albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Amazon Apparel: Pulling Together the Numbers

This week, we published our second annual survey of US Amazon apparel shoppers. The report builds on our already substantial library of data and insights on Amazon’s incursion into fashion retail. In this week’s note, we pull together some of our proprietary findings to review the scale of Amazon’s expansion into the category.

What Amazon Sells

In September, we analyzed Amazon Fashion’s women’s and men’s clothing offering and found 1.1 million items available for purchase, up 27% from February 2018, when we conducted a similar analysis. Despite Amazon’s ongoing expansion of its private-label collections, we recorded an uptick in the proportion of clothing items listed for sale by third-party merchants and a corresponding decline in the proportion of such items listed for sale by Amazon itself: The percentage of clothing products on the site offered by third-party sellers grew from 86.3% in February to 88.9% in September.

Our September 2018 research also recorded a womenswear-to-menswear ratio of 1.5 to 1 on Amazon. The women’s tops and tees category had the most listings, followed by men’s shirts. Activewear was one of the most-listed categories within both womenswear and menswear, with sports clothing ranking third in womenswear and second in menswear in terms of total number of items available.

When we researched Amazon’s own brands in May 2018, we recorded 4,904 private-label products across clothing, footwear and accessories, meaning apparel represented 74% of all Amazon’s private-label products at the time. The company offered 74 private labels then, and 66 of them included apparel items.

We also found last May that most of Amazon’s private labels comprised fewer than 100 products. One exception was Amazon’s core womenswear brand, Lark & Ro, which included 578 products, equivalent to 8.5% of Amazon’s total private-label offering at the time.

What Shoppers Buy on Amazon

Our 2019 consumer survey found that Amazon is now America’s most-shopped retailer for clothing and footwear, as measured by the proportion of respondents who had bought such items from the site in the past 12 months. In our 2018 survey, Amazon shared the second-place spot with Target.

According to our most recent survey, men’s or women’s footwear is the most-shopped apparel category on Amazon.com, followed by women’s casual clothing and men’s casual clothing. Men’s or women’s sports clothing ranked fifth.

Nike, Adidas and Under Armour are the most-bought apparel brands on Amazon.com, according to our latest survey. But Amazon’s combined private labels ranked fourth, with 17% of Amazon apparel shoppers saying they had bought an Amazon private label item in the past 12 months, up from 11% a year earlier. Moreover, slightly more than one in five Amazon apparel shoppers said they are interested in trying the company’s private labels.

And how are consumers perceiving those private labels? Research we conducted in June 2018 found the average Amazon private-label product generates a customer rating of four stars out of five, suggesting overall solid customer satisfaction levels. However, this average conceals a range running from 3.1 stars for menswear brand Crafted Collar to 4.6 stars for boys’ and girls’ apparel brand Spotted Zebra.

So, even though Amazon is growing its apparel collections largely through third-party merchants, its own private labels are generating meaningful consumer awareness, interest and trial purchase. Rivals will have to work hard to compete head-on with Amazon’s apparel offering, which already numbers 1.1 million items and continues to grow. The increases we recorded in Amazon’s shopper numbers and apparel ranges over the past year underscore just how big a challenge those rivals face.

