albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Measuring Amazon’s Quiet Incursion into Beauty

In recent years, Amazon.com has made inroads into a number of categories not traditionally associated with the site. While there has been much coverage of its ventures into grocery and apparel, the industry and media have focused less attention on the development of its US beauty offering. However, new Coresight Research data have confirmed Amazon’s strength in beauty in the US, on both the supply and demand sides.

Supply: Amazon Beauty Offers 200,000+ Products from 2,500 Brands

Amazon has built a beauty and personal care offering that spans close to a quarter million products from around 2,500 brands. In collaboration with competitive intelligence provider DataWeave, we aggregated data on products listed on Amazon.com’s US beauty and personal care website, and found the following:

- Amazon.com features 212,818 beauty and personal care products across 2,499 brands spanning eight major beauty categories. Makeup and skincare are the top beauty categories on Amazon as measured by number of products listed, accounting for, respectively, 34% and 26% of beauty listings. Within makeup, we identified 959 unique brands and 71,571 products.

- A limited number of brands account for the bulk of beauty products listed on the site. Just 4% of the 2,499 beauty brands sold on Amazon account for some 52.1% of all beauty product listings on the site.

- Third-party listings dominate Amazon’s beauty offering, representing 92.4% of all beauty products available on the site.

- Luxury beauty is the only beauty category in which Amazon itself accounts for the majority of listings; it sells 89% of luxury beauty products listed on the site as a first party. This suggests Amazon is focusing its first-party distribution in beauty on higher-price-point items. It also suggests the retailer has built successful commercial relationships with some major luxury beauty brands or their agents. If that is the case, it is in contrast to the dynamic in other luxury categories such as apparel, where brands are often cited as being reluctant to partner with a “commodity” site such as Amazon.

Demand: Coresight Research Survey Data Confirm the Beauty Category’s Popularity on Amazon

Our February 2019 consumer survey found very strong demand for beauty products on Amazon.com:

- Beauty and personal care products comprise the third-most-shopped category on Amazon, behind apparel (including footwear) and books/e-books, as measured by the number of respondents who said they had bought those categories on the site in the past 12 months.

- This demand has propelled Amazon into position as America’s second-most-shopped retailer for beauty, grooming or personal care products, according to our survey. Walmart was the only retailer from which a greater number of respondents had bought these categories in the past 12 months.

Key Insights

Amazon has quietly built a highly impressive offering and customer base in the beauty category. The strength of its first-party listings in luxury beauty is particularly notable, given some high-end brands’ apparent reluctance to strike supply deals with Amazon. We see further opportunities for Amazon to sustain growth in demand by adjusting its offering. For example, if Amazon were to grow its first-party listings as a proportion of all beauty listings, it could win share of spending from those consumers who are wary of buying from third-party sellers (our previous research indicated some shopper resistance to buying beauty items from third parties). Also, despite Amazon’s already substantial offering, there are opportunities for many brands to scale up on the site, as a limited number of brands currently account for a large share of beauty listings.

