From the Desk of Deborah Weinswig

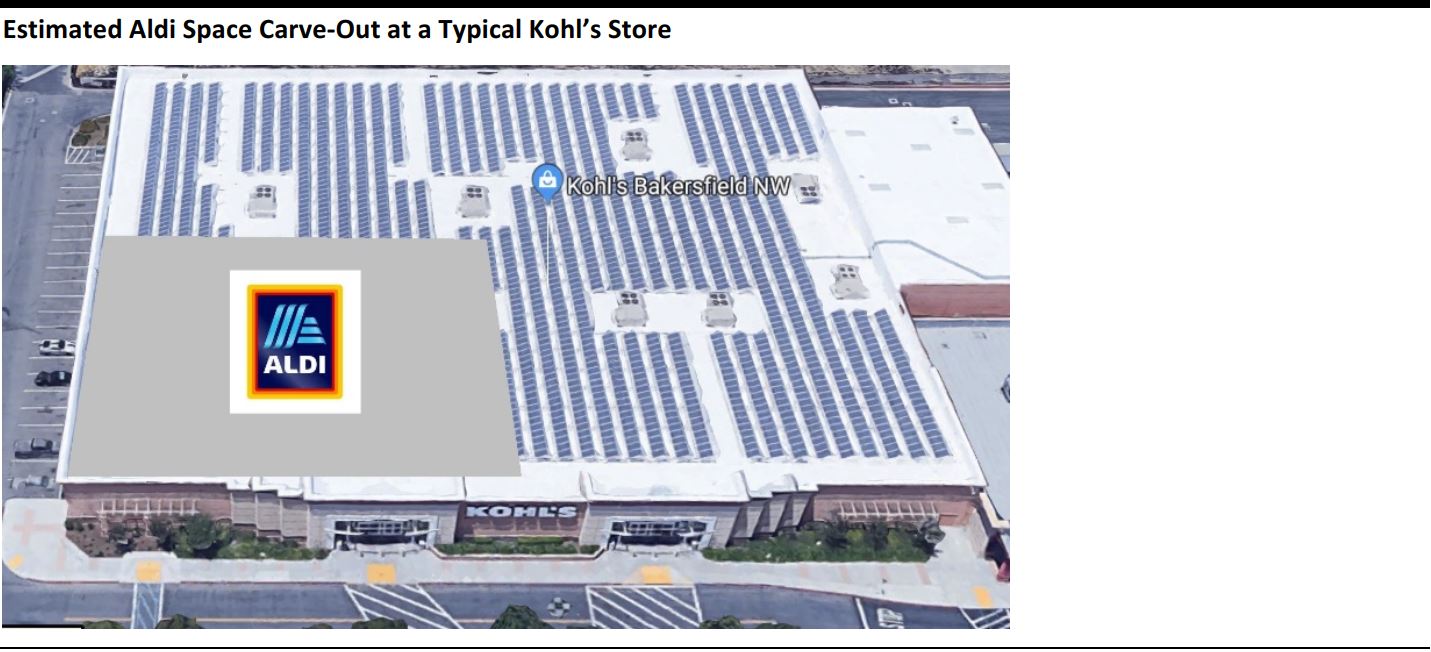

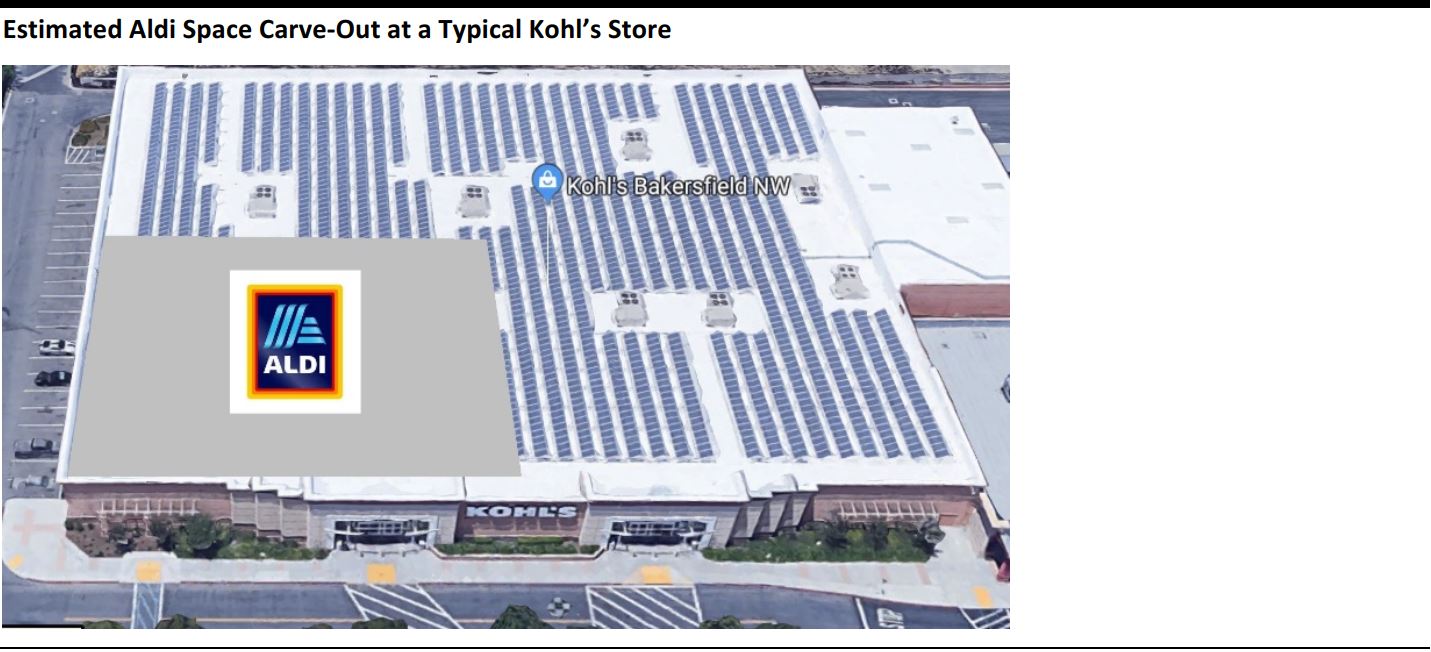

Last week, Kohl’s announced that it would be slimming down 12 of its stores and that, as part of a pilot program, 5–10 of those stores will carve out space for separate, adjoining stores that will be leased to grocery discounter Aldi. Kohl’s CEO Kevin Mansell said on the company’s fourth-quarter conference call that Aldi would be the company’s initial partner as Kohl’s downsizes stores through carve-outs, but that it could lease excess space to other grocery retailers or to service providers such as fitness centers in the future. Mansell identified such outlets as “traffic drivers” that Kohl’s knows it “can coexist together [with] for a long time.”

