albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Introducing Retail Tech Retail technology goes as far back as the invention of the abacus in 300-500 BC. The next breakthrough happened in 1883 with the invention of the cash register. The retail-tech environment remained fairly static for about a century until IBM launched the PC in 1980, sparking the PC revolution, followed about 15 years later by the Internet revolution. Then the iPhone arrived in 2007, launching the smartphone era. Technology timelines are compressing, and the magnitude of each successive wave is expanding exponentially. It took about a decade for consumers to become comfortable with online shopping, but consumers adopted mobile commerce much more rapidly. Soon, 5G wireless technology will dramatically transform commerce, business and our lives. Retailers spent $91.8 billion on technology and store improvements in 2017, according to the latest data from the US Census Bureau. Despite the impressive magnitude of this figure, retail spends a relatively low percentage of revenues on capital improvements, with figures in the low single digits – compared to 4.63% for all US companies, according to data from NYU Professor of Finance Aswath Damodaran. Within this low capital improvement ratio, less than 40% goes to technology, with the remaining 60+% going to stores and store improvements, according to retailers offering this breakdown. Our Coresight RetailTech 20 list includes giants in the space, with nearly $1 billion in annual revenues, nearly $4 trillion in market capitalization and serving end-markets totaling at least $440 billion. We have divided the 20 companies into six segments – with the caveat that many big companies serve multiple segments: (1) Artificial intelligence (AI)/analytics; (2) Cloud; (3) Connectivity; (4) E-commerce; (5) In-store; and, (6) Software. Among those segments, analytics and AI offer great promise to solve the challenges faced in retail and other sectors. The two terms are often used interchangeably, though analytics is a product and AI is a technology. Analytics can employ AI, but AI has many other applications such as machine learning and computer vision, which do not employ analytics. Both can be used to better understand the customer to make relevant and personalized product selections and offers, as well as to remain competitive in a data-centric world. Most major global technology companies are jumping on the AI bandwagon, by developing chips or software tools. While IBM (through its Watson software as a service) and Nvidia (through high-performance graphics processors originally for gaming that have been repurposed for AI) have received a great deal of attention, most major providers of cloud-based computing services, such as Amazon, Microsoft and Alibaba, also offer AI platforms. Moreover, most tech giants, including software companies such as Baidu, Facebook and Google, have assembled teams of engineers to design their own AI chipsets. 5G wireless and the Internet of Things (IoT) may change business and our lives the same way the advent of the Internet revolutionized the world. 5G features include the ability to connect a large number of people and objects to the Internet at very high speeds, and these devices will be able to talk to one other, offering value from the network effect of the connected nodes. Consumers will be able to gather even more utility and enjoyment from being able to shop everywhere, at any time with rich multimedia content. The pace of the development of retail technology has accelerated following the advent of electronic and mobile commerce, and analytics and AI offer further capabilities to enrich and empower consumer’s shopping experience. Global tech giants are also key players in retail tech, in AI/analytics, cloud, connectivity, e-commerce, in-store and software, and many of them are engaged in multiple segments. Get more information from our report Introduction to Retail Tech.

US RETAIL & TECH HEADLINES

- Costco is leading competitors when it comes to combating in-store theft, reporting that its shrinkage rate was just 0.11-0.12% of sales, compared to the 1.33% average retailers lost in 2017.

- Costco said it mitigates theft through store layout, limited entrances and exits and its membership model, which helps the store control inventory. The retailer also attributes its low shrink to the wages it pays employees.

- Amazon said its one-day Prime delivery program is now available on more than 10 million products across the continental US. Amazon noted that when it launched two-day delivery in 2005, it offered only one million items, meaning its one-day program is already 10 times bigger.

- The e-commerce giant in April announced plans to upgrade Amazon Prime from two-day shipping to just one day.

- After less than six months of regular Saturday deliveries, FedEx ended speculation about when it would deliver on Sunday in most of the US by announcing it would become the first of the big three parcel delivery services to regularly deliver to residences seven days a week starting in January.

