From the Desk of Deborah Weinswig

US Retailers Walmart and Kroger Are Taking the E-Commerce Battle Overseas

Over the last couple of weeks, there have been significant announcements of US retailers acquiring and divesting properties in regions outside the US. These actions likely represent the latest moves by the retailers to gain a foothold to compete against Amazon and Alibaba globally.

Walmart is one US retailer that appears to be picking its battles. The company recently announced its plans to acquire a majority stake in Indian e-commerce company Flipkart. Walmart is paying $16 billion for a 77% stake in the company; the remainder will be held by Flipkart cofounder Binny Bansal and Tencent, Tiger Global Management and Microsoft. Flipkart launched in 2007 and is one of India’s largest e-commerce marketplaces, offering over 80 million products across more than 80 categories. It pioneered cash on delivery, no-cost EMI and easy returns in the Indian market and has acquired Myntra, Jabong and PhonePe. Amazon reportedly made a bid for a 60% stake in the company, but Flipkart management ultimately chose Walmart.

There are two interesting aspects to this transaction. First, Flipkart is unprofitable, which led Walmart to reduce its EPS guidance for its current fiscal year. Walmart has apparently started to behave more like Amazon, choosing an acquisition that is strategic—but dilutive to earnings. Flipkart is not expected to offer profits for Walmart shareholders for some time. The second interesting aspect is Walmart’s statement that it supports Flipkart’s plans to complete a public stock offering sometime in the future.

Walmart also recently announced that it is reducing its presence in Europe and that it plans to merge its Asda supermarket with rival Sainsbury’s. In the transaction, Walmart will receive $4.1 billion in cash while retaining a 42% stake in the business.

In other news, Kroger recently raised the temperature of the grocery wars by announcing that it would expand internationally through a deal with UK online supermarket Ocado. Under the agreement, Kroger will invest $247 million for a 5% stake in Ocado and gain access to Ocado’s systems for managing warehouse operations, automation, logistics and delivery route planning. Ocado is an online-only retailer and uses artificial intelligence and machine learning to help predict changes in customer demand for 50,000 items. Its warehouses can collaborate to pick a typical 50-item order in a matter of minutes, the company claims. For Ocado, this agreement with Kroger follows a series of deals announced in Sweden, France and Canada. It was likely prompted by Amazon’s acquisition of Whole Foods Market and its subsequent announcement that it would integrate Whole Foods’ loyalty program into the Amazon Prime subscription offering.

These overseas acquisitions are bringing US retailers into the backyard of Alibaba, which has been aggressively expanding throughout Asia. Most recently, Alibaba acquired e-commerce company Daraz—which is active in Pakistan, Bangladesh, Myanmar, Sri Lanka and Nepal—from Rocket Internet for an undisclosed amount. In March, Alibaba invested an additional $2 billion to increase its stake in Southeast Asian e-commerce marketplace Lazada from 51% to 83%, raising its total investment to $4 billion. In August 2017, Alibaba invested $1.1 billion in Indonesian e-commerce company Tokopedia.

Following its unsuccessful attempt to invest in Flipkart, Amazon appears to be facing more urgency to establish a meaningful presence in Asia. Amazon does offer Prime and Amazon Web Services in Singapore, which it could use as a launchpad for further expansion throughout Southeast Asia.

While the grocery wars initially appeared to be limited to the US, moves by global e-commerce giants are prompting major domestic grocers to focus on international partnerships and expansion, largely in Asia. The frequency of these types of announcements and headlines is likely to increase as these titans square off and claim their territory.

