From the Desk of Deborah Weinswig

The Sainsbury’s-Asda Merger Would Create the UK’s “Amazon Crusher”

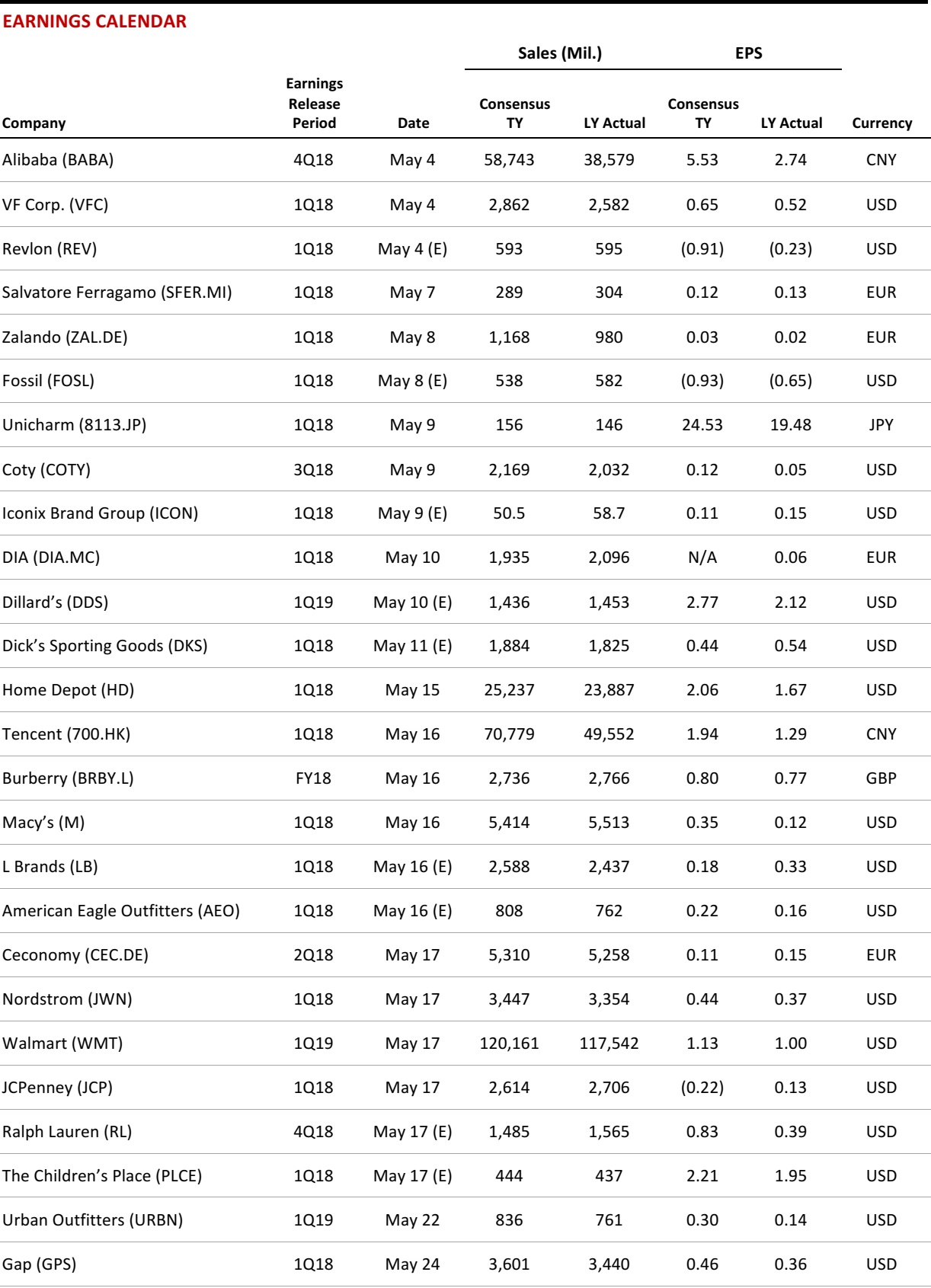

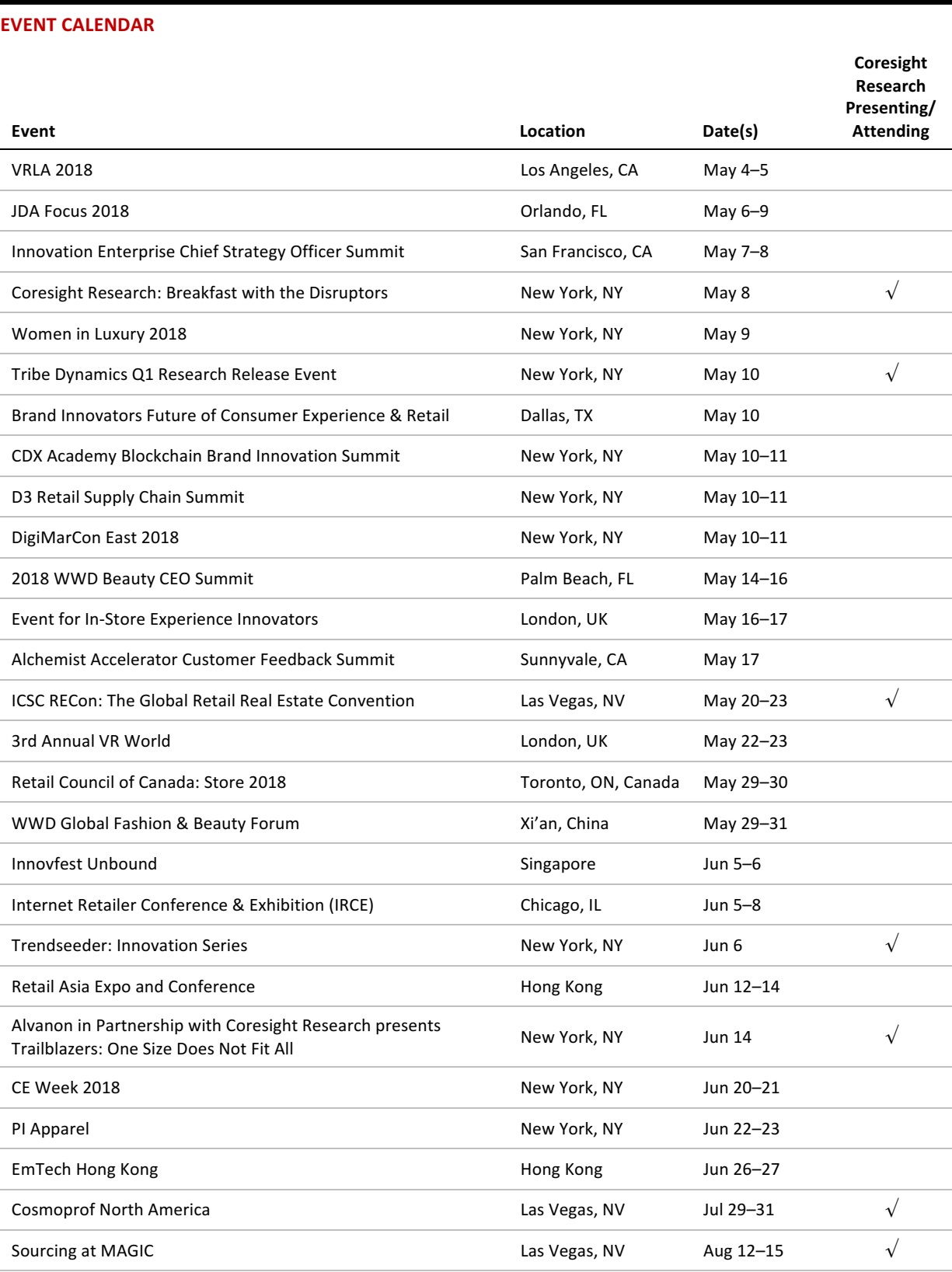

This week, two of the UK’s biggest grocery retailers, Sainsbury’s and Walmart-owned Asda, announced plans to merge. The combination would create the UK’s biggest grocery retailer, with total revenues of £51 billion ($37.5 billion). We think that it would also create the UK’s biggest retailer of nonfood categories.

The new company would span online and offline grocery, two strong clothing brands and a large general merchandise operation. And it would offer fulfillment across a number of banners and store formats as well as home delivery that includes traditional delivery options and rapid delivery in grocery and general merchandise. In short, it would be the closest thing to an “Amazon crusher” that we are likely to see in UK retail—and it could serve as a template for retailers in other countries as they battle Amazon for market share.

The Potential Sainsbury’s-Asda Network of Brands and Fulfillment

Scales are indicative only.

Source: Coresight Research

Scales are indicative only.

Source: Coresight Research

Creating the UK’s Top Nonfood Retailer and, Potentially, Its Biggest Apparel Retailer

The merger could make Sainsbury’s-Asda the UK’s top apparel retailer. We estimate that the new company would have annual apparel sales of over £3 billion, setting up a rivalry with Marks & Spencer for the title of the UK’s leading clothing and footwear retailer. Marks & Spencer saw apparel-only sales of around £3.2 billion last year, we estimate, and those sales are declining.

We further estimate that the new combined entity would see total sales of around £9–£10 billion across apparel and general merchandise, making it the UK’s biggest nonfood retailer. That would put it ahead of Amazon UK, which booked revenues of £8.8 billion last year, though its gross merchandise volume including marketplace sales will have been even higher.

