DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

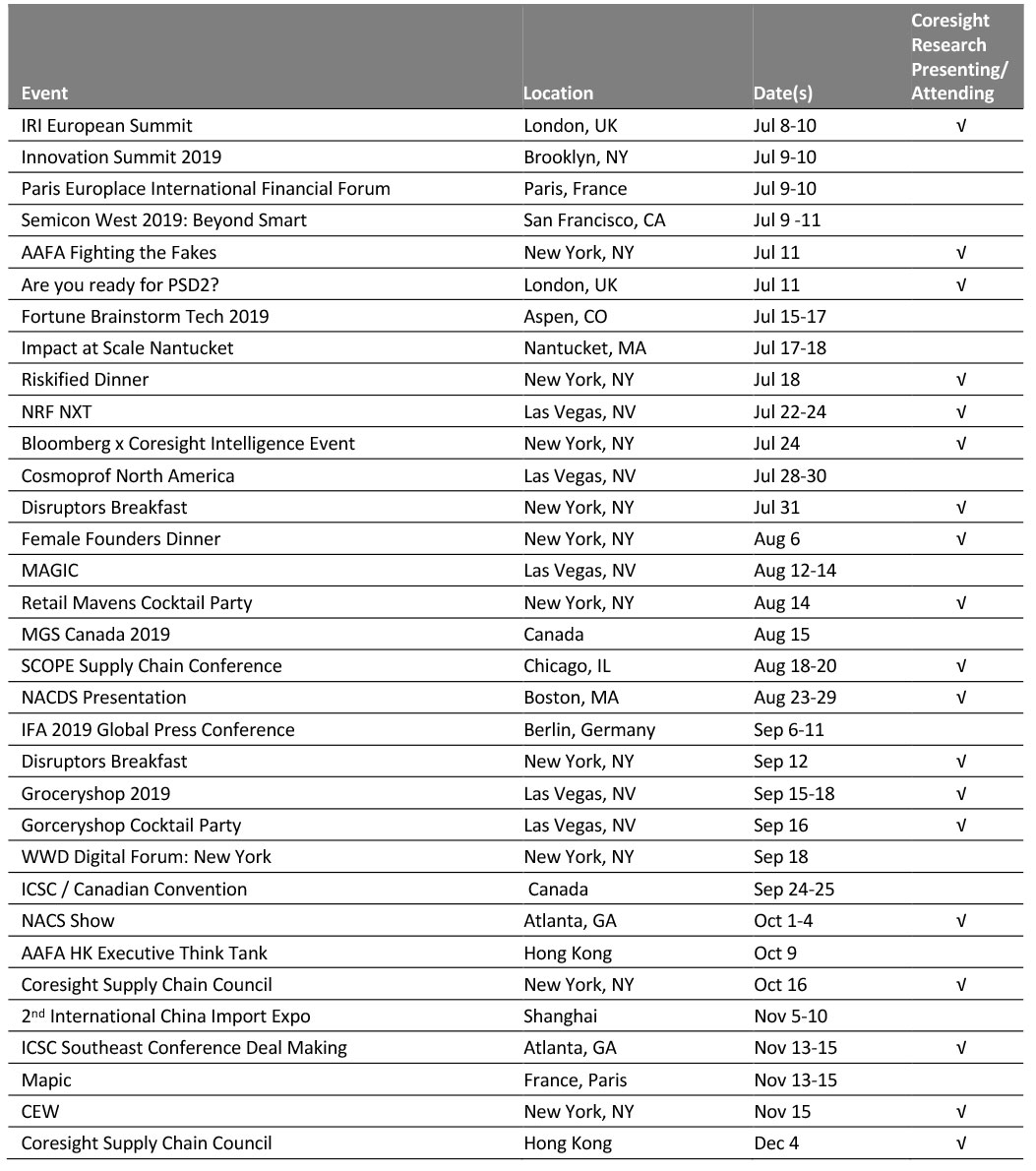

At Midyear, What’s the State of US Retail? US retail growth has slowed meaningfully this year, with 2018’s strong performance creating tough comparatives. The retail boom from later 2017 to later 2018 boosted many sectors, including the hitherto-struggling apparel retailer and department store sectors. However, that support appears to have been temporary: So far this year, both sectors have seen sales fall, albeit in the context of a deflationary apparel category. Nonstore retail, the bulk of which is accounted for by online-only retailers, has bucked the trend, growing 10.7% so far this year versus 10.5% growth in the corresponding period of 2018. The table below shows retail sales growth for the first five months of 2019 and 2018, plus consumer price inflation for the same periods. The slowing growth in grocery and home-improvement this year has come despite an uptick in inflation in 2019. [caption id="attachment_91934" align="aligncenter" width="700"] *The inflation metrics used are: Nondurable goods for all retail; food at home for grocery retailers; apparel and footwear for apparel stores and department stores; tools, hardware, outdoor equipment and supplies for home-improvement retailers

*The inflation metrics used are: Nondurable goods for all retail; food at home for grocery retailers; apparel and footwear for apparel stores and department stores; tools, hardware, outdoor equipment and supplies for home-improvement retailers Source: US Census Bureau/US Bureau of Labor Statistics/Coresight Research [/caption] Store Closures Jump So far this year, the number of announced US store closures has jumped by around two-thirds year over year — to 6,986 closures as of June 21. This year-to-date total already comfortably exceeds the 5,864 closures we recorded for 2018 overall. Closures represent a mix of bankruptcies and retailers actively managing their store fleets.

- The three retailers announcing the most closures year to date in 2019 are Payless ShoeSource (bankruptcy), Gymboree (bankruptcy) and Dressbarn (closure of chain by parent Ascena Retail Group).

- For the same period of 2018, the three retailers that had announced the most closures were Toys “R” Us (bankruptcy), Walgreens (reducing its store estate after acquiring Rite Aid stores), plus Sears and Kmart (reducing store estate).

- Our Weekly US and UK Store Openings and Closures Tracker has recorded 10 major US retail bankruptcies so far this year – versus 16 in all of 2018.

US RETAIL & TECH HEADLINES

