albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

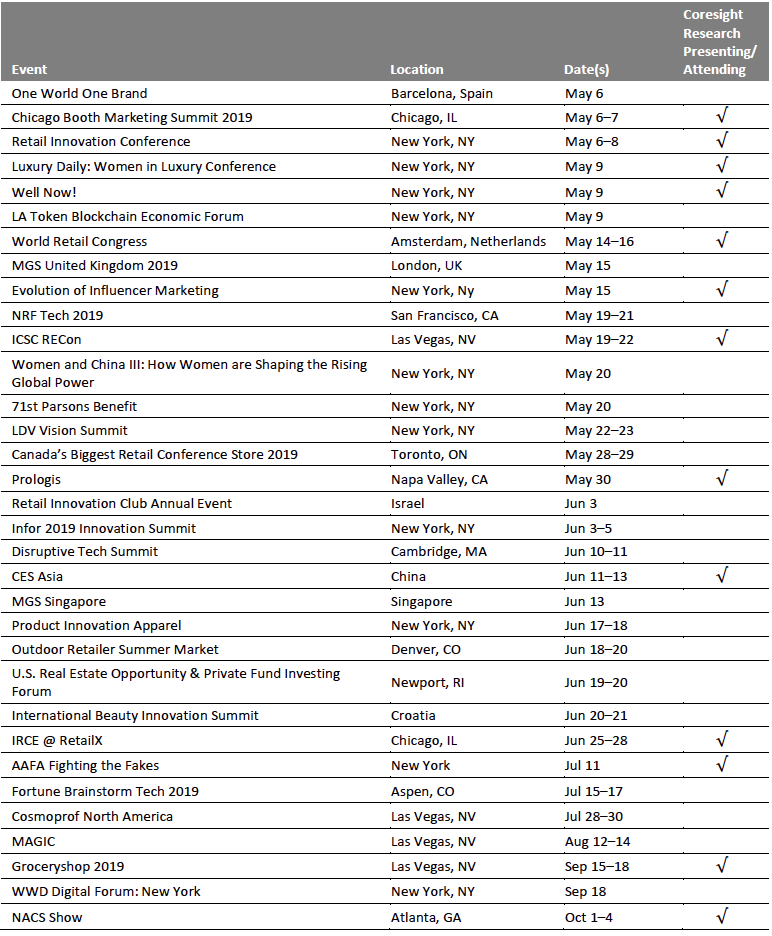

Amazon Sees a Leveling Off in Two Long-Term Drivers of Its Retail Expansion: Did This Spur the Launch of One-Day Prime Delivery? Last week, Amazon reported barnstorming numbers for the first quarter, with earnings per share coming in 51% ahead of analyst expectations. However, selling products to consumers is no longer the driver of Amazon’s expansion. Stripping out currency effects, revenue growth in the quarter was supported by a 42% jump in revenue at cloud business Amazon Web Services and a 42% rise in revenue from subscription services. Online retail revenues were up “only” 12%. Last week also saw Amazon announce that US Prime members will soon benefit from one-day delivery instead of two-day (Prime members in some other countries already enjoy one-day delivery). In this week’s note, we review the apparent maturing of two metrics that have underpinned Amazon’s grab for consumer dollars in recent years: Prime membership rates and third-party unit sales. And, we consider whether Prime’s switch to one-day delivery in the US reflects a search for new support for retail market share gains. Two Key Supports for Amazon’s Retail Growth Look to Have Peaked Almost half of US consumers say they have a Prime membership. But, as shown in the chart below, the proportion of US consumers with Prime membership, as recorded by Prosper Insights & Analytics, has at best leveled off. At worst, membership rates have not only peaked, they now show a greater volatility than in previous years, when the trend was not just upward, but smooth. Meanwhile, on the supply side, the share of unit sales on Amazon accounted for by third-party merchants (worldwide) has plateaued at 52%–53% since the first quarter of 2018. As with Prime membership, this metric had previously seen a near-consistent upward trend. [caption id="attachment_86185" align="aligncenter" width="700"] Base for Prime membership data: 7,000+ US Internet users ages 18+ in each month

