albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Blockchain Could Democratize Retail Operations and Promote Cooperation

Blockchain, a fairly new technology created in 2008, has found applications in sectors ranging from finance to logistics. The technology is likely to start having a significant impact on the retail industry in the near future, particularly in areas such as supply chain and logistics, product sourcing and tracking, e-commerce, payments, loyalty programs, and customer data management.

A blockchain-based database uses cryptography to securely and permanently record transactions in a decentralized network that is open to all participants. Each user is responsible for verifying the data in the database and storing the transaction record. Blockchain technology eliminates the need for third-party verification, enables real-time information exchange and is highly secure, due to data encryption. Since each user of a blockchain database has a copy of the ledger, the risk of a single point of failure is minimized, increasing the overall security of the system.

Smart contracts are one blockchain application that can help streamline processes such as payments. These self-executing contracts work like computer programs, eliminating the need for intermediaries. Blockchain also has the potential to improve many other processes, such as the digitalization of supply chains and retail operations. The technology enables partners in a supply chain to track items accurately throughout the product cycle, a particularly valuable capability in industries such as apparel, where sourcing systems are highly fragmented and geographically dispersed. Blockchain also holds much potential in terms of tracking goods that are often counterfeited, such as luxury products and pharmaceuticals, and perishables such as fresh food.

In retail, blockchain application development is still at a nascent stage, but many companies are already experimenting with the technology. Walmart is working with IBM to develop a food-safety blockchain platform that digitalizes fresh-food traceability throughout the product cycle. The system will enable Walmart to respond more quickly and effectively to food-safety issues. E-commerce and technology giant Alibaba announced a partnership for its own blockchain-based food-tracking system in April 2018. The system will authenticate, verify and record transfers of ownership and give consumers access to reliable and comprehensive information on products’ origins. The system will ultimately help protect consumers from counterfeiting and enable partners to detect fraud and react quickly to food contamination problems.

Other companies that apply blockchain technology will provide consumers with access to reliable information about the provenance of products and the sustainability of supply chains. Traditional labeling systems can be manipulated, but the decentralized and encrypted nature of the blockchain makes for secure and traceable supply chains. Tech firm Provenance is working with UK retailer Co-op to track fresh products and with fashion retailer Martine Jarlgaard to track each stage within the garment supply chain.

Blockchain’s distributed nature provides two additional benefits in the retail industry. First, it allows consumers to retain more control over their data, reducing the likelihood of it being mishandled. Such security has become an even bigger priority following the introduction the European Union’s General Data Protection Regulation (GDPR). Second, it encourages companies to collaborate on loyalty programs, as all participants are able to see and verify information shared in a blockchain-based database.

The retail industry is beginning to develop a variety of applications for blockchain technology, but its greatest potential likely lies in its ability to encourage collaboration among retail players. The technology makes all partners in a system equal, while offering improved privacy and security.

Please click here to read our recent report Blockchain in Retail: Decentralizing the Digitalization of Retail Operations.

QUESTION OF THE WEEK

[caption id="attachment_80381" align="aligncenter" width="650"] Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (719 in 2018 and 985 in 2019)

Base: US Internet users ages 18+ who have bought clothing or footwear on Amazon.com in the past 12 months (719 in 2018 and 985 in 2019)Source: Coresight Research[/caption]

