Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

Luxury Brands Are Employing Social Values, Sustainability and Limited-run Collaborations Luxury brands are employing social values, sustainability and limited-run collaborations to enhance their brand positioning and attract new luxury consumers. Differentiation has become one of the biggest problems for luxury brands in this ever-changing industry. Having an appropriate point of differentiation is key to becoming an industry leader. Social values in the luxury industry now include greater accessibility, gender equality, size inclusion and design diversity. Luxury brands have to navigate the fine line of greater inclusivity while maintaining elements of exclusivity. Many consumers today are willing to pay more for sustainable products, especially millennials, who are social media disrupters and are gradually becoming the main force of luxury consumption. Sustainable luxury is far more than environmental protection: It promotes innovation, creativity and social contribution. In today’s luxury business, limited-run collaborations are becoming an increasingly important tool for branding. Limited-run collaborations let seemingly disparate brands share the benefits – and carry greater consumer appeal due to their limited nature. Digitalization has leveled the luxury marketplace and once-exclusive brands with very limited distribution can now be easily found online: Farfetch and other online luxury shops are broadening access to luxury brands. This is just one of the factors pushing change in luxury: greater access is also pushing brands toward greater inclusivity. The luxury goods industry is beginning to pay more attention to the diversity of culture and sizes. Direct-to-consumer luxury brand Reformation announced it would extend sizing with a “permanent inclusive” sizing collection after success with plus-sized denim. By designing unisex clothes and products, a number of high-end luxury designers, such as Chanel and Salvatore Ferragamo, have sought to dissolve gender rules. Shoppers increasingly expect brands to be environmentally friendly – and luxury is no exception. According to a Cotton Inc. Supply Chain Insights report released in May 2018, around half of US consumers said they paid more to buy clothing made from natural fibers. In fact, luxury’s higher price tag means consumers actually expect more in terms of sustainability and social responsibility. Changing consumer preferences have actively inspired brands to re-examine their sustainability profiles – and in many cases take steps to enhance their positions. LVMH’s program LIFE 2020, launched in 2015, outlines a course in four strategic areas: the environmental footprint of the products, sustainable procurement, greenhouse gas emissions and the environmental impact of production facilities and stores. Luxury brands are also collaborating to create new products, offering access to new consumer segments as they unite seemingly disparate brands. The Louis Vuitton X Supreme is one example: Supreme is a US street brand established in 1994. It is a representative of skateboarding and hip-hop fashion culture, and has a large number of fans among young people. Its product collaboration with Louis Vuitton was highly successful. Luxury has gradually transformed from an ethos of exclusivity and uniqueness to one of inclusivity, transparency and egalitarianism. Consumers are paying increasing attention to sustainability, especially millennials, who are social media disrupters and are gradually becoming the main force in luxury consumption. Limited-run collaborations have become an increasingly important tool for successful branding. It allows seemingly disparate brands to share the prestige, image and popularity, while also improving both brands’ reputations. Get more information from our report Luxury Differentiation via (Social) Values, Sustainability and Limited-Run Collaborations. Click to see day 1 insights, day 2 insights and day 3 insights.

Click to see day 1 insights, day 2 insights and day 3 insights.

US RETAIL & TECH HEADLINES

Weak US Retail Sales, Industrial Output Highlight Slowing Economy

(May 15) Reuters

Weak US Retail Sales, Industrial Output Highlight Slowing Economy

(May 15) Reuters

- US retail sales unexpectedly fell in April as households cut back on purchases of motor vehicles and a range of other goods, pointing to a slowdown in economic growth after a temporary boost in the first quarter.

- The Commerce Department said retail sales slipped 0.2% last month after surging 1.7% in March, the largest increase since September 2017. Retail sales in April increased 3.1% from a year ago.

Adobe Adds Amazon Selling and Other New Features to its Magento E-commerce Platform

(May 14) Digital Commerce 360

Adobe Adds Amazon Selling and Other New Features to its Magento E-commerce Platform

(May 14) Digital Commerce 360

- Adobe Systems announced several updates to its Magento ecommerce platform at its Imagine user development conference. Adobe is adding Amazon.com integrations and Google Shopping ad tools.

- The new Magento Amazon Sales Channel enables Magento merchants to more easily sell on Amazon by integrating product catalogs with the marketplace and enabling merchants to manage Amazon listings.

- The biggest retailer in the world will now offer next-day delivery for online orders, following Amazon, which on April 25 announced plans for one-day delivery for all Amazon Prime members.

- Walmart it is rolling out next-day delivery in Phoenix, Las Vegas and California over the next few days and plans to reach roughly 75% of US consumers by the end of 2019, including 40 of the top 50 major metros.