- Walmart says it has been working to address the needs of low-income shoppers for some time. Now, Walmart will accept Supplemental Nutrition Assistance Program (SNAP) cards for online grocery orders at all of the company’s 2,500-plus pickup locations.

- For SNAP customers, the process of placing an online order is as simple as it is for those paying with debit or credit. At checkout, they select a pickup time and choose “EBT card” as the payment option.

Amazon Prime Day Will Actually Be Two Days This Year

(June 25) CNN Business

Amazon Prime Day Will Actually Be Two Days This Year

(June 25) CNN Business

- Amazon announced Prime Day this year will start at midnight on Monday, July 15, and run for 48 hours. The company boasts the event will include more than a million deals around the world.

- In 2018, Prime Day lasted 36 hours, which was longer than in prior years. Amazon tested its inaugural Prime Day in July of 2015 to celebrate its 20th anniversary. It designed the day to replicate Black Friday.

Buy Now, Pay Later Solution Provider Expands to Canada

(June 24) Retail TouchPoints

Buy Now, Pay Later Solution Provider Expands to Canada

(June 24) Retail TouchPoints

- Sezzle, an installment payments solution provider, now lets retailers accept payment from shoppers in Canada. The platform lets shoppers divide payments into interest-free installments paid over up to six weeks at no additional cost.

- The platform is aimed at consumers who prefer a “buy now, pay later” payment method, such as Millennials and Gen Zers without credit cards.

Toys “R” Us Coming Back to the United States with New Retail Stores

(June 24) Business Times

Toys “R” Us Coming Back to the United States with New Retail Stores

(June 24) Business Times

- The childhood memories of millions of Americans disappeared with the closure of over 700 Toys “R” Us stores last year. Now, thanks to one of its executives, the popular toy store is coming back to the US.

- Richard Barry, a former Toys “R” Us executive who is now CEO of new entity called Tru Kids Inc., has reportedly been pitching his vision to reincarnate the chain with plans to open a minimum of two retail stores in the US within the year.

Walmart Adds AI-powered Cameras to 1,000+ Stores to Reduce Checkout theft

(June 24) Fox Business

Walmart Adds AI-powered Cameras to 1,000+ Stores to Reduce Checkout theft

(June 24) Fox Business

- Walmart is working to reduce checkout theft in more than 1,000 US stores with the help of cameras powered by artificial intelligence. The retailer began investing in the surveillance program, called Missed Scan Detection, to combat shrinkage — loss due to several causes including theft, scanning errors, waste and fraud.

