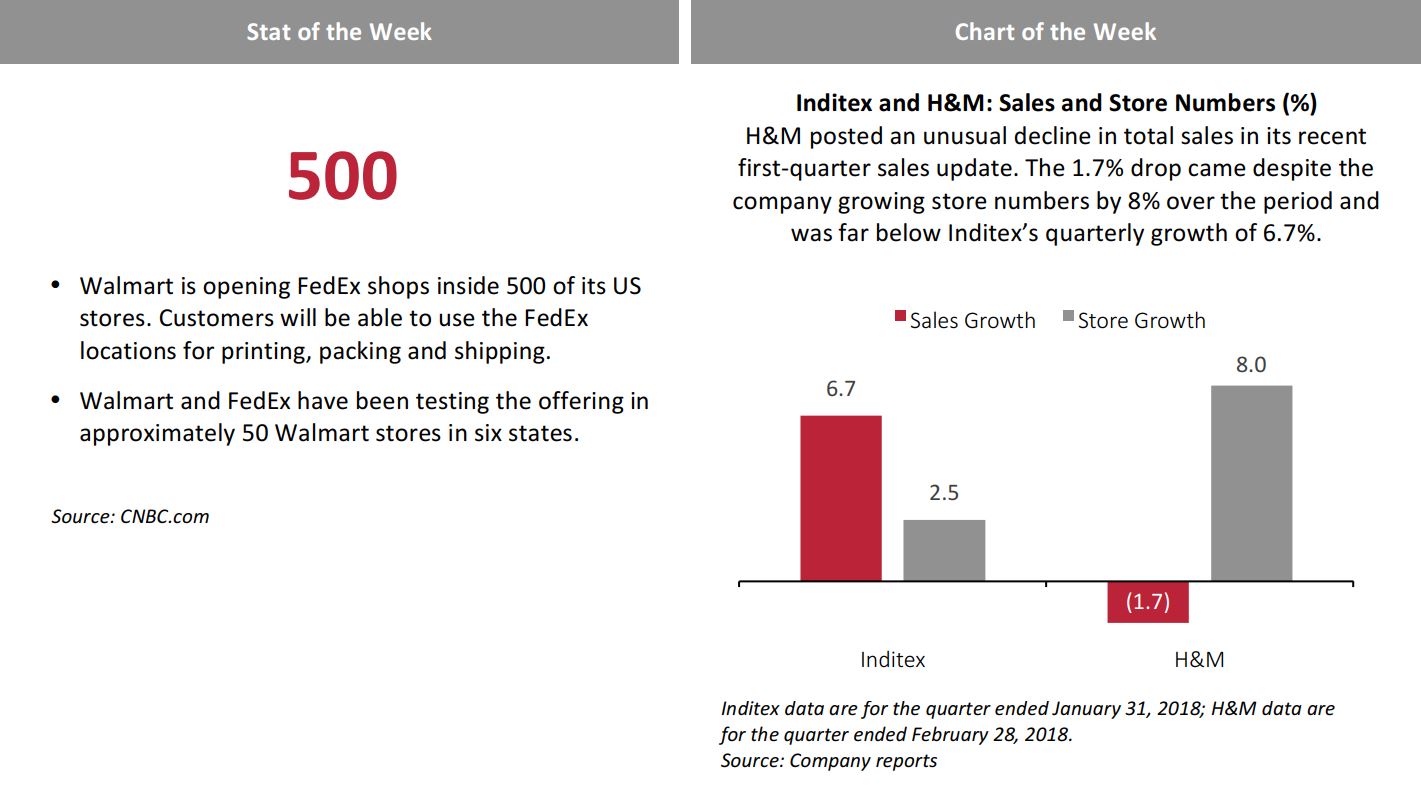

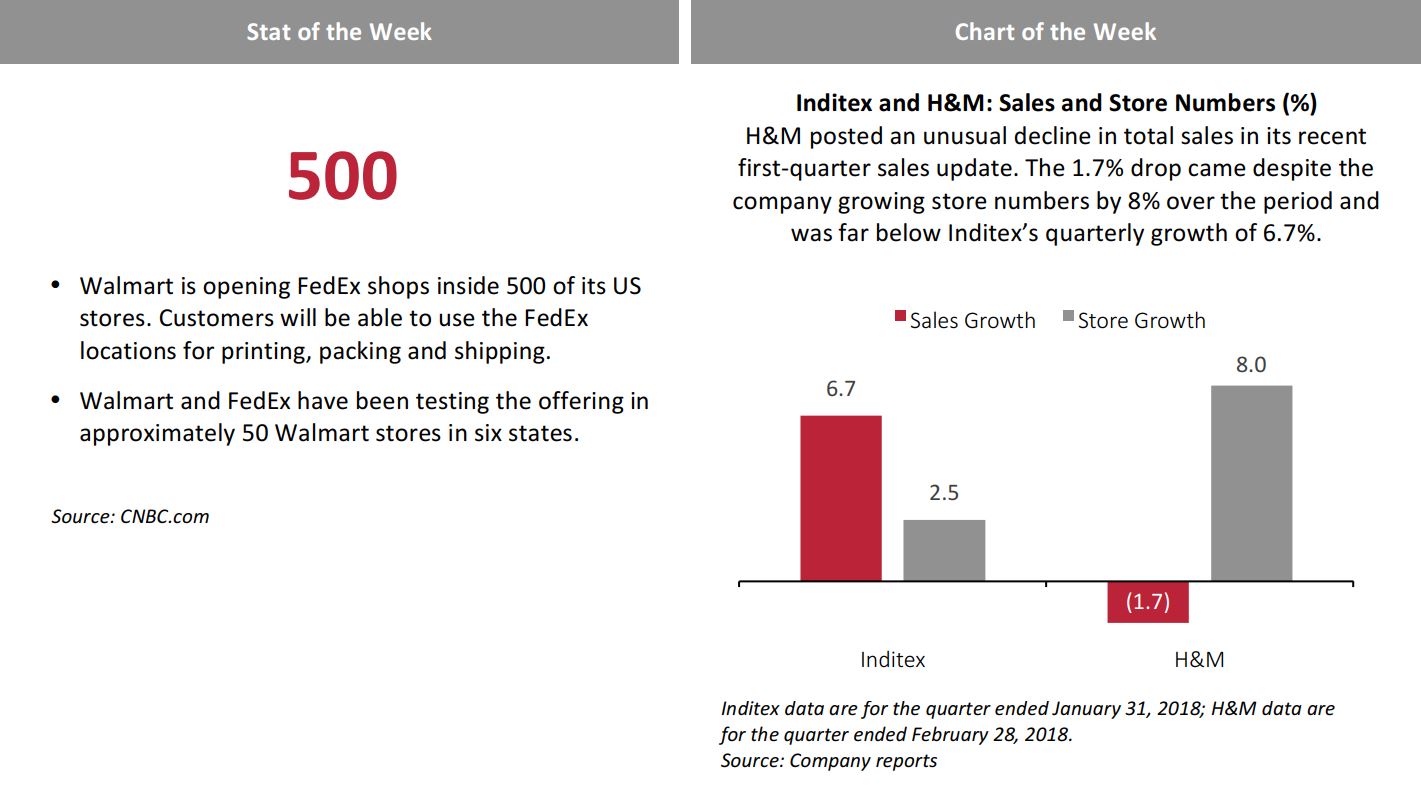

Inditex data are for the quarter ended January 31, 2018; H&M data are for the quarter ended February 28, 2018.

Source: CNBC.com and Company reports

Inditex data are for the quarter ended January 31, 2018; H&M data are for the quarter ended February 28, 2018.

Source: CNBC.com and Company reports

From the Desk of Deborah Weinswig

Reviewing the Landscape of Startups Tackling the Retail Returns Problem

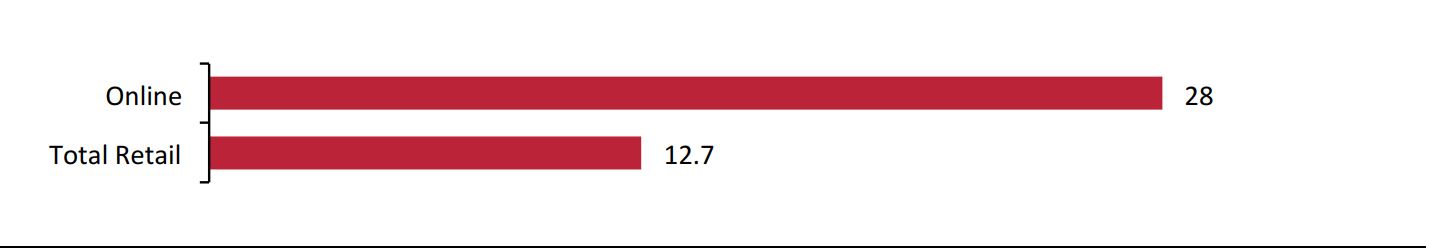

As e-commerce continues to grow, so, too, does the range of services designed to tackle returns, one of the biggest headaches that comes with online retail. American consumers returned approximately $351 billion of merchandise bought offline and online last year, according to the National Retail Federation. That is equivalent to around 10% of all retail sales, but return rates tend to be considerably higher in online retail and especially in online apparel retail.

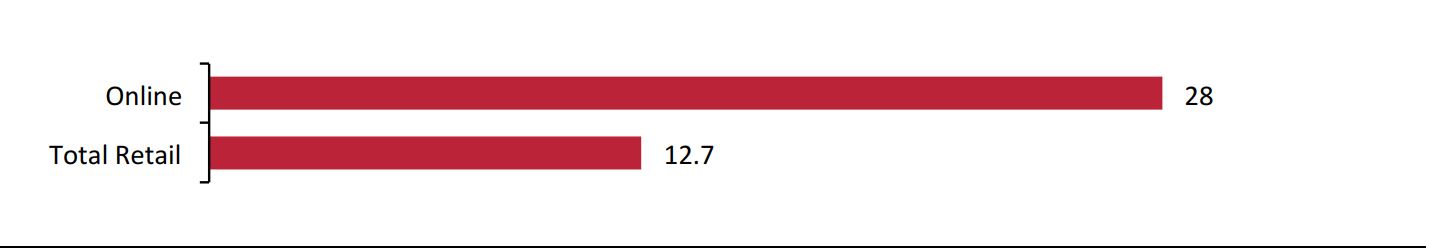

US: Estimated Average Return Rate as % of Apparel Purchases

Total retail data are for 2017; online data are for 2016.

Source: National Retail Federation/True Fit

Total retail data are for 2017; online data are for 2016.

Source: National Retail Federation/True Fit

Last month,

we discussed in this note how some brick-and-mortar retailers are tightening return policies to reduce abuse. This week, we review several of the emerging tech-driven services that can help online retailers reduce or process returns.

At the Shoptalk 2018 conference this week, consulting firm Newmine launched its Chief Returns Officer product. Newmine says that it processes data from multiple sources and uses “data science and AI principles” to determine the cause of returns in near real time. Retailers using the service receive actionable recommendations for resolving problems during the selling season.

Supply.ai’s ReturnSense is a returns prevention platform that learns customer behavior, detects the likelihood of returns, alerts the retailer and intervenes in the purchase process to mediate with customers about their product choices. The firm says its algorithm draws from over 1,000 data variables to predict which orders are likely to be returned. The company says that its service prevents returns and makes shoppers feel more confident in their purchase choices.