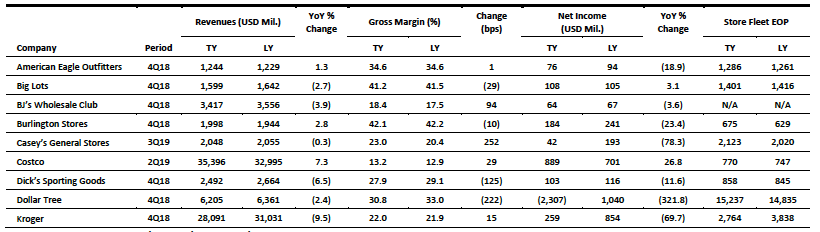

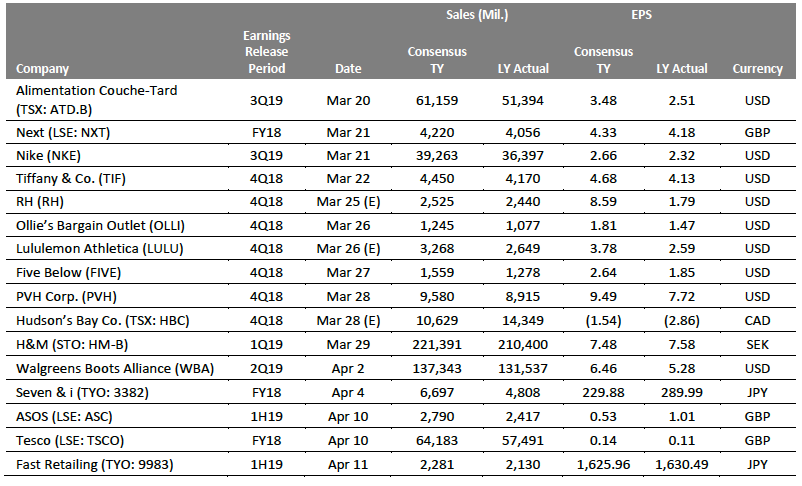

US RETAIL EARNINGS

[caption id="attachment_80380" align="aligncenter" width="820"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

US RETAIL & TECH HEADLINES

![]() US Retail Sales Edge Up in January, but December Figure Is Revised Sharply Lower

US Retail Sales Edge Up in January, but December Figure Is Revised Sharply Lower

(Mar. 11) CNBC.com

- US retail sales unexpectedly rose in January, increasing 0.2% month over month, according to the Commerce Department. Sales were lifted by an increase in purchases of building materials and discretionary spending.

- Retail sales rose 2.3% year over year in January. Receipts in December, however, were much weaker than initially thought, declining by a revised 1.6% month over month following an initial report of a 1.2% drop.

![]() Amazon Suppliers Panic amid Purge Aimed at Boosting Profits

Amazon Suppliers Panic amid Purge Aimed at Boosting Profits

(Mar. 7) Bloomberg.com

- Amazon has abruptly stopped buying products from many of its wholesalers, sowing panic. The company is encouraging vendors to sell directly to consumers on its marketplace instead. Amazon makes more money that way by offloading the cost of purchasing, storing and shipping products.

- The company is determined to boost profits in its core e-commerce business, even if that means disrupting relationships with longtime vendors.

![]() Amazon to Close US Pop-Up Stores and Focus on Opening More Bookstores

Amazon to Close US Pop-Up Stores and Focus on Opening More Bookstores

(Mar. 6) Reuters.com

- An Amazon spokesperson announced on Mar. 6 the company will close all of its US pop-up stores and focus instead on opening more bookstores. The announcement followed a Wall Street Journal report earlier that day stating the company will close its 87 US pop-up stores by the end of April, according to some employees at the stores.

- The online retail giant will also open more 4-Star stores, which sell items rated 4 stars or higher by Amazon customers.

![]() Dollar Tree to Close up to 390 Family Dollar Stores, Reports $2.3 Billion Loss

Dollar Tree to Close up to 390 Family Dollar Stores, Reports $2.3 Billion Loss

(Mar. 6) CNBC.com

- Discount retailer Dollar Tree plans to close 390 Family Dollar stores this year and renovate 1,000 other locations. The company will also rebrand about 200 Family Dollar stores as Dollar Tree outlets. As of Feb. 2, the company had 7,001 Dollar Tree locations and 8,236 Family Dollar stores.

- The company’s fourth-quarter earnings were heavily adjusted to exclude a $2.73 billion write-down against its Family Dollar business, among other charges.

![]() Diesel USA Files Chapter 11

Diesel USA Files Chapter 11

(Mar. 5) RetailDive.com

- Jeans retailer Diesel USA filed for Chapter 11 protection on Mar. 5, citing a decrease in wholesale orders, a “general downturn in the brick-and-mortar retail industry,” expensive long-term leases, a decrease in net sales and multiple instances of theft and fraud.

- The reorganization plan includes relocating some stores to locations with a smaller footprint, opening a temporary pop-up concept, launching new stores in strategic locations and a rebranding effort.

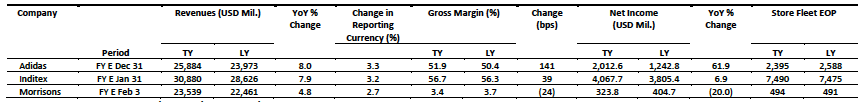

EUROPE RETAIL EARNINGS

[caption id="attachment_80379" align="aligncenter" width="868"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

The Entertainer Acquires Early Learning Centre from Mothercare

The Entertainer Acquires Early Learning Centre from Mothercare

(Mar. 12) Retail-Week.com

- Toy retailer The Entertainer has bought Early Learning Centre (ELC) and its portfolio of toy brands from Mothercare in a deal worth around £13.5 million ($17.6 million). ELC operates in 80 Mothercare stores in the UK and in 400 stores internationally through franchise and online channels.

