From the Desk of Deborah Weinswig

Amazon Taps the Plus-Size Market: A Fast-Growing Retailer Meets a Higher-Growth Apparel Market

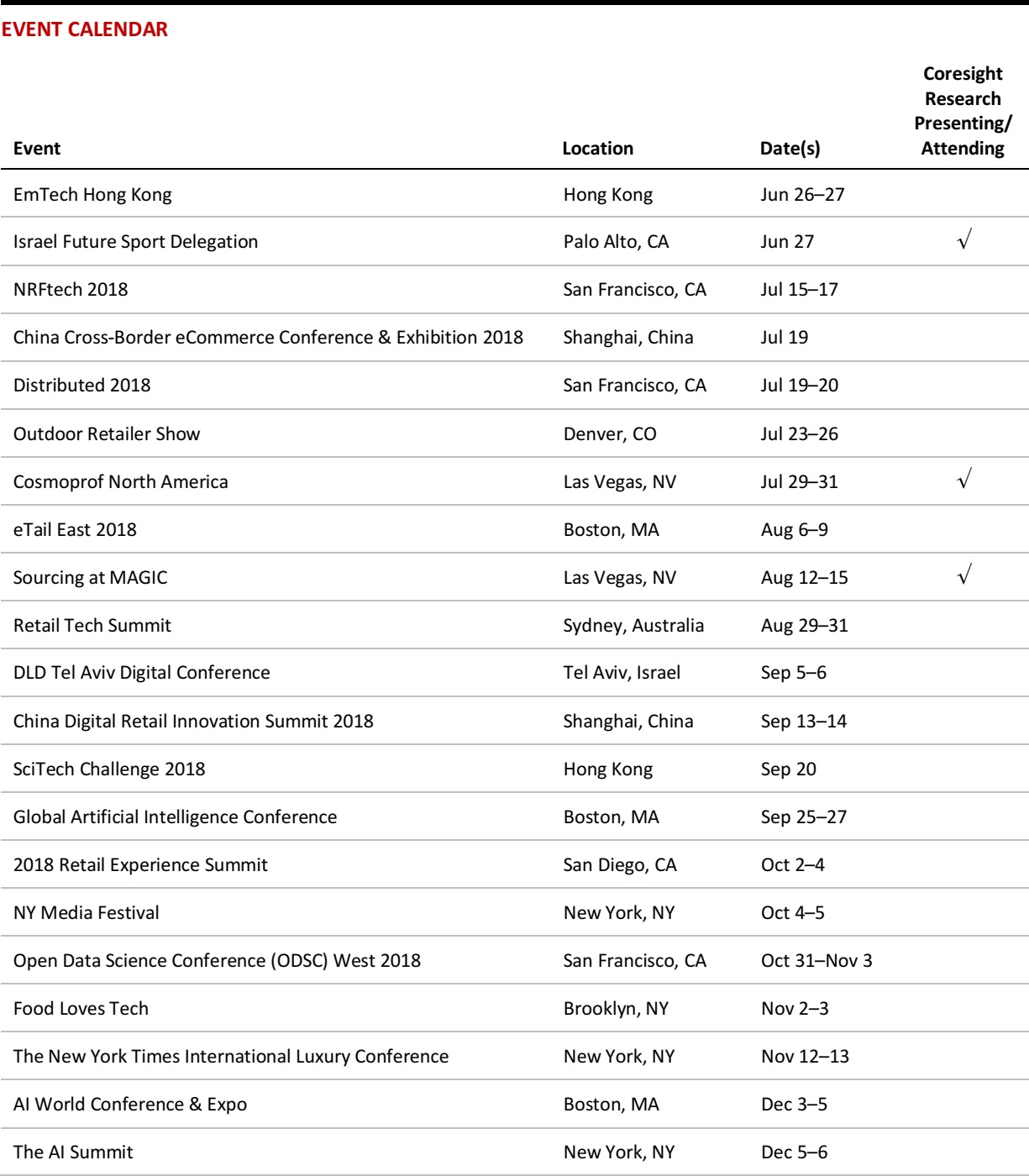

On June 14, Coresight Research’s New York team cohosted a daylong conference called One Size Does Not Fit All: Inclusive Design & the Modern Consumer, which focused attention on underserved and niche apparel markets, including adaptive fashion for disabled consumers and the plus-size market. Many attendees expressed interest in the changing nature of the plus-size market and the opportunities it presents for new entrants.

In this week’s note, we build on those conversations as we discuss a relative newcomer to the plus-size market: Amazon. Drawing on recently collated data on Amazon’s private-label offering that competitive intelligence provider DataWeave produced for Coresight Research, we show the scale of Amazon’s own offering in women’s plus-size clothing.

Amazon’s plus-size offering is notable because it represents the confluence of a fast-growing apparel retailer and a higher-growth market. Amazon is already America’s

second-most-shopped retailer of apparel, and it looks to be grabbing market share from incumbents. Meanwhile, the US plus-size market is

growing considerably faster than the total women’s clothing market.