- FedEx Ground typically shifts to six- or seven-day operations during the peak season: The shift to seven days will be permanent.

- Walmart Canada has debuted a new checkout system called "fast lane" that lets customers avoid cashiers and registers. The fast lane is designed for users of the company's mobile app My Walmart.

- The fast lane could be built into future stores. The system has debuted in a newly opened store in Toronto that Walmart said would serve as a prototype for future store renovations.

- Home improvement retailer Lowe’s has acquired the retail analytics platform of e-commerce software company Boomerang Commerce. Lowe’s will integrate the platform’s technology into its retail business as it looks to digitize its approach to pricing and merchandising.

- Following the transaction, Boomerang’s Commerce IQ service will operate as an independent business under the CommerceIQ.ai brand.

EUROPE RETAIL & TECH HEADLINES

- UK retail sales dropped 2.7% year over year in May, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales decreased 3.0%. The BRC noted that decline is against a strong comparative of 4.1% total sales growth in May 2018, which was encouraged by sunny weather and the royal wedding of Prince Harry and Meghan Markle.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended May, total food sales grew 1.9% and total nonfood sales fell 1.1%.

- Amazon is bringing nearly 100 small online merchants to the high street with a series of pop-up shops across the UK in a year-long pilot program.

- The project will see Amazon open 10 stores. The first shop, at St. Mary’s Gate in central Manchester, opened on June 3. Further stores will be in Wales, Scotland, the Midlands, Yorkshire and the Southeast.

- Dutch hypermarket Spar has launched an online store in Hungary. The site offers home delivery to Budapest and 49 neighboring municipalities.

- Customers can request deliveries from Monday to Saturday in two-hour time slots. Spar offers free delivery for orders over €76 ($86) and orders below that amount are charged €1.50 to €3 ($1.7 to $3.4) delivery fee. Customers can also collect orders through a drive-in service at Interspar hypermarkets.

OTB Acquires Stake in Amiri

(June 3) Businessoffashion.com

OTB Acquires Stake in Amiri

(June 3) Businessoffashion.com

- Italian fashion group Only the Brave (OTB) has acquired a minority stake in California luxury fashion label Amiri, founded by Mike Amiri, for an undisclosed sum.

- In April, OTB announced an investment of €200 million ($225 million) over the next three years in a wider plan to power growth, including through M&A.

- Sir Philip Green, Chairman of Arcadia Group, has disclosed plans to invest £135 million ($171 million) over the next three years to rescue the struggling group, according to an email sent to its 18,000 employees.

- Around £75 million ($95 million) will be used to refurbish stores and the remaining £60 million ($76 million) will be spent on improving online operations.

- Luxembourg-based online fashion retailer Global Fashion Group plans to raise €300 million ($338 million) in an initial public offering (IPO) on Germany’s Frankfurt Stock Exchange later this year.

- Global Fashion Group hopes the fresh funds will increase its value and help it build out its presence in emerging markets.

ASIA RETAIL AND TECH HEADLINES

- New York’s Museum of Modern Art plans to open its largest store in Asia at the K11 Musea mall in Hong Kong in August.

- The 6,000-square-foot store will display work from up and coming and established artists such as Kaws and Yayoi Kusama. Products go through a selection process to be deemed fit for display at the store.

- Alibaba is participating in the 6.18 Shopping Festival, originally started by rival JD.com in 2010 and running for 18 days from June 1. Alibaba tailored this year’s festival to help over 200,000 brands tap into China’s smaller cities and rural areas, the company said.

- Alibaba will launch 1.5 million new products and manufacturers will release 100,000 promotional products during the festival “to give less-developed markets easier access to reasonably priced, high-quality goods,” according to the company. Alibaba will also launch “Daily Deals” which allow factories to sell directly to customers.

- Japanese cosmetics brand SK-II has partnered with Korea travel retailer The Shilla Duty-Free to launch a high-tech store, called Future X Smart Store, in Singapore’s Changi airport. The store uses the latest digital technology with in-store elements to create a convenient and comfortable shopping experience.