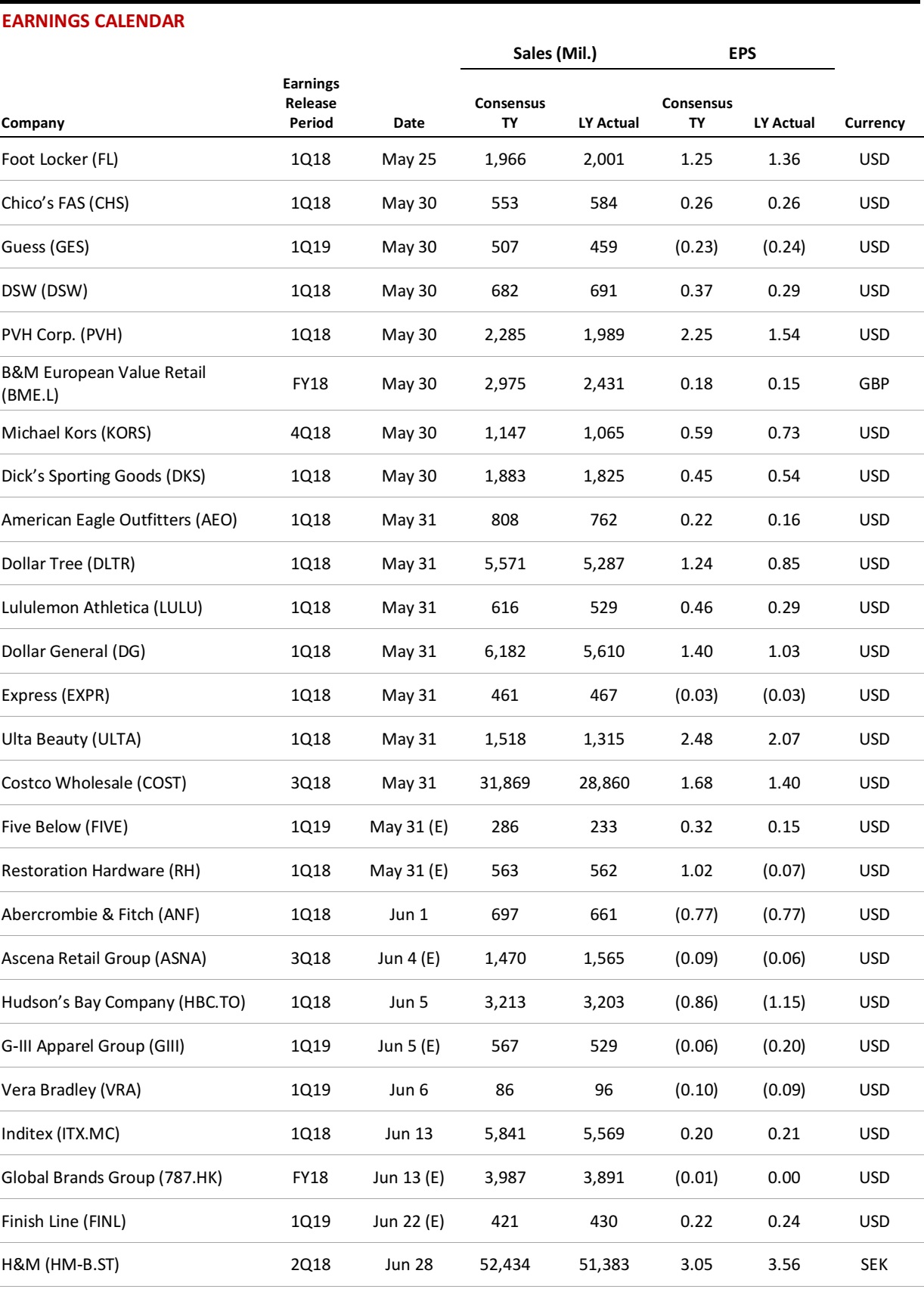

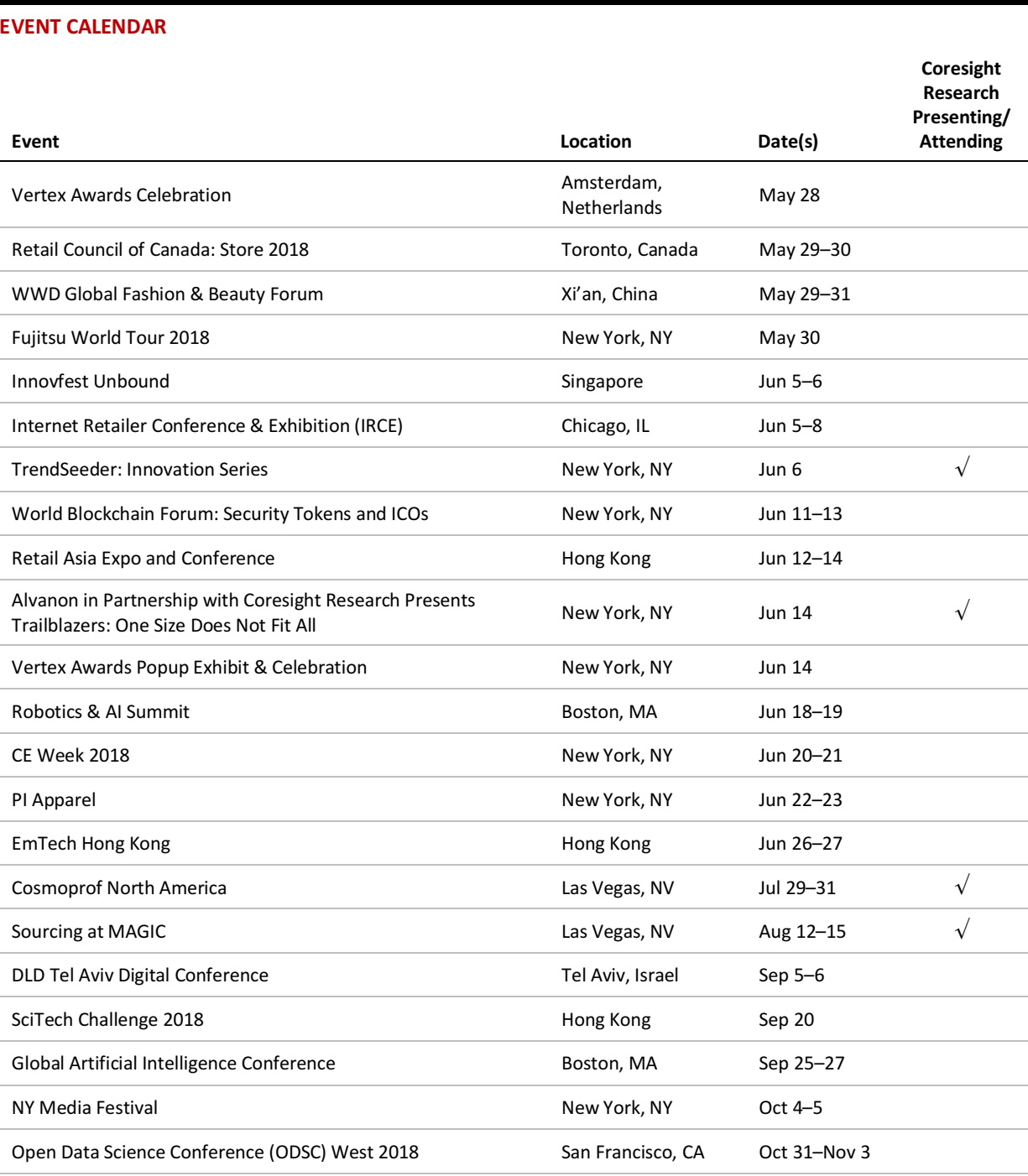

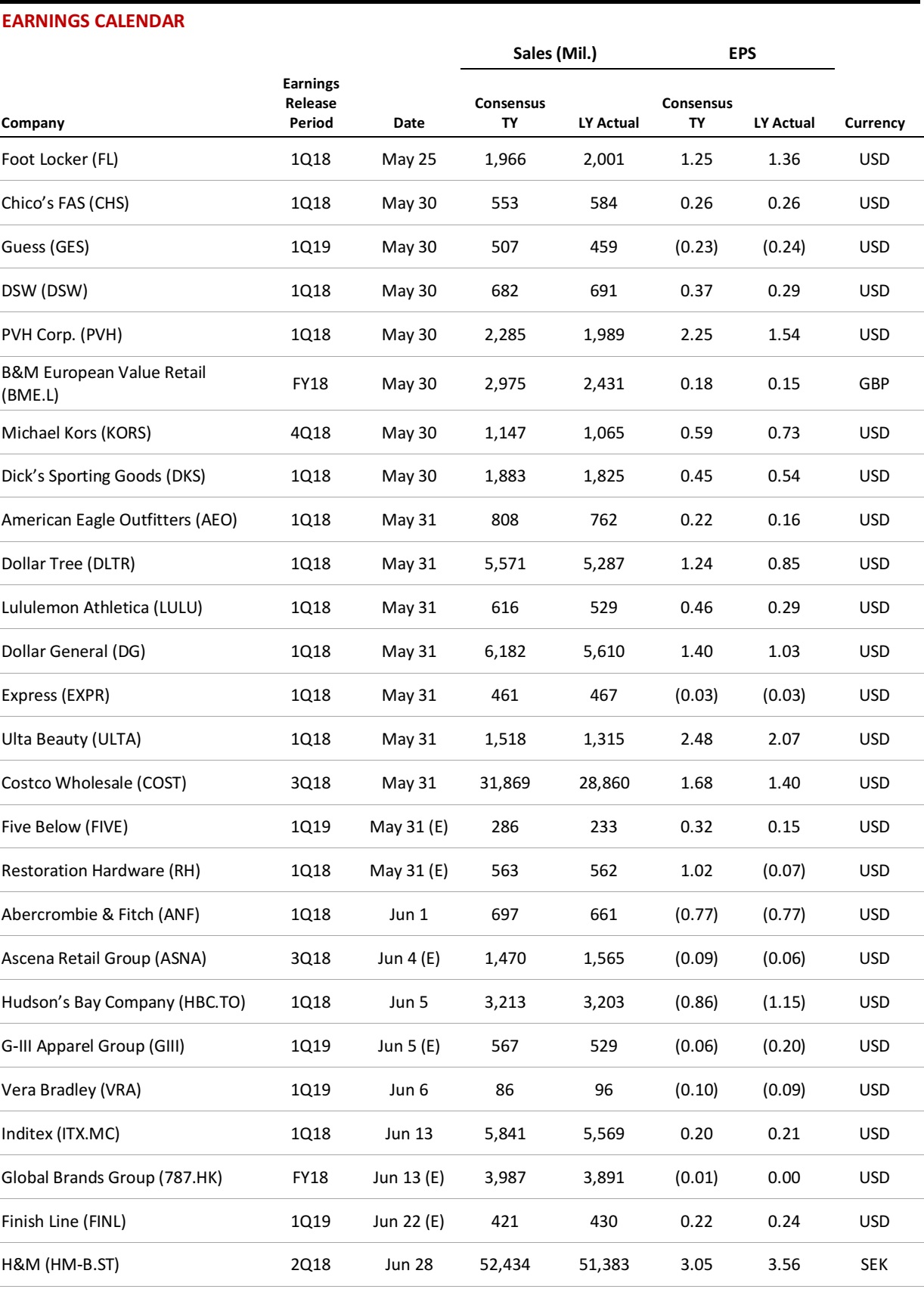

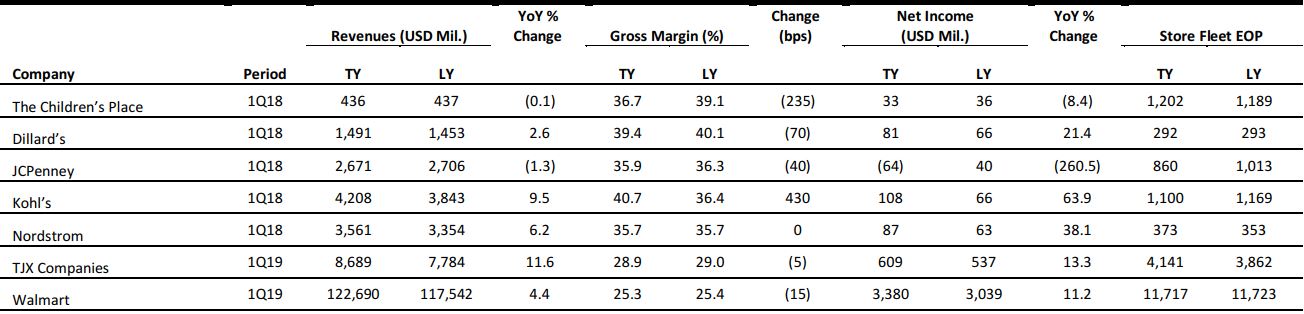

US RETAIL EARNINGS

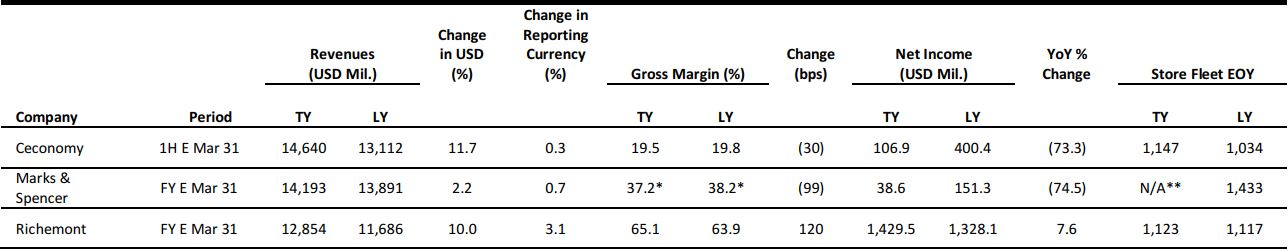

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

Climbing Gas Prices Didn’t Keep Consumers from Spring Spending

(May 15) WSJ.com

Climbing Gas Prices Didn’t Keep Consumers from Spring Spending

(May 15) WSJ.com

- Despite rising gas prices, Americans ramped up their spending at the start of spring, signaling that modest wage gains and the recent tax overhaul helped buoy spending. Retail sales—a measure of spending at stores, online-shopping websites and restaurants—rose by a seasonally adjusted 0.3% in April from the prior month.

- That growth was largely broad-based, and held up even when excluding gasoline and autos. Food and beverage stores and clothing and accessories retailers both clocked their largest sales gains since last year. A weak spot was spending at restaurants and bars, which declined by 0.3%.

BJ’s Wholesale Files for IPO in Shifting US Retail Landscape

(May 17) CNBC.com

BJ’s Wholesale Files for IPO in Shifting US Retail Landscape

(May 17) CNBC.com

- Warehouse club operator BJ’s Wholesale Club has filed for an IPO to list itself on the New York Stock Exchange, marking its bid to become a public company again.