In nonfood categories, the Sainsbury’s-Asda combination would bring together the following:

- The variety store Argos, which was acquired by Sainsbury’s in 2016 and which sells around £4.1 billion of general merchandise per year.

- Asda’s highly successful George apparel brand, which is believed to generate sales north of £2 billion per year (we estimate that George sales totaled about £2.2 billion in 2017).

- Sainsbury’s newer but high-growth Tu clothing brand, which we estimate saw net sales of around £840 million last year.

- Asda’s and Sainsbury’s own general merchandise sales, which we think are likely to total approximately £2–£3 billion per year.

An Omnichannel Leader

The new company would lead in its range of fulfillment options, too. Argos has been an omnichannel leader for many years, having pioneered the concept of reserve online, pick up in-store in the UK and having rolled out same-day delivery in 2015. Sainsbury’s and Asda each have mature online grocery operations, and Sainsbury’s also has a nascent one-hour delivery service called Chop Chop. In addition, Sainsbury’s has a large network of convenience stores that it could use as local collection points.

Sainsbury’s has already installed Argos shops-in-shops and collection points in its stores; this week, management noted that there is an opportunity to bring Argosin to Asda stores, too. Such moves, together with the cross-selling of brands such as George and Tu in Argos, would create an impressive network that connects strong brands with a multiplicity of collection and delivery options. We think that the breadth and depth of the combined company’s offering would make it the market leader in terms of “anytime, anywhere” shopping.

At the companies’ press conference on Monday, Walmart International CEO Judith McKenna said that Walmart is considering deploying Argos in the US and elsewhere, further suggesting that this mix of offerings could be one way for retailers in many markets to fight the growth of Amazon.