- Grocery Outlet believes it’s the perfect time to go public. The 73-year-old discount supermarket has grown to more than 300 stores in the US, most on the west coast. It hopes to raise $100 million.

- Grocery Outlet is profitable: It reached $2.3 billion in revenue a year ago. Its success is yet another sign of strength in discount sectors of the grocery and retail industries.

- Walmart indicated that shoppers will absorb some of the costs from President Donald Trump’s tariffs on Chinese imports.

- Walmart’s response to potential higher levies will likely set the tone for other discount retailers. In its favor, Walmart’s clout with suppliers gives it more room to maneuver.

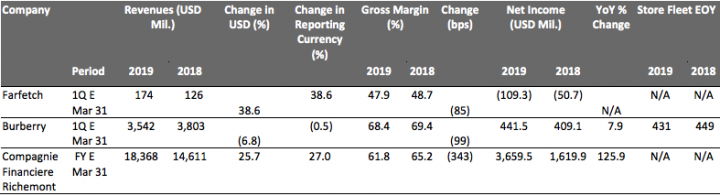

EUROPE RETAIL EARNINGS

[caption id="attachment_88960" align="aligncenter" width="720"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

- Stephen Clarke, CEO of WH Smith, has decided to step down from his position on October 31. Clarke has served as group CEO for the last six years and been with the company for 15 years.

- Carl Cowling, MD of the WH Smith High Street business since 2017, has been appointed as group CEO starting November 1.

Sports Direct Dissolves Stake in MySale Group

(May 20) Bloomberg.com

Sports Direct Dissolves Stake in MySale Group

(May 20) Bloomberg.com

- According to a regulatory filing on Monday, Sports Direct founder Mike Ashley has sold his stake in Australian online retailer MySale Group for an undisclosed amount. Sports Direct, the fourth largest shareholder of MySale Group, had a 4.8% stake in the company.

- The sale follows MySale Group’s withdrawal from the UK market. Earlier this month, MySale sold its UK website cocosa.co.uk to BrandAlley to focus on the Australia and New Zealand markets.

Amazon Invests in Food Delivery Company Deliveroo

(May 17) Company press release

Amazon Invests in Food Delivery Company Deliveroo

(May 17) Company press release

- Amazon has invested $575 million in UK online food delivery service Deliveroo. With this investment, alongside existing backers such as T. Rowe Price, Greenoaks and Fidelity, Deliveroo has raised $1.53 billion.

- Deliveroo plans to invest in its UK tech team, develop new products, expand its delivery reach and launch new innovations.

- Sir Philip Green, Chairman of Arcadia Group, is considering closing the group’s international stores as part of a restructuring plan.

- Arcadia, which includes a string of banners including Topshop, Miss Selfridge and Wallis, also said that if it cannot reach an agreement on the closure of nearly 50 UK stores, rental cuts and a reduction in annuity payments before the group’s next rental payment at the end of June, Arcadia could face administration.

- Britain’s health and beauty retailer Boots has introduced a digital version of its Advantage loyalty card. Currently, Boots’ Advantage plan has nearly 17.1 million active members.

- The digital card is linked to the Boots app and will allow users to collect and redeem loyalty points directly from smartphones.

CMA Plans to Review JD Sports-Footasylum Deal

(May 17) Gov.uk

CMA Plans to Review JD Sports-Footasylum Deal

(May 17) Gov.uk

- Britain’s Competition and Markets Authority (CMA) intends to investigate the JD Sports acquisition of smaller rival Footasylum. The CMA will assess if the acquisition represents a significant reduction in competition in the UK market.

- JD Sports, which already owns a 19% stake in Footasylum, announced in March a £90 million ($120 million) bid for the shares it does not own. JD Sports and Pentland Group – Footasylums’ parent company – have been prohibited from taking further measures to merge the two businesses until the CMA makes a decision.

ASIA RETAIL AND TECH HEADLINES

- Italian denim brand Replay has opened its first store in India, in partnership with Reliance brands. The store will showcase denim wear, casual wear, footwear and accessories.

- The new store is located in Ambience Mall, near New Delhi. Replay is planning to open a flagship store in Maker Maxity mall and three other stores in Mumbai and New Delhi later this year.

Alibaba Invests in Furniture Chain Macalline

(May 17) insideretail.asia

Alibaba Invests in Furniture Chain Macalline

(May 17) insideretail.asia

- Alibaba has invested $640 million in China’s furniture retailer Red Star Macalline Group. Alibaba made the investment in the form of convertible bonds issued by Macalline’s controlling shareholder.

- Alibaba has acquired 3.7% of Macalline’s Hong Kong-traded shares and can acquire 10% of Macalline’s Shanghai-traded shares if it converts all its bonds. The deal shows renewed interest by Alibaba in the home furnishing business.