QUESTION OF THE WEEK

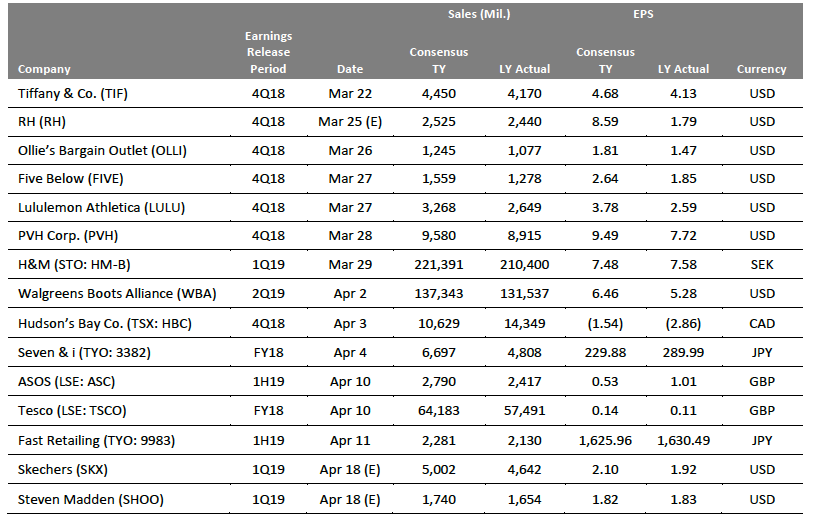

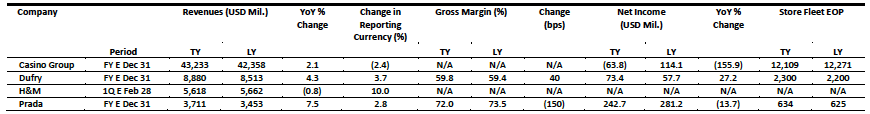

US RETAIL EARNINGS

[caption id="attachment_81449" align="aligncenter" width="826"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

US RETAIL & TECH HEADLINES

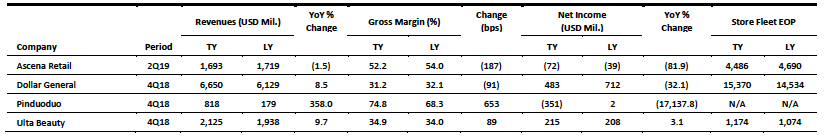

Dollar General Will Open 975 Stores This Year

Dollar General Will Open 975 Stores This Year

(Mar. 14) CNN.com

- Dollar General said it will open 975 new stores in the US this year and remodel 1,000 older stores with new checkout lines to drive last-minute impulse purchases.

- The company has been growing for years in rural areas. It opened 900 stores in 2018 and 1,315 in 2017. Dollar General now has more than 15,300 stores across the country and has seen sales increase for 29 straight years.

![]() US Fintech to Buy Worldpay as Electronic Payments Business Booms

US Fintech to Buy Worldpay as Electronic Payments Business Booms

(Mar. 18) Reuters.com

- US fintech firm Fidelity National Information Services (FIS) has agreed to buy payment processor Worldpay for about $35 billion in the biggest electronic payments industry deal to date.

- The deal is part of a wave of consolidation in the financial technology sector as firms seek to bulk up on payment systems. Global payments are set to reach $3 trillion a year in revenue by 2023 as more consumers switch from cash to digital payments, according to consulting firm McKinsey.

Watch Out Warby Parker—VSP to Open Brick-and-Mortar Stores

(Mar. 13) ChainStoreAge.com

- VSP Global, the parent of VSP Vision Care, a national vision benefits company, announced it will open three stores under the Eyeconic banner. The move comes as consumers are increasingly buying eyeglasses from discount retailers and specialty players such as Warby Parker.

- The new stores will open in Chicago throughout 2019 and be designed as an extension of VSP’s Eyeconic.com e-commerce site.

![]() Toys “R” Us Real Estate Arm Exits Bankruptcy with New Name

Toys “R” Us Real Estate Arm Exits Bankruptcy with New Name

(Mar. 11) FoxBusiness.com

- Shuttered toy retailer Toys “R” Us’s real estate subsidiary has emerged from bankruptcy with a new name and organizational structure, according to a press release.

- The firm will now be called Hill Street Properties after previously operating as Toys R Us Property Co., also known as PropCo. Raider Hill Advisors, which advised the firm during bankruptcy proceedings, will provide day-to-day oversight of the firm’s dealings and manage its remaining properties.

![]() Sephora to Open 35 US Stores in 2019

Sephora to Open 35 US Stores in 2019

(Mar. 11) RetailDive.com

- In 2019, specialty beauty retailer Sephora plans to open 35 new stores in the US. The first new location will open in New York City at the Hudson Yards development.

- The new stores will be in 32 different cities, including Dallas, Houston, Los Angeles, Seattle, Charlotte and Washington, DC. California will be home to nine of the new locations.

EUROPE RETAIL EARNINGS

[caption id="attachment_81448" align="aligncenter" width="870"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

Sainsbury’s and Asda Commit to £1 Billion in Price Cuts Post-Merger in Bid to Win Regulatory Approval

Sainsbury’s and Asda Commit to £1 Billion in Price Cuts Post-Merger in Bid to Win Regulatory Approval

(Mar. 19) Company press release

- Sainsbury’s and Asda stated they would reduce prices of everyday items by around 10% should the UK’s Competition and Markets Authority (CMA) approve their merger. The CMA had previously published provisional findings and expressed “extensive” concerns about the merger, saying the retailers would need to sell at least 300 stores to a single buyer to gain approval.

