albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Strong Demand for Value Fashion, E-Commerce Pure Plays and Sportswear Brands Is Keeping the Pressure on Europe’s Middleground Apparel Retailers Large midmarket retailers are finding business ever more challenging, as the combination of e-commerce and high-growth, store-based retailers has created an explosion in choice for consumers. Meanwhile, variation in consumer identities, tastes and shopping preferences has led to market fragmentation and increased competition for retailers across many fronts. In Europe, retailers such as Marks & Spencer and Debenhams are closing stores in the UK, and the department store middle ground in Germany has experienced consolidation with the merger of Galeria Kaufhof and Karstadt.

Middleground retailers are likely to continue to lose share as consumers gravitate toward three growth segments: high-quality, low-price private-label retailers and brand-heavy off-pricers in the discount segment; Internet-only retailers bidding to capture greater share in apparel; and sportswear brands, which are increasingly selling directly to consumers through their own brick-and-mortar stores.

Primark has engineered success by raising its retail standards. By offering attractive stores and combining fast fashion with standard apparel offerings, the chain has lured shoppers from midmarket rivals. Boohoo has focused more heavily on building a compelling product assortment. These value retailers have likely driven consolidation in the value segment, although their strength does not necessarily apply to the overall discount segment. Many other long-standing European value players have experienced mixed performance due to intensified competition.

Zalando is Europe’s biggest Internet-only apparel retailer and management views it as Europe’s largest distributor of several major apparel brands. The company seeks to grow revenues from €5.4 billion to €13 billion from 2018 to 2023/2024, representing a 15%-20% CAGR. Zalando also aims to grow its gross merchandise volume at a 20%-25% CAGR during the period.

While growing rapidly, Zalando and other Internet-only retailers are also seeing escalating fulfillment costs. As they seek to overcome long-standing delivery hurdles and offer greater convenience, their fulfillment costs are climbing quickly as a percentage of revenues, negating any economies of scale and leverage of their cost base.

Meanwhile, shoppers in the UK, Germany, France and other countries have been devoting more of their apparel budgets to sportswear, and Euromonitor International forecasts the trend will continue over the next five years. Sportswear brands are increasingly selling directly to consumers through their own brick-and-mortar stores. At the same time, healthy demand for premium branded sportswear is giving a boost to online multibrand platforms such as ASOS, Zalando and Amazon, and increased demand for major sportswear brands is also driving the growth of online fashion platforms.

Millennials (those born between 1980 and the late 1990s/2000) are driving demand for sportswear brands, as well as supporting growth at budget fashion retailers and e-commerce pure plays. Younger consumers drive the fashion market today, though it is not clear to what extent these shoppers’ preferences are linked to their age or how their preferences may shift over time.

High-growth value players such as Primark and Boohoo appear to be consolidating the discount segment at the expense of some legacy discount players. Still, strong consumer demand for brand-heavy sportswear offerings is likely to support growth at multibrand e-commerce platforms.

Please click here to read our report Strong Demand for Value Fashion, E-Commerce Pure Plays and Sportswear Brands Sustains Pressure on Europe’s Middleground Apparel Retailers.

QUESTION OF THE WEEK

[caption id="attachment_82123" align="aligncenter" width="640"] Base: US Internet users ages 18+ who have bought beauty, grooming or personal care products in the past year, surveyed in February 2019

Base: US Internet users ages 18+ who have bought beauty, grooming or personal care products in the past year, surveyed in February 2019Source: Coresight Research[/caption]