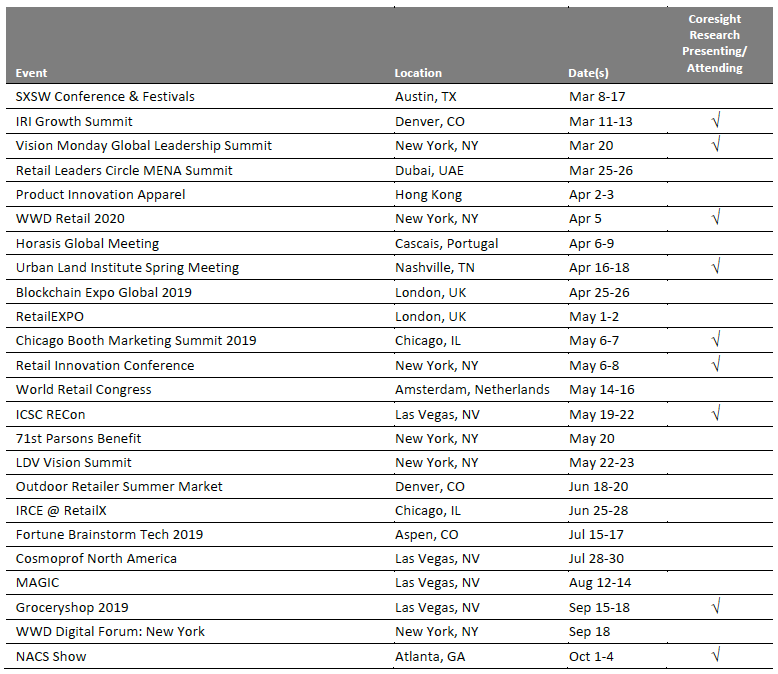

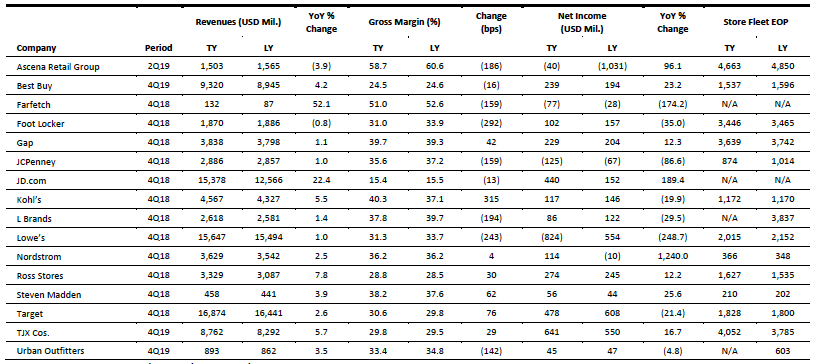

US RETAIL EARNINGS

[caption id="attachment_79574" align="aligncenter" width="816"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

US RETAIL & TECH HEADLINES

![]() Amazon to Launch New Grocery-Store Business

Amazon to Launch New Grocery-Store Business

(Mar. 1) WSJ.com

- Amazon is planning to open dozens of grocery stores in several major US cities, according to people familiar with the matter. The company reportedly plans to open its first outlet in Los Angeles as early as the end of this year.

- The new stores will be distinct from the company’s upscale Whole Foods Market chain. It isn’t yet clear whether they will carry the Amazon name.

Gap and Old Navy Are Splitting Up

Gap and Old Navy Are Splitting Up

(Mar. 1) CNN.com

- Gap and Old Navy have been trending in opposite directions for years and are finally splitting up.

- Gap said on Feb. 28 that it will break into two companies. One will contain Old Navy, while the other, yet-to-be-named business, will comprise Gap, Banana Republic and other brands, including Athleta and Hill City.

The Children’s Place to Buy Gymboree Brand, While Gap Snags Janie and Jack

The Children’s Place to Buy Gymboree Brand, While Gap Snags Janie and Jack

(Mar. 2) CNBC.com

- Children’s apparel retailer Gymboree has sold its brand to rival The Children’s Place. Gap plans to acquire the bankrupt retailer’s Janie and Jack high-end children’s clothing line.

- The Children’s Place will pay $76 million for the rights to both Gymboree and its Crazy 8 brand. The retailer will also take over a contract with Singapore-based Zeavion Holding, which acquired the Gymboree Play & Music business in 2016.

![]() Tesla Is Closing Stores and Shifting All Sales Online

Tesla Is Closing Stores and Shifting All Sales Online

(Feb. 28) CNBC.com

- Tesla is shifting all its sales online and giving customers a week to return newly purchased vehicles if they aren’t satisfied. The move to e-commerce-only sales will enable Tesla to reduce headcount and cut some operating expenses.

- In a blog post, the company emphasized that shifting to online-only sales would allow it to sell its Model 3 vehicles for the base price of $35,000.

Target Announces Launch of Third-Party Marketplace Target+

Target Announces Launch of Third-Party Marketplace Target+

(Feb. 25) TechCrunch.com

- Target announced it will launch Target+, a new program designed to expand the assortment on Target.com with merchandise from third-party sellers. Unlike Walmart and Amazon, which allow any third party to apply to sell on their marketplaces, Target plans to take a more curated approach to adding sellers.