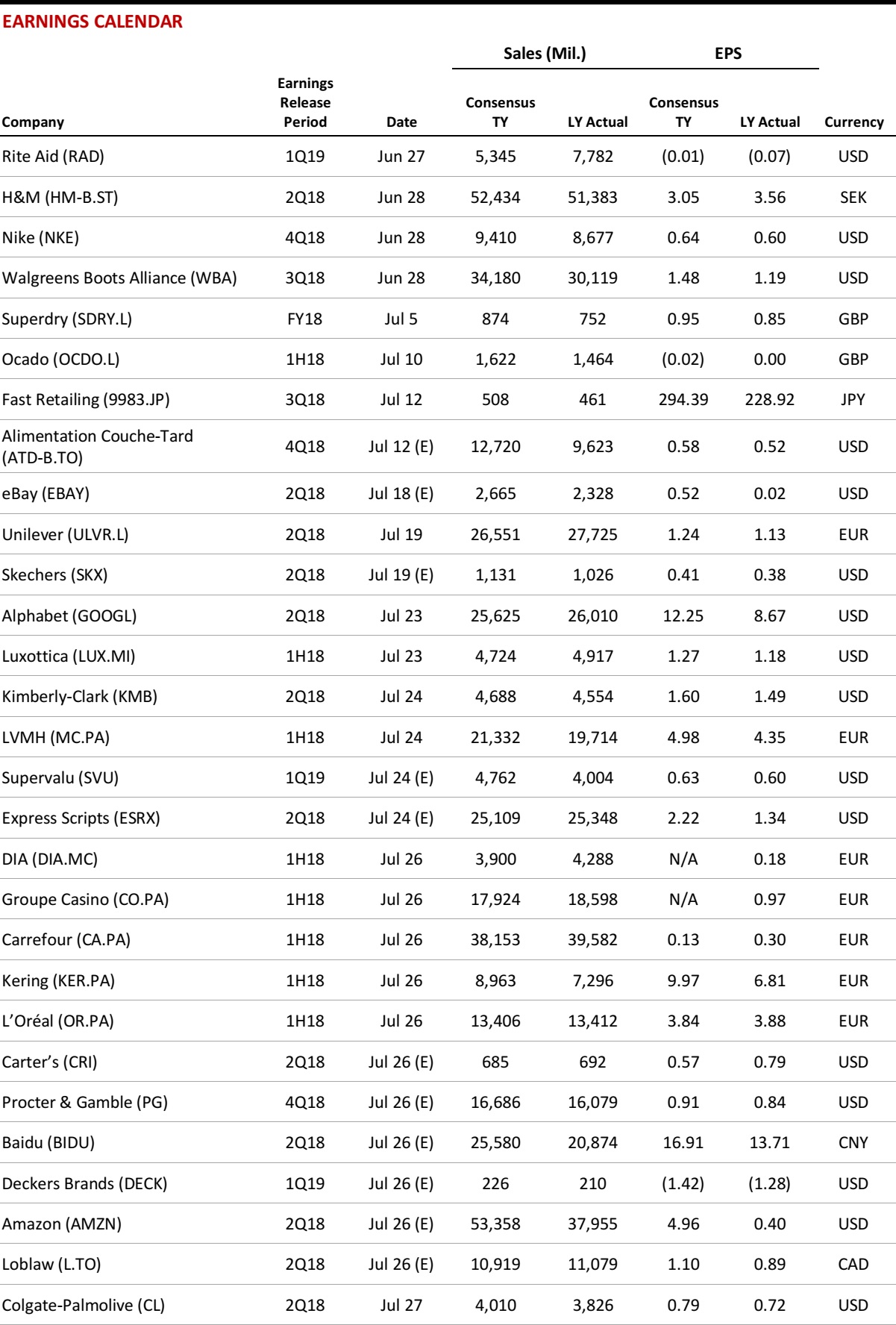

Plus-Size Products Account for Just 6.6% of Amazon’s Private-Label Womenswear Products

Amazon has rapidly built out a substantial private-label clothing, footwear and accessories offering in an effort to build share in the $400 billion US apparel market. In

our most recent analysis, we identified 4,904 Amazon private-label products available across women’s, men’s and children’s clothing, footwear and accessories. Of those, 3,219 were women’s clothing products.

