albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

The US Adaptive Clothing and Footwear Market: A $47.3 Billion Opportunity

Inclusive apparel refers to clothing, footwear and accessories that serve needs not met by traditional fashions. Apparel specifically designed to help individuals with disabilities dress and live with more independence is often called “adaptive apparel.” The market for adaptive apparel includes individuals with disabilities or mobility, sensory or motor-processing difficulties and those undergoing various medical treatments.

According to the World Health Organization’s World Report on Disability 2011, around 785 million people ages 15 and older, or 15.6% of the global population ages 15 and older, have a disability. Based on data from the World Health Organization and Euromonitor International, we estimate the market for adaptive clothing, footwear and accessories will reach approximately $47.3 billion in the US this year and approximately $288.7 billion globally.

According to the US Census Bureau’s American Community Survey, more than 40.7 million Americans, or 12.7% of the US population, reported they had a disability in 2017, with “disability” defined as difficulty with hearing, vision, cognition, walking or climbing stairs or difficulty with self-care and independent living. Approximately 15.4 million people surveyed reported a cognitive disability, while 14.3 million said they had difficulty with daily living activities such as dressing and 7.9 million said they had difficulty with self-care.

Many companies are now designing and launching adaptive apparel lines and creating private-label brands to improve quality of life for people who have been diagnosed with a disability or chronic disease. Retailers are recognizing the opportunity to provide more specialized, functional fashion for consumers with a wide variety of clothing needs. For example, some companies are designing apparel for patients recovering from medical treatments who are seeking short-term fashion solutions, while others are designing fashionable and functional clothing options for people who use wheelchairs or fashions that provide sensory relief.

In 2017, Target introduced an adaptive apparel line for men, women and children that focuses primarily on sensory-friendly garments. The company offers clothing made with soft fabrics and no tags or seams in sizes 00–26. The same year, Zappos introduced an online marketplace called Zappos Adaptive that features “functional fashionable products to make life easier.” Product categories include slip-on shoes, sensory-friendly clothing and postsurgical wear.

In 2018, Marks & Spencer (M&S) became the first British high-street retailer to launch an adaptive clothing line for children with sensory or physical disabilities. The company’s Adapted for Easy Dressing collection features items made with soft material, fewer seams and hidden care labels. The collection aims to be fashionable, but with no unnecessary details.

Nike has made strides in the adaptive world with its sneaker offerings. The company created two types of sneakers to help people of all ages and abilities get their shoes on and off more easily, the FlyEase and the Adapt BB. The company designed the FlyEase shoes in 2016 at the request of a customer with cerebral palsy who could not tie his own shoes. Wearers of Nike’s Adapt BB sneakers can lace and tighten the shoes via Bluetooth technology. The company said the shoes’ “lace engine” houses every component needed to make them “smart.”

Retailers and designers that take the opportunity to truly understand the adaptive clothing needs of consumers can generate a positive social and economic impact while also gaining first-mover advantage by becoming the go-to provider of particular styles. We expect this category to continue to grow as designers and retailers focus more closely on meeting the apparel needs of all communities by creating inclusive designs that incorporate both fashion and function.

Please click here to read our extensive report on adaptive clothing and footwear.