- BJ’s move to list itself comes as the US retail industry is undergoing a massive transformation due to the increasing shift of consumer dollars being spent online. Warehouse club operators, however, have largely bucked the downturn, as their business models rely mainly on recurring membership revenues rather than just topline sales.

PayPal Buying Swedish Startup iZettle for $2.2 Billion, Expanding Retail Payment Business

(May 18) TheGlobeandMail.com

PayPal Buying Swedish Startup iZettle for $2.2 Billion, Expanding Retail Payment Business

(May 18) TheGlobeandMail.com

- PayPal has agreed to buy Swedish financial technology startup iZettle for $2.2 billion, the American online payments provider’s biggest-ever acquisition. The deal will allow PayPal to expand into the retail payment terminals business in international markets, where it will compete with Silicon Valley firm Square.

- Stockholm-based iZettle offers small businesses a miniature credit card reader that turns smartphones and tablets into payment registers. It is present in 12 countries in Europe and Latin America and offers other services for managing small businesses.

Adobe to Buy Magento Commerce for $1.68 Billion

(May 22) Reuters.com

Adobe to Buy Magento Commerce for $1.68 Billion

(May 22) Reuters.com

- Adobe Systems said that it would buy e-commerce services provider Magento Commerce from private equity firm Permira for $1.68 billion in cash, its biggest deal in nearly a decade. Adobe said that the deal will help bolster its Experience Cloud business, which provides services including analytics, advertising and marketing.

- Magento was acquired by Permira from eBay in 2015 and counts Canon, Helly Hansen, Paul Smith and Rosetta Stone among its clients.

JCPenney CEO Ellison Jumps Ship to Lowe’s

(May 22) Reuters.com

JCPenney CEO Ellison Jumps Ship to Lowe’s

(May 22) Reuters.com

- JCPenney CEO Marvin Ellison is leaving the struggling retailer to join home improvement chain Lowe’s, the companies said. Ellison joined JCPenney in 2014 with a strong reputation honed through 12 years at Home Depot. The 52-year-old will take over at Lowe’s on July 2.

- At JCPenney, Ellison was tasked with stemming a two-year-long sales decline as the company struggled to stay relevant in a brutal US retail landscape, where customers are increasingly turning to online shopping.

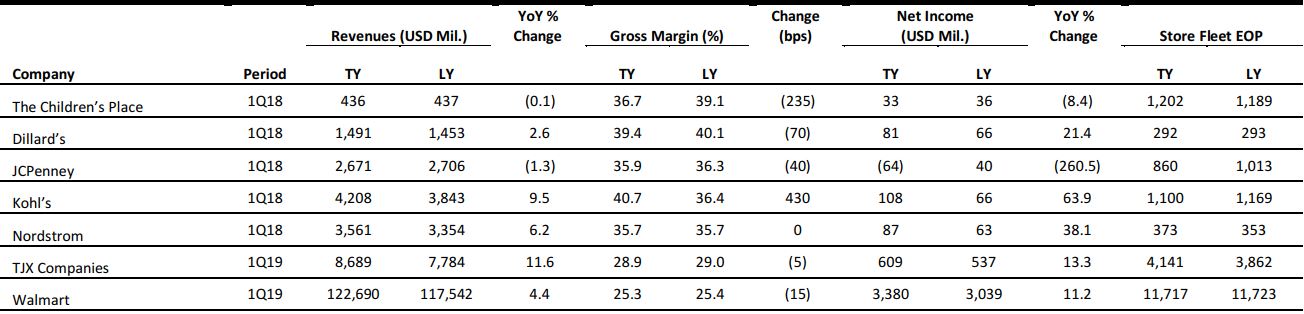

EUROPE RETAIL & TECH HEADLINES

*Gross margin is for the UK only; Marks & Spencer does not report gross profit at a group level.

**Marks & Spencer did not provide end-of-year store numbers for fiscal year 2018.

Source: Company reports/Coresight Research

*Gross margin is for the UK only; Marks & Spencer does not report gross profit at a group level.