- Mothercare will receive £6 million ($7.8 million) when the deal concludes, including up to £5.5 million ($7.2 million) for inventory “due within a few months of completion” and £2 million ($2.6 million) in earn-out fees over two years. Mothercare said the divestment was “the next step towards being free of bank debt.”

Ocado Launches Trial for One-Hour Delivery Service

Ocado Launches Trial for One-Hour Delivery Service

(Mar. 8) RetailGazette.com

- British online grocery retailer Ocado has begun testing its new one-hour delivery service, Ocado Zoom, in West London. The service is powered by the Stuart same-day delivery platform.

- Stuart’s technology will seamlessly integrate with Ocado’s website, app and back end and automatically allocate orders to whichever available independent courier is best suited for a particular delivery.

Debenhams in Advanced Refinancing Talks

Debenhams in Advanced Refinancing Talks

(Mar. 11) FashionNetwork.com

- British multinational retailer Debenhams confirmed it is in advanced stages of negotiations with its lenders to secure a £150 million ($195.9 million) lifeline as it seeks to hold off major shareholder Mike Ashley’s attempts to take control of the company.

- The latest announcement follows Ashley’s recent calls for a complete overhaul of the Debenhams board and a proposal to step down from his current position as CEO of Sports Direct to take on an executive role at Debenhams.

Maplin and Warren Evans Make Online Comeback

Maplin and Warren Evans Make Online Comeback

(Mar. 11) Metro.news

- Two high-street casualties, electronics retailer Maplin and bed retailer Warren Evans, are now making an online comeback. Maplin collapsed in February last year, leading to the closure of all 217 of its stores and the loss of 2,500 jobs, but the company has been trading online since late January.

- Warren Evans, which closed all 14 of its stores after filing for bankruptcy in February last year, is now set to reopen for business online this month.

![]() Portuguese Investor Acquires Intertoys

Portuguese Investor Acquires Intertoys

(Mar. 8) RetailDetail.eu

- Portuguese investor Green Swan has made a strong entry into the Dutch toy market by acquiring Dutch toy store chain Intertoys, which filed for bankruptcy last month.

- At least 120 of Intertoys’ 286 stores will be safe from closure as a result of the acquisition. However, 91 stores will close by May and the future of the other 75 locations remains uncertain.

ASIA RETAIL & TECH HEADLINES

Lazada Shores Up Its E-Commerce Business in Southeast Asia

Lazada Shores Up Its E-Commerce Business in Southeast Asia

(Mar. 8) InsideRetail.asia

- Alibaba-owned e-commerce company Lazada announced a series of initiatives to expand its cross-border operations for international brands and merchants. The company’s cross-border sales have quadrupled over the past three years.

- Lazada’s initiatives include revamping its Global Collection, an exclusive channel that features an assortment from cross-border merchants around the world. Global Collection 2.0 uses algorithm-based search features to help customers easily find sellers offering popular and high-quality products.

![]() Mumuso Plans to Open over 300 Stores in India by Mid-2022

Mumuso Plans to Open over 300 Stores in India by Mid-2022

(Mar. 11) IndiaRetailing.com

- South Korean lifestyle brand Mumuso plans to open more than 300 stores in India by mid-2022 with a revenue target of INR 10 billion ($143.4 million), according to a statement from Mumuso India.

- The retailer, which launched operations in India in 2018 with stores in Kolkata and Mumbai, plans to open a mix of company-owned and franchise locations in Delhi, Chennai, Bengaluru, Hyderabad, Kolkata, Pune, Goa, Jaipur, Indore, Surat and other cities.

Alibaba Buys 14% Stake in STO Express

Alibaba Buys 14% Stake in STO Express

(Mar. 11) Reuters.com

- Alibaba Group is acquiring a 14% stake in one of China’s leading express carriers, STO Express, in a deal worth $693 million. This is the e-commerce giant’s fourth major investment in a China-based courier company. It has already invested in YTO Express Group, Best and ZTO Express.