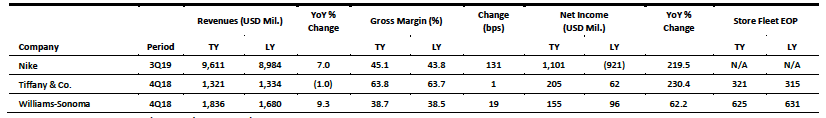

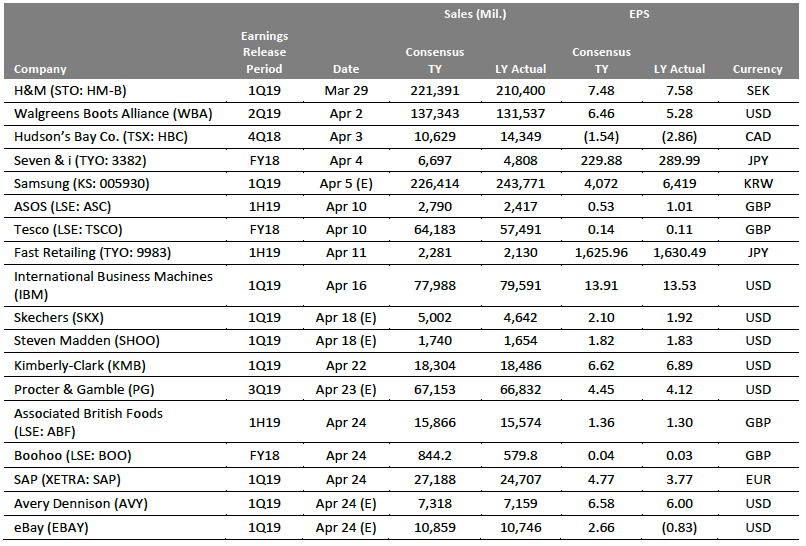

US RETAIL EARNINGS

[caption id="attachment_81982" align="aligncenter" width="826"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

US RETAIL & TECH HEADLINES

![]() Tiffany’s Sparkle Dims in Q4

(Mar. 25) RetailDive.com

Tiffany’s Sparkle Dims in Q4

(Mar. 25) RetailDive.com

- In the fourth quarter, Tiffany’s worldwide net sales declined 1%, to $1.3 billion, and comps also declined 1%. The company attributed the performance to macro headwinds, notably stock market volatility that rattled its wealthy clientele, and noted “softer demand by local customers and foreign tourists across most regions and product categories.”

- The jeweler has been attracting younger consumers by offering new collections and greater transparency regarding the source of its diamonds, but the decline of the middle class is complicating its progress at home.

![]() Saks Off 5th Launches Private-Label Beauty Line

(Mar. 22) RetailDive.com

Saks Off 5th Launches Private-Label Beauty Line

(Mar. 22) RetailDive.com

- Saks Off 5th, the off-price unit run by Hudson’s Bay Company’s Saks Fifth Avenue, announced the launch of a private-label beauty collection called Fifth City. The line includes more than 35 products ranging from face, lip and eye makeup to brushes and accessories.

- Fifth City items are priced from $4.99 to $60 and the line is available at selected US stores and on the SaksOff5th.com website.

![]() Levi’s CEO Sees “Clear Runway” for Growth as Company Tries to Woo Women Back to Jeans from Yoga Pants

(Mar. 21) CNBC.com

Levi’s CEO Sees “Clear Runway” for Growth as Company Tries to Woo Women Back to Jeans from Yoga Pants

(Mar. 21) CNBC.com

- Following a stronger-than-expected IPO, Levi Strauss CEO Chip Bergh said on Mar. 21 that Levi’s has a “clear runway for growth” as it looks to boost women’s jeans sales.

- The denim brand has expanded into womenswear and T-shirts in an effort to broaden its reach. Gaining market share among women is key, as many women have been shifting to yoga pants and leggings from jeans.

![]() Glossier Valuation Reaches $1.2 Billion After $100 Million Funding Round

(Mar. 19) RetailTouchPoints.com

Glossier Valuation Reaches $1.2 Billion After $100 Million Funding Round

(Mar. 19) RetailTouchPoints.com

- Direct-to-consumer beauty company Glossier has raised $100 million in a series D funding round led by Sequoia Capital. The company is now valued at $1.2 billion, according to The Wall Street Journal. In 2018, Glossier generated more than $100 million in revenue, largely by selling unisex skincare, makeup and fragrances.

- In February 2018, the company secured $52 million in series C funding that boosted its total funding to $86 million and its valuation to $390 million.

![]() Ikea’s First City-Center Store in the US Opens in NYC Next Month

(Mar. 19) Curbed.com

Ikea’s First City-Center Store in the US Opens in NYC Next Month

(Mar. 19) Curbed.com

- Ikea, the iconic Swedish furniture retailer, is set to debut its first city-center location in the US. The Ikea Planning Studio will open at 999 Third Avenue in New York City on April 15, and it will look quite different from the sprawling, bright-blue buildings that have been a cornerstone of the brand.

- The new store will feature more styled living areas that showcase a curated selection of smart solutions for city living rather than the dizzying array of products typically found in the company’s big-box stores.

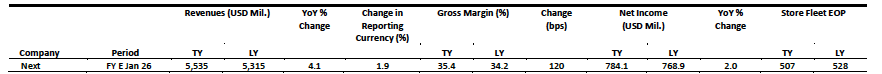

EUROPE RETAIL EARNINGS

[caption id="attachment_82006" align="alignleft" width="882"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

Debenhams Warns Any Sports Direct Offer Won’t Address Funding Concerns

(Mar. 26) Reuters.com

Debenhams Warns Any Sports Direct Offer Won’t Address Funding Concerns

(Mar. 26) Reuters.com

- Sports Direct founder Mike Ashley has made a cash offer to buy Debenhams in order to prevent a financial rescue plan that could wipe out Sports Direct’s stake in the ailing British department store.