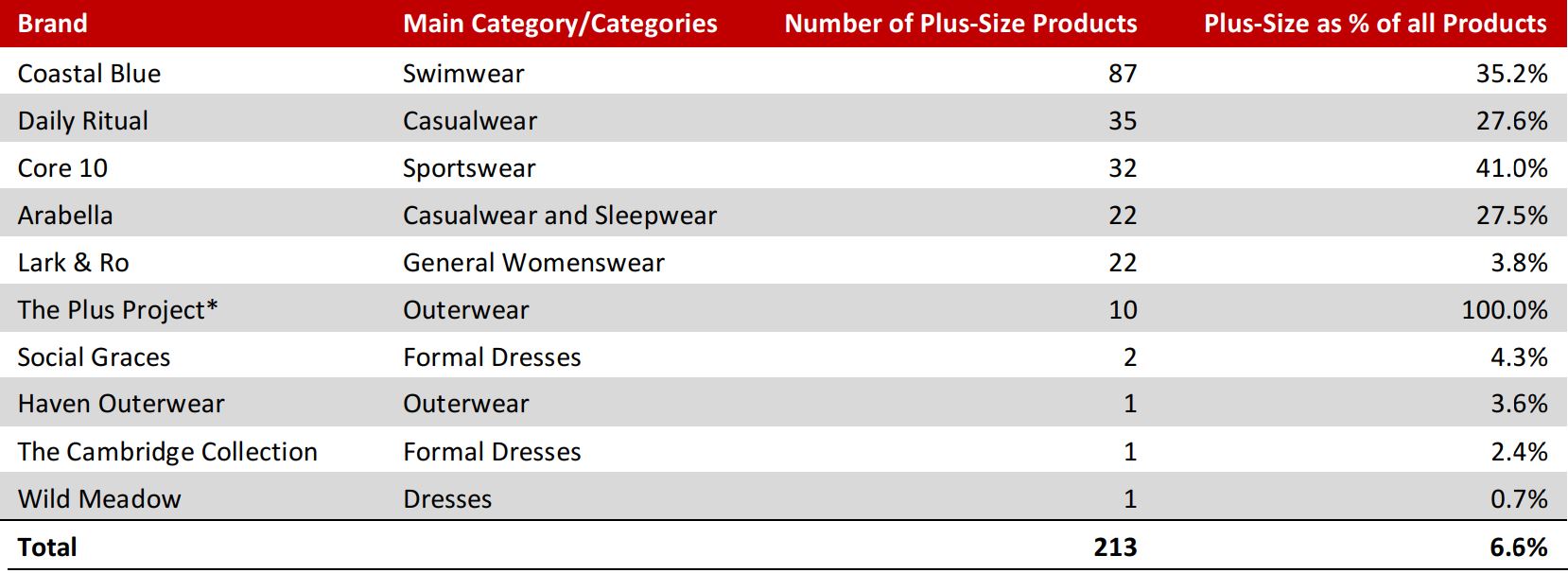

Several of Amazon’s womenswear brands contain substantial plus-size offerings, yet the retailer’s plus-size ranges overall remain relatively minor compared with its total private-label offering. As the table below shows, we identified 213 private-label women’s clothing products that were categorized as plus-size: that is equivalent to just 6.6% of the 3,219 private-label womenswear products the company sells. And Amazon’s plus-size offering is highly concentrated:

- Some 45 of Amazon’s 74 identified private labels offer women’s clothing. But only 10 of these offer plus-size womenswear and only one of them—The Plus Project—is a dedicated plus-size brand.

- In descending order, sportswear brand Core 10, swimwear brand Coastal Blue, and casualwear brands Daily Ritual and Arabella register the greatest proportion of products categorized as plus-size.

- Lark & Ro is Amazon’s core womenswear private label and its biggest apparel brand by total number of products offered. However, only 22 of Lark & Ro’s products are categorized as plus-size, equivalent to just 3.8% of the brand’s range.

Amazon Apparel Private Labels: Plus-Size Offering

To offer some comparison, our recent research on various department stores’ plus-size offerings found that 37% of jeans and 17% of dresses offered online by JCPenney were available in plus sizes. At Kohl’s, 26% of jeans and 16% of dresses offered online were stocked in plus sizes. Amazon therefore has some distance to go before its private-label plus-size offerings rival those of major department stores in terms of number of products offered.

Amazon’s Segmented Approach to Fashion Suggests that It Will Grow Its Plus-Size Offering

We think that Amazon’s apparent strategy of building many niche apparel brands that each focus on a specific category or serve a specific consumer segment may be one reason that its plus-size offering is somewhat limited and heavily skewed toward certain private labels. The company’s segmented approach is reflected in its large number of brands, range of price points and presence across clothing and footwear subcategories. This strategy implies that Amazon’s plus-size offering will not be evenly distributed across its own brands, but also suggests that the retailer is likely to build out its plus-size offering further. In our view, the underserved plus-size market is one segment where opportunities await Amazon.

US RETAIL & TECH HEADLINES

US Retail Sales Post Biggest Gain in Six Months

(June 14) Reuters.com

US Retail Sales Post Biggest Gain in Six Months

(June 14) Reuters.com

- Retail sales increased by 0.8% month over month in May, double the forecast rise of 0.4% and representing the biggest advance since November 2017. April sales growth was revised upward to 0.4% from the previously reported 0.2%.

- This unexpectedly high growth rate has made forecasters optimistic about retail growth in the April–June quarter as a whole, with some estimates suggesting a 4.6% annualized growth rate, more than double the rate seen in the first quarter.

Amazon Is Stacking Whole Foods with Execs to Weave It into Jeff Bezos’ Broader Vision

(June 14) CNBC.com

Amazon Is Stacking Whole Foods with Execs to Weave It into Jeff Bezos’ Broader Vision

(June 14) CNBC.com

- Amazon has rapidly implemented changes in its retail operations since buying Whole Foods for $13.7 billion last year. Some high-level Whole Foods executives have left, and Amazon has altered relationships with suppliers.

- Amazon CEO Jeff Bezos is looking to leverage Whole Foods to expand Amazon’s presence in physical retail, but Whole Foods CEO John Mackey has reportedly told employees that he has had “many, many clashes” with Amazon.

GameStop Said It Is Considering Alternatives, Including a Sale of the Company

(June 19) DallasNews.com

GameStop Said It Is Considering Alternatives, Including a Sale of the Company

(June 19) DallasNews.com

- GameStop is considering a sale, stating recently that it is “in exploratory discussions with third parties regarding a potential transaction.”

- The company is in the midst of trying to adapt to the digital gaming world, taking steps such as purchasing wireless phone stores and growing its digital business, as investors have decided that digital gaming is turning the company into the next Blockbuster Video.

Microsoft Reportedly in Talks with Walmart to Build Checkout-Free Stores Like Amazon Go

(June 14) Gizmodo.com

Microsoft Reportedly in Talks with Walmart to Build Checkout-Free Stores Like Amazon Go

(June 14) Gizmodo.com

- According to Reuters, Microsoft is now working on tech that would allow retailers to build checkout-free stores. However, instead of installing the technology in its own stores, the company is reportedly in talks about a potential partnership with Walmart to build Amazon Go–like checkout-free stores.

- Moving into the world of checkout-free retail would put Microsoft in another head-to-head competition with Amazon: Microsoft’s Azure cloud storage and service business ranks second behind Amazon’s AWS.

Gap Names Former CEO of Billabong as New Head of Brand

(June 13) StarTribune.com

Gap Names Former CEO of Billabong as New Head of Brand

(June 13) StarTribune.com

- Gap Inc. has named Neil Fiske, former CEO of Billabong and Eddie Bauer, as the new CEO and President of Gap.

- Fiske will take over the struggling Gap flagship brand on June 20.

