albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

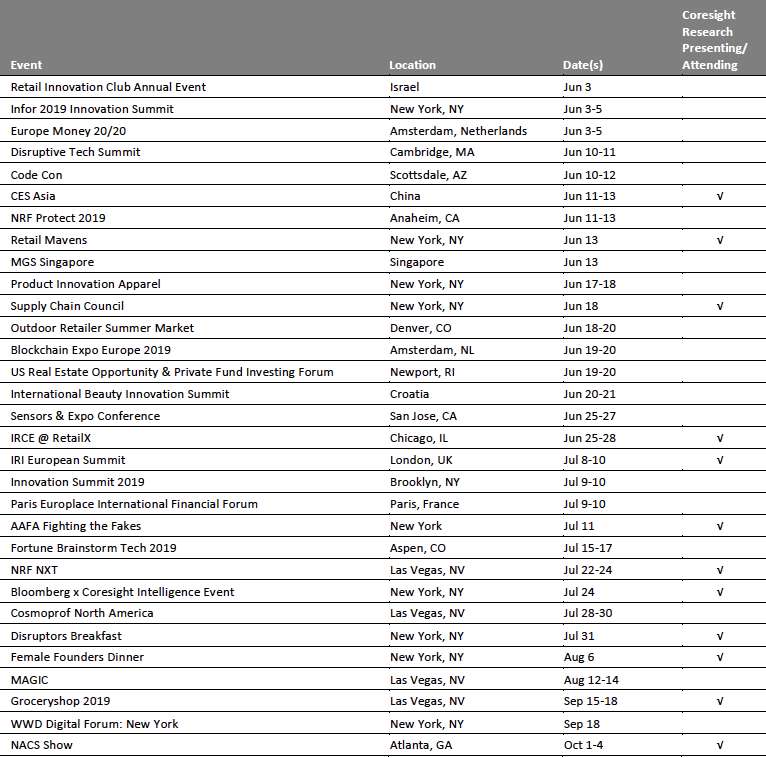

As Lidl Prepares to Open a Raft of New US Stores, We Explain Why Bigger Is Not Always Better for European Discount Retailers Lidl is set to jump-start its US store-opening plans with 25 new stores by spring 2020. This would take the still-nascent chain close to 100 US stores — well behind its initial plans for 100 stores by summer 2018, a target that Lidl now expects to hit by the end of 2020. It is small fry compared to the 1,894 total that rival Aldi currently operates in the US market. The new stores include some conversions from the Best Market format, following Lidl’s acquisition of the 27-store chain in late 2018 (Best Market has stores in New Jersey and New York). Lidl’s new store openings will be on the east coast including Maryland, New Jersey, New York, North Carolina, Pennsylvania, South Carolina and Virginia. Lidl has been opening between five and nine stores every six months. [caption id="attachment_89602" align="aligncenter" width="700"] Source: Company website[/caption]

Lidl will also close two stores, reflecting a shift in its real estate strategy: Lidl noted the closures were “part of [a] move to operate in the most convenient locations,” suggesting it is focusing on proximity to shoppers rather than establishing destination stores. As we have previously discussed, the company has moved away from the larger store formats it initially launched in the US market, and now advertises for multiple types of stores, suggesting a new flexibility in its approach to real estate, including shopping-center stores and metropolitan stores for high-density areas. While Lidl appears to be opting for multiple store formats, a smaller footprint seems to be a common thread, representing a reversion to a more traditional discount size format.

Lidl is not the only European discounter that has reassessed its US real estate strategy. In apparel, Primark has trodden a similar path of opening large-format stores before downsizing to slightly more compact formats. Primark has reduced store sizes at Freehold (New Jersey), Danbury (Connecticut) and the King of Prussia Mall (Pennsylvania). In February, the company noted that the downsizings had contributed to a much-reduced US operating loss. Primark opened its Brooklyn store in July 2018 and recently reported “excellent trading,” and that it saw positive comparable sales growth in the US in the first half of its 2019 fiscal year.

Lidl and Primark were aiming to build brands and attract shoppers in the US market with large, glossy stores. While we expect Primark to continue to offer substantial, high-quality stores in the US as it does in Europe, both retailers appear to have learned that extra space does not in itself make stores a destination for shoppers.

Source: Company website[/caption]

Lidl will also close two stores, reflecting a shift in its real estate strategy: Lidl noted the closures were “part of [a] move to operate in the most convenient locations,” suggesting it is focusing on proximity to shoppers rather than establishing destination stores. As we have previously discussed, the company has moved away from the larger store formats it initially launched in the US market, and now advertises for multiple types of stores, suggesting a new flexibility in its approach to real estate, including shopping-center stores and metropolitan stores for high-density areas. While Lidl appears to be opting for multiple store formats, a smaller footprint seems to be a common thread, representing a reversion to a more traditional discount size format.