- The retailers said they would deliver £1 billion ($1.3 billion) worth of lower prices within three years post-merger. Sainsbury’s also said it would cap its fuel profit at 3.5p ($0.05) per liter, while Asda said it would maintain its current fuel pricing strategy.

Debenhams Is Now Considering a Pre-Pack Administration

Debenhams Is Now Considering a Pre-Pack Administration

(Mar. 18) RetailGazette.co.uk

- British department store retailer Debenhams is reportedly mulling a pre-pack administration, an insolvency process in which an associated party, such as a lender, immediately buys a company after it enters administration. Debenhams is reportedly considering the option to avoid a deal with Sports Direct amid ongoing tension between the two retailers’ boards.

- The news comes a week after Sports Direct offered Debenhams a 12-month, interest-free loan of £150 million ($200 million) in exchange for additional equity in the business.

JD Sports Agrees to Buy Remaining Shares of Footasylum for £90 Million

JD Sports Agrees to Buy Remaining Shares of Footasylum for £90 Million

(Mar. 18) FT.com

- JD Sports is set to acquire Footasylum, its smaller, Manchester-based rival, in a £90 million ($120 million) deal, subject to shareholder approval.

- JD Sports, which raised its stake in Footasylum to more than 18% last month, will pay 82.5p ($1.03) in cash for each share, a 77.4% premium to Footasylum’s 46.5p ($0.62) closing share price on Mar. 15.

![]() Lush Demos Visual Search App and Fresh “Digital Packaging” at SXSW

Lush Demos Visual Search App and Fresh “Digital Packaging” at SXSW

(Mar. 14) MobileMarketer.com

- UK-based cosmetics retailer Lush introduced its pilot mobile app, Lush Labs, at the South by Southwest (SXSW) conference in Texas last week and showcased 54 new bath products that were created to celebrate the 30th anniversary of the company’s first bath bomb.

- The app, still in development, has a visual search feature that allows users to access rich information on the bath products’ “digital packaging,” such as ingredients and price, as well as videos of what the products look like when dropped in a tub of water.

![]() Zalando Is Axing Some of Its Private Labels

Zalando Is Axing Some of Its Private Labels

(Mar. 15) Bloomberg.com

- Berlin-based Zalando is pruning its private-label clothing and footwear brands as it seeks to add more established brands to its assortment, which already includes the likes of Nike, Adidas and Hugo Boss.

- Rubin Ritter, the company’s Co-CEO, says Zalando has cut more than a third of its 18 in-house labels for everything from coats to children’s wear and that the remaining ones are under review. The online retailer wants to boost the annual worth of its shipped merchandise to €20 billion ($23 billion) within five years.

Poundworld Founders Open New Discount Retailer One Below

Poundworld Founders Open New Discount Retailer One Below

(Mar. 13) RetailGazette.co.uk

- Poundworld’s founders have launched a new discount chain called One Below. The chain’s first store opened in Rothwell, West Yorkshire, on Mar. 1. and three others have since opened in Manchester, Doncaster and Leeds.

- One Below will stock over 5,000 products priced at 29p–£1 ($0.38–$1.33) and the company plans to open 50 stores nationally by the end of the year, creating 1,000 jobs.

ASIA RETAIL & TECH HEADLINES

Singtel’s VIA Alliance Partners with Japan’s Netstars

Singtel’s VIA Alliance Partners with Japan’s Netstars

(Mar. 19) SBR.com.sg

- VIA, a cross-border mobile payments alliance created by Singaporean telecom company Singtel, has entered the Japanese market through a collaboration with Japanese mobile payment technology company Netstars.

- By partnering with Netstars, VIA will add 100,000 new stores to its network of 1.6 million merchant partners across Asia. Netstars seeks to grow its merchant network to 1 million stores across Japan by the end of 2020.

Fung Retailing and JD.com Launch AI Checkout Facility

Fung Retailing and JD.com Launch AI Checkout Facility

(Mar. 14) InsideRetail.asia

- Fung Retailing and JD.com have collaborated to unveil a new AI-powered checkout system in two Circle K stores in Hong Kong’s AI Retailing Zone. The system is the first of its kind in Hong Kong and is designed to make checkout an easy, hassle-free process.