- The retailer says each partner will be “carefully selected” and then invited into the program — a move it hopes will help keep quality high. Target plans to start with additions in categories such as home, toys, electronics and sporting goods.

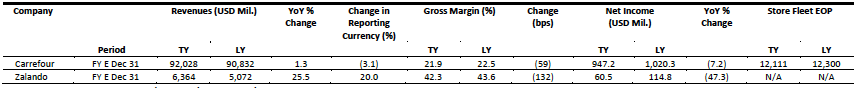

EUROPE RETAIL EARNINGS

[caption id="attachment_79573" align="aligncenter" width="858"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

![]() UK Registers Weak Retail Sales Growth in February

UK Registers Weak Retail Sales Growth in February

(Mar. 5) BRC.org.uk

- Retail sales in the UK grew 0.5% year over year in February, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales decreased 0.1% as consumers continued to spend cautiously amid Brexit uncertainty.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended February, total food sales grew 2.4% and total nonfood sales declined 0.4%.

![]() Findel Rejects Sports Direct’s Takeover Bid

Findel Rejects Sports Direct’s Takeover Bid

(Mar. 5) RetailGazette.co.uk

- Findel, owner of e-commerce company Studio.co.uk, has rejected a £140 million ($182 million) takeover bid by British sports retailer Sports Direct. Findel’s board said the offer “significantly undervalues the group.”

- Sports Direct had previously increased its stake in Findel from 29.9% to 36.8%. Under the UK’s takeover code, Sports Direct was obliged to make a cash offering for the remaining Findel shares at a price of 161 pence ($2.09) each.

![]() BetterBathrooms Enters Administration

BetterBathrooms Enters Administration

(Mar. 4) BMMagazine.co.uk

- British bathroom retailer BetterBathrooms has entered administration and ceased operations across its 13 showrooms and two trade counters in the UK. The company will temporarily keep 10 employees to help wind up operations, while 352 employees will lose their jobs.

- The company suffered from severe cash-flow difficulties and an extended period of soft trading, according to joint administrator Phil Pierce.

Voi Technology Raises $30 Million Series A Round

Voi Technology Raises $30 Million Series A Round

(Mar. 4) Tech.eu

- Sweden-headquartered electric scooter startup Voi Technology has raised $30 million in a series A round of funding led by Balderton Capital, Vostok New Ventures, LocalGlobe, Raine Ventures, Project A and Creandum.

- The startup will use the funds to expand across Europe and invest in R&D. The company plans to enter Italy, Germany, Norway and France in the near future.

![]() Zalando to Expand Beauty Delivery Service to Five New Markets

Zalando to Expand Beauty Delivery Service to Five New Markets

(Mar. 5) Gondola.be

- Berlin-based e-commerce retailer Zalando is expanding cosmetics delivery to five new markets: Belgium, France, Italy, Denmark and Sweden. The company previously offered cosmetics only in Germany, Poland and Austria.

- Customers in Sweden and Denmark will soon be able to choose from 6,000 beauty products across 200 brands. Zalando will roll out the service across the remaining markets over the next month.

ASIA RETAIL & TECH HEADLINES

Zomato Agrees to Sell UAE Unit to Delivery Hero

Zomato Agrees to Sell UAE Unit to Delivery Hero

(Mar. 5) EconomicTimes.IndiaTimes.com

- Zomato Media, the owner of Indian online food delivery platform Zomato.com, has agreed to sell its food service business in the United Arab Emirates to German online food delivery provider Delivery Hero.

- The acquisition is worth about $172 million. The sale proceeds will help Zomato boost its cash reserves and reduce its reliance on Alibaba’s Ant Financial affiliate, which is its largest shareholder.

Volvo Begins Trial of First Driverless Electric Bus in Singapore

Volvo Begins Trial of First Driverless Electric Bus in Singapore

(Mar. 5) CNBC.com

- Sweden-based Volvo Buses and Singapore’s Nanyang Technological University (NTU) have unveiled a driverless electric bus that generates zero emissions and requires 80% less energy than a diesel-powered bus.

- The autonomous vehicle will be tested on the NTU campus under conditions similar to real road conditions in Singapore. The data from the trials will be used to improve the technology before the bus is tested on public roads, according to Volvo and NTU.

Alibaba Forms Strategic Alliance with Office Depot

Alibaba Forms Strategic Alliance with Office Depot

(Mar. 4) InsideRetail.asia

- Alibaba and US specialty retailer Office Depot have partnered to create a cobranded online store to better serve small and medium-sized businesses in the US.

- The collaboration marks Alibaba’s first US partnership with a major retailer. The agreement will give Alibaba access to Office Depot’s 1,800-strong sales team, which sells to over 10 million business customers.

![]() JD.com Partners with Farfetch to Tap Chinese Luxury Retail Market

JD.com Partners with Farfetch to Tap Chinese Luxury Retail Market

(Mar. 1) InsideRetail.asia

- JD.com has expanded its partnership with UK-based online luxury fashion retailer Farfetch and agreed to merge its Toplife luxury shopping platform into Farfetch China.

- Under the agreement, JD.com will be able to use Farfetch’s technology and logistics platform to connect foreign brands with Chinese customers. JD.com’s customers will gain access to more than 1,000 luxury brand and boutique partners on Farfetch’s marketplace.

7-Eleven Partners with Future Group to Enter India

7-Eleven Partners with Future Group to Enter India

(Feb. 28) Asia.Nikkei.com

- Japanese-owned convenience store chain 7-Eleven has partnered with a subsidiary of Future Retail, part of India’s Future Group conglomerate, to open its first store in India later this year.

- In addition to building new locations, Future Group will convert some of its existing stores in India to 7-Eleven shops. The agreement is slated to last 80 years.

LATAM RETAIL & TECH HEADLINES

InRetail to Open 150 Mass Discount Stores Each Year Until 2021

InRetail to Open 150 Mass Discount Stores Each Year Until 2021

(Mar. 4) America-Retail.com

- Peruvian retail group InRetail plans to open 150 mass discount stores and 70 pharmacies each year until 2021. The discount stores will average 1,600 square feet.

- The group has budgeted 2.1 billion nuevos soles ($632.5 million) in investments, 48% of which will be used for food retail, 39% for shopping malls and 13% for pharmacies.

![]() PlayVox Raises Fresh Funds from Five Elms Capital

PlayVox Raises Fresh Funds from Five Elms Capital

(Mar. 1) LatamList.com

- Quality assurance software company PlayVox has raised $7 million from Five Elms Capital in its latest funding round. The funds will be used to expand the team in Manizales, Colombia, and to release new features for the company’s global customer base.

- PlayVox founder Oscar Giraldo said, “It has never been more critical to provide high-quality service to customers than it is today. We take pride in helping companies maximize each and every interaction with their valuable customers.”

Falabella Plans to Close Stores at Nonstrategic Locations

Falabella Plans to Close Stores at Nonstrategic Locations

(Mar. 1) Df.cl

- Chilean department store chain Falabella plans to review the strategic value of its stores and close the worst-performing locations.

- CEO Gaston Bottazzini said store closures are more likely in markets where the company has a greater presence, such as Argentina and Chile, than in markets such as Mexico, where Falabella seeks to grow.

![]() Walmex Workers Extend Strike Deadline amid Payroll Issues

Walmex Workers Extend Strike Deadline amid Payroll Issues

(Mar. 4) America-Retail.com

- Walmart workers in Mexico have extended their strike deadline until Mar. 20 as the National Association of Commerce and Private Offices seeks a salary increase of 20% for the 8,000 Walmex workers it represents.

- The union alleges workers who worked overtime were not compensated adequately and says some workers have complained of sexual abuse and harassment by superiors.

Bezos Expeditions Participates in NotCo $30 Million Funding Round

Bezos Expeditions Participates in NotCo $30 Million Funding Round

(Mar. 1) Emol.com

- Chilean food tech startup NotCo has raised $30 million in a funding round led by The Craftory. Bezos Expeditions, Kaszek Ventures and IndieBio also participated in the round. NotCo uses artificial intelligence to find plant-based replacements for dairy products.

- The company will use the fresh funds to develop new products and expand into the US as well as additional markets in Latin America.

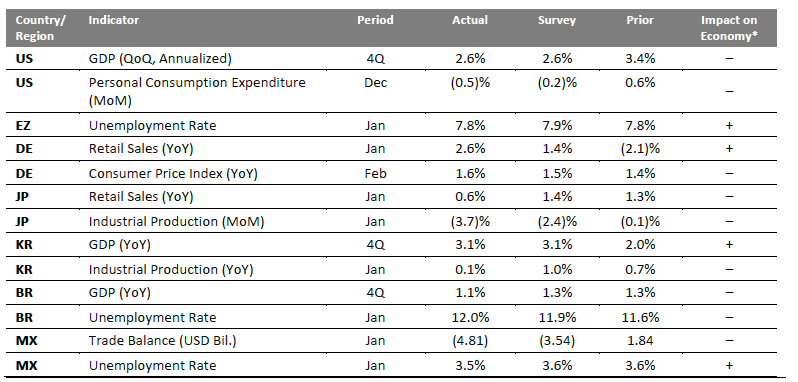

MACRO UPDATE

Key points from global macro indicators released Feb. 27-Mar. 5, 2019:

1) US: GDP rose 2.6% quarter over quarter in the fourth quarter, in line with the consensus estimate but below the 3.4% growth reported in the third quarter. In December, consumer spending dropped for the first time since September 2016, falling 0.5% month over month and missing the consensus estimate of a 0.2% decline.

2) Europe: In January, eurozone unemployment held steady at 7.8%, the lowest rate since October 2008 and ahead of the consensus estimate of 7.9%. In Germany, retail sales rebounded in January, rising 2.6% year over year, versus a 2.1% decline in December.

3) Asia Pacific: In Japan, retail sales rose 0.6% year over year in January, below both the 1.4% consensus estimate and December’s 1.3% growth. South Korea’s GDP expanded 3.1% year over year in the fourth quarter, in line with the consensus estimate and accelerating from 2.0% growth in the third quarter.

4) Latin America: Brazil’s GDP grew 1.1% year over year in the fourth quarter, versus the consensus estimate of 1.3%. In Mexico, the trade deficit stood at $4.81 billion in January, well below December’s $1.84 billion surplus.

[caption id="attachment_79572" align="aligncenter" width="798"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impactSource: US Bureau of Economic Analysis/Eurostat/Federal Statistical Office (Germany)/Ministry of Economy, Trade and Industry (Japan)/Statistics Korea/Korean Statistical Information Service/CEIC/Agência Brasil/National Institute of Statistics and Geography (Mexico)/Coresight Research[/caption]

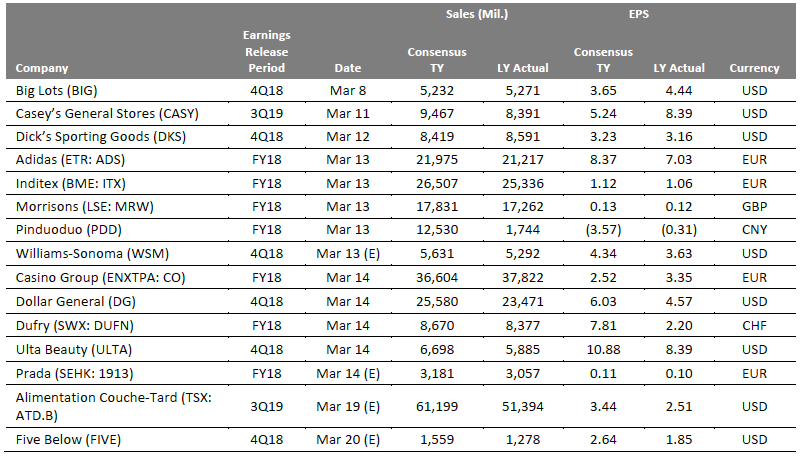

EARNINGS CALENDAR

EVENT CALENDAR