Kohl’s stands apart from peers such as Macy’s and JCPenney in that it has not closed any stores. But its announcement that it is seeking to rightsize selected stores is another indication that department store retailers are increasingly recognizing that they are overspaced.

Kohl’s is a predominantly off-mall department store retailer and its locations in open-air centers are fundamentally square boxes. The company’s core estate of larger stores (which are the kind we expect to see downsized) average 88,000 gross square feet.

Aldi’s stores are smaller square boxes. According to two recent Aldi US real estate brochures, the company looks for stores that are 17,000–22,000 gross square feet in size. If we split the difference and assume that Aldi will take an average of 20,000 square feet of space from each of the Kohl’s stores involved in the pilot program, then the implication is that Aldi will take approximately 23% of space from each of the downsized Kohl’s stores.

Source: Google Street View/company reports/Coresight Research

Aldi aims to operate 2,500 US stores by the end of 2022, up from a current 1,755 (per Aldi’s online store locator). We believe that Aldi opened approximately 150 US stores in 2017, and we estimate that it will open 200 more in 2018. The expansion of retailers such as Aldi, Lidl, dollar stores and off-price chains is underpinning strong demand at open-air shopping centers, which we noted in our January 2018 report

What Retail Apocalypse? Reviewing Trends in US Brick-and-Mortar Retail.

By carving out space for Aldi stores, Kohl’s is giving Aldi access to such open-air centers, including those where high occupancy levels mean that there are no existing retail units available for Aldi to move into. Kohl’s operates 1,158 stores in 49 US states, providing a potentially wide network of locations for Aldi to tap—although, of course, availability depends on which stores Kohl’s is willing to downsize.

This looks to be a win-win for Kohl’s and Aldi. For Kohl’s, it provides a complementary, traffic-driving tenant ready to take space as it downsizes a swathe of stores. For Aldi, it provides more potential locations in a real estate market that sees high occupancy rates at in-demand open-air centers.

Lastly, this move is the latest manifestation of fresh thinking from Kohl’s. Late last year, some Kohl’s stores began selling Amazon technology devices, such as the Echo, and accepting returns on behalf of Amazon. In a still-faltering department store sector, the company’s creative approaches to product, services and real estate are to be welcomed.

