Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

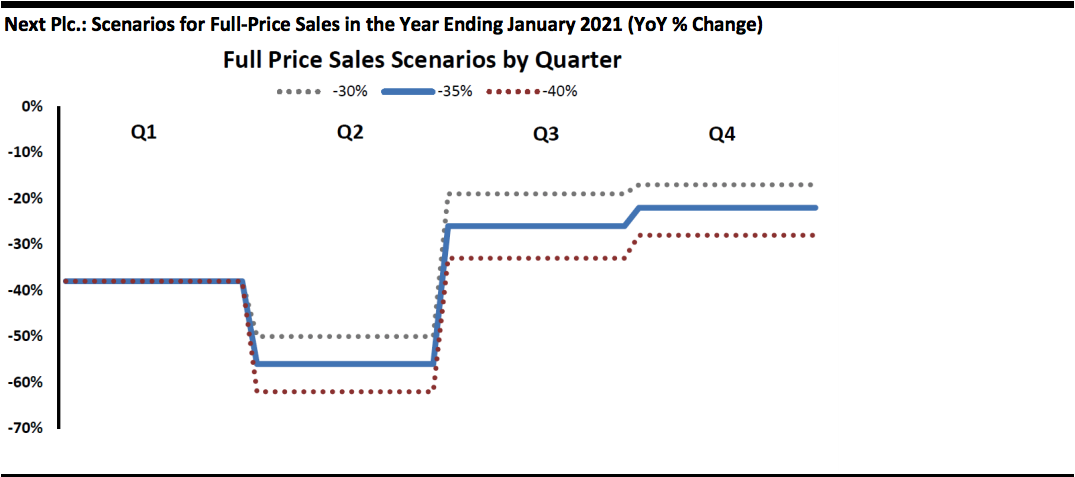

What Could the Shape of a Retail Recovery Look Like? The timing, shape and strength of a post-coronavirus retail recovery remain highly uncertain. At Coresight Research, we have been laying out our expectations and adjusting these as the context shifts, consumer behavior changes and new data points become available. In the UK, leading apparel retailer Next published a trading update this week—and with it, a typically detailed discussion of recent trends and the company’s outlook. Below, we show how Next has modeled the possible recovery in its retail sales for the remainder of the current fiscal year. Depressingly, even by the fourth quarter—the holiday peak—the company models its sales to be down by between 17% and 28% year over year. Countries and sectors will recover at their own pace—but we see Next’s recovery model as a scenario with potential applicability for discretionary retail sales more generally, and possibly of relevance to the US as well as the UK. [caption id="attachment_108783" align="aligncenter" width="700"] The three lines represent upper, middle and lower scenarios, with the numerical legend labels referring to the estimated percentage change in sales for the full year

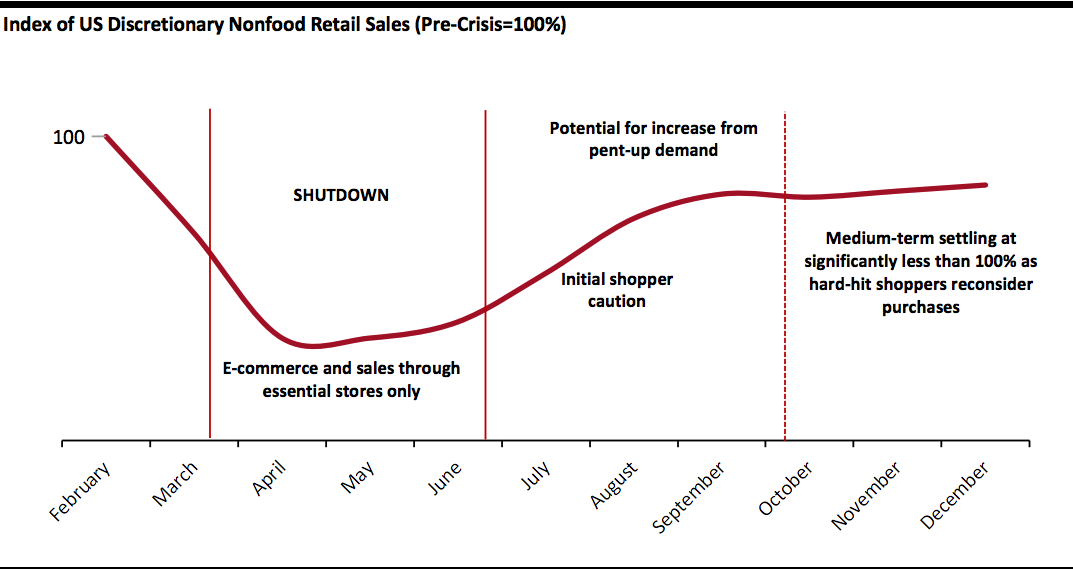

The three lines represent upper, middle and lower scenarios, with the numerical legend labels referring to the estimated percentage change in sales for the full yearSource: Company reports[/caption] Coresight Research’s recovery model for discretionary nonfood retail sales in the US market characterizes the downturn and recovery for discretionary retail into several stages, including shopper caution, the potential for the release of pent-up demand and retail sales subsequently settling significantly below pre-crisis levels through the end of 2020. We expect US discretionary nonfood retail sales to decline by 60+% during the shutdown phase (with remaining sales channeled primarily through e-commerce and stores deemed essential), driving a decline in total retail sales of between one-third and 40%. We further estimate that discretionary nonfood sales could be down by between 5% and 20% year over year during the recovery phase, impacted by weak store traffic and depressed disposable incomes. [caption id="attachment_108784" align="aligncenter" width="700"]

