albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

The Dynamic Enterprise Wearables Market Wearable technology has shown promising growth, with applications in healthcare, fitness, retail and education, using devices such as smartwatches, smart glasses, activity trackers, wearable cameras and audio, among others. Enterprises wearables are devices used to perform work-related activities. Advancements in technology have made wearable devices potentially valuable tools for business. Coresight Research estimates that the number of enterprise wearable device shipments will grow at a 23% CAGR during a four-year period to reach approximately 23.4 million in total shipments by 2022. We estimate that shipments of smartwatches accounted for around 95% of total enterprise wearable device shipments in 2018; however, we expect this share to fall to approximately 89% in 2022 as devices such as smart clothing and smart glasses gain share. This growth will be supported by advancements in technology and increased mobile penetration. Bring Your Own Device (BYOD), an approach that allows employees to bring their own personal devices for work use, has gained traction. Alongside the rapid increase in the devices worn has been a corresponding increase in the services, applications and data stored on the devices, including more data exchanged between devices. The imminent arrival of 5G technology will boost the deployment of the Internet of Things (IoT)-connected devices, which will enable better communication between mobile devices and business infrastructure. In 2018, Apple had the largest market share in global shipments of all wearable devices (consumer and enterprise) at 26.8%, followed by Xiaomi at 13.5%, Fitbit with 8%, Huawei with 6.6% and Samsung with 6.2%. Although Xiaomi and Huawei have a higher share of global shipments than Samsung, the two companies’ enterprise penetration is negligible as they focus on consumers. The Apple Watch is the only wearable Apple offers that has a meaningful number of applications for the enterprise sector (AirPods do not have an established enterprise use). The key enterprise apps for the Apple watch include: Good Technology (for email and calendar invitations), Microsoft (for its OneNote, PowerPoint and OneDrive apps), Trello (for its collaboration and planning app) and Slack (a team communication app.) Fitbit saw its sales grow to over $1.5 billion in 2018 and the company expects B2B sales to reach $100 million in 2019, with growth climbing into the double digits, driven by global growth and revenue from solutions-based software. Key Fitbit offerings for enterprises include: Fitbit Care (a connected health platform for enterprises, health plans and health systems) and Fitbit Plus (an application to track advanced health metrics such as blood pressure and medication adherence). Its enterprise clients include large companies such as IBM and service providers including healthcare insurance company Humana. Samsung has evolved its business around software and solutions offerings for wearable devices. In October 2018, Samsung partnered with HSBC’s flagship branch on Fifth Avenue in New York to give all branch employees a Samsung Gear S3 watch to test its functionality in the banking sector. In June 2018, Samsung partnered with operations platform company Alice, which develops solutions for the hospitality sector, to create an app exclusively for the Viceroy Hotel Group. Samsung is also driving innovation in retail enterprise wearables designed to keep in-store teams connected. The global enterprise wearables market is becoming more dynamic, but is still in the innovation stage, and we expect the opportunity to attract many new entrants. We also expect growth in healthcare to outpace other verticals as the opportunities and benefits are greater than in other sectors. In retail, we expect smartwatches to play a major role in keeping associates connected and providing real-time information about stock and other store information. Get more information from our report Enterprise Wearables: A Dynamic Market.QUESTION OF THE WEEK