**Marks & Spencer did not provide end-of-year store numbers for fiscal year 2018.

Source: Company reports/Coresight Research

Marks & Spencer Confirms Further Store Closures

(May 22) Company press release

Marks & Spencer Confirms Further Store Closures

(May 22) Company press release

- Marks & Spencer has confirmed that it is considering closing a further 14 UK Clothing and Home stores. These closures, combined with the 21 stores the company has already closed, will bring the company’s total store closure count to more than 100 by 2022.

- The British retailer said that it will open 15 fewer Simply Food stores this year as it scales back openings in its Food segment. Marks & Spencer’s accelerated redesign of its UK store estate is part of its wider five-year transformation plan and its goal to take at least a third of sales online.

Matchesfashion’s Full-Year Revenues Surge

(May 21) RetailGazette.co.uk

Matchesfashion’s Full-Year Revenues Surge

(May 21) RetailGazette.co.uk

- London-based global luxury retailer Matchesfashion has reported a surge of 44% in full-year revenues, to £293 million ($394 million). In the year ended January 31, EBITDA jumped by 34%, to £26 million ($35 million).

- Matchesfashion noted that a rise in online sales, which now account for 95% of the company’s total sales, contributed to growth. The retailer said that sales from outside the UK contributed to 82% of its online business, and that it has launched local-language websites in France and South Korea.

House of Fraser May Close Half of Stores in Turnaround (May 19) Telegraph.co.uk

(May 19) Telegraph.co.uk

- House of Fraser may close up to half of its 59 stores in the UK and prompt thousands of job losses if its restructuring plans are approved by its creditors and landlords.

- The exact number of store closures is yet to be decided, as the retailer is pursuing an insolvency process known as a company voluntary arrangement (CVA). China’s C.banner International is looking to secure a 51% stake in House of Fraser, but the deal rests on the retailer securing a CVA.

Carrefour May Close 227 DIA Stores in France After June 4

(May 21) Reuters.com

Carrefour May Close 227 DIA Stores in France After June 4

(May 21) Reuters.com

- French retail group Carrefour has not found buyers for 227 of 273 former DIA stores, placing them at risk of closure after June 4. A Carrefour spokesman said that the retailer had received offers for just 46 of the 273 stores.

- The stores are part of a network of 600 stores that Carrefour acquired from Spanish supermarket chain DIA in 2014. The French retailer said that it plans to sell or close the struggling stores in northern and eastern France by the end of 2018.

Pets at Home Group Grows Full-Year Revenues, Comps

(May 22) Company press release

Pets at Home Group Grows Full-Year Revenues, Comps

(May 22) Company press release

- British pet supplies retailer Pets at Home posted 7.8% growth in group revenue, to £834 million ($1.1 billion), in the year ended March 29. Merchandise revenue growth was 6.8% and comp growth was 5.0%. Revenue growth for services and other segments was 13.7% and comp growth was 8.5%.

- The company’s gross margin fell by 249 basis points and profit before tax fell by 16.6% due to price investments in merchandise.

MediaMarktSaturn and Fnac Darty Form Retail Alliance

(May 17) EcommerceNews.eu

MediaMarktSaturn and Fnac Darty Form Retail Alliance

(May 17) EcommerceNews.eu

- Europe’s largest consumer electronics retailers, MediaMarktSaturn and Fnac Darty, are joining forces to form a retail alliance. The two firms announced that they have signed a memorandum of understanding to begin exclusive discussions about the venture, but have not yet officially formed an alliance.

- In the first phase of the alliance, the retailers will explore areas of cooperation, such as strategic partnerships with international suppliers. The two firms said that other retailers are welcome to join their alliance.

ASIA RETAIL & TECH HEADLINES

Baidu Spins Out Its Global Ad Business to Sharpen Its Focus on Artificial Intelligence

(May 23) TechCrunch.com

Baidu Spins Out Its Global Ad Business to Sharpen Its Focus on Artificial Intelligence

(May 23) TechCrunch.com

- Chinese search giant Baidu is spinning out its business units responsible for utility apps and mobile ads to sharpen its focus on artificial intelligence (AI). As part of the spinout, Baidu is selling a large chunk of its equity in the Global DU business to as-yet-undisclosed investors. The plan is to sell “a majority equity stake” in order to take Global DU independent.

- This will allow Baidu to focus more keenly on AI. The firm said that it will set up a new global business unit around its AI-powered services in the US and Southeast Asia. The plan is to allow these services to work more closely with Baidu’s AI labs, which include locations in Silicon Valley and Seattle.

Didi Chuxing, China’s Answer to Uber, Said to Consider Hong Kong Listing in Second Half of 2018

(May 23) SCMP.com

Didi Chuxing, China’s Answer to Uber, Said to Consider Hong Kong Listing in Second Half of 2018

(May 23) SCMP.com

- Didi Chuxing, China’s largest ride-hailing service provider, is considering an IPO in Hong Kong that is expected to value the company at $70–$80 billion. The Beijing-based company is preparing to list as early as the second half of this year and is open to options that include weighted voting rights, according to people familiar with the situation who don’t want to be identified because the information isn’t public.

- China has one of the world’s most dynamic technology startup scenes, thanks to the rapid rise of an Internet economy supported by a high mobile penetration rate and mobile-first consumer habits. A wave of Chinese technology IPOs in the next 12–24 months would likely set a record for Hong Kong, said John Hall, co-head of J.P. Morgan’s investment banking unit in the Asia-Pacific region and global head of technology services.

Tencent’s WeChat Allows Residents in China’s Most Populous Province to Skip Government Queues

(May 23) SCMP.com

Tencent’s WeChat Allows Residents in China’s Most Populous Province to Skip Government Queues

(May 23) SCMP.com

- WeChat now enables residents in China’s Guangdong province to skip the queues at government offices and face-to-face talks with civil servants, thanks to a WeChat Mini Program called Yue Sheng Shi, which can handle 142 different local government functions.