- “We will deepen our existing collaboration with STO in technology, last-mile delivery across China and New Retail logistics. This investment is a step forward in our pursuit of the goal of 24-hour delivery anywhere in China and 72 hours globally,” Alibaba said in a statement.

![]() Lippo Malls Indonesia Retail Trust to Acquire Lippo Mall Puri for $354.7 Million

Lippo Malls Indonesia Retail Trust to Acquire Lippo Mall Puri for $354.7 Million

(Mar. 12) StraitsTimes.com

- Singapore-headquartered Lippo Malls Indonesia Retail Trust (LMIRT) plans to acquire Lippo Mall Puri in West Jakarta in a deal worth 3.7 trillion rupiah ($354.7 million). LMIRT stated in a regulatory filing that the deal will be financed through a combination of debt and equity.

- LMIRT intends to complete the acquisition in the second half of 2019, according to a statement from LMIRT Management, the REIT manager of LMIRT.

Future Retail to Invest INR 2 Billion to Open New Stores

Future Retail to Invest INR 2 Billion to Open New Stores

(Mar. 11) In.FashionNetwork.com

- Future Retail, a subsidiary of Indian retail conglomerate Future Group, announced plans to invest INR 2 billion ($28.7 million) to open around 25 Big Bazaar stores in the eastern region of India, including seven or eight stores in Kolkata and its suburbs, beginning this year.

- The eastern region of the country contributed 25% of Big Bazaar’s national sales and West Bengal alone accounted for 30% of sales within the region, according to Manish Agarwal, Future Retail’s CEO for the eastern region.

LATAM RETAIL & TECH HEADLINES

Rappi and La Comer Collaborate to Enhance Their Digital Capabilities

Rappi and La Comer Collaborate to Enhance Their Digital Capabilities

(Mar. 11) America-Retail.com

- Colombia-headquartered Rappi, an on-demand delivery startup, and Mexican retail chain La Comer are joining forces to improve their digital offerings in Mexico. Rappi expects to attain 1.2 million new users during the first year of the partnership, according to a joint statement from the companies.

- “Our mission is to bring all our users the freshest products in less than 60 minutes, and as an extension of our value proposition in alliance with Grupo La Comer, you will be able to find tens of thousands of products at the same price as in your stores in different formats,” said Alejandro Zamudio, Rappi’s Director of Consumer Goods.

![]() Prüne to Enter Colombia with Five Stores

Prüne to Enter Colombia with Five Stores

(Mar. 8) Modaes.com

- Argentinian accessories retailer Prüne plans to enter the Colombian market and open at least five stores in Bogotá’s main shopping centers beginning in September. The company will launch e-commerce operations throughout Colombia at the same time.

- Colombia will be Prüne’s fourth international market. It already operates in Chile, Peru and Uruguay.

Zara to Launch E-Commerce Platform in Brazil

Zara to Launch E-Commerce Platform in Brazil

(Mar. 11) America-Retail.com

- Zara, a subsidiary of Spanish multinational clothing retailer Inditex, announced it will launch its e-commerce platform in Brazil on Mar. 20. Inditex has 72 stores in Brazil, making the country the group’s second-largest market in Latin America by number of stores.

- In Latin America, Zara already has e-commerce operations in Mexico.

Sarkany to Return to Colombia with Falabella

Sarkany to Return to Colombia with Falabella

(Mar. 11) Modaes.com

- Argentinian women’s footwear retailer Sarkany plans to return to Colombia and open a new store in Bogotá by September. The company previously operated in Colombia for five years, but ended operations there in 2011.

- The new outlet will be located within a Falabella department store in the Unicentro shopping center. Sarkany will also launch e-commerce operations in Colombia by the end of the year.

![]() Mercado Libre Seeks to Raise $1.85 Billion

Mercado Libre Seeks to Raise $1.85 Billion

(Mar. 12) America-Retail.com

- Argentinian e-commerce platform Mercado Libre announced it intends to raise $1 billion by offering shares on the Nasdaq stock exchange. In addition, online payments platform PayPal has committed to making a strategic investment of $750 million in Mercado Libre through the purchase of common shares.

- Under a separate agreement, an affiliate of Dragoneer Investment Group will buy $100 million in convertible, perpetual, preferred series A shares. The investments from PayPal and Dragoneer are dependent on the closing of Mercado Libre’s public offering and are due to be completed at the same time or shortly afterwards.