Other technology providers include Returnly, a fintech platform that turns product returns into repurchases by enabling customers to buy again with instant exchanges and refunds, before they have even returned their items. Appriss Retail’s Verify service is a consumer-based returns authorization system that uses predictive algorithms and statistical models to distinguish those engaged in fraudulent and abusive behavior and deny them the ability to make returns. The company says it is the most widely used returns optimization tool in retail.

In the physical world, Happy Returns provides centralized, in-person return points for online retailers. The California-based startup sets up Return Bars inside shopping malls and stores to accept returned items on behalf of online retailers and give the customers making the returns an immediate refund.

Supply.ai states that it costs retailers an average of $28 to process each returned item. But returns from international customers can be especially costly for retailers if they are the ones paying for postage—for some international orders, the cost of free shipping and free return can be greater than the cost of the product ordered. Service providers such as ZigZag Global offer cost-effective ways to consolidate, process or liquidate international returns. ZigZag Global says it can open and inspect goods on behalf of retailers, consolidate returns into larger shipments to make logistics more cost effective, and list returned stock that retailers do not want shipped back on marketplace websites in a number of countries.

In addition to these specialized services, artificial intelligence–based services from firms such as Celect and Blue Yonder can indirectly reduce return rates by optimizing inventory so that it gets into shoppers’ hands more quickly—before shoppers change their mind or decide they no longer need the product they ordered. Other indirect ways of limiting returns include providing shoppers with presale apparel fitting services such as True Fit, which helps shoppers pick the right size when buying fashion online.