- La Roche Posay, a subsidiary of French personal care company L’Oréal, launched the Effaclar Spotscan anti-acne advice app for the China market at the Viva Technology Paris 2019 event, in partnership with Alibaba.

- Effaclar Spotscan will be unveiled on Alibaba’s e-commerce platforms Tmall and Taobao in June 2019. The app will offer personalized advice and skin care remedies using artificial intelligence technology.

- English Premier League football team Wolverhampton Wanderers plans to open a Wolves Megastore retail outlet in Shanghai. The store will open on July 15, when the team plays in the Premier League Asia Trophy tournament to be held in Shanghai and Nanjing.

- Wolverhampton Wanderers’ MD Laurie Dalrymple said that the club sees China as a key market, both in terms of fan acquisition and to develop its commercial aspirations.

- Hong Kong luggage retailer Samsonite will open its first Asian premium store at Jewel Changi Airport, Singapore. The premium store offers a more luxurious shopping experience.

- Samsonite has also opened an American Tourister store at Jewel Changi Airport and plans to open a store in the Funan Mall in Singapore in the second half of this year.

Spencer’s Retail to Acquire Nature’s Basket

(May 20) yourstory.com

Spencer’s Retail to Acquire Nature’s Basket

(May 20) yourstory.com

- Indian retailer Spencer’s has announced it will acquire grocery retailer Godrej Nature’s Basket in a cash deal worth INR 3 billion ($43 million). This deal is subject to the approval of the shareholders of both companies.

- Once completed, Spencer will have access to 36 Nature Basket stores in Mumbai, Pune and Bengaluru.

LATIN AMERICA RETAIL AND TECH HEADLINES

- US retailer Bath & Body Works will open its first store in Guatemala in the last week of May. The retailer has more than 23 stores in South and Central America in partnership with regional companies.

- The new 1,012-square-foot store will be in the Miraflores shopping center and offer products such as the classic Signature Collection, Aromatherapy, Coco Shea, Water, Men’s and Home Fragrance.

Falabella to Sell its Products via Linio in Colombia and Peru

(May 20) fashionnetwork.com

Falabella to Sell its Products via Linio in Colombia and Peru

(May 20) fashionnetwork.com

- Chilean department store chain Falabella has announced it will start selling on Mexican e-commerce retailer Linio in Colombia and Peru in the next two months. The companies have completed the integration in Chile.

- Falabella acquired Mexican e-commerce retailer Linio in August 2018 to sell Falabella products on the Linio site as part of its plan to improve e-commerce sales in all regions.

Mercado Libre Offers New Brands on its Virtual Platform in Peru

(May 20) America-retail.com

Mercado Libre Offers New Brands on its Virtual Platform in Peru

(May 20) America-retail.com

- Latin American e-commerce site Mercado Libre launched three new brands in Peru on May 20, including technology brand Bitel, beauty brand Kareol and sports brand Best, with products selling at a 50% launch discount.

- Technology, beauty and sport categories account for more than 80% of sales made by Mercado Libre in Peru. Mercado Libre allows new brands to sell directly through its site, strengthening its digital strategy.

- Argentina sports retailer Dexter has set up “smart mirrors” in its Buenos Aires stores.

- Customers can get information about available colors and sizes of garments and suggestions on clothing combinations using the “smart mirrors.”

- Walmart Mexico has launched this year’s days of discount “Hot Days.” Price reductions, bonuses and interest-free payment facilities will be available online, on the app and in stores between May 27 and 31.

- In 2018, Walmart’s Hot days event was exceptional, as it was the first omnichannel experience for shoppers in Mexico. The main intention of Hot Days is to promote Walmart’s e-commerce offering by combining the online shopping experience with the physical store.

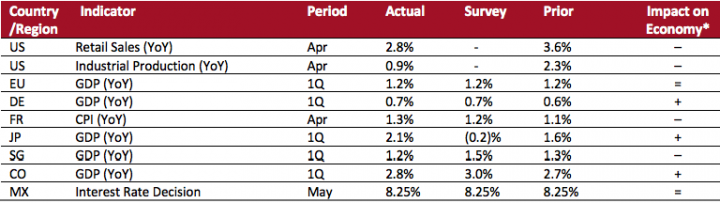

MACRO UPDATE

Key points from global macro indicators released May 15-21, 2019:- US: Seasonally adjusted retail sales grew 2.8% year over year in April, down from 3.6% in March. The home-improvement and clothing sectors witnessed sales growth of 1.2% and 0.2% in April, respectively, slower than 3.4% and 2.4% growth reported in March. US industrial production increased 0.9% year over year in April, the smallest increase since February 2017, slowing from a revised 2.3% growth in March.