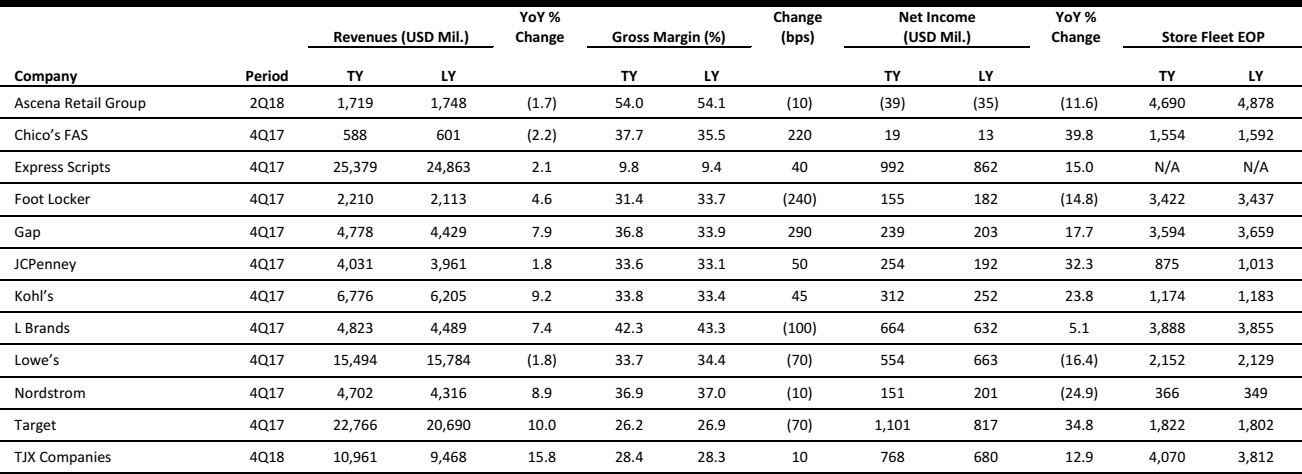

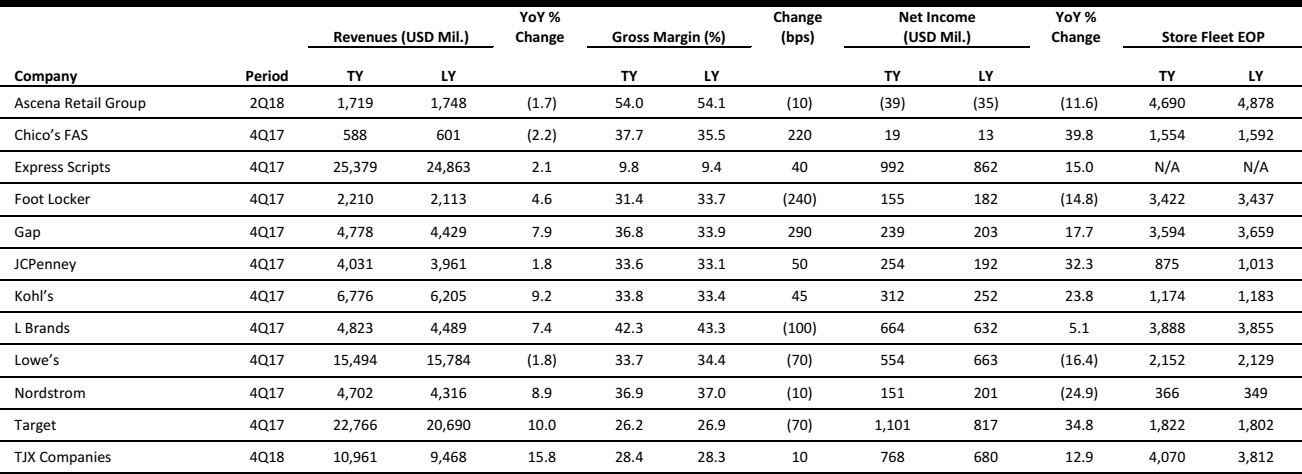

US RETAIL EARNINGS

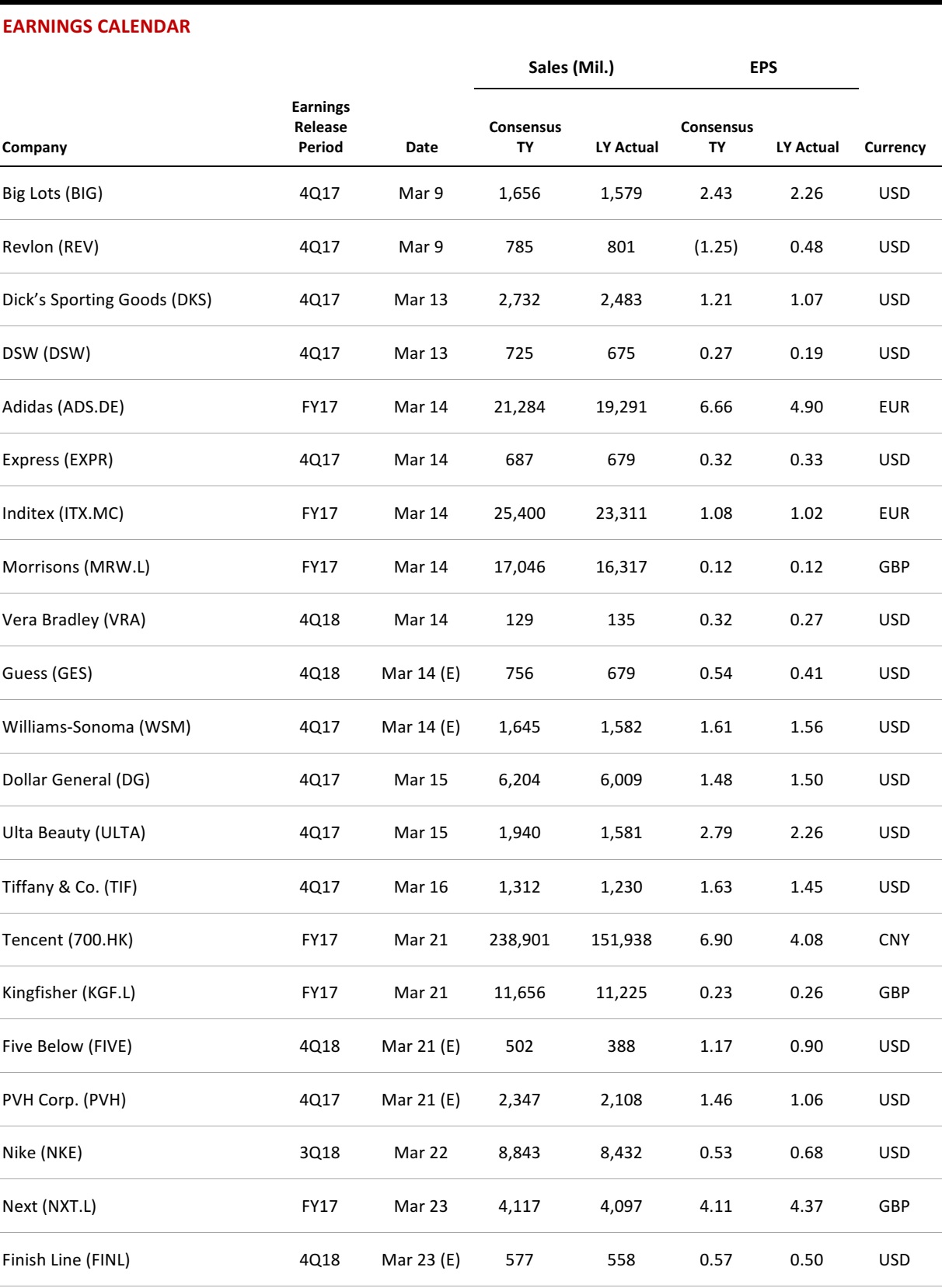

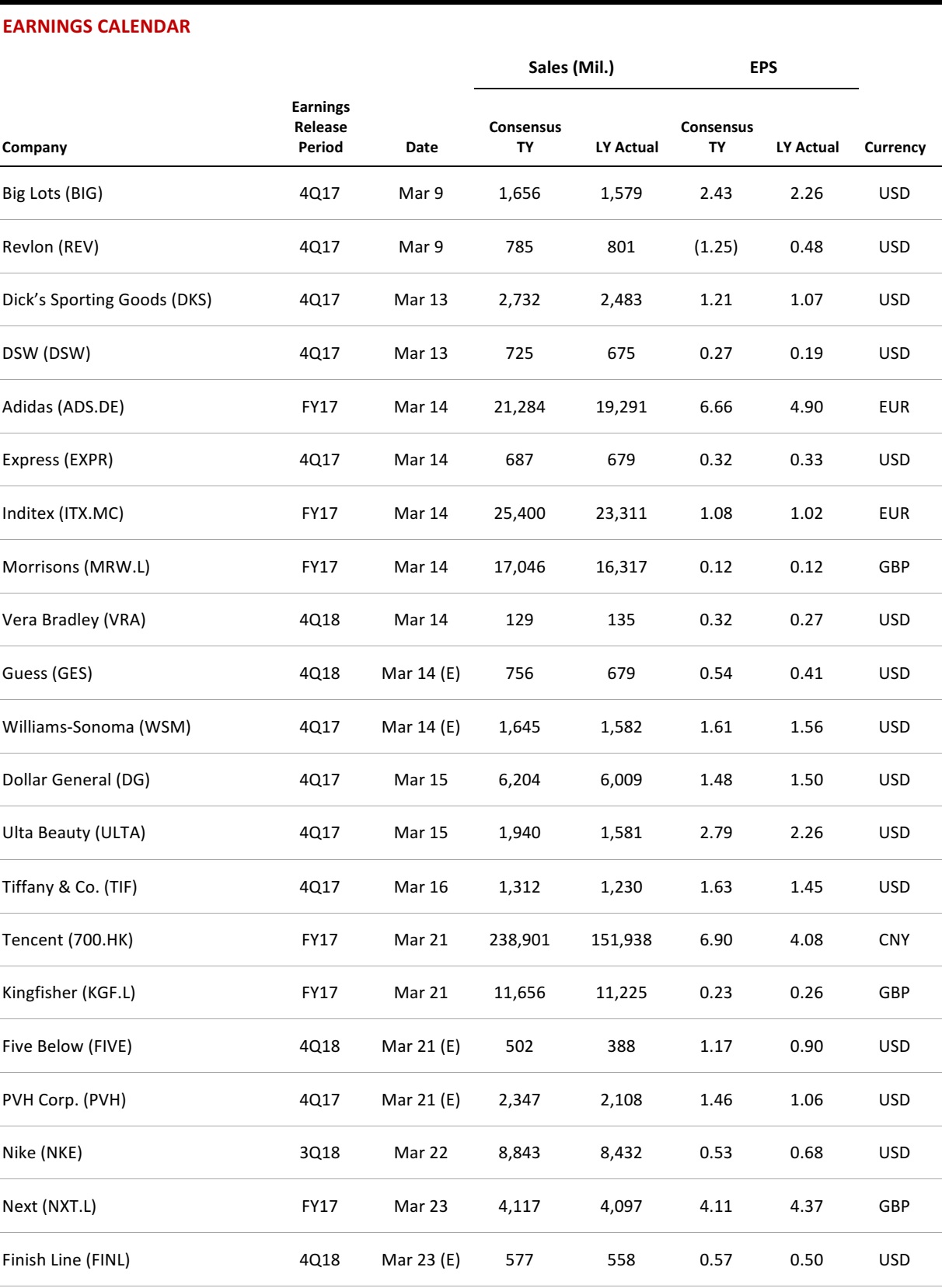

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Target Hikes Base Wage to $12 an Hour, One-Upping Walmart Despite Earnings Squeeze

(March 6) Investors.com

Target Hikes Base Wage to $12 an Hour, One-Upping Walmart Despite Earnings Squeeze

(March 6) Investors.com

- Target said it will raise its minimum wage for current associates to $12 an hour this spring, after hiking its base wage to $11 in October, trumping Walmart once again even as the brick-and-mortar discount giants both missed on earnings in their most recent quarters and gave weak guidance.

- On Tuesday, CEO Brian Cornell also reiterated Target’s commitment to raise its minimum wage all the way to $15 an hour by the end of 2020, which “establishes Target as an employer of choice.”

Toys“R”Us and Why the Retail Downturn Is All About Debt

(March 6) Marketplace.org

Toys“R”Us and Why the Retail Downturn Is All About Debt

(March 6) Marketplace.org

- In 2004, after years of flat sales and falling profits, the Toys“R”Us board of directors put the company up for sale. In 2005, the board sold the company for $6.6 billion to private equity firms Bain Capital and KKR and real estate investment firm Vornado. The firms put up about 20% of the total and borrowed the rest.

- As of last summer, sales at Toys“R”Us had fallen for five years. Word got out that the company might go bankrupt, and toymakers panicked, with some demanding to be paid up front in cash. The retailer didn’t have it. And that’s what drove the company to file for Chapter 11 bankruptcy in September.

Retail’s Big Opportunity: 87% of US Consumers Grasp the Power of Conversational Commerce

(March 6) RetailTouchPoints.com

Retail’s Big Opportunity: 87% of US Consumers Grasp the Power of Conversational Commerce

(March 6) RetailTouchPoints.com