- Debenhams said the offer would not address its immediate funding needs and that any proposal should provide the offer price and terms of consideration, a plan detailing how Debenhams’ existing debt would be repaid, and a proposal to address its immediate funding requirements.

Ocado and Coles Form International Partnership

(Mar. 26) Company press release

Ocado and Coles Form International Partnership

(Mar. 26) Company press release

- British supermarket Ocado signed an exclusive services agreement with Australian supermarket Coles to develop Coles’ online grocery business in Australia using the Ocado Smart Platform.

- Coles and Ocado have agreed to build two customer fulfillment centers in Australia, one in Sydney and one in Melbourne.

![]() Go Instore Tech Drives Sales Growth for Currys PC World

(Mar. 21) ChargedRetail.co.uk

Go Instore Tech Drives Sales Growth for Currys PC World

(Mar. 21) ChargedRetail.co.uk

- British electronics retailer Currys PC World has partnered with London-based tech startup Go Instore, whose new live video commerce technology enables online customers to virtually enter a retailer’s physical store and interact with staff via webcam.

- Currys PC World used the technology to provide online customers with an immersive, one-way HD video feed and two-way audio conversation with in-store HP sales experts. The retailer saw an increase in HP product purchases as a result of the technology implementation.

![]() New Look Hires Nigel Oddy as COO

(Mar. 25) TheRetailBulletin.com

New Look Hires Nigel Oddy as COO

(Mar. 25) TheRetailBulletin.com

- Fashion retailer New Look has hired Nigel Oddy, former CEO of UK retailers The Range and House of Fraser, as COO, effective Apr. 1.

- Oddy joins New Look at a difficult time for the retailer. The company is undergoing a refinancing program, departing international markets and working on a company voluntary arrangement that has led to several store closures and accompanying job cuts.

Sainsbury’s and Asda Offer to Sell up to 150 Stores to Win Merger Approval

(Mar. 25) RetailGazette.co.uk

Sainsbury’s and Asda Offer to Sell up to 150 Stores to Win Merger Approval

(Mar. 25) RetailGazette.co.uk

- Sainsbury’s and Asda have offered to sell 125–150 stores to gain approval from the UK’s Competition and Markets Authority (CMA) for their proposed £12 billion ($15.9 billion) merger.

- The proposal, however, falls considerably short of the 300 stores that the CMA had prescribed the retailers sell in order to gain approval.

Boohoo Group Acquires MissPap

(Mar. 26) Company press release

Boohoo Group Acquires MissPap

(Mar. 26) Company press release

- UK-based fashion retailer Boohoo Group has acquired the brand and intellectual property assets of women’s pure-play fashion retailer MissPap for an undisclosed amount.

- “MissPap is a brand with great potential [that] can leverage the group’s expertise. This acquisition further strengthens our multibrand platform, representing an exciting opportunity to accelerate our offering to our ever-growing range of customers globally,” said Boohoo Group CEO John Lyttle.

ASIA RETAIL & TECH HEADLINES

![]() Taobao Launches Home and Living Brand Jiyoujia in Singapore

(Mar. 25) SBR.com.sg

Taobao Launches Home and Living Brand Jiyoujia in Singapore

(Mar. 25) SBR.com.sg

- Alibaba-owned e-commerce platform Taobao has debuted its Jiyoujia home and living channel in Singapore, in the NomadX multilabel concept store. This is the first time the company has introduced its merchants and products to consumers outside China.

- “Singapore is an important market for Taobao, and we continue to witness strong and sustained demand for the home and living category here by shoppers. In fact, the…category is our fastest-growing segment here,” said Mickey Xiong, Taobao’s Country Director for Southeast Asia.

PVH Corp. Set to Reacquire Tommy Hilfiger License in Five Asian Markets

(Mar. 25) WWD.com

PVH Corp. Set to Reacquire Tommy Hilfiger License in Five Asian Markets

(Mar. 25) WWD.com

- PVH Corp. announced it will reacquire the license for the Tommy Hilfiger brand in five Asian markets – Hong Kong, Macau, Singapore, Malaysia and Taiwan – from investment holding company Dickson Concepts.

- The deal, which aligns with PVH’s strategy to gain more direct control over its brands, is expected to conclude in the second quarter of this year.