- The AI-powered cameras — which use an algorithm to capture items that aren't scanned properly during checkout — rolled out to more than 1,000 stores about two years ago.

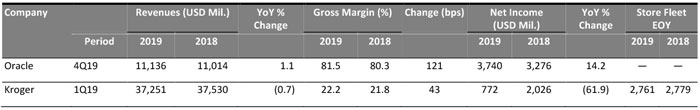

US RETAIL EARNINGS

EUROPE RETAIL & TECH HEADLINES

Waitrose Teams Up With IRI On Customer Behavior Portal

(June 24) ESMMagazine.com

Waitrose Teams Up With IRI On Customer Behavior Portal

(June 24) ESMMagazine.com

- British supermarket chain Waitrose has launched a cloud-based customer behavior portal in partnership with UK-based insights agency IRI. The portal is designed to help the retailer and its suppliers monitor brand performance and enhance customer service.

- It includes a self-service reporting system where users can gain insights on latest trends, the efficiency of promotions, pricing variations and approaches.

Game Accepts £52 Million Sports Direct Takeover

(June 24) RetailGazette.co.uk

Game Accepts £52 Million Sports Direct Takeover

(June 24) RetailGazette.co.uk

- British video-game retailer Game has agreed to a £52 million ($66.28 million) buyout by sportswear retailer Sports Direct. In 2017, Sports Direct bought a 26% stake in Game and increased it to 38.5% earlier this month.

- The acquisition may allow gamers to partake in live battles in purpose-built gaming arenas in the group’s House of Fraser stores.

Aldi UK Plans To Expand Its Local Banner Trial to Other Locations

(June 24) retailgazette.co.uk

Aldi UK Plans To Expand Its Local Banner Trial to Other Locations

(June 24) retailgazette.co.uk

- Aldi has announced plans to extend its smaller format Local banner trial to other UK locations after positive customer feedback for its first Local store in Balham, London. Aldi asserted that this is not a move into convenience retailing.

- Aldi will open a new local store in Camden, London. Existing stores in Archway, Eastcote, Kingston, Kilburn, Tooting and Romford will also be converted to the Local store format.

Germany’s Metro Board Says $6.6 Billion Bid Underprices Company

(June 23) Reuters.com

Germany’s Metro Board Says $6.6 Billion Bid Underprices Company

(June 23) Reuters.com

- German cash-and-carry retailer Metro has responded to a takeover offer of €5.8 billion ($6.6 billion) from EP Global Commerce (EPGC), an acquisition entity owned by Czech and Slovak investors, saying it significantly undervalues the company and does not reflect its value creation plan.

- EPGC stated that its offer price of €16 ($14.3) for each ordinary share and €13.8 ($12.34) for each preferred share indicates a 34.5% premium to its initial investment offer in August. EPGC already has a stake of nearly 11% in Metro.

New Look Posts Profits This Year

(June 25) theretailbulletin.com

New Look Posts Profits This Year

(June 25) theretailbulletin.com

- After incurring a £35.7 million ($45.5 million) loss in the previous year, British fashion retailer New Look posted an operating profit of £33.2 million ($42.3 million) in the year ended March 30.

- New Look recently implemented a comprehensive restructuring that reduced its long-term debt and added £150 million ($191 million) of new capital. The company said it has made good financial progress and will have a stronger position in the new financial year.

ASIA RETAIL AND TECH HEADLINES

JD’s Logistics Forms ¥1.5 Billion Fund

(June 24) reuters.com

JD’s Logistics Forms ¥1.5 Billion Fund

(June 24) reuters.com

- JD announced its logistics unit has formed an investment fund worth ¥1.5 billion ($218 million).

- The fund will invest in companies and technologies focused on logistics.

Carrefour Divests Majority China Stake to Suning.com

(June 23) Company press release

Carrefour Divests Majority China Stake to Suning.com

(June 23) Company press release

- French hypermarket chain Carrefour has announced the sale of an 80% stake in its China business to retailer Suning.com. The deal values Carrefour’s China operations at an enterprise value of around €1.4 billion ($1.6 billion).

- The transaction will be paid in cash and is expected to close by the end of 2019. Carrefour Group will retain a 20% stake in the company and two seats out of seven on Carrefour China’s supervisory board.

