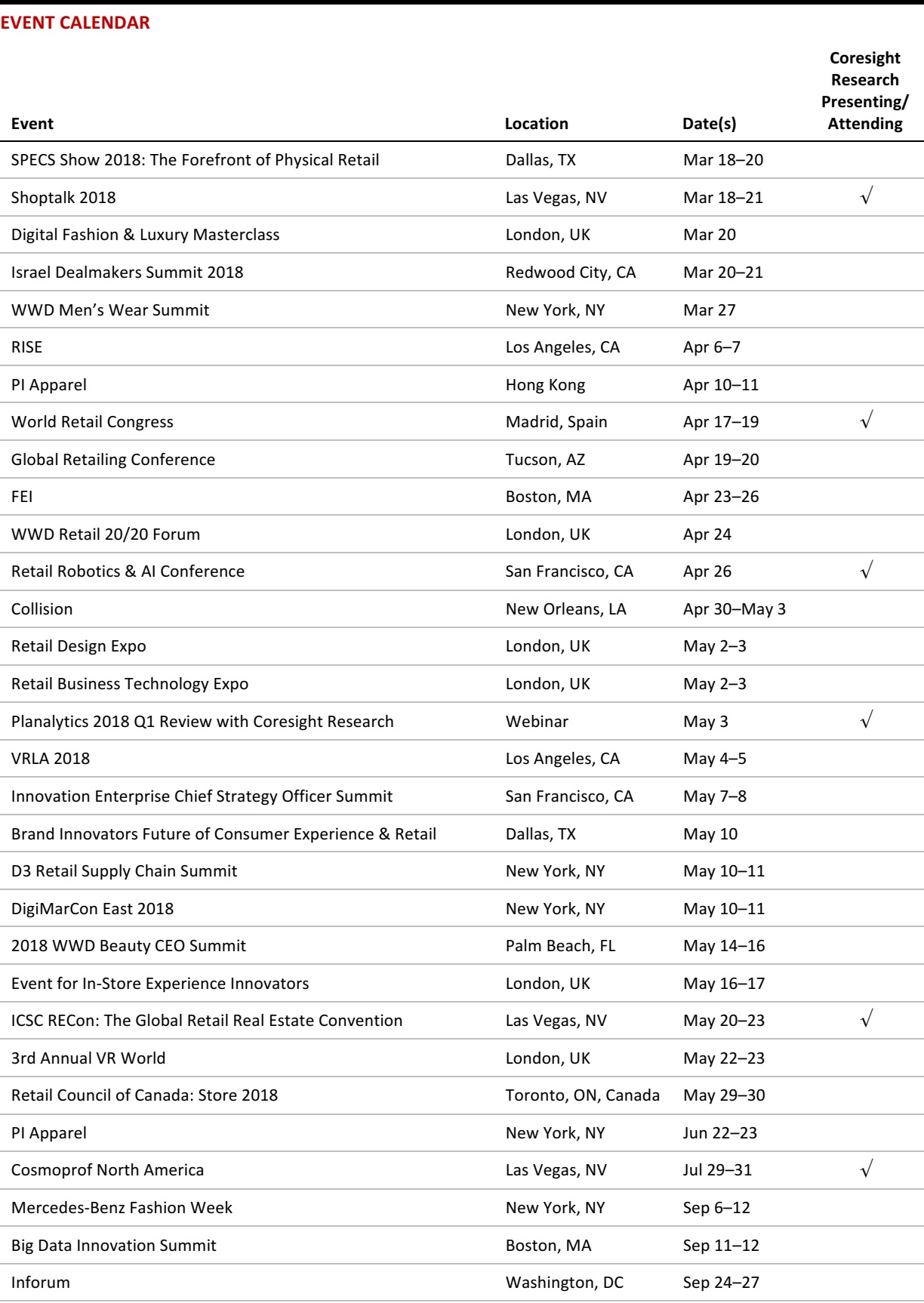

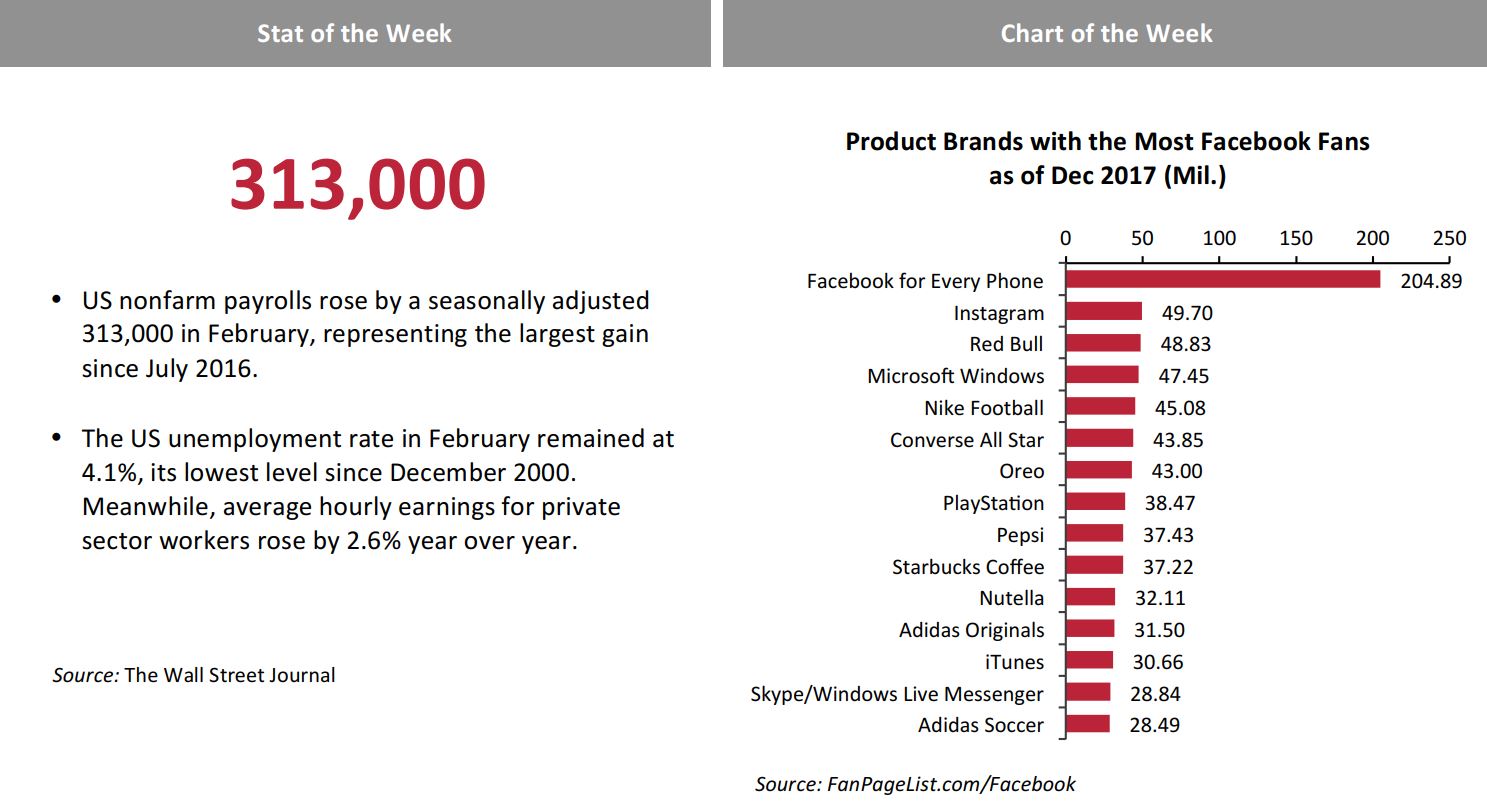

Source: The Wall Street Journal and FanPageList.com/Facebook

Source: The Wall Street Journal and FanPageList.com/Facebook

From the Desk of Deborah Weinswig

Tired of Your Old Jeans? Recycle ’Em!

US retailer Target just announced that for a two-week period (March 11–24), customers in the Pacific Northwest can drop off any kind of denim jeans at its stores and receive a coupon good for 20% off a new pair of jeans in-store or at Target.com. The retailer is only accepting full-length jeans as part of the recycling initiative—no shorts, jackets or vests—and they must be left at the drop-off boxes in the stores. Target ran a similar type of trade-in program in 2017, but for used car seats. The company said that it recycled 2.5 million pounds of car seats through the effort.

Target is running the trade-in program in partnership with a German company called I:CO (short for “I:Collect”), which bills itself as a “global solutions provider and innovator for collection, reuse and recycling of used clothing and shoes.” I:CO operates a unique, worldwide take-back system and logistics network that collects clothing and shoes in more than 60 countries. It offers collection, sorting, preparation and open- or closed-loop recycling that returns materials to the textile industry and other industries. It sorts donated denim into two piles: one to be sold secondhand and one to be recycled. Metal buttons and other decorations are recycled as metal, and dust created during recycling is pressed into briquettes for making cardboard. Textiles that have no other use are used as fuel for energy production.

I:CO’s list of partners includes global brands such as Adidas, C&A, Forever 21, Kenneth Cole, Levi’s, M&S and Timberland. The company is also working with Madewell, which makes a donation to Habitat for Humanity for returned jeans, and with The North Face, which offers coupons in exchange for returned clothing and footwear. I:CO works with international research institutes and recycling companies and is a division of Germany’s SOEX, which is engaged in the collection, processing, recycling and trading of recyclables in Germany, the UK and the Middle East. SOEX also operates PicknWeight Kilo stores, which sell used clothing by the kilogram in four German cities.