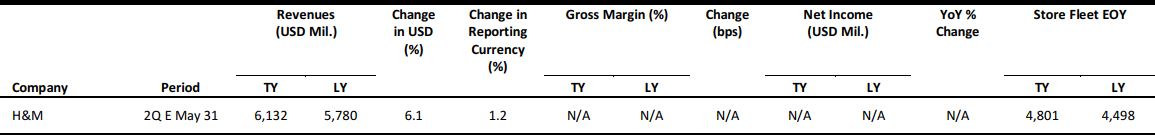

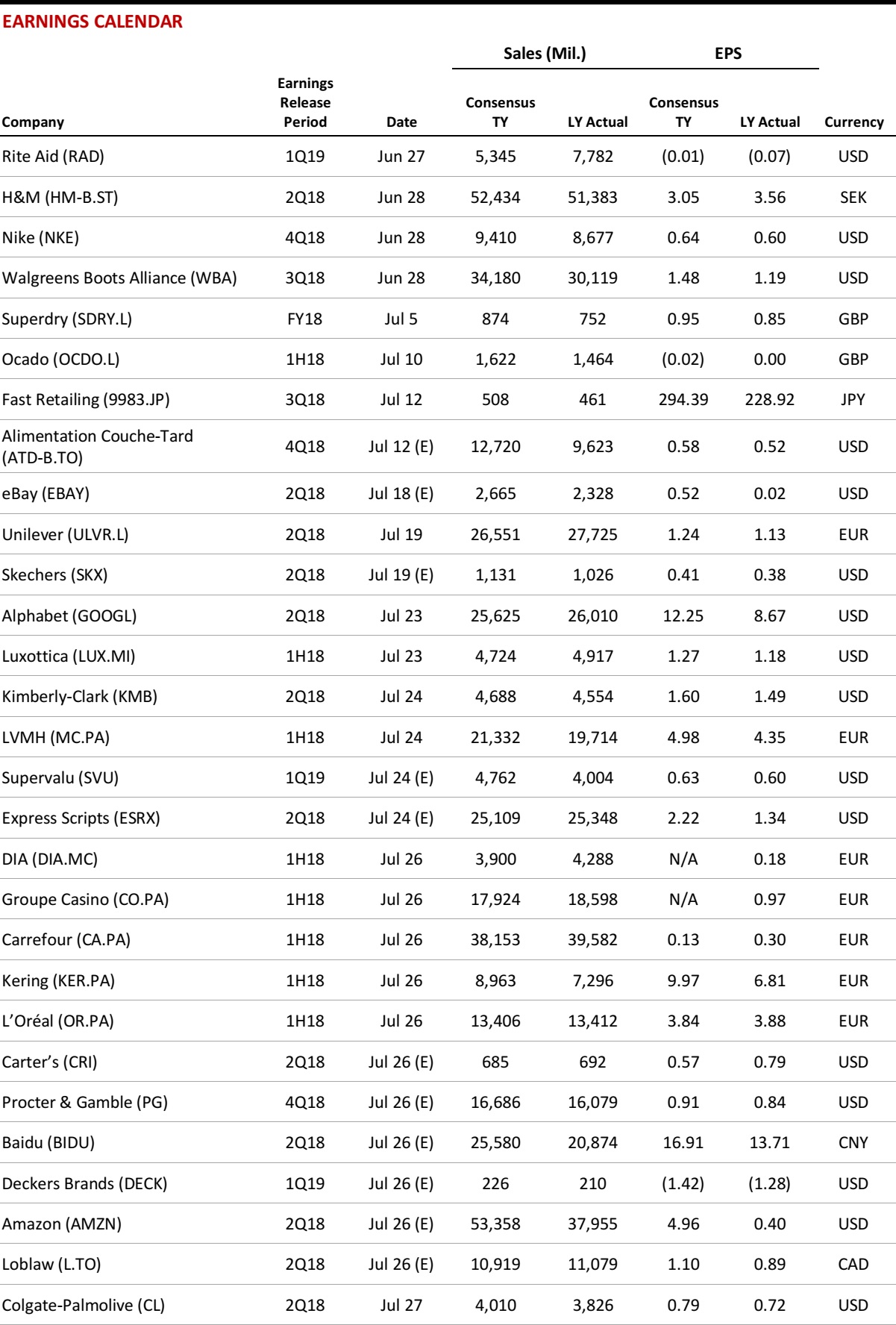

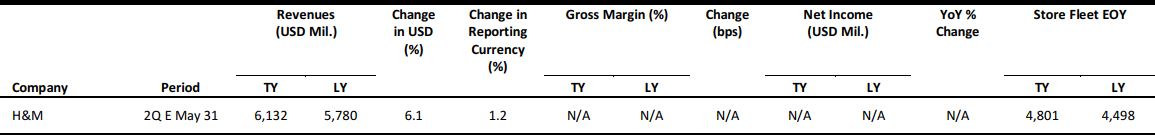

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

Debenhams Reports Continued Weakness, Prompting Profit Warning

(June 19) Company press release

Debenhams Reports Continued Weakness, Prompting Profit Warning

(June 19) Company press release

- British department store retailer Debenhams reported a decline of 1.5% in group transaction value and a decline of 1.7% in group comps (down 2.2% at constant currency) in the third quarter ended June 16. Online sales remained buoyant, rising by 16% in the quarter.

- Poor performance during the quarter prompted Debenhams to further lower its guidance and issue its third profit warning for the year. The company now expects its fiscal year 2018 gross margin to decline by 150 basis points; it had previously guided for a gross-margin decline of 100 basis points. The company now guides for full-year profit before tax of £35–£40 million ($46–$53 million), down from £50–£61 million ($66–$80 million) previously.

