From the Desk of Deborah Weinswig

It’s Been a Year Since Amazon Announced Its Intention to Acquire Whole Foods

This weekend will mark a year since Amazon announced its intention to acquire Whole Foods Market for $42 a share, its largest acquisition ever with an initial deal value of $13.7 billion. Amazon announced the deal on June 16 and closed it on August 28 last year.

Amazon kicked off its new ownership role with a bang, deploying banners in Whole Foods stores advertising its consumer electronics products, such as the Kindle and Echo, and slashing prices on some grocery items by as much as 43%. In November 2017, the company further cut prices on best-selling grocery items and staples that included organic turkeys for the holidays, eggs, bananas, steak and a slew of other organic products.

The acquisition sent shock waves through the grocery industry, unleashing a flurry of M&A activity and new partnerships. Much of this activity was centered on deals that would enable or enhance last-mile delivery. For example, Target acquired software company Grand Junction for an undisclosed amount in August 2017 and announced the acquisition of same-day delivery company Shipt in December 2017 for $550 million in cash. The Shipt acquisition, which has since closed, was one of Target’s largest acquisitions ever.

In a similar vein, Albertsons acquired meal-kit company Plated in September 2017 and Walmart acquired technology-based last-mile delivery service Parcel in October 2017. It is notable that all of these acquisitions took place in 2017, roughly falling in the interim between Amazon’s Whole Foods acquisition announcement and its completion of the deal.

Other retailers have expanded their relationship with same-day grocery delivery service Instacart, whose client list has grown by more than six times. Instacart now works with more than 200 supermarkets, including Costco, Sam’s Club, Albertsons and Sprouts Farmers Market.

The Amazon combination has been good for Whole Foods’ business. Since the acquisition, Whole Foods’ foot traffic has been up 3% every quarter, according to Thasos Group. United Natural Foods (UNFI), Whole Foods’ main distributor, recently reported an 11.8% increase in quarterly revenues, driven by a 24.3% sales increase to “supernatural” chains such as Whole Foods. In addition, Whole Foods stores have become hubs for Amazon’s Prime Now delivery program, which offers free two-hour delivery in 14 cities, including Baltimore, Boston, Philadelphia and Richmond, VA.

This year, Amazon released details of the integration of its Prime subscription program for Whole Foods customers. Prime members will receive an additional 10% discount on sale items, which typically include hundreds of products, plus weekly discounts on certain best-selling items. Amazon initially rolled out the program in Florida and plans to expand it to all Whole Foods locations nationwide this summer.

Yet Whole Foods is not Amazon’s only brick-and-mortar operation. Two more Amazon Books stores are scheduled to open this year, bringing the total to 18. Amazon is also reportedly planning to open two more of its Amazon Go automated stores, in Chicago. It opened its first Amazon Go to the public in Seattle in January of this year. Amazon is also accepting returns and operating smart-home stores-in-stores inside Kohl’s department stores. And it is stationing pickup lockers inside Whole Foods stores, which should help drive further foot traffic at the grocery chain.

Following an initial blitz after the acquisition closed, Amazon appears to have distilled a strategy to use its Whole Foods stores as distribution hubs for its same-day grocery service while offering benefits to Prime members. Those benefits entice even more customers to sign up for the Prime program, creating a virtuous circle for Amazon.

At the time of writing, we are about one month out from Amazon’s fourth Prime Day shopping festival, which took place on July 10, 2017. We estimate that it will fall on Monday, July 9, 2018. This year’s Prime Day will be the first one that includes Whole Foods as part of the Amazon portfolio, and we anticipate that the company will use its roughly 480 new grocery stores to promote and enhance the shopping holiday.

US RETAIL & TECH HEADLINES

Target Makes a Big Leap in the Delivery Wars Against Amazon, Walmart

(June 7) CNBC.com

Target Makes a Big Leap in the Delivery Wars Against Amazon, Walmart

(June 7) CNBC.com

- Target is now more than halfway through with its rollout of same-day delivery with Shipt and a curbside pickup service known as Drive Up. Its goal is to have the services available at the majority of Target stores before the holiday season.

