Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

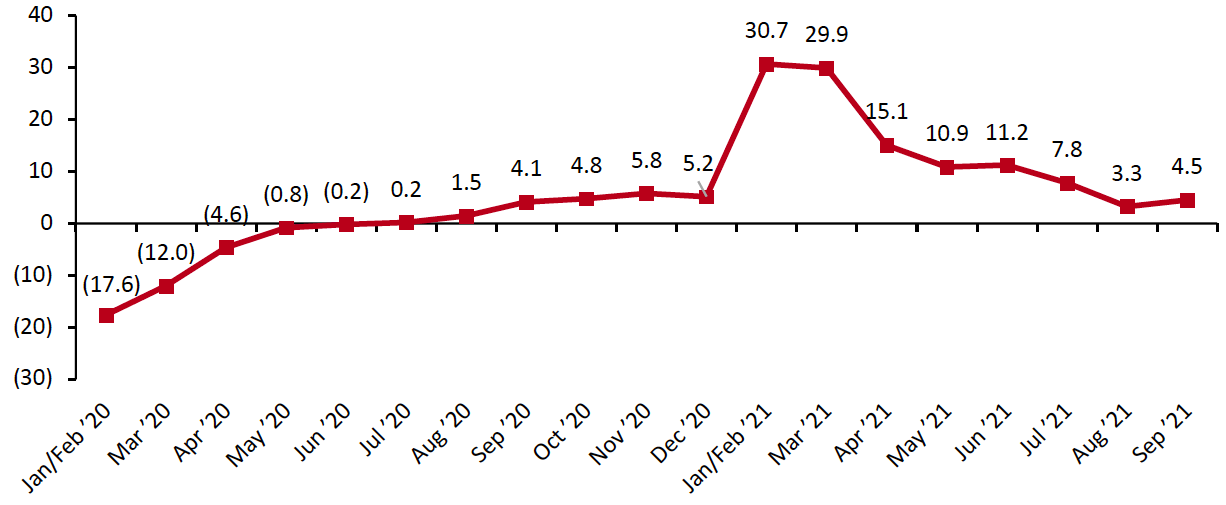

Luxury and Beauty Fuel Singles’ Day Sales as China’s Consumers Repatriate Spending This year’s extended Singles’ Day event has begun—although the eponymous 11.11 event peak will be on Thursday next week. We look at the apparently strong demand for luxury goods including high-end beauty at the shopping festival. First, we note the mixed context for 11.11 this year. China Retail Growth Has Halved Singles’ Day 2021 follows an unusually weak period for China’s retail sector. Early in the year, annual growth was very strong as the sector lapped the declines of early 2020. However, after that recovery, year-over-year growth has moderated to the low single digits. This compares to growth falling in the range of 7.0%–9.9% in each of the 12 months before the pandemic. As shown in Figure 1, post-pandemic growth has recently settled at half the prepandemic rate.Figure 1. Total China Retail Sales (ex. Food Service; incl. Automobiles and Gasoline): YoY % Change [caption id="attachment_135478" align="aligncenter" width="700"]