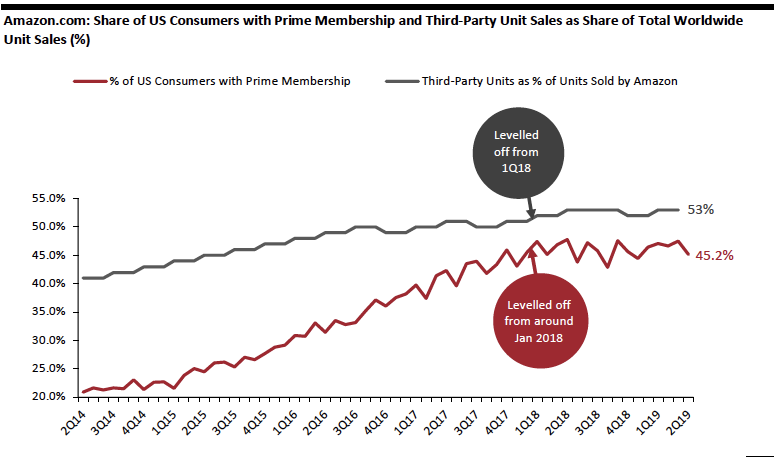

Base for Prime membership data: 7,000+ US Internet users ages 18+ in each monthSource: Prosper Insights & Analytics/company reports[/caption] Why Does This Matter? Prime drives loyalty. Not just in repeat purchases of the types of products consumers have traditionally bought on Amazon, such as electronics and media products, but in categories with which Amazon.com is not traditionally associated, such as beauty, groceries and clothing. This cross-category purchasing has supported Amazon’s successful entry into these newer markets: Coresight Research data show that, by number of shoppers, Amazon is now the most-shopped apparel retailer in the US, it is the number one retailer for online grocery purchases and is second-most-shopped retailer for purchases of beauty and personal care products. Third-party sellers have built out Amazon’s offering in these nontraditional categories. Exclusive Coresight Research data shows the extent to which third-party sellers have helped Amazon build an offering in categories such as apparel and beauty: Our data, collected in partnership with DataWeave, shows that third-party merchants account for fully 88.9% of Amazon.com’s clothing listings and 92.4% of the site’s beauty and personal care offering. Just as these two engines of growth have stalled, Amazon’s retail sales growth has been losing momentum. As we show below, the year-over-year rise in its first-party sales slowed from 21% in the first quarter of 2016 to 12% in the first quarter of 2019. The growth in third-party sales is likely to have had some impact, but the increase in revenues from these merchants has slowed too, with the rate of growth in third-party (3P) seller services halving from 46% in the first quarter of 2016 to 23% in the first quarter of 2019. [caption id="attachment_86186" align="aligncenter" width="700"]

*Data for 1Q16 are for “Retail Products” prior to a change in segment names; the data are continuous. Data reflect first-party sales where Amazon records revenues gross (i.e., first-party sales).

*Data for 1Q16 are for “Retail Products” prior to a change in segment names; the data are continuous. Data reflect first-party sales where Amazon records revenues gross (i.e., first-party sales).Source: Company reports[/caption] A slower expansion in sales is natural as Amazon reaches greater scale and maturity. Nevertheless, this slowing dovetails with the leveling off in both Prime membership rates in the US and the contribution from third-party sales. These patterns imply that Amazon will need to find new props to sustain rapid gains in retail market share—and the upgrade for US Prime members to one-day shipping could suggest the search for those props is already underway.

