From the Desk of Deborah Weinswig

The State of Artificial Intelligence: Where Are We Now?

The term “artificial intelligence” (or “AI”) is

en vogue and is often incorrectly used to refer to things that do not technically qualify as AI. Processors can add apparent “intelligence” to machines by enabling them to turn thermostats on and off at certain times and make well-intended recommendations on which pants go with which shirt, but these are just programs that run through amounts of data and derive associations. And while predictive analytics can appear to act like AI, it is really just applying these associations to future functions. Here, we focus more narrowly on AI in the context of using computers to mimic (or exceed) human intelligence.

There are three main calibers, or levels, of AI. The first caliber is called

artificial narrow intelligence(ANI), which refers to using computer power to excel in one very specific area, such as playing chess, optimizing hybrid vehicle efficiency or making product recommendations. Practically every type of intelligent system we use today fits into this category.

Artificial general intelligence (AGI) is the second caliber, and it refers to computers that are roughly as intelligent as humans and that can perform practically any intellectual task we can. Computers at this level need to be able to reason, plan into the future, understand complex concepts and learn, including from experience. Ray Kurzweil, an American author, computer scientist, inventor and futurist, has estimated that computers would have to process 10 quadrillion (or 10

16) calculations per second to equal the power of the human brain. China’s Tianhe-2 supercomputer is currently the world’s fastest, capable of operating at 33.8 petaflops (quadrillion floating-point operations per second), and it appears to have sufficient speed for AGI.

The third caliber,

artificial superintelligence (ASI), refers to supercomputers whose intelligence exceeds that of humans in just about every area, including creativity, wisdom and social intelligence. This category is the focus of science-fiction writers who imagine horrific scenarios in which the machines come to realize that humans are the problem and decide to eradicate all of humanity.

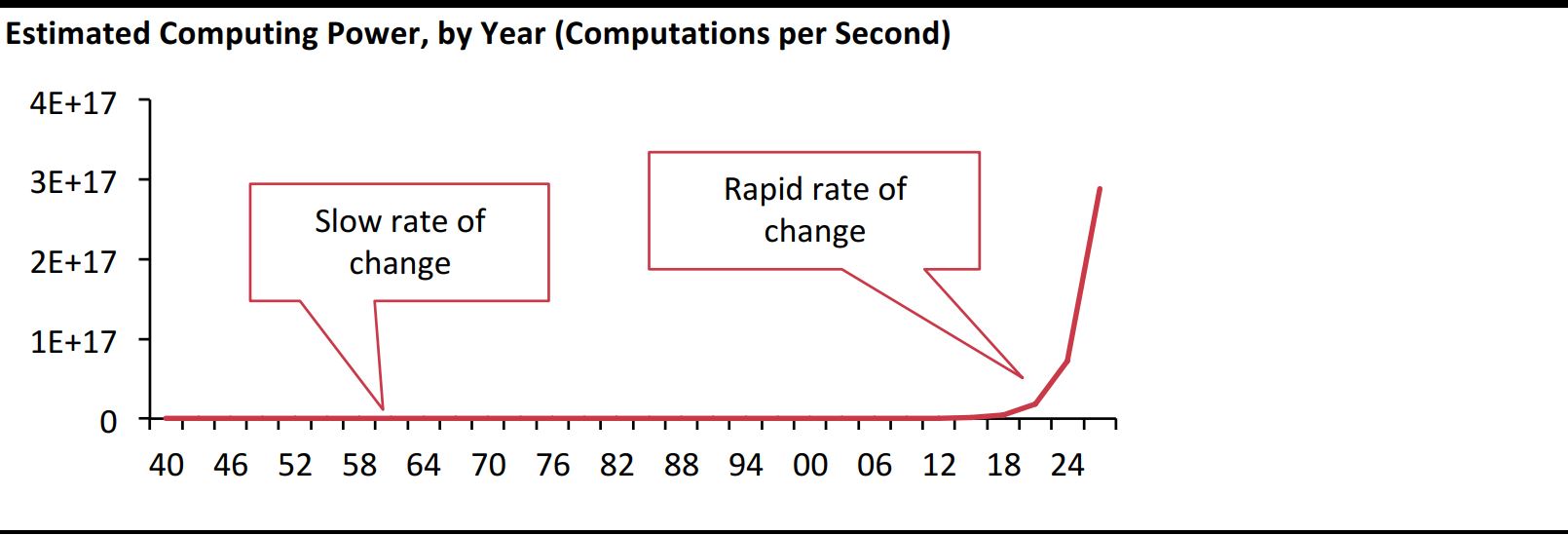

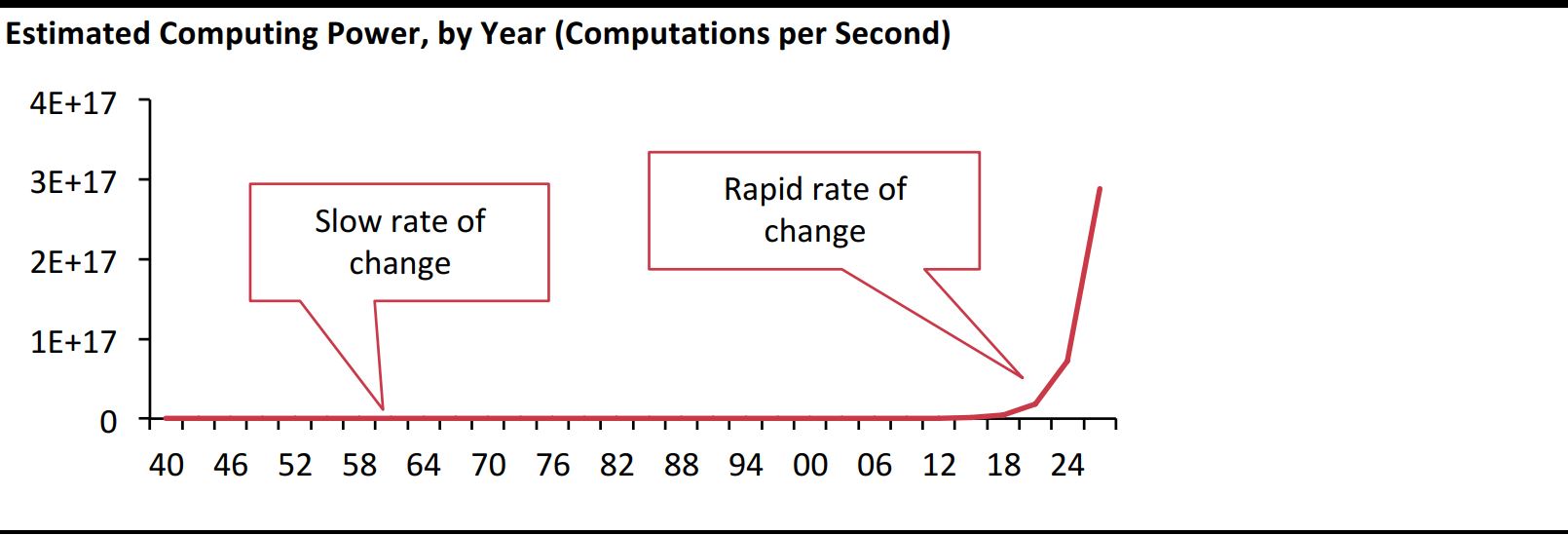

Today, it appears that we are stuck at the ANI level and that the second and third levels of AI are still incredibly far off. What is different for those of us currently alive is that we have always lived in times of continuing technology improvements, the rate of which continues to accelerate. Think of the slow rate of technology improvement during the first half of the 20th century compared with the second half, which saw milestones such as the invention and improvement of the transistor in the late 1940s and early 1950s, the launch of the IBM PC in 1981 and the launch of the smartphone about 10 years ago. One driver of technological change is Moore’s law, named for Intel cofounder Gordon Moore’s observation that the number of transistors that could be incorporated in a silicon wafer (which drives computing power) appeared to double every 18 months (the rate was subsequently modified to every 24 months). Computing power is following this curve and will soon push computation speeds to higher and higher numbers of petaflops.

The figure below shows available computing power, by year (which follows Moore’s law). We are living in the time depicted on the right side, where growth is increasing exponentially.

Source: Mother Jones/Coresight Research

We are likely to continue to see an accelerating rate of technological change, fueled by ever-increasing computing power that is (hopefully) propelling us toward a future in which intelligent machines can help us solve problems, cure diseases and generally benefit society.

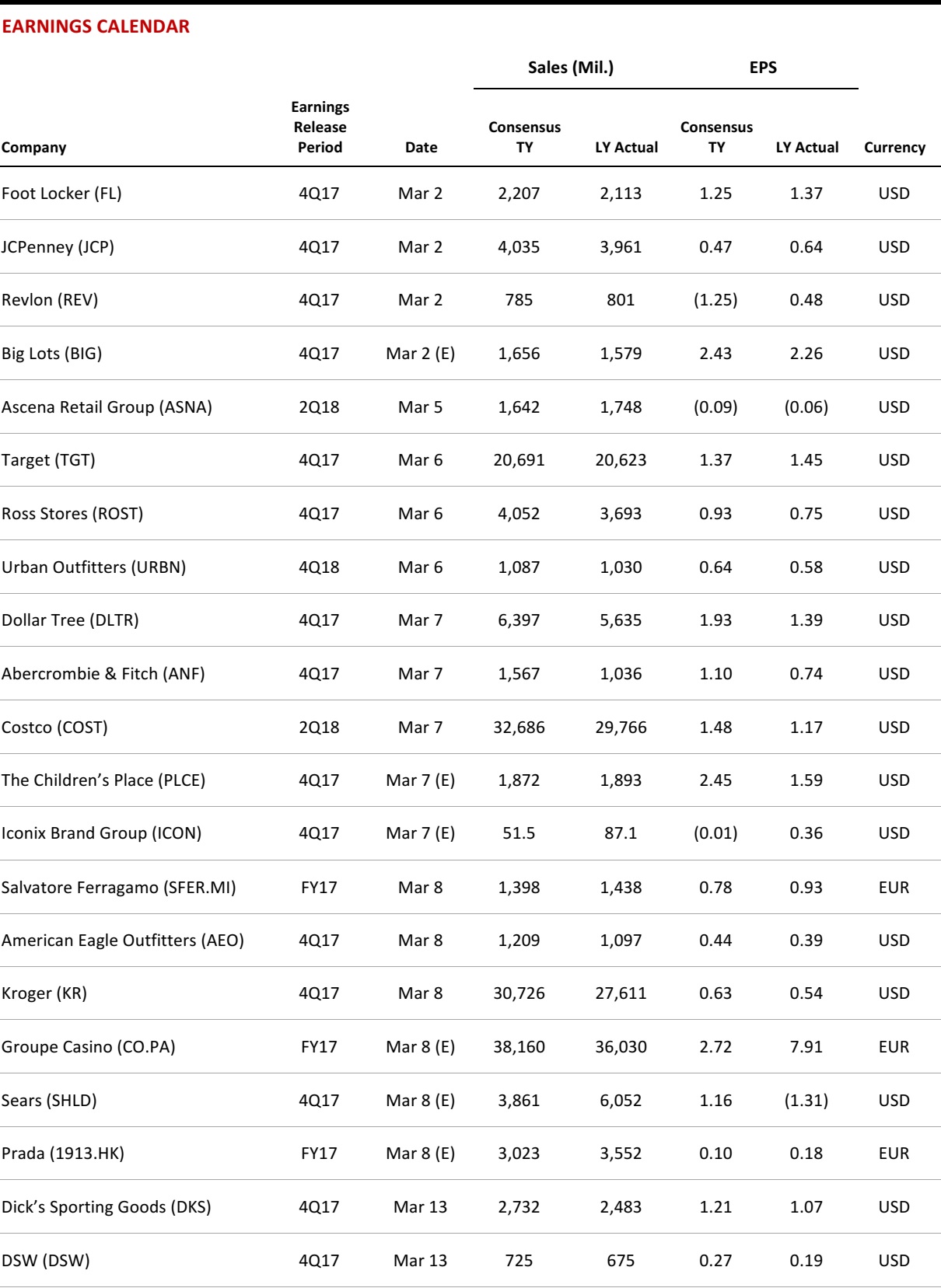

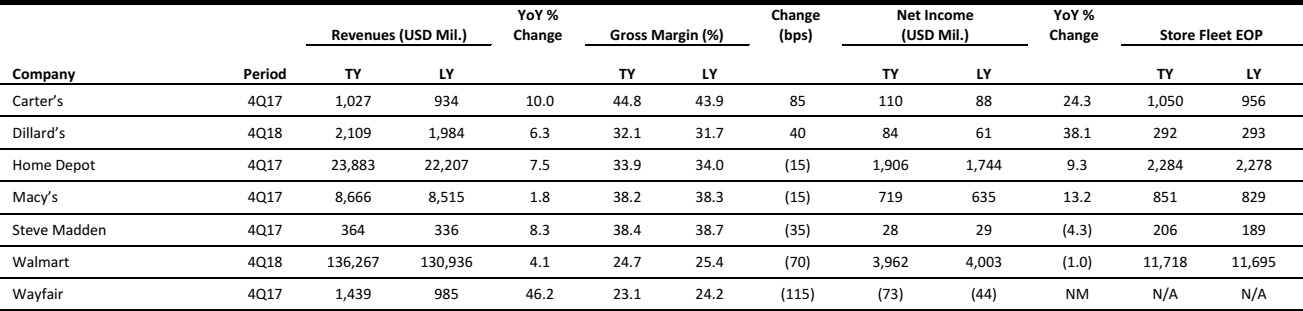

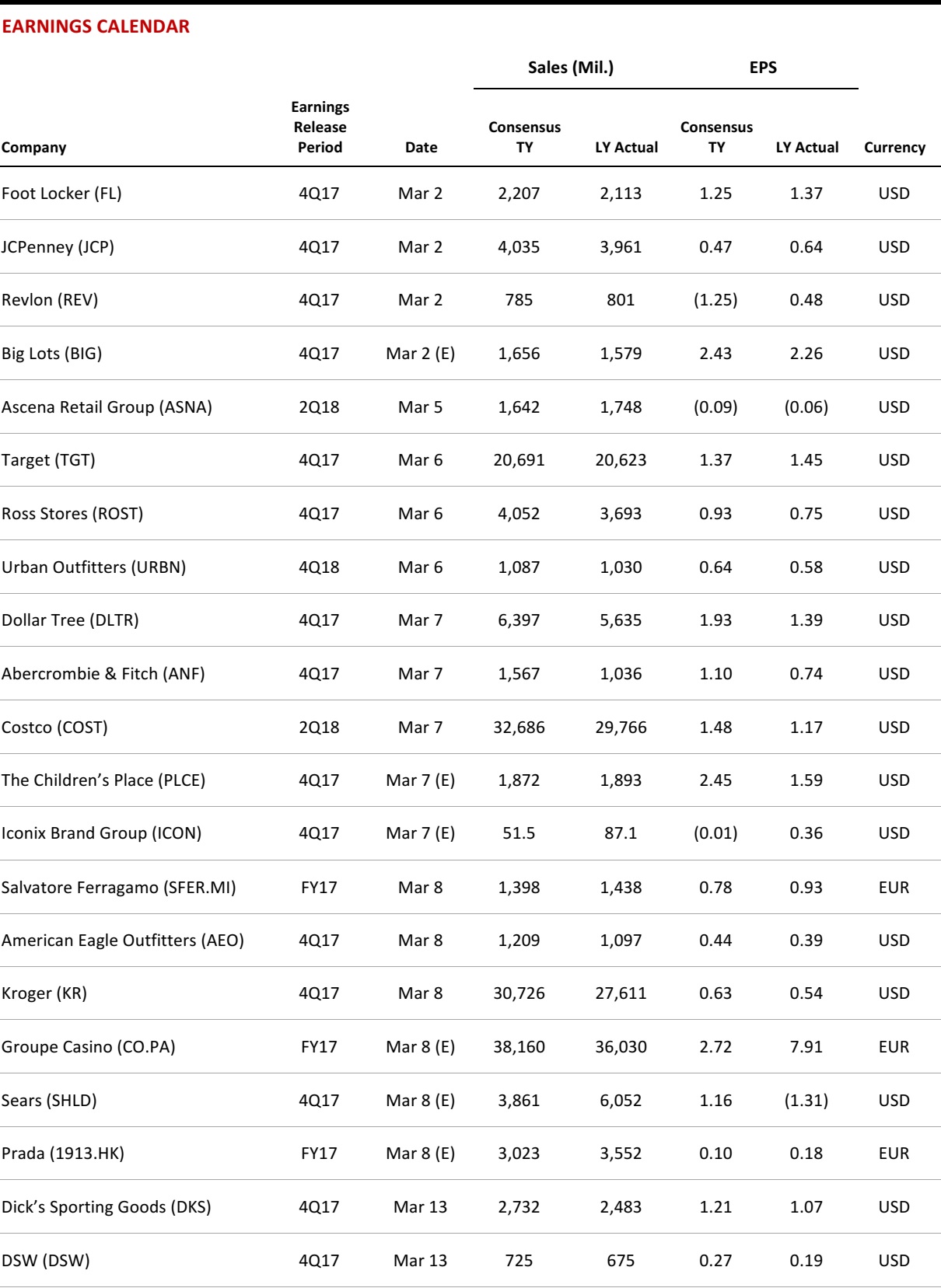

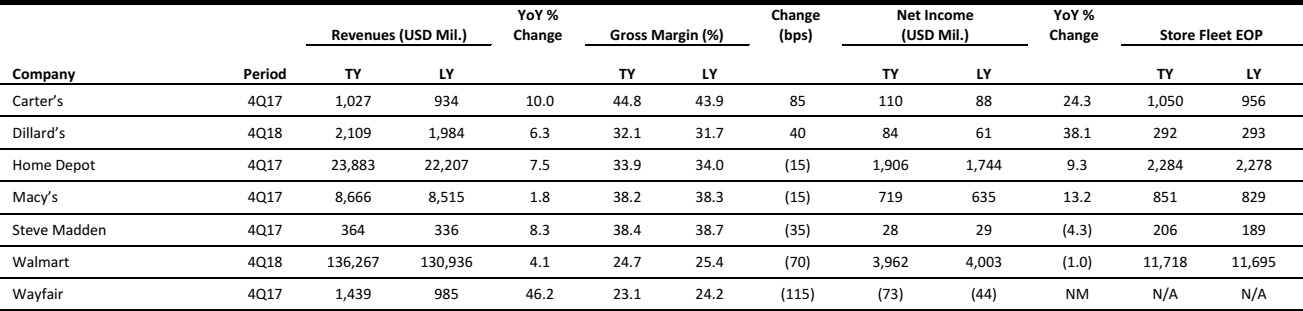

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Amazon Wasn’t Alone in Investing in Grocery Stores Last Year

(February 27) CNBC.com

Amazon Wasn’t Alone in Investing in Grocery Stores Last Year

(February 27) CNBC.com

- Grocery store openings declined by 29% last year as expansion plans cooled and some supermarkets prepared to file for bankruptcy in the year Amazon acquired Whole Foods, according to a new report from Jones Lang LaSalle (JLL).

- But investments in grocery-anchored shopping centers in 2017 climbed 5.3% from 2016, making the sector one of the only retail sectors to see deal growth in a year of low transaction volume. “Grocery is considered to have a moat around it to defend against e-commerce, and because of that, these [assets] are seen by retail property investors as a safe investment,” James Cook, JLL’s director of retail research in the Americas, told CNBC.

Manhattan Landlords Cut Deals to Stave Off Vacant Storefronts

(February 27) Bloomberg.com

Manhattan Landlords Cut Deals to Stave Off Vacant Storefronts

(February 27) Bloomberg.com

- After a drought in 2017, more deals are getting done as landlords begin to accept the new reality. Retail landlords throughout the US are facing a contracting universe of tenants as merchants cut back on brick-and-mortar locations and shopping shifts online.

- In Manhattan, home to some of the most valuable retail real estate in the world, a sharp rise in rents following the recession exacerbated the problem, with property owners clinging to unrealistic income expectations. Today, the glut of empty space is taking a toll, pushing landlords to make concessions to plug holes.

Starbucks Opens Its First Reserve Store and Said It Sees Retail Rents Easing

(February 27) CNBC.com

Starbucks Opens Its First Reserve Store and Said It Sees Retail Rents Easing

(February 27) CNBC.com

- On Tuesday, Starbucks opened the first of 1,000 planned, upscale Starbucks Reserve stores as part of a broad strategy to defend against high-end coffee rivals such as Intelligentsia Coffee & Tea and Blue Bottle Coffee.

- The new Reserve store is located in Starbucks’ Seattle headquarters building and will expand on the company’s showcase Seattle Reserve Roastery drink menu with new items such as nitro draft lattes. It also will serve food from Princi Italian bakery and alcoholic drinks from a “mixology” bar.

Hawaii’s 2nd-Largest Retail Company Buys 3 Shopping Centers

(February 27) USNews.com

Hawaii’s 2nd-Largest Retail Company Buys 3 Shopping Centers

(February 27) USNews.com

- Hawaii’s second-largest retail property owner, Alexander & Baldwin, announced that it bought three shopping centers on different islands for $254 million. The three centers are Laulani Village on Oahu, Pu’unene Shopping Center on Maui and Hokulei Village on Kauai.

- Alexander & Baldwin bought the properties as part of a strategy to accumulate retail property throughout Hawaii while selling its mainland real estate holdings, the Honolulu Star-Advertiser reported Monday.

Target CEO Says Majority of US Retail Sales Will Continue to Be in Stores

(February 22) BizJournals.com

Target CEO Says Majority of US Retail Sales Will Continue to Be in Stores

(February 22) BizJournals.com

- In an interview on CNBC, Target CEO Brian Cornell said that the majority of US retail sales will continue to take place at stores. While he said that e-commerce sales are growing, stores will hold an integral role for the foreseeable future.

- Cornell said the winning retailers of the future will be the ones that are able “to combine great physical assets” with digital interaction. Target is coming off a successful holiday season, with same-store sales up more than 3% during November and December.

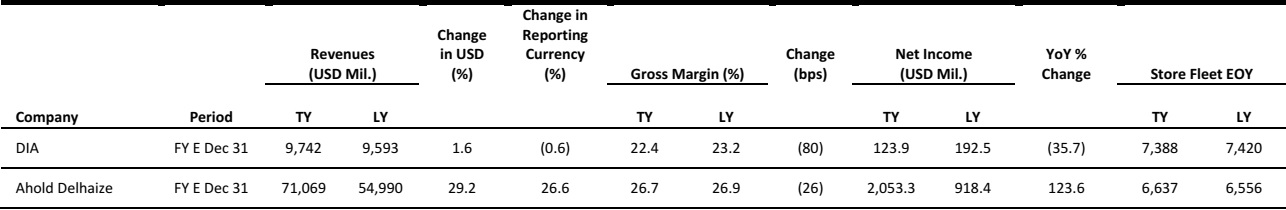

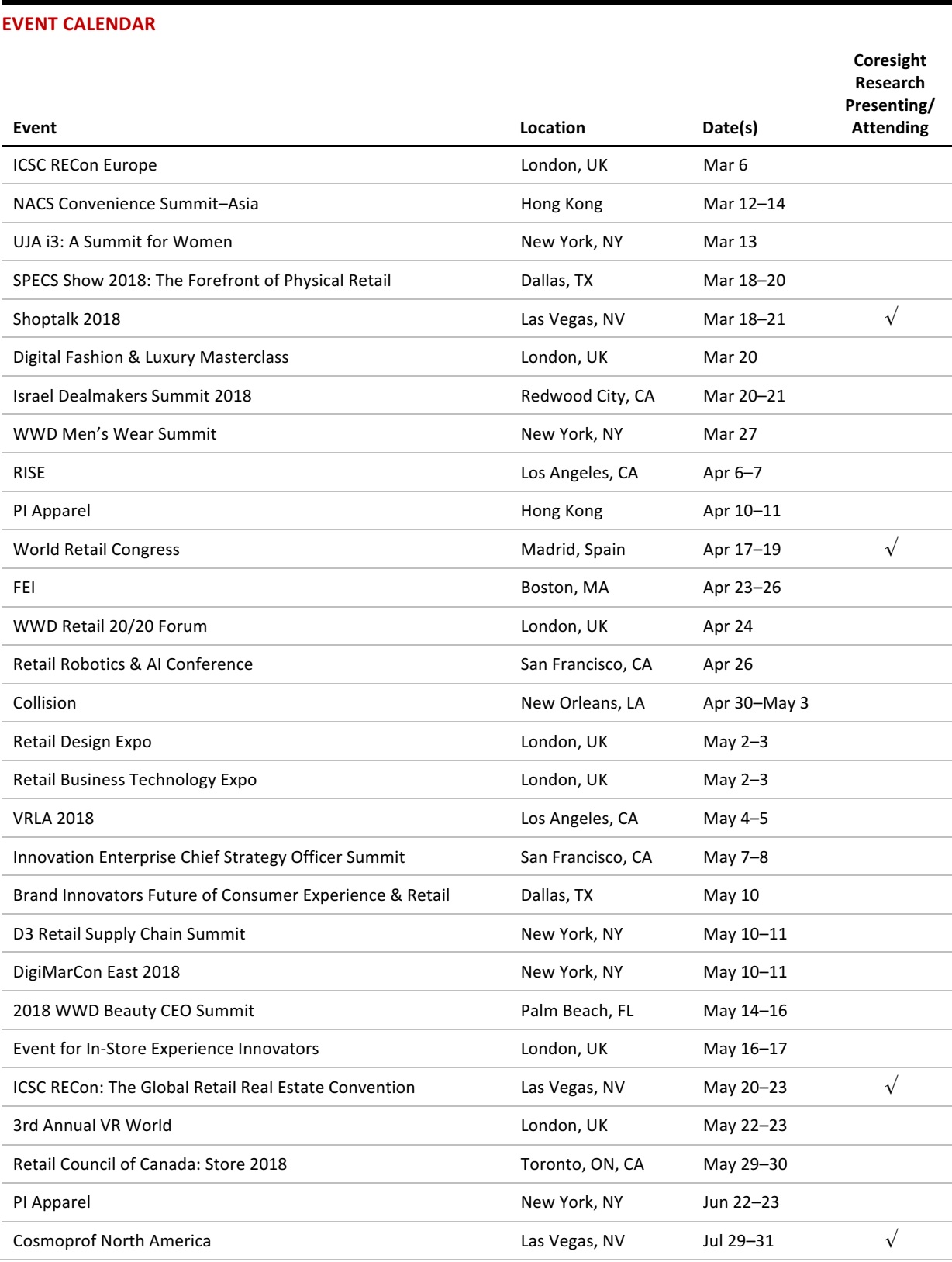

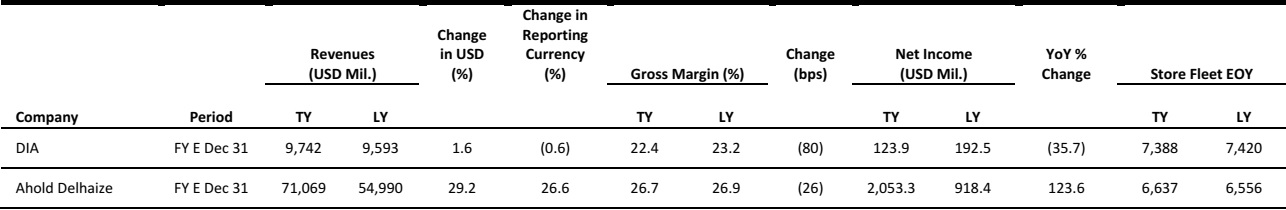

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

Primark’s First-Half Sales Growth Dented by Warm October

(February 26) Company press release

Primark’s First-Half Sales Growth Dented by Warm October

(February 26) Company press release

- British conglomerate Associated British Foods (ABF) reported a preclose trading update for the 24 weeks ended March 3, 2018. ABF said that it expects Primark’s sales to have risen by 7% at constant currency and by 9% as reported during the first half, driven by increased selling space.

- ABF expects to report that Primark’s comparable sales fell by 1% during the period, as growth was hindered by an unusually warm October—a month when comps saw a “significant decline.” However, ABF expects Primark’s UK comps to be up 4% for the first half. The company expects Primark’s operating margin to be similar to that reported for the year-ago period and it plans to open 1.2 million square feet of selling space over fiscal year 2018.

Sir Philip Green Sought Arcadia Buyer, Says Leaked Email

(February 25) TheTimes.co.uk

Sir Philip Green Sought Arcadia Buyer, Says Leaked Email

(February 25) TheTimes.co.uk

- Sir Philip Green asked HSBC to help him find a buyer for Arcadia Group, according to a leaked email obtained by The Sunday Times. This news comes barely a week after Green issued a denial of a report that he was planning to sell all or part of the group to Chinese buyers.

- The email indicates that Green met with Ian Stuart, HSBC UK’s chief executive, and David Barraclough, a managing director at the bank, in February 2016. Barraclough said that Green was concerned by the growing pension deficit at Arcadia and felt that he needed to sell some part of the group to plug the gap. He sought Stuart’s and Barraclough’s “assistance and offered to meet any Chinese prospective partner [they] consider[ed] appropriate.”

Pavers Rescues Jones Bootmaker

(February 26) RetailGazette.co.uk

Pavers Rescues Jones Bootmaker

(February 26) RetailGazette.co.uk

- British footwear retailer Jones Bootmaker has been sold to competitor Pavers through a pre-pack administration deal. This move comes less than a year after private equity firm Endless acquired Jones Bootmaker and put it up for sale following tough trading.

- Pavers has now gained control of 42 of Jones Bootmaker’s 47 stores as well as its website and branding. The five stores that did not form part of the pre-pack deal will be shut, resulting in 86 redundancies. The deal includes 389 employees retaining their jobs.

Moncler Forecasts Further Growth After Sales Rise by 15% in 2017

(February 26) Company press release and Reuters.com

Moncler Forecasts Further Growth After Sales Rise by 15% in 2017

(February 26) Company press release and Reuters.com

- Italian lifestyle brand Moncler posted sales growth of 15% at constant currency, to €1,194 million ($1,468 million), in the year ended December 31, 2017. Comparable sales were up 14%, while EBIT grew by 15% and net income jumped 27%.

- The group forecast further growth in 2018 and plans to expand selected product categories and do away with catwalk shows. Moncler intends to launch products monthly in order to cater to shifting trends among young shoppers.

Spar to Trial Contactless and Cash Register–Free Payments

(February 22) RetailDetail.eu

Spar to Trial Contactless and Cash Register–Free Payments

(February 22) RetailDetail.eu

- In Belgium, supermarket group Spar is set to trial Amazon Go–like contactless and cash register–free payments in collaboration with Retail Partners Colruyt Group (RPCG).

- Spar’s Belgian stores are part of RPCG, which has developed a smartphone app that customers can use to scan and pay for groceries. The trial will be conducted in selected Spar stores in spring this year.

ASIA RETAIL & TECH HEADLINES

Alibaba to Buy Major Food Delivery App Ele.me

(February 27) ATimes.com

Alibaba to Buy Major Food Delivery App Ele.me

(February 27) ATimes.com

- Rumors that Alibaba was planning to acquire Ele.me, one of the major online food delivery platforms in China, have been confirmed by an insider close to the deal, Yicai.com reported. Alibaba will buy the company as a whole, and the final purchase price is still under discussion.

- The current valuation of the platform is about $9.5 billion. The report said it is highly possible that the firm will be placed under the leadership of Daniel Zhang, Alibaba’s CEO, and serve as the infrastructure of Alibaba’s “new retail” strategy.

Toys“R”Us Planning to Close More Stores

(February 27) HRMAsia.com

Toys“R”Us Planning to Close More Stores

(February 27) HRMAsia.com

- Amid stiff competition from online retailers and bigger toy stores such as Hamleys, US toy retail chain Toys“R”Us is reportedly set to scale back on its global operations. The Wall Street Journal has reported that the company, which operates more than 500 stores in Asia alone, is planning to close down dozens of stores, though their locations were unspecified.

- This follows an official update at the start of this year, when the company announced it would shut down 182 stores by April, potentially affecting some 4,500 workers. The toy giant filed for bankruptcy last year, right before the holiday season. To make matters worse, the retailer registered less-than-stellar sales during the 2017 holiday period.

Online Buying Poised for HK Expansion

(February 26) TheStandard.com.hk

Online Buying Poised for HK Expansion

(February 26) TheStandard.com.hk

- Although Hong Kong has a dense physical retail environment, its revenue in the e-commerce market is forecast to grow at an annual rate of 9.8% until 2022, says Pascal Martin, a partner at OC&C Strategy Consultants. Currently, the average revenue per user in the city is US$928, slightly lower than the US$1,114 in Singapore, the US$1,250 in Japan and the HK$1,495 in South Korea.

- E-commerce penetration is expected to reach almost 50% of the world’s population this year, data from marketing company Statista show. One of the areas with the most growth potential globally is the Asia-Pacific region, Martin says.

Tencent and JD.com Expand “Retail Kingdom”

(February 26) ATimes.com

Tencent and JD.com Expand “Retail Kingdom”

(February 26) ATimes.com

- Internet giant Tencent and leading e-commerce site JD.com moved to secure a total 11% stake of BBK Commercial Chain, a large, domestic chain enterprise, aiming to further expand their strategy of “new retail” to uproot more brick stores, The Paper reported.

- Insiders think China’s retail industry has gradually formed a pattern of “Tencent & JD” against “Alibaba & Suning.” Both sides are constantly building up their retail kingdoms via buying up offline retailers.

Retail AI Startup Capillary Technologies Raises $20 Million

(February 21) TheHindu.com

Retail AI Startup Capillary Technologies Raises $20 Million

(February 21) TheHindu.com

- Capillary Technologies announced that it has raised approximately $20 million over the past year from its existing investors, including Warburg Pincus and Sequoia Capital. The cloud-based software solutions startup uses artificial intelligence (AI) to enable top retailers such as Walmart, Starbucks and Dubai-based Al-Futtaim to engage with their customers.

- With these funds, Capillary expects to strengthen its new product development, powered by AI and machine learning, to cater to Asia and other upcoming emerging markets. The company said it also plans to invest in its newly launched consumer goods vertical.

LATAM RETAIL & TECH HEADLINES

How This Hot IPO Is Outfoxing Brazil’s Payment Industry Players

(February 27) Investors.com

How This Hot IPO Is Outfoxing Brazil’s Payment Industry Players

(February 27) Investors.com

- Brazil’s economy is bouncing back, which is good news for micromerchants such as taxi drivers, physical therapists and food truck operators. It’s also good news for PagSeguro, a payment processor that caters to those individual entrepreneurs and small businesses.

- PagSeguro, which provides online and mobile services, sells low-cost payment devices that enable micromerchants to accept credit or debit cards rather than cash. Some analysts compare PagSeguro to US-based Square, which also focuses on small merchants.

This Delivery App Puts a Courier on Every Corner

(February 27) Bloomberg.com

This Delivery App Puts a Courier on Every Corner

(February 27) Bloomberg.com

- Rappi, a two-year-old delivery startup, is a mashup of Uber Eats, Instacart and TaskRabbit. Summoned via smartphone, Rappi’s couriers deliver poke bowls, groceries and even cash, and run errands that include paying bills. Regular customers average more than four orders a week.

- Rappi, which charges customers about $1 an order or a flat $7 a month, has become such a hit in Bogotá and Mexico City that the company has raised $185 million—a near record in Latin America—to set up shop in each of the region’s major cities.

Mexico Retail Sales Fall for Second Month in December

(February 26) Reuters.com

Mexico Retail Sales Fall for Second Month in December

(February 26) Reuters.com

- Mexican retail sales fell for the second month in a row in December, dropping 0.5% from November, the national statistics agency said on Monday. Sales slid 2.0% in December from the same month a year earlier, the fifth such decline in five months. The figure represents the biggest annualized drop in sales for any month since March 2013.

- Earlier in February, Mexico’s retail association, ANTAD, said that sales at stores open for at least a year rose by 3.9% in January from the same month a year earlier.

Mercado Libre Is Opening Fulfillment Centers in Mexico to Fuel Growth

(February 26) Tamebay.com

Mercado Libre Is Opening Fulfillment Centers in Mexico to Fuel Growth

(February 26) Tamebay.com

- Mercado Libre, a major Latin American marketplace and e-commerce firm, has said that it will open two large distribution centers in Mexico as part of an effort to improve its logistics in the country and fuel its development and growth.

- The distribution centers will encompass a total of 1.4 million square feet and be located in the state of Mexico, close to Mexico City. Mercado Libre is hoping to improve efficiency because the area is vast, with many geographical problems in terms of fulfillment.

MWC 2018: Telefónica Rolls Out Aura Voice Assistant in Chile

(February 26) SantiagoTimes.cl

MWC 2018: Telefónica Rolls Out Aura Voice Assistant in Chile

(February 26) SantiagoTimes.cl

- Allying with tech giants Facebook, Google and Microsoft, Telefónica has launched Aura, an artificial intelligence–powered digital assistant, in six countries. The company has also announced a new initiative to bring 100 million people in Latin America online by using mobile networking technology for the first time.

- First announced at last year’s Mobile World Congress, Aura works much like Amazon’s Alexa, Apple’s Siri and Microsoft’s Cortana, allowing customers to request information and control devices through voice commands.

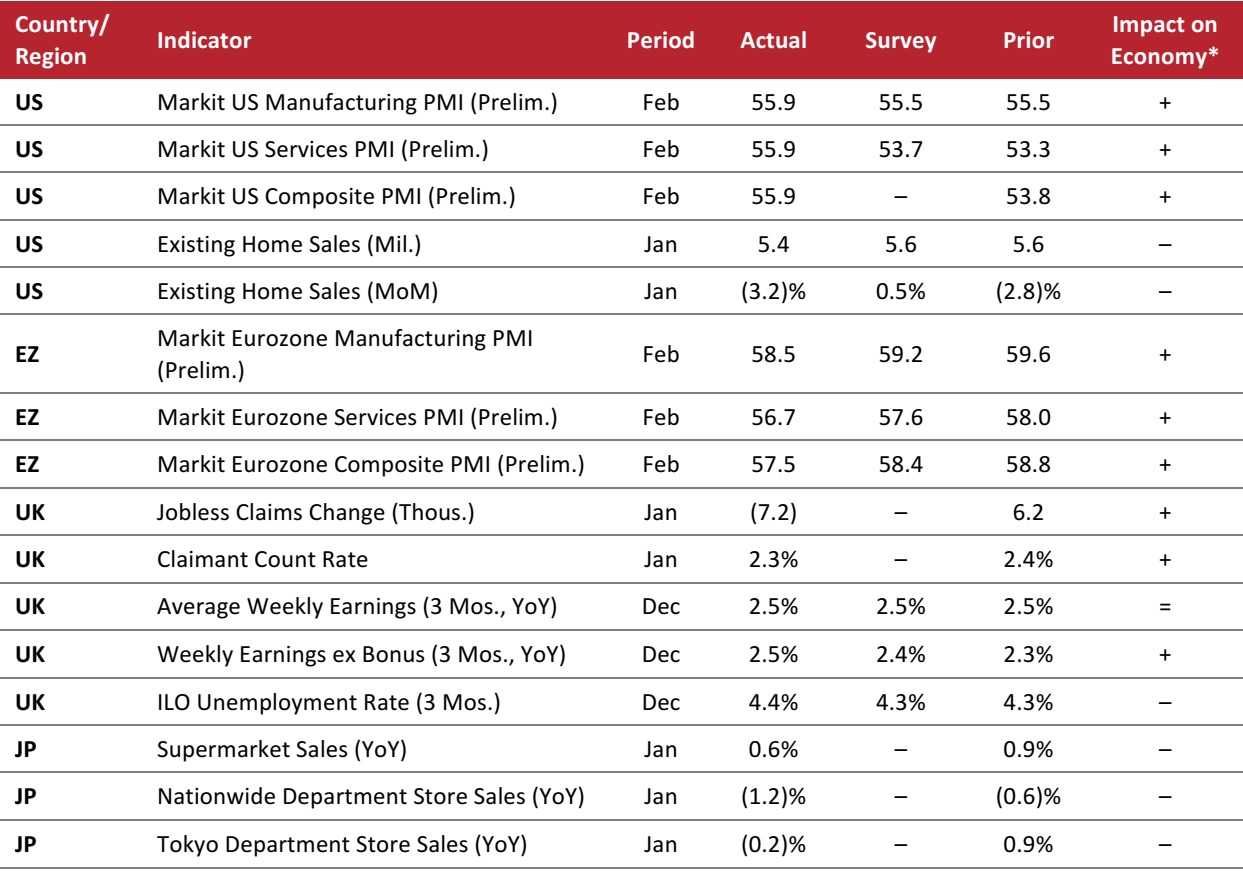

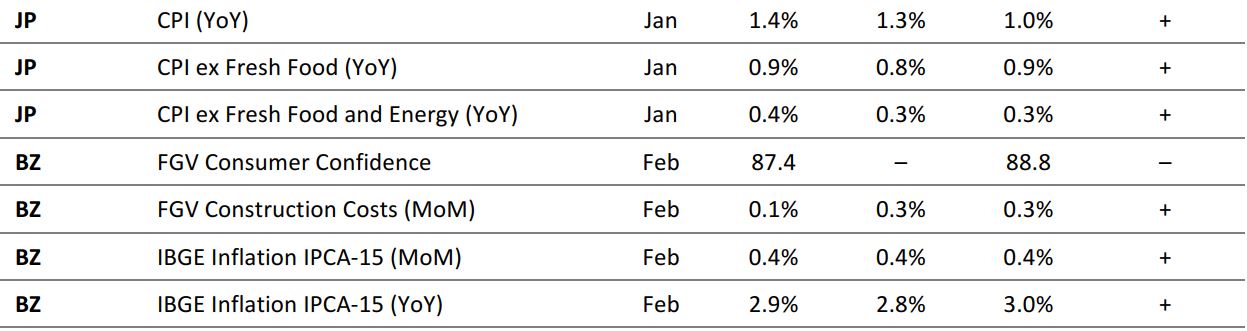

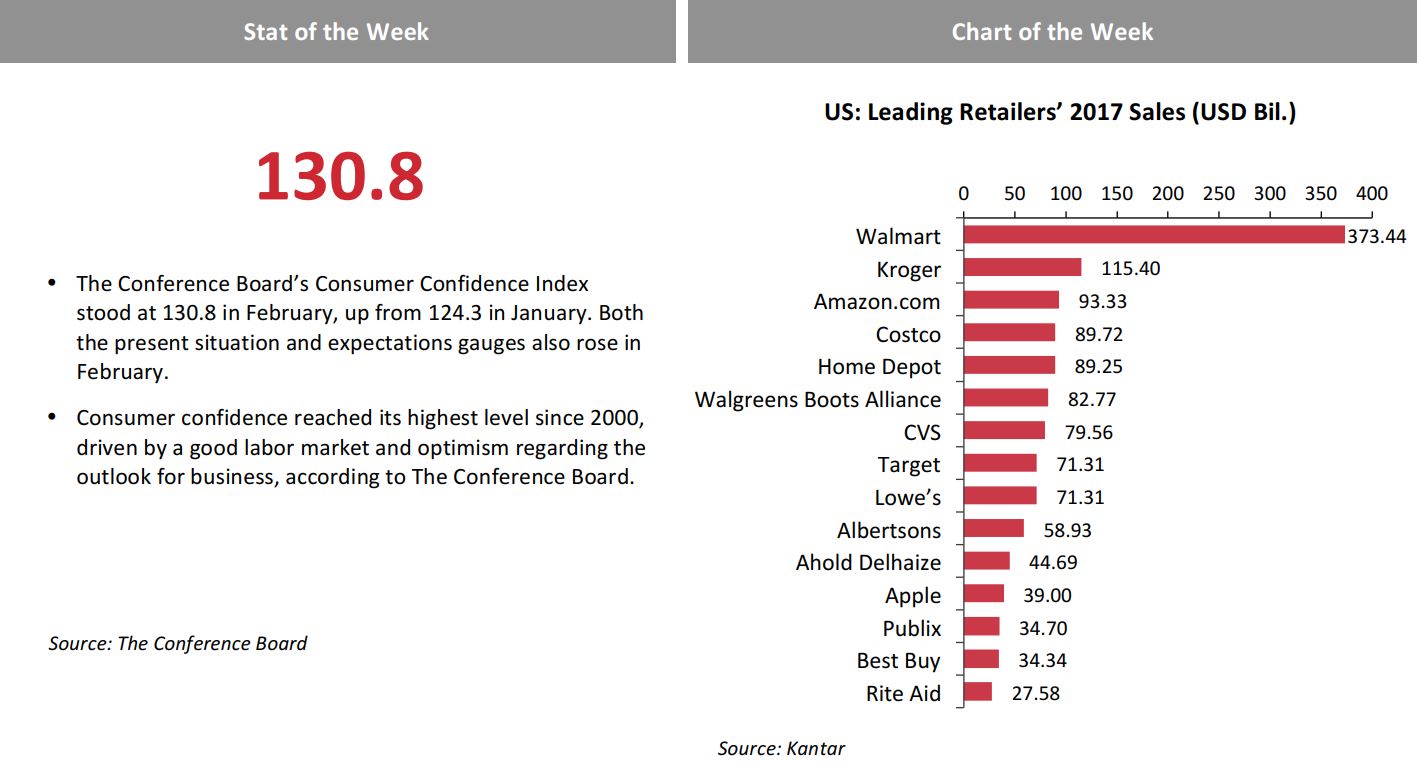

MACRO UPDATE

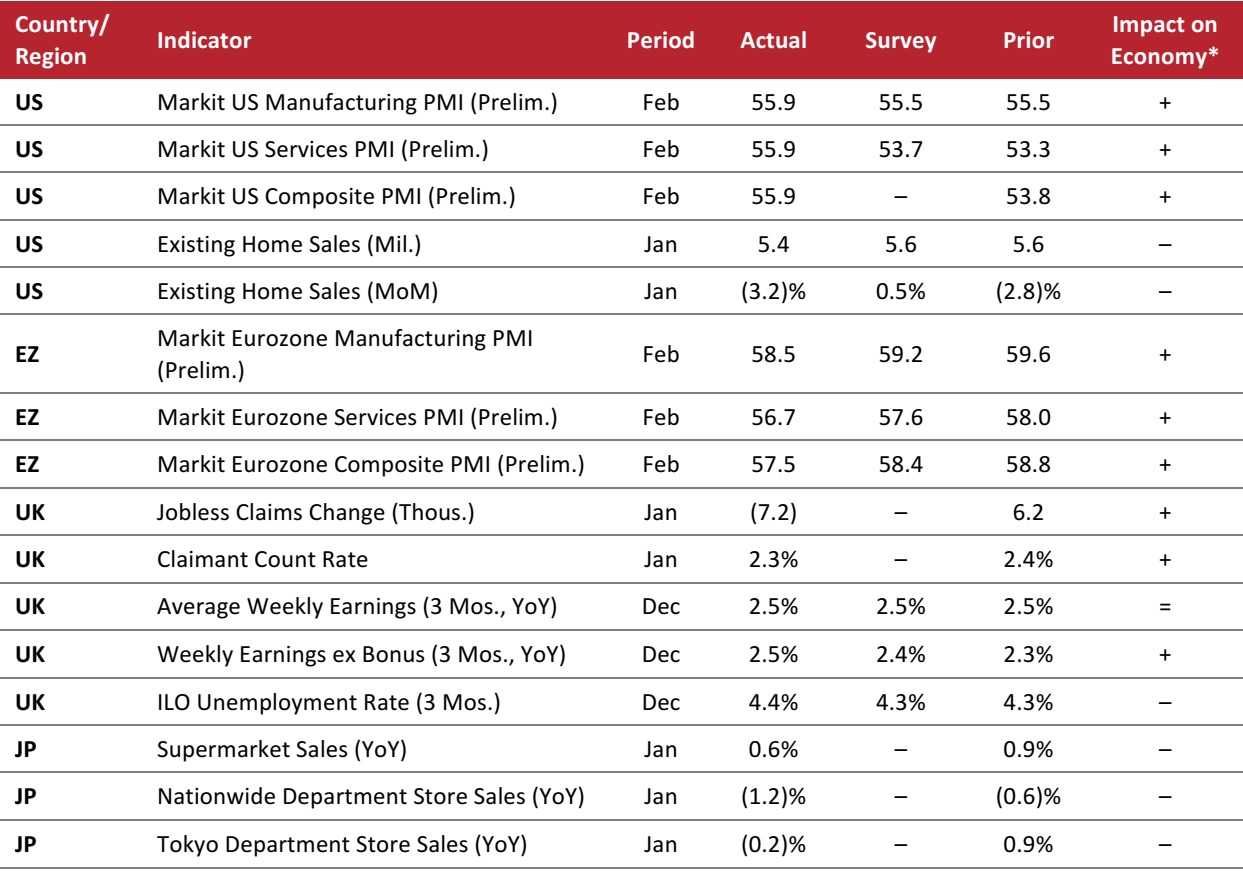

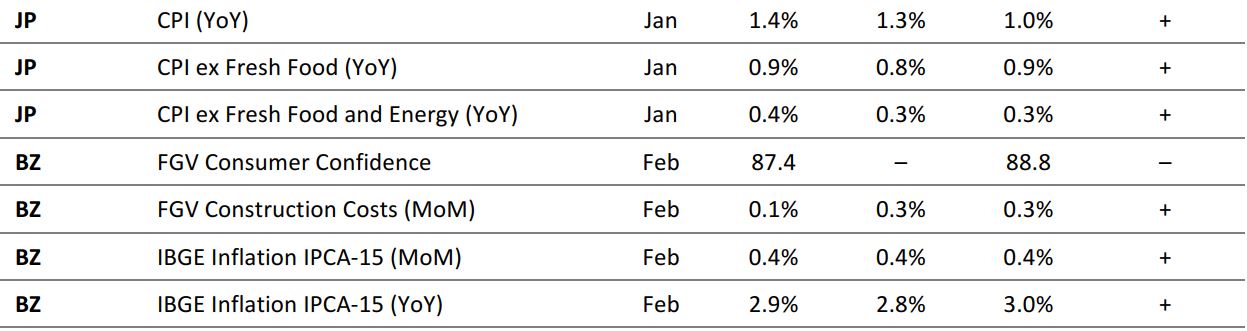

Key points from global macro indicators released February 21–28, 2018:

- US: The Markit US Manufacturing, Services and Composite Purchasing Managers’ Indexes (PMIs) remained above the expansion threshold of 50.0 in February. Existing home sales decreased by 3.2% month over month in January.

- Europe: In the eurozone, the Markit Eurozone Manufacturing, Services and Composite PMIs stayed above the expansion threshold in February. In the UK, the number of people claiming to be unemployed and the rate of people claiming benefits both fell in January from December. The UK unemployment rate ticked up slightly in December, to 4.4%.

- Asia-Pacific: In Japan, supermarket sales were up 0.6% year over year in January, while nationwide department store sales were down 1.2% and Tokyo department store sales were down 0.2%. The Consumer Price Index (CPI) in Japan rose by 1.4% year over year in January, increasing by more than it did in the prior month. The CPI excluding food prices increased by 0.9% year over year in January, while the CPI excluding food and energy prices increased by 0.4% year over year.

- Latin America: In Brazil, consumer confidence weakened to 87.4 in February. Construction costs in the country increased by 0.1%, slightly less than the prior month’s increase. Inflation in Brazil, as measured by the IBGE IPCA-15, edged up by 0.4% month over month and rose by 2.9% year over year in February.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Markit/National Association of Realtors/UK Office for National Statistics/Japan Chain Stores Association/Japan Department Store Association/Ministry of Internal Affairs and Communications Japan/Fundação Getulio Vargas/Instituto Brasileiro de Geografia e Estatística/Coresight Research