Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

How Are US Consumers Shopping for Groceries Online? Grocery has been a laggard in the e-commerce space: We estimate that e-commerce will capture around 2.7% of US food and drink retail sales this year versus around 20% of US nonfood retail sales. But the grocery e-commerce market is evolving fast — and, month by month, it is pulling in more shoppers. Our second annual US Online Grocery Survey published this week showed the scale of growth, with more than one-third of US consumers now shopping for groceries on the Internet. Some 36.8% of respondents said they bought groceries online in the past year, up substantially from 23.1% in last year’s survey. Based on Census Bureau adult population data, that equates to roughly 35 million more consumers buying groceries online between 2018 and 2019, taking the total pool of online shoppers to approximately 93 million US adults. However, many new online grocery shoppers appear to be tentative or occasional shoppers who are dipping their toes in the water instead of jumping in. And these cautious consumers seem to be diluting the proportion of grocery shopping the average shopper does online: When we asked respondents how much of their grocery shopping they do online, the proportion of online shoppers saying they do “most” or “all or almost all” of their grocery shopping online declined from a combined 14.3% in 2018 to 11.8% in 2019. Instead, we saw increases in the proportion doing “some” of their shopping online and the proportion doing “a small amount” of their shopping online. Further data points confirm that some shoppers buying grocery products online are not undertaking regular, full-basket shops on the Internet. Our survey again found that Amazon is the most-shopped retailer for online groceries, but its most-shopped service is not AmazonFresh or Prime Now — which are set up to deliver fresh food items — but its regular Amazon.com site, which delivers ambient grocery products that are shipped through the mail one or a few items at a time. This implies many Amazon shoppers are buying only limited types of grocery products on the Internet. Meanwhile, our data indicated that leading multichannel retailers such as Walmart, Target and Kroger are serving more conventional “large-basket” shopping trips online. We think these data points underline how nascent the US online grocery market is, and how unfamiliar online grocery shopping remains to many consumers. The pool of shoppers has widened substantially in the past year, and we expect that to continue. But those companies interested in growing the total online grocery market will need to convince these online shoppers, old and new, to spend more online, whether by converting them from purchasing a few items to a full basket, or by driving up their frequency of shop.

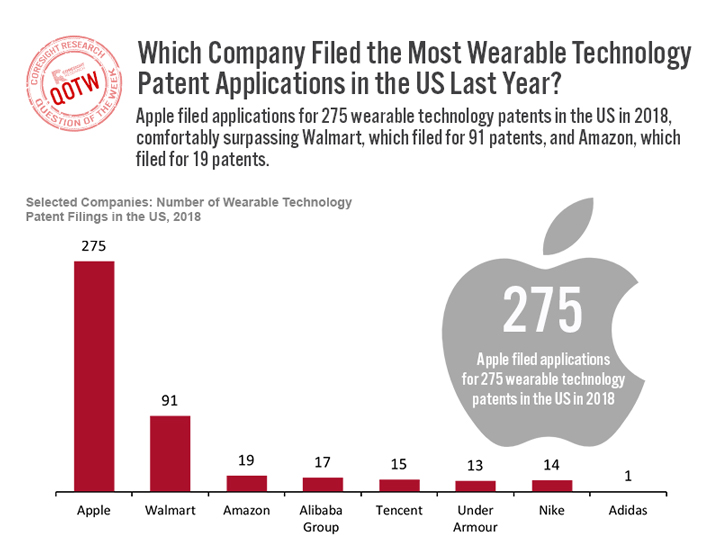

QUESTION OF THE WEEK

[caption id="attachment_88109" align="aligncenter" width="720"] Based on data for 66 selected major retail, consumer goods and technology companies.

Based on data for 66 selected major retail, consumer goods and technology companies. Source: Grata Data[/caption]

US RETAIL & TECH HEADLINES

- Uber’s disappointing initial public offering may be good reason for other tech companies going public this year to be concerned. The ride-hailing company priced its shares at $45 – and ended Friday 7.6% lower at $41.57 per share, a disappointing Wall Street debut.

- Although at least 10 companies this year went public and opened lower, Uber was the first company ever with a $4 billion-plus offering to do so.

- Target announced the 18 startups that will be participating in its two upcoming accelerator programs this year. The Metro Target Retail Accelerator, Certified by Techstars, is in its fourth year and for the first time is working in partnership with German wholesaler and retailer Metro AG.

- The Target Incubator is new this year and will host startups that promote “better for the world” ideas, according to Target.

