FROM THE DESK OF DEBORAH WEINSWIG

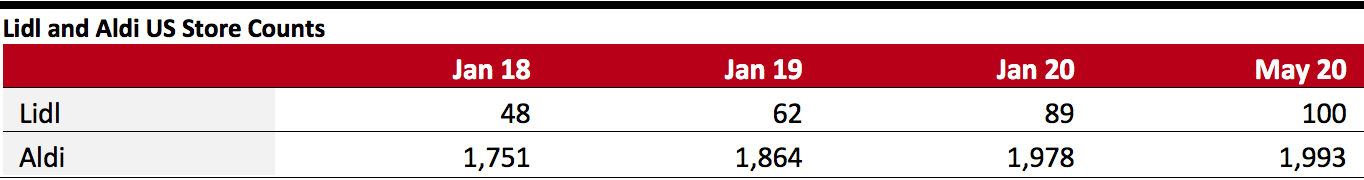

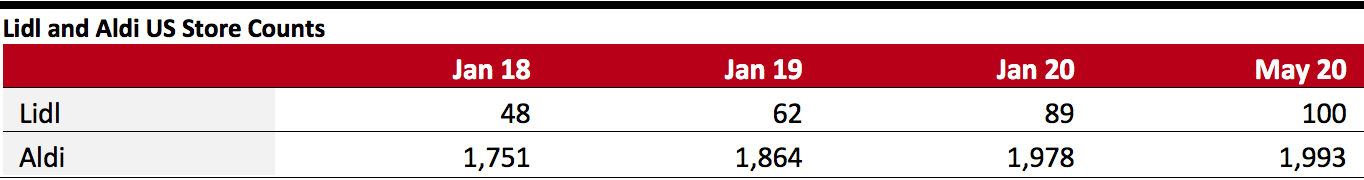

Lidl US Reaches 100 Stores as Aldi US Closes In on 2,000-Store Milestone

Two years behind schedule, Lidl US has reached its 100-store milestone. Back in 2017, as Lidl entered the US market, the

Washington Post reported that the privately owned company was aiming to have 100 US stores by mid-2018, but a series of seeming missteps and recalibrations saw store openings slow to a trickle. After a spell of slow progress, we have seen Lidl increase its store fleet partly by converting some Best Market stores to the Lidl banner: Lidl acquired Best Market and its 27 stores in New York and New Jersey in November 2018.

Aldi US, meanwhile, is closing in on the 2,000-store mark. In June 2017,

Aldi US announced a $3.4 billion plan to open 900 stores, taking its store count from 1,600 at that time to 2,500 by 2022.

[caption id="attachment_110408" align="aligncenter" width="700"]

Source: Company websites

Source: Company websites[/caption]

The economic shock of the coronavirus crisis is likely to fuel some

trading down in grocery, including between retailers—and we see this supporting growth at hard discounters Aldi and Lidl as well as differentiated value retailers such as Grocery Outlet. Fueled by stockpiling and panic buying, on top of solid underlying demand, Grocery Outlet reported comparable sales growth of 17.4% in the quarter ended March 28, 2020, versus 5.1% comp growth in the prior quarter.

So, how do these three discount grocery retailers measure up in market-share terms?

Being privately owned, Aldi and Lidl do not publish financials. However, based on our sales-per-store estimates, we estimate that Lidl had just a 0.1% share of US supermarket sales in 2019, while Aldi had a sector share of 3% and Grocery Outlet just 0.4% in the same year. These figures suggest a potentially long runway for growth, especially at Lidl and Grocery Outlet. The data also reflect the fragmented nature of the US grocery landscape, where single-digit market shares are the norm even for large players.

One possible headwind to discount formats is rapidly increasing demand for e-commerce. Value retailers typically struggle to square fewer frills with the costs of offering online grocery services. In the US, Aldi offers delivery and pickup services through a partnership with Instacart; such a third-party manual-picking service offers Aldi an asset-light way of offering online grocery services. However, Coresight Research data suggest Aldi is underindexing rivals in terms of online grocery penetration rates: Our

annual online grocery consumer survey found that Aldi has disproportionately few online grocery shoppers compared to in-store shoppers.