- Natural language–powered chatbots and voice assistants such as Alexa and Siri are gaining traction for many retail-related tasks: 66% of US consumers use voice or text agents in their daily lives, and 21% use voice or text agents to shop, pay bills, bank online or send money, according to a report from Mastercard and Mercator Advisory Group.

- This figure is likely to go higher, since consumer awareness of conversational commerce is climbing: 87% of shoppers are aware of these technologies and are beginning to grasp their benefits, the report says.

Walmart, Nike Suppliers Put on Notice by China Tariff Threat

(March 6) Bloomberg.com

Walmart, Nike Suppliers Put on Notice by China Tariff Threat

(March 6) Bloomberg.com

- Some of China’s biggest manufacturers that supply US multinationals from Walmart to Nike find themselves in President Donald Trump’s crosshairs as his administration discusses new import tariffs. The US is considering taxing imports from shoes and clothing to consumer electronics.

- The American Apparel & Footwear Association said that some 98% of shoes and 97% of clothing sold in the US are imported. Most of that manufacturing comes from China.

Nordstrom Rejects Family’s Takeover Offer and Threatens to End Talks

(March 6) BizJournals.com

Nordstrom Rejects Family’s Takeover Offer and Threatens to End Talks

(March 6) BizJournals.com

- The Nordstrom family made an opening offer to take publicly traded Nordstrom private, but it was not enough, according to a committee representing the board. Nordstrom had recently resumed plans to take the company private. Last week, it came out that the Nordstrom family may be finalizing those plans.

- The Seattle-based retailer said Monday that it was notified by the Nordstrom family that a group of family members intended to submit a proposal to purchase all of the outstanding shares of common stock not already owned by the group, and about 21% of the shares owned by the Nordstrom family members in the group, for $50 per share in cash.