Poundworld Lays Off 98 Staff

(June 19) RetailGazette.co.uk

Poundworld Lays Off 98 Staff

(June 19) RetailGazette.co.uk

- French retail group Carrefour has partnered with tech giant Google to allow customers in France to shop for Carrefour products across Google’s platforms, which include Google Assistant, Google Home and the Google Shopping website. The integrated shopping experience is expected to launch in early 2019.

- Carrefour and Google are also opening an innovation lab in Paris this summer, which will see the retailer’s engineers collaborate with Google Cloud AI experts to create new customer experiences. Carrefour will also leverage Google’s G Suite productivity tools and expertise to accelerate its digital transformation.

ASOS Bans Sale of Silk, Mohair and Cashmere Products on Its Site

(June 19) RetailGazette.co.uk

ASOS Bans Sale of Silk, Mohair and Cashmere Products on Its Site

(June 19) RetailGazette.co.uk

- British online pure play ASOS announced a new animal welfare policy that includes the removal of products made from silk, mohair and cashmere from its site. The retailer has also banned its suppliers from using any part of endangered, exotic or vulnerable species in the manufacturing of its products.

- ASOS will continue to sell leather and lambswool goods as long as they are by-products of the meat industry.

Back Market Raises Investment from Eurazeo and LVMH CEO

(June 14) RetailDetail.eu

Back Market Raises Investment from Eurazeo and LVMH CEO

(June 14) RetailDetail.eu

- French startup Back Market, a marketplace for refurbished phones, tablets and laptops, has received funds of €41 million ($47 million) from investment fund Eurazeo, LVMH CEO Bernard Arnault and other investors.

- The startup did not disclose the size of individual investments or its total valuation. Back Market intends to use the funds to grow its operations and expand into the US.

Trouva Launches in Berlin

(June 19) TheRetailBulletin.com

Trouva Launches in Berlin

(June 19) TheRetailBulletin.com

- UK-based Trouva, a curated online marketplace for brick-and-mortar boutiques, has launched in Berlin, Germany. This news follows its recent announcement that it had raised $10 million in a funding round led by BGF Ventures, Index Ventures and Octopus Ventures.

- Trouva’s platform enables small, independent, offline boutique retailers to sell online. It will provide stores in Berlin with in-store inventory management software, AI technology, a logistics platform and the ability to offer same-day collection for online orders and global shipping.

Bonmarché Reports Rise in Profits, Signals Turnaround

(June 19) Company press release

Bonmarché Reports Rise in Profits, Signals Turnaround

(June 19) Company press release

- British value womenswear retailer Bonmarché reported a surge of 38.1% in profit before tax in the year ended March 31. Underlying profit before tax rose by 27.0%, indicating that the company’s turnaround efforts are bearing fruit. Revenues declined by 2.1%, while online sales soared by 34.5% in the year.

- The retailer said that trading at the beginning of the new financial year has been stronger than during the second half of fiscal year 2018, although it expects the trading environment to remain difficult.

ASIA RETAIL & TECH HEADLINES

Toss, Korea’s Top Payment App, Raises $40 Million from Sequoia China and Singapore’s GIC

(June 18) TechCrunch.com

Toss, Korea’s Top Payment App, Raises $40 Million from Sequoia China and Singapore’s GIC

(June 18) TechCrunch.com

- Toss, the largest payment app in South Korea, has pulled in $40 million in fresh investment from Singapore sovereign wealth fund GIC and Sequoia China. The deal for Viva Republica, Toss’s parent company, comes just over a year after it raised $48 million from payment giant PayPal and others. No new valuation was disclosed, but the funding is intended to bring new investors in and help accelerate the business in anticipation of a large fundraising round later.

- Viva Republica says that Toss’s registered user base doubled to 8 million over the past year and it claims the app is processing $1.4 billion in transaction volume per month. The company forecasts that its annual transaction run rate will surpass $18 billion. Toss has introduced additional services beyond peer-to-peer payments, such as consumer-financing products.

Razer Leads $3.3 Million Investment in Australia’s Esports Mogul

(June 18) TechCrunch.com

Razer Leads $3.3 Million Investment in Australia’s Esports Mogul

(June 18) TechCrunch.com

- Razer, a gaming hardware company that went public in Hong Kong last year, is resuming its investment strategy after leading a $3.3 million deal for Australia-based Esports Mogul, which operates a platform called Mogul Arena for organizing e-sports competitions and a gaming news website. The firm is focused on Asia and Latin America and it went public in Australia via a reverse listing through which it raised $7 million.

- The new money will go toward developing Mogul Arena for mobile and funding user acquisition and monetization pushes, Esports Mogul said. Razer already works with Esports Mogul, and this deal will increase the companies’ collaboration, which will focus on integrating Razer’s payment system.

Google Makes $550 Million Strategic Investment in Chinese E-Commerce Firm JD.com

(June 18) TechCrunch.com

Google Makes $550 Million Strategic Investment in Chinese E-Commerce Firm JD.com

(June 18) TechCrunch.com

- Google agreed to a strategic partnership with e-commerce firm JD.com through which Google will purchase $550 million worth of shares in the Chinese firm. The companies said that they would “collaborate on a range of strategic initiatives, including joint development of retail solutions” in Europe, the US and Southeast Asia.

- The goal is to merge JD.com’s experience and technology in supply chain and logistics with Google’s customer reach, data and marketing in order to produce new kinds of online retail. Initially, the deal will see JD.com products offered for sale on the Google Shopping platform across the world, but it seems clear that the companies have other future collaborations in mind.