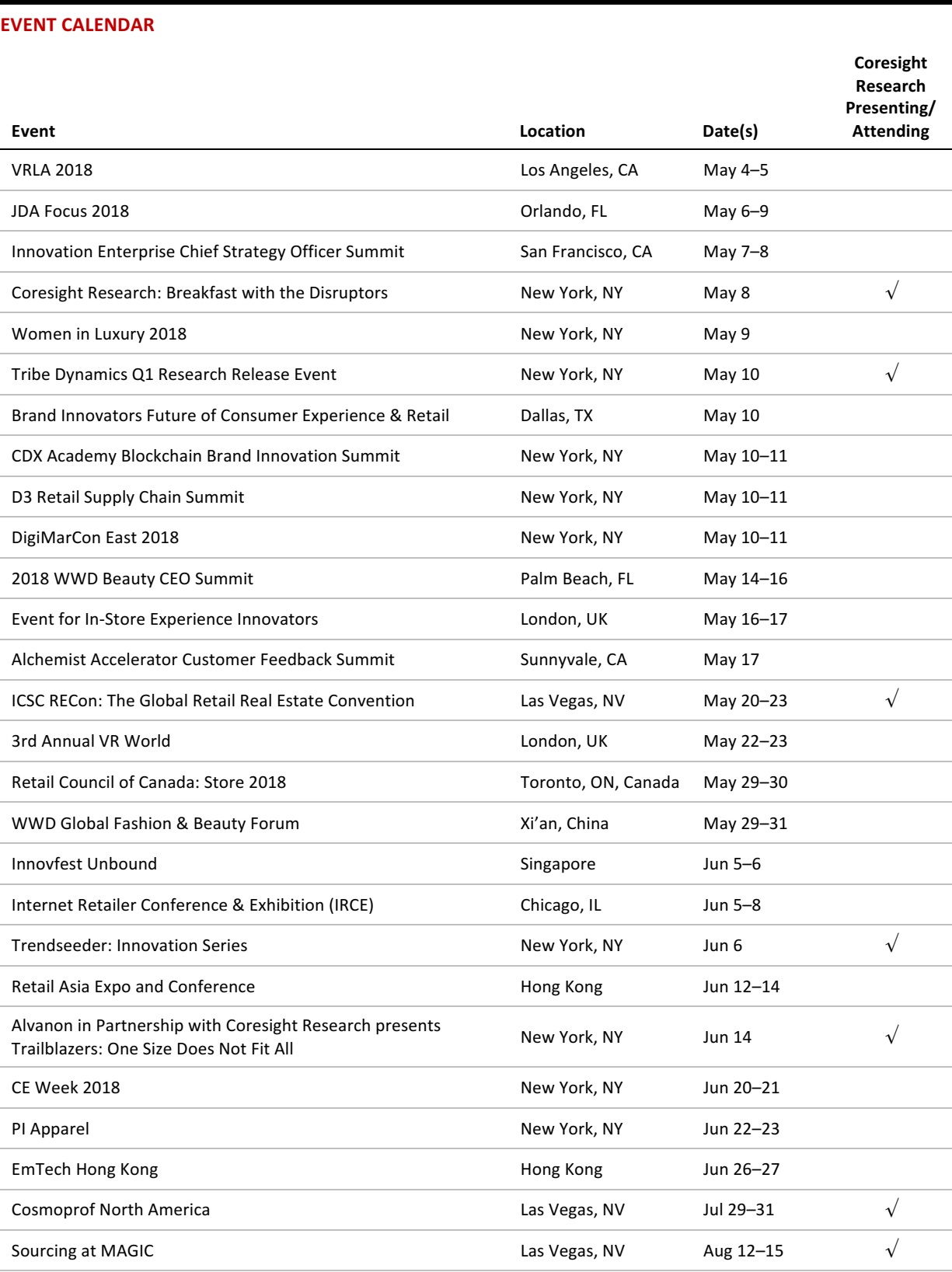

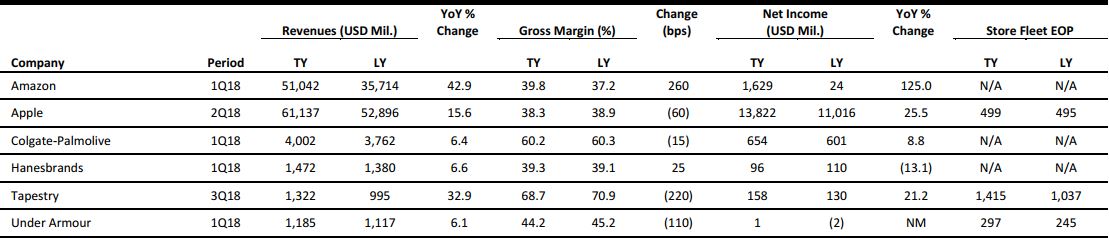

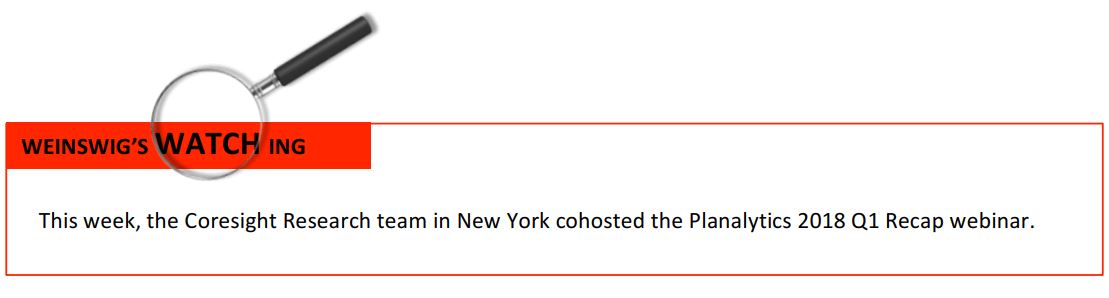

US RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Amazon Plans More Prime Perks at Whole Foods, and It Will Change the Industry

(May 1) CNBC.com

Amazon Plans More Prime Perks at Whole Foods, and It Will Change the Industry

(May 1) CNBC.com

- Amazon is planning new Whole Foods benefits for its Prime members, sources told CNBC. The new perks will bring the might of Amazon’s membership program to the grocery industry, folding Whole Foods into a network other grocers will struggle to compete with.

- Whole Foods will begin offering Prime members an additional 10% off of already discounted products. The company has already begun to roll out other perks such as free delivery of Whole Foods products to Prime members in certain locations, 5% cash back when members use its Visa rewards card at Whole Foods stores and exclusive member deals.

Under Armour Still Under Siege in the US

(May 1) CNNMoney.com

Under Armour Still Under Siege in the US

(May 1) CNNMoney.com

- Under Armour is still struggling to compete with the two sneaker kings, Nike and Adidas, in the US, and on Tuesday, it reported that revenue in North America dropped slightly from a year ago. Under Armour is doing extremely well in the rest of the world: in the first quarter, sales were up 21% year over year in Latin America; up 23% in the Europe, Middle East and Africa region; and up 35% in Asia.

- The problem is that the international strength isn’t enough to offset Under Armour’s trouble in the US. North America sales account for nearly three-quarters of its revenue and the North America unit also lost money last quarter.

Retail’s Other Problem: Too Few Clerks in the Store

(April 30) WSJ.com

Retail’s Other Problem: Too Few Clerks in the Store

(April 30) WSJ.com

- Many of America’s biggest retailers have been slashing staff even faster than they have been closing stores, a dynamic that has left fewer clerks and longer checkout lines at remaining locations. Some companies attribute the declining head count to staff cuts at headquarters and a switch to smaller stores that need fewer workers.

- Others have added technology such as self-checkout lanes or shelf-ready packaging that they say makes existing workers more productive. And still others have hired more full-time workers, eliminating the need for two or three part-timers.

Walmart Looks to Scale Back in UK and Brazil, with an Eye on India

(April 29) WSJ.com

Walmart Looks to Scale Back in UK and Brazil, with an Eye on India

(April 29) WSJ.com

- The world’s biggest retailer has concluded it can’t take on the whole world by itself. Walmart is in discussions to give up control over hundreds of stores in the UK and Brazil, two big markets where it has struggled for years, according to people familiar with the talks.