As e-commerce grows apace and multi channel retailers face competition from pure plays that typically offer generous return policies, we expect to see more retailers invest in services that can reduce, process or streamline product returns.

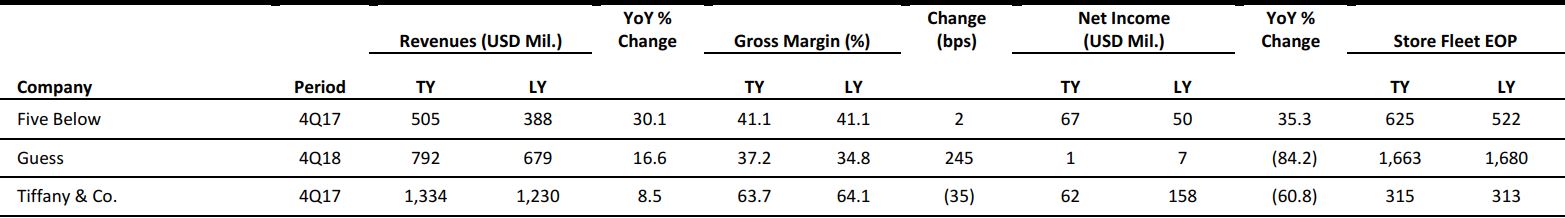

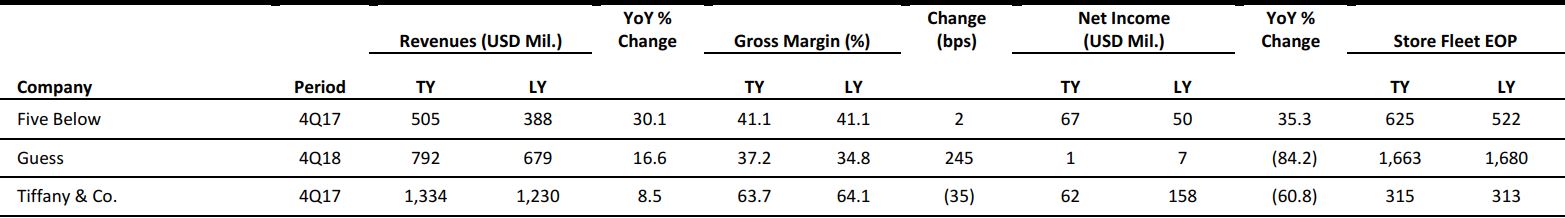

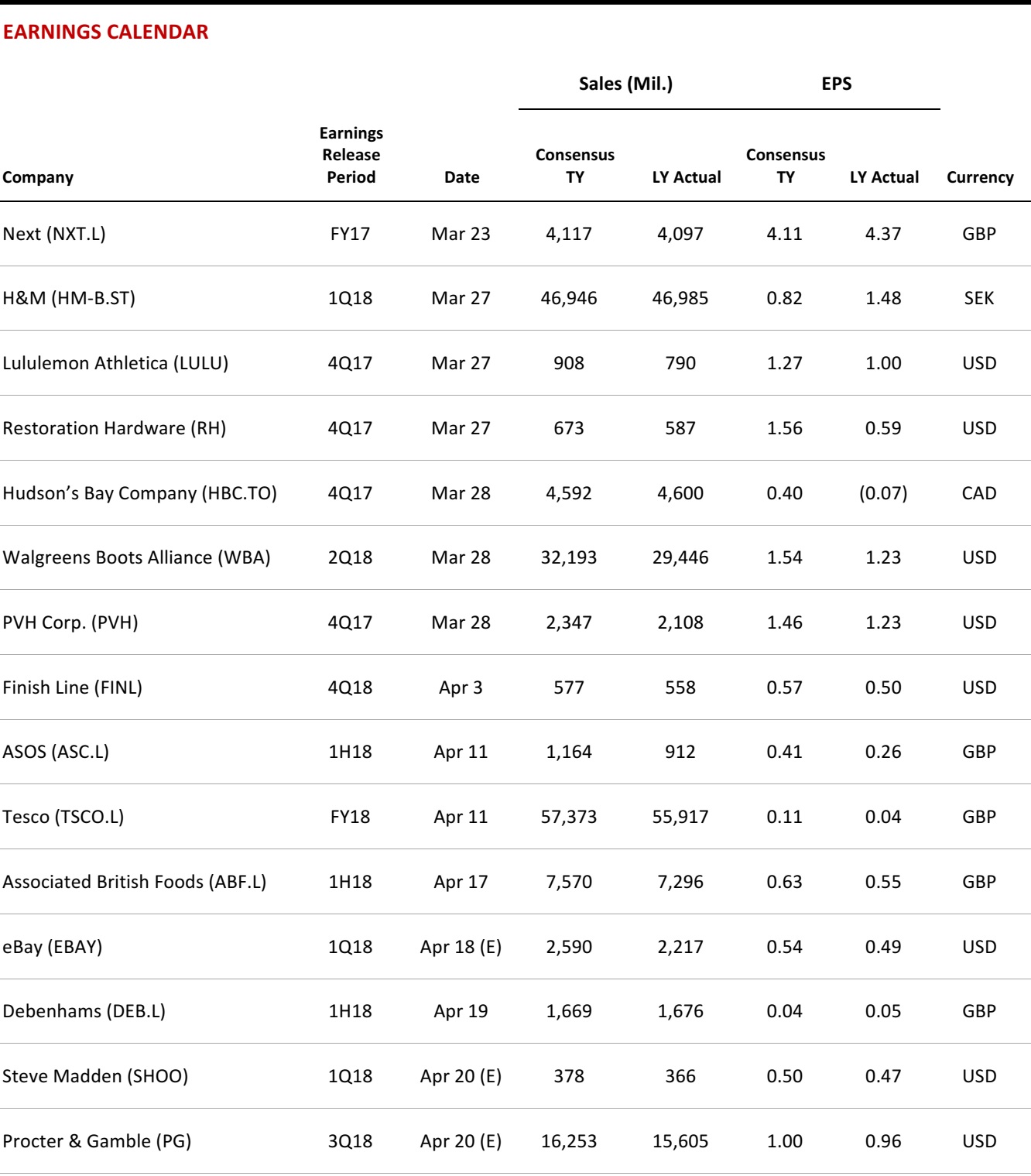

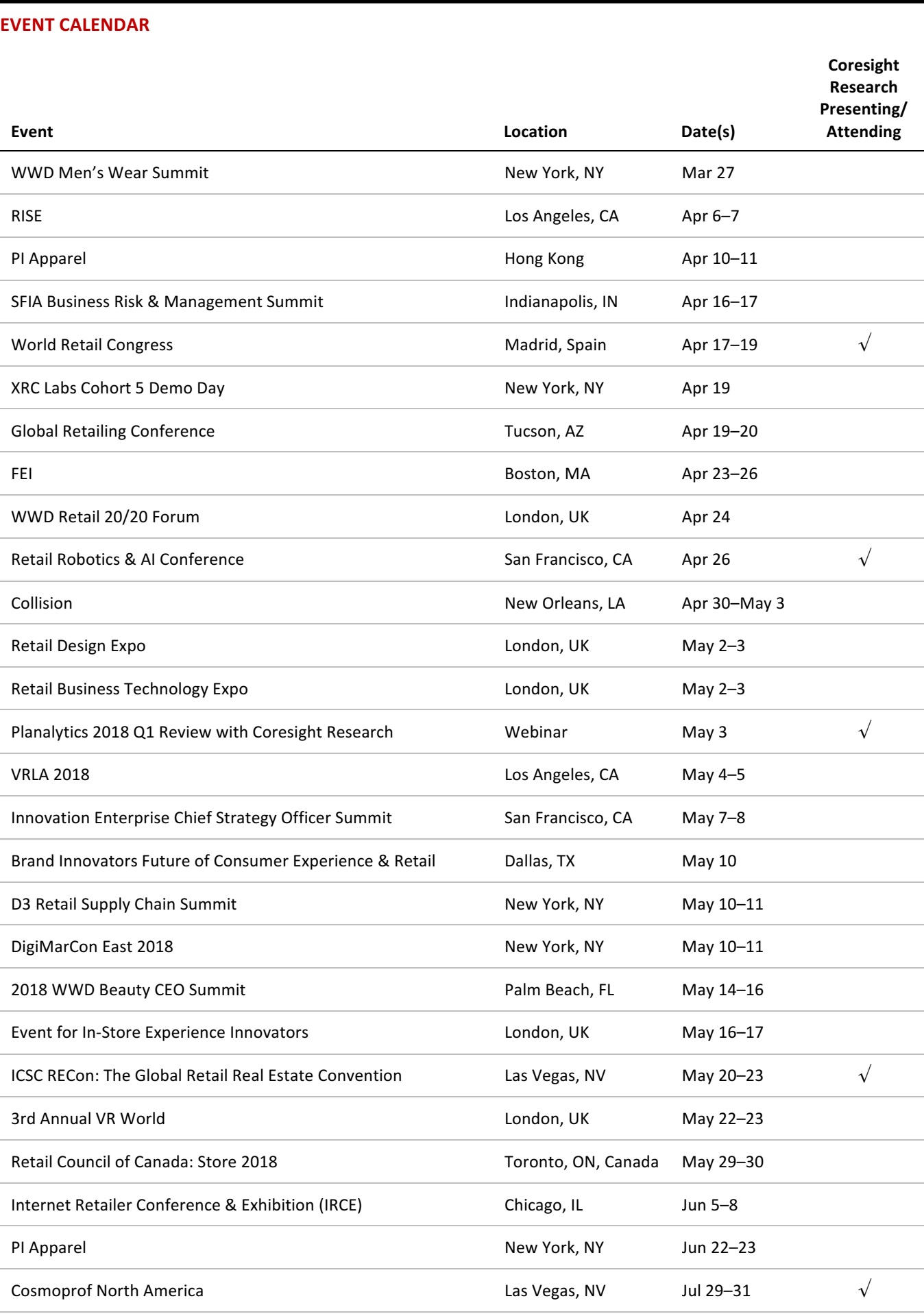

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

The Children’s Place Expands into China, Targeting a $150 Million Payday

(March 20) FootwearNews.com

The Children’s Place Expands into China, Targeting a $150 Million Payday

(March 20) FootwearNews.com

- The Children’s Place announced that it has signed an exclusive licensing agreement with Zhejiang Semir Garment Co. (Semir) to bring The Children’s Place brand into the Greater China market, encompassing Mainland China, Taiwan, Hong Kong and Macau.

- Over the first five years, Semir will open at least 300 Children’s Place retail locations—stocking a mix of apparel, footwear and accessories—in Greater China, as well as operate the brand’s e-commerce business. The partnership is projected to generate $125–$150 million in sales by 2022.

Retail Bankruptcy Tracker: Claire’s and Grocers Throw in the Towel

(March 20) Pymnts.com

Retail Bankruptcy Tracker: Claire’s and Grocers Throw in the Towel

(March 20) Pymnts.com

- As sad as the end of Toys“R”Us may be, the iconic toy store is far from the only retailer struggling these days. Say goodbye to Claire’s, the girls’ accessories chain, which on March 19 filed for Chapter 11 bankruptcy protection.