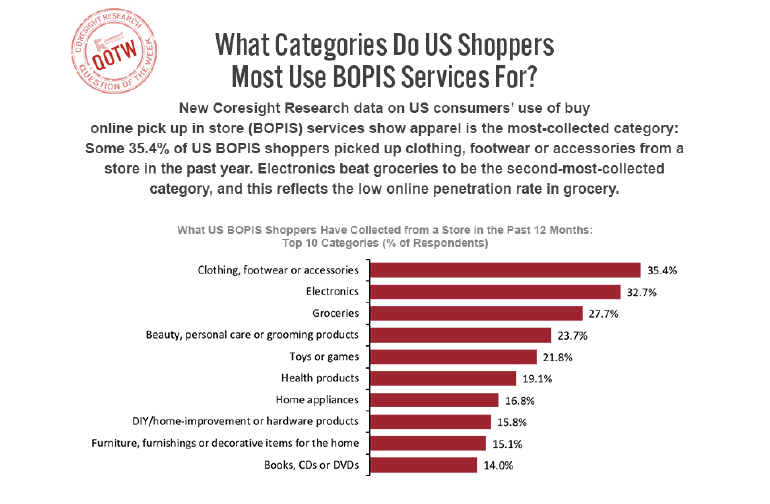

QUESTION OF THE WEEK

[caption id="attachment_86189" align="aligncenter" width="700"] Base: 786 US Internet users ages 18+ who have collected an online purchase from a store in the

Base: 786 US Internet users ages 18+ who have collected an online purchase from a store in thepast 12 months, surveyed in April 2019

Source: Coresight Research[/caption]

US RETAIL & TECH HEADLINES

- US consumer spending rebounded in March while the Federal Reserve’s preferred underlying inflation gauge eased to a one-year low, reinforcing the central bank’s patient stance on interest rates.

- Purchases, which make up more than two-thirds of the economy, rose 0.9% in March from the prior month, after a 0.1% percent February increase. Personal income rose 0.1% percent in March, less than forecast.

- Amazon is in the process of speeding up its free Prime two-day delivery to free shipping in one day for eligible items for Prime members. The company is investing $800 million to get that done, which will happen this year.

- The change doesn't reflect any move on Amazon's part to shift away from the US Postal Service, UPS, FedEx or other shippers to use its own shipping infrastructure.

- Indochino is expanding its presence in the Northeast and also looking overseas for growth. The made-to-measure menswear retailer will open three stores in New York, New Jersey, and Connecticut this year and into 2020. Indochino will open its 44th location on April 26 in Greenwich, CT.

- The new store will feature high ceilings, large windows and a lounge area where customers can relax and enjoy a coffee before designing their one-of-a-kind garments.

PayPal Ventures Leads $11 Million Investment Round in Retail Startup Happy Returns

(April 25) CNBC

PayPal Ventures Leads $11 Million Investment Round in Retail Startup Happy Returns

(April 25) CNBC

- PayPal’s venture capital arm is leading an $11 million investing round in Happy Returns, marking the largest funding round to date for the online returns service and bringing its total to $25 million.

- Happy Returns operates more than 350 Return Bars in malls and on college campuses for shoppers to return items bought online when the brand doesn’t have its own physical store.

- Macy’s has held preliminary discussions with New York City officials about building a skyscraper on top of its flagship store in Manhattan’s Herald Square as the old-guard retailer seeks to unlock value from its real estate.

- The company has floated plans for a 1.2 million-square-foot office tower that would be used by other tenants. Macy’s probably would push for zoning changes around its property to allow for the 800-foot building.

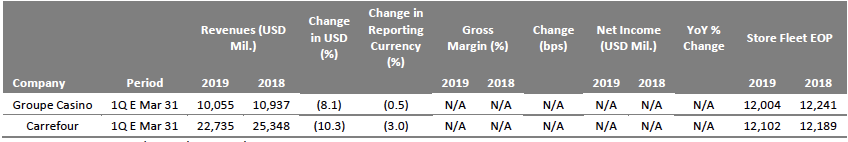

EUROPE RETAIL EARNINGS

[caption id="attachment_86190" align="aligncenter" width="700"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

Sainsbury’s and Asda Merger Blocked by the CMA

(April 25) cnbc.com, press release

Sainsbury’s and Asda Merger Blocked by the CMA

(April 25) cnbc.com, press release

- The UK’s competition regulator, the Competition and Markets Authority (CMA), has blocked Sainsbury’s proposed £7.3 billion ($9.4 billion) buyout of Walmart’s Asda. The grocery retailers have mutually called off their planned merger, opting not to challenge the CMA.