- The store features a Discovery Bar for customers to learn about products, a Smart Product Scan that uses image recognition technology to locate products and Skincare GPS that helps shoppers quickly learn about products and locate items in the store.

Alibaba Cloud, WeWork and SoftBank Telecom Form Partnership to Support Business Expansion in China

(June 3) dqindia.com

Alibaba Cloud, WeWork and SoftBank Telecom Form Partnership to Support Business Expansion in China

(June 3) dqindia.com

- Alibaba Cloud has announced a partnership with American coworking space company WeWork and SoftBank Telecom to form a one-stop platform to help businesses enter the China market.

- Alibaba Cloud will offer cloud and data intelligence technology, IT infrastructure and enterprise software, while WeWork will offer coworking spaces and organize networking events, while SoftBank Telecom will offer IT consulting services.

JD.com to Invest $500 Million in Aihuishou

(June 3) pandaily.com

JD.com to Invest $500 Million in Aihuishou

(June 3) pandaily.com

- JD.com will merge its second-hand e-commerce service Paipai with second-hand goods recycling and selling platform Aihuishou in a bid to standardize the electronics recycling process and expand its focus to other secondhand product categories such as books and home appliances.

- JD.com will invest more than $500 million in Aihuishou, which will bring the valuation of Aihuishou to over $2.5 billion. After the merger, JD.com will be the new entity’s largest shareholder.

- Australian fashion retailer Cotton On has started selling in India through online shopping site Myntra. AVS Global Network, a retailer for global fashion brands, has secured the contract to sell Cotton On products in India.

- Cotton On also plans to open a physical store either in Delhi or Mumbai by the end of 2020.The Cotton On Group has eight brands, of which only its garments brand Cotton On and footwear and accessories brand Ruby are available in India. The rest will be launched in the coming months.

- Malaysian retailer Aeon Malaysia will invest about 500 million ringgit ($119 million) on new malls and renovations this year.

- Aeon Malaysia plans to open a new mall in Nilai, Negeri Sembilan, renovate its Aeon Taman Maluri mall in Kuala Lumpur and upgrade selected Aeon Daiso and Aeon Wellness stores.

LATIN AMERICA RETAIL AND TECH HEADLINES

- Chilean department store Ripley has posted turnover of 390.8 billion pesos ($600.4 million) in the first quarter of 2019, up 4.9% year over year.

- Net profit declined 32.6% year over year to 6.8 billion pesos ($10.4 million). Ripley’s e-commerce business posted a revenue increase of 43.5%.

- Italian luxury fashion brand Dolce & Gabbana has expanded its operations in Mexico by opening new offices and a showroom in the Terret Polanco Corporate business center in Mexico City.

- Dolce & Gabbana has stores in Cancun and Mexico City, and has opened several stores in the last three years.

- Louis Vuitton has launched an exhibition in Mexico City called Louis Vuitton Time Capsule. The exhibition is set up in the Palacio de Hierro de Polanco, one of the largest department stores in Latin America.

- The exhibition showcases the history of Louis Vuitton and the craftsmanship of its bags. It will be open from May 29 to June 23.

Covergirl Enters Peru with Three Store Openings

(June 3) America-retail.com

Covergirl Enters Peru with Three Store Openings

(June 3) America-retail.com

- American cosmetics brand Covergirl has landed in Peru with three stores opened in partnership with local fragrance retailer Perfumerias Unidas. Covergirl will sell its products at concessions in the Chilean department store Ripley.

- The three locations are in Miraflores, Salaverry and La Rambla. The shops offer a variety of makeup products in a space of about 30 square feet each.

- Home Depot Mexico has announced an investment of 2.0 billion pesos ($99 million) to fund new openings, expansion and store refurbishment, and to boost its online store.

- Home Depot opened its 15th store in Mexico in Nezahualcóyotl on June 3, investing 198 million pesos ($10 million). The new store is approximately 19,685 square feet and offers nearly 25,000 products.

