albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Gauging the Lockdown-Driven Slump in Europe Discretionary Retail

In Europe, lockdowns are being eased, implying that we are on the cusp of a (likely tentative) recovery for discretionary retailers. However, newly released data points continue to add to the picture of decline amid lockdowns. We discuss what our Europe retail team has seen recently, with a focus on the apparel category.

H&M reported deep declines in major markets for the period March 1 to May 6 (which includes periods prior to lockdowns in some countries): Sales in France were down 71%, Germany down 46% and UK sales down 60%. At a group level, total sales were down 57%, within which online sales were up 32%.

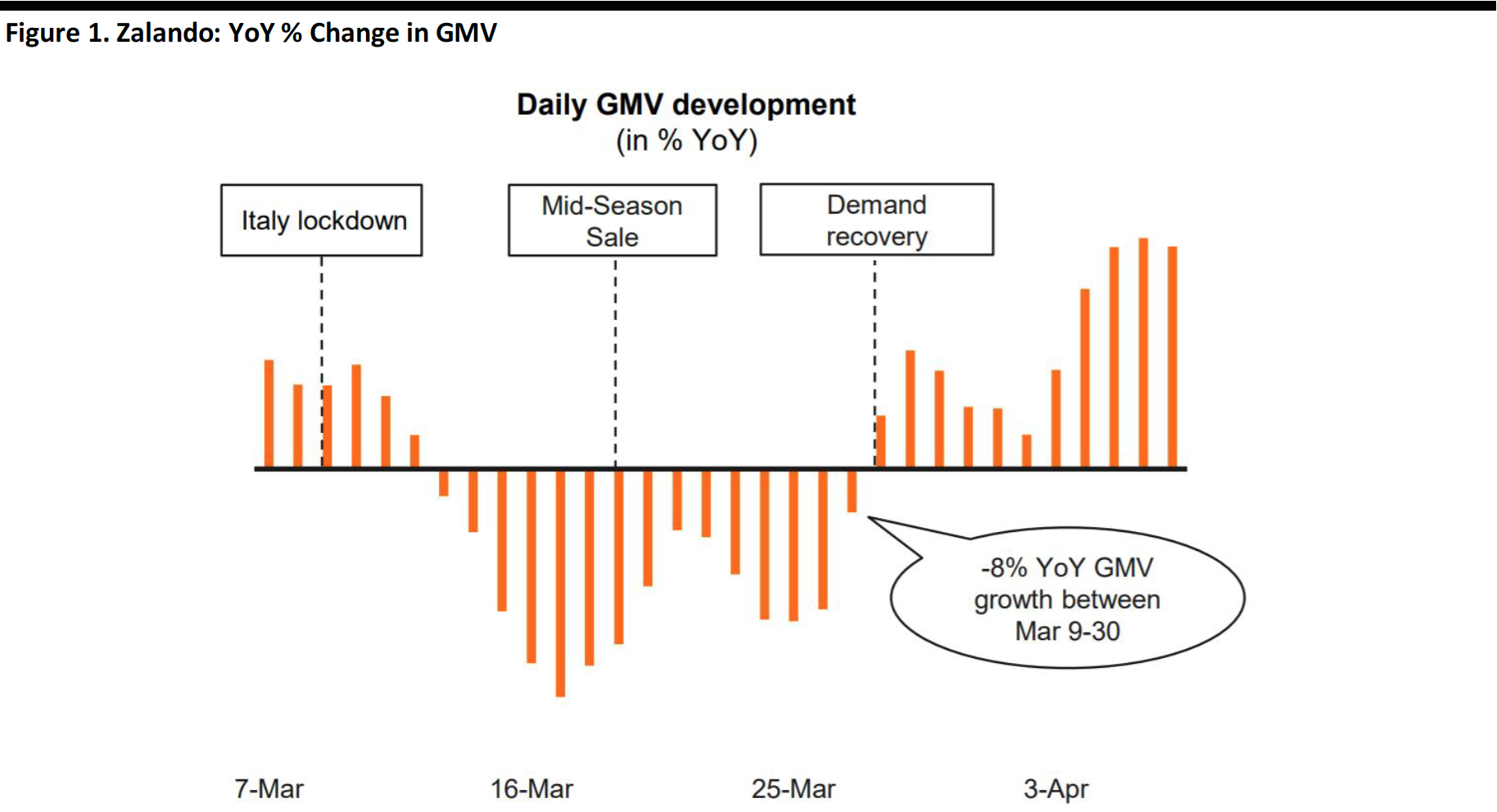

Zalando, whose main market is Germany, saw a sharp decline in March followed by a recovery in April. Reporting first-quarter 2020 results, management guided for 10–20% growth in both gross merchandise volume and revenues for the full year.