- Nike made waves in 2018 with its introduction of the Nike Live store concept, a members-only store that relied heavily on the mobile app.

- Nike's latest advancement pushes the utility of its app even further. A new feature employs computer vision and the user's smartphone camera to scan a customer's feet and then applies that to the company's various shoe designs, providing customers with the recommended shoe size.

- Walmart is rolling out an online pet pharmacy and opening additional veterinary clinics. The retailer plans to bring its number of clinics to 100 from the current 21 in operation.

- Walmart will kick off the expansion with new clinics in the Dallas-Fort Worth area. In addition, Walmart will roll out a WalmartPetRX.com e-commerce pet pharmacy with prescriptions for cats, dogs, horses and livestock.

- Amazon Go was supposed to be frictionless digital experience: Customers come in, grab what they want, and the store automatically tabulates and bills them for the goods they walk out with — no human intervention required.

- But Amazon, which has been aggressively pursuing unbanked shoppers, made a quick about-face, assuring the press that, yes, cash would soon be an option in Go stores.

Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

- UK women’s wear retailer Select is expected to launch a company voluntary agreement (CVA) this week. It officially entered into administration on May 9.

- Cafer Mahiroglu, CEO of Select, said there will be no shop closures or lay-offs and the CVA will help revive the retailer. Select took out a CVA in April last year, saving nearly 2,000 jobs and cutting rents up to 75%.

- UK retail sales grew 4.1% year over year in April, versus last April’s rise of 3.1%, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales increased 3.7% year over year.

- In the three months ended April, total food sales grew 2.8% year over year, while nonfood sales declined 0.1%. According to the report, retail sales were below expectations this year as Easter fell in April compared to last year when it fell in March.

- American e-commerce company eBay has opened a new physical “concept store” at the i10 building in Wolverhampton, UK. The pop-up store will feature 40 small local companies showcasing their products for a month.

- The traders will be able to record sales and traffic metrics using QR codes, giving insights into the interaction between physical and online retail. They will offer free workshops and tutorials to create an interactive experience for customers.

- British fashion retailer Joules has appointed Nick Jones as its new CEO. Jones will replace Colin Porter, who served eight years.

- Prior to Joules, Jones worked with Marks & Spencer and Asda. Jones will start at the end of 2019 with an aim to increase the company’s growth and online business in the UK.

- British department store Debenhams received a green light from its creditors on Thursday to implement its CVA. The votes in favor were notably higher than the required minimum of 75% on each proposal.

- As a part of the plan, 22 stores are projected to close by January 2020, and a total of 50 stores in the long-term. The CVA calls for the company to review rents in 105 stores and place 1,200 jobs at risk.

- Sports Direct boss Mike Ashley is preparing to open 31 luxury “Frasers” stores over the next five years; these will reportedly be on the sites of existing House of Fraser stores and on some new sites. Frasers will focus on designer labels while House of Fraser will cater to more mass-market shoppers.

- Mike Ashley plans to invest hundreds of millions of pounds to relaunch House of Fraser. He bought the struggling department store out of administration last August for £90 million ($117 million).

ASIA RETAIL AND TECH HEADLINES

- Tmall has partnered with the New Zealand Food Basket, which owns 18 food and beverage brands, to give consumers in China direct access to buy New Zealand food and beverage products.

- Nine brands are now available: Pic’s, Babich, Vogel’s, Rockit, Future Cuisine, Pāmu, Zealong, Fiordland Lobster and Oha Honey, the remaining nine brands will begin selling on Tmall in June.

Alibaba and Bailian Joint Venture Ego Store Debut in Shanghai

(May 9) insideretail.asia

Alibaba and Bailian Joint Venture Ego Store Debut in Shanghai

(May 9) insideretail.asia

- Ego store, a joint venture between Alibaba and Bailian Group, has opened its first store in Shanghai. The store is the first of 500 fresh food and convenience stores the brand plans to open this year.

- The store is equipped with three self-checkout machines using Alipay and encourages customers to pay using Bailian wallet. About two-thirds of the Ego store area is dedicated to fresh products and the remaining space sells bottled and packaged foods.

Reliance Industries Buys Hamleys Toy Stores

(May 9) in.reuters.com

Reliance Industries Buys Hamleys Toy Stores

(May 9) in.reuters.com

- Indian conglomerate Reliance Industries has acquired toy retailer Hamleys from China’s C.banner International Holdings for $88.5 Million.

- Hamleys has 167 stores in 18 countries, out of which 88 stores are in India. Reliance Industries was already the master franchisee for the Hamleys brand in India.