- Walmart is near a deal to sell a majority stake in its UK grocery chain Asda to rival J Sainsbury, according to people familiar with the situation. Walmart would retain around 40% of the merged company.

Amazon Hiking US Prime Fee to $119

(April 26) RetailDive.com

Amazon Hiking US Prime Fee to $119

(April 26) RetailDive.com

- Amazon is raising the price of its flagship Prime membership in the US by $20, increasing the annual fee from $99 to $119, CFO Brian Olsavsky said on a conference call last Thursday.

- The e-commerce giant also offers lower-priced memberships, for students and people on federal assistance programs, for example, but even at full price, Olsavsky called it the best deal in retail considering its many perks.

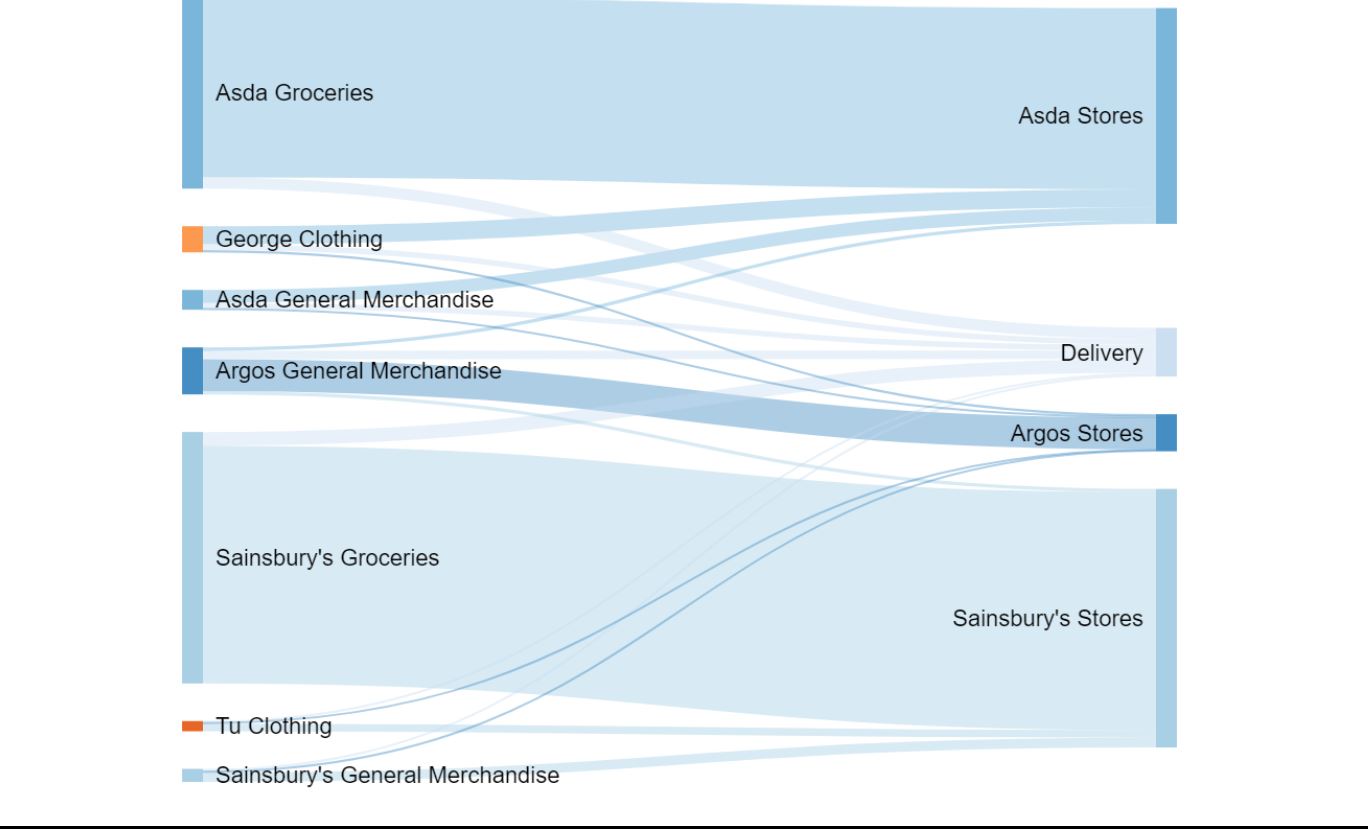

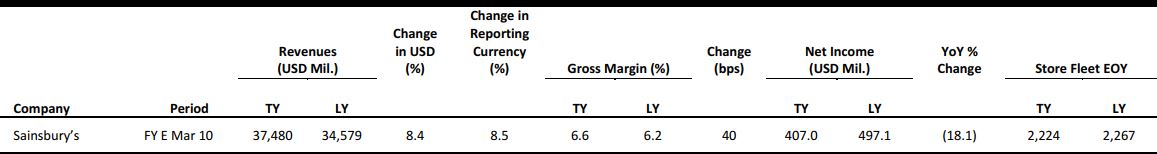

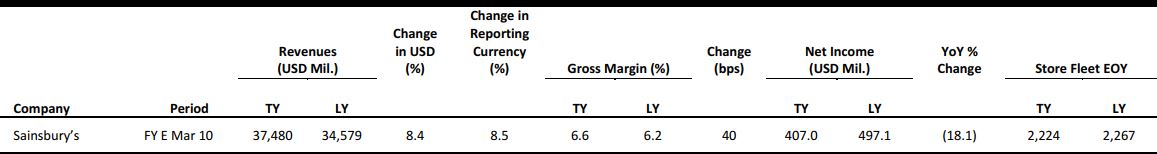

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

Sainsbury’s and Asda Agree to Merge

(April 30) Company press release

Sainsbury’s and Asda Agree to Merge

(April 30) Company press release

- Two of the UK’s biggest grocery retailers, Sainsbury’s and Asda, plan to merge. The merger would result in Asda owner Walmart holding 42% of the issued share capital of the new company and receiving £2.975 billion ($4.1 billion) in cash. Walmart would hold a maximum 29.9% of the total voting rights in the new company.

- The merger would create the UK’s biggest grocery retailer, which would be a major retailer of nonfood categories, bringing together Asda’s George clothing brand and the Sainsbury’s-owned Argos general merchandise chain. The merger is likely to raise concerns over competition that could result in regulators requiring the disposal of some stores.