January and February figures are reported together

January and February figures are reported togetherSource: National Bureau of Statistics/Coresight Research[/caption] We believe that the weak run continued into October, based on data for Golden Week, which ran October 1–7. Holiday-season tourism spending, which includes retail and food-service spending, during Golden Week 2021 declined by 4.7% year over year on a comparable basis—that came on top of deep declines last year, resulting in a two-year aggregate slump of 34.1%, according to China’s Ministry of Culture and Tourism. This was largely as a result of Covid-19 travel restrictions and a negative wealth effect, amid government actions to curb house price inflation. However, one positive effect of that Golden Week decline is the likelihood of pent-up demand, added spending power and the repatriation of some retail demand—in theory, consumers should be willing and able to spend this Singles’ Day. Repatriation of Spend Boosts Luxury and Beauty The shift of some purchasing from overseas to within China is reflected in the noises we are hearing from the country’s two biggest e-commerce platform companies—Alibaba and JD.com. At Alibaba’s 11.11 Global Shopping Festival virtual press conference on October 27, 2021, General Manager at Tmall Anita Lyu confirmed that many Chinese consumers that turned to cross-border e-commerce platforms since the beginning of the pandemic have stuck to this new behavior, stating that “An average of 400 global brands have joined Tmall Global each month. There has been a shift in demand from well-known brands to more niche brands that offer innovative products.” Luxury goods and high-end beauty specifically are categories that are very often purchased overseas by Chinese consumers and we have seen the major platforms report strong demand as they have sought to cater to domestic demand. Luxury Alibaba’s Tmall Luxury Division expects this year’s event to be its biggest 11.11 campaign yet: More than 200 luxury and designer brands are participating, including Hèrmes and Saint Laurent for the first time. Reflecting the repatriation of luxury demand, the head of Tmall’s luxury division Janet Wang noted that watches, handbags and jewelry had seen “marked” growth during the pre-sale period in late October. JD.com has pointed to a surge in both imported and domestic product sales. In the first 10 minutes of Singles’ Day, JD Worldwide Import Supermarket saw sales reach 39 times that of those in the same period last year. Like Alibaba, JD.com has seen strong luxury demand: sales volumes for luxury shoes and leather goods brand Tod’s in the first minute of the event were greater than that of the entire day last year. In anticipation of strong demand, JD said that it has doubled down on new fashion items across the flagship stores of over 300 luxury brands. Both of the major platform companies recognize that tangibility and physical retail experiences are more important in luxury than in traditional e-commerce categories, and both are seeking to serve that demand. Tmall Luxury Pavilion has launched a series of online-to-offline events, such as pop-up stores and a digital art gallery, in partnership with luxury brands. Moreover, JD is serving demand for real-world luxury through its “omnichannel selling system”: Its partnership with Prada and Miu Miu has featured in six cities, including Beijing, Shanghai and Shenzhen. Beauty On JD.com, early sales volumes for 50 high-end beauty brands including Estée Lauder, Helena Rubinstein, Clinique and Guerlain were up by more than 100% versus last year. Anticipating strong demand for globally sourced beauty brands, Alibaba has worked with Cainiao Network to launch a “dedicated perfume flight route” and create special packaging that addresses safety concerns associated with transporting fragrances to China via air. Alibaba has reported increased consumer interest in eco-friendly, organic, niche and innovative products—and we expect this to be felt in the shape of beauty demand, such as for clean beauty products and emerging brands—we saw clean, organic and all-natural beauty brands win the 11.11 Go Global Pitch Fest, for example. Post-Singles’ Day Prospects Global travel is likely to pick up further in 2022, boosting the overseas market for luxury and beauty products. However, the online channel looks set to retain its appeal, permanently shifting some demand from travel-based to domestic e-commerce. Lifted by this shift, we expect luxury sales within China to grow solidly in the coming years and for China to overtake the US as the largest market for luxury goods by 2025.

US RETAIL AND TECH HEADLINES

NIKE Files To Trademark “Virtual Goods” (November 2) BlockWorks.com- NIKE has announced plans to trademark its virtual goods in the US, for use in computer programs, online games and online virtual worlds. The company has filed seven requests with the US Patent and Trademark Office.

- The filed requests include its “Swoosh” and “Air Jordan” logos for use on virtual bags, clothing, equipment, footwear and headwear, among others. NIKE stated that it is looking for material designers who can visualize new material concepts and play a key role in redefining its digital world.

- Ralph Lauren has reported a revenue increase of 26% year over year for its second quarter (ended September 25, 2021), driven by double-digit growth across all of its regions. The company reported net income of $193.3 million, after a loss of $39.1 million in the same period last year.

- Ralph Lauren expects fiscal 2022 revenues to increase by 34%–36% year over year and to record an operating margin of 12%–12.5%. It also expects to resume its share repurchase program, beginning in the second half of the fiscal year.

- Marketplace delivery platform Uber Eats has introduced a new “baby and kids hub” category on its app, offering delivery of baby, kids and family essentials. The company has partnered with national retail chain buybuyBaby and popular baby brands including The Honest Company, Lalo, Little Spoon and Yumi to offer a catalog of essential baby and home products.

- Uber Eats stated that diapers, first-aid kits, organic baby food, placemats, thermometers and wipes would be available in the hub. To search, customers can open the app and select the “Baby” category or search using the baby emoji.

- Under Armour has reported comparable revenue growth of 8% year over year and net income growth of 191% for its third quarter, ended September 30, 2021. The company attributed the increase to heightened consumer demand for athletic apparel and sneakers.

- The company revised its full-year 2021 outlook to 25% revenue growth, increasing from the earlier expectation of a low-twenties increase. The company expects operating income to reach $425 million, compared to the previously forecasted figure of $215 million.

- Wayfair has launched an immersive video commerce platform named Wayfair On Air, introducing video content to help online shoppers find products. Wayfair On Air is available on the Wayfair app and will feature several new episodes per day.

- Wayfair stated that it plans to build upon the feature, expanding its cast of creators to deliver richer content to engage and inspire customers. Current creators include celebrity chef Danny Boome, family blogger Amiyrah Martin and shopping expert Albany Irvin.