Target’s sustainability efforts extend well beyond the denim trade-in program. One of its recently launched private-label brands—Universal Thread—has been designed for fit and sustainability. Some styles are made from recycled cotton and jeggings are finished with a natural substance that helps reduce the amount of water, chemicals and energy used during production. Some of the label’s jeans even have pockets made with polyester made from recycled plastic bottles.

Other brands have instituted ongoing recycling programs. Patagonia accepts all its garments for recycling and pledges that its returned clothing will not end up in a landfill or incinerator. The company also sells used clothing obtained through its trade-in program at its Portland, Oregon, retail store.Since 2005, the company has recycled more than 95 tons of clothing. Patagonia began making recycled polyester from plastic soda bottles in 1993, becoming the first outdoor clothing manufacturer to transform trash into fleece. Today, it recycles soda bottles, manufacturing waste and worn-out garments into polyester fibers to produce base layers, shell jackets, board shorts and fleece. In addition, Patagonia launched Tin Shed Ventures, an investment fund that supports environmentally and socially responsible startups.

H&M’s recycling effort is titled, simply, “Recycle Your Clothes.” The company partners with I:CO to recycle clothing that customers drop off in stores. The surplus is donated to the H&M Foundation, which split sit among social projects and recycling projects. In addition, local charity organizations receive 0.02 euros for each kilogram of textiles H&M collects. H&M says it has collected a total of 55,000 metric tons of garments since launching its recycling initiative in 2013.

This year, Target expects to prevent more than 50,000 pounds of denim from ending up in landfills. This figure is a drop in the bucket in terms of clothing waste, as the US generates 25 billion pounds of textile waste per year, or 82 pounds per resident, according to the Council for Textile Recycling. Only about 15% of that amount is donated or recycled; the remaining 85%, or 21 billion pounds, is buried in landfills. That means that discarded apparel makes up more than 5% of all municipal solid waste generated in the US.

Target’s latest trade-in program is another indication that recycling is very much in fashion. The “everything old is new again” concept has even extended to the runway: at this year’s London Fashion Week, two designers presented clothes made from plastic bottles and sustainable wool as part of their collections.