However, evidence from other countries suggests that discount formats and online grocery can grow in tandem. For high-quality discount formats, we see opportunities for market consolidation and the raising of standards in the discount segment—as well as potential trading down by consumers, as tailwinds counterbalance more limited e-commerce offerings in the medium term.

US RETAIL AND TECH HEADLINES

Rag & Bone Boosts Online Sales with New Technology Investment

(May 27) FashionNetwork.com

- Luxury fashion brand Rag & Bone has partnered with behavioral marketing platform BounceX to advance its direct-to-consumer approach with a new technology investment. Under the partnership, the technology by BounceX will help Rag & Bone increase onsite identification to improve targeting and drive revenues with remarketing strategies.

- BounceX sends personalized triggered emails to enhance the customer experience and boost conversion. Rag & Bone reported that the new technology has identified over 40% of its site traffic; the abandonment-email approach identified only 8%.

REI Teams Up with West Elm

(May 26) ChainStoreAge.com

- Sporting goods retailer REI has collaborated with home-furnishing retailer West Elm to launch a co-curated lifestyle products collection, “REI x West Elm.” The collection features 35 products priced between $6 and $199 and is available online on both REI’s and West Elm’s sites.

- The introductory assortment includes folding outdoor chairs, a portable shade shelter, bright reusable tableware, a collapsible campfire table, a double-sided outdoor blanket, outdoor pillows and more. The two companies have also coproduced an exclusive Camp Monsters podcast episode which will be available on REI’s “Camp Monsters” podcast series.

JCPenney Launches Linden Street Brand

(May 26) Company press release

- Department-store chain JCPenney has launched its new, private home brand, Linden Street, which is available at the company’s flagship store and jcp.com. The brand offers quilts and comforters priced between $90 and $220 and sheet sets starting at $40.

- Products in the new bedding collection are made of 100% cotton, and most are free from over 300 harmful substances. They are packed with biodegradable labels and recycled polyester.

Macy’s Announces $1.1 Billion Bond Offering

(May 26) Company press release

- Department-store chain Macy’s has launched a funding round offering $1.1 billion in secured notes, due in 2025. The retailer intends to use the notes, along with cash on hand, to repay the borrowings under its current $1.5 billion revolving credit facility.

- The debt will be backed by a first mortgage on the company’s stores in Downtown Brooklyn, Union Square in San Francisco and State Street in Chicago, in addition to 35 mall-based stores and 10 distribution centers. Macy’s said that with the offering, it expects to have sufficient liquidity to fund its operations and pay off maturing debt in fiscal years 2020 and 2021.

Ahold Delhaize USA Appoints Ira Kress as President, Giant Food

(May 26) Company press release

- Ahold Delhaize USA has appointed Ira Kress as President of its supermarket chain Giant Food, effective immediately. He has been serving as Interim President of Giant Food since last summer.

- Kress joined Giant Food in store operations management in 1984; he has over 36 years of retail experience. In addition, Kress held a leadership role in human resources at Ahold Delhaize USA and serves as a board member of the Ahold Delhaize USA Family Foundation.

EUROPE RETAIL AND TECH HEADLINES

UK To Reopen Nonessential Retail from June 15

(May 25) Gov.uk

- UK Prime Minister Boris Johnson has announced that nonessential retailers can reopen their stores from June 15. The government is giving retailers three weeks to prepare, as store reopenings are subject to satisfying five tests as well as complying with Covid-19 guidelines.

- The UK government has updated its guidelines and is working with local authorities to regularly perform spot checks. Johnson stated that reopening nonessential retail is the next step toward restoring and relaunching the UK’s economy.

Mallzee Launches ‘Lost Stock’ Mystery Clothing Box

(May 26) RetailGazette.co.uk

- Personal shopping app Mallzee has teamed up with Sajida Foundation to launch a mystery clothing box service called Lost Stock, to help unemployed Bangladeshi factory workers. The Lost Stock boxes are priced at £35 ($43) and include new clothing from retailers including Gap, New Look and Topshop, worth over £70 ($86).

- Customers can report their gender, size and tastes when making a purchase, in order to tailor the box to their style. The box is delivered within six weeks. The profits from each order will go towards feeding Bangladeshi garment workers and their families affected by the cancellation of orders due to the coronavirus crisis.

Lidl To Trial Click-and-Collect Service in Poland

(May 26) ChargedRetail.co.uk

- German discount retailer Lidl and its sister company Kaufland are testing a new click-and-collect service in select stores across Poland. As a part of the trial, customers will be able to purchase products online and pay for them when they collect their order.

- Lidl has also started implementing its own Lidl Pay payment system at several Polish stores. Both these moves form part of the company's effort to improve its online retail footprint.

Aldi UK To Launch Automated Traffic Light System at Store Entrances

(May 26) Company press release

- Supermarket chain Aldi has begun implementing a new automated “traffic light system” at its UK stores to cap the number of shoppers permitted in store at any given time. The lights at the entrance will indicate when shoppers can enter stores based on individual store customer limitations that are in line with two-meter social distancing rules.

- Following a successful trial, Aldi will launch the system across all of its UK stores, starting this week. The retailer also reported that it will give priority to NHS and other frontline workers by allowing them to come to the front of the queue.

Albert Heijn To Launch Digital-Savings Feature

(May 25) Company press release

- Dutch supermarket chain Albert Heijn plans to launch a new digital-savings feature in its AH app from June. The new feature will allow customers with bonus cards to earn €0.10 ($0.11) in stamps for every €1 ($1.10) spent at Albert Heijn, in store or online.

- The new feature will replace the paper stamps and savings books that customers have been using to redeem their credit. Each customer will also receive 6% interest on the accumulated savings.

ASIA RETAIL AND TECH HEADLINES

Snapdeal Partners with Dailyhunt

(May 26) EconomicTimes.com

- Indian e-commerce platform Snapdeal has partnered with news app Dailyhunt to add a news vertical on its platform. This partnership will enable Snapdeal to provide a news feed related to sports, politics, business, art, technology and cinema.

- Through this partnership, Snapdeal aims to personalize the experience of every user by providing them content in their local language. The news content will be available in 14 different languages including Hindi, Kannada, Marathi and Tamil.

Tencent To Invest in Technology Infrastructure

(May 26) ChannelNewsAsia.com

- Chinese tech company Tencent to invest ¥500 billion ($70 billion) in technology infrastructure, including artificial intelligence, cloud computing and cyber security, over the next five years. This move is due to increasing demand for cloud services and business software.

- Tencent will also use the funds to invest in other segments, including blockchain, servers, big data centers, 5G networks and the Internet of Things. The company said that cloud businesses have suffered due to the coronavirus pandemic, but it expects to see adoption of cloud services among offline industries and public sectors in the long term.

IKEA India Resumes Online Operations and Launches Click-and-Collect Service

(May 25) CNBCTV18.com

- The Indian arm of IKEA has resumed its online operations and launched a click-and-collect contactless shopping service in the city of Hyderabad, effective May 25. The chain intends to resume its online operations in Mumbai and Pune as well.

- Online shoppers choosing collection can pick up their orders from the Click & Collect station in the store’s car park.

Safilo Partners with Ports

(May 25) Company press release

- Italian eyewear company Safilo has announced a 10-year license agreement with luxury fashion brand Ports to design, manufacture and distribute Ports sunglasses and optical frames. Under this partnership, Safilo will expand its distribution in the Mainland China market, and the first eyewear collection will launch in January 2021.

- According to Safilo, this partnership will enable the company to further expand its presence in Mainland China. Ports currently operates six stores in China, France and Italy.

JioMart Expands Services to 200 Indian Cities

(May 25) TimesOfIndia.com

- On May 23 and May 24, Indian online grocery platform JioMart launched in over 200 cities in India. The platform was previously piloted in select neighborhood areas of Mumbai and is currently available in metro cities, including Bengaluru and Kolkata, as well as tier-2 towns in Rajasthan and Odisha.

- The JioMart platform does not have an app yet, but customers can order products on its website at a discount of 5% on the maximum retail price. The JioMart platform currently offers essential items in grocery, such as fruit and vegetables.

Source: Company websites[/caption]

The economic shock of the coronavirus crisis is likely to fuel some trading down in grocery, including between retailers—and we see this supporting growth at hard discounters Aldi and Lidl as well as differentiated value retailers such as Grocery Outlet. Fueled by stockpiling and panic buying, on top of solid underlying demand, Grocery Outlet reported comparable sales growth of 17.4% in the quarter ended March 28, 2020, versus 5.1% comp growth in the prior quarter.

So, how do these three discount grocery retailers measure up in market-share terms?

Being privately owned, Aldi and Lidl do not publish financials. However, based on our sales-per-store estimates, we estimate that Lidl had just a 0.1% share of US supermarket sales in 2019, while Aldi had a sector share of 3% and Grocery Outlet just 0.4% in the same year. These figures suggest a potentially long runway for growth, especially at Lidl and Grocery Outlet. The data also reflect the fragmented nature of the US grocery landscape, where single-digit market shares are the norm even for large players.

One possible headwind to discount formats is rapidly increasing demand for e-commerce. Value retailers typically struggle to square fewer frills with the costs of offering online grocery services. In the US, Aldi offers delivery and pickup services through a partnership with Instacart; such a third-party manual-picking service offers Aldi an asset-light way of offering online grocery services. However, Coresight Research data suggest Aldi is underindexing rivals in terms of online grocery penetration rates: Our annual online grocery consumer survey found that Aldi has disproportionately few online grocery shoppers compared to in-store shoppers.

However, evidence from other countries suggests that discount formats and online grocery can grow in tandem. For high-quality discount formats, we see opportunities for market consolidation and the raising of standards in the discount segment—as well as potential trading down by consumers, as tailwinds counterbalance more limited e-commerce offerings in the medium term.

Source: Company websites[/caption]

The economic shock of the coronavirus crisis is likely to fuel some trading down in grocery, including between retailers—and we see this supporting growth at hard discounters Aldi and Lidl as well as differentiated value retailers such as Grocery Outlet. Fueled by stockpiling and panic buying, on top of solid underlying demand, Grocery Outlet reported comparable sales growth of 17.4% in the quarter ended March 28, 2020, versus 5.1% comp growth in the prior quarter.

So, how do these three discount grocery retailers measure up in market-share terms?

Being privately owned, Aldi and Lidl do not publish financials. However, based on our sales-per-store estimates, we estimate that Lidl had just a 0.1% share of US supermarket sales in 2019, while Aldi had a sector share of 3% and Grocery Outlet just 0.4% in the same year. These figures suggest a potentially long runway for growth, especially at Lidl and Grocery Outlet. The data also reflect the fragmented nature of the US grocery landscape, where single-digit market shares are the norm even for large players.

One possible headwind to discount formats is rapidly increasing demand for e-commerce. Value retailers typically struggle to square fewer frills with the costs of offering online grocery services. In the US, Aldi offers delivery and pickup services through a partnership with Instacart; such a third-party manual-picking service offers Aldi an asset-light way of offering online grocery services. However, Coresight Research data suggest Aldi is underindexing rivals in terms of online grocery penetration rates: Our annual online grocery consumer survey found that Aldi has disproportionately few online grocery shoppers compared to in-store shoppers.

However, evidence from other countries suggests that discount formats and online grocery can grow in tandem. For high-quality discount formats, we see opportunities for market consolidation and the raising of standards in the discount segment—as well as potential trading down by consumers, as tailwinds counterbalance more limited e-commerce offerings in the medium term.