- Starting this week, Chicago will become the first major US city to have access to both Shipt and Drive Up delivery service. By the end of the month, Target aims to offer same-day delivery in 135 markets across the US.

Amazon Go Cashierless Stores Coming to Willis Tower, Ogilvie

(June 7) ChicagoTribune.com

Amazon Go Cashierless Stores Coming to Willis Tower, Ogilvie

(June 7) ChicagoTribune.com

- Sources report that Amazon is planning to open Amazon Go cashierless stores in two Chicago locations: Willis Tower and the Ogilvie Transportation Center. Willis Tower sees 25,000 office workers and tourists visit each day, while the Ogilvie Transportation Center is one of Chicago’s largest transportation hubs.

- Seattle is currently home to the only active Amazon Go store. The stores are cashierless and use smartphone scanners, cameras and sensors to track purchases and charge customers.

Sticky Fingers Top Source of “Shrink” at US Retailers

(June 12) MCall.com

Sticky Fingers Top Source of “Shrink” at US Retailers

(June 12) MCall.com

- Criminal activity, along with bookkeeping errors, canceled out an average of 1.33% of sales in 2017 versus 1.44% in 2016, according to the National Retail Federation and the University of Florida.

- At the same time, six in 10 retailers said shrink was less of a problem last year versus four in 10 in 2016. For the years ahead, cybersecurity is a top concern and many retailers have introduced online incident response plans.

Walmart’s ModCloth Is Opening Retail Stores Across the US

(June 7) BusinessInsider.com

Walmart’s ModCloth Is Opening Retail Stores Across the US

(June 7) BusinessInsider.com

- ModCloth, the Walmart-owned clothing site, is opening brick-and-mortar stores in San Francisco, Los Angeles, New York and Washington, DC, after years of operating mostly online. Walmart purchased ModCloth for an estimated $50–$75 million last year.

- ModCloth seeks to eliminate online shoppers’ troubles with finding the right fit, allowing customers to try on clothes in the store and then order them online. Walmart has branded these new stores “FitShops.”

Amazon Expands Whole Foods Discounts to 10 States

(June 11) CNNMoney.com

Amazon Expands Whole Foods Discounts to 10 States

(June 11) CNNMoney.com

- Amazon recently announced that it will expand its Prime Whole Foods discount to 10 more states, bringing the total number of states in which the discount is available to 23. The announcement closely follows Amazon’s introduction of the discount at the end of May.

- Shoppers using the Amazon Prime Visa credit card will receive a 5% discount on Whole Foods purchases, while Prime members will also be given an additional 10% off sale items and access to rotating deals in the store.

US Retailers and ATM Networks Join Forces to Improve Payments Security

(June 8) Retail-Business-Review.com

US Retailers and ATM Networks Join Forces to Improve Payments Security

(June 8) Retail-Business-Review.com

- The National Retail Federation, other retail groups and two ATM networks in the US have formed a new coalition intended to boost the security of the country’s electronic payments system.

- The group will emphasize several priority areas, including stronger user authentication, open standards setting, payment security innovation and network routing competition. The coalition will also focus on consumer expectations for security, convenience and flexibility in payment options.