Source: Coresight Research

Source: Coresight Research[/caption] Underscoring the possible slowness of retail recovery in the US are data points from our April 22 survey of US consumers: Almost 54% of all respondents anticipate spending less on holiday this year than last, due to the economic impact of the outbreak; and 28% expect to spend a lot less on holiday 2020 than holiday 2019. Read more: Coronavirus Insights: US Survey Update—Shoppers’ Post-Lockdown Expectations Sound Alarm Bells for Retail US Holiday 2020 Retail First Look: Coronavirus Crisis Likely To Meaningfully Hit Demand Coronavirus Insights: What Will a Retail Recovery Look Like?

US RETAIL AND TECH HEADLINES

Alphabet Profit Up Despite Slowdown in Ad Sales (April 28) Company press release- Google’s parent company Alphabet reported a 3% year-over-year rise in profit to $6.8 billion in the first quarter of the year, ended March 31. Revenues increased 13% to $41.2 billion, versus the 17% growth recorded in the first quarter of 2019 and slightly above the consensus estimate of $40.9 billion.

- The company’s core advertising business grew 10.4% to $33.8 billion, versus 16% growth from the previous quarter. Google saw a decline in ad revenues from the travel, auto and retail sectors in March, which impacted overall ad revenues for the quarter, owing to the coronavirus crisis.

- Electronics retailer Best Buy has announced that it will gradually reopen stores, allowing customers to schedule in-store consultations in about 200 of its US stores. Starting in May, customers can schedule meetings with dedicated sales consultants to discuss their technology needs and potential purchases.

- Best Buy will also resume in-home delivery, installation and repairs, having put new safety precautions in place. As a result of the coronavirus outbreak, the retailer had temporarily shut stores, suspended all in-home services and introduced curbside pickup for online orders last month.

- Retail real-estate company Simon Property Group plans to reopen 49 of its malls and outlet centers across the US between May 1 and May 4, according to an internal memo. Operating hours at the malls and outlet centers will be reduced to 11:00 a.m. to 7:00 p.m. Monday through Saturday, and 12:00 p.m. to 6:00 p.m. on Sundays, to allow for overnight cleaning.

- The company mentioned that it will offer free temperature testing, masks approved by the Centers for Disease Control and Prevention and hand-sanitizing packets to shoppers. Simon Property Group also stated that it is taking several steps to enforce social distancing and regularly sanitize high-touch areas.

- CVS Health has announced plans to expand its Covid-19 testing capabilities. The drugstore retailer will offer self-swab tests to individuals meeting the criteria of Centers for Disease Control and Prevention in parking lots or at drive-thru windows at select CVS Pharmacy locations. The tests can be scheduled online, starting in May.

- At present, CVS Health performs 1,000 tests a day at each of its rapid test sites, located across five US states. It intends to set up nearly 1,000 rapid test sites nationwide by the end of May, with the goal of performing about 1.5 million tests per month.

- Specialty retailer Chico’s plans to reopen its boutiques in North America, starting May 4, 2020. The retailer plans to reopen its business in three phases, beginning with the fulfilment of national orders through retail locations using store inventories.

- The second phase will offer “buy online, pick up in store” (BOPIS) services, including curbside pickup, and the third phase will see the introduction of a new shop-by-appointment service

EUROPE RETAIL AND TECH HEADLINES

John Lewis Partnership Appoints Former Sainsbury’s Executive To Lead Waitrose (April 29) Company press release- The John Lewis Partnership has appointed James Bailey as Executive Director of its supermarket chain Waitrose, effective immediately. Bailey most recently served as Grocery Buying Director at supermarket chain Sainsbury’s.

- The parent company announced that it is seeking an executive director for its department-store chain, John Lewis, and will make an announcement soon. The two new executive directors will be part of the seven-person management team led by the partnership’s Chairman, Sharon White.

- Apparel retailer Next reported that its full-price sales plunged 41%, with retail sales down 52% and online sales down 32% in the quarter ended April 25. Next said that the decline in sales had been faster and steeper in March than the company had anticipated, and it has forecast lower sales during the first and second half of the year.

- Next has reinforced its finances by furloughing employees, selling property, cutting costs and suspending share buybacks and dividends. It has also secured additional borrowing facilities through the government’s Covid Corporate Financing Facility.