MACRO UPDATE

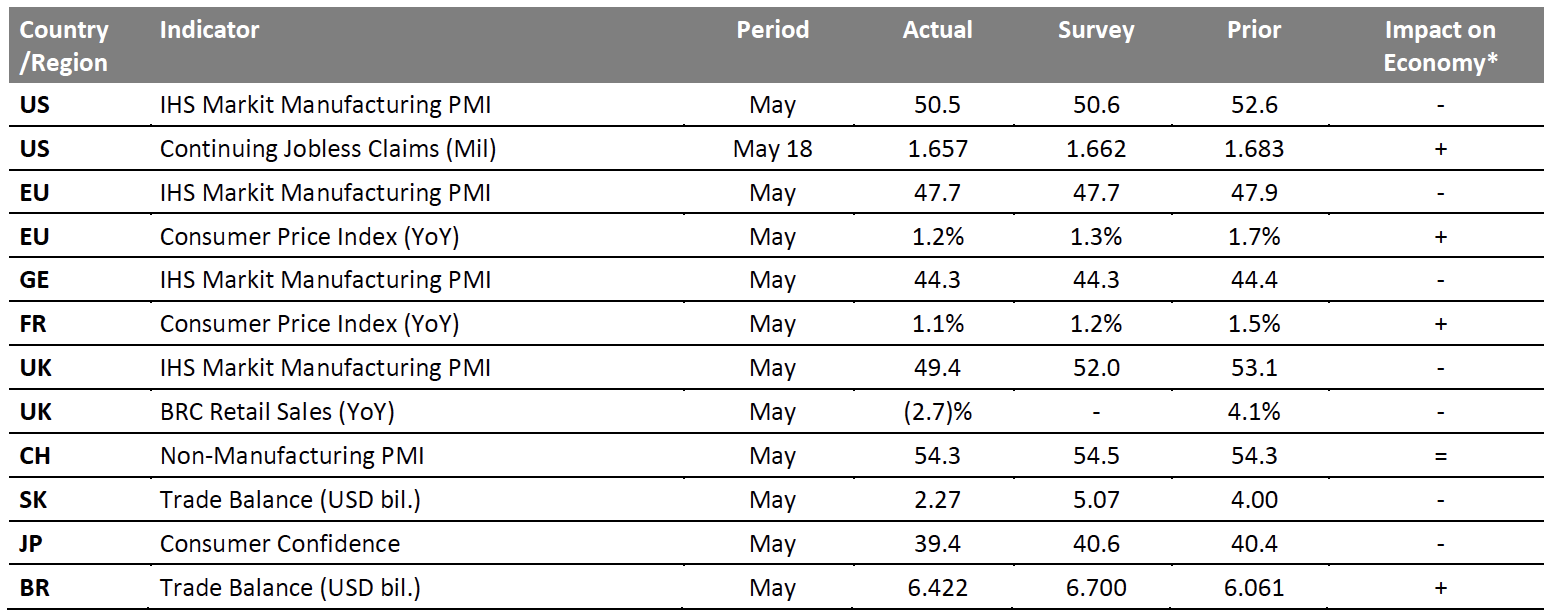

Key points from global macro indicators released May 29-June 4, 2019: US: The IHS Markit manufacturing PMI decreased to 50.5 in May from 52.6 in April, the lowest level since September 2009 and below the consensus estimate of 50.6. Continuing jobless claims in the US decreased to 1.657 million in the week ended May 17 from 1.683 million in the previous week. Europe: In the eurozone, the IHS Markit manufacturing PMI decreased to 47.7 in May from 47.9 in April. In the UK, BRC-recorded retail sales were (2.7)% year over year in May, versus 4.1% in April. Asia Pacific: Korea recorded a trade surplus of $2.27 billion in May, versus the $4.0 billion surplus in April. In Japan, consumer confidence fell to 39.4 in May from 40.4 in April and was below the consensus estimate of 40.6. Latin America: Brazil recorded a trade surplus of $6.422 billion in May, versus the $6.061 billion surplus recorded in April. [caption id="attachment_90001" align="aligncenter" width="700"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: Markit Economics/US Department of Labor/ /Eurostat/INSEE, France/China Federation of Logistics and Purchasing (CFLP)/Korean Customs Service/Cabinet Office, Japan/Ministerio de Comercio, Brazil/Coresight Research[/caption]