- Also, Winn-Dixie will close 35 stores in Florida after its owner, Southeastern Grocers, filed for bankruptcy last week, according to Bloomberg. Under the same ownership, BI-LO, Harveys Supermarket and Fresco Y Más will also close stores, for a total of 94 closures across all Southeastern Grocers brands.

Walmart to Bring FedEx Shops into 500 of Its US Stores

(March 20) CNBC.com

Walmart to Bring FedEx Shops into 500 of Its US Stores

(March 20) CNBC.com

- Walmart is bringing FedEx shops for printing, packing and shipping into 500 of its US stores, adding to the number of services it offers customers as it races against Amazon. Walmart and FedEx have been testing the arrangement in roughly 50 locations.

- Following a successful pilot program, the small-format FedEx Office shops will be in 500 Walmart locations within two years.The FedEx Offices will allow shoppers to have their packages held there for up to five business days, which can be more convenient for some customers and can appeal to those concerned about so-called porch pirates.

Amazon Has Considered Buying Some Toys“R”Us Stores

(March 19) Bloomberg.com

Amazon Has Considered Buying Some Toys“R”Us Stores

(March 19) Bloomberg.com

- Amazon has looked at the possibility of expanding its retail footprint by acquiring some locations from bankrupt Toys“R”Us, according to people familiar with the situation.

- The online giant isn’t interested in maintaining the Toys“R”Us brand, but has considered using the soon-to-be-vacant spaces for its own purposes. Such a move would let Amazon quickly expand its brick-and-mortar presence, coming on the heels of buying Whole Foods Market and its more than 450 locations last year.