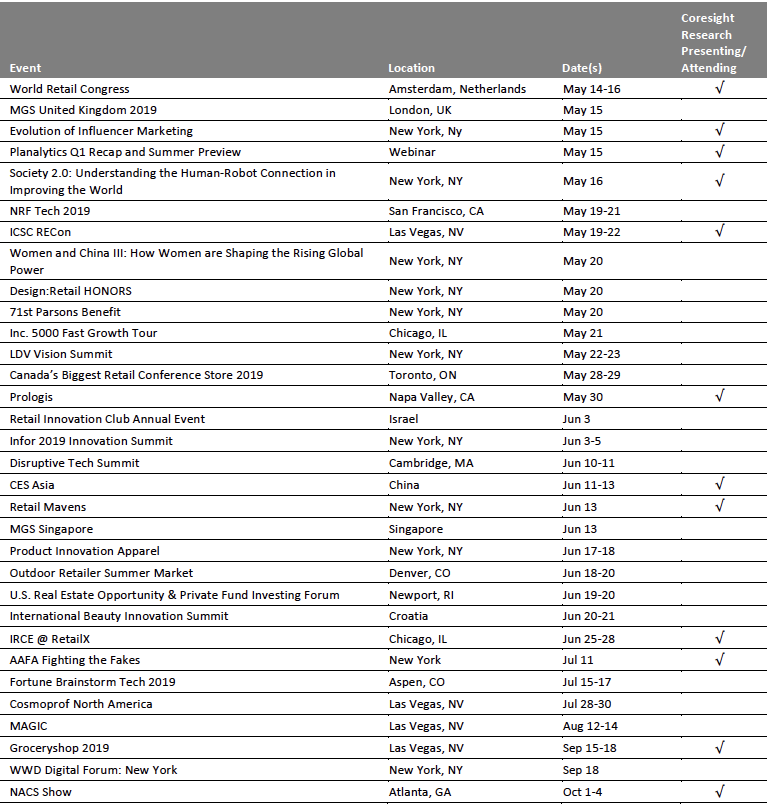

[caption id="attachment_87201" align="aligncenter" width="670"] Eight most popular options shown

Eight most popular options shownBase: 1,803 US Internet users who have bought groceries in-store in the past 12 months, surveyed in April 2019

*Incl. Harris Teeter, Fred Meyer and Smith’s Food & Drug

Source: Coresight Research[/caption]

US RETAIL & TECH HEADLINES

- Flexe is a Seattle-based logistics startup that operates an on-demand warehouse marketplace. The company announced a $43 million investment round to meet demand for “pop-up” storage space.

- Flexe operates much like Airbnb: It matches retailers with warehouses that have excess capacity.

- Retail operator Hudson's Bay said it is considering alternatives for ailing department store chain Lord & Taylor, including a possible sale. The Canadian company, which acquired Lord & Taylor in 2006, wants to invest in its better-performing businesses Saks Fifth Avenue and Hudson's Bay.

- Hudson's Bay sold Lord & Taylor's flagship Fifth Avenue building in February to space leasing company WeWork for $1.1 billion.

Planet Fitness Is Moving into old Toys “R” Us and Sears Stores

(May 6) CNN Business

Planet Fitness Is Moving into old Toys “R” Us and Sears Stores

(May 6) CNN Business

- Planet Fitness said this week that it will open 225 gyms this year. Some of those will be in sites that Toys "R" Us or Sears once occupied, though the company declined to give a specific number.

- The gym chain has been on a growth streak in recent years: It has more than 1,800 gyms in the United States, up about 60% compared to just three years ago. Planet Fitness says it believes it has the potential to reach 4,000 nationwide.

- The deal is done — Maurices is now owned by OpCapita, a private equity firm based in London. The new owners officially took over Duluth's homegrown women's apparel retailer.

- OpCapita announced in March it would pay $300 million for a controlling stake in Maurices, which Ascena Retail Group owned for the past 14 years. Ascena will continue to hold a minority stake.

- Walmart announced that its video-on-demand service, Vudu, will launch 12 original movies and series starting later this year.

- The new Vudu lineup will include “shoppable” interactive content, with viewers able to purchase products featured in the shows. One executive said pop-up windows are being tested for purchases, and ads would be targeted.

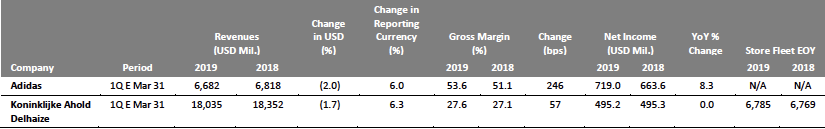

EUROPE RETAIL EARNINGS

[caption id="attachment_87202" align="aligncenter" width="825"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

Fenty Beauty Expands in the UK with Boots Partnership

(May 5) FashionNetwork.com

Fenty Beauty Expands in the UK with Boots Partnership

(May 5) FashionNetwork.com

- US brand Fenty Beauty has partnered with health and beauty retailer Boots to expand its retail presence in the UK. From May 10, Fenty Beauty’s product range will be available at 32 Boots locations – and be available for next-day click and collect at any store through the Boots website.

- Boots has a waiting list for customers who want a preview of the Fenty Beauty products on May 9, a day before they are available in-store.

BrandAlley UK Buys Cocosa

(May 3) TheRetailBulletin.com

BrandAlley UK Buys Cocosa

(May 3) TheRetailBulletin.com

- UK-based online fashion retailer BrandAlley has entered into an unconditional agreement to buy online luxury website Cocosa from MySale Group for £1.5 million ($1.97 million) in cash. The deal comprises the cocosa.co.uk website, the trademark and a database of nearly two million members and customers.