![]() Smiggle Plans Asia Expansion

(Mar. 25) InsideRetail.asia

Smiggle Plans Asia Expansion

(Mar. 25) InsideRetail.asia

- Australian stationery retailer Smiggle is set to expand in Asia and the Middle East. The brand’s owner, Premier Investments, is planning to open stores in South Korea, Thailand, Indonesia, the Philippines and the UAE, expanding the brand’s reach to over 100 new locations by July 2019.

- The development follows a period of strong sales for Smiggle in Asia. The company saw sales growth of 34.8% in the region in the first half of its fiscal year, which ended in January 2019.

Tencent to Launch WeChat Pay in India

(Mar. 24) TheDrum.com

Tencent to Launch WeChat Pay in India

(Mar. 24) TheDrum.com

- Chinese technology giant Tencent plans to enter the lucrative mobile payments market in India by introducing WeChat Pay in the country, pitching it against Google Pay and Paytm. Tencent has reportedly met with officials at the National Payments Corporation of India in order to obtain a license for the app.

- Tencent has already partnered with banks such as Axis Bank, HDFC and ICICI in India in a bid to launch WeChat Pay in the country by the end of June.

Under Armour Set to Open Regional Headquarters in Hong Kong, Targets Asia Expansion

(Mar. 24) SCMP.com

Under Armour Set to Open Regional Headquarters in Hong Kong, Targets Asia Expansion

(Mar. 24) SCMP.com

- American sportswear brand Under Armour announced it will open a regional headquarters later this year in Hong Kong. The company will use the office as a base for its Asia-Pacific expansion. Asia is a key overseas growth market for Under Armour as it expands beyond its US roots.

- “As part of the transformation into this new operating model, one of the things that we wanted to do was to really empower our regions,” said Patrik Frisk, the company’s President and COO. “So, we decided to move into an APAC, Latin America, EMEA and North America structure.”

LATAM RETAIL & TECH HEADLINES

![]() Medipiel to Launch E-Commerce Platform

(Mar. 22) America-Retail.com

Medipiel to Launch E-Commerce Platform

(Mar. 22) America-Retail.com

- Colombian beauty and skincare chain Medipiel is planning to launch an e-commerce platform by May. The company expects to generate $1 billion in sales through the new channel in the second half of the year.

- Medipiel General Manager Pablo Lema López said the e-commerce site will help drive greater recognition of the beauty and skincare brands Medipiel sells and allow the company to reach a wider consumer base.

![]() Supermarket Sales in Argentina Decline 10.5% in January

(Mar. 25) America-Retail.com

Supermarket Sales in Argentina Decline 10.5% in January

(Mar. 25) America-Retail.com

- Supermarket sales in Argentina declined 10.5% year over year in January at constant prices, according to the National Statistics and Censuses Institute. January marked the seventh consecutive month in which both supermarket and shopping center sales declined in the country.

- Sales at large shopping centers in Argentina declined 15.1% year over year in January at constant prices.

Empresas Partners with Accenture to Implement Digital Transformation

(Mar. 22) Df.cl

Empresas Partners with Accenture to Implement Digital Transformation

(Mar. 22) Df.cl

- Empresas, the parent company of Chilean pharmacy chains Salcobrand and PreUnic, has entered a five-year partnership with Accenture. The agreement will enable Empresas to enhance its data and analytical capabilities and digitally transform its operations.

- Matías Verdugo, General Manager of Empresas, said the agreement “will allow us to continue improving our customer experience, speeding up changes in the operation and providing more stability and security to computer systems.”

Crocs Returns to Mexico with a New Production Plant

(Mar. 25) Modaes.com

Crocs Returns to Mexico with a New Production Plant

(Mar. 25) Modaes.com

- US footwear retailer Crocs is returning to Mexico through a partnership with Foam Creations, which is owned by Italy’s Finproject. Foam Creations has opened a plant in the Stiva Industrial Park in the state of Nuevo León, where it plans to manufacture footwear for Crocs and other shoe brands.

- In May 2018, Crocs closed two factories it had operated in Guanajuato.

Buenos Aires’ Del Parque Shopping Center to Close

(Mar. 25) America-Retail.com

Buenos Aires’ Del Parque Shopping Center to Close

(Mar. 25) America-Retail.com

- Del Parque, a shopping center in the heart of Buenos Aires, announced it plans to wind up operations by the end of June due to a decline in consumption. The shopping mall has been in operation for over 23 years.

- “Given the…losses that we had been experiencing for a year and a half, the decision was made to close,” said Marcelo Chane, General Manager of the shopping center. “And while there is interest in the property, there is nothing concrete. It was decided to plan the closing in advance to avoid situations such as suspensions or not being able to pay salaries on time.”