Retail Landlords Get Ready to Deal with Empty Toys“R”Us Spaces

(March 15) NREIOnline.com

Retail Landlords Get Ready to Deal with Empty Toys“R”Us Spaces

(March 15) NREIOnline.com

- Few in commercial real estate were shocked following the announcement that Toys“R”Us has moved to liquidate all its US stores. The liquidation filing means that more than 800 stores in the US will shutter, taking a major toy industry player off the market.

- Some are viewing the closures as an opportunity. There already have been prospective tenants aiming to be considered first for the store spaces, and fitness centers, grocery stores and discount retailers may be most likely to take up some of the space.

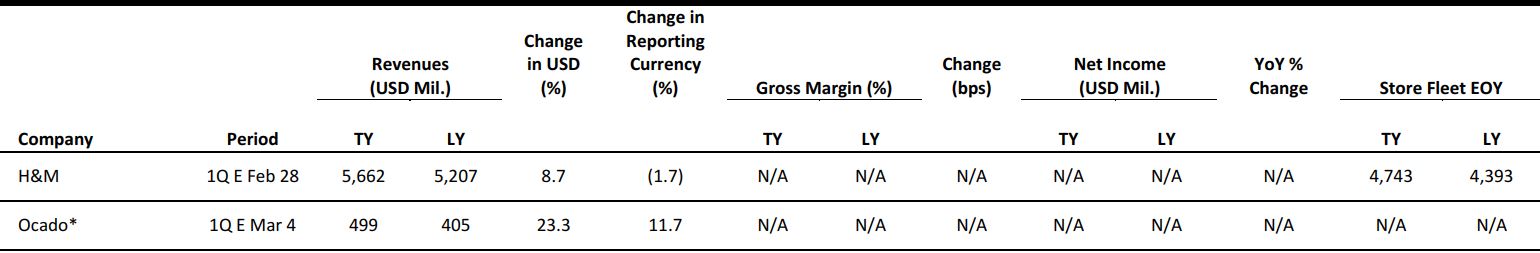

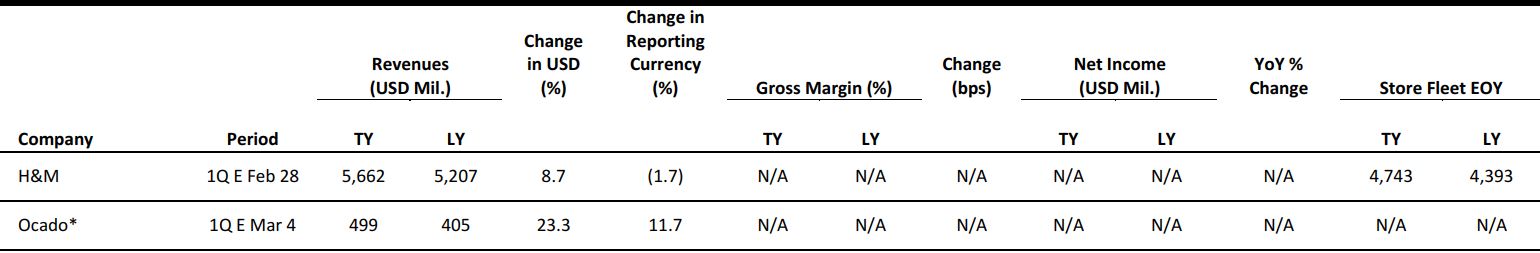

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

Ocado Posts Double-Digit Revenue Growth amid Disruptions Due to Inclement Weather

(March 20) Company press release

Ocado Posts Double-Digit Revenue Growth amid Disruptions Due to Inclement Weather

(March 20) Company press release

- British online grocery retailer Ocado posted retail revenue growth of 11.7%, to £363.4 million ($499 million), in the first quarter ended March 4, 2018. Ocado said that it was impacted by inclement weather in the final week, equivalent to nearly 1% of sales over the quarter.

- Management remarked that its partnerships with French retailer Groupe Casino and Canadian food retailer Sobeys are progressing well, and that its Ocado Solutions e-commerce technology business is looking forward to more partnerships in the future.

John Lewis to Bring a “Curated Shopping Experience” to New Store at Westfield

(March 19) DrapersOnline.com

John Lewis to Bring a “Curated Shopping Experience” to New Store at Westfield

(March 19) DrapersOnline.com

- British department store retailer John Lewis is looking to bring a “curated shopping experience” to its new 230,000-square-foot store that launched on March 20, 2018, at the Westfield London shopping center.

- The new store houses a Style Studio, where shoppers can book personal or group consultations with their choice of five personal stylists, and a Discovery Room, where customers can book appointments to learn new skills such as how to light a room or how to throw a dinner party.

Dunnes Exits British Market

(March 18) Independent.ie

Dunnes Exits British Market

(March 18) Independent.ie

- Irish retailer Dunnes Stores has closed all its stores in Scotland over the last six months and shut its second-to-last store in England. Less than three years ago, Dunnes operated 11 stores in the UK and it was reportedly looking to scale up its business by acquiring 40 additional stores.

- According to local press reports, the retailer told staff that it is “pulling out of the UK market with Brexit future costs being seen as the main contributor to [the company’s] decision.”

Debenhams Partners with Swoon

(March 20) UK.FashionNetwork.com

Debenhams Partners with Swoon

(March 20) UK.FashionNetwork.com

- British department store Debenhams has partnered with designer furniture brand Swoon Editions to bring its products to high-street shoppers. The move is part of the Debenhams Redesigned strategy, which includes the retailer’s recent announcement of a partnership with international furniture and home décor brand Maisons du Monde.

- A selection of Swoon’s furniture, lighting and dinnerware will be available in the Debenhams Westfield White City store in March, and will be made available to a broader audience online later this year.

Spar Enters Greece, Plans to Operate 350 Stores in the Next Four Years

(March 20) ESMMagazine.com

Spar Enters Greece, Plans to Operate 350 Stores in the Next Four Years

(March 20) ESMMagazine.com

- Supermarket group Spar has announced the formation of a new Greek entity, Spar Hellas, and plans to operate around 350 stores in Greece over the next four years. The first 10 stores are set to open in July and the company hopes to have at least 80 in operation by the end of the year.

- Spar Hellas has signed a strategic cooperation deal with Greek firm Asteras Group that will see the latter convert most of its existing 200 stores to the Spar brand. A separate agreement with Mesis Hellas will result in Spar’s store estate increasing substantially.