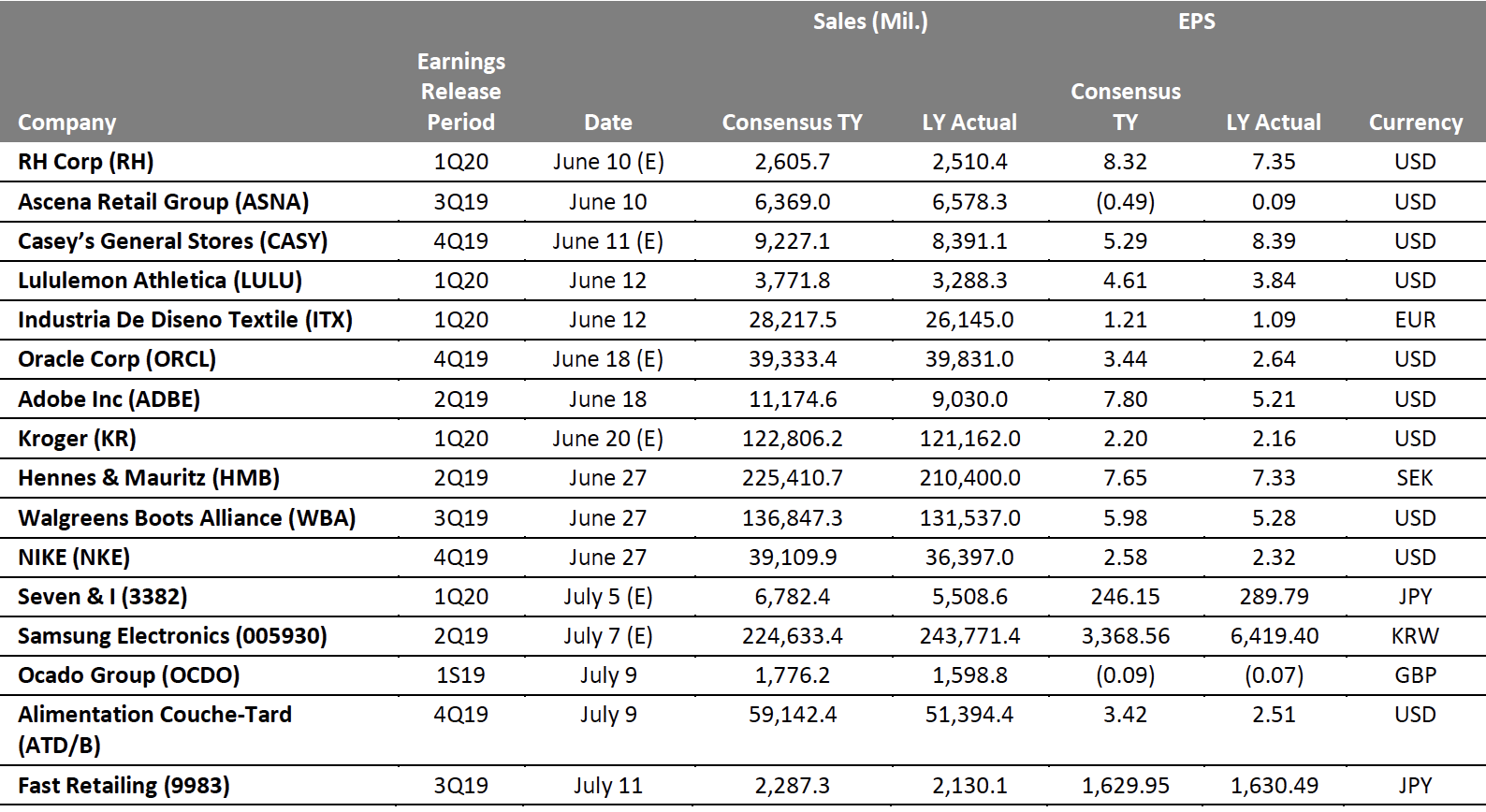

EARNINGS CALENDAR

[caption id="attachment_90002" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