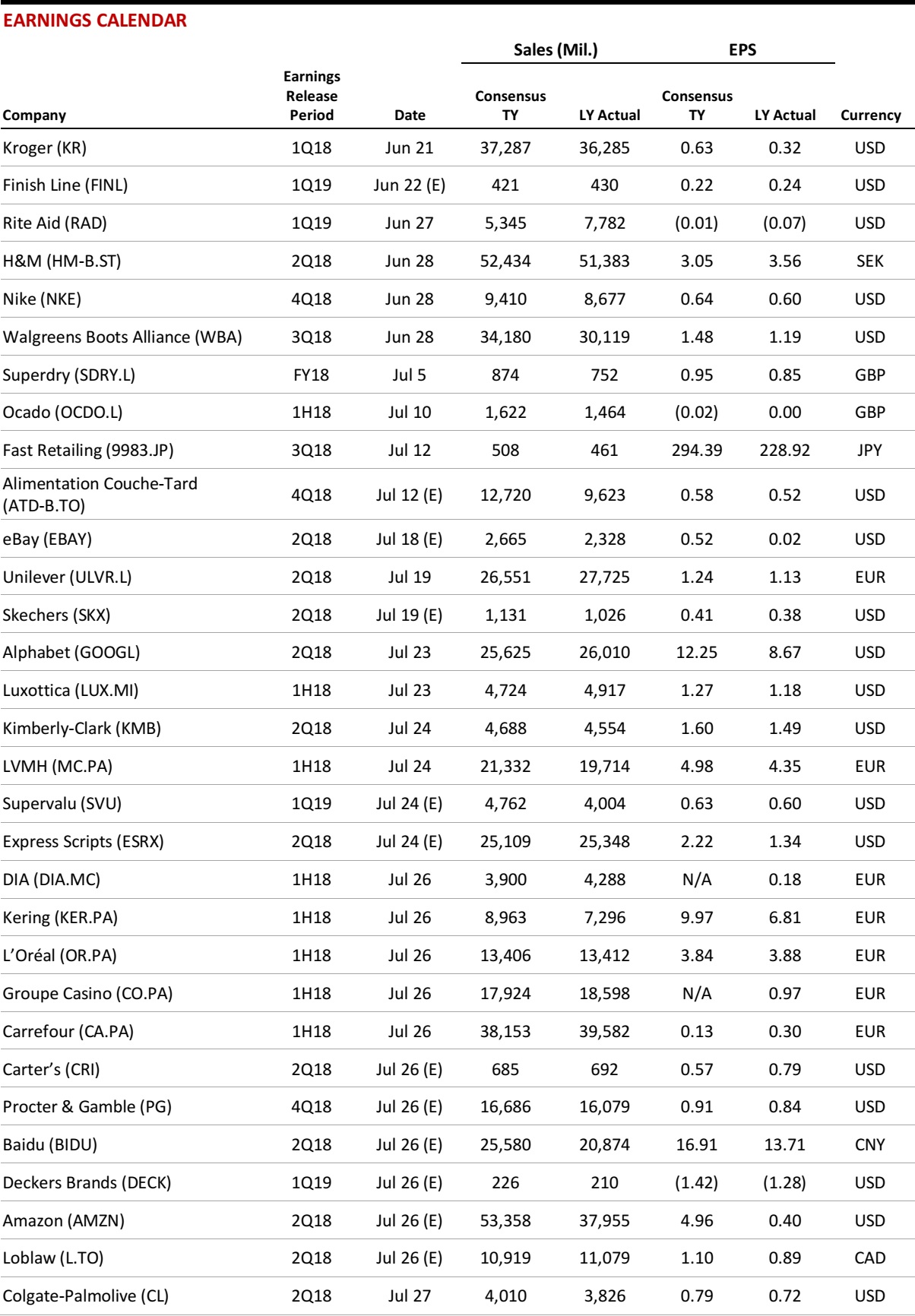

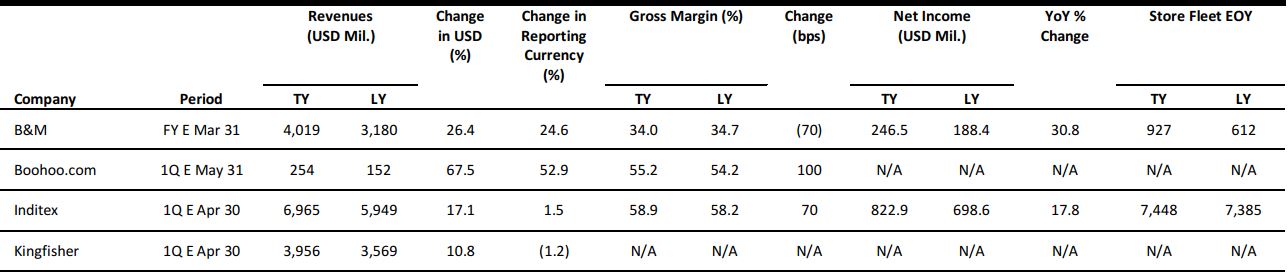

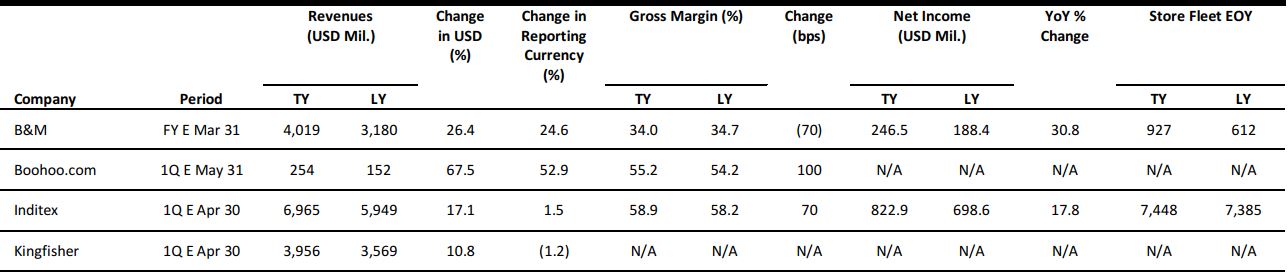

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research

ROPE RETAIL & TECH HEADLINES

Struggling New Look Stumbles into Operating Los

(June 12) Company press release

Struggling New Look Stumbles into Operating Los

(June 12) Company press release

- British fashion retailer New Look reported a revenue decline of 7.3%, to £1.3 billion ($1.8 billion), in the year ended March 24, even as a turnaround plan is under way. New Look brand comps were down 11.4% and UK comps were down 11.7%.

- During the year, New Look’s operating loss totaled £74.3 million ($98.3 million), compared with an operating profit of £76.4 million ($100.2 million) in FY17. Executive Chairman Alistair McGeorge implicated “a well-documented combination of external and self-inflicted issues” in the company’s performance.

Carrefour Partners with Google to Innovate on New Shopping Experiences in France

(June 11) Company press release

Carrefour Partners with Google to Innovate on New Shopping Experiences in France

(June 11) Company press release

- French retail group Carrefour has partnered with tech giant Google to allow customers in France to shop for Carrefour products across Google’s platforms, which include Google Assistant, Google Home and the Google Shopping website. The integrated shopping experience is expected to launch in early 2019.

- Carrefour and Google are also opening an innovation lab in Paris this summer, which will see the retailer’s engineers collaborate with Google Cloud AI experts to create new customer experiences. Carrefour will also leverage Google’s G Suite productivity tools and expertise to accelerate its digital transformation.

Groupe Casino to Divest €1.5 Billion Worth of Assets

(June 12) Company press release

Groupe Casino to Divest €1.5 Billion Worth of Assets

(June 12) Company press release

- French retailer Groupe Casino announced plans to dispose of noncore assets, including real estate, worth an estimated €1.3 billion ($1.5 billion). Half of the disposals will be completed in 2018 and the remaining in early 2019, the retailer said.

- The firm stated that the offloading of these assets complements the ongoing disposal of Via Varejo in Brazil, and that the disposals, along with Casino’s self-financed reduction in debt, should help reduce its net debt in France by €1 billion ($1.18 billion) by the end of 2018.

Poundworld Enters Administration

(June 12) TheRetailBulletin.com

Poundworld Enters Administration

(June 12) TheRetailBulletin.com

- British value retailer Poundworld has entered administration, placing more than 5,000 jobs at risk. Poundworld operates 335 stores across the UK.

- Deloitte has been appointed to oversee administration proceedings after talks failed with potential buyer Rcapital.