IBM’s New AI Supercomputer Can Argue, Rebut and Debate Humans

(June 19) SCMP.com

IBM’s New AI Supercomputer Can Argue, Rebut and Debate Humans

(June 19) SCMP.com

- IBM hosted another “Man vs. Machine” contest in San Francisco on Monday. A system that IBM calls Project Debater faced off against two humans in two separate debates. The verdict: humans are still ahead, but the gap is closing. According to IBM, the technology represents a breakthrough in equipping computers with the ability to “truly understand language” and then be “expressive.”

- This is one of the tech sector’s hottest areas and one that companies around the world are vigorously pursuing. The promise is that AI can help us access and analyze large amounts of data faster and more efficiently than humans can.

LATAM RETAIL & TECH HEADLINES

Google Ploughs Money into Brazil

(June 13) ZDNet.com

Google Ploughs Money into Brazil

(June 13) ZDNet.com

- Google has made unprecedented investments of R$700 million ($189 million) in Brazil over the last 15 months and is looking to foster continued growth in the country. Between 2013 and 2016, the company invested R$500 million ($135 million) in the country.

- Google Brazil head Fabio Coelho stated that the company will continue to invest significantly in Brazil, with R$125 million ($33 million) of yearly investment planned for the foreseeable future. The funds have gone toward projects that include three undersea cables, a data center for local provision of cloud computing services and a studio in Rio de Janeiro for content production for YouTube.

Brazilian PC Market Continues to Grow

(June 15) ZDNet.com

Brazilian PC Market Continues to Grow

(June 15) ZDNet.com

- The PC market in Brazil continues to grow as a result of manufacturers’ and retailers’ price reduction strategies in response to a sales slowdown last year, according to recent research. Companies have been adjusting prices to match buyer behavior in the recession since the end of last year.

- The strategy appears to be bearing fruit: between January and March, some 1.34 million PCs were sold, up 21% year over year, and sales totaled R$3 billion ($788,000), up 22.6% from the first quarter of 2017.

Napster Hires LatAm Head

(June 18) ZDNet.com

Napster Hires LatAm Head

(June 18) ZDNet.com

- Music streaming firm Napster has hired a new vice president for its business development and operations in Latin America. MarcioKanamaru will be based in São Paulo and tasked with leading the company’s growth strategy in the region, covering marketing, sales and operations. According to Kanamaru, local and regional growth of the digital music business presents “promising opportunities” for Napster to build on its existing streaming platform.

- Napster President and CEO Bill Patrizio said that Kanamaru brings expertise in business development and a track record of growing organizations in the technology, media and telecom spaces.

Amazon Looks to Brazil to Expand Its Hold on Beauty

(June 15) Pymnts.com

Amazon Looks to Brazil to Expand Its Hold on Beauty

(June 15) Pymnts.com

- Grupo Boticário and Natura Cosmeticos, two rising brands in Brazilian beauty, are both being heavily recruited by Amazon to sell via its Brazil platform, according to Reuters. The move represents an early play by Amazon on the world’s fourth-largest market for beauty products. As of 2018, Brazilians are spending roughly $30 billion a year on makeup, hair treatments and other wellness and self-care products. The only nations that see higher beauty sales are the US, China and Japan.

- This is one of many recent plays by Amazon to consolidate and expand its gains in South America. Amazon has already been online for books and video streaming, but in what has been called a flip of its usual script, it is moving in on beauty almost a year later. The company usually moves on categories such as electronics and toys in a market before going after areas such as health, wellness and beauty.