E-Commerce Platform Tiki Plans to Raise $100 Million

(June 24) insideretail.asia

E-Commerce Platform Tiki Plans to Raise $100 Million

(June 24) insideretail.asia

- Vietnamese e-commerce platform Tiki will raise $100 million from a funding round led by Singapore-based private equity fund manager Northstar Group.

- Tiki initially aimed to raise up to $75 million, which increased to $100 million and may hit $150 million if target key performance indicators are met.

Tata to Build Its Own Apparel Empire

(June 24) bloomberg.com

Tata to Build Its Own Apparel Empire

(June 24) bloomberg.com

- Indian conglomerate Tata Group, which runs Zara stores in India, plans to launch a new retail division called Trent Group, similar to Zara’s proposition but with price-points tailored to suit Indian consumers’ pocketbooks.

- Trent Group has adjusted its supply chain to deliver runway styles to customers in just 12 days, similar to the turnaround time taken by Zara. Trent plans to open 40 stores under its department store banner Westside and hundreds of Zudio clothing brand stores every year.

Tokopedia Acquires Bridestory

(June 24) insideretail.asia

Tokopedia Acquires Bridestory

(June 24) insideretail.asia

- Indonesian technology company Tokopedia has acquired online wedding service marketplace Bridestory.com. The website connects over 27,000 wedding vendors to around 3.5 million customers annually and helps users plan weddings on their smartphones.

- Tokopedia has stated that Bridestory.com will run its operations independently. The acquisition also includes Parentstory, Bridestory’s new service for parents to connect with age-specific children’s activity providers.

Lawson Plans Expansion to Target Travelers in Thailand

(June 25) insideretail.asia

Lawson Plans Expansion to Target Travelers in Thailand

(June 25) insideretail.asia

- Thai conglomerate Saha Group, transport facilities firm VGI Global Media and Japanese convenience store operator Lawson have formed an alliance, called Saha Lawson, to open convenience stores at subway stations and airports across Thailand.

- The venture will launch with a registered capital of THB 20 million ($645,000). Saha Lawson will hold a 60% stake, while VGI will hold 30% and Saha Group will hold 10%.

LATIN AMERICA RETAIL AND TECH HEADLINES

Walmart Launches Grocery Delivery Through WhatsApp in Mexico

(June 25) reuters.com

Walmart Launches Grocery Delivery Through WhatsApp in Mexico

(June 25) reuters.com

- After Mexico’s anti-trust officials blocked Walmart’s deal to purchase delivery app Cornershop, the retailer’s Mexican unit Walmex has announced the launch of grocery delivery through messaging service WhatsApp.

- Customers in Mexico can message their shopping list to Walmart’s WhatsApp number and have groceries delivered within 90 minutes for 49 pesos ($2.55), or at a later time for 39 pesos ($2.03). Customers pay by card or cash on delivery.

Dufry Group Opens Its First Dunhill Store in Brazil

(June 24) trbusiness.com

Dufry Group Opens Its First Dunhill Store in Brazil

(June 24) trbusiness.com

- Swiss travel retailer Dufry has introduced British menswear brand Dunhill to Brazil with the launch of its new duty-free shop at Guarulhos International Airport in São Paulo.

- The 646-square-foot store will offer luxury menswear, footwear and accessories. Dunhill will increase Dufry’s luxury offer at the airport, in which the travel retailer already runs 12 boutiques from various beauty and fashion labels.

Avon On App to Launch in Colombia

(June 24) fashionnetwork.com

Avon On App to Launch in Colombia

(June 24) fashionnetwork.com

- Global beauty brand Avon plans to launch its Avon On app in Colombia in July. The Avon On app is a one-stop virtual platform for customers to manage orders, explore and share beauty products and get information on new products.

- Through the Avon On platform, the company hopes to expand customer coverage and improve the ordering process.

Ripley to Transform Seven Stores to Optimize its Omnichannel Operation

(June 21) america-retail.com

Ripley to Transform Seven Stores to Optimize its Omnichannel Operation

(June 21) america-retail.com

- Chilean department store Ripley has announced plans to transform seven of its stores into small distribution centers. Ripley plans to enhance its e-commerce platform and fast-track delivery time to less than 90 minutes.