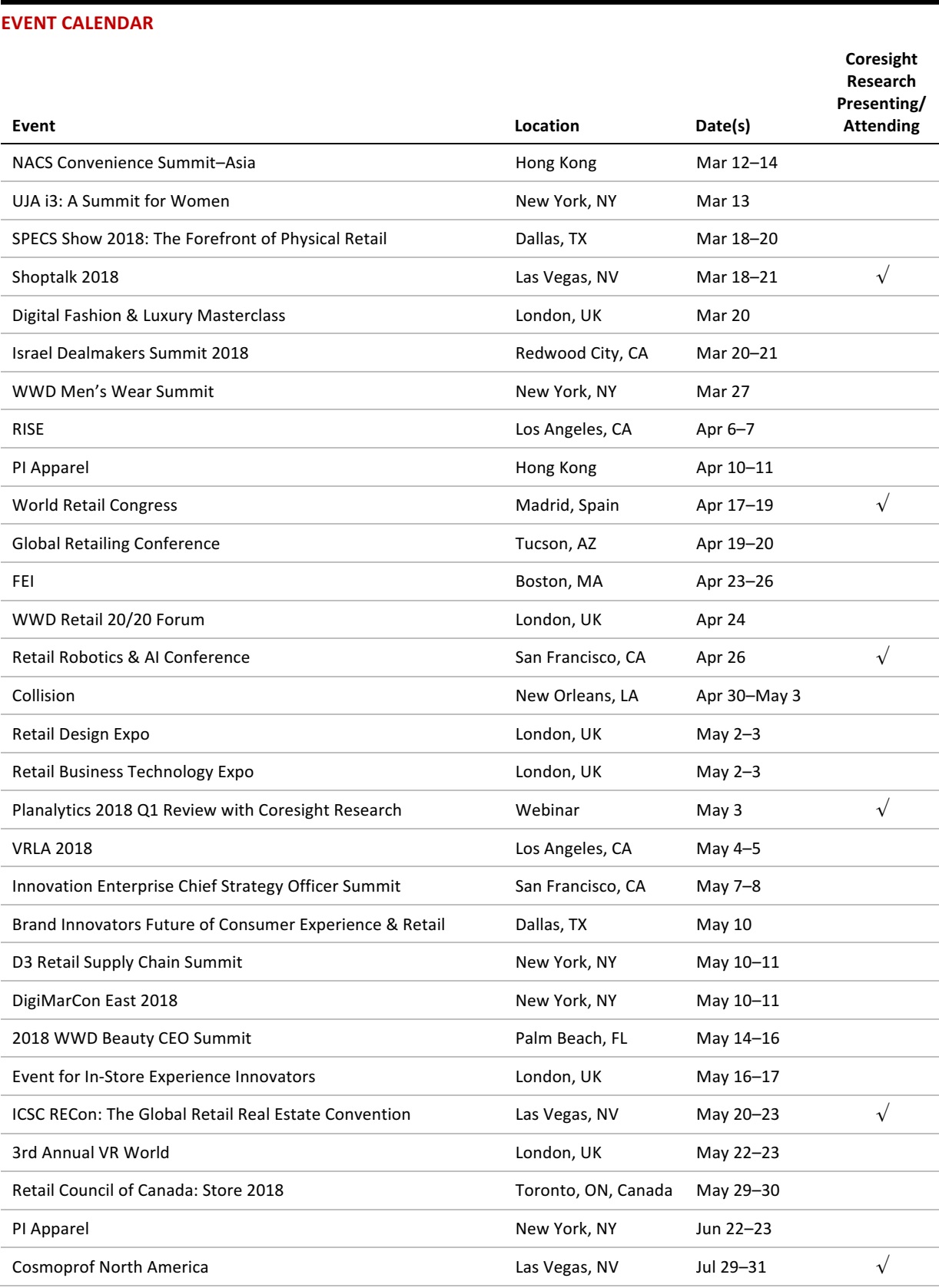

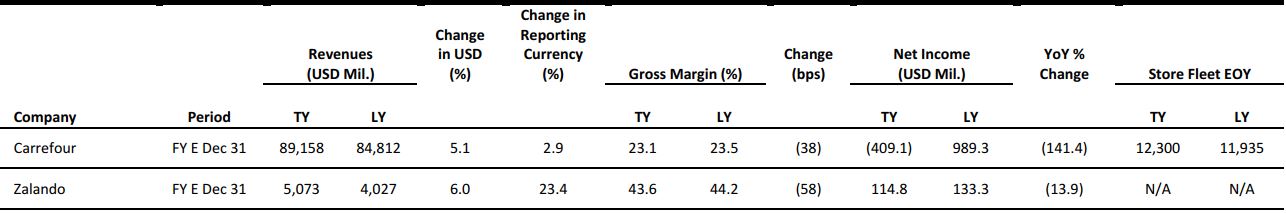

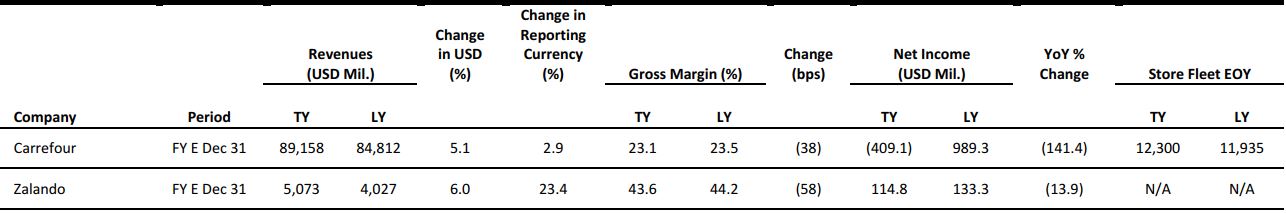

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

UK Retail Sales Growth Accelerates in February

(March 6) BRC press release

UK Retail Sales Growth Accelerates in February

(March 6) BRC press release

- In February, UK total retail sales grew by 1.6%, a rate that was slightly higher than January’s, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales grew by 0.6%, in line with the rise in January. The growth was against undemanding comparatives: in February 2017, total sales rose by 0.4% and comparable sales fell by 0.4%.

- The BRC splits food and nonfood retail sales only on a rolling three-month basis. In the three months ended February, food sales grew by 2.8% on a comparable basis and by 4.0% on a total basis, level with the 12-month total average of 3.9% and the highest rate seen since October 2012. Nonfood retail sales fell by 1.1% on a comparable basis and by 0.5% on a total basis, below the 12-month total average of 0.0%.

Sports Direct Raises Stake in Debenhams

(March 2) Reuters.com

Sports Direct Raises Stake in Debenhams

(March 2) Reuters.com

- British sportswear chain Sports Direct has raised its stake in department store retailer Debenhams from 23% to 29.7% in the hope of extending its relationship with the company into “a strategic partnership.”

- Liam Rowley, Head of Strategic Investments at Sports Direct, said that both firms could achieve synergies by combining their e-commerce operations and also explore opportunities to work together in international markets.

Eataly to Open First UK Store in 2020

(March 5) ESMMagazine.com

Eataly to Open First UK Store in 2020

(March 5) ESMMagazine.com

- Eataly, an Italian food emporium, is set to open its first UK store in 2020, in London. The store will be located at 135 Bishopsgate, near Spitalfields and Shoreditch, and will span 42,000 square feet across two floors of the building.

- The new store will feature a restaurant and bar, on-site production facilities and a cookery school as well as a wide range of Italian products for sale. Eataly operates in Italy and has stores in 11 cities in other countries.

El Corte Inglés Introduces Alipay in its Stores

(March 5) ESMMagazine.com

El Corte Inglés Introduces Alipay in its Stores

(March 5) ESMMagazine.com

- Spanish retailer El Corte Inglés announced this week that it will introduce the Alipay payment system across its stores in Europe. This should particularly benefit the more than 150,000 Chinese shoppers who visit El Corte Inglés stores annually.

- Spain’s second-largest bank, BBVA, has developed technology to help El Corte Inglés process payments made through Alipay. The bank became Alipay’s partner in June 2017 to help local Spanish retailers integrate the payment platform into their offerings.