- Carrefour reported strong revenue growth with a 7.8% year-over-year rise in comparable sales over the first quarter, ended March 31. First-quarter sales touched €19.45 billion ($21.07 billion), guided by a strong performance in January and February and household stockpiling in March, ahead of coronavirus lockdown initiatives in all countries in which it operates.

- Carrefour reported 45% growth in food e-commerce sales and 30% growth in organic product sales during the period, as consumers were stockpiling dry groceries and products with long shelf lives. Comparable sales in food rose 9.9% while nonfood comparable sales fell 3.5%.

- Marks & Spencer (M&S) has obtained government funding to preserve liquidity during the coronavirus pandemic. The retailer has been identified as an qualified issuer to access funds via the government’s Covid Corporate Financing Facility and has signed an agreement with the lending syndicate of banks on its current £1.1 billion ($1.4 billion) credit line to substantially ease or withdraw the terms of the covenant conditions.

- M&S has said this funding will “underpin the recovery strategy and accelerated transformation” during 2021. The company also stated that it will not pay dividends for the financial year 2020–21, generating a cash saving of £210 million ($262 million).

- German discount retailer Aldi Süd has implemented a digital access control system in its stores in partnership with German tech startup Sensalytics. The system has been installed in approximately half of the retailer’s 1,930 stores in Germany, to monitor the number of customers in store following the coronavirus pandemic.

- The sensor-based device offers a real-time record of the number of customers in store via an app, SMS or call, enabling the retailer to comply with regulatory requirements related to the maximum number of customers in a store at any given time.

- Adidas reported that its operating profits plunged 93% year over year to €65 million ($70.4 million) in the first quarter, ended March 31. Net sales declined 19% year over year to €4.7 billion ($5 billion).

- Adidas’s e-commerce sales were up 35%, with 55% growth recorded in March alone. The company predicted that its sales will fall 40% in the second quarter, ending June 30, as more than 70% of its stores are currently closed worldwide.

- UK-based online marketplace Atterley has launched a crowdfunding campaign to raise £500,000 ($619,688), with plans to further develop its marketplace technology and expand its international presence, including in the UK. The retailer recorded sales growth of 200% year over year amid the coronavirus lockdown.

- Atterley founder Michael Welch said that the coronavirus crisis will change the retail environment, and retailers will have to adapt to rapidly changing consumer buying behavior. The online retailer offers more than 2,000 brands and is used by over 250 independent boutiques globally.

ASIA RETAIL AND TECH HEADLINES

Google Launches Menu-Sharing Feature on Google Pay App in Singapore (April 28) InsideRetail.Asia- Google has introduced a new menu-discovery feature on its Google Pay app in Singapore, to make it convenient for customers to connect with restaurants and order food for delivery, amidst the coronavirus lockdown. The platform includes nearly 150 major food chains and over 100 small food businesses.

- Customers can use the feature to browse menus, purchase food items from the offerings and opt for delivery or self-pickup. The app also has a link which allows users to share food menus with family and friends.

- Indian e-commerce company Flipkart has invested a total of $90 million into its digital payment subsidiary PhonePe and its marketplace business, according to regulatory filings. So far, the group has infused a total of $928 million in PhonePe and $1.88 billion in its marketplace business.

- PhonePe faced challenges last month when India's central bank placed a moratorium on its sole Unified Payments Interface partner Yes Bank. Additionally, the company has also seen its transactions drop 35% as offline stores remain closed during the coronavirus crisis.

- Clothing and accessories retailer Esprit plans to close all of its stores in Asia outside Mainland China, owing to the slump in sales during the nine months ended March 31. The retailer will close 56 company-operated stores located in Hong Kong, Macau, Malaysia, Singapore and Taiwan by the end of June.

- Esprit will continue to trade in these markets by operating wholesale and licensing businesses, mostly through department stores. The company stated that the stores slated for closure represented less than 4% of the group’s turnover during the nine months ended March 31.

- Amazon India has strengthened its partnership with Indian Railways to leverage the Covid-19 Parcel Special Trains network—which is operated by Indian Railways to transport good—amid the coronavirus pandemic. The retailer plans to ramp up its operations to 55 railway routes to ensure faster deliveries. This partnership will enable retailers in Amazon India’s network to ship essential products across the country during the nationwide lockdown.

- Last year, Amazon partnered with Indian Railways across 13 railway routes to transfer goods.

- The Straits Times Press, subsidiary of publisher Singapore Press Holdings (SPH), has entered into an agreement with alcohol distributor Thai-Pore Enterprise to divest its wholly owned convenience-store chain Buzz Shop for an undisclosed sum. Buzz Shop operates and franchises a chain of over 50 convenience stores in Singapore.

- SPH stated that this divestment will help the company to focus on its main business segments of media, retail real estate, purpose-built student accommodation and aged care. As part of the deal, SPH will retain the rights to distribute and sell its publications at all Buzz Shop outlets.