- The strategy includes reducing product display space to make way for a collection of online orders. Ripley has plans to implement this idea across all its outlets.

Adidas Opens New Stores in Mexico

(June 23) fashionnetwork.com

Adidas Opens New Stores in Mexico

(June 23) fashionnetwork.com

- German sports brand Adidas has expanded operations in Mexico with the opening of two new stores, in the states of Mexico and Yucatán, under its concept Adidas Originals.

- Adidas is expanding its various formats in Mexico. In addition to the Adidas Originals concept, the brand has grown with its outlet format in Mexico City and Monterrey.

Mary Kay To Expand Its Product Portfolio in Peru

(June 25) fashionnetwork.com

Mary Kay To Expand Its Product Portfolio in Peru

(June 25) fashionnetwork.com

- US beauty company Mary Kay plans to expand its product portfolio in Peru with the launch of 20 new products by the end of 2019. Mary Kay also plans to strengthen its perfume and skin care line.

- Mary Kay already makes some of its packaging in Peru, and may make some of its cosmetics there in the future.

MACRO UPDATE

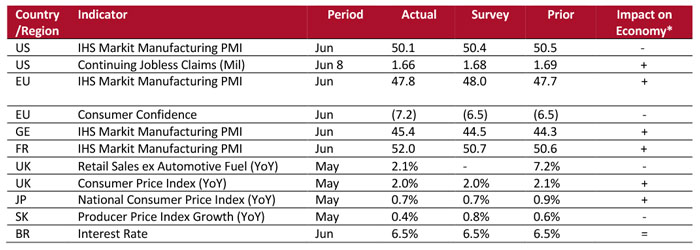

Key points from global macro indicators released June 19–25, 2019:- US: The IHS Markit manufacturing Purchasing Managers’ Index (PMI) decreased to 50.1 in June from 50.5 in May and below the consensus estimate of 50.4. Continuing jobless claims in the US fell to 1.66 million in the week ended June 8 from 1.69 million in the previous week.

- Europe: In the eurozone, the IHS Markit manufacturing PMI increased slightly, to 47.8 in June, from 47.7 in May. In the UK, retail sales excluding automotive fuel grew 2.1% year over year in May, below the 7.2% growth recorded in April.

- Asia Pacific: In Japan, the consumer price index was up 0.7% year over year in May, below the 0.9% growth recorded in April. In Korea, the producer price index was up 0.4% year over year in May, below the 0.6% growth recorded in April.

- Latin America: In Brazil, the central bank held the interest rate steady at 6.5%

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: Markit Economics/US Department of Labor/Eurostat/Destatis/INSEE/Office for National Statistics /Ministry of Economy, Trade and Industry, Japan/Bank of Korea/Banco Central Do Brasil/Coresight Research [/caption]

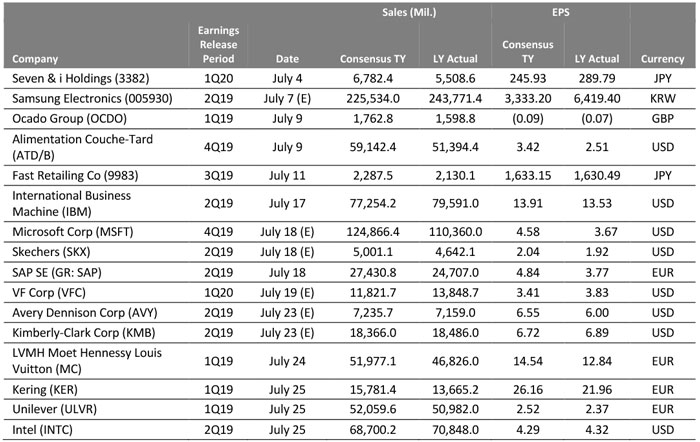

EARNINGS CALENDAR

[caption id="attachment_91960" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

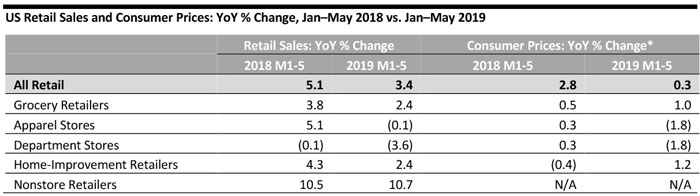

EVENT CALENDAR