- The CMA concluded that the outcome of the transaction could cause a substantial decline of competition, at both national and local levels. It found that the merger would result in increased prices, reduced quality and choice of products, and a poorer shopping experience.

- British department store Debenhams has formally commenced its company voluntary agreement (CVA) and, as part of the process, will close up to 22 underperforming stores next year, placing nearly 1,200 jobs at risk.

- The ailing department store had assigned administrators who immediately sold part of Debenhams to a newly incorporated company in return for reducing the firm’s £600 million ($777 million) debt.

- Micolet, a UK-based online marketplace for second-hand women’s apparel, will expand to Poland and the Netherlands later this year. With this expansion, Micolet will be active in eight countries across Europe.

- Micolet was founded with just €3,000 ($3,363) in 2015 and currently generates “millions of euros” in revenues, the company says. It has grown at a rate of 50,000 new customers every month, has more than 200,000 items for sale, and adds more than 1,000 items to the marketplace for purchase every day.

- British department store John Lewis has launched a new “Try On” augmented reality (AR) feature in its retail app. The new feature will take customers to a live selfie screen where they can virtually sample different shades of lipstick; the app will follow the movement of users’ lips in real time.

- The app allows users to see themselves wearing more than 300 brands of lipstick, including leading brands such as MAC, Bobbi Brown, YSL, Charlotte Tilbury, BECCA and Lancôme.

- Spanish luxury fashion brand Loewe, owned by LVMH, has opened a three-level flagship Casa Loewe store on New Bond Street in London. The store replaces its Mount Street boutique to become the only Loewe shop in the city.

- Besides showcasing its latest collections, the new store will offer a pop-up space that will present a collection of art installations by 14 artists representing a range of art forms.

- US-based robot cloud services firm Bossa Nova plans to introduce its autonomous, shelf-scanning robots to UK supermarkets this year. The company opened its first European office in Sheffield last year.

- Bossa Nova unveiled the robots at Walmart in the US last year. The mass merchandiser has introduced the technology in 50 of its US stores so far and is deploying it to a further 300 stores.

ASIA RETAIL & TECH HEADLINES

Alibaba Launches Three New Tmall Genie Smart Speakers

(April 25) alizila.com

Alibaba Launches Three New Tmall Genie Smart Speakers

(April 25) alizila.com

- Alibaba formally launched the three new versions of its smart speaker Tmall Genie. The first, unveiled at the company’s annual Tmall Beauty Awards in March, is a smart makeup mirror that responds to voice commands and adjusts its brightness to mimic different lighting environments.

- The second, the Tmall Genie CC, is aimed at Chinese families, has a small built-in screen and offers video content. Finally, an in-vehicle smart speaker created in collaboration with Amap, Alibaba Group’s navigation solutions provider, can be paired with a dashcam to see real-life road images for driving directions on the dashboard screen.

- US apparel and accessories brand Bebe has re-entered the Indian market after it had closed all its stores globally in 2017 due to declining sales. Now it has partnered with Mumbai-based Mikaya Brands to open its first accessories store in the city of Ahmedabad.

- Bebe plans to launch 15 more accessories stores and 10 apparel stores in India over the next two years.

- Southeast Asian sultanate Brunei has opened a shop on Chinese e-commerce giant JD.com. The first product on offer is the blue shrimp that Brunei is famous for cultivating.

- Brunei’s national store will offer high-quality fresh products that are lesser known in China.

- Indian online grocer BigBasket has raised $150 million in a fresh funding round led by Mirae Asset-Naver Asia Growth Fund, CDC Group and Alibaba Group. The company plans to invest $100 million to boost its supply chain, reduce delivery times and ensure quality of dairy and fresh products.

- BigBasket wants to enable two-hour delivery in the top 10 cities in India in which it operates by July 2019. It will invest in its milk subscription business BB Daily and unstaffed vending machine unit BB Instant to provide better and faster service.