[caption id="attachment_109692" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

In the UK, Sainsbury’s Group reported that clothing sales were down 53% in the seven weeks to April 25 (which includes a short period before the UK lockdown began on March 23). General merchandise sales in Sainsbury’s supermarkets were down 22% over the same period.

Sainsbury’s owns general merchandiser Argos, and this banner grew its sales by 9% in the seven weeks ended April 25—this was despite trading online only from March 23 as nonessential stores were forced to close (Argos continues to offer buy-and-collect services from its stores within Sainsbury’s supermarkets, but its 573 standalone Argos stores are shut). Sainsbury’s management attributed this exceptional performance to shoppers equipping themselves for life at home during lockdown and guided for low-teens-percentage sales declines at Argos during the lockdown period in its current half year, as those purchases ease.

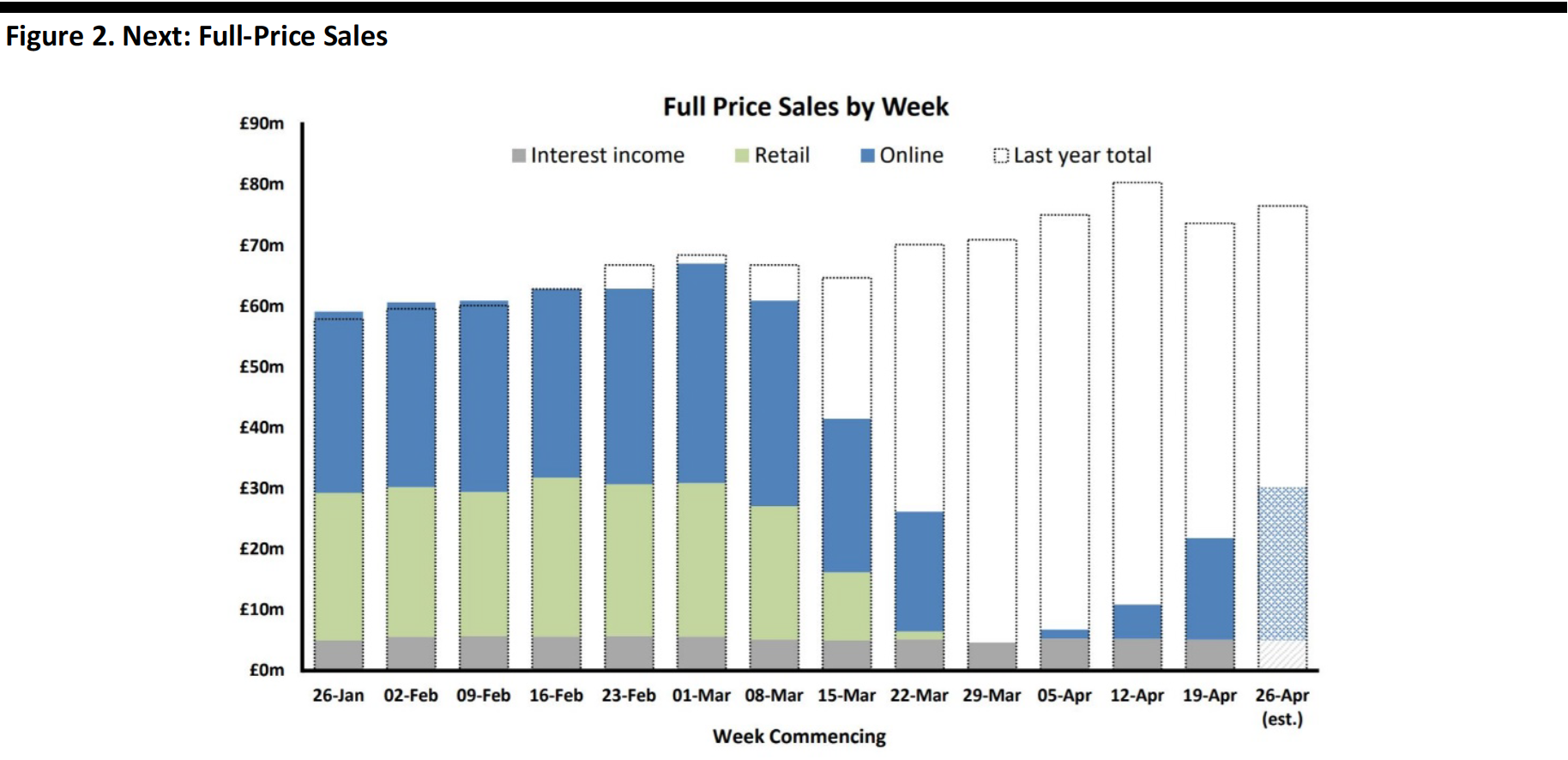

UK fashion retailer Next was one of the first to present a detailed picture of demand, reporting full-price product sales down 41% in the period January 26 to April 25. In-store sales were down 52%, while online was down 32%. As shown below, these averages conceal much sharper declines after the UK lockdown began on March 23, and on March 26, Next temporarily closed its UK warehouses serving online sales.