- The platform enables users to pay traffic tickets, make appointments for marriage registration, and extend visas on passports and other travel documents, as well as perform other functions related to medical care, social security and labor arbitration. Users in Guangdong, China’s most populous province, are required to register for this WeChat-based initiative with their real name and other personal information to access all the functions.

ZTE Estimates at Least $3 Billion in Losses from US Ban

(May 23) SCMP.com

ZTE Estimates at Least $3 Billion in Losses from US Ban

(May 23) SCMP.com

- ZTE is estimating losses of at least ¥20 billion ($3.1 billion) from a US technology ban that has halted major operations as clients pull out of deals and expenses mount. The telecom gear and smartphone maker is hopeful, however, that a deal will be reached soon and already has a plan in place to swing idled factories into action within hours if Washington agrees to lift its seven-year moratorium on purchases of American chips and components.

- Shenzhen-based ZTE depends on US components, such as chips from Qualcomm, to build its smartphones and networking gear. The ban, for breaching terms of a settlement over sanction-breaking sales to Iran, has all but mothballed China’s second-largest telecoms gearmaker and entangled it in a trade dispute between the world’s two largest economies.

LATAM RETAIL & TECH HEADLINES

Google Selects First Cohort of Launchpad Accelerator in Brazil

(May 22) ZDNet.com

Google Selects First Cohort of Launchpad Accelerator in Brazil

(May 22) ZDNet.com

- Google has selected the first cohort for the Brazilian version of its Launchpad Accelerator program. The global acceleration initiative, introduced five years ago, includes a few months of technical support and training for startups as well as equity-free financing and a couple of weeks at Google’s offices.

- To support entrepreneurial ecosystems in important markets for Google, the company started launching local versions of the Launchpad Accelerator, including in Tel Aviv, Israel, and Lagos, Nigeria. The Brazilian city of São Paulo is the latest addition to the list and six startups have been selected for the inaugural program.

Sony Brazil Focuses on Premium Products

(May 18) ZDNet.com

Sony Brazil Focuses on Premium Products

(May 18) ZDNet.com

- Sony remains focused on driving a premium product strategy in Brazil and plans to launch a range of consumer devices locally. The newly appointed president for Sony’s Brazil operations, Kenichiro Hibi, will focus on targeting consumers of higher-end products, in line with the company’s global positioning.

- According to Hibi, who previously held senior positions at the firm in the US, India and Russia, the idea is to significantly enhance the company’s performance in Brazil, already “an important market” for Sony. “Brazilians are heavy users of new technologies and we want to deliver to customers the latest in audio and video experiences,” Hibi said.

Salesforce Wants More User Success Stories in Brazil

(May 16) ZDNet.com

Salesforce Wants More User Success Stories in Brazil

(May 16) ZDNet.com

- Salesforce wants to encourage Brazilian customers to invest in systems supporting digital transformation by creating a sense of urgency around resuming their innovation strategies. The cloud CRM vendor is optimistic about Brazil and has doubled the size of its annual Salesforce World Tour event in São Paulo, with over 8,000 people signed up to attend.

- According to Latin America COO Enrique Ortegon, the opportunities in Brazil are all about digital transformation, with a focus on mobility and customer experience. “Brazilian companies are now facing the decision of investing in modernization again or facing their own fast and painful death,” Ortegon said.

Sweden’s IKEA to Open in Colombia as Part of 2020 Regional Expansion

(May 21) TheCityPaperBogota.com

Sweden’s IKEA to Open in Colombia as Part of 2020 Regional Expansion

(May 21) TheCityPaperBogota.com

- Swedish home furnishings giant IKEA has entered into a franchise agreement with Chilean retailer Falabella in order to expand into South America, with stores planned for 2020 in Peru, Chile and Colombia. IKEA announced that it aims to open at least nine stores in those three nations over 10 years and that it will offer customers in those countries the option to buy online.

- The IKEA-Falabella venture will be operated by Inter IKEA Group, whose CEO, Torbjörn Lööf, announced the $600 million investment in the region. “We are very happy to bring IKEA to South America together with Empresas Falabella, given their experience and leadership in the region,” said Lööf.