- Cocosa has been MySale Group’s main UK trading website, and its sale is part of MySale Group’s strategy to shift focus to the Australia and New Zealand markets.

- Discount retailer Lidl has launched an app-based loyalty card in Germany, after successful trials in Austria, Denmark, Poland and Spain. Initially, the company will roll out the “Lidl Plus” virtual membership card to shoppers in Berlin and Brandenburg, Germany.

- Upon registering, the user receives a welcome discount of €5 ($5.60) which can be encashed when the user spends at least €25 ($28). Lidl also offers various discount coupons, free product vouchers and additional partner perks depending on how much the customer spends.

- Swedish furniture retailer Ikea has appointed Peter Jelkeby as its new country retail manager for the UK and Ireland markets. Jelkeby will replace Javier Quiñones, who took the role of country retail manager for US markets.

- Jelkeby has been with Ikea 20 years and will be responsible for modernizing Ikea’s online retailing and digital operations in the UK and Ireland.

Poundland’s Pep&Co to Extend in Over 500 Stores

(May 2) RetailGazette.co.uk

Poundland’s Pep&Co to Extend in Over 500 Stores

(May 2) RetailGazette.co.uk

- British discount retailer Poundland is extending its budget clothing line Pep&Co to a further 500 stores across the UK.

- In 2018, Poundland introduced Pep&Co to over 300 of its Dealz stores in the UK and Ireland. The new initiative means all 850 Poundland stores in the UK and Ireland, including Dealz stores in Ireland, will offer the Pep&Co fashion range.

Asia Retail and Tech Headlines

- French personal care and beauty brand Sephora will launch its first outlet in Korea in October, in the capital’s upscale Gangnam district with retail space of 547 sq. ft.

- Sephora plans to launch five more physical stores and an online store in Korea by next year.

- Spanish clothing retailer Oysho has opened its first store in Singapore. The store is in Jewel Changi Airport and has a retail space of 2,369 sq. ft.

- The store features products from the brand’s sleepwear, lingerie, gym wear, beachwear, footwear, sportswear and accessories range. It also features Oysho’s sports range, which showcases garments suited for boxing, skiing and trekking.

Alibaba’s Tmall will Launch Go-To Platform to Discover New Products

(May 3) retailnews.asia

Alibaba’s Tmall will Launch Go-To Platform to Discover New Products

(May 3) retailnews.asia

- Alibaba’s Tmall has announced it will launch a dedicated gateway for customers to discover new products through its Taobao mobile app.

- Customers can click on the Tmall icon in the Taobao app to go to the Tmall New Products channel. The channel will give customers in-depth information and recommendations on new products.

Moschino Now Available on JD.com

(May 4) jingdaily.com

Moschino Now Available on JD.com

(May 4) jingdaily.com

- Italian luxury brand Moschino has launched on Chinese e-commerce site JD.com.

- Moschino introduced its full line of 2019 spring and summer collection on the site, which includes apparel, handbags, shoes and accessories.

- Selected, part of Bestseller Fashion Group, will launch a “Future You” store concept in a series of stores in Beijing. The concept store will feature smart mirrors to find the best fit.

- The store will also include projections, kinetic signage and a live social media feed to create a connected experience and educate the customer.

- Indian retail tech startup RealTell launched its flagship product RealTell Retail for fashion and lifestyle brands. RealTell Retail products based on AI and machine learning help retailers increase footfall and basket size by gamifying the offline shopping experience.

- The company says its service will help customers discover discount prices for fashion and other retail products. The startup has deployed its service in more than 900 stores under lifestyle manufacturer Crimsoune Club.

Latam Retail and Tech Headlines

- US skincare and makeup brand Estée Lauder has launched its technology-driven sales system in its Oechsle store in Peru.

- The new sales system comes with recognition technology that helps the company sell products virtually: Customers can virtually “try on” products on a tablet screen.

- Brazilian children’s footwear brand Bibi plans to open six new physical stores and one online store in Peru in 2019 and 2020.

- The company will open three stores in 2019, two in Arequipa and Trujillo and one in Lima. In 2020, the company aims to extend to another province, although the locations have not yet been disclosed.

- Walmart Chile has announced the company plans to invest $260 million to build more than 20 new stores. The company will also invest $36 million to remodel existing stores.