[caption id="attachment_109693" align="aligncenter" width="700"] Source: Company reports[/caption]

Source: Company reports[/caption]

The British Retail Consortium (BRC) this week reported that total UK retail sales were down by 19.1% for April (formally April 5 to May 2), the first full month of lockdown. Online nonfood sales increased by 57.9% in April, taking e-commerce to 69.9% of total nonfood sales, versus 29.9% in the same month one year earlier. For the three months ended April, in-store sales of nonfood items were down 36% (the BRC splits total food and nonfood performance on a rolling three-month basis).

The latest data from the UK’s Office for National Statistics are for March, when clothing and footwear specialist stores saw sales fall by 34.2% and 44.2%, respectively. The Office for National Statistics reports UK retail sales for April on May 22, and we estimate that the store-based nonfood retail sector will report a total year-over-year sales decline of close to three-quarters for the month, with e-commerce accounting for the lion’s share of remaining sales in this sector.

In Germany, meanwhile, sales at clothing and footwear specialist stores fell 51.9% year over year in March, according to Eurostat.

US RETAIL AND TECH HEADLINES

Loves Furniture Acquires 27 Art Van Stores

(May 12) Company press release

- American furniture retailer Loves Furniture has acquired the inventory and assets of Art Van Furniture portfolio’s 27 US stores in a $6.9 million deal. The stores formerly operated under the Art Van Furniture, Levin Furniture and Wolf Furniture brands.

- Loves Furniture intends to re-brand all the purchased stores and add them to its growing portfolio. The retailer plans to add over 1,000 new employees and will consider re-hiring Art Van employees who recently lost their jobs due to store closures.

GNC Sales Decline; Weighs Chapter 11 Bankruptcy

(May 11) Company press release

- Health-supplements retailer GNC has announced revenue of $472.6 million, representing a year-over-year decline of 16.3%, for the quarter ended March 31, 2020. The company recorded a $157.5 million asset impairment related to disruption from the coronavirus pandemic, which led to a net loss of $200.1 million.

- GNC reported that it is evaluating refinancing and restructuring options for its borrowings, including the potential for a Chapter 11 bankruptcy filing if it cannot convince lenders to delay $50 million in debt payments due May 16. The company has a negative free cash flow of $15.9 million and $137.4 million in cash and cash equivalents.

Simon Property Group Revenues Tumble; To Reopen Half of Its Properties in the Coming Week

(May 11) Company press release

- Real-estate investment trust Simon Property Group reported a 20.2% year-over-year decline in net income to $437.6 million in the first quarter of 2020, ended March 31. Revenues were down 7% to $1.4 billion.

- The company expects to reopen nearly half of its retail properties by May 18, which will implement social distancing and safety measures. The company was forced to temporarily close all of its US centers in March due to the coronavirus lockdown.

Under Armour Sales Decline 23% Due to Lockdowns

(May 11) Company press release

- Under Armour reported a 23% year-over-year decline in revenue to $930.2 million for the first quarter ended March 31, 2020, due to the impact of the coronavirus. The net loss was $589.7 million, compared with a profit of $22.5 million in the previous year.

- The retailer plans to temporarily lay off some retail employees and cut about $325 million in operating costs in 2020, to help it weather the impact of the crisis.

KKR To Invest $750 Million in Coty

(May 11) Company press release

- Beauty company Coty has announced a strategic partnership with global investment firm KKR, under which Coty will receive an initial investment of $750 million through the sale of convertible preferred shares to KKR. Coty has also agreed to sell a majority stake in its professional beauty and hair brands Wella, Clairol, OPI and ghd to KKR at an enterprise value of $4.3 billion.

- Coty will carve out Wella into a standalone entity as part of the deal, in which KKR will acquire a 60% stake, with Coty holding the remainder. Coty reported a sales decline of 23% year over year to $1.5 billion in the three months ended March 31 and announced plans to reduce fixed costs by $700 million.

EUROPE RETAIL AND TECH HEADLINES

UK Retail Sales Drop in April Due to Lockdowns

(May 13) BRC.org.uk

- UK retail sales plunged 19.1% year over year in April, according to the BRC-KPMG Retail Sales Monitor, the sharpest decline in sales on record, due to the enforced closure of nonessential stores. Comparable sales, excluding shops that have been forced to close, increased 5.7% year over year in April, as online retailers performed strongly.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended April, total food sales increased 4.5% and total nonfood sales were down 17.5%. Online sales excluding food items increased by 57.9% in April, significantly above the average annual growth rate of 8.5%.