Lidl is not the only European discounter that has reassessed its US real estate strategy. In apparel, Primark has trodden a similar path of opening large-format stores before downsizing to slightly more compact formats. Primark has reduced store sizes at Freehold (New Jersey), Danbury (Connecticut) and the King of Prussia Mall (Pennsylvania). In February, the company noted that the downsizings had contributed to a much-reduced US operating loss. Primark opened its Brooklyn store in July 2018 and recently reported “excellent trading,” and that it saw positive comparable sales growth in the US in the first half of its 2019 fiscal year.

Lidl and Primark were aiming to build brands and attract shoppers in the US market with large, glossy stores. While we expect Primark to continue to offer substantial, high-quality stores in the US as it does in Europe, both retailers appear to have learned that extra space does not in itself make stores a destination for shoppers.

US RETAIL & TECH HEADLINES

- US retail sales unexpectedly fell in April as households cut back on purchases of motor vehicles and a range of other goods, pointing to a slowdown in economic growth after a temporary boost in the first quarter.

- The Commerce Department said retail sales slipped 0.2% month over month in April after surging 1.7% month over month in March, the largest increase since September 2017. Retail sales in April increased 3.1% from a year ago.

Adobe Adds Amazon Selling and Other New Features to its Magento E-commerce Platform

(May 14) Digital Commerce 360

Adobe Adds Amazon Selling and Other New Features to its Magento E-commerce Platform

(May 14) Digital Commerce 360

- Adobe Systems announced several updates to its Magento e-commerce platform at its Imagine user development conference. Adobe is adding Amazon.com integrations and Google Shopping ad tools.

- The new Magento Amazon Sales Channel enables Magento merchants to more easily sell on Amazon by integrating product catalogs with the marketplace and enabling merchants to manage Amazon listings.

- The biggest retailer in the world will now offer next-day delivery for online orders, following Amazon, which on April 25 announced plans for one-day delivery for all Amazon Prime members.

- Walmart it is rolling out next-day delivery in Phoenix, Las Vegas and California over the next few days and plans to reach roughly 75% of US consumers by the end of 2019, including 40 of the top 50 major metros.

The TJMaxx of Supermarkets Is Going Public

(May 14) CNN Business

The TJMaxx of Supermarkets Is Going Public

(May 14) CNN Business

- Grocery Outlet believes it’s the perfect time to go public. The 73-year-old discount supermarket has grown to more than 300 stores in the US, most on the west coast. It hopes to raise $100 million.

- Grocery Outlet is profitable: It reached $2.3 billion in revenue a year ago. Its success is yet another sign of strength in discount sectors of the grocery and retail industries.

- Walmart indicated that shoppers will absorb some of the costs from President Donald Trump’s tariffs on Chinese imports.

- Walmart’s response to potential higher levies will likely set the tone for other discount retailers. In its favor, Walmart’s clout with suppliers gives it more room to maneuver.

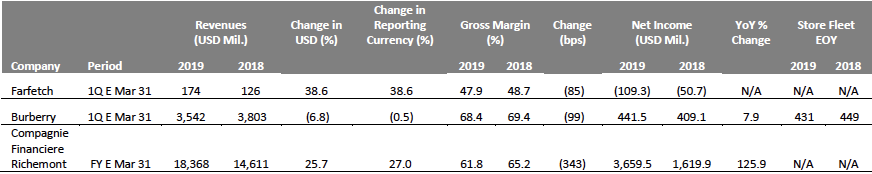

EUROPE RETAIL EARNINGS

[caption id="attachment_89607" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

- Walgreens Boots Alliance (WBA), the US owner of UK health and beauty chain Boots, is reportedly mulling the closure of over 200 stores in the next two years. WBA said in April that it is reviewing its UK store estate but did not specify the number of stores it plans to close.

- Sources within the company told Sky News that the company had not yet decided, but that “a significant number” are expected to close. If the company decides to shut the 200-plus stores, it would comprise a little under 10% of the group’s UK stores.

Signa Sells Kika Eastern Europe to XXXLutz

(May 24) Company press release

Signa Sells Kika Eastern Europe to XXXLutz

(May 24) Company press release

- On May 24, Austrian real estate firm Signa Holding announced it would sell the Eastern European stores in its furniture chain Kika to Austrian online furniture retailer XXXLutz for an undisclosed sum.

- The deal involves 22 properties and the retail business with 1,500 staff in Hungary, Czech Republic, Slovakia and Romania. The proceeds from the transaction will be invested into the company’s modernization program in Austria.

- On May 23, Italian retail and supply chain group Shernon Holding was declared bankrupt by a Milan bankruptcy court. The group managed 55 stores of the Italian hypermarket chain Mercatone Uno. Last month, the court rejected an application by Shernon Holding to make a deal with creditors that would keep the company’s jobs intact until May.

