by Japanese investment firm Softbank and existing investors Prosus, Accel and Wellington Management.