- UK retailer WH Smith has extended its franchise partnership with Thailand’s travel retail group King Power to Singapore. The previous franchise deal covered Hong Kong only.

- The partnership aims to grow WH Smith’s presence in Singapore and explore opportunities in rail and metro stations, ferry terminals and commercial centers. It excludes airport locations, which WH Smith will continue to run directly.

- Walmart-owned Indian e-commerce company Flipkart announced the launch of its online grocery store Supermart in Mumbai on Wednesday. Supermart is already present in Bengaluru, Chennai, Hyderabad and Delhi.

- Supermart delivery will cover 85-90% of Mumbai. It offers 10,000 products, including 600 to 700 of its private labels.

- com has invested in a pig-farming business in collaboration with Jingqishen, a pork supplier company. JD.com will share some of its technological capabilities with Jingqishen to build a smart supply chain.

- JD’s facial recognition technology for hogs will be used to construct profiles for each pig and monitor its growth, while blockchain technology will trace a pig from birth to butcher. It will also use automated feeding devices and flexible fences.

- The Metropolitan Museum of Art in New York launched a flagship store on Alibaba’s Tmall on May 10.

- The online store will feature more than 50 products, including kitchen aprons, tableware, picture frames and umbrellas.

LATIN AMERICA RETAIL AND TECH HEADLINES

- American beauty brand Avon has launched its online store in Argentina. Avon aims to increase profits of independent resellers and promote its products with the new online platform.

- The store will also be available in an app version that will allow merchants to increase sales channels, connect with new shoppers and transform their social network contacts into a multiplied portfolio.

- Walmart has renovated its store in La Pampa, Argentina, as part of its structural improvement plan. It invested 68 million Argentine pesos ($1.5 million).

- Walmart is also carrying out a renovation project in Chile and will spend $136 million to remodel its stores nationwide in 2019.

- The Walmart Chile store in Isabel La Catolica is the second store in Chile to use the scan and pay app, the first is in the Lider Midmall supermarket in Maipú.

- The scan and pay app lets customers scan products as they shop, then pay through the app, no cashier lines necessary.

- US lingerie and beauty products retailer Victoria’s Secret will open its first flagship store in Chile at the Parque Arauco shopping complex this autumn.

- The flagship store will have an area of 8,073 sq. ft. where all its lingerie collections will be displayed, including its youthful Pink proposal, its Victoria Sport line and a range of beauty, accessories and perfumes.

Reebok Partners with Rappi to Provide Home Delivery in Chile

(May 13) america-retail.com

Reebok Partners with Rappi to Provide Home Delivery in Chile

(May 13) america-retail.com

- Footwear and apparel brand Reebok, owned by German sportswear retailer Adidas, has partnered with delivery startup company Rappi in Chile to provide home delivery.

- Reebok products are available in the Rappi mobile application, which can deliver them from Monday to Sunday during business hours between 10 am and 10 pm. The shipping cost is around 2,000 Chilean pesos ($3).

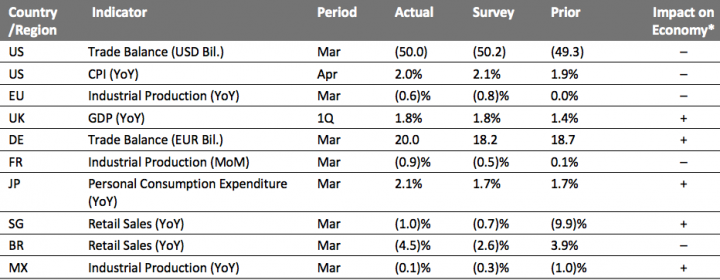

MACRO UPDATE

Key points from global macro indicators released May 8–14, 2019:- US: The trade deficit increased slightly to $50.0 billion in March from $49.3 billion in February but remained below the consensus estimate of $50.2 billion and the recent December high of $59.8 billion. The US consumer price index (CPI) increased 2.0% year over year in April, advancing from 1.9% in March, but lower than the consensus estimate of 2.1%.

- Europe: Eurozone industrial production fell 0.6% year over year in March versus the consensus estimate of a 0.8% decline, following zero growth in February. In the UK, GDP advanced 1.8% year over year in the first quarter of 2019, up from 1.4% growth reported in the fourth quarter of 2018 and in line with the consensus estimate. Germany’s trade surplus widened to €20.0 billion in March from €18.7 billion in February, ahead of the consensus estimate of €18.2 billion.