ASIA RETAIL & TECH HEADLINES

Alibaba Doubles Down on Lazada with Fresh $2Billion Investment and New CEO

(March 18) TechCrunch.com

Alibaba Doubles Down on Lazada with Fresh $2Billion Investment and New CEO

(March 18) TechCrunch.com

- Alibabais increasing its control of Southeast Asian e-commerce market place Lazada by injecting another $2 billion into the business and replacing its CEO with a long-standing Alibaba executive.

- Alibaba first acquired control of Lazada in April 2016, when it bought 51% of the business for $1 billion. It added another $1 billion last summer to increase its equity to around 83%. Alibaba has invested $4 billion to date, which it said will “accelerate the growth plans” and help further tie the Lazada business into Alibaba’s core e-commerce service.

Y Combinator–Backed Dahmakan Acquires Rival to Tap Thailand’s $1 Billion Food-Delivery Market

(March 20) TechinAsia.com

Y Combinator–Backed Dahmakan Acquires Rival to Tap Thailand’s $1 Billion Food-Delivery Market

(March 20) TechinAsia.com

- Malaysian ready-to-eat food delivery startup Dahmakan has made its first foray into the Thai market by acquiring Bangkok-based competitor Polpa. Similar to Dahmakan, Polpa is a vertically integrated, “full-stack” food-delivery service. It designs its own menus, runs its own kitchens and prepares its own food, which it then delivers on demand.

- Online food delivery is one of Asia’s biggest tech sectors.Among the fastest-growing markets is Thailand, where the food-delivery industry has more than doubled in size over the past four years. Worth $463 million in 2014, food delivery in the country is projected to hit $1.02 billion in orders by the end of 2018, according to research consultancy Euromonitor International.

AirAsia, Southeast Asia’s Low-Cost Airline, Is Considering an ICO

(March 16) TechCrunch.com

AirAsia, Southeast Asia’s Low-Cost Airline, Is Considering an ICO

(March 16) TechCrunch.com

- AirAsia, a low-cost airline in Southeast Asia, is considering an initial coin offering (ICO) as part of a push into financial services. Tony Fernandes, CEO of the $3 billion company, which is publicly listed in Malaysia, said that he is analyzing the potential to hold an ICO that would enable AirAsia to raise money by introducing its own cryptocurrency.

- “We have two things that are very interesting [that] will have relevance to ICOs. One is our loyalty card, where we have [loyalty program] Big Points, and I think those BigPoints can be easily transferred to the blockchain,” Fernandes said.

European Mobile Banking Startup N26 Raises $160 Million from Tencent, Allianz, Others

(March 20) VentureBeat.com

European Mobile Banking Startup N26 Raises $160 Million from Tencent, Allianz, Others

(March 20) VentureBeat.com

- Mobile banking startup N26 has raised $160 million in a series C round of funding led by Allianz Group’s investment arm, Allianz X, and Chinese tech titan Tencent, with participation from other existing shareholders. N26 had previously raised around $55 million from some notable investors, including Peter Thiel’s Valar Ventures. With another $160 million in the bank, the company said it plans to double down on its global growth efforts.

- Founded in 2013 as Number26, the Berlin-based startup rebranded as N26 two years ago, when it obtained its own banking license. The company serves 850,000 customers across 17 European markets with online-only bank accounts that can be accessed through Android and iOS apps. The underlying promise is speed and efficiency, as people can open an account within minutes of applying.

LATAM RETAIL & TECH HEADLINES

Huawei Readies Return to Brazilian Smartphone Market

(March 19) ZDNet.com

Huawei Readies Return to Brazilian Smartphone Market

(March 19) ZDNet.com

- Huawei is planning to make and sell smartphones in Brazil again after withdrawing from the local consumer market three years ago. According to the firm’s vice president for Brazil, Liu Wei, Huawei is making a thorough assessment of the current conditions of the smartphone market and plans to reenter the consumer business in the coming months.

- “2018 is going to be very important for us here in Brazil. We are currently carrying out a lot of marketing research, talking to channels and engaging with the government ahead of the relaunch,” Wei said. The company has learned a few lessons from the time it operated in the Brazilian consumer market between 2013 and 2015, and Wei said the market research will be crucial to the company as it plans its return to the consumer space.

Amazon Launches Debit Card in Mexico to Drive E-Commerce Adoption

(March 14) Pymnts.com

Amazon Launches Debit Card in Mexico to Drive E-Commerce Adoption

(March 14) Pymnts.com

- Amazon has made a push into the financial market in Mexico, rolling out a debit card for the first time ever. With Mexicans reluctant to shop online, Amazon is hoping to encourage more of it by providing a new way to purchase things. According to a Reuters report, the debit card, called Amazon Rechargeable, is aimed at providing a new way to shop over the Internet.

- “Clients that don’t have a credit or debit card will find Amazon Rechargeable an easy and practical way to convert cash into a payment method,” said Fernando Ramirez, Amazon’s product manager in Mexico, in a statement to Reuters. The card is backed by Mastercard and Grupo Financiero Banorte. Users can put cash on the card in convenience stores located throughout Mexico.

Brazilian Retail Sales Up More than Expected in January

(March 13) Reuters.com

Brazilian Retail Sales Up More than Expected in January

(March 13) Reuters.com

- Brazil’s retail sector expanded at a faster-than-expected pace in January, suggesting a solid start to the year following lackluster economic growth in the fourth quarter. Retail sales rose by 0.9% from December, the fastest pace of growth since June and surpassing the 0.6% median forecast in a Reuters poll of economists.

- Sales advanced 3.2% from the year before, the tenth straight increase, compared with a consensus estimate for a 2.5% rise. Record-low interest rates and slow inflation have propped up consumer spending over the last year, adding fuel to Latin America’s largest economy.

How China’s Ride-Hailing Giant Didi Plans to Challenge Uber in Mexico

(March 19) Reuters.com

How China’s Ride-Hailing Giant Didi Plans to Challenge Uber in Mexico

(March 19) Reuters.com

- Chinese ride-hailing giant Didi Chuxing is planning to hit its archrival, Uber, where it hurts. Mexico is one of Uber’s most prized and profitable markets. The San Francisco firm boasts a near monopoly there, with 7 million users in more than three dozen cities. Which is precisely why Didi wants to knock Uber from that comfortable perch.