Made.com Grows Full-Year Sales by 40%

(April 30) RetailGazette.co.uk

Made.com Grows Full-Year Sales by 40%

(April 30) RetailGazette.co.uk

- British online furniture retailer Made.com has posted a 40% increase in annual sales. The company grew sales to £127 million (~$173 million) in 2017.

- CEO Philippe Chainieux said, “People are getting more confident buying big-ticket items online. This shift is once in a generation.”

Carpetright CVA Gains Shareholder Approval

(April 30) Company press release

Carpetright CVA Gains Shareholder Approval

(April 30) Company press release

- UK retailer Carpetright has gained shareholder approval for its proposed company voluntary arrangement (CVA), which will allow it to restructure and exit some stores. Implementation of the CVA is dependent on Carpetright securing up to £15 million (~$20.5 million) of interim funding and successfully raising equity capital.

- Upon final approval, the CVA will allow Carpetright to close a proposed 92 stores.

Mothercare Appoints Rothschild

(April 28) Telegraph.co.uk

Mothercare Appoints Rothschild

(April 28) Telegraph.co.uk

- Struggling maternity and babywear retailer Mothercare is working with investment bank Rothschild to find outside financing, according to the Sunday Telegraph. Accountancy firm KPMG is handling separate discussions with Barclays and HSBC over Mothercare’s existing debt.

- Earlier in April, Mothercare reported that it was considering closing up to one-third of its 143 UK stores by entering a CVA.

Poundworld the Latest Major UK Retailer to Seek CVA

(April 26) SkyNews.com

Poundworld the Latest Major UK Retailer to Seek CVA

(April 26) SkyNews.com

- UK discount retailer Poundworld is the latest major high-street name to seek a CVA. The company is aiming to close more than a quarter of its 355-store estate. According to Sky News, Poundworld will announce proposals for a CVA in the first half of May.

- Sky News also reported that department store chain House of Fraser has appointed KPMG to advise on its restructuring options, including exploring the possibility of a CVA. This will fuel expectations that a substantial number of House of Fraser’s 59 stores will face the axe.

ASIA RETAIL & TECH HEADLINES

Volkswagen in Talks to Manage Didi Fleet, Codevelop Self-Driving Cars

(May 1) SCMP.com

Volkswagen in Talks to Manage Didi Fleet, Codevelop Self-Driving Cars

(May 1) SCMP.com

- Volkswagen, the world’s biggest automaker, is in talks to form a joint venture with China’s Didi Chuxing to manage part of the ride-hailing company’s fleet of cars and help develop “purpose-built” vehicles for Didi’s services.

- As part of the deal, which is expected to be signed early next month, the German automaker will initially manage a fleet of about 100,000 new vehicles for Didi, of which two-thirds will be Volkswagen Group cars, said a senior executive at Volkswagen.

China’s E-Commerce Giants Are Reaching for the Wallets of Overseas Chinese

(May 2) SCMP.com

China’s E-Commerce Giants Are Reaching for the Wallets of Overseas Chinese

(May 2) SCMP.com

- Chinese consumers living overseas represent an increasingly lucrative segment for China’s leading e-commerce companies, including Alibaba and JD.com, especially as online spending growth in China is expected to slow as e-commerce penetration plateaus in major cities. By offering shipping to other countries, the e-commerce sites are giving Chinese brands an opportunity to expand internationally.

- Since 2015, Alibaba and JD.com have been expanding their global shipping options, and they currently allow Chinese consumers based in Australia, the US, Southeast Asia, Greater China and other regions to buy directly from their e-commerce platforms. “We are focused on Chinese consumers [in Australia]…these consumers are familiar with us. Many of them have emigrated to Australia, but even though they are living in another land, they still lead a Chinese lifestyle,” said Alibaba CEO Daniel Zhang in an interview in Sydney.

Baidu Brings Group of PE Firms into Its Financial Services Business via $1.9 Billion Investment

(April 30) TechCrunch.com

Baidu Brings Group of PE Firms into Its Financial Services Business via $1.9 Billion Investment

(April 30) TechCrunch.com

- Baidu has turned to the financial industry to bolster its consumer finance business. The Chinese search giant confirmed that it has sold a majority share in its Financial Services Group (FSG) business to a consortium of private equity firms in a deal worth $1.9 billion.

- The deal—which some had speculated about at the end of last year—will see FSG renamed as Du Xiaoman. The group of investors, led by TPG and The Carlyle Group, will pay around $1.06 billion for a majority stake. A further $840 million will be given to Du Xiaoman. Following the transaction, Baidu will own 42% of the business, which will operate independently. Guang Zhu, who had been SVP and GM of FSG, will become CEO of Du Xiaoman.

Tencent Reportedly Plans to Invest About $470 Million in Bluehole

(May 1) EsportsObserver.com

Tencent Reportedly Plans to Invest About $470 Million in Bluehole

(May 1) EsportsObserver.com

- Tencent is reportedly planning to spend roughly $470 million to buy shares in game developer Bluehole, developer of the multiplayer online game PlayerUnknown’s Battlegrounds. Multiple South Korean news outlets have reported ongoing talks between Tencent, Bluehole and current investors. A Bluehole spokesperson confirmed that talks were under way, but did not comment on investors or the amount under discussion.

- In August last year, rumors began swirling that Tencent had acquired a minority stake in Bluehole, which Bluehold has since denied on multiple occasions. Yet it is believed that Tencent already owns a minority share of about 1.5% or 5%, depending on the report, that it acquired in 2017, as well as the rights to exclusively publish the game in China.

LATAM RETAIL & TECH HEADLINES

São Paulo Subway Introduces Interactive Doors

(April 30) ZDNet.com

São Paulo Subway Introduces Interactive Doors

(April 30) ZDNet.com

- One of the lines of the São Paulo Metro has rolled out interactive doors to improve communication with passengers. The technology, introduced in three subway stations, consists of four sets of doors with screens where customer information is displayed along with advertisements. The doors are fitted with lenses and sensors that collect data such as the amount of people standing in front of the doors and their facial expressions.

- The technology is also able to detect whether the faces looking at the screens are male or female and estimate the age of those commuters. The information collected on reactions to ads, as well as gender and approximate age, will be utilized as part of the sales pitch to companies wanting to advertise on the subway line.