- Dubai-based fast fashion chain Lifestyle has turned to technology to grow in the Indian market by introducing in-store tech, self-checkout kiosks, mobile POS and virtual trial rooms to boost sales.

- It has launched an app called Lifestyle Buddy that allows shoppers to scan QR codes at its stores and place orders online. The app also provides personalized offers to customers to increase conversions and purchase value. Lifestyle will also invest in digital marketing to connect with customers.

- French sporting goods retailer Decathlon has opened its first store in Vietnam, in Vincom Mega Mall Royal City, Hanoi. The store is 46,285 square feet and offers more than 14,000 items covering 70 sports.

- Decathlon plans to open its second store in Ho Chi Minh City on May 25. It has set up a factory in Thai Binh province and partnered with more than 100 retailers and brands to offer attractive prices to local customers.

- French beauty retailer Sephora will return to Hong Kong after a 10-year absence with eight new stores over the next three years. It will open the first of these in IFC Mall in August 2019 and a second store at Windsor House in Causeway Bay in the fourth quarter of 2019. Six more stores will follow.

- Sephora plans to feature local Hong Kong brands along with its in-house brands. Vending machines will be placed in the stores to support its loyalty program. It will also offer customer service and digital skincare consultations via its app.

LATAM RETAIL & TECH HEADLINES

Victoria’s Secret First Store in Guatemala Puts the Accent on Beauty

(April 29) fashionnetwork.com

Victoria’s Secret First Store in Guatemala Puts the Accent on Beauty

(April 29) fashionnetwork.com

- US lingerie and beauty products retailer Victoria’s Secret will open its first store in Guatemala in the first week of May, in the Miraflores shopping center. It will enter the Guatemalan market with the help of David Group, a leading retail corporation headquartered in Panama.

- The first store will follow its beauty and accessories format, with a limited range of clothing and the main focus on the brand’s makeup, skin creams and accessories.

Amazon and Western Union Launch a New Form of International Payments for Purchases in Uruguay

(April 27) iproup.com

Amazon and Western Union Launch a New Form of International Payments for Purchases in Uruguay

(April 27) iproup.com

- Amazon has partnered with US financial services and communications company Western Union to launch a new international payment option in Uruguay.

- Customers will be able to make purchases on Amazon’s international website or mobile application and pay in the local currency later through the PayCode option at Western Union facilities operated by the Uruguayan chain of payments and collections Abitab.

- Swedish fashion retailer H&M has launched its online store in Mexico and partnered with four local celebrities—Danna Paola, Mario Bautista, Paulina Goto and José Pablo Minor—to be the faces of the campaign for the launch.

- The online store will offer exclusive collections throughout the year. It will also provide an option that allows a product ticket to be scanned in stores for detailed information on the item. Similar items can also be found online by taking a picture of the garment.

- Chilean retail group Falabella is preparing its mix of products and locations in preparation for the launch of Swedish furniture retailer Ikea’s first store in Chile. High-flow client sites, such as Falabella’s malls, will be prioritized rather than Ikea’s original independent store format.

- The company is also working on an alliance with Rappi in Chile and Peru for Tottus express offices, in addition to the automation of Sodimac's dispatch center in Chile.

- US clothing brand Guess will open an exclusive accessories store in Real Plaza Salaverry shopping center in Lima, Peru in August 2019. The new store is part of the brand’s expansion plan in the Peruvian market.

- The new store will have Guess-branded watches, bags, fashion accessories and footwear. It will also offer special collaborations and brand capsules to differentiate it from traditional Guess lines.

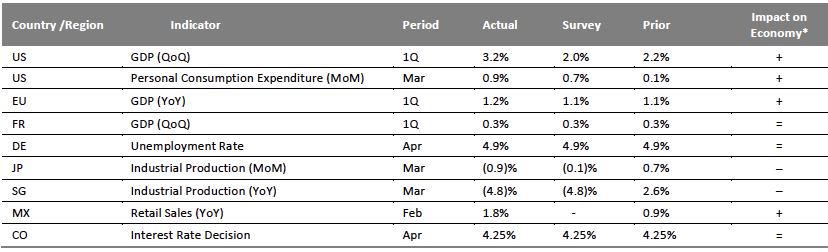

MACRO UPDATE

Key points from global macro indicators released April 24–30, 2019:- US: GDP rose 3.2% quarter over quarter in the first quarter of 2019, above both the 2.0% consensus estimate and the 2.2% growth recorded in the fourth quarter of 2018. The US personal consumption expenditure increased 0.9% month over month in March, beating the consensus estimate of 0.7% growth and substantially exceeding 0.1% rise reported in February.