- Walmart Chile will continue to expand pickup options by adding 30 new pickup stations.

- Spanish fashion house Adolfo Domínguez and Gin Group plan to open new stores in Mexico and Colombia over the next few months.

- The company will launch two stores in Mexico and another two stores in Colombia. The company has expanding into the Mexican market in the last two years, increasing the store count from seven to 21.

- Walmart de México y Centroamérica has opened a new distribution center in Guadalajara, with an investment of 190 million pesos ($10 million).

- The new center will improve two-day delivery within the metropolitan area of Guadalajara. It will also serve the states of Jalisco, Guanajuato, Sinaloa, Aguascalientes, San Luis Potosi, Michoacan, Nayarit, Colima, Baja California Sur, Durango and Zacatecas.

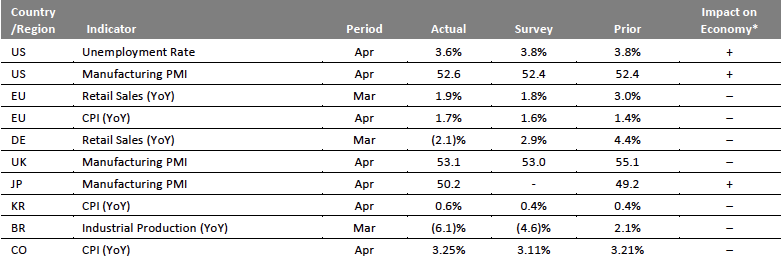

MACRO UPDATE

Key points from global macro indicators released May 1-7, 2019:- US: The unemployment rate fell from 3.8% in March to 3.6% in April, the lowest since 1969. The US manufacturing purchasing managers’ index (PMI) increased from 52.4 in March to 52.6 in April, above the consensus estimate of 52.4.

- Europe: Eurozone retail sales rose 1.9% year over year in March, above the consensus estimate of a 1.8% increase, but lower than 3.0% sales growth reported in February. In Germany, retail sales declined 2.1% year over year in March versus the consensus estimate of a 2.9% increase, following a 4.4% rise in February. Sales of food, beverages and tobacco in Germany dropped 5.7% year over year, while supermarket and hypermarket sales declined 5.5%. In the UK, the manufacturing PMI dropped from 55.1 in March to 53.1 in April, slightly above the consensus estimate of 53.0.

- Asia Pacific: In Japan, the manufacturing PMI rose from 49.2 in March to 50.2 in April, just above the 50 threshold that separates contraction from expansion. In Korea, the consumer price index (CPI) increased 0.6% year over year in April, higher than the 0.4% rise in March.

- Latin America: Brazil’s industrial production slumped 6.1% year over year in March, compared to 2.1% growth in February. Colombia’s CPI increased 3.25% year over year in April, above both the consensus estimate of a 3.11% increase and the 3.21% rise reported in March.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Bureau of Labor Statistics/IHS Markit/Eurostat/CEIC/banco central de Colombia/Coresight Research[/caption]

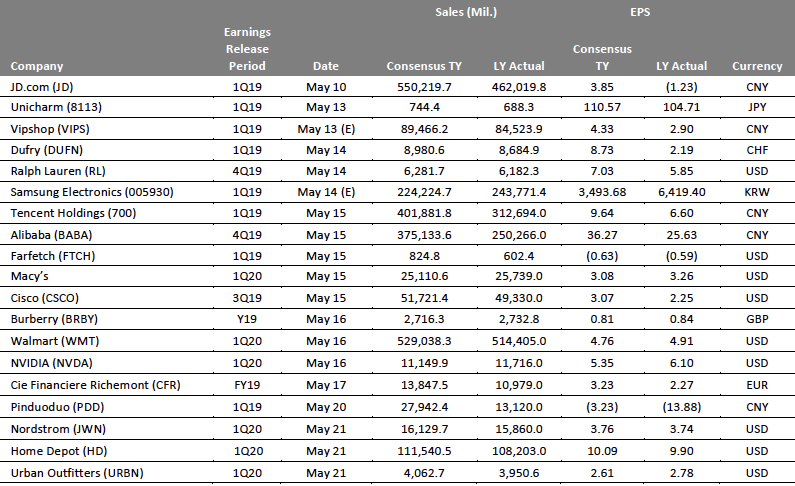

EARNINGS CALENDAR

[caption id="attachment_87204" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

EVENT CALENDAR