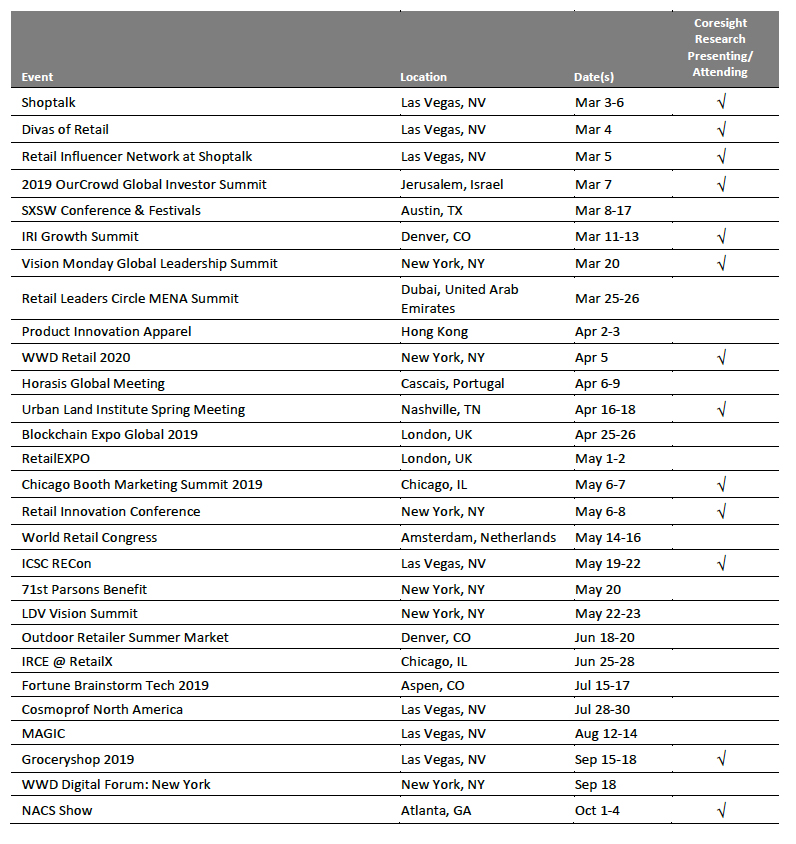

QUESTION OF THE WEEK

[caption id="attachment_78506" align="aligncenter" width="846"] Base: 1,732 US Internet users ages 18+

Base: 1,732 US Internet users ages 18+Source: Coresight Research[/caption]

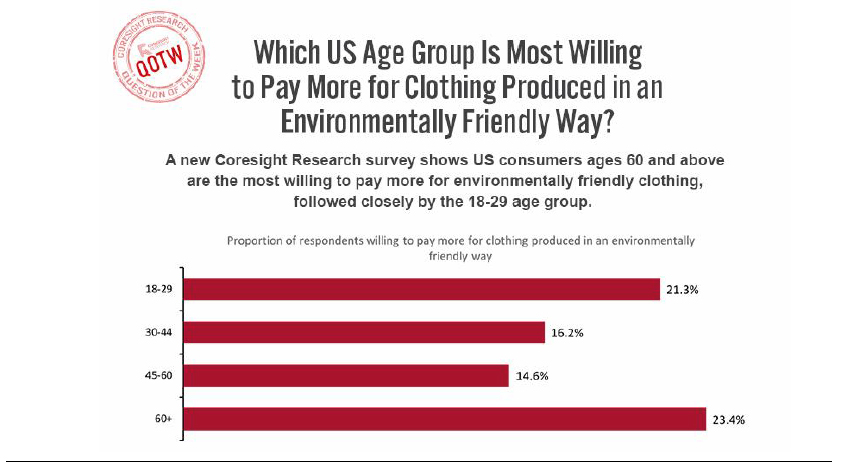

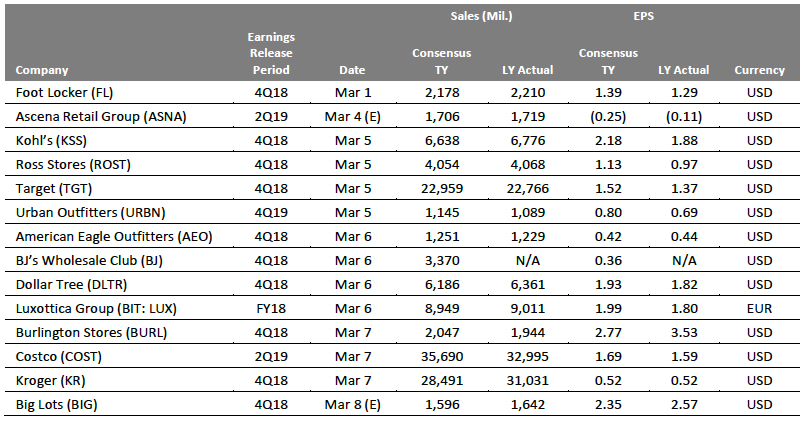

US RETAIL EARNINGS

[caption id="attachment_78507" align="aligncenter" width="824"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