- The Chinese firm is poaching Uber employees for its Mexico management team. Didi employees are riding incognito with Uber drivers and chatting up passengers to pinpoint weaknesses, according to people familiar with the strategy. And the company is thinking bigger than Uber, with ambitions for bike sharing, scooters and motorcycles in Mexico. “I would not want to go to war with Didi,” said Beijing-based investor and adviser Jeffrey Towson. “They don’t lose.”

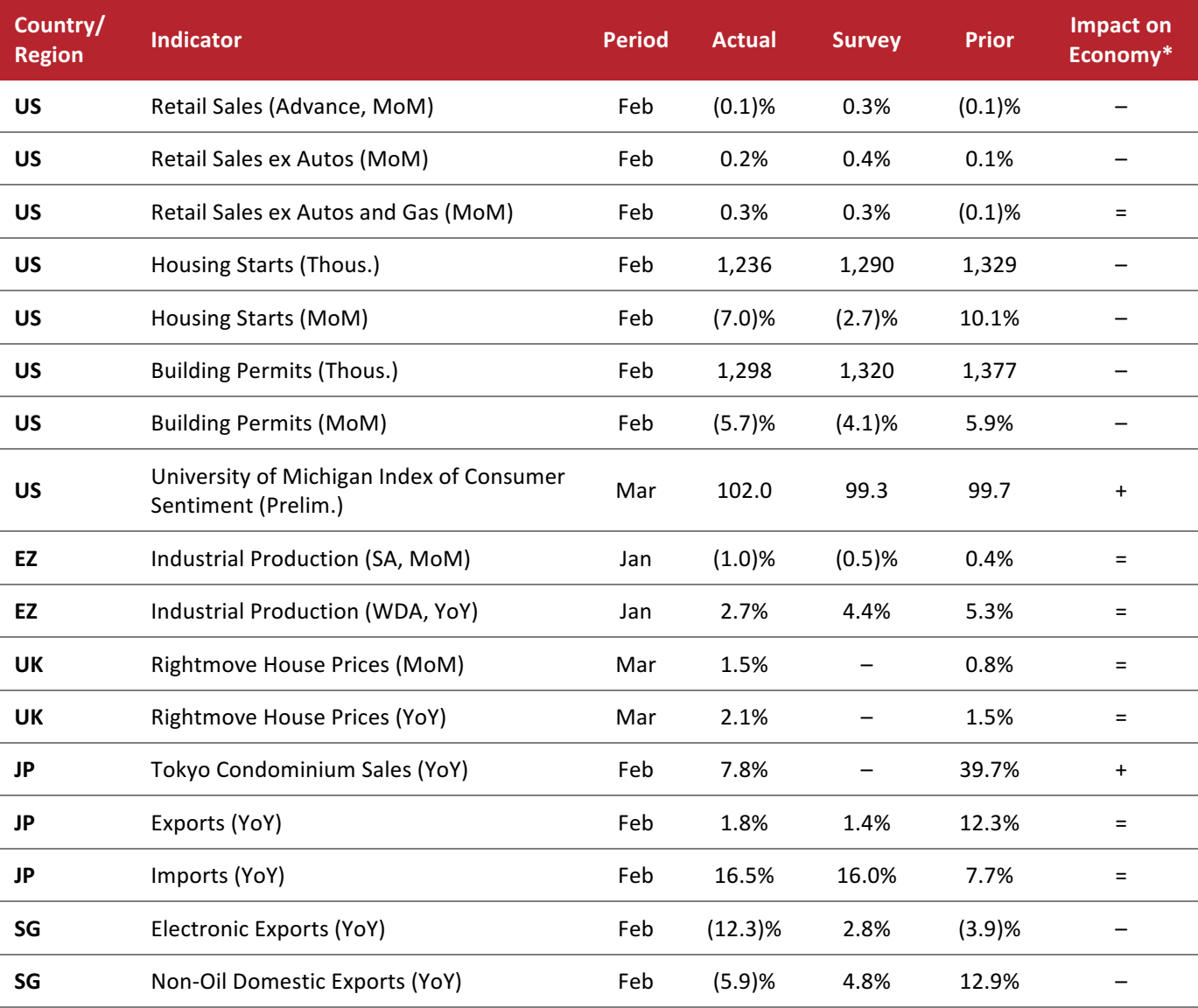

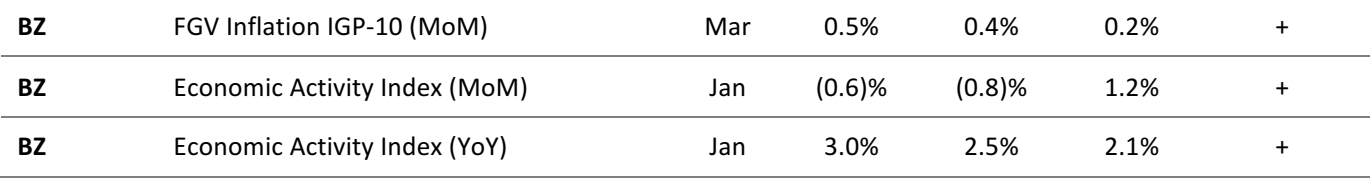

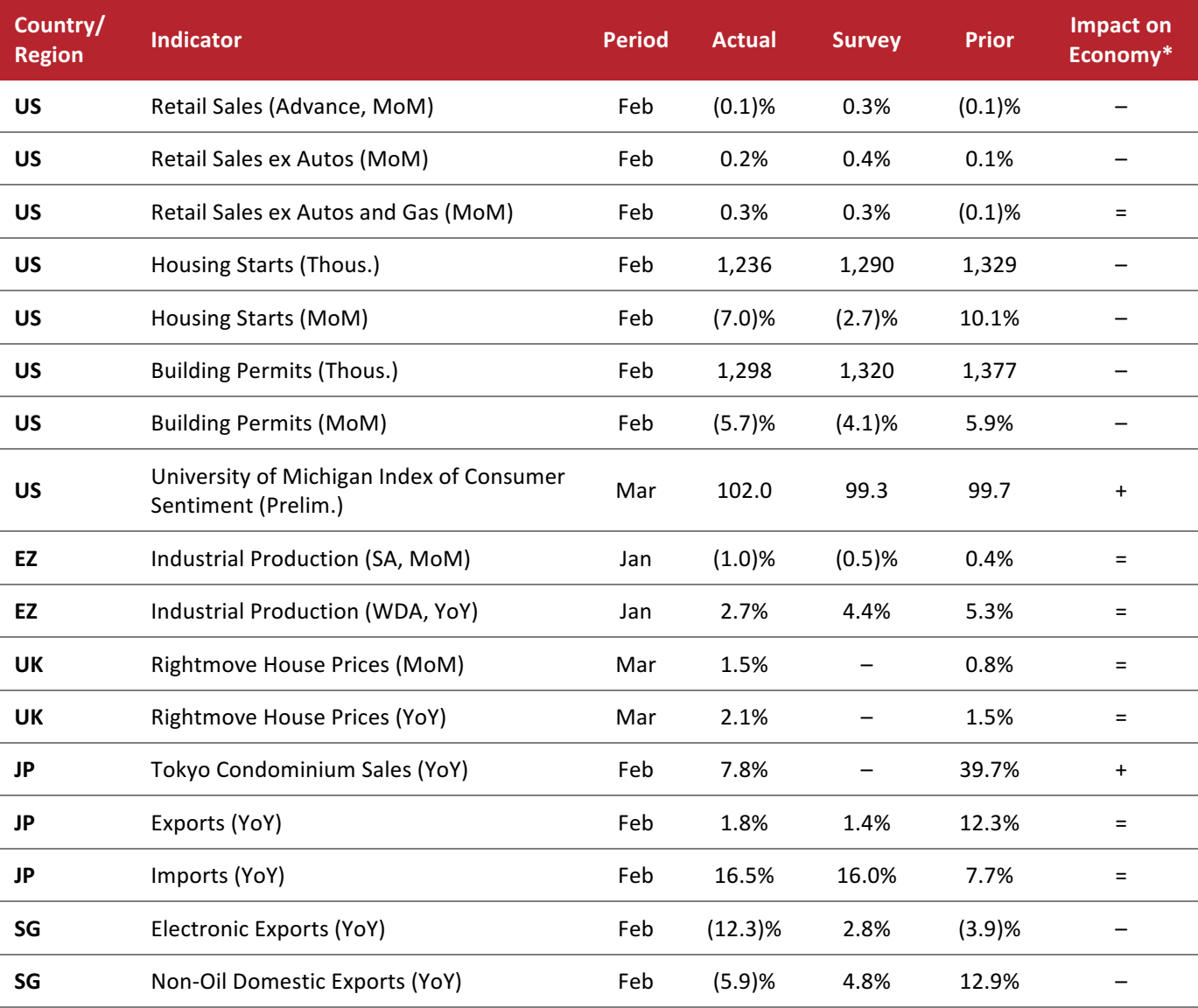

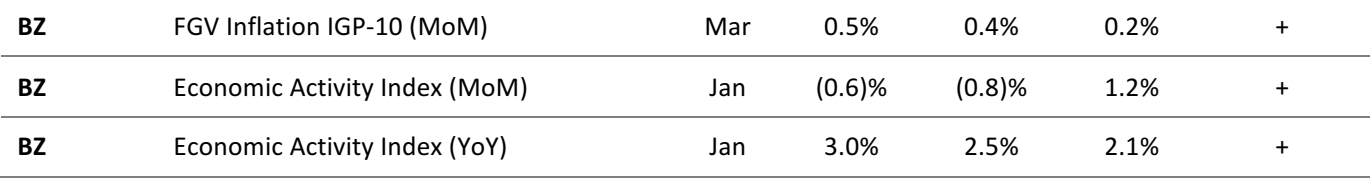

MACRO UPDATE

Key points from global macro indicators released March 14–21, 2018:

1) US: Retail sales decreased by 0.1% month over month in February. Housing starts dropped by 7.0% month over month and building permits decreased by 5.7% month over month in February. Consumer sentiment increased further in March, with the University of Michigan Index of Consumer Sentiment reaching 102.

2) Europe: In the eurozone, industrial production decreased by 1.0% month over month but increased by 2.7% year over year in January. In the UK, house prices increased by 1.5% month over month and by 2.1% year over year in March.

3) Asia-Pacific: In Japan, Tokyo condominium sales increased by 7.8% year over year in February. Japanese exports increased by 1.8% and imports increased by 16.5% year over year in February. In Singapore, non-oil domestic exports decreased by 5.9% year over year in February.

4) Latin America: In Brazil, the FGV Inflation IGP-10 inflation gauge increased by 0.5% month over month in March. The Brazilian Economic Activity Index dropped by 0.6% month over month but increased by 3.0% year over year in January.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/University of Michigan/Eurostat/Rightmove/Real Estate Economy Research Institute/Ministry of Finance Japan/International Enterprise Singapore/Fundação Getulio Vargas/Banco Central do Brasil/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/University of Michigan/Eurostat/Rightmove/Real Estate Economy Research Institute/Ministry of Finance Japan/International Enterprise Singapore/Fundação Getulio Vargas/Banco Central do Brasil/Coresight Research