Brazilian Central Bank Regulates Credit Fintechs

(April 27) ZDNet.com

Brazilian Central Bank Regulates Credit Fintechs

(April 27) ZDNet.com

- The Brazilian Central Bank created a new regulatory framework for fintechs that provide credit services to end consumers. The new regulations cut the middlemen—that is, banks—from credit provision processes performed by fintechs. Under the new rules, Brazilian fintechs will be able to act as direct credit providers if they are using their own resources or as lending platforms under the peer-to-peer model.

- However, the fintechs will have to comply with operational and technology-related requisites according to their size and area of focus. The Central Bank also wants these companies to adhere to a series of cybersecurity-related requirements by May 2019. The introduction of the regulations represents a significant milestone for the startup community operating in financial services, since the new companies will now be operating under a legal framework.

Totvs Still Leads Brazilian ERP Market

(April 24) ZDNet.com

Totvs Still Leads Brazilian ERP Market

(April 24) ZDNet.com

- Brazilian software firm Totvs still holds the pole position in the local enterprise resource platform (ERP) segment in Brazil, according to a recent study. The local company has a 35% market share, followed by SAP with a 31% share and Oracle with a 15% share.

- The numbers were included in the 29th edition of an IT market study by Brazilian business school Fundação Getúlio Vargas that covered 8,000 large and medium-sized businesses across the country. When breaking down the market presence by size of user organization, Totvs is the leader within small companies with up to 170 licenses, with 50% market share.

Walmart de Mexico Profit Up 18%

(April 26) MarketWatch.com

Walmart de Mexico Profit Up 18%

(April 26) MarketWatch.com

- Walmart de Mexico (Walmex) said its net profit rose by 18% in the first quarter on higher sales that were helped by the Easter holiday in March and by market-share gains. Walmex made net profit of MXN 8.35 billion ($443 million) in the January–March period, up from MXN 7.06 billion ($370 million) in the first quarter of 2017.

- Walmex, which runs 3,156 stores in Mexico and Central America, said sales in the quarter grew by 9.4%, to MXN 145.1 billion ($7.7 billion), and were up 11.4% in constant currency terms. Same-store sales, which exclude stores opened in the past year, rose by 10% in Mexico and by 7.1% in Central America.