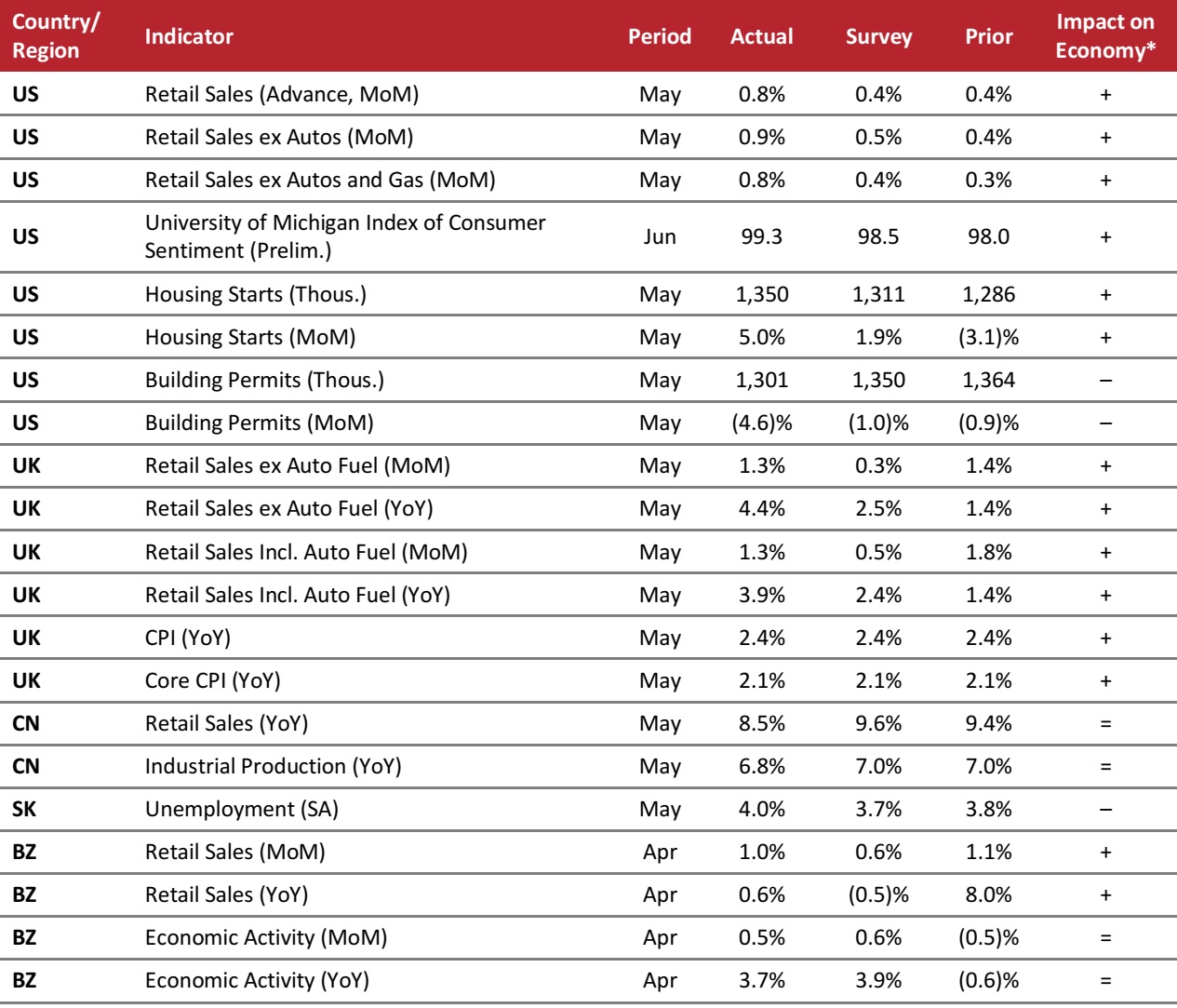

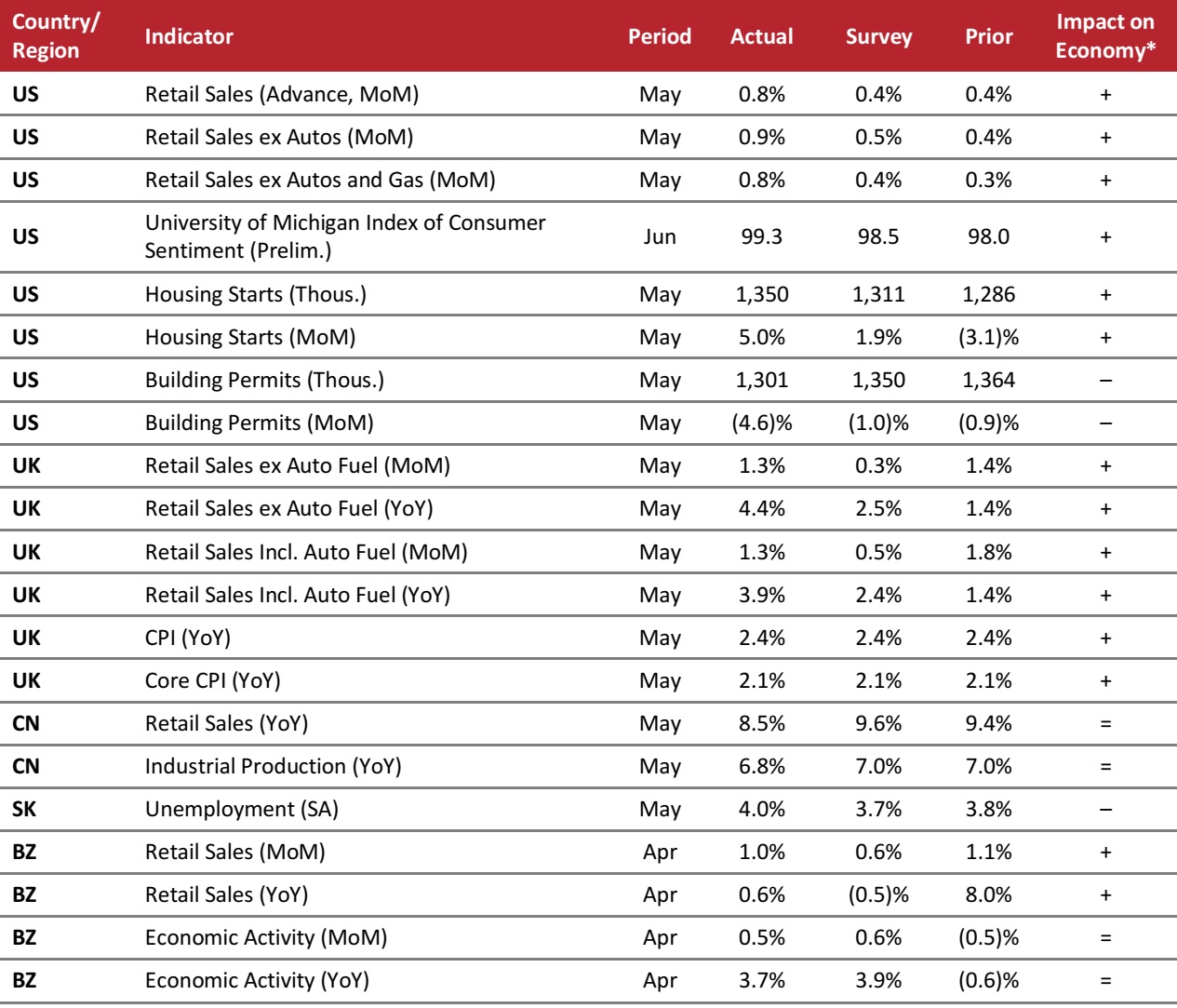

MACRO UPDATE

Key points from global macro indicators released June 13–20, 2018:

- US: Retail sales increased by more than analysts had expected in May, rising by 0.8% month over month. The University of Michigan Index of Consumer Sentiment reading increased to 99.3 in June. Housing starts showed strength in May, but building permits dropped by more than expected month over month.