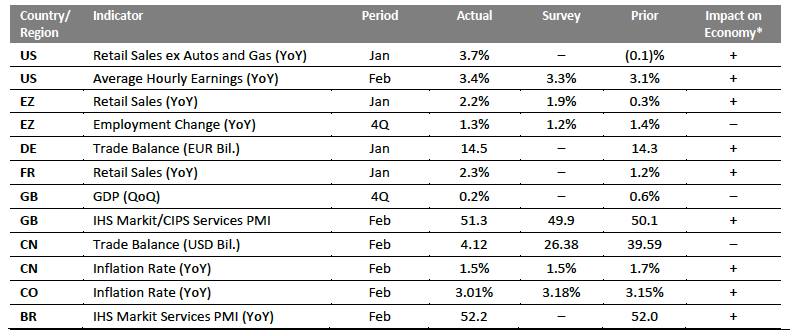

MACRO UPDATE

Key points from global macro indicators released Mar. 6-12, 2019:

1) US: Retail sales excluding autos and gas increased 3.7% year over year in January, versus a 0.1% decline in December. Average hourly earnings increased 3.4% year over year in February, following 3.1% growth in January. 2) Europe: In the eurozone, retail sales in real terms increased 2.2% year over year in January, beating the 1.9% consensus estimate and ahead of December’s 0.3% increase. In Germany, the trade balance increased to €14.5 billion in January from €14.3 billion the previous month. In the UK, GDP increased 0.2% in the fourth quarter of 2018 following 0.6% growth in the third quarter. 3) Asia Pacific: In China, the trade balance shrank from $39.59 billion in January to $4.12 billion in February, missing the consensus estimate of $26.38 billion. Inflation in China rose 1.5% year over year in February, compared with 1.7% in January. 4) Latin America: In Colombia, inflation rose 3.01% year over year in February, versus 3.15% in January. In Brazil, the IHS Markit Services Purchasing Managers’ Index (PMI) stood at 52.2 in February, up slightly from 52.0 in January. [caption id="attachment_80378" align="aligncenter" width="798"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impactSource: US Census Bureau/US Bureau of Labor Statistics/Eurostat/Federal Statistical Office (Germany)/National Institute of Statistics and Economic Studies (France)/IHS Markit/Office for National Statistics (UK)/National Bureau of Statistics of China/General Administration of Customs (China)/National Administrative Department of Statistics (Colombia)/Coresight Research[/caption]

EARNINGS CALENDAR

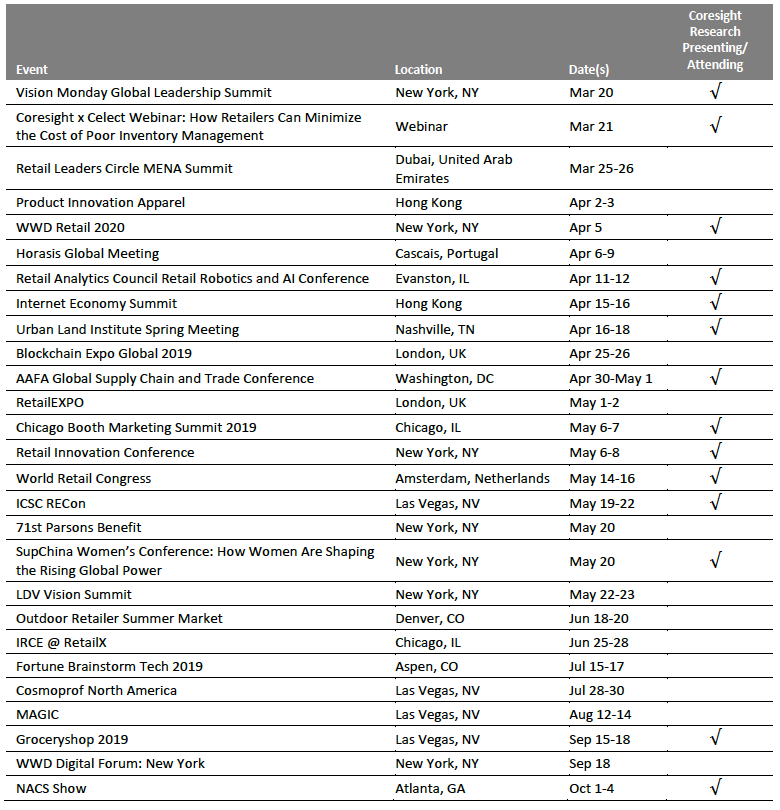

EVENT CALENDAR