US RETAIL & TECH HEADLINES

![]() The Average Tax Refund Is Down More than $500 This Year

The Average Tax Refund Is Down More than $500 This Year

(Feb. 25) CBSNews.com

- Three weeks into tax season, Americans’ tax refunds are shrinking, with the average tax refund down more than $500 this year. The average refund issued through Feb. 15 was 16% smaller than at the same time last year, according to IRS data.

- Experts caution against reading too much into the IRS figures, which can swing dramatically week to week. About 28 million tax refunds are being delayed until after Feb. 27 due to laws related to the Earned Income Tax Credit.

US Fashion Retailer Swoops into Rental Marketplace

US Fashion Retailer Swoops into Rental Marketplace

(Feb. 25) Ecotextile.com

- American Eagle Outfitters has introduced a subscription service that offers users the chance to order garments from the company’s latest collections before deciding whether to return or keep them.

- Users of the retailer’s “Style Drop” platform pay a flat monthly subscription fee and are not required to wash the clothes they’ve ordered before they return them.

![]() US Private Equity Giant KKR Weighing Bid for Walmart-Owned Asda

US Private Equity Giant KKR Weighing Bid for Walmart-Owned Asda

(Feb. 25) ProactiveInvestors.co.uk

- US private equity giant KKR is mulling a bid for Asda, the Walmart-owned chain whose proposed merger with fellow UK supermarket Sainsbury’s was thrown into doubt last week following a report from the UK’s Competition and Markets Authority. KKR previously struck deals to buy out Toys “R” Us and Alliance Boots.

- According to the Sunday Times, KKR senior advisor Tony De Nunzio, who is the former CEO of Asda, is said to be working on the deal.

HBC to Close Home Outfitters and 20 Saks OFF 5TH Stores

HBC to Close Home Outfitters and 20 Saks OFF 5TH Stores

(Feb. 22) Retail-Insight-Network.com

- Canada-based retailer Hudson’s Bay Company (HBC) is set to close all 37 of its Home Outfitters stores in Canada this year. The retailer is also considering closing up to 20 of its 133 Saks OFF 5TH stores in the US, following a strategic review of the business.

- The decisions are part of HBC’s plan to reduce costs, simplify its business and improve overall profitability. The review of the Saks OFF 5TH stores will allow HBC to focus on the best-performing locations and the banner’s online platform.

Retail Layoffs Are Piling Up

Retail Layoffs Are Piling Up

(Feb. 20) CNN.com

- US employment in the retail sector grew steadily coming out of the Great Recession, reaching an all-time high of 15.9 million workers in January 2017, but after that, growth sagged and then flatlined.

- Today, retail employs about the same number of people as it did two years ago, and liquidations of chain stores such as Payless ShoeSource, Charlotte Russe and Toys “R” Us have put tens of thousands of workers out of their jobs.

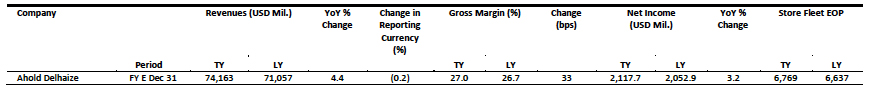

EUROPE RETAIL EARNINGS

[caption id="attachment_78508" align="aligncenter" width="870"] Source: Company reports/Coresight Research[/caption]

Source: Company reports/Coresight Research[/caption]

EUROPE RETAIL & TECH HEADLINES

Aldi Opens New Distribution Center in England, Creating 400 Jobs

Aldi Opens New Distribution Center in England, Creating 400 Jobs

(Feb. 25) RetailGazette.co.uk

- German supermarket retailer Aldi has opened a 645,834-square-foot warehouse in Sheppey, England, that will create 400 new jobs. The warehouse will serve around 60 stores in the southeast area of the country.