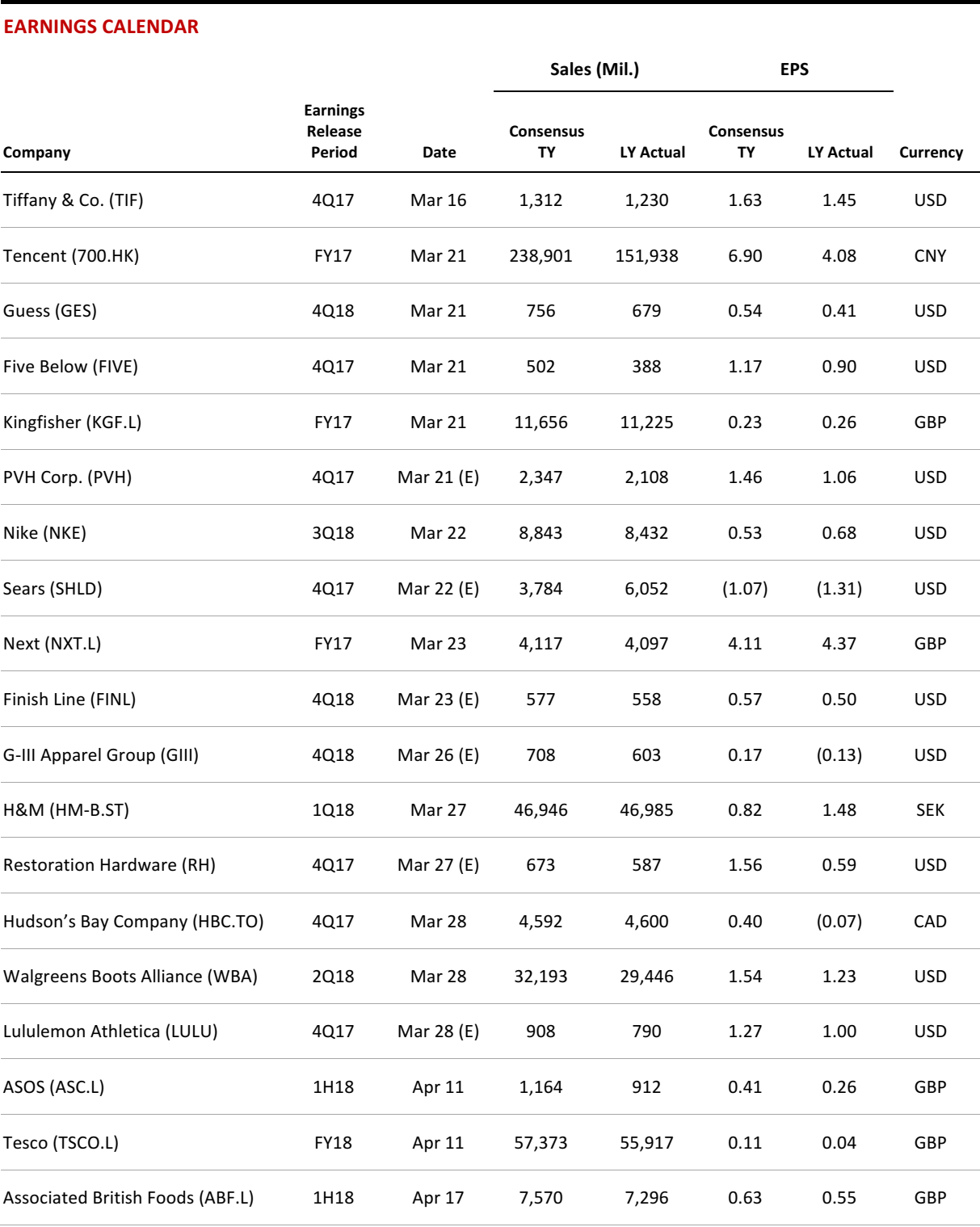

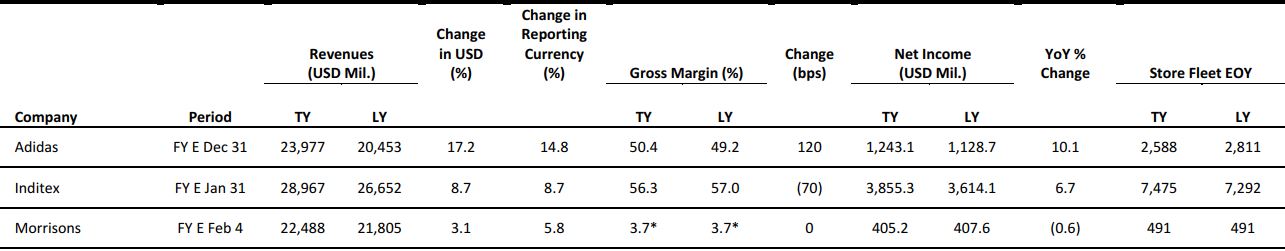

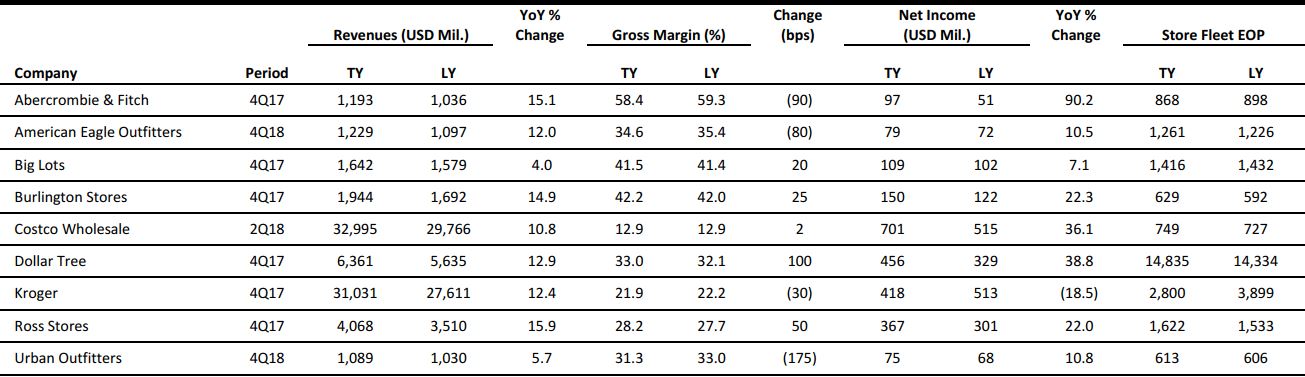

US RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

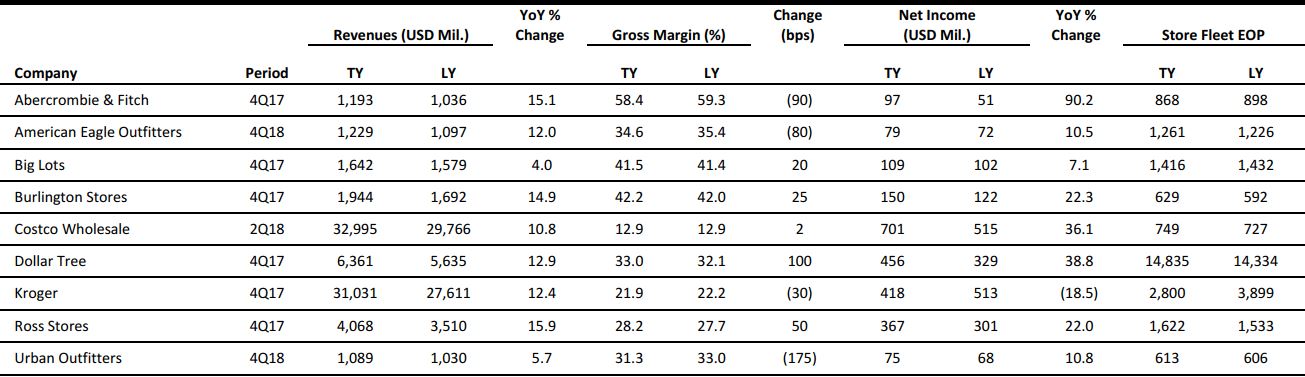

US RETAIL & TECH HEADLINES

Instacart Expands Kroger Partnership amid Amazon Squeeze

(March 12) Bloomberg.com

Instacart Expands Kroger Partnership amid Amazon Squeeze

(March 12) Bloomberg.com

- Kroger announced it’s expanding a tie-up with Instacart in a bid to help the two companies solve the same problem: Amazon.com.