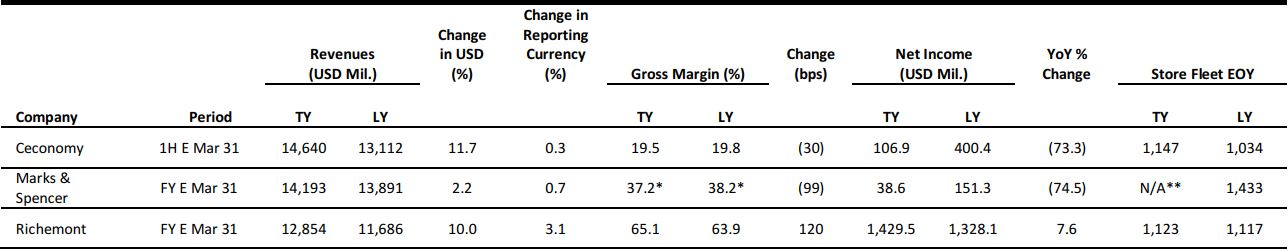

MACRO UPDATE

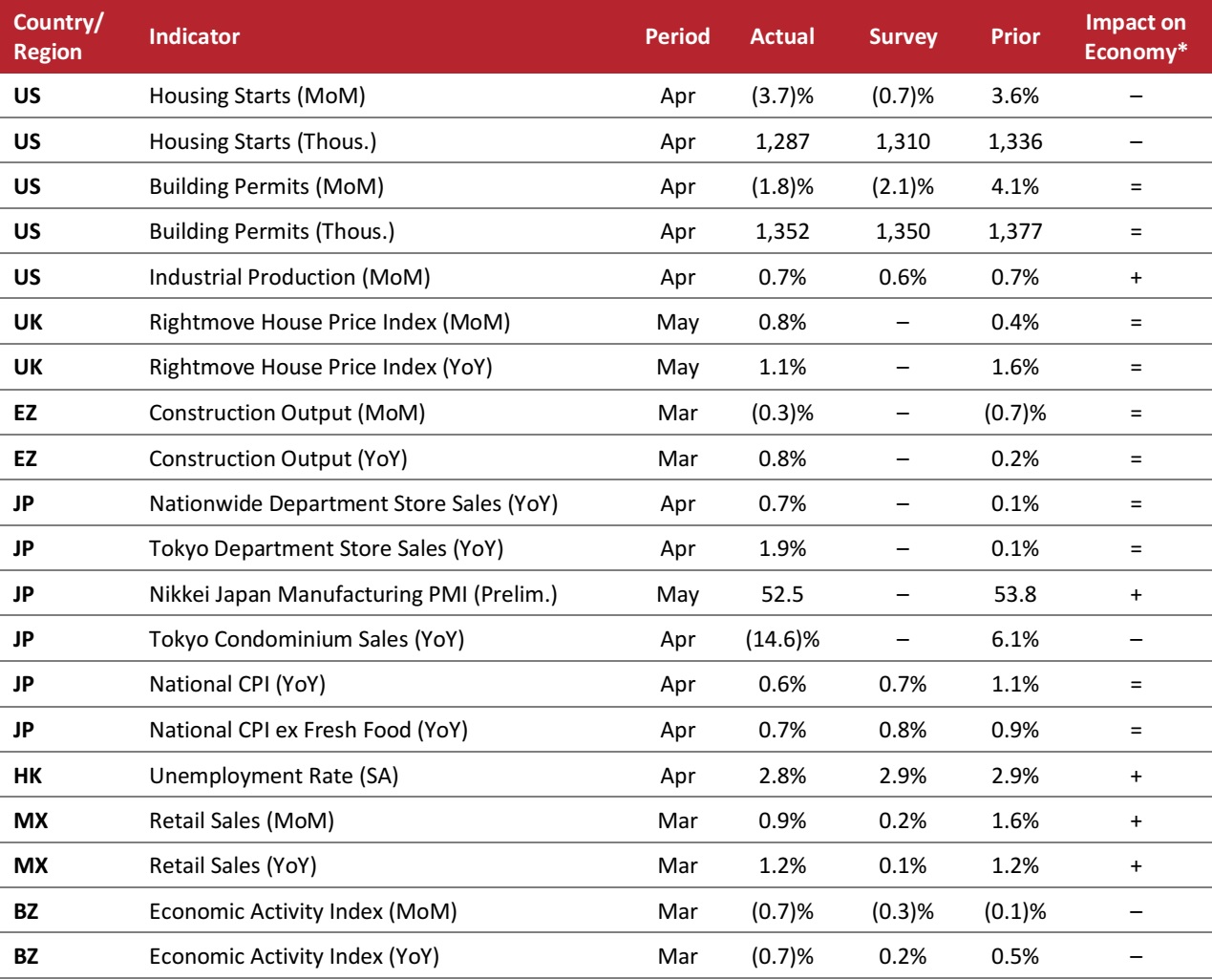

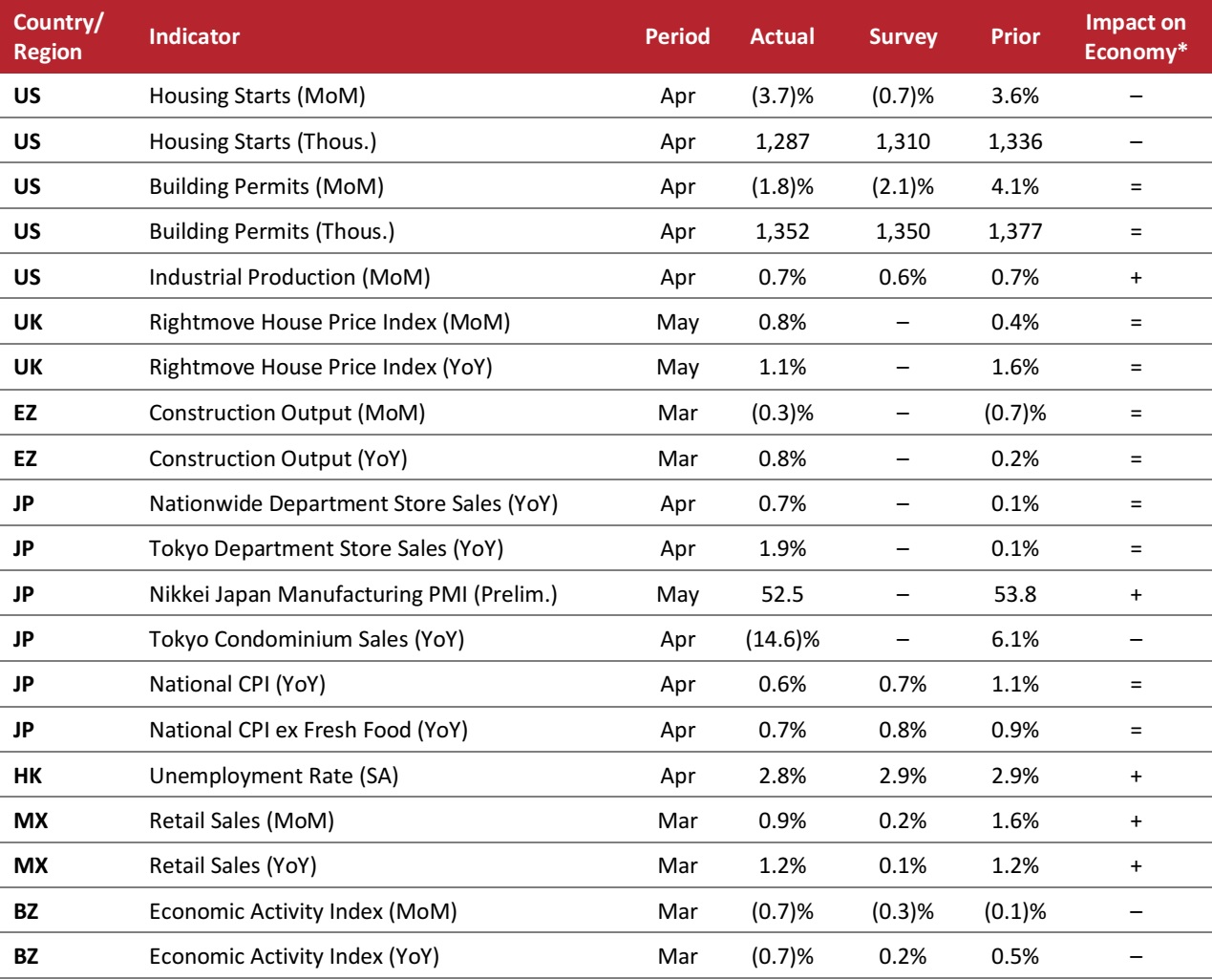

Key points from global macro indicators released May 16–23, 2018:

- US: Housing starts decreased by 3.7% month over month in April, to 1,287,000, coming in below the consensus estimate. Building permits dropped by 1.8% month over month in April. Industrial production increased by 0.7% month over month in April.

- Europe: In the UK, house prices increased by 0.8% month over month and by 1.1% year over year in May. In the eurozone, construction output decreased by 0.3% month over month in March, but increased by 0.8% year over year.

- Asia-Pacific: In Japan, Tokyo department store sales increased by 1.9% year over year in April, while Tokyo condominium sales dropped by 14.6% year over year. Consumer prices in Japan showed positive growth in April. In Hong Kong, the unemployment rate edged down further in April, to 2.8%.

- Latin America: In Mexico, retail sales increased by 0.9% month over month and by 1.2% year over year in March. In Brazil, the Economic Activity Index dropped by 0.7% year over year in March; the reading was below the consensus estimate, which called for a 0.2% increase.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Federal Reserve/Rightmove/Eurostat/Japan Department Store Association/Markit/Real Estate Economy Research Institute/Japan Ministry of Internal Affairs and Communications /Hong Kong Census and Statistics Department/Instituto Nacional de Estadística y Geografía/Banco Central do Brasil/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Federal Reserve/Rightmove/Eurostat/Japan Department Store Association/Markit/Real Estate Economy Research Institute/Japan Ministry of Internal Affairs and Communications /Hong Kong Census and Statistics Department/Instituto Nacional de Estadística y Geografía/Banco Central do Brasil/Coresight Research

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research BJ’s Wholesale Files for IPO in Shifting US Retail Landscape

(May 17) CNBC.com

BJ’s Wholesale Files for IPO in Shifting US Retail Landscape

(May 17) CNBC.com