EUROPE RETAIL AND TECH HEADLINES

Asda Announces Multiple Initiatives to Support Shoppers with Hidden Disabilities (November 2) Company press release- British supermarket chain Asda has announced the introduction of several initiatives to support shoppers with hidden disabilities, including promoting a “quieter hour” Monday through Thursday at 2 p.m. each week. The company has also provided additional training for 85,000 employees to help serve disabled customers.

- Asda will also sponsor Purple Tuesday 365, an annual learning subscription service designed to assist organizations and its employees to offer better experiences for people with special needs. Additionally, the company is in the process of updating its online store locator to improve accessibility information in toilets and changing rooms, as well as including braille and hearing loops.

- Depop, a peer-to-peer social e-commerce company based in London, has been certified as climate-neutral for the first time by leading climate solutions provider South Pole, as it successfully offsets all material sources of greenhouse gas emissions.

- Depop has offset greenhouse gas emissions from shipping since January 2020. It has since expanded to cover the remainder, including emissions from its cloud services, IT equipment, offices and utilities, as well as employees’ travel and work-from-home activities.

- Netherlands-based retailer Jumbo has introduced a new home delivery hub in Zwolle to serve its customers in Flevoland, Overijssel and other nearby provinces.

- The company stated that the new delivery hub will address the rising demand for online grocery shopping. It also announced plans to open more central home-delivery locations to enable quick and efficient grocery delivery.

- UK-based apparel retailer Next reported an increase of 17.0% in full-price sales in its third quarter (ended October 30) compared to the corresponding quarter in 2019.

- Next recorded 40.0% growth in its online sales on a two-year basis and a 49.5% rise year to date compared to 2019. The company stated that it will maintain its fourth-quarter full-price sales guidance at 10% and its full-year profit before tax at £800 million ($1.1 billion).

- Zalando’s gross merchandise volume (GMV) during its third quarter (ended September 30, 2021) increased by 25.3% year over year to reach €3.1 billion ($3.6 billion). Revenue climbed by 23.4% year over year. However, the company recorded an adjusted EBIT of €9.8 million ($11.3 million) compared to €118.2 million ($137.0 million) in the same quarter last year and reported a net loss of €8.4 million ($9.4 million), a significant decrease from its net profit of €58.5 million ($67.8 million) last year.

- The company stated that it has continued to advance its strategic agenda in the quarter, including expanding its active customer base and establishing deeper customer relationships in order to transform into a sustainable fashion and lifestyle platform.

ASIA RETAIL AND TECH HEADLINES

Grab Announces Partnership with Lazada To Offer On-Demand Same-Day Delivery Services (November 2) Company press release- Super-app company Grab has partnered with South Asia-based e-commerce platform Lazada, enabling Lazada’s sellers to offer same-day delivery services in Singapore via GrabExpress.

- Over 50 Lazada sellers will offer instant delivery services using GrabExpress, with plans to onboard more sellers. The partnership will also offer increased earning opportunities for GrabExpress delivery partners.

- South Korea-based online grocery delivery platform Market Kurly has announced plans to launch a local initial public offering (IPO) in the first half of 2022. The company is yet to disclose the date for the IPO.

- Market Kurly stated that it plans to use the proceeds from the forthcoming IPO to improve its infrastructure improvement and hire more staff.

- NIKE’s contracted factories in Vietnam, which manufacture its footwear and sportswear, have resumed operations after months of suspension caused by a sudden rise in Covid-19 cases in May 2021.

- The company contracts more than 200 factories in Vietnam, with approximately half of NIKE’s footwear produced in the country.

- India-based beauty, fashion and wellness omnichannel retailer Nykaa’s IPO listing valued at ₹53,520 million ($717.8 million) has closed with share oversubscription of 82.4 times. The company saw very strong subscriptions from high-net-worth investors and financial institutions.

- Institutional stock saw oversubscription 92 times, stock for retail was oversubscribed 12 times and the portion reserved for employees almost two times, according to Bombay Stock Exchange (BSE) data.

- India-based Tata group’s retail arm Trent Limited has reported a consolidated net profit of ₹800 million ($10.7 million) in its second quarter, ended September 2021). The company reported a net loss of ₹785.6 million ($10.5 million) in the comparable quarter last year.

- Trent Limited’s revenue from operations recorded a two-fold jump to ₹11,780.8 million ($157.8 million) from ₹5,853.7 million ($78.4 million) last year. Trent Chairman Noel N. Tata stated the company continues its expansion through digital platforms and stores, as well as by building differentiated brands.