Morrisons Sales Up in First Quarter; Expands Online Offering

(May 12) Company press release

- British supermarket chain Morrisons reported a 5.7% increase in total sales excluding fuel for the first quarter, ended May 10, 2020. The company’s comparable sales excluding fuel were up 5.7% for the quarter, of which retail contributed 5.1% and wholesale 0.6%.

- Morrisons has expanded its online offering significantly, providing different home-delivery options, especially for vulnerable customers. It aims to offer click-and-collect from almost 280 Morrisons stores by mid-June, up from the six trial stores in mid-March.

Lidl Launches WhatsApp Chatbot To Provide Store Traffic Information

(May 12) ChargedRetail.co.uk

- Lidl has launched an online chatbot via messaging platform WhatsApp in Ireland. Customers can now send a message to Lidl through the messaging app with the day and time they intend to visit, while the chatbot notifies them of the store’s traffic status to avoid queues.

- The program uses real-time data and customer transaction numbers to assess which hours of the day are quietest or busiest, so that customers can schedule their shopping trips accordingly.

Kingfisher First-Quarter Sales Drop 24% Due to Lockdown

(May 12) Company press release

- Home-improvement retailer Kingfisher reported a 24% decline in sales to £2.2 billion ($2.7 billion) for the first quarter ended April 30, due to the coronavirus lockdown. E-commerce sales were up 251.7% in April in comparison to a 59.0% increase in March.

- Kingfisher stated that it has taken effective measures to reduce costs and preserve cash. The company has access to over £2 billion ($2.5 billion) in total liquidity as of May 8, 2020, with cash balance of £700 million ($865 million).

Asda Launches Dedicated Website for Its Cupboard Filler Food Box

(May 11) Company press release

- Asda has launched a new dedicated online platform, foodboxes.asda.com, in partnership with e-commerce tech firm StarStock, to enable vulnerable customers to purchase its “Cupboard Filler” food box. Asda promises to deliver the food box within two days of an order being placed.

- The new food box contains 31 essential items that have been in high demand during the lockdown. It is priced at £30 ($37), including the delivery cost. Asda stated that the delivery will be made by a third-party vendor to prevent additional pressure to the retailer’s existing grocery delivery service.

ASIA RETAIL AND TECH HEADLINES

Paytm Mall Records 50% Increase in Demand for Electronic Products

(May 12) EconomicTimes.com

- Indian e-commerce platform Paytm Mall has recorded a 50% increase in demand for electronic products after the government allowed online sales of nonessential products from May 4 in zones that were less affected by the coronavirus. The platform has recently seen a surge in demand for electronic products, including mobile phones, headphones, speakers and electronic accessories.

- Paytm Mall has also witnessed demand for board games, such as chess, monopoly and scrabble. The company expects strong sales in nonessential categories over the coming weeks.

Alumak Partners with Lazada To Provide Working Capital Loans

(May 12) InsideRetail.asia

- Indonesian fintech startup Alumak has partnered with e-commerce company Lazada to provide working capital loans to Lazada’s online merchants. Alumak will provide online merchants with a working capital of up to $5,000 after sourcing funds from its credit partners.

- Business owners can draw down the capital in full or in part, and the interest will be charged only on drawn funds. This partnership enables online merchants to get access to funding and help them keep their businesses afloat during the coronavirus crisis.

Razer To Set Up Vending Machines for Masks

(May 11) ChannelNewsAsia.com

- Gaming products manufacturer Razer plans to set up vending machines in Singapore to distribute about 5 million free surgical masks. The company will install 20 vending machines at various malls and co-working spaces by June 1, 2020.

- To receive a mask, users will have to download Razer’s digital wallet app, Razer Pay, and scan a QR code at the vending machine. Currently, Razer can manufacture up to 5 million masks per month, and it plans to expand production to 10 million masks per month.

IKEA To Open Small-Store Concept in Singapore

(May 11) InsideRetail.asia

- IKEA plans to open its first Southeast Asian small-store concept at Jem shopping mall in Singapore next year. The new store will feature IKEA’s entire product range as well as the IKEA restaurant, but it will not feature a children’s play area.

- The store will span an area of about 70,000 square feet across three floors and will be the retailer’s third store in Singapore, in addition to its stores in Alexandra and Tampines.

SPAR Expands Store Footprint in China

(May 11) Company press release

- Supermarket chain SPAR has expanded its footprint with the opening of six new supermarkets in China. The new supermarkets opened in three provinces between March 13 and May 1.

- SPAR opened four supermarkets in the Guangdong province and one supermarket each in Beijing and Shandong.