Bring! Raises $2.5 Million in Series A Funding

(February 28) Tech.eu

Bring! Raises $2.5 Million in Series A Funding

(February 28) Tech.eu

- Swiss shopping assistant app Bring! has raised $2.5 million in its series A funding round led by Swisscom Ventures, which is telecom firm Swisscom’s investment arm, Swiss Founders Fund and several angel investors. The app allows users to share shopping lists with other people in their households.

- Bring! intends to add a shopping feature to the app soon and further develop its artificial intelligence functions. It is currently available to users in Switzerland and Germany and will use the fresh funds to grow across Europe.

ASIA RETAIL & TECH HEADLINES

Top China Tech Firms Heed Beijing’s Call to Bring Listings Home

(March 5) Bloomberg.com

Top China Tech Firms Heed Beijing’s Call to Bring Listings Home

(March 5) Bloomberg.com

- China’s biggest overseas-traded technology companies, from search giant Baidu to Sogou, are investigating ways to float shares on Chinese exchanges as Beijing encourages its largest corporations to bring their listings home.

- Chinese enterprises have long pursued the prestige and capital associated with marquee overseas debuts. But technology businesses from Alibaba to Tencent have in recent years outstripped their old-economy peers to become the nation’s largest, and virtually none are traded domestically. Market regulators are now pushing the industry to package Chinese Depositary Receipts for local investors.

Alibaba Rival JD.com Posts First Annual Profit as a Public Company

(March 2) TechCrunch.com

Alibaba Rival JD.com Posts First Annual Profit as a Public Company

(March 2) TechCrunch.com

- com, the nearest e-commerce competitor to Alibaba in China, has reported its first year of profitability as a public company. For its fiscal 2017 year, JD.com posted a slim, ¥116.8 million ($18.0 million) profit on total revenue of ¥362.3 billion ($55.7 billion), which was a 40.3% increase over 2016’s revenue.

- The company’s fiscal profit was helped by a surprise, $35 million profit in the first quarter and a lucrative third quarter in which it posted a ¥1 billion ($151 million) profit thanks to its own efforts on Singles’ Day, China’s online shopping holiday. The company posted a ¥909.2 million ($139.7 million) loss for the fourth quarter, but that marked a 28% decrease year over year.

Tech Firms Question Hong Kong’s Plan to Lure Next Alibaba

(March 5) Bloomberg.com

Tech Firms Question Hong Kong’s Plan to Lure Next Alibaba

(March 5) Bloomberg.com

- Technology companies and service providers are questioning key parts of Hong Kong’s plan to allow dual-class shares just as firms including Xiaomi and Tencent Music Entertainment Group are considering going public.

- Hong Kong Exchanges (HKEX) wants to change its rules so that company founders can stay in control after their firms list, but the proposals may cause trouble for China’s tech titans, which use an unusual type of corporate structure that restricts foreign ownership of their firms. Representatives for the companies are lobbying for HKEX and the Securities and Futures Commission of Hong Kong to clear up the issue.

Tencent Music, Spotify’s Strategic Partner in China, Is Valued at More than $12 Billion

(February 28) TechCrunch.com

Tencent Music, Spotify’s Strategic Partner in China, Is Valued at More than $12 Billion

(February 28) TechCrunch.com

- Swedish music company Spotify has finally filed to go public and, in doing so, has shed light on another huge music company that has been tipped for IPO—Tencent Music Entertainment—which is now valued at more than $12 billion. Tencent and Spotify announced a share swap in December that saw each side take an undisclosed slice of the other for strategic purposes going forward.

- According to Spotify’s filing, it took 9% of Tencent Music Entertainment, which it valued at €910 million ($1.12 billion) at the time. That translates to a total valuation of €10.11 billion ($12.3 billion), although Spotify includes 10% leeway above and below that figure. In exchange, Tencent got 7.5% of Spotify, becoming one of its largest shareholders.

LATAM RETAIL & TECH HEADLINES

Tech M&A Continues to Rise in Brazil

(March 1) ZDNet.com

Tech M&A Continues to Rise in Brazil

(March 1) ZDNet.com

- In terms of January M&A activity in Brazil, the IT sector was the busiest, according to a report by PwC Brazil. Some 11 transactions involving IT businesses took place during the month, up 83% from a year earlier. The sector represented 23% of all transactions registered during the month.

- The second-busiest sector in terms of M&A transactions was financial services, followed by food production, with four transactions. Overall, however, there was a decrease in the number of M&A deals in Brazil in January, with 47 deals done during the month compared with 54 in the same month the year before. In geographic terms, the state of São Paulo saw 60% of the deal activity, with 28 M&A transactions in January.

Microsoft Brazil Changes Billing Currency to Reais

(March 1) ZDNet.com

Microsoft Brazil Changes Billing Currency to Reais

(March 1) ZDNet.com

- In an effort to make clients’ software spending more predictable, Microsoft Brazil will now bill new channel contracts and renewals for products in Brazilian reais rather than US dollars. “We are an ecosystem business and partners are critical in our strategy to be a smart cloud services company focused on the digital transformation of our customers,” said Felipe Podolano, Microsoft Brazil’s channels and sales director for small and medium-sized businesses.

- “The new billing policy in reais reflects the importance of Microsoft Brazil to the corporation and we believe it will contribute to the evolution of our business in the country, allowing us to broaden the adoption and use of commercial software and cloud services,” Podolano added. About 80% of Microsoft’s portfolio is available for purchase in reais and that option will be extended progressively to other offerings such as the Cloud Solution Provider program.

Amazon Prepares to Hire for Web Services Office in Argentina

(March 5) TheStar.com

Amazon Prepares to Hire for Web Services Office in Argentina

(March 5) TheStar.com

- Amazon’s data services division is recruiting for several positions in Argentina, signaling the online retailer is expanding its presence in Latin America beyond Mexico and Brazil. The Seattle-based company is advertising for eight full-time positions for its Amazon Web Services (AWS) cloud-computing business. The job postings on the company website include a senior consultant on migration, sales account managers and a technical trainer.

- “Would you like to be part of a team focused on increasing adoption of Amazon Web Services by developing accounts in Argentina?” the postings read. The company also tweeted a tango picture on its Latin America AWS account with the caption “When we care about something, we dance to celebrate! #AWSArgentina,” which links to a page with the postings and a mention of a local office.