Peas&Love Secures Funds of €1.2 Million to Develop Rooftop Urban Farms

(June 7) RetailDetail.eu

Peas&Love Secures Funds of €1.2 Million to Develop Rooftop Urban Farms

(June 7) RetailDetail.eu

- Belgian startup Peas&Love has secured funds of €1.2 million ($1.4 million) to develop 150 urban farming projects on rooftops in 12 European regions over the next five years.

- The startup currently operates four such farms across 600 plots on the rooftops of the Cameleon shopping center and the World Trade Center in Brussels and a hotel and bank BNP Paribas Fortis’s headquarters in Paris.

ASIA RETAIL & TECH HEADLINES

Rakuten to Acquire M-Commerce Startup Curbside

(June 8) TechCrunch.com

Rakuten to Acquire M-Commerce Startup Curbside

(June 8) TechCrunch.com

- Japanese e-commerce giant Rakuten is set to acquire Curbside, a Silicon Valley startup specializing in mobile ordering and curbside pickup. Neither firm disclosed details of the all-cash deal.

- Curbside was founded in 2013 and had previously raised $40–$50 million from several investors, including CVS, Index Ventures, Qualcomm Ventures and others.

Alibaba Gives Digital Makeover to 100 RT-Mart Stores with “New Retail” Infrastructure

(June 12) RetailNews.Asia

Alibaba Gives Digital Makeover to 100 RT-Mart Stores with “New Retail” Infrastructure

(June 12) RetailNews.Asia

- Alibaba announced that it is equipping 100 RT-Mart hypermarkets, operated by Sun Art Retail Group, with its “New Retail” infrastructure, which will offer store operators customer insights and supply chain management, smart logistics and electronic payment capabilities.

- The digitalization will enable customers to access a wider variety of products and services and benefit from a frictionless shopping experience whether they are buying through the Taobao app or shopping at a physical store.

Mercari to Raise Up to $1.2 Billion in IPO to Expand Overseas

(June 11) Reuters.com

Mercari to Raise Up to $1.2 Billion in IPO to Expand Overseas

(June 11) Reuters.com

- Japanese online flea market Mercari is looking to raise $1.2 billion in an IPO in a bid to expand overseas and replicate its domestic success in foreign markets. Mercari stated in a regulatory filing that the IPO was priced at ¥3,000 ($27.29) per share, valuing it around $3.7 billion.

- The company is expected to list on June 19 on the “market of the high-growth and emerging stocks” section, commonly called the Mothers market, of the Tokyo Stock Exchange.

Indiegogo Expands Efforts to Bring Chinese Startups to a Global Audience

(June 6) TechCrunch.com

Indiegogo Expands Efforts to Bring Chinese Startups to a Global Audience

(June 6) TechCrunch.com

- International crowdfunding firm Indiegogo has stepped up its efforts to bring Chinese startups to a global audience by launching the Indiegogo China Global Fast-Track Program, after running a pilot program in China over the last couple of years.

- The dedicated program will help provide Chinese firms with guidance on crowdfunding and marketing in the US and other countries as well as access to a network of retailers, marketing firms, Indiegogo manufacturer partner Arrow Electronics and Indiegogo shipping partner Ingram Micro.

LATAM RETAIL & TECH HEADLINES

E-Commerce Startup FailBox Gains Market Share Following Support from Investors

(June 11) Informador.mx

E-Commerce Startup FailBox Gains Market Share Following Support from Investors

(June 11) Informador.mx

- E-commerce startup FailBox strengthened its business thanks to a boost in popularity among suppliers following its participation in the Shark Tank México TV show, during which entrepreneurs Carlos Bremer and Arturo Elías Ayub promised to invest in the company.

- FailBox sells products with damaged packaging at a discount of up to 70%. The products are new and within their warranty period, but, because of the damaged packaging, cannot be sold by the original retailer.

Zonamerica to Open a Tech Campus in Cali, Colombia

(June 9) Latam.Tech

Zonamerica to Open a Tech Campus in Cali, Colombia

(June 9) Latam.Tech

- Uruguayan workspaces operator Zonamerica will open a new tech campus in Cali, Colombia, in August 2019. The campus will host companies with a strong focus on innovation and technology.