- Europe: In the UK,retail sales excluding auto fuel increased by 1.3% month over month and by 4.4% year over year in May. Consumer prices in the UK increased by 2.4% year over year in May, in line with the consensus estimate.

- Asia-Pacific: In China, retail sales increased by 8.5% year over year in May, coming in slightly below the consensus estimate of 9.6%. Industrial production in China increased by 6.8% year over year in May. In South Korea, the unemployment rate increased to 4.0% in May.

- Latin America: In Brazil, retail sales increased by 1.0% month over month and by 0.6% year over year in April. Economic activity in Brazil showed modest growth in April.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/University of Michigan/UK Office for National Statistics/National Bureau of Statistics of China/Statistics Korea/Instituto Brasileiro de Geografia e Estatística/Banco Central do Brasil/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/University of Michigan/UK Office for National Statistics/National Bureau of Statistics of China/Statistics Korea/Instituto Brasileiro de Geografia e Estatística/Banco Central do Brasil/Coresight Research

To offer some comparison, our recent research on various department stores’ plus-size offerings found that 37% of jeans and 17% of dresses offered online by JCPenney were available in plus sizes. At Kohl’s, 26% of jeans and 16% of dresses offered online were stocked in plus sizes. Amazon therefore has some distance to go before its private-label plus-size offerings rival those of major department stores in terms of number of products offered.

To offer some comparison, our recent research on various department stores’ plus-size offerings found that 37% of jeans and 17% of dresses offered online by JCPenney were available in plus sizes. At Kohl’s, 26% of jeans and 16% of dresses offered online were stocked in plus sizes. Amazon therefore has some distance to go before its private-label plus-size offerings rival those of major department stores in terms of number of products offered.

US Retail Sales Post Biggest Gain in Six Months

(June 14) Reuters.com

US Retail Sales Post Biggest Gain in Six Months

(June 14) Reuters.com

Amazon Is Stacking Whole Foods with Execs to Weave It into Jeff Bezos’ Broader Vision

(June 14) CNBC.com

Amazon Is Stacking Whole Foods with Execs to Weave It into Jeff Bezos’ Broader Vision

(June 14) CNBC.com

GameStop Said It Is Considering Alternatives, Including a Sale of the Company

(June 19) DallasNews.com

GameStop Said It Is Considering Alternatives, Including a Sale of the Company

(June 19) DallasNews.com

Microsoft Reportedly in Talks with Walmart to Build Checkout-Free Stores Like Amazon Go

(June 14) Gizmodo.com

Microsoft Reportedly in Talks with Walmart to Build Checkout-Free Stores Like Amazon Go

(June 14) Gizmodo.com

Gap Names Former CEO of Billabong as New Head of Brand

(June 13) StarTribune.com

Gap Names Former CEO of Billabong as New Head of Brand

(June 13) StarTribune.com

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Debenhams Reports Continued Weakness, Prompting Profit Warning

(June 19) Company press release

Debenhams Reports Continued Weakness, Prompting Profit Warning

(June 19) Company press release

Poundworld Lays Off 98 Staff

(June 19) RetailGazette.co.uk

Poundworld Lays Off 98 Staff

(June 19) RetailGazette.co.uk

ASOS Bans Sale of Silk, Mohair and Cashmere Products on Its Site

(June 19) RetailGazette.co.uk

ASOS Bans Sale of Silk, Mohair and Cashmere Products on Its Site

(June 19) RetailGazette.co.uk

Back Market Raises Investment from Eurazeo and LVMH CEO

(June 14) RetailDetail.eu

Back Market Raises Investment from Eurazeo and LVMH CEO

(June 14) RetailDetail.eu

Toss, Korea’s Top Payment App, Raises $40 Million from Sequoia China and Singapore’s GIC

(June 18) TechCrunch.com

Toss, Korea’s Top Payment App, Raises $40 Million from Sequoia China and Singapore’s GIC

(June 18) TechCrunch.com

Razer Leads $3.3 Million Investment in Australia’s Esports Mogul

(June 18) TechCrunch.com

Razer Leads $3.3 Million Investment in Australia’s Esports Mogul

(June 18) TechCrunch.com

Google Makes $550 Million Strategic Investment in Chinese E-Commerce Firm JD.com

(June 18) TechCrunch.com

Google Makes $550 Million Strategic Investment in Chinese E-Commerce Firm JD.com

(June 18) TechCrunch.com

IBM’s New AI Supercomputer Can Argue, Rebut and Debate Humans

(June 19) SCMP.com

IBM’s New AI Supercomputer Can Argue, Rebut and Debate Humans

(June 19) SCMP.com

Google Ploughs Money into Brazil

(June 13) ZDNet.com

Google Ploughs Money into Brazil

(June 13) ZDNet.com

Brazilian PC Market Continues to Grow

(June 15) ZDNet.com

Brazilian PC Market Continues to Grow

(June 15) ZDNet.com

Napster Hires LatAm Head

(June 18) ZDNet.com

Napster Hires LatAm Head

(June 18) ZDNet.com

Amazon Looks to Brazil to Expand Its Hold on Beauty

(June 15) Pymnts.com

Amazon Looks to Brazil to Expand Its Hold on Beauty

(June 15) Pymnts.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/University of Michigan/UK Office for National Statistics/National Bureau of Statistics of China/Statistics Korea/Instituto Brasileiro de Geografia e Estatística/Banco Central do Brasil/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/University of Michigan/UK Office for National Statistics/National Bureau of Statistics of China/Statistics Korea/Instituto Brasileiro de Geografia e Estatística/Banco Central do Brasil/Coresight Research