- The court found the firm had accumulated debts of €90 million ($101 million) in just nine months, with operating losses of €5-6 million ($5.6-6.7 million) per month, and had neither bank credit nor assurances from suppliers.

- British retailer Marks & Spencer has confirmed a dividend cut and a £601.3 million ($763 million) 1-for-5 fully underwritten rights issue priced at 185p ($2.35) a share to fund a joint venture with online grocer Ocado.

- M&S will pay Ocado £750 million ($951 million) for a 50% stake in the joint venture. This includes an initial payment of £562.5 million ($713 million) on closing and conditional payment of £187.5 million ($238 million).

- Nearly eight prospective buyers are getting ready for second-round bids to acquire a majority stake in the Chinese operations of German wholesaler Metro AG, according to sources that spoke to Reuters. Metro’s China unit is valued at between €1.3 billion ($1.5 billion) and €1.8 billion ($2 billion).

- The sources said Metro has requested shortlisted bidders, including social media giant Tencent Holdings and retailer Suning, to submit final offers by June 10 and that the process could conclude in September.

Miss Selfridge London Flagship to Close

(May 28) FashionNetwork.com

Miss Selfridge London Flagship to Close

(May 28) FashionNetwork.com

- London-based fashion company Arcadia Group plans to shut its Miss Selfridge flagship store on London’s Oxford Street in July amid restructuring. Arcadia has announced plans to close 25 additional stores under separate insolvency proceedings on top of its list of 23 stores previously earmarked for closure under a Company Voluntary Arrangement (CVA).

- Miss Selfridge, which currently employs 50 staff, will move into a basement concession of the neighboring Topshop store. The current premises of the flagship store will be leased to another retailer.

ASIA RETAIL AND TECH HEADLINES

H&M to Partner with Indian E-Commerce Companies Jabong and Myntra

(May 27) retailnews.asia

H&M to Partner with Indian E-Commerce Companies Jabong and Myntra

(May 27) retailnews.asia

- Swedish fashion retailer H&M will begin online sales in India in partnership with Indian e-commerce companies Jabong and Myntra in the next three to four months.

- The deal has a term of six years. India is the second region after China in which H&M sells its products on external platforms.

- Alibaba-owned shopping website Taobao has opened a physical multi-label store called Taostyle to sell clothing from brands that sell on its online site. The pilot store at Hangzhou’s Kerry Center mall currently offers about 350 products from over 20 brands and the collections are displayed on a rotational basis.

- The store combines the offline and online shopping experience by providing a QR code on each garment, which, when scanned by customers, links to product details on the Taobao site.

- Chinese e-commerce company Meituan has launched a global delivery platform, called Meituan Delivery.

- Meituan Delivery will give its partners access to its delivery network to help them cut logistics costs and improve operating efficiency.

- Philippines-based multi-format retailer Robinsons Retail will open 150 new stores in the Philippines this year. Robinsons plans to invest 3-5 billion pesos ($57.8-96.3 million) to open the new stores.

- As of December 2018, Robinsons Retail had 1,910 stores which include supermarkets, do-it-yourself stores, department stores, specialty stores, drugstores and convenience stores, covering a total gross floor area of 15.94 million square feet.

Alibaba Reportedly Plans $20 Billion Hong Kong Listing

(May 28) Bloomberg.com

Alibaba Reportedly Plans $20 Billion Hong Kong Listing

(May 28) Bloomberg.com

- Alibaba Group is reportedly considering a $20 billion listing on the Stock Exchange of Hong Kong, and will file a listing application in the second half of 2019, according to sources that spoke to Bloomberg. This would be the company’s second listing, it is already listed on the New York Stock Exchange.

- This deal could diversify Alibaba’s funding channels and help improve liquidity.

Kidsland Opens FAO Schwarz Beijing Store

(May 28) insideretail.asia

Kidsland Opens FAO Schwarz Beijing Store

(May 28) insideretail.asia

- Chinese toy retailer Kidsland has opened US toy retailer FAO Schwarz’s first Asian store in Beijing.

- The store is inside the Kidsland flagship store at the China World mall. FAO Schwarz plans to open one large and several medium-sized stores in China in the next two years. Kidsland will also launch an experiential store in China in the coming one to two years.

LATIN AMERICA RETAIL AND TECH HEADLINES

Natura to Acquire Avon

(May 24) america-retail.com

Natura to Acquire Avon

(May 24) america-retail.com

- Brazilian cosmetics brand Natura has agreed to acquire US beauty brand Avon. Natura and Avon will be combined and its shares will be owned by a new company.

- Natura’s shareholders will hold 76% of the new company and Avon’s shareholders 24%. The new company will become the fourth largest beauty group in the world.