- Europe: Eurozone GDP increased 1.2% year over year in the first quarter of 2019, the same pace as in the fourth quarter of 2018 and in line with the consensus estimate. In Germany, GDP advanced 0.7% year over year in the first quarter, up slightly from 0.6% in the fourth quarter of 2018 and in line with the consensus estimate. France’s consumer price index (CPI) rose 1.3% year over year in April from 1.1% in March and above the consensus estimate of a 1.2% rise.

- Asia Pacific: In Japan, GDP expanded 2.1% year over year in the first quarter, following a revised 1.6% increase in the fourth quarter of 2018 and beating the consensus estimate of a 0.2% decline. Singapore’s GDP grew 1.2% year over year in the first quarter, the slowest growth since the second quarter of 2009, below both the consensus estimate of a 1.5% rise and the 1.3% increase reported in the fourth quarter of 2018.

- Latin America: Colombia’s GDP increased 2.8% year over year in the first quarter versus the consensus estimate of a 3.0% rise and following a revised 2.7% growth reported in the fourth quarter of 2018. Mexico’s central bank left its key interest rate unchanged at a decade high of 8.25%, in line with the consensus estimate.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: US Census Bureau/Bureau of Economic Analysis/Eurostat/Destatis, Germany/CEIC/Statistics Bureau, Japan/Department of Statistics Singapore/Coresight Research[/caption]

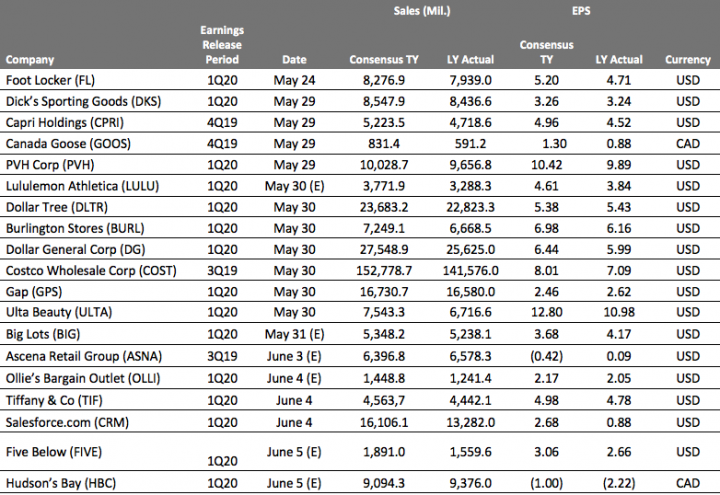

EARNINGS CALENDAR

[caption id="attachment_88990" align="aligncenter" width="720"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

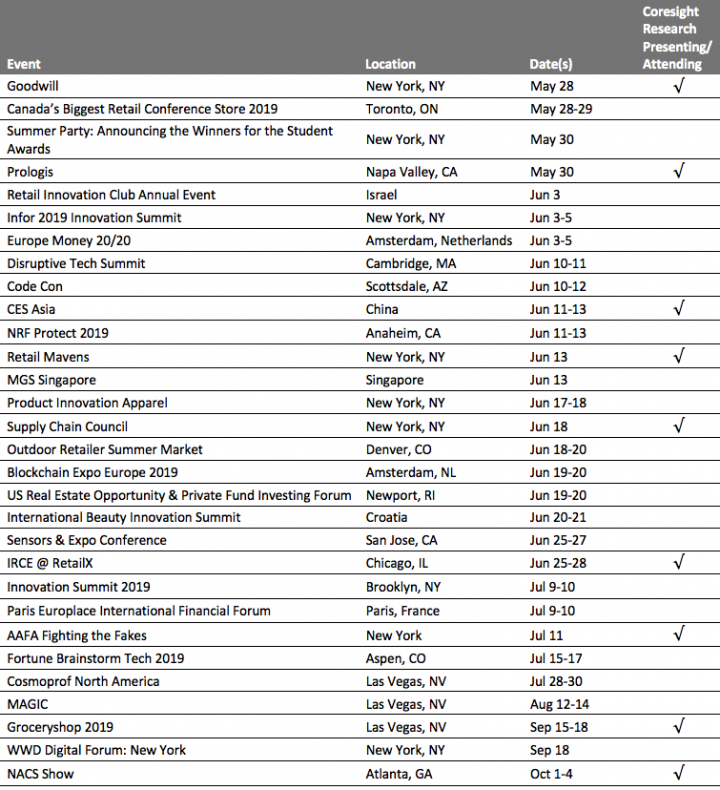

EVENT CALENDAR