- The solution uses image-recognition technology to recognize up to five products a second and enables customers to complete the checkout process in as little as four seconds.

Cambodian Internet Startup Groupin Raises $5 Million

Cambodian Internet Startup Groupin Raises $5 Million

(Mar. 18) TechinAsia.com

- Cambodian Internet startup Groupin has raised $5 million in a series A round of funding from Belt Road Capital Management, a private equity firm focused on the Greater Mekong region. Groupin is the holding company of Cambodian e-commerce company Little Fashion and digital media firm Mediaload, which operates in Cambodia and Myanmar.

- According to Belt Road’s press release, this is the largest funding round to date raised by a Cambodian startup.

Alipay Partners with Barclaycard

Alipay Partners with Barclaycard

(Mar. 14) PYMNTS.com

- Ant Financial’s Alipay mobile and online payment platform has partnered with UK-based credit card and payment services provider Barclaycard to enable UK retailers to accept payments through Alipay. The collaboration will allow UK retailers to expand their engagement with Chinese tourists shopping in the country.

- “Alipay users will benefit from a more convenient and familiar in-store payments process – enhancing their overall shopping experience,” said Rob Cameron, Barclaycard’s CEO and Global Head of Payment Acceptance.

![]() Yijiupi Raises $100 Million in Series D+ Funding Round

Yijiupi Raises $100 Million in Series D+ Funding Round

(Mar. 18) Kr-Asia.com

- Chinese e-commerce company Yijiupi has raised $100 million from American private equity firm Warburg Pincus in a series D+ funding round, according to private equity deals tracker Pedaily.cn.

- Yijiupi raised $200 million from Meituan Dianping and Tencent in a series D round last September. Prior to that, it had raised over ¥500 million ($74.5 million) since holding its series A round in December 2014.

LATAM RETAIL & TECH HEADLINES

![]() Walmex Reaches Agreement with Union

Walmex Reaches Agreement with Union

(Mar. 14) Reuters.com

- Walmart de México has reached an agreement with the Revolutionary Confederation of Laborers and Farmworkers (CROC), averting the possibility of a strike. The retailer will offer its workers an average annual salary increase of 5% and an annual bonus linked to store performance, according to a company statement.

- CROC, which had previously sought a 20% salary hike, confirmed the agreement in a separate statement.

Falabella to Wind Up Sodimac Operations in Viña del Mar, Chile

Falabella to Wind Up Sodimac Operations in Viña del Mar, Chile

(Mar. 18) Df.cl

- Chilean multinational department store chain Falabella announced it will no longer be associated with the iconic Sodimac Homecenter home improvement store in the city of Viña del Mar. Falabella will not operate the store beyond next year.

- “It is an old store that responded to the needs of the market at the time. We are always studying new locations and improvements to existing stores. We hope to reinstate the store in another location in the shortest time possible,” the company said in a statement.

Oxford Peru Launches Its First Store in Lima

Oxford Peru Launches Its First Store in Lima

(Mar. 18) America-Retail.com

- Bicycle retailer Oxford Peru has opened a new store in Lima. The company has operated in Peru for 15 years, but the Lima store will be its first flagship format and is designed to provide a more fun shopping experience.

- “In this new store, we will focus on offering the best products in our two lines: cycling and fitness,” said Oswaldo Aza, the company’s Country Manager.

![]() Bogotá Fashion Week Expects to Generate $600,000

Bogotá Fashion Week Expects to Generate $600,000

(Mar. 18) America-Retail.com

- Bogotá Fashion Week, one of Colombia’s most important annual fashion events, will run Apr. 2–4. The organizers estimate it will generate business worth more than $600,000 this year.

- The event will feature 48 designers and over 50 national and international buyers.

Molinos Announces Price Increases

Molinos Announces Price Increases

(Mar. 18) America-Retail.com

- Argentina’s largest branded food products company, Molinos Río de la Plata, announced to supermarkets and wholesalers it will raise prices 5%–15% beginning Mar. 18.