Brazil’s Magazine Luiza Raises Offer to Buy Netshoes

(May 27) fashionnetwork.com

Brazil’s Magazine Luiza Raises Offer to Buy Netshoes

(May 27) fashionnetwork.com

- Brazilian e-commerce sports company Netshoes announced on May 26 that Brazilian retailer Magazine Luiza has increased its offer to buy the online shoe retailer to $3 per share from $2 per share. The new offer values Netshoes at $93.18 million.

- Netshoes announced that its board has approved the offer and recommended its shareholders accept it.

- Spanish fashion retailer Zara has remodeled its store in the Jockey Plaza shopping center in Lima, making it the largest Zara store in Peru.

- The store was remodeled to increase the store space by 10,764 square feet, bringing the total to 32,292 square feet.

- Cencosud Shopping, the mall-operator subsidiary of Chilean retail group Cencosud, posted a profit of $147.2 million in the first quarter of 2019, compared to the $11.4 million profit recorded in the first quarter of 2018.

- Turnover increased to $85.87 million from the $14.8 million recorded in the year-ago quarter. Cencosud Shopping consolidated 32 assets from across the group’s businesses under its umbrella last November, prompting the jump in profits and turnover in the first quarter.

- Walmart Argentina has expanded its Great Value offer by creating a basket with everyday essentials such as oil, flour, jam, tomato puree, noodles, rice, sweet cookies, salty cookies, tea bags and canned food.

- With this offer, which lasts through June, Walmart Argentina wants to strengthen its own brand assortment.

MACRO UPDATE

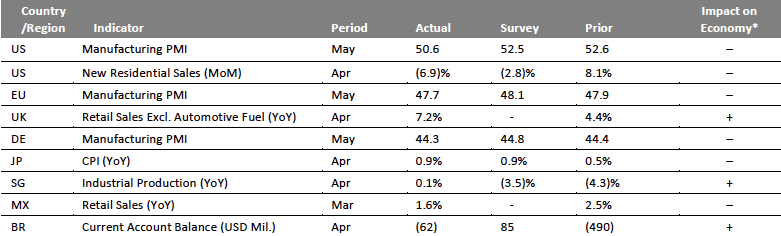

Key points from global macro indicators released May 22–28, 2019:- US: The IHS Markit manufacturing purchasing managers index (PMI) decreased to 50.6 in May from 52.6 in April, below the consensus estimate of 52.5. New residential property sales in the US dropped 6.9% month over month in April versus the consensus estimate of a 2.8% decline and a revised 8.1% gain reported in March.

- Europe: The Eurozone manufacturing PMI dropped from 47.9 in April to 47.7 in May, below the consensus estimate of 48.1. In the UK, seasonally unadjusted retail sales advanced 7.2% year over year in April from the 4.4% growth recorded in March. The UK grocery, clothing and department store/mixed-goods sectors witnessed an uptick in sales owing to the late Easter timing and warm April weather.

- Asia Pacific: In Japan, the consumer price index (CPI) rose 0.9% year over year in April, in line with the consensus estimate but higher than the 0.5% rise recorded in March. Singapore’s industrial production grew 0.1% year over year in April versus the consensus estimate of a 3.5% decline, recovering from the revised 4.3% contraction in March.

- Latin America: Mexico’s retail sales increased 1.6% year over year in March, slipping from revised 2.5% growth recorded in February. Brazil posted a current account deficit of $62 million in April versus the consensus estimate of an $85 million surplus, though narrower than the $490 million deficit recorded in March.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Census Bureau and Department of Housing and Urban Development/IHS Markit/Office for National Statistics/Statistics Bureau, Japan/Department of Statistics Singapore/INEGI, Mexico/CEIC/Coresight Research[/caption]

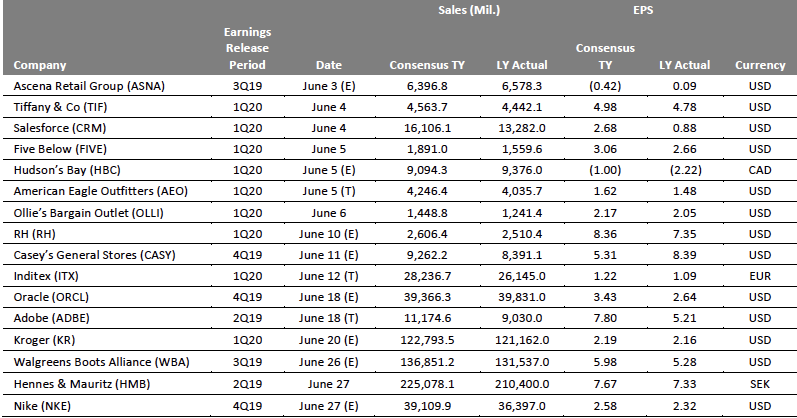

EARNINGS CALENDAR

[caption id="attachment_89625" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR