From the Desk of Deborah Weinswig

There Is Much We Can Learn from Retail in China

Shopping is different in China. There, it’s an integral part of social conversations, and it’s not uncommon for people to show each other what’s in their digital shopping carts at dinners and other gatherings. Online, Chinese retailers offer shoppers a significant amount of entertainment and content that keeps them interested and browsing for longer periods of time. Western shopping sites, by contrast, tend to be more transaction driven.

Chinese shopping holidays are also unique, and less driven by promotions than Western shopping occasions are. During the annual November 11 (“Singles’ Day”) online shopping festival, Chinese shoppers watch a televised gala featuring celebrities and entertainers, play video games starring the Tmall cat mascot, and shop, shop, shop while being entertained. Last year on Singles’ Day, Alibaba alone generated $25.4 billion in sales—dwarfing Cyber Monday’s overall total of $6.6 billion in sales.

Another difference is that Chinese consumers do the majority of their online shopping on mobile phones. On Singles’ Day last year, mobile accounted for 90% of online sales, a rate far higher than the mobile commerce rates regularly seen in the West. Chinese shoppers, especially those in second- and third-tier cities, have leapfrogged the desktop PC phase of online shopping and moved straight to mobile.

China is quickly going cashless, too. When shopping in physical stores, Chinese consumers rarely pay with cash, and even street food and farmers’ market vendors accept mobile payments through the WeChat Pay and Alipay platforms. Beyond shopping, Chinese consumers can use digital payments for utility bills, taxi and subway rides, and many other services.

Shoppers in China also use their smartphones to access small retailers via WeChat Mini Programs. These low-memory, location-based mobile apps are embedded in WeChat, so users can open them easily instead of having to download and install separate retail apps. WeChat offers an open platform that allows businesses to access its ecosystem, negating the need for them to develop expensive, independent, full-function apps. Location-based Mini Programs allow users to search their vicinity to discover and interact with stores. There are some 580,000 Mini Programs available on WeChat and approximately 170 million people use them every day.

As they travel around the world, Chinese consumers are exporting their shopping behaviors and preferences. On average, Chinese tourists travel twice yearly, and the number traveling overseas continues to grow and drive retail spending globally. By 2021, 192 million Chinese travelers are expected to spend $458 billion per year, according to the United Nations World Tourism Organization. Much of the current growth in outbound travel is driven by newly affluent residents of lower-tier cities in China. They spend an average of $2,449 per overseas trip, 10% more than their peers from higher-tier cities, as they frequently make purchases on behalf of friends and family at home.

China is also an emerging leader in artificial intelligence (AI), and the country is deploying the technology in retail and other sectors. The size of the Chinese population means that there is a tremendous amount of data available to calibrate AI systems. Moreover, the Chinese government is very supportive of AI development. In 2017, the government announced that it seeks to lead the world in AI technology by 2025. The plan specifically identifies AI as the main engine of China’s progress toward becoming a major economic power and lays out plans for the AI industry to grow to ¥1 trillion by 2030.

The retail industry in China has evolved separately from the industry in the West, and it has accomplished many of the goals that US retailers are still striving toward, including combining shopping with entertainment and making shopping and payment as frictionless as possible. While the ease of sharing via social media has enabled consumers all over the world to seek recommendations and compare purchases with friends and family, in China, it has helped turn shopping into a group activity that’s fun to participate in, like a team sport.

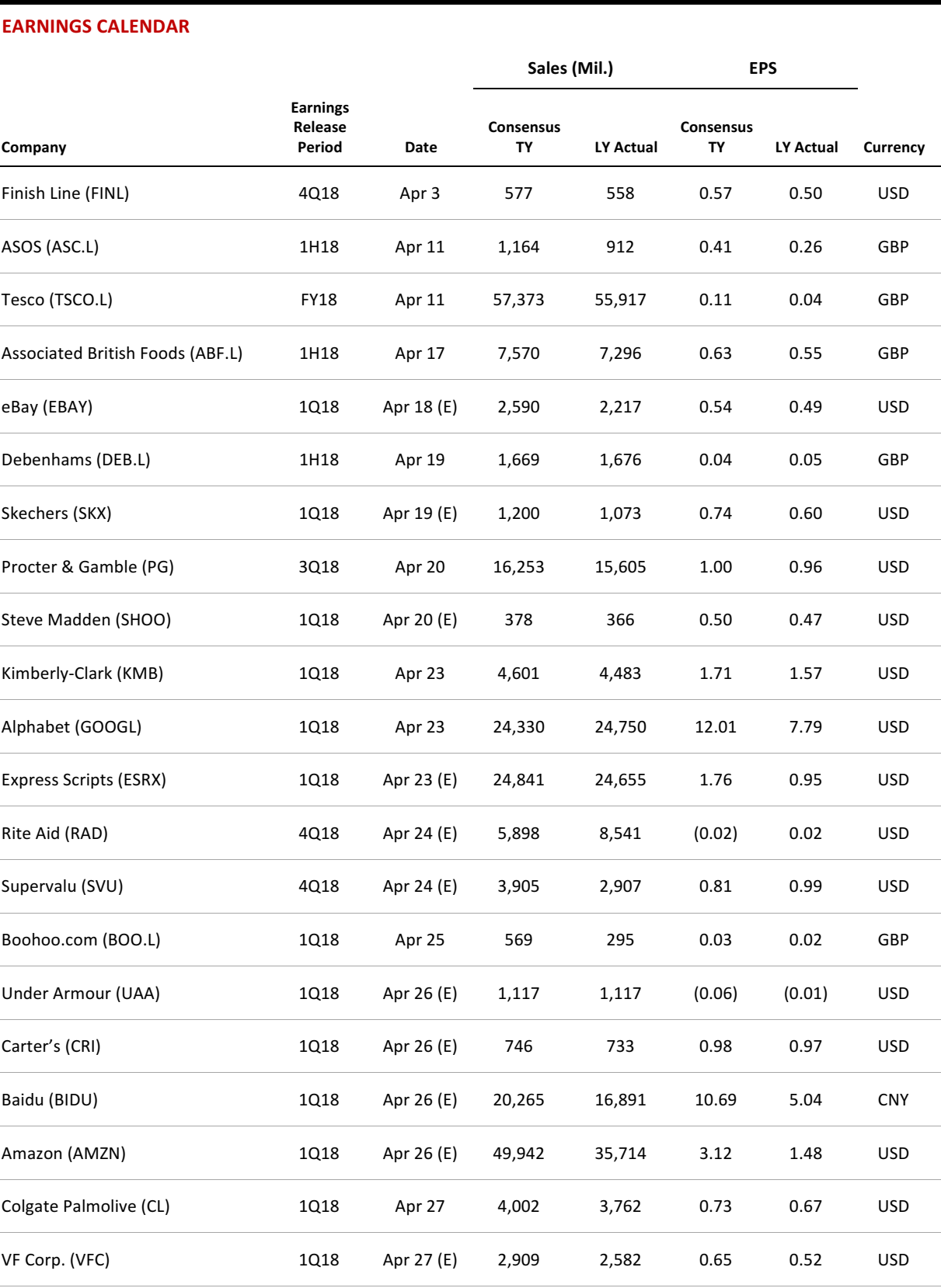

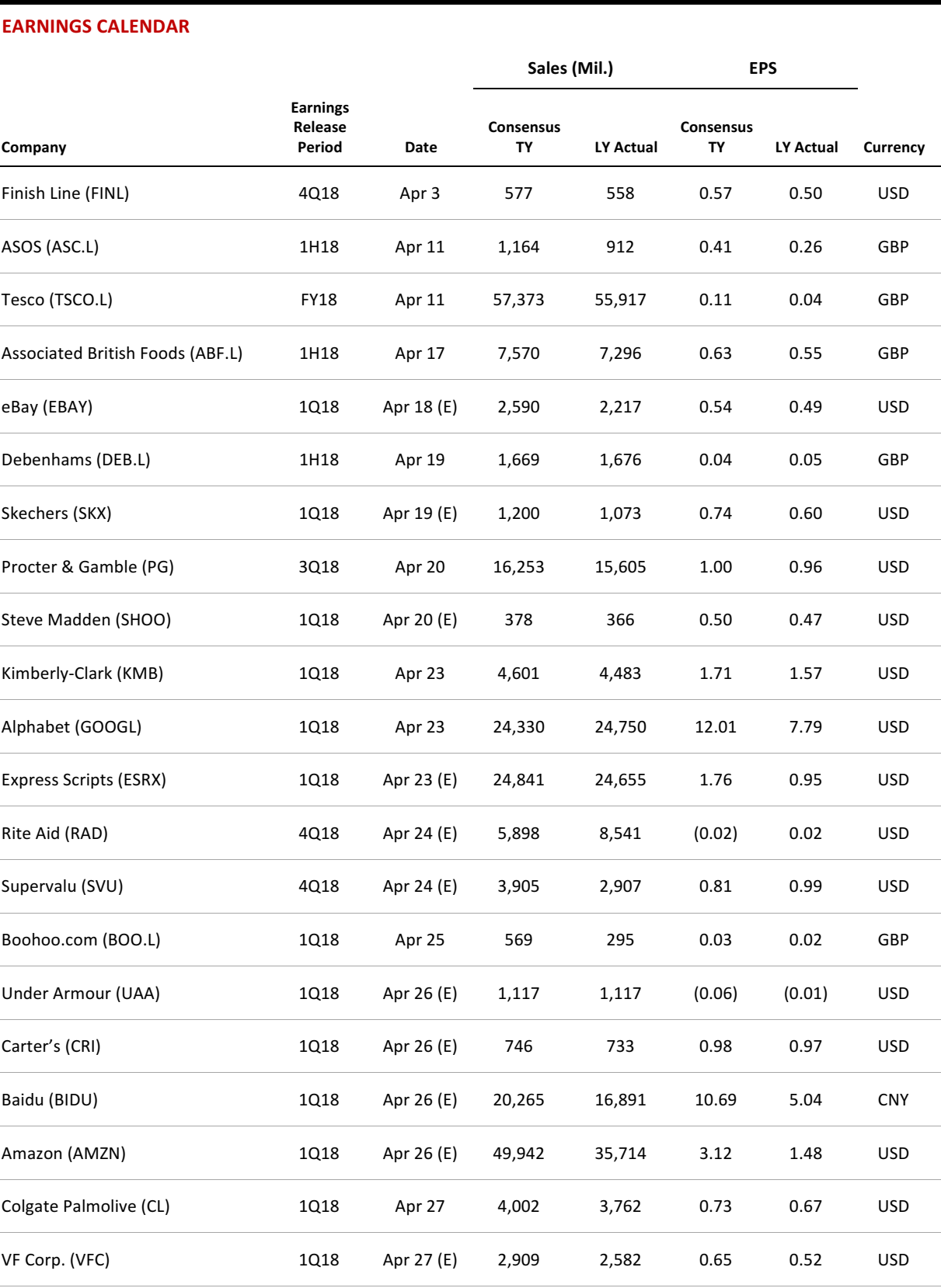

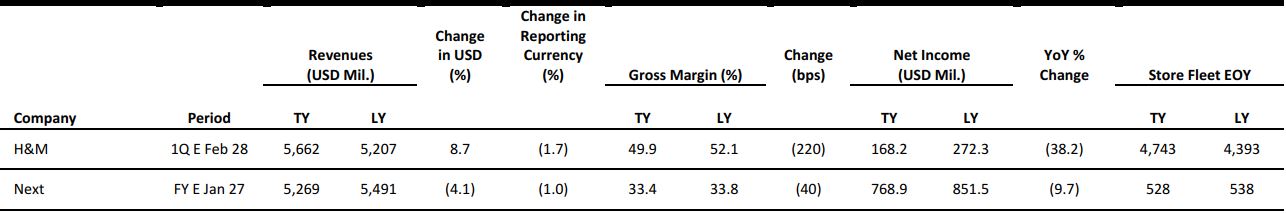

US RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Mall Developers Brookfield and GGP to Merge in $9.25 Billion Deal

(March 27) RetailDive.com

Mall Developers Brookfield and GGP to Merge in $9.25 Billion Deal

(March 27) RetailDive.com

- Brookfield Property Partners has agreed to buy fellow mall developer GGP for $9.25 billion in cash, Brookfield said on Monday in a press release.

- The deal between the mall operators, which must be approved by GGP’s shareholders, would create a new REIT, according to the release. For each GGP common share, GGP shareholders can choose either $23.50 in cash, one Brookfield unit or one share of the new REIT.

As Grocery Wars Rage, Target and Kroger Mull a Merger

(March 23) FastCompany.com

As Grocery Wars Rage, Target and Kroger Mull a Merger

(March 23) FastCompany.com

- Target and Kroger are discussing a possible merger, several people with knowledge of the matter tell Fast Company. The talks come as the grocery industry grapples with Amazon’s increasing hold on the market.

- Amazon’s acquisition last year of Whole Foods—a deal valued at $13.7 billion—forced grocers and retailers alike to come to terms with the holes in their businesses. That led to a series of partnerships and acquisitions aimed at pulling sleepy grocery retailers out of complacency.

“Speed Up or Die” Is the New Reality for US Apparel Retailers

(March 26) ChicagoTribune.com

“Speed Up or Die” Is the New Reality for US Apparel Retailers

(March 26) ChicagoTribune.com

- In the spring of 2009, Kohl’s executives gathered six apparel vendors into a hotel near Los Angeles and threw down the gauntlet. Their request: make 12,000 apparel items in six weeks or less from two samples.

- Of the six, only fashion designer Jackie Wilson was able to deliver the goods on time, taking five weeks and four days to produce the white rayon shirts with an attached purple vest. Almost a decade later, the quest by big retail chains to offer fast fashion—on-trend apparel delivered before it goes out of style—remains a challenge.

The Rapidly Changing Retail World Is Closing Some Doors, Opening New Ones

(March 26) MCall.com

The Rapidly Changing Retail World Is Closing Some Doors, Opening New Ones

(March 26) MCall.com

- Terminology aside, the situation is pretty clear: the retail world is changing quickly, and its makeover won’t stop anytime soon. Consider that e-commerce sales accounted for about 10% of all US retail sales at the end of last year, up from around 6% in 2012.

- Many sectors, however, have avoided the disruption. For example, home improvement stores still provide customers with in-person assistance, while off-price retailers such as Ross and T.J. Maxx remain one of the thorns in the side of traditional department stores.

JD Sports’ $558 Million Deal to Acquire Finish Line Will Shake Up the Athletic Retail Landscape

(March 26) FootwearNews.com

JD Sports’ $558 Million Deal to Acquire Finish Line Will Shake Up the Athletic Retail Landscape

(March 26) FootwearNews.com

- After months of speculation about the future of Finish Line, the retailer is selling itself to European athletic retail giant JD Sports Fashion in a $558 million deal. JD Sports will acquire 100% of the issued and outstanding Finish Line shares at a price of $13.50 per share in cash.

- The deal gives JD Sports a major foothold in the US market, with a brick-and-mortar and online presence. The backing of one of Europe’s most successful retailers could help reposition Finish Line—which has been struggling to compete with Foot Locker and other athletic goods sellers—compete more effectively.

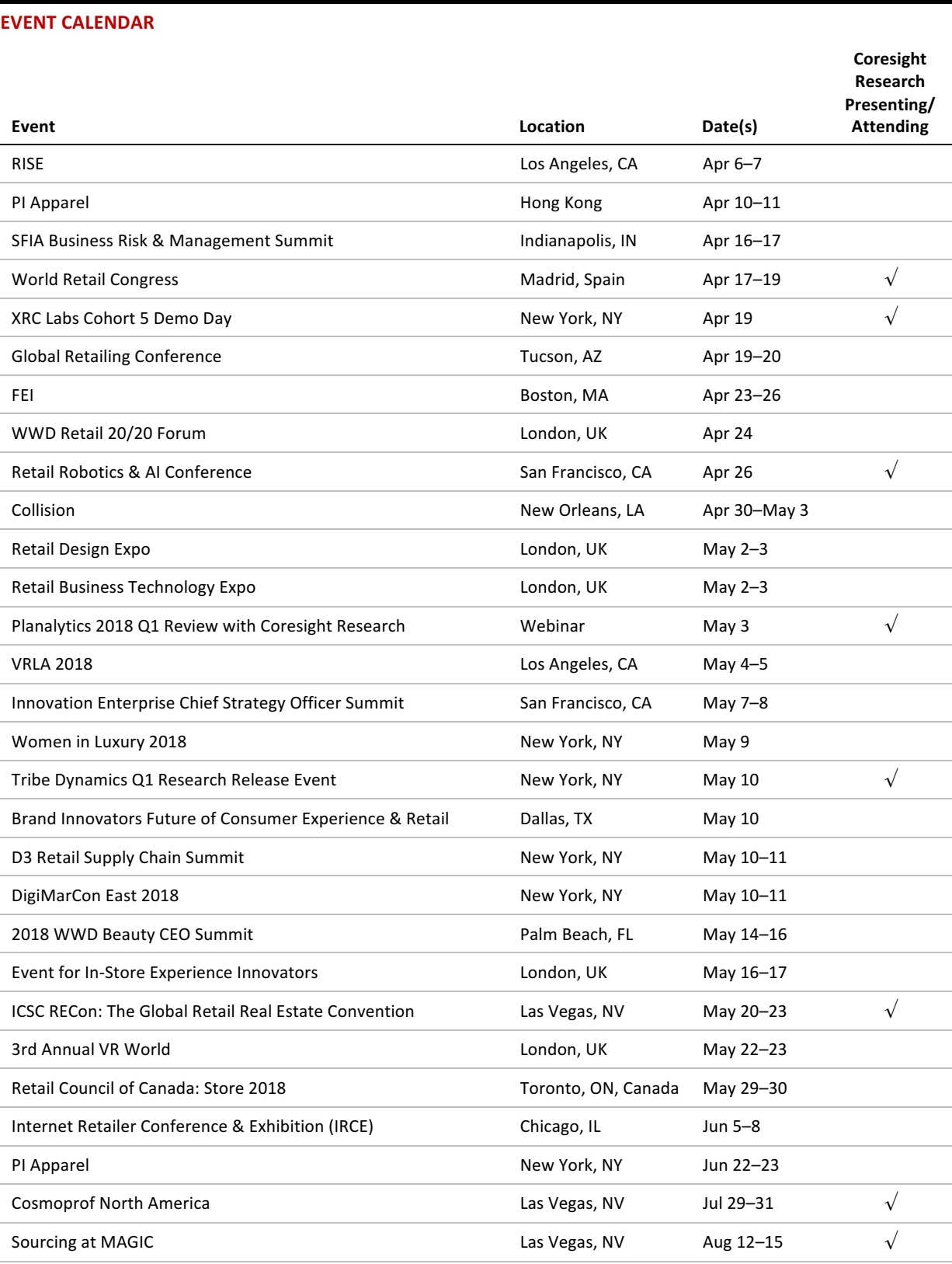

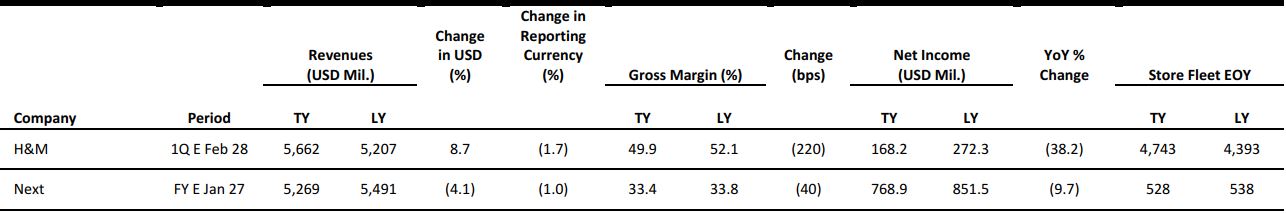

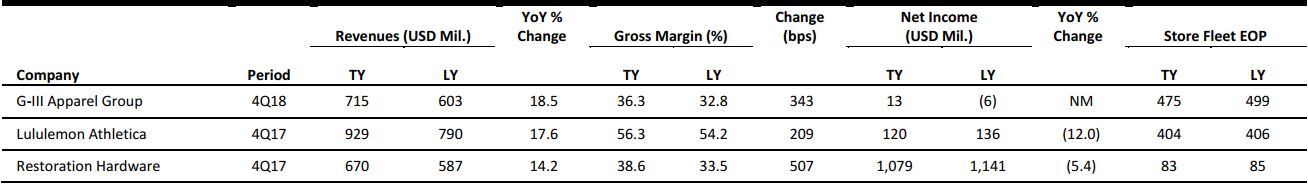

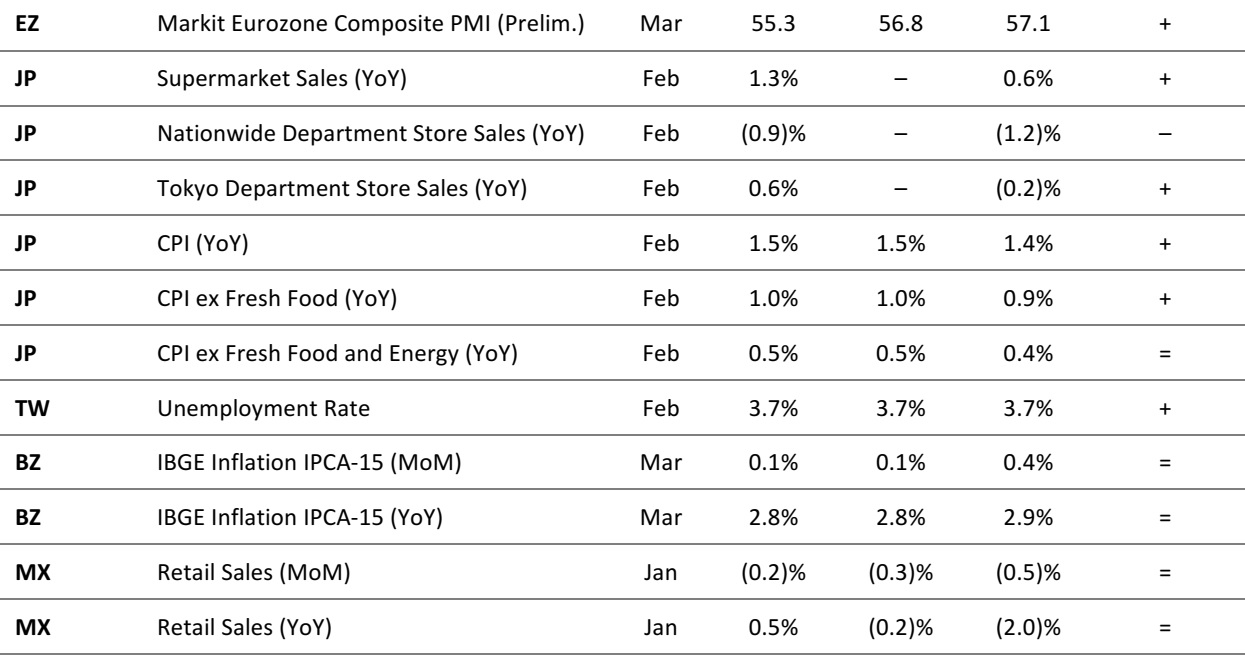

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

Groupe Casino’s Monoprix to Serve French Customers Through Amazon’s Prime Now

(March 26) Company press release

Groupe Casino’s Monoprix to Serve French Customers Through Amazon’s Prime Now

(March 26) Company press release

- French retailer Groupe Casino announced that customers will soon be able to buy groceries from its Monoprix supermarket chain through Amazon’s Prime Now quick delivery service.

- The service will initially be available for customers in Paris and surrounding areas. Through Prime Now, French shoppers will be able to buy “thousands of grocery items,” including Monoprix’s own-brand products and fresh produce, for high-speed delivery.

Zalando Enters Beauty Market

(March 23) Company press release

Zalando Enters Beauty Market

(March 23) Company press release

- German online pure play Zalando has launched a beauty category on its website. Shoppers can now choose from an assortment of more than 120 brands, including mass market brands L’Oréal and Maybelline, natural brands L:A Bruket and Weleda, and South Korean brand Missha.

- Zalando offers more than 4,000 beauty products for women and expects to introduce products exclusively for men in autumn or winter this year. Zalando also plans to open a physical store in Berlin later this year.

Carrefour Launches Its Own Mobile Payment Tool

(March 26) RetailDetail.eu

Carrefour Launches Its Own Mobile Payment Tool

(March 26) RetailDetail.eu

- French retailer Carrefour has launched its own mobile payment tool, Carrefour Pay, on its Carrefour & Moi app. The tool works in a similar manner as Apple Pay. After linking their bank cards to the app, users can use Carrefour Pay at 3,000 Carrefour stores in France and in some stores in Belgium that have contactless NFC technology.

- Carrefour Pay is currently available only to Android users using Pass Mastercards or C-Zam cards. Carrefour said the mobile payment tool will be made available to all bank cards by the end of the year.

House of Fraser Owner to Inject Funds

(March 26) TheGuardian.com

House of Fraser Owner to Inject Funds

(March 26) TheGuardian.com

- House of Fraser owner Sanpower will inject about £15 million ($21 million) into the department store chain to assuage fears about its shrinking financial health. This news comes a day after The Sunday Times reported that House of Fraser is seeking about £40 million ($56 million) from turnaround firm Alteri Investors.

- A House of Fraser spokesperson stated that the retailer only agreed to meet with Alteri at the turnaround specialist’s request. The retailer could not have sought fresh financing in any case due to existing arrangements with its lenders, a spokesperson said.

Select Files for Restructuring, Threatening 1,750 Jobs

(March 27) RetailGazette.co.uk

Select Files for Restructuring, Threatening 1,750 Jobs

(March 27) RetailGazette.co.uk

- British value fashion chain Select has become the latest high-street retailer to file for a company voluntary agreement (CVA), threatening the closure of its 183 stores and the employment of 1,750 staff. Select’s parent, Genus UK, said that it is pursuing a CVA to allow it to cut down rents across its stores in England and Wales.

- Genus UK said that it had no plans to close stores, but the CVA proposal includes a clause that allows landlords to “take back loss-making sites.” Creditors of the firm are expected to vote on the CVA proposal on April 13.

ASIA RETAIL & TECH HEADLINES

Grab Vanquishes Uber with Local Strategy, Billions from SoftBank

(March 27) Bloomberg.com

Grab Vanquishes Uber with Local Strategy, Billions from SoftBank

(March 27) Bloomberg.com

- Uber agreed to swap its business with Grab in Southeast Asia for a 27.5% stake. The deal is a vindication for Grab cofounder Anthony Tan’s strategy of tailoring services to local needs and working with incumbent taxi operators instead of against them. As Uber looked to conquer ride sharing around the world, Grab was focused on serving the 620 million people that share its home in Southeast Asia.

- Tan has turned Grab into a ride-hailing juggernaut since it was born in a tiny Kuala Lumpur storage room about six years ago, and he has raised $4 billion from investors, led by SoftBank. Rich funding has helped him lure top talent and survive through the losses generated by a fierce battle with Uber to win over customers.

Foxconn Unit to Buy Belkin for $866 Million in Brand Push

(March 27) Bloomberg.com

Foxconn Unit to Buy Belkin for $866 Million in Brand Push

(March 27) Bloomberg.com

- FIT Hon Teng, part of contract manufacturing giant Foxconn, has agreed to buy Belkin. It is the latest move by billionaire Foxconn founder Terry Gou to expand in branded goods. FIT will pay $866 million in cash for Belkin, a maker of Wi-Fi routers, mobile device chargers and keyboards. Belkin owns more than 700 patents and the deal will give FIT access to strong research and development capacity.

- Gou, whose empire includes the main assembler of Apple’s iPhones, is seeking to expand beyond contract production to capture more of the value chain in branded groups. In 2016, he led a deal for control of Japan’s Sharp, and he is also investing in artificial intelligence and big data. “Belkin International is a world-recognized brand, with a wide range of offerings of consumer electronics products, services and solutions,” FIT said in its filing to the Hong Kong exchange.

Alibaba and Ford Unveil Car Vending Machine in Guangzhou

(March 26) SCMP.com

Alibaba and Ford Unveil Car Vending Machine in Guangzhou

(March 26) SCMP.com

- Chinese e-commerce giant Alibaba and US carmaker Ford have unveiled an unstaffed car vending machine in China’s southern city of Guangzhou. The machine stands about five stories tall and contains 42 cars of various models, including the Ford Explorer SUV and Mustang.

- Alibaba said users of Tmall, Alibaba’s flagship online shopping platform, with good credit scores can buy a car from the machine, without any human help, in under 10 minutes. They simply select a model on Alibaba’s Taobao mobile app and have their face scanned by the app. Then, when they arrive at the machine, it will verify their identity before delivering the vehicle.

Alibaba Gives “Sight” to Its Smart Speaker

(March 26) Alizila.com

Alibaba Gives “Sight” to Its Smart Speaker

(March 26) Alizila.com

- Alibaba has launched its newest human-computer interaction platform, called AliGenie 2.0. The platform has “sight” capability that enables it to do everything from reading bedtime stories to children in Chinese to recognizing different medicine bottles.

- The platform, developed by Alibaba’s A.I. Labs and launched last week, is used in Alibaba’s Tmall Genie, the top-selling voice-controlled speaker in China, the only market where it is currently available. Powered by AliGenie, the speaker can understand commands in Mandarin Chinese, the most widely used language in the world.

LATAM RETAIL & TECH HEADLINES

Brazil’s IoT Plan to Start Deployment Next Month

(March 26) ZDNet.com

Brazil’s IoT Plan to Start Deployment Next Month

(March 26) ZDNet.com

- Brazil will begin deploying its national Internet of Things (IoT) plan next month, according to the country’s Ministry of Science, Technology, Innovation and Communication. Aimed at modernizing the provision of public and private services, developing skills and entrepreneurship, and fostering innovation, the plan is designed to place Brazil at the forefront of the IoT in coming years.

- Some details that are core to actually starting work on the plan were part of a decree signed by President Michel Temer last Wednesday. These include bringing together digital initiatives currently being led by the government across various ministries, such as the Internet for All plan, a project relaunched earlier this year that aims to address lack of connectivity in remote regions of the country.

Brazil Improves Environment for Cloud Adoption

(March 23) ZDNet.com

Brazil Improves Environment for Cloud Adoption

(March 23) ZDNet.com

- Brazil has made some improvement in terms of the local environment for adoption of cloud computing, according to a recent study. The 2018 BSA Cloud Computing Scorecard from BSA, The Software Alliance, an advocacy organization for the global software industry, has ranked Brazil number 18 out of 24 countries, behind emerging countries such as South Africa, Argentina and Mexico.

- The BSA study ranks countries’ preparedness for the adoption and growth of cloud-computing services. While Brazil’s current position may seem rather bad, the country actually climbed four positions from last year. According to the study, cloud adoption in emerging markets still lags, mainly due to a lack of standards regarding cybersecurity.

Google Develops Data Analytics Service in Brazil

(March 21) ZDNet.com

Google Develops Data Analytics Service in Brazil

(March 21) ZDNet.com

- Google will further develop its data consulting services in Brazil by extending them to 12 of its largest local customers this year. Based on analytics product DataLab, which launched in Brazil last year, the local version of the initiative has three professionals dedicated solely to helping Google’s big enterprise users enhance their data analytics capabilities.

- According to Rafael Russo, Google Brazil’s head of data and measurement, the service is aimed at C-level professionals. “The transformational nature of the work requires a high level of customization of analysis and recommendations so that the insights produced can be as actionable as possible and generate results,” Russo told ZDNet.

Fiesta Mart to be Acquired by Mexican Retailer

(March 26) ProgressiveGrocer.com

Fiesta Mart to be Acquired by Mexican Retailer

(March 26) ProgressiveGrocer.com

- Hispanic retailer Bodega Latina, doing business as El Super and a subsidiary of Mexican company Grupo Comercial Chedraui, will acquire Fiesta Mart, which operates 63 Hispanic-themed stores located mainly in the Dallas and Houston areas. The deal will create one of the largest Hispanic-focused supermarket companies in the US, with a total of 122 stores in California, Arizona, Nevada, New Mexico and Texas and revenues of about $3 billion.

- “The acquisition of Fiesta allows us to meaningfully expand into Texas via an established, well-known supermarket operator,” said Carlos Smith, President and CEO of Bodega Latina. “Through the combination of the strengths of our two organizations, we will be well positioned to significantly accelerate our vision of efficiently offering high-quality products at the lowest possible prices.”

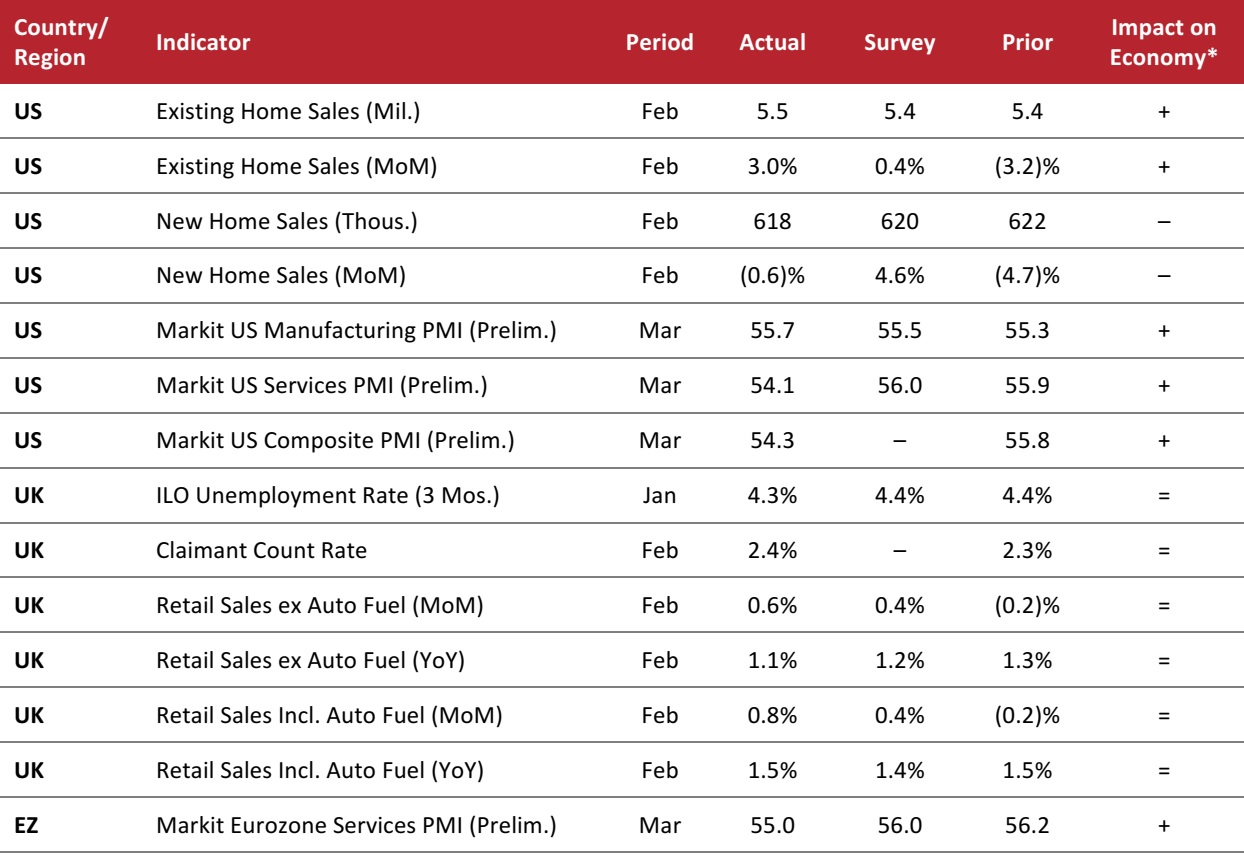

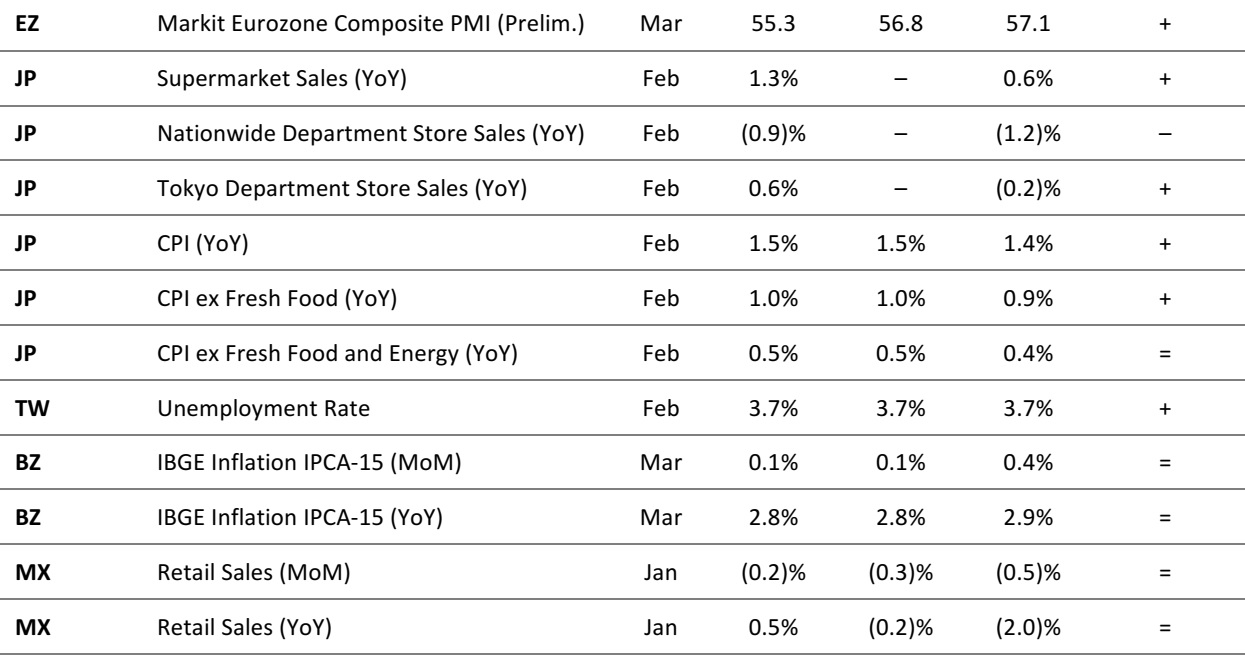

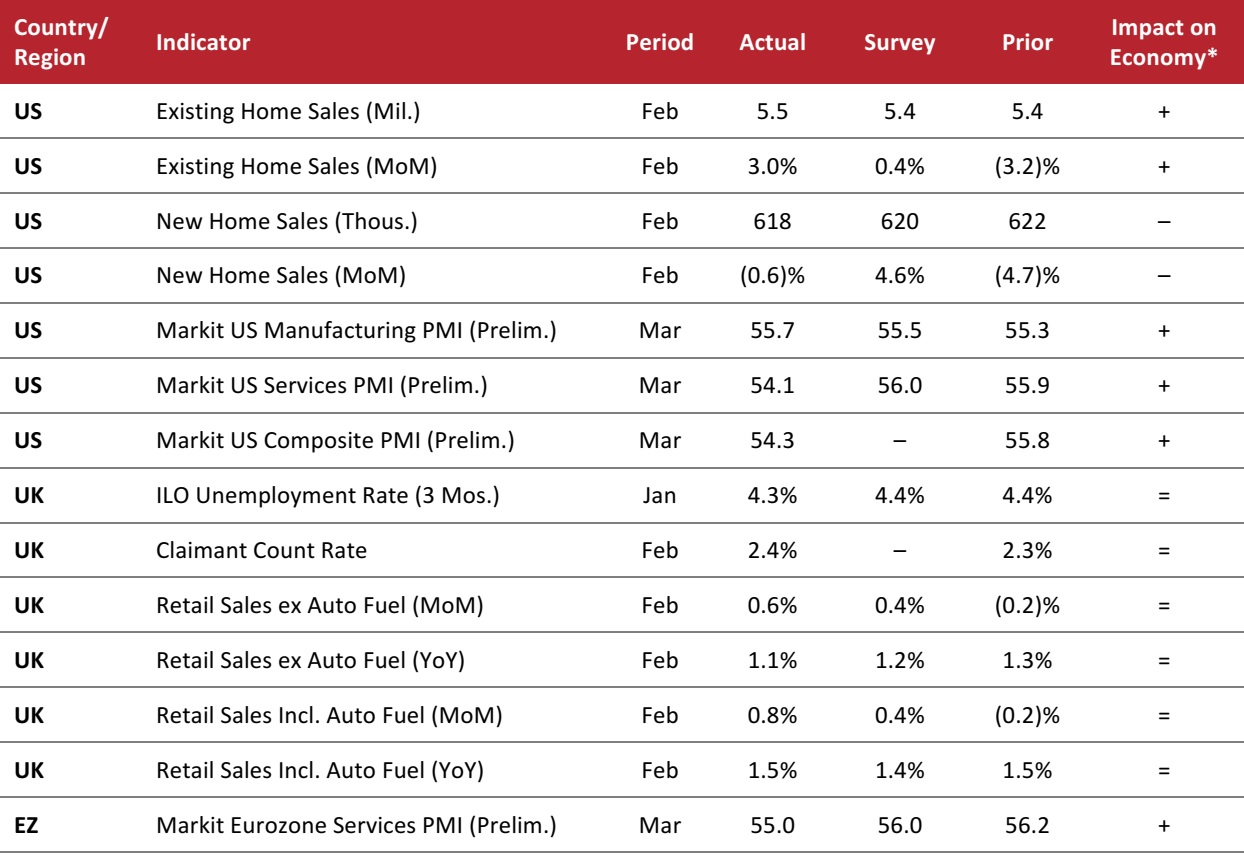

MACRO UPDATE

Key points from global macro indicators released March 21–28, 2018:

- US: Existing home sales increased by 3.0% month over month in February, while new home sales dropped by 0.6% month over month. The Markit US Manufacturing Purchasing Managers’ Index (PMI) stayed above the expansion threshold of 50.0 in March.

- Europe: In the UK, the ILO unemployment rate ticked down to 4.3% in January. The UK claimant count rate stood at 2.4% in February. UK retail sales increased by 1.1% year over year in February, slightly below the consensus estimate. In the eurozone, the Markit Eurozone Services and Composite PMIs stayed above the expansion threshold in March.

- Asia-Pacific: In Japan, supermarket sales increased by 1.3% year over year in February. Nationwide department store sales continued their downward trend in February, while Tokyo department store sales ticked up by 0.6% year over year.

- Latin America: In Brazil, inflation rose by 2.8% year over year in March, in line with the consensus estimate. In Mexico, retail sales increased in January by more than the market had expected, growing by 0.5% year over year.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/Markit/US Census Bureau/UK Office for National Statistics/Japan Chain Stores Association/Japan Department Store Association/Japan Ministry of Internal Affairs and Communications/Taiwan Directorate General of Budget, Accounting and Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/Markit/US Census Bureau/UK Office for National Statistics/Japan Chain Stores Association/Japan Department Store Association/Japan Ministry of Internal Affairs and Communications/Taiwan Directorate General of Budget, Accounting and Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

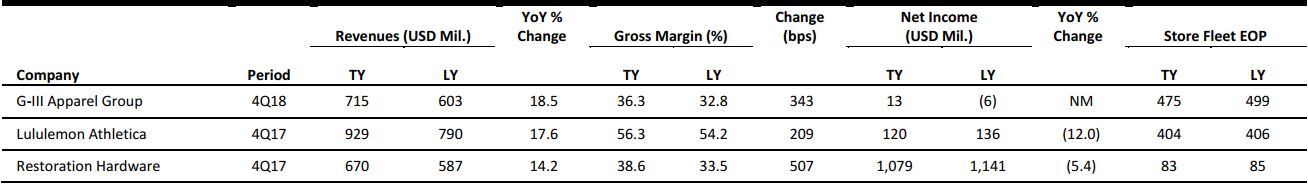

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Brazil’s IoT Plan to Start Deployment Next Month

(March 26) ZDNet.com

Brazil’s IoT Plan to Start Deployment Next Month

(March 26) ZDNet.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/Markit/US Census Bureau/UK Office for National Statistics/Japan Chain Stores Association/Japan Department Store Association/Japan Ministry of Internal Affairs and Communications/Taiwan Directorate General of Budget, Accounting and Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/Markit/US Census Bureau/UK Office for National Statistics/Japan Chain Stores Association/Japan Department Store Association/Japan Ministry of Internal Affairs and Communications/Taiwan Directorate General of Budget, Accounting and Statistics/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research