- The Cali campus will be the first facility of its kind in Colombia. The space will offer companies services such as cloud storage, virtual desks, IT security and rentable workstations. Zonamerica already operates a similar facility in Montevideo, Uruguay.

Startup Farm and Banco do Brasil Collaborate to Boost Fintech

(June 7) Dci.com.br

Startup Farm and Banco do Brasil Collaborate to Boost Fintech

(June 7) Dci.com.br

- Startup accelerator Startup Farm and Brazilian bank Banco do Brasil announced that they are creating a partnership aimed at fostering fintech startups in Brazil.

- Startup Farm will help Banco do Brasil develop relationships with fintech startups that will work with the bank to create tech-driven innovations in financial services.

Huawei Announces a Deal with Positivo Tecnologia for Its Brazil Comeback

(June 6) BNAmericas.com

Huawei Announces a Deal with Positivo Tecnologia for Its Brazil Comeback

(June 6) BNAmericas.com

- Chinese information technology company Huawei announced an agreement with Brazilian electronics manufacturer Positivo Tecnologia that will enable the sale of Huawei’s smartphones in the Brazilian market. Huawei’s phones are expected to return to the Brazilian retail market during the third quarter of 2018.

- Positivo Tecnologia will be responsible for the marketing and retail sale of Huawei’s smartphones, which will be imported from China. Huawei stopped selling smartphones in Brazil for about four years in the wake of fiscal and competitive issues.