- Aldi is the fastest-growing supermarket in the UK, according to research firm Kantar Worldpanel. The retailer plans to open 130 stores in London, Brighton and Deal by 2020.

![]() John Lewis Shortlists Startups for In-Store Innovation Program

John Lewis Shortlists Startups for In-Store Innovation Program

(Feb. 19) RetailGazette.co.uk

- British retailer John Lewis has shortlisted six startups out of 160 for its JLab innovation program, which focuses on transforming the in-store retail experience. The retailer will hold further discussions with the startups and potentially work with them in the future.

- The shortlisted firms are SeloyLive, Oriient, Ruuby, MemoMi, MakersCAFE and LettUs Grow.

Harrods Announces Partnership with Farfetch

Harrods Announces Partnership with Farfetch

(Feb. 26) RetailGazette.co.uk

- British department store Harrods has partnered with Farfetch Black & White Solutions, Farfetch’s e-commerce turnkey offering, to build a new and improved global e-commerce platform.

- Harrods Managing Director Michael Ward said, “Partnering with Farfetch Black & White Solutions allows Harrods to work with the market leader in e-commerce technology to deliver a seamless service online, which will continue to feel instantly and unmistakably Harrods.”

![]() Blossom Capital Raises $85 Million to Invest in European Startups

Blossom Capital Raises $85 Million to Invest in European Startups

(Feb. 26) Tech.eu

- London based venture-capital fund Blossom Capital has raised $85 million to invest in early-stage companies across Europe. Former Index Ventures and LocalGlobe investor Ophelia Brown launched the firm in 2018.

- Blossom Capital will use a data-driven approach to identify early-stage deals in Europe and will focus on startups operating outside the popular tech hubs.

![]() Casino Sells 33 French Supermarkets and One Geant Hypermarket

Casino Sells 33 French Supermarkets and One Geant Hypermarket

(Feb. 18) RetailDetail.eu

- French supermarket group Casino sold 17 of its own stores and 16 franchise stores to German retailer Lidl. Casino also sold one Geant hypermarket to a franchisee of competitor E.Leclerc.

- Casino has been reducing its store fleet for more than a year to reduce debt. The group hopes to sell real estate worth €1.5 billion ($1.7 billion) by the first half of 2019.

Marks & Spencer and Ocado Confirm Joint Venture

Marks & Spencer and Ocado Confirm Joint Venture

(Feb. 27) Company press release

- The UK’s Marks & Spencer (M&S) and Ocado Group announced the creation of a 50/50 joint venture that will see M&S acquire a 50% share of Ocado’s UK retail business for up to £750 million ($997.5 million).

- The new entity will trade as Ocado.com and benefit from access to M&S’s brands, products and customer database. The integration will begin no later than September 2020, following the termination of Ocado’s current sourcing agreement with grocery retailer Waitrose. The deal does not include Ocado’s technology business, which sells services to other retailers such as Kroger in the US and Sobeys in Canada.

ASIA RETAIL & TECH HEADLINES

PhonePe Partners with Walmart India

PhonePe Partners with Walmart India

(Feb. 26) EconomicTimes.IndiaTimes.com

- Walmart India and Flipkart-owned digital payments platform PhonePe have partnered to enable customers at Walmart’s 23 Best Price wholesale cash-and-carry stores to pay via the PhonePe app.

- Best Price customers will be able to use the government-promoted Unified Payment Interface payment option in stores and online for the first time.