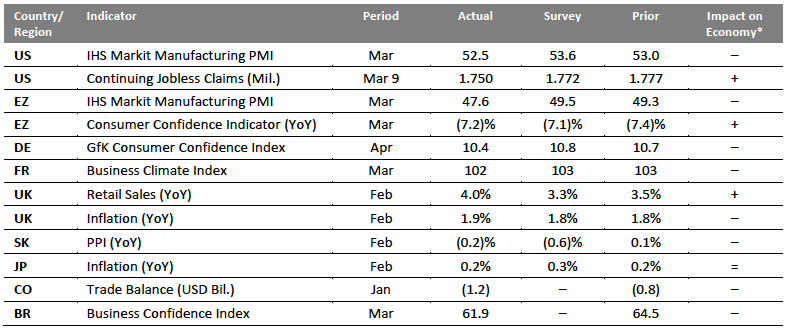

MACRO UPDATE

Key points from global macro indicators released March 20–26, 2019:

1) US: The IHS Markit Manufacturing Purchasing Managers’ Index (PMI) decreased to 52.5 in March from 53.0 in February and came in below the consensus estimate of 53.6. Continuing jobless claims decreased to 1.750 million in the week ended Mar. 9 from 1.777 million in the previous week. 2) Europe: In the eurozone, the IHS Markit Manufacturing PMI decreased to 47.6 in March from 49.3 in February and was below the consensus estimate of 49.5. In the UK, retail sales grew 4% year over year in February, exceeding January’s 3.5% growth and the consensus estimate of 3.3% growth. 3) Asia Pacific: In South Korea, the Producer Price Index (PPI) decreased 0.2% year over year in February, compared with a 0.1% increase in January and the consensus estimate of a 0.6% decline. In Japan, annual inflation stood at 0.2% in February, unchanged from January and below the consensus estimate of 0.3%. 4) Latin America: Colombia’s trade deficit rose to $1.2 billion in January from $0.8 billion in December. In Brazil, the Business Confidence Index registered 61.9 in March, below February’s 64.5 reading. [caption id="attachment_81981" align="aligncenter" width="790"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impactSource: IHS Markit/US Bureau of Labor Statistics/Eurostat/GfK/National Institute of Statistics and Economic Studies (France)/Office for National Statistics (UK)/Bank of Korea/Ministry of Internal Affairs and Communication (Japan)/National Administrative Department of Statistics (Colombia)/National Confederation of Industry (Brazil)/Coresight Research[/caption]

EARNINGS CALENDAR

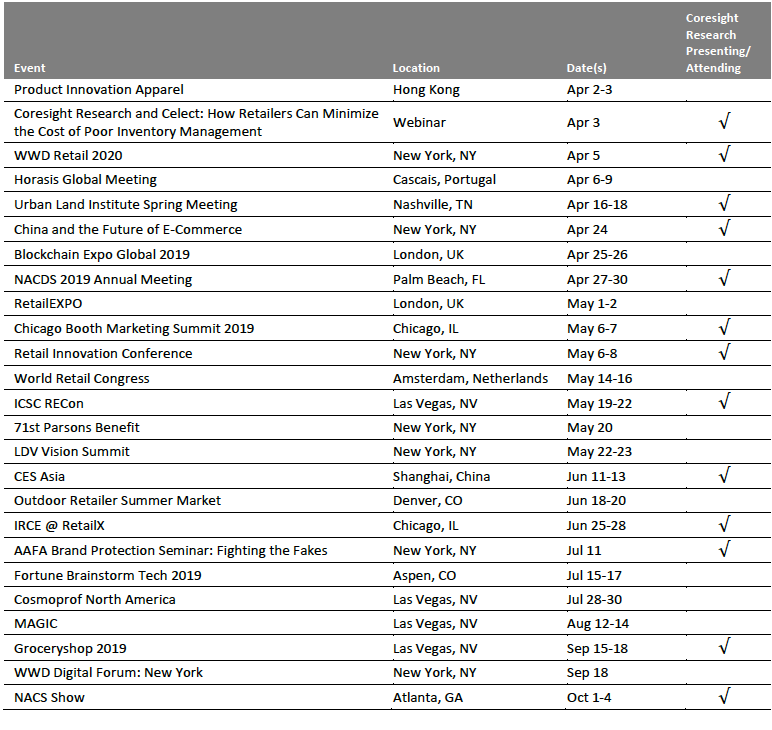

EVENT CALENDAR