- The price increases apply to almost 300 products, including staples such as rice, flour, oil and coffee. Between January and February, food prices rose 9.3% in Argentina and global inflation hit 6.8%.

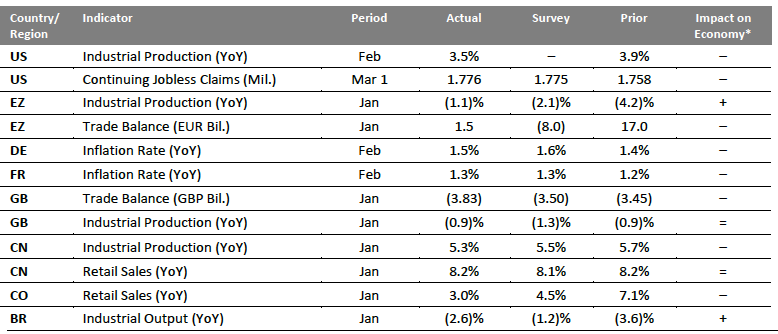

MACRO UPDATE

Key points from global macro indicators released Mar. 13–19, 2019:

1) US: Industrial production increased 3.5% year over year in February, versus 3.9% growth in January. Continuing jobless claims increased to 1.776 million in the week ended Mar. 1 from 1.758 million the previous week. 2) Europe: In the eurozone, industrial production declined 1.1% year over year in January, beating the consensus estimate of a 2.1% decline and marking an improvement over December’s 4.2% decline. In Germany, inflation rose to 1.5% year over year in February from 1.4% in January. 3) Asia-Pacific: In China, industrial production expanded 5.3% year over year in January, versus a 5.7% increase in December and missing the consensus estimate of 5.5% growth. Retail sales in China grew 8.2% year over year in January, the same rate as in December and edging past the consensus estimate of 8.1% growth. 4) Latin America: Colombia’s retail sales grew 3.0% year over year in January, below December’s 7.1% growth and the consensus estimate of 4.5% growth. Industrial output in Brazil shrank 2.6% year over year in January, versus a 3.6% decline in December and missing the consensus estimate of a 1.2% decline. [caption id="attachment_81447" align="aligncenter" width="778"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impactSource: US Federal Reserve/US Bureau of Labor Statistics/Eurostat/Federal Statistical Office (Germany)/National Institute of Statistics and Economic Studies (France)/Office for National Statistics (UK)/National Bureau of Statistics of China/National Administrative Department of Statistics (Colombia)/Brazilian Institute of Geography and Statistics/Coresight Research[/caption]

EARNINGS CALENDAR

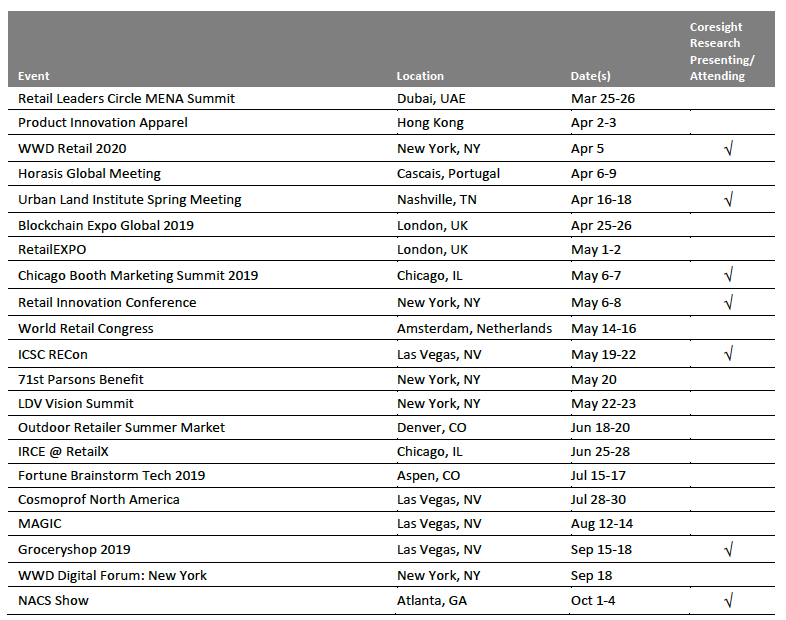

EVENT CALENDAR