JD.com Partners with Rakuten on Drone Delivery in Japan

JD.com Partners with Rakuten on Drone Delivery in Japan

(Feb. 22) Asia.Nikkei.com

- Chinese e-commerce giant JD.com is collaborating with Japan’s Rakuten to develop unstaffed delivery options in Japan. Under the partnership, Rakuten will use JD’s drones and autonomous robots for delivery.

- “We are delighted to begin this collaboration with JD, which boasts the most cutting-edge proprietary delivery network in China as well as a track record and know-how in delivery with drones and UGVs,” said Koji Ando, Group Managing Executive Officer of Rakuten.

![]() Amazon to Provide E-Commerce Training to Small Firms in Vietnam

Amazon to Provide E-Commerce Training to Small Firms in Vietnam

(Feb. 23) E.VNExpress.net

- Amazon is set to help 100 small and medium-sized companies in Vietnam grow their businesses by training them how to better promote their exports and build their brands on the site.

- “Vietnamese businesses are well known for their top production capabilities. When combined with our worldwide resources, it will create conditions for them to develop and build brands in the international market,” said Bernard Tay, Director of Amazon Global Selling in Southeast Asia.

ViSenze Partners with Samsung to Enhance Mobile Shopping Experience

ViSenze Partners with Samsung to Enhance Mobile Shopping Experience

(Feb. 25) InsideRetail.Asia

- Singapore-based artificial intelligence company ViSenze has partnered with Samsung to help consumers discover and purchase products conveniently using the Shopping by Bixby Vision app on Samsung devices.

- The collaboration will enable Samsung smartphone users to leverage ViSenze’s automated visual-commerce technology and personalized visual-search capabilities.

![]() Pinduoduo Plans 3,500 New Hires

Pinduoduo Plans 3,500 New Hires

(Feb. 24) Xinhuanet.com

- Chinese online social commerce platform Pinduoduo expects to create 3,500 jobs in 2019 as it seeks to build its infrastructure and strengthen its technological innovation capabilities.

- The company reported order growth of 158% on its mobile app in 2018. The new positions will primarily consist of marketing specialists, agricultural and antipoverty experts, data analysts, technical engineers, operational staff and other specialists.

LATAM RETAIL & TECH HEADLINES

Merqueo Raises $14 Million in Latest Funding Round

Merqueo Raises $14 Million in Latest Funding Round

(Feb. 21) LatamList.com

- Colombian online supermarket Merqueo has raised $14 million in its latest funding round, led by Portland Private Equity and supported by Endeavor Catalyst, the co-investment fund of Endeavor.

- “This new capital injection will allow us to keep growing and revolutionizing the sector. Our goal is to always offer the best service at the best price. This is just the beginning of what we are building here,” said Merqueo CEO Miguel McAllister.

![]() Mercado Libre to Invest $300 Million to Expand in Mexico

Mercado Libre to Invest $300 Million to Expand in Mexico

(Feb. 21) Modaes.com

- Argentinean e-commerce giant Mercado Libre plans to invest $300 million this year to expand its business in Mexico, one of its fastest-growing markets.

- As part of the expansion, the company intends to launch a new distribution center in Mexico State and hire approximately 1,000 employees, according to Mexican newspaper El Universal.

Soriana Reports Worst Results in 10 Years

Soriana Reports Worst Results in 10 Years

(Feb. 25) America-Retail.com

- Mexican supermarket chain Soriana reported a revenue decline of 0.1% in 2018, its worst performance in 10 years. Annual revenue totaled 153.5 billion pesos ($8 billion), while operating cash flow declined 12%, to 10.9 billion pesos ($57 million), and net profit fell 21%, to 3.6 billion pesos ($1.9 million).

- The company said an operational efficiency program that led to 11 store closures affected annual results.

![]() Falabella Shuts Flagship Store in Buenos Aires

Falabella Shuts Flagship Store in Buenos Aires

(Feb. 22) Df.cl

- Chilean department store chain Falabella has closed its iconic megastore on Florida Street in Buenos Aires, Argentina. In 2018, the company indicated it was unlikely to renew its lease for the store.