- Europe: Eurozone GDP expanded by 1.2% year over year in the first quarter of 2019, advancing from 1.1% growth recorded in the fourth quarter of 2018. In France, GDP grew 0.3% in the first quarter, in line with the consensus estimate and maintaining the same pace for the third quarter in a row. In Germany, the total number of unemployed people decreased by 12,000 month over month to 2.2 million in April on a seasonally adjusted basis, while the unemployment rate remained stable month over month at 4.9%, meeting the consensus estimate.

- Asia-Pacific: In Japan, industrial production fell 0.9% month over month in March versus the consensus estimate of a 0.1% decline, following the 0.7% growth recorded in February. In Singapore, industrial production contracted 4.8% year over year in March, in line with the consensus estimate, marking a reversal from 2.6% output growth in February.

- Latin America: Mexico’s retail sales increased 1.8% year over year in February, advancing from 0.9% growth reported in January, driven by rising consumer confidence, which peaked in February. Colombia held its benchmark interest rate unchanged at 4.25%, in line with the consensus estimate.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source US Bureau of Economic Analysis/Eurostat/CEIC/Singapore Department of Statistics/Banco de la República, Colombia/Coresight Research[/caption]

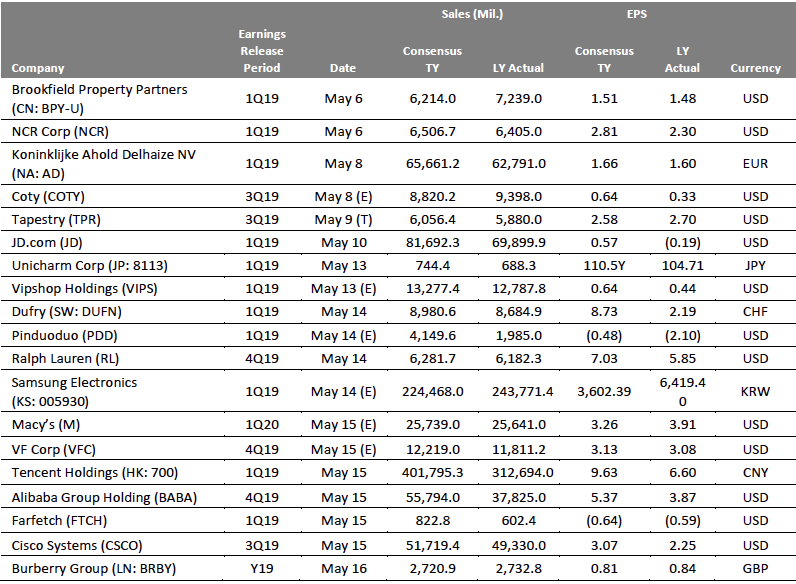

EARNINGS CALENDAR

[caption id="attachment_86205" align="aligncenter" width="796"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

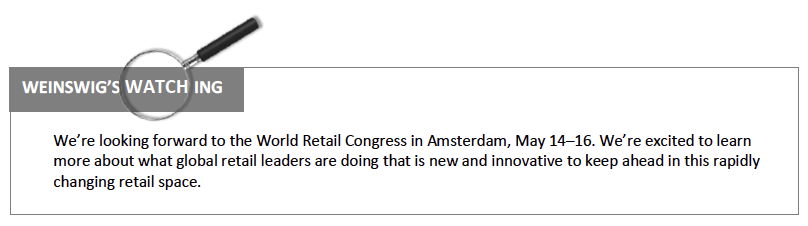

EVENTS CALENDAR