MACRO UPDATE

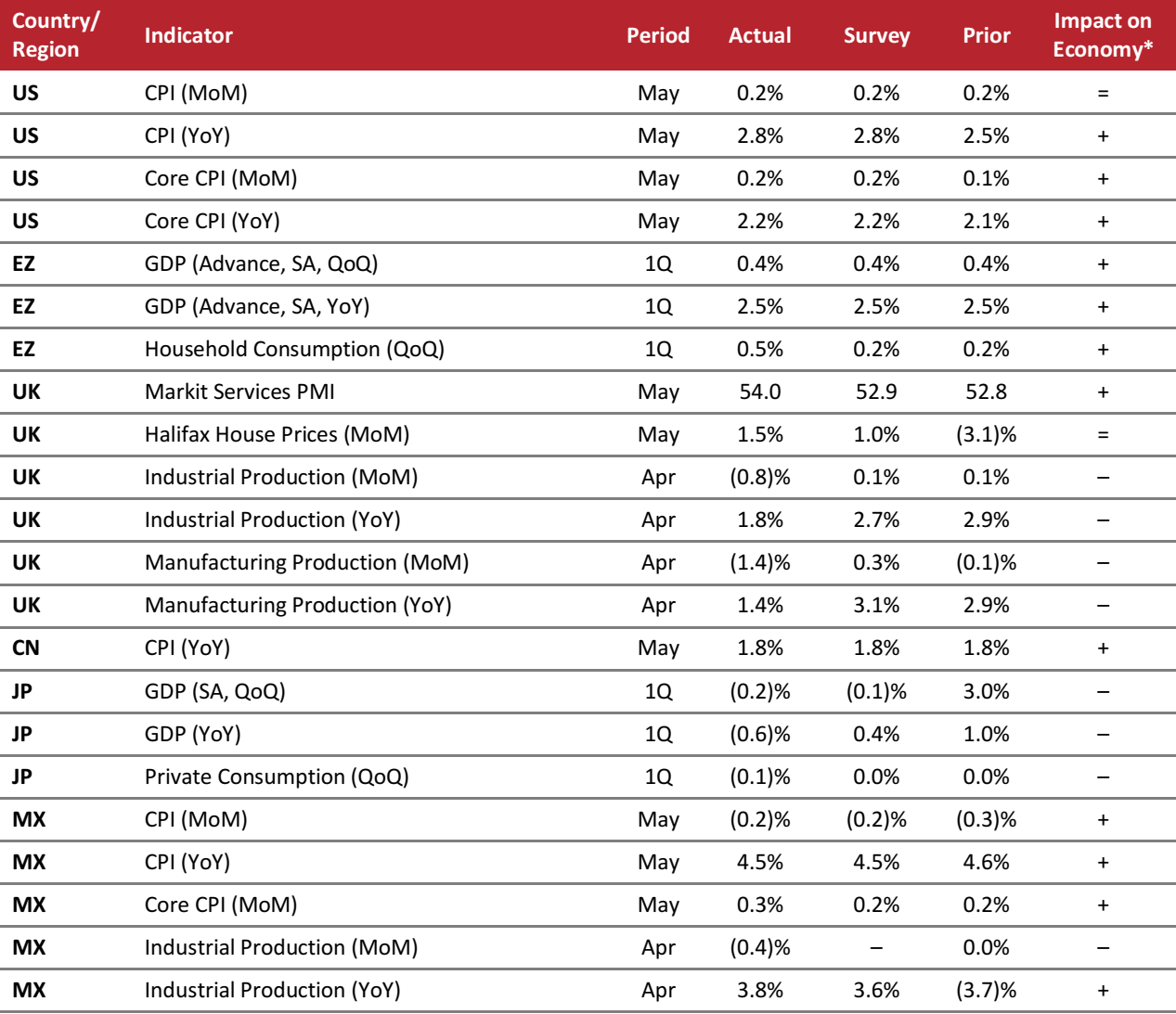

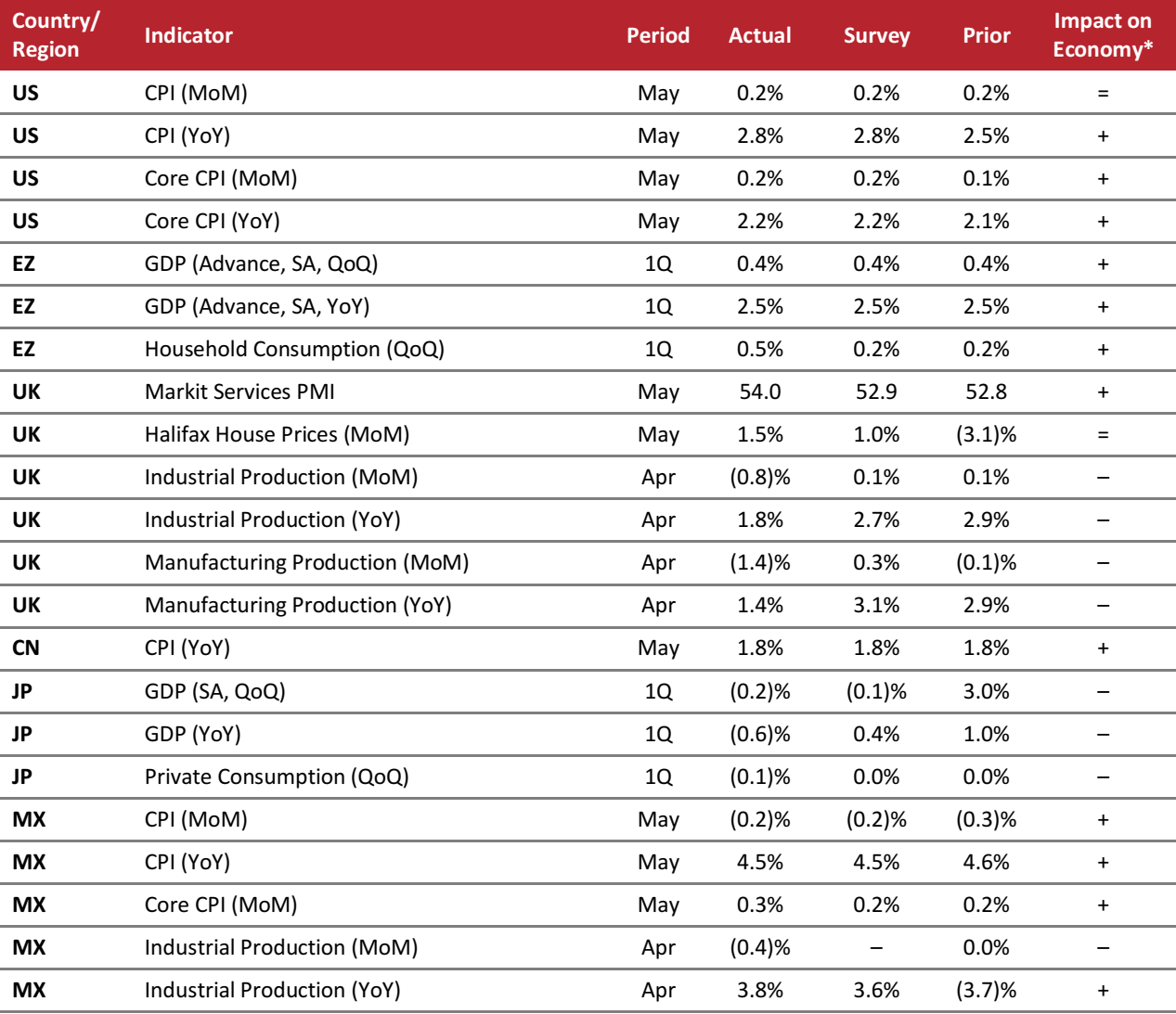

Key points from global macro indicators released June 6–12, 2018:

- US: The Consumer Price Index (CPI) increased by 0.2% month over month in May. The core CPI rose by 2.2% year over year in May, its largest rise since February 2017 and following a 2.1% increase in April.

- Europe: In the eurozone, GDP rose by 0.4% quarter over quarter and by 2.5% year over year in the first quarter. In the UK, the Services Purchasing Managers’ Index (PMI) rose to a three-month high of 54.0 in May after registering 52.8 in April.

- Asia-Pacific: In China, the CPI increased by 1.8% year over year in May; the increase was the same as April’s and in line with analysts’ expectations. In Japan, first-quarter GDP was revised down to an annualized 0.6% drop.

- Latin America: In Mexico, industrial output fell by 0.4% in April from the previous month, driven by decreases in production from the manufacturing sector. On a year-over-year basis in April, industrial output was up 3.8% in Mexico.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/US Bureau of Economic Analysis/US Bureau of Labor Statistics/Eurostat/Markit/China Federation of Logistics and Purchasing/Japan Ministry of Economy, Trade and Industry/Instituto Nacional de Estadística y Geografía/Coresight Research