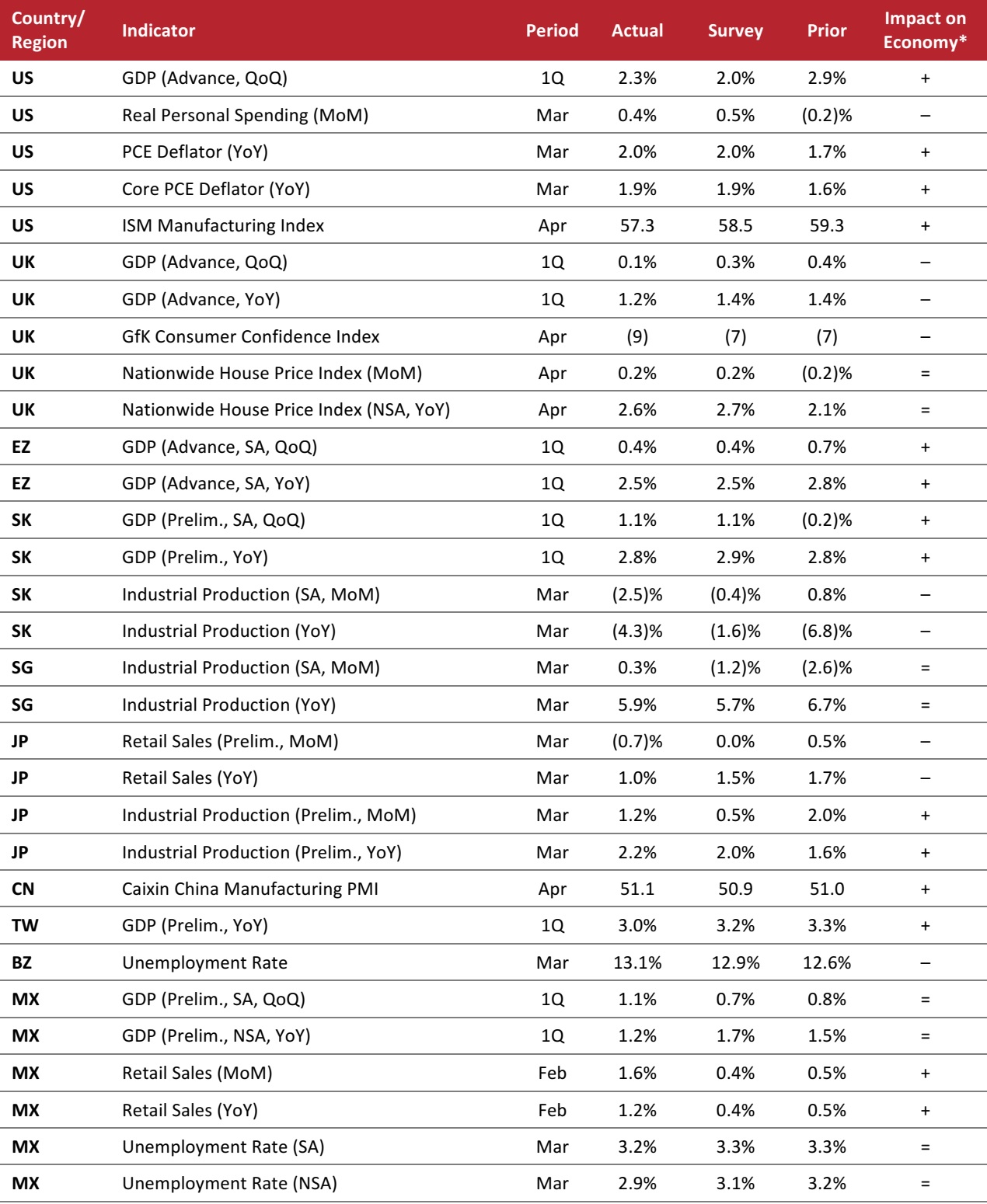

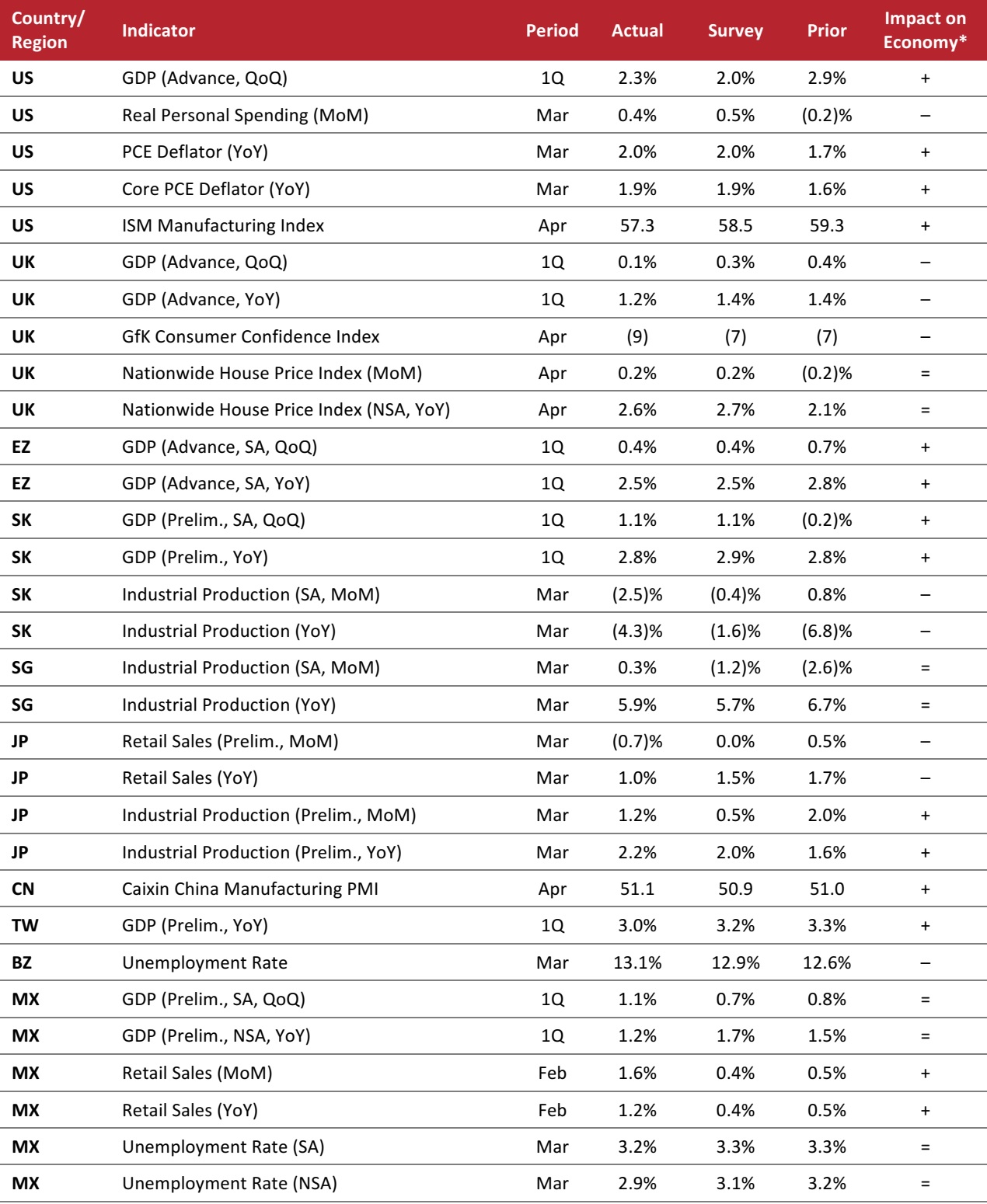

MACRO UPDATE

Key points from global macro indicators released April 25–May 2, 2018:

- US: GDP increased by 2.3% quarter over quarter in the first quarter, coming in ahead of the consensus estimate of 2.0%. In March, real personal spending increased by 0.4% month over month, which was slightly below the market’s estimate. The core Personal Consumption Expenditure (PCE) deflator increased by 1.9% year over year in March.

- Europe: In the UK, GDP increased by less than analysts had expected in the first quarter, rising by 1.2% year over year. Consumer confidence in the UK fell to (9) in April. In the eurozone, GDP increased by 2.5% year over year in the first quarter.

- Asia-Pacific: In South Korea, GDP increased by 2.8% year over year in the first quarter; the rate was slightly below the consensus estimate. Industrial production in South Korea dropped by 4.3% year over year in March. In China, the Caixin Manufacturing Purchasing Managers’ Index (PMI) stood at 51.1 in April. In Taiwan, GDP grew by 3.0% year over year in the first quarter.

- Latin America: In Brazil, the March unemployment rate stood at 13.1%, which was higher than the consensus estimate. In Mexico, GDP grew modestly in the first quarter. Retail sales in Mexico increased by 1.2% year over year in February. The unemployment rate in Mexico was 3.2% in March.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/National Association of Realtors/Institute for Supply Management (ISM)/GfK NOP (UK)/Nationwide Building Society/UK Office for National Statistics/Eurostat/Bank of Korea/Statistics Korea/Singapore Economic Development Board/Japan Ministry of Economy, Trade and Industry/China Federation of Logistics and Purchasing/Taiwan Directorate-General of Personnel Administration/Markit/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/National Association of Realtors/Institute for Supply Management (ISM)/GfK NOP (UK)/Nationwide Building Society/UK Office for National Statistics/Eurostat/Bank of Korea/Statistics Korea/Singapore Economic Development Board/Japan Ministry of Economy, Trade and Industry/China Federation of Logistics and Purchasing/Taiwan Directorate-General of Personnel Administration/Markit/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

Scales are indicative only.

Source: Coresight Research

Scales are indicative only.