- Instacart landed Whole Foods Market as its first national partner in 2014, bringing delivery service to the grocery chain’s customers. Then Amazon bought Whole Foods, and in due course, announced free two-hour delivery from some stores in Texas, Virginia and Ohio. Then San Francisco, then Atlanta…. On the other end, Amazon’s push into grocery is leaving brick-and-mortar supermarket chains like Kroger scrambling to compete.

Claire’s Accessories on Brink of Bankruptcy as Debt Piles Up

(March 12) RetailGazette.co.uk

Claire’s Accessories on Brink of Bankruptcy as Debt Piles Up

(March 12) RetailGazette.co.uk

- US-based accessories retailer Claire’s is reportedly on the verge of collapse as it prepares to file for bankruptcy. According to Bloomberg, the retailer is sitting on around $2 billion worth of debt, more than 10 times a key measure of its annual earnings.

- The move to file for bankruptcy came ahead of a $60 million interest payment due on March 13. A further $1.4 billion of its debt is set to mature next year. In the proposed deal, control of the company would be passed from Apollo Global Management to lenders.

Bankrupt Bon-Ton Stores Races to Find Life-Saving Deal

(March 12) Reuters.com

Bankrupt Bon-Ton Stores Races to Find Life-Saving Deal

(March 12) Reuters.com

- Bankrupt regional department store chain Bon-Ton Stores, under pressure from a group of hedge funds to liquidate, began a race on Monday to find a buyer to keep open some of its stores. US Bankruptcy Judge Mary Walrath approved sale procedures on Monday and an April 2 deadline to accept bids for the chain.

- Bon-Ton has not yet received any initial bids, also called stalking horse bids, which help stoke interest and attract potential buyers to an auction it intends to hold on April 9. The company faces a possible liquidation just as Toys“R”Us, the largest US toy retailer, is preparing to go out of business.

Alibaba Founders Invest $20 Million in USRetailer

(March 9) ChainStoreAge.com

Alibaba Founders Invest $20 Million in USRetailer

(March 9) ChainStoreAge.com

- Blue Pool Capital, a financial firm that principally invests the wealth of Alibaba founders Jack Ma and Joe Tsai, has invested $20 million in women’s fashion rental business Rent the Runway, Recode reported. The company was founded in 2009 as an online site where women could rent designer dresses for special occasions.

- It has since expanded its merchandise assortment to include more casual and workwear offerings and has also added brick-and-mortar locations. With the new funds, Rent the Runway is valued at a little less than $800 million, the report said.

Toys“R”Us and Why the Retail Downturn Is All About Debt

(March 9) Marketplace.org

Toys“R”Us and Why the Retail Downturn Is All About Debt

(March 9) Marketplace.org

- Toys“R”Us was founded in 1948 in Washington, DC, as a baby furniture business. By the mid-80s, it was a public company with hundreds of toy stores around the world and more than a billion dollars in sales. But soon, the company started losing ground to discount chains.

- In 2004, after years of flat sales and falling profits, the Toys“R”Us board of directors put the company up for sale. The buyers were a group of private equity firms, investment firms that bundle together money from investors to buy companies, fix them up by cutting costs and increasing sales, and then sell them or take them public to cash out.

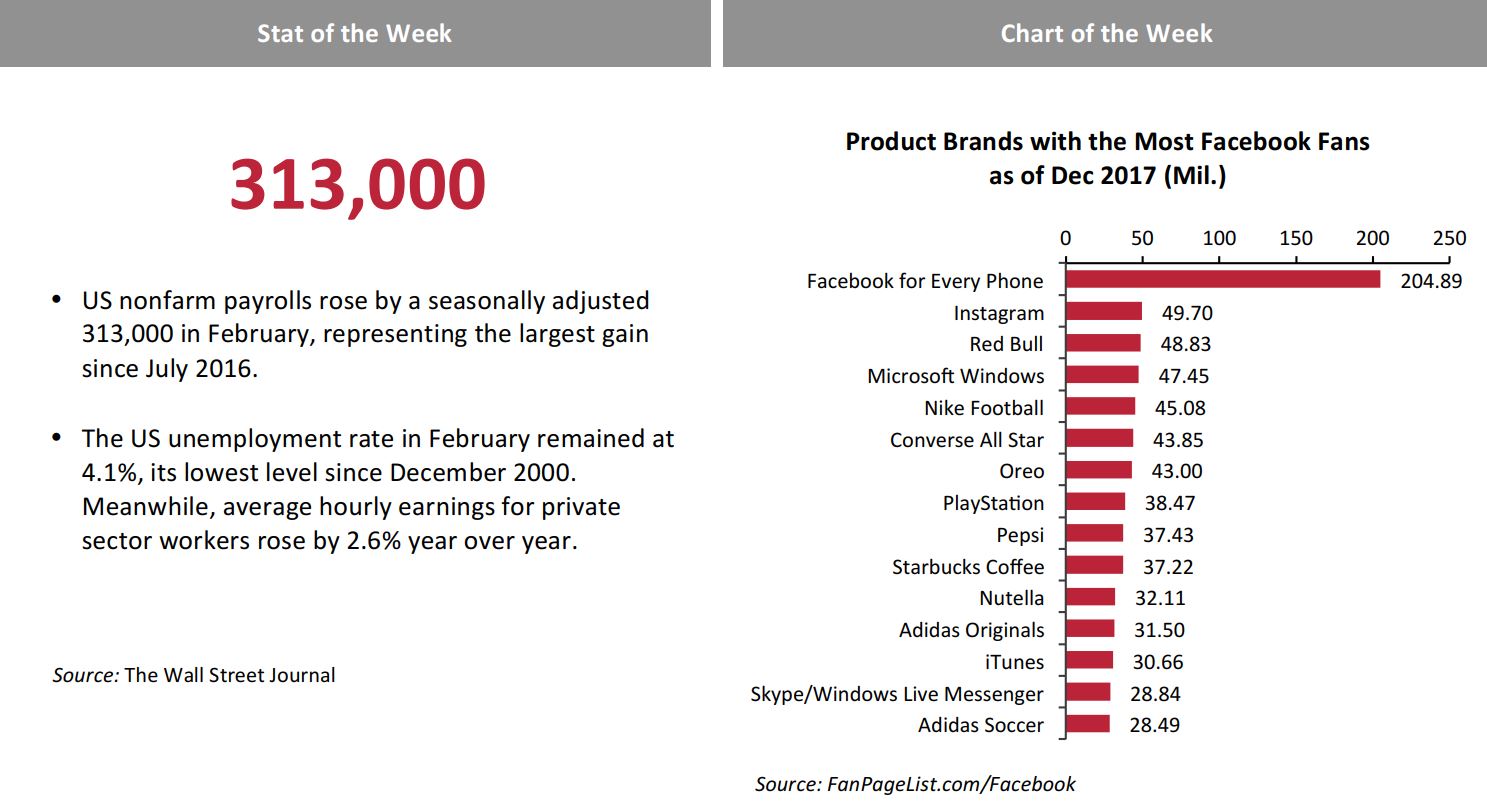

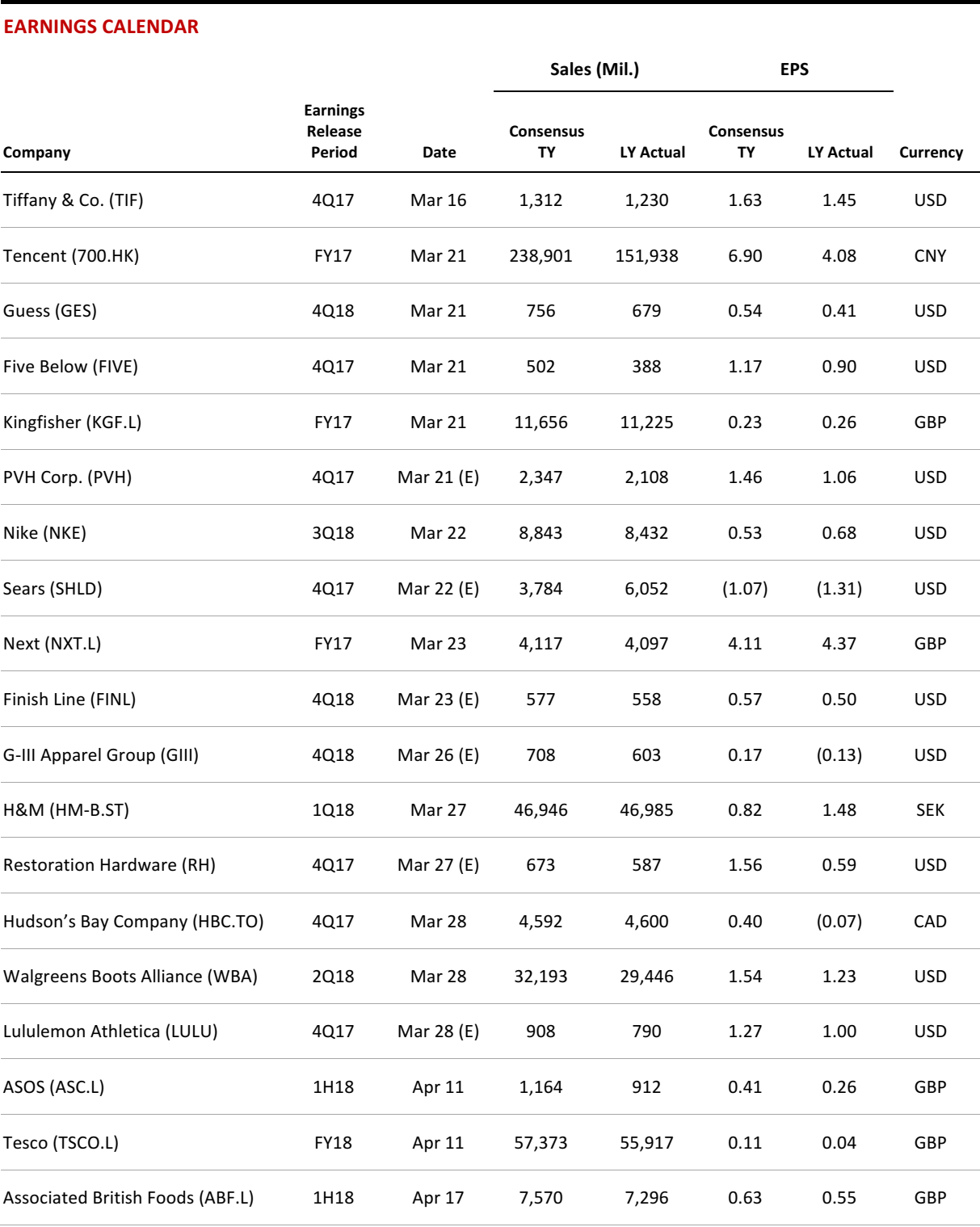

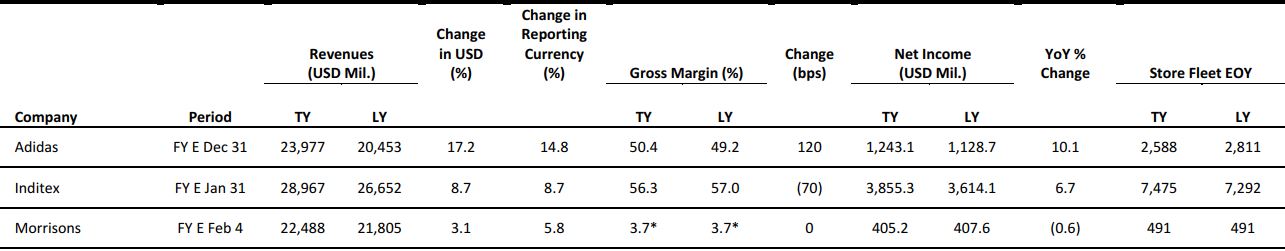

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

French Connection Posts Revenue Growth, Narrows Losses

(March 13) Company press release

French Connection Posts Revenue Growth, Narrows Losses

(March 13) Company press release

- British retailer French Connection posted group revenue growth of 0.5%, to £154.0 million ($214.0 million), in the fiscal year ended January 31, 2018. In the previous year, the group’s revenues fell by 6.7%. Retail comparable sales edged up 0.8%, while underlying operating loss narrowed to £0.6 million ($0.8 million), an improvement of £3.1 million ($4.3 million) over the previous year.

- Though it is still early in the year, Chairman and CEO Stephen Marks believes that the group is “in a very strong position to make significant progress again.”

Prada Reports Drop in 2017 Revenues, Forecasts Return to Growth in 2018

(March 9) Company press release

Prada Reports Drop in 2017 Revenues, Forecasts Return to Growth in 2018

(March 9) Company press release

- Luxury fashion group Prada posted 2017 net revenues of €3.1 billion ($3.8 billion), a decline of 3.6% as reported and of 2% at constant currency. Among geographies, Japan, the Middle East and the US recorded significant declines in sales. Ready-to-wear and leather goods performed positively, while footwear contracted.

- CEO Patrizio Bertelli said that the group has “seen a promising start to 2018” and that management is “expecting a return to growth in 2018.”

Aldi Looking to Establish Physical Store Network in China

(March 10) ESMMagazine.com

Aldi Looking to Establish Physical Store Network in China

(March 10) ESMMagazine.com

- German discount retailer Aldi is looking to establish a physical store network in China, nearly a year after setting up an online presence through Alibaba-run e-commerce site Tmall.com. Through the website, Aldi currently sells a range of German products, including wine, snacks and breakfast items, sourced from Australia.

- Aldi is reportedly building a team of managers with European retail experience and has plans to open some 50 stores in China over the coming few years.

Harvey Nichols Collaborates with Farfetch in Online Push

(March 11) WWD.com

Harvey Nichols Collaborates with Farfetch in Online Push

(March 11) WWD.com

- British department store Harvey Nichols and e-commerce platform Farfetch have joined forces to consolidate their presence in the luxury retail market. The partnership will help the department store reach a wider market and allow Farfetch to include the renowned Harvey Nichols brand in its offering.

- The e-commerce partnership spans several years and Harvey Nichols will launch on Farfetch during the second half of this year.

L’Oréal Unveils Tech to Personalize Foundations and Serums

(March 12) Adweek.com

L’Oréal Unveils Tech to Personalize Foundations and Serums

(March 12) Adweek.com

- At lifestyle festival SXSW, L’Oréal unveiled technology that personalizes foundations and serums for a person’s skin color and texture. The foundation is made by determining a customer’s skin color using a spectrometer. The reading is entered into a tablet that instructs a machine to combine ingredients and dispense the personalized foundation into a bottle.

- For the serum, a customer first consults with a professional. Data collected during the consultation is entered into a tablet connected to a 3D printer-like machine, which uses 2,000 algorithms to analyze the data, mix ingredients in the right proportions and dispense the serum into a bottle.

ASIA RETAIL & TECH HEADLINES

Singapore’s Golden Gate Raising $100 Million VC Fund

(March 11) Bloomberg.com

Singapore’s Golden Gate Raising $100 Million VC Fund

(March 11) Bloomberg.com

- Singapore’s Golden Gate Ventures is raising a $100 million third fund to continue investing in Southeast Asia’s burgeoning market for e-commerce, payments and mobile apps. The new fund is expected to have a first close before the end of this month and its final close by the end of 2018.

- Golden Gate Ventures was one of the earliest venture capital firms to target Southeast Asia’s nascent technology sector. It has launched two funds and invested in more than 30 companies across the region. They include online classified app Carousell, Jakarta-based healthcare platform Alodokter and Appota, a Vietnamese mobile platform with more than 30 million users.

India’s Ola Takes Its Uber Rivalry to Australia with Launch in Sydney

(March 13) TechCrunch.com

India’s Ola Takes Its Uber Rivalry to Australia with Launch in Sydney

(March 13) TechCrunch.com

- Ola, Uber’s key rival in India, has taken its first step overseas via a full launch in Sydney, Australia. The company announced its plans to enter Australia at the end of January and said it has signed up more than 7,000 registered drivers in Sydney. Initially, passengers will be able to enjoy free rides for a limited time. The company plans to introduce other promotions in a bid to keep its service competitive once it begins charging.

- “We are excited to officially start operating on the East Coast with the launch in Sydney. We’ve been very pleased with how the service has been received by customers, driver partners and the community in Perth, and can’t wait to continue building on these experiences and learnings for our second city launch,” said Chandra Nath, Head of International for Ola.

Grab Launches a Bike-Sharing Service in Southeast Asia

(March 9) TechCrunch.com

Grab Launches a Bike-Sharing Service in Southeast Asia

(March 9) TechCrunch.com

- Southeast Asian Uber rival Grab has jumped into the bike-sharing space by launching a service in Singapore. GrabCycle Beta will offer services from a range of businesses, including bike-sharing services oBike (in which Grab is an investor), GBikes and Anywheel, plus electric scooter rental service PopScoot.

- The project is the first to launch under GrabVentures, Grab’s new innovation arm, which is focused on projects in verticals such as payments and transportation. The project ties into Grab’s payment efforts because GrabPay Credits, its virtual currency, are used to pay for cycle rental.

India’s Prime Venture Partners Closes New $60 Million Fund for Seed Investments

(March 8) TechCrunch.com

India’s Prime Venture Partners Closes New $60 Million Fund for Seed Investments

(March 8) TechCrunch.com

- India’s Prime Venture Partners has refueled its tanks for more angel investing after announcing a new fund of around $60 million. The firm was started by three managing partners—serial entrepreneurs Sanjay Swamy, ShripatiAcharya and AmitSomani—in 2011. This fund represents the third (and largest) investment vehicle for the firm. Its previous fund, of $46 million, closed in 2015, and the firm has made 19 investments to date.

- The firm has backed Ezetap, HackerEarth and ZipDial (which sold to Twitter) and it focuses on just four to five deals per year, according to Somani. With this new fund, Prime Venture Partners is targeting around 15 deals with a total investment size averaging about $4.5 million per company.

LATAM RETAIL & TECH HEADLINES

Indra Launches Digital Transformation Unit in Brazil

(March 12) ZDNet.com

Indra Launches Digital Transformation Unit in Brazil

(March 12) ZDNet.com

- Spanish IT outsourcer Indra has launched its digital transformation business unit, Minsait, in Brazil. The division will support Brazilian clients in projects related to the Internet of Things, mobile technologies, big data and analytics.

- Minsait was launched in 2016 and already operates in Mexico, Italy and Spain. According to Indra, the company was already supporting local clients in their innovation initiatives, but wanted to be sure of the business generation capacity of the market before launching the digital transformation unit in Brazil.

São Paulo Mayor Seeks Backing to Build Local “Silicon Valley”

(March 9) ZDNet.com

São Paulo Mayor Seeks Backing to Build Local “Silicon Valley”

(March 9) ZDNet.com

- São Paulo Mayor JoãoDoria is looking for support from technology giants for his project to build a local version of Silicon Valley. Provisionally named International Center of Technology and Innovation (Citi), the innovation center would include incubators, research centers and universities as well as residential areas for entrepreneurs.

- Citi would be created on the fringes of the sprawling metropolis, on a site where São Paulo’s main produce wholesale market is currently located. According to the Mayor’s Office, companies including Google, Facebook, Microsoft, IBM and Cisco have been approached to provide support for the project, intended to be the largest technology innovation cluster in Latin America.

Carrefour Brasil Plans to Expand; Considers Purchases and Partnerships

(March 13) Reuters.com

Carrefour Brasil Plans to Expand; Considers Purchases and Partnerships

(March 13) Reuters.com

- Carrefour Brasil plans to aggressively expand its store network, and will consider acquisitions and partnerships as part of that drive. The company plans to open 20 wholesale stores in 2018, 10 Carrefour Market stores, and 20 Carrefour Express convenience stores. It also plans to convert five to seven hypermarkets into wholesale stores this year and has the potential to open a total of 120–140 new stores by 2022.

- The expansion plans, particularly in the wholesale Atacadão format, reflect the company’s ambitions to gain and consolidate market share as Brazil’s food retail market turns a corner after a years-long recession in the country.

Amazon May Finally Bring Its Full Retail Business to Brazil

(March 8) Engadget.com

Amazon May Finally Bring Its Full Retail Business to Brazil

(March 8) Engadget.com

- In 2017, Amazon Brazil started allowing third-party sellers to list their items on the website, but that could have been just the beginning of the e-commerce titan’s expansion in the biggest retail market in Latin America. According to Reuters, the company held a meeting with manufacturers in Brazil last week to discuss its plans to stock and sell goods itself in the country.

- It has also been reported that Amazon will use its own transportation and call centers in Brazil for customer service and that it will store its goods in its own facilities in Greater São Paulo. Amazon told Reuters that it has been holding “hundreds of meetings with potential vendors and suppliers about its business in Brazil and possible future plans” over the past five years.

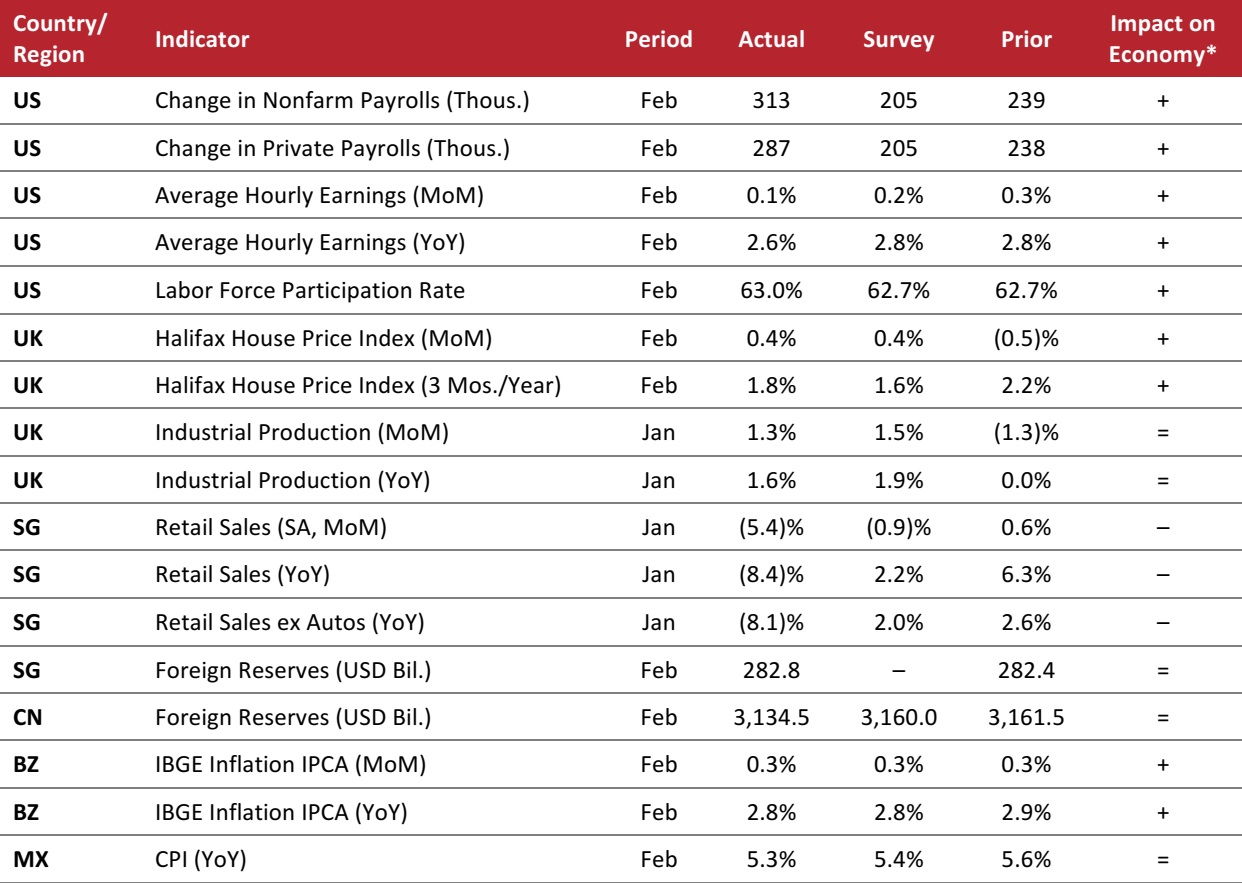

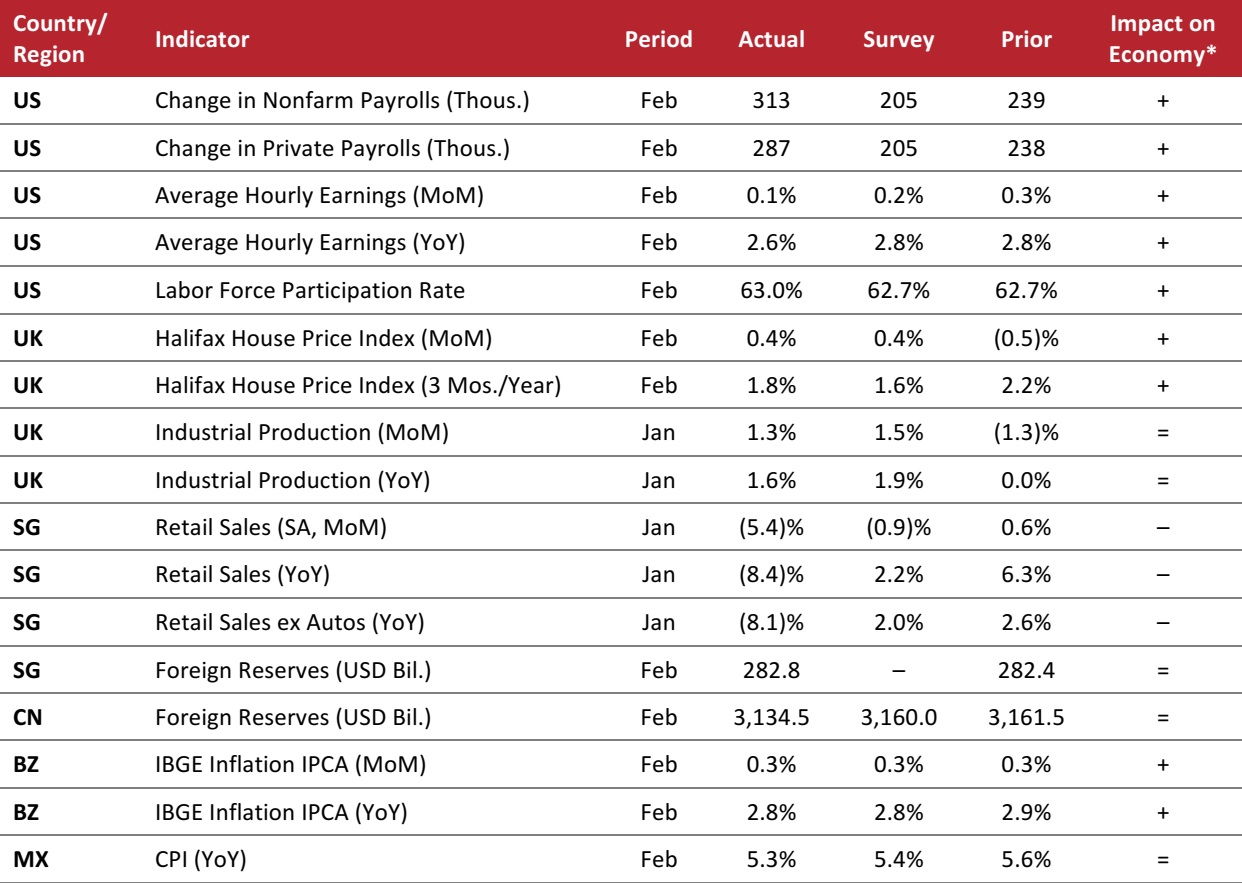

MACRO UPDATE

Key points from global macro indicators released March 7–14, 2018:

- US: Nonfarm payrolls increased by 313,000 in February, a big gain over January’s figure and signaling a healthy labor market. Average hourly earnings increased by 2.6% year over year, down from 2.8% in the previous period, indicating an easing of inflationary pressure.

- Europe: In the UK, house prices increased by 0.4% month over month in February, in line with the consensus estimate. UK industrial production in January increased by less than analysts had expected, growing by 1.6% year over year.

- Asia-Pacific: In Singapore, retail sales dropped by 8.4% year over year in January, missing the consensus estimate of a 2.2% increase. Foreign reserves in Singapore edged up to $282.8 billion in February. In China, foreign reserves decreased to $3,134.5 billion in February.

- Latin America: In Brazil, inflation edged down to 2.8% year over year in February, in line with the market’s expectation. In Mexico, the Consumer Price Index (CPI) increased by 5.3% year over year in February, slightly below the increase seen in January.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Markit/Halifax/UK Office for National Statistics/Singapore Department of Statistics/Monetary Authority of Singapore/The People’s Bank of China/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Markit/Halifax/UK Office for National Statistics/Singapore Department of Statistics/Monetary Authority of Singapore/The People’s Bank of China/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

Source: The Wall Street Journal and FanPageList.com/Facebook

Source: The Wall Street Journal and FanPageList.com/Facebook Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Instacart Expands Kroger Partnership amid Amazon Squeeze

(March 12) Bloomberg.com

Instacart Expands Kroger Partnership amid Amazon Squeeze

(March 12) Bloomberg.com

Claire’s Accessories on Brink of Bankruptcy as Debt Piles Up

(March 12) RetailGazette.co.uk

Claire’s Accessories on Brink of Bankruptcy as Debt Piles Up

(March 12) RetailGazette.co.uk

Bankrupt Bon-Ton Stores Races to Find Life-Saving Deal

(March 12) Reuters.com

Bankrupt Bon-Ton Stores Races to Find Life-Saving Deal

(March 12) Reuters.com

Alibaba Founders Invest $20 Million in USRetailer

(March 9) ChainStoreAge.com

Alibaba Founders Invest $20 Million in USRetailer

(March 9) ChainStoreAge.com

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Prada Reports Drop in 2017 Revenues, Forecasts Return to Growth in 2018

(March 9) Company press release

Prada Reports Drop in 2017 Revenues, Forecasts Return to Growth in 2018

(March 9) Company press release

Aldi Looking to Establish Physical Store Network in China

(March 10) ESMMagazine.com

Aldi Looking to Establish Physical Store Network in China

(March 10) ESMMagazine.com

Singapore’s Golden Gate Raising $100 Million VC Fund

(March 11) Bloomberg.com

Singapore’s Golden Gate Raising $100 Million VC Fund

(March 11) Bloomberg.com

Indra Launches Digital Transformation Unit in Brazil

(March 12) ZDNet.com

Indra Launches Digital Transformation Unit in Brazil

(March 12) ZDNet.com

Carrefour Brasil Plans to Expand; Considers Purchases and Partnerships

(March 13) Reuters.com

Carrefour Brasil Plans to Expand; Considers Purchases and Partnerships

(March 13) Reuters.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Markit/Halifax/UK Office for National Statistics/Singapore Department of Statistics/Monetary Authority of Singapore/The People’s Bank of China/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Markit/Halifax/UK Office for National Statistics/Singapore Department of Statistics/Monetary Authority of Singapore/The People’s Bank of China/Instituto Brasileiro de Geografia e Estatística/Instituto Nacional de Estadística y Geografía/Coresight Research