Target Makes a Big Leap in the Delivery Wars Against Amazon, Walmart

(June 7) CNBC.com

Target Makes a Big Leap in the Delivery Wars Against Amazon, Walmart

(June 7) CNBC.com

Sticky Fingers Top Source of “Shrink” at US Retailers

(June 12) MCall.com

Sticky Fingers Top Source of “Shrink” at US Retailers

(June 12) MCall.com

US Retailers and ATM Networks Join Forces to Improve Payments Security

(June 8) Retail-Business-Review.com

US Retailers and ATM Networks Join Forces to Improve Payments Security

(June 8) Retail-Business-Review.com

Source: Company reports/Coresight Research

Source: Company reports/Coresight Research Carrefour Partners with Google to Innovate on New Shopping Experiences in France

(June 11) Company press release

Carrefour Partners with Google to Innovate on New Shopping Experiences in France

(June 11) Company press release

Poundworld Enters Administration

(June 12) TheRetailBulletin.com

Poundworld Enters Administration

(June 12) TheRetailBulletin.com

Peas&Love Secures Funds of €1.2 Million to Develop Rooftop Urban Farms

(June 7) RetailDetail.eu

Peas&Love Secures Funds of €1.2 Million to Develop Rooftop Urban Farms

(June 7) RetailDetail.eu

Alibaba Gives Digital Makeover to 100 RT-Mart Stores with “New Retail” Infrastructure

(June 12) RetailNews.Asia

Alibaba Gives Digital Makeover to 100 RT-Mart Stores with “New Retail” Infrastructure

(June 12) RetailNews.Asia