- Asia Pacific: In Japan, personal consumption expenditure increased 2.1% year over year in March, rising for the fourth consecutive month and beating the consensus estimate of 1.7% growth. In Singapore, retail sales declined 1.0% year over year in March, following a 9.9% decline in February; February’s decline was mainly due to an early Chinese New Year season. Most retail segments in Singapore witnessed a decline in March, with optical goods and book stores registering the biggest decline at 6.4%.

- Latin America: Brazil’s retail sales slumped 4.5% year over year in March versus the consensus estimate of a 2.6% decline, the biggest decline since December 2016. Brazil’s supermarket, food and drink, and tobacco retailer revenues witnessed the greatest decline, falling 5.7% year over year in March. Mexico’s industrial production fell 0.1% year over year in March versus the consensus estimate of a 0.3% drop, following the revised 1.0% decline reported for February.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: US Census Bureau/Bureau of Labor Statistics//Eurostat/Office for National

Statistics/CEIC/Statistics Bureau, Japan/Department of Statistics Singapore/Coresight Research[/caption]

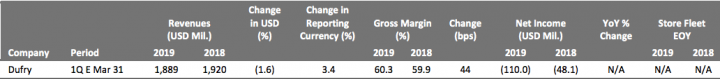

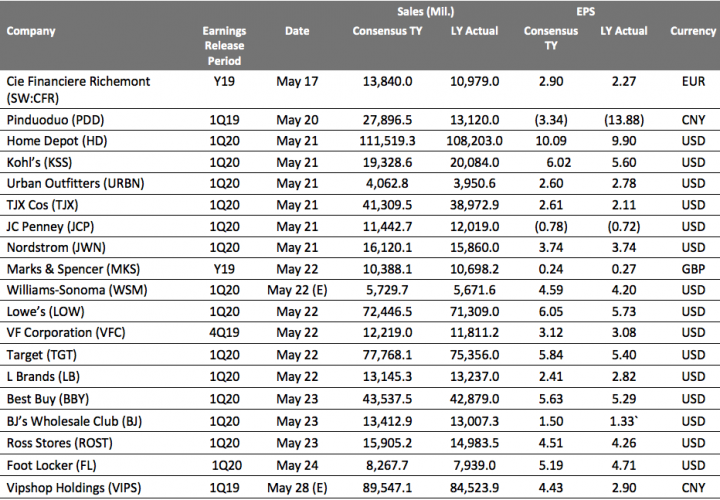

EARNINGS CALENDAR

[caption id="attachment_88105" align="aligncenter" width="720"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

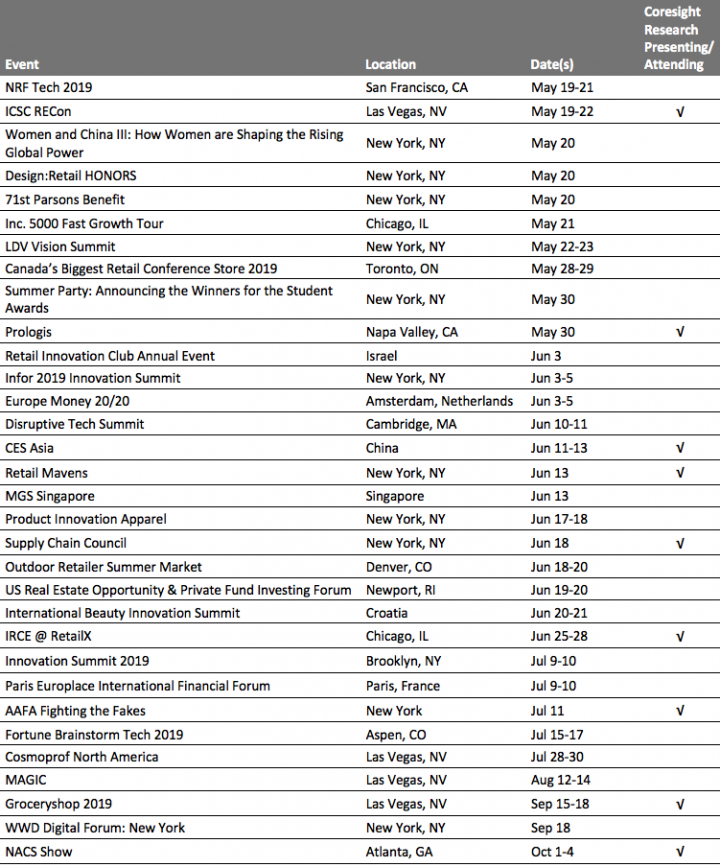

EVENT CALENDAR