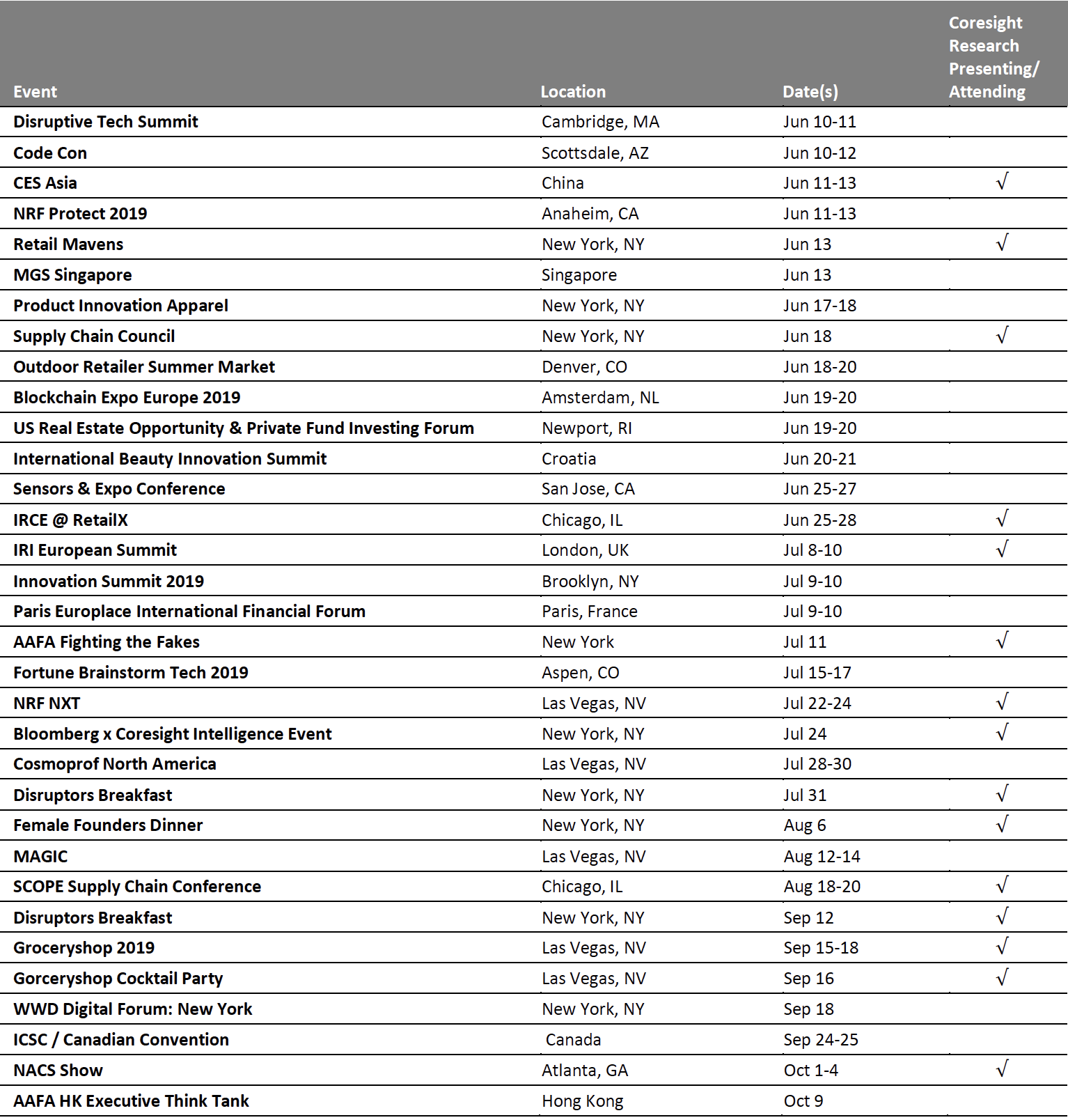

EVENT CALENDAR