Source: Coresight Research

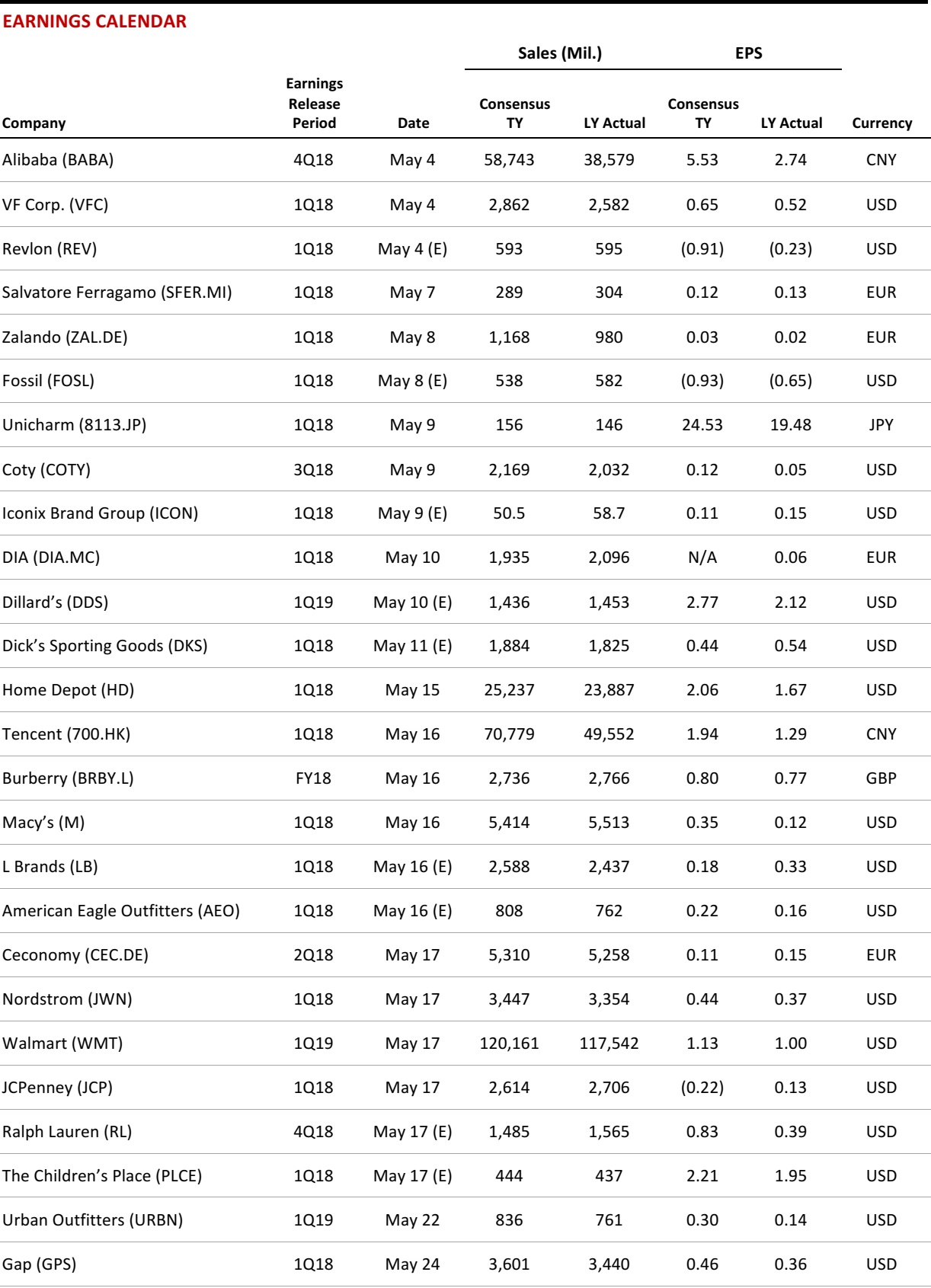

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Amazon Plans More Prime Perks at Whole Foods, and It Will Change the Industry

(May 1) CNBC.com

Amazon Plans More Prime Perks at Whole Foods, and It Will Change the Industry

(May 1) CNBC.com

Under Armour Still Under Siege in the US

(May 1) CNNMoney.com

Under Armour Still Under Siege in the US

(May 1) CNNMoney.com

Retail’s Other Problem: Too Few Clerks in the Store

(April 30) WSJ.com

Retail’s Other Problem: Too Few Clerks in the Store

(April 30) WSJ.com

Amazon Hiking US Prime Fee to $119

(April 26) RetailDive.com

Amazon Hiking US Prime Fee to $119

(April 26) RetailDive.com

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Sainsbury’s and Asda Agree to Merge

(April 30) Company press release

Sainsbury’s and Asda Agree to Merge

(April 30) Company press release

Mothercare Appoints Rothschild

(April 28) Telegraph.co.uk

Mothercare Appoints Rothschild

(April 28) Telegraph.co.uk

Poundworld the Latest Major UK Retailer to Seek CVA

(April 26) SkyNews.com

Poundworld the Latest Major UK Retailer to Seek CVA

(April 26) SkyNews.com

Volkswagen in Talks to Manage Didi Fleet, Codevelop Self-Driving Cars

(May 1) SCMP.com

Volkswagen in Talks to Manage Didi Fleet, Codevelop Self-Driving Cars

(May 1) SCMP.com

China’s E-Commerce Giants Are Reaching for the Wallets of Overseas Chinese

(May 2) SCMP.com

China’s E-Commerce Giants Are Reaching for the Wallets of Overseas Chinese

(May 2) SCMP.com

Baidu Brings Group of PE Firms into Its Financial Services Business via $1.9 Billion Investment

(April 30) TechCrunch.com

Baidu Brings Group of PE Firms into Its Financial Services Business via $1.9 Billion Investment

(April 30) TechCrunch.com

Tencent Reportedly Plans to Invest About $470 Million in Bluehole

(May 1) EsportsObserver.com

Tencent Reportedly Plans to Invest About $470 Million in Bluehole

(May 1) EsportsObserver.com

São Paulo Subway Introduces Interactive Doors

(April 30) ZDNet.com

São Paulo Subway Introduces Interactive Doors

(April 30) ZDNet.com

Brazilian Central Bank Regulates Credit Fintechs

(April 27) ZDNet.com

Brazilian Central Bank Regulates Credit Fintechs

(April 27) ZDNet.com

Totvs Still Leads Brazilian ERP Market

(April 24) ZDNet.com

Totvs Still Leads Brazilian ERP Market

(April 24) ZDNet.com

Walmart de Mexico Profit Up 18%

(April 26) MarketWatch.com

Walmart de Mexico Profit Up 18%

(April 26) MarketWatch.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/National Association of Realtors/Institute for Supply Management (ISM)/GfK NOP (UK)/Nationwide Building Society/UK Office for National Statistics/Eurostat/Bank of Korea/Statistics Korea/Singapore Economic Development Board/Japan Ministry of Economy, Trade and Industry/China Federation of Logistics and Purchasing/Taiwan Directorate-General of Personnel Administration/Markit/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Economic Analysis/National Association of Realtors/Institute for Supply Management (ISM)/GfK NOP (UK)/Nationwide Building Society/UK Office for National Statistics/Eurostat/Bank of Korea/Statistics Korea/Singapore Economic Development Board/Japan Ministry of Economy, Trade and Industry/China Federation of Logistics and Purchasing/Taiwan Directorate-General of Personnel Administration/Markit/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research