Mexico’s Femsa Sees Profits Down 70% on Venezuela Hit

(March 5) Reuters.com

Mexico’s Femsa Sees Profits Down 70% on Venezuela Hit

(March 5) Reuters.com

- Mexican bottler and retailer Femsa said on Tuesday that its net profit fell more than 70% in the fourth quarter, hit by the revaluation of assets in its Venezuelan Coca-Cola bottling Revenues rose by more than 11%, to MXN 122.5 billion (~$6.52 billion) from nearly MXN 110 billion (~$5.85 billion) in the last quarter of 2016.

- Femsa controls Coca-Cola Femsa, the world’s largest Coke bottler, which reported a $1.2 billion net loss in the fourth quarter and was hampered by a change in the reporting of its results in Venezuela. Higher fuel costs in Mexico, higher labor costs and depreciation in Central America also took a toll on Coca-Cola Femsa’s results.

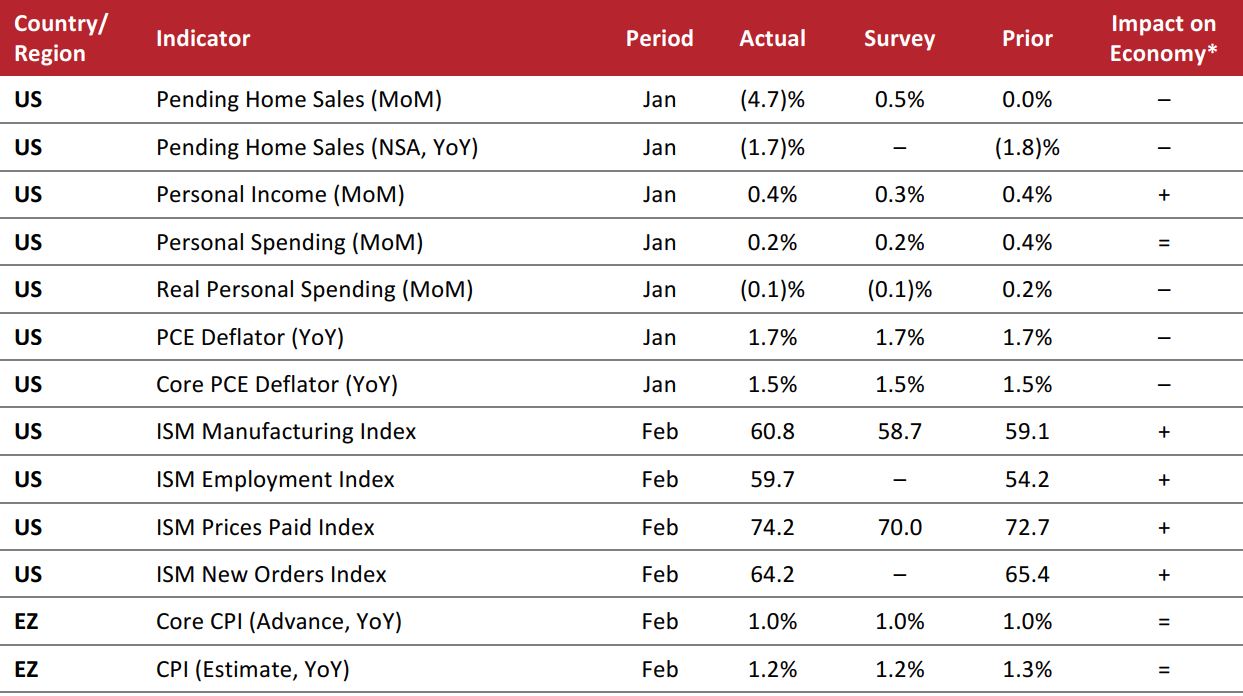

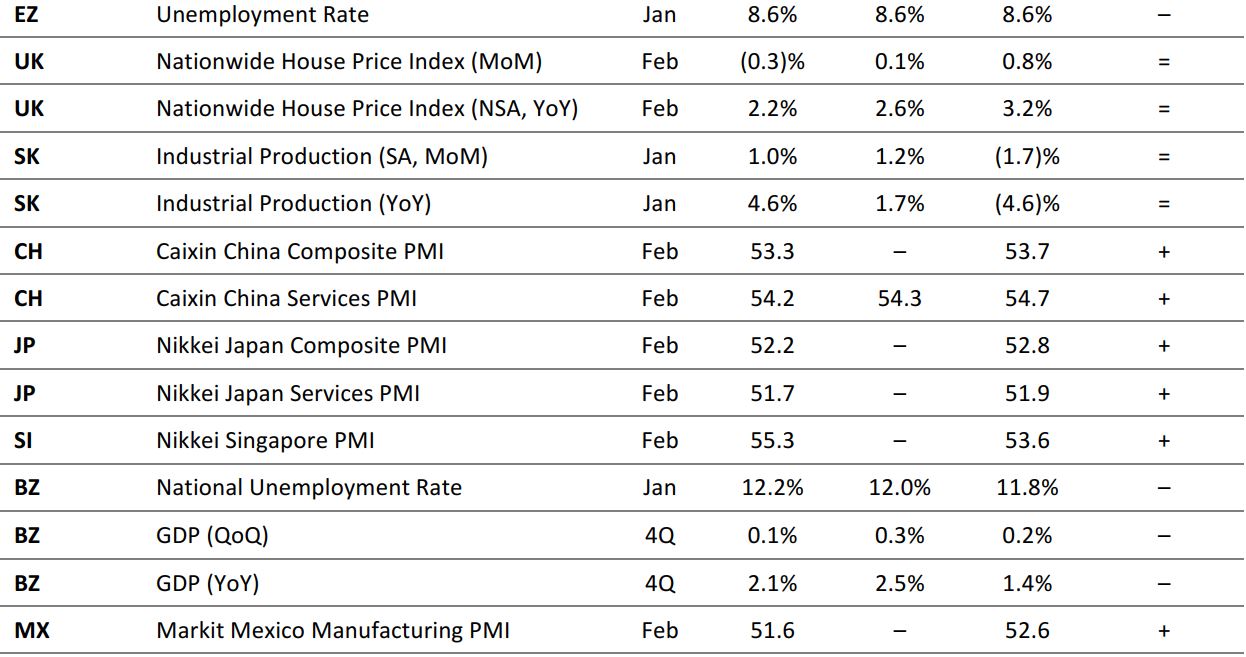

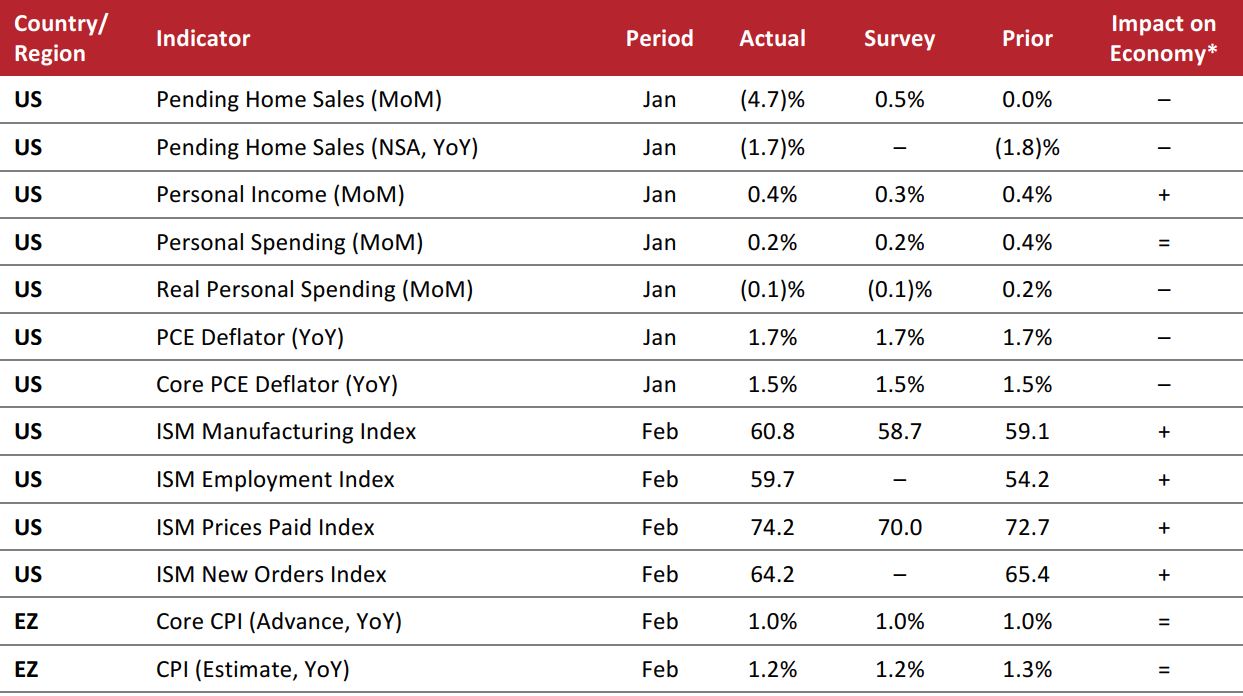

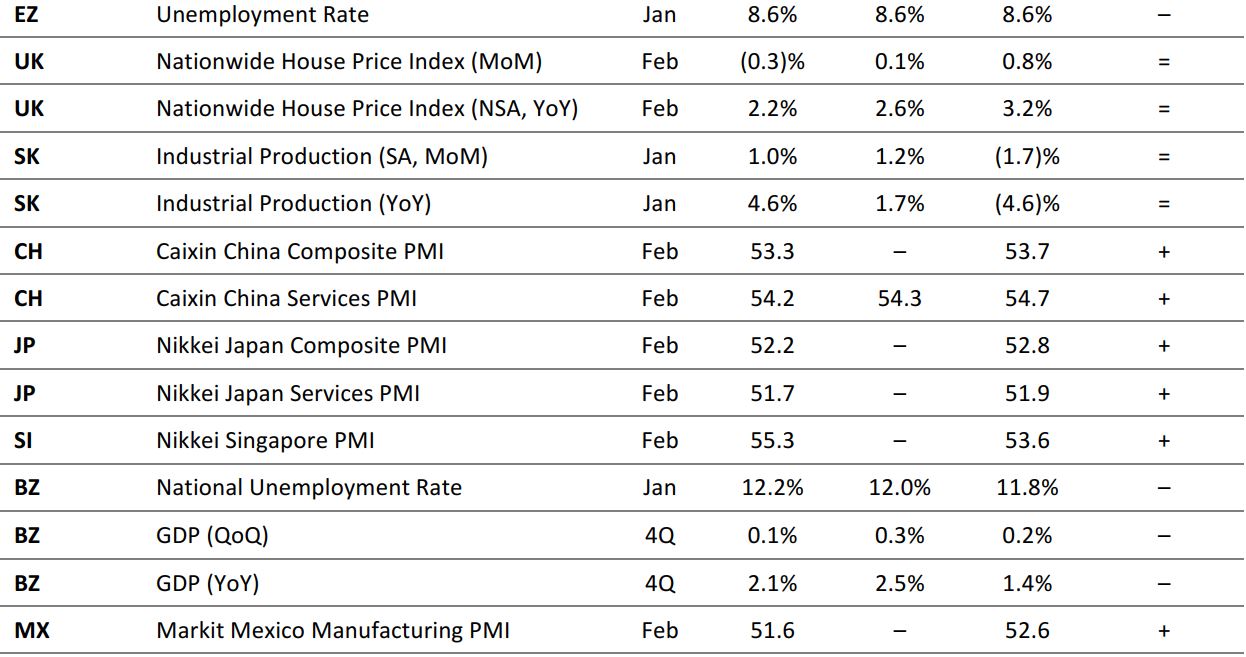

MACRO UPDATE

Key points from global macro indicators released February 28–March 7, 2018:

- US: Pending home sales dropped by 4.7% month over month in January and by 1.7% year over year. Real personal spending edged down by 0.1% month over month in January. The core Personal Consumption Expenditure (PCE) deflator increased by 1.5% year over year in January.

- Europe: In the eurozone, the core Consumer Price Index (CPI) increased by 1.0% year over year in February, in line with the consensus estimate. The unemployment rate in the eurozone stayed at 8.6% in January. In the UK, house prices decreased in February, falling by 0.3% month over month versus the market’s estimate of a 0.1% increase.

- Asia-Pacific: In South Korea, industrial production increased by 1.0% month over month in January, versus the consensus estimate of 1.2%. In China, Japan and Singapore, Purchasing Managers’ Indexes (PMIs) stayed above the expansion threshold in February.

- Latin America: In Brazil, the unemployment rate increased to 12.2% in January. Brazil’s GDP increased by 2.1% year over year in the fourth quarter, below the 2.5% consensus estimate. In Mexico, the Markit Manufacturing PMI stayed above the expansion threshold in February.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: National Association of Realtors/US Bureau of Economic Analysis/Institute for Supply Management (ISM)/Eurostat/Nationwide Building Society/Statistics Korea/Markit/Instituto Brasileiro de Geografia e Estatística/Coresight Research