PayPal Buying Swedish Startup iZettle for $2.2 Billion, Expanding Retail Payment Business

(May 18) TheGlobeandMail.com

PayPal Buying Swedish Startup iZettle for $2.2 Billion, Expanding Retail Payment Business

(May 18) TheGlobeandMail.com

*Gross margin is for the UK only; Marks & Spencer does not report gross profit at a group level.

**Marks & Spencer did not provide end-of-year store numbers for fiscal year 2018.

Source: Company reports/Coresight Research

*Gross margin is for the UK only; Marks & Spencer does not report gross profit at a group level.

**Marks & Spencer did not provide end-of-year store numbers for fiscal year 2018.

Source: Company reports/Coresight Research Carrefour May Close 227 DIA Stores in France After June 4

(May 21) Reuters.com

Carrefour May Close 227 DIA Stores in France After June 4

(May 21) Reuters.com

Pets at Home Group Grows Full-Year Revenues, Comps

(May 22) Company press release

Pets at Home Group Grows Full-Year Revenues, Comps

(May 22) Company press release

MediaMarktSaturn and Fnac Darty Form Retail Alliance

(May 17) EcommerceNews.eu

MediaMarktSaturn and Fnac Darty Form Retail Alliance

(May 17) EcommerceNews.eu

Tencent’s WeChat Allows Residents in China’s Most Populous Province to Skip Government Queues

(May 23) SCMP.com

Tencent’s WeChat Allows Residents in China’s Most Populous Province to Skip Government Queues

(May 23) SCMP.com

Salesforce Wants More User Success Stories in Brazil

(May 16) ZDNet.com

Salesforce Wants More User Success Stories in Brazil

(May 16) ZDNet.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Federal Reserve/Rightmove/Eurostat/Japan Department Store Association/Markit/Real Estate Economy Research Institute/Japan Ministry of Internal Affairs and Communications /Hong Kong Census and Statistics Department/Instituto Nacional de Estadística y Geografía/Banco Central do Brasil/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Federal Reserve/Rightmove/Eurostat/Japan Department Store Association/Markit/Real Estate Economy Research Institute/Japan Ministry of Internal Affairs and Communications /Hong Kong Census and Statistics Department/Instituto Nacional de Estadística y Geografía/Banco Central do Brasil/Coresight Research