- The closure leaves Falabella with 10 stores in Argentina. The company also operates the Sodimac chain of home improvement stores in the country.

![]() Nike to Open Third Kicks Lounge Store in Peru

Nike to Open Third Kicks Lounge Store in Peru

(Feb. 25) America-Retail.com

- American sports retailer Nike announced it will open its third Kicks Lounge concept store in Peru, at Lima’s Plaza Norte shopping center.

- The new store opening is part of Nike’s growth strategy in Peru, where “sneaker culture” has caught on. The company’s other two Kicks Lounge stores in the country are located at the Real Plaza Salaverry and Jockey Plaza shopping centers in Lima.

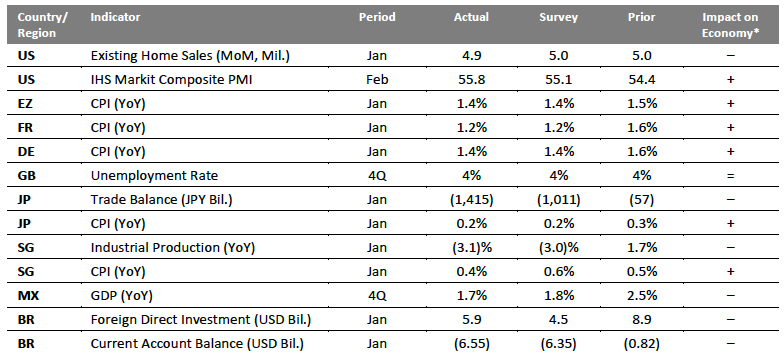

MACRO UPDATE

Key points from global macro indicators released Feb. 20–26, 2019: 1) US: In January, existing home sales dropped to their lowest level since November 2015, falling 1.2% to a seasonally adjusted 4.9 million units, below the consensus estimate of 5.0 million. The IHS Markit Composite Purchasing Managers’ Index (PMI) rose from 54.4 in January to an eight-month high of 55.8 in February, ahead of the consensus estimate of 55.1. 2) Europe: The eurozone Consumer Price Index (CPI) increased 1.4% year over year in January, in line with the consensus estimate but below December’s 1.5% growth. In France, the CPI rose 1.2% year over year in January, in line with the consensus estimate but marking the lowest growth rate since March 2018. 3) Asia Pacific: In Japan, the trade deficit widened to ¥1.42 trillion in January, exceeding both the consensus estimate of a ¥1.01 trillion deficit and the ¥57 billion deficit reported in December. In Singapore, industrial production fell 3.1% year over year in January, down from 1.7% growth in December and below the consensus estimate of a 3.0% decline. 4) Latin America: Mexico’s GDP grew 1.7% year over year in the fourth quarter, versus the consensus estimate of 1.8%. In Brazil, net foreign direct investment totaled $5.9 billion in January, ahead of the consensus estimate of $4.5 billion but down from $8.9 billion in December. [caption id="attachment_78509" align="aligncenter" width="784"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impactSource: National Association of Realtors (US)/IHS Markit/Eurostat/National Institute of Statistics and Economic Studies (France)/Federal Statistical Office (Germany)/Office for National Statistics (UK)/Ministry of Finance (Japan)/Statistics Bureau (Japan)/Singapore Department of Statistics/National Institute of Statistics and Geography (Mexico)/Central Bank of Brazil/Coresight Research[/caption]

EARNINGS CALENDAR

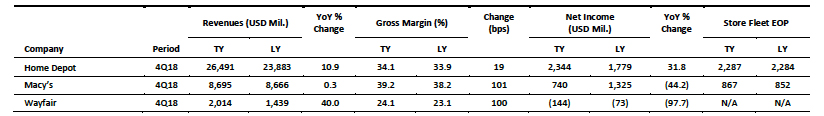

EVENT CALENDAR