Inditex data are for the quarter ended January 31, 2018; H&M data are for the quarter ended February 28, 2018.

Source: CNBC.com and Company reports

Inditex data are for the quarter ended January 31, 2018; H&M data are for the quarter ended February 28, 2018.

Source: CNBC.com and Company reports Total retail data are for 2017; online data are for 2016.

Source: National Retail Federation/True Fit

Total retail data are for 2017; online data are for 2016.

Source: National Retail Federation/True Fit

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Ocado Posts Double-Digit Revenue Growth amid Disruptions Due to Inclement Weather

(March 20) Company press release

Ocado Posts Double-Digit Revenue Growth amid Disruptions Due to Inclement Weather

(March 20) Company press release

Spar Enters Greece, Plans to Operate 350 Stores in the Next Four Years

(March 20) ESMMagazine.com

Spar Enters Greece, Plans to Operate 350 Stores in the Next Four Years

(March 20) ESMMagazine.com

Alibaba Doubles Down on Lazada with Fresh $2Billion Investment and New CEO

(March 18) TechCrunch.com

Alibaba Doubles Down on Lazada with Fresh $2Billion Investment and New CEO

(March 18) TechCrunch.com

Huawei Readies Return to Brazilian Smartphone Market

(March 19) ZDNet.com

Huawei Readies Return to Brazilian Smartphone Market

(March 19) ZDNet.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/University of Michigan/Eurostat/Rightmove/Real Estate Economy Research Institute/Ministry of Finance Japan/International Enterprise Singapore/Fundação Getulio Vargas/Banco Central do Brasil/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/University of Michigan/Eurostat/Rightmove/Real Estate Economy Research Institute/Ministry of Finance Japan/International Enterprise Singapore/Fundação Getulio Vargas/Banco Central do Brasil/Coresight Research