From the Desk of Deborah Weinswig

Amazon Primed to Shine the Spotlight on Its Private-Label Offerings During Prime Day This Year

Amazon officially announced this week that this year’s Prime Day event will last for 36 hours, beginning at 12 p.m., PDT (3 p.m., EDT), on Monday, July 16, and running through July 17. Last year, the company proclaimed that Prime Day was “too big for 24 hours” and gave Prime members 30 hours in which to shop. This year’s shopping holiday will last even longer and feature more than 1 million deals worldwide.

In 2017, Prime Day sales hit an estimated $1 billion, according to Cowen and Company; other research firms estimate that Amazon's global Prime Day sales were well over $2 billion last year. Amazon commented that it had added tens of millions of Prime members during the shopping holiday. Amazon said that the event grew by more than 60% compared with the same 30 hours in 2016 and we estimate that, this year, sales could grow by around 40%.

Previous years’ Prime Days focused heavily on Amazon-branded consumer electronics, such as Kindle e-readers, Fire tablets, Echo intelligent electronic devices and Fire TV hardware. This year’s lineup includes a $120 Fire TV cube that enables users to find programs and change channels via voice command.

This year, Amazon is approaching Prime Day with an expanded portfolio of private-label brands across apparel, household goods and consumer goods. Amazon offers nearly 80 brands of its own, up from nearly 40 last year, according to news website Business Insider. Top-selling brands include Mama Bear (diapers and baby products), Basic Care (over-the-counter medicines), Presto (household cleaning products), Solimo (personal care products as well as coffee) and Wag (dog food), according to e-commerce data firm One Click Retail.

The Solimo private label was just launched in June, but its light roast coffee pods (compatible with K-Cup coffeemakers) have already earned the mysterious “Amazon’s Choice” badge. Products designated with the “Amazon’s Choice” label feature low returns and high customer ratings, and they are more popular than other items.

Clearly, Amazon’s size and its status as the first place consumers often go to search for products online give it enormous power to suggest its own products—which are likely higher-margin—first to consumers. For example, if a consumer tells her Alexa intelligent assistant to “buy batteries,” the default selection is the company’s own AmazonBasics batteries.

The AmazonBasics brand extends well beyond batteries, offering products as diverse as LED light bulbs, luggage, office furniture, kitchen equipment, bedding and computer equipment. The Amazon Essentials brand includes men’s shirts, pants, underwear, outerwear and activewear, as well as clothing for women, girls and boys. It is notable that Amazon markets some of its private labels—such as AmazonBasics and Amazon Essentials—under its own name, but not all of them. The company’s Lark & Ro (women’s clothing) and Franklin & Freeman (men’s shoes) brands, for example, do not employ the Amazon name. Separately, Amazon has been targeting deals in its Whole Foods grocery stores to just “Prime” members, apparently distancing the stores from the Amazon name.

Many of Amazon’s house labels have become major national brands in their own right. AmazonBasics has already taken a third of the online market for batteries, eclipsing both Energizer and Duracell, according to a recent

New York Times article. And Amazon’s private-label sales could reach $25 billion by 2025, up from an estimated $7.5 billion this year, according to SunTrust.

Prime Day is a tool to encourage more consumers to sign up for Prime subscriptions. Subscribers, in turn, receive more deals and additional services, which encourages them to keep the service, creating a virtuous circle for Amazon. Moreover, many services, such as one- to two-hour delivery and the ability to order from Echo devices, are offered exclusively to Prime members. In its shareholders’ letter this April, Amazon disclosed that the number of Prime members had exceeded 100 million.

This year, Amazon announced that its 1 million plus Prime Day deals worldwide will include TVs, smart home devices, kitchen items, groceries, toys, fashion, furniture, appliances, back-to-school supplies and everyday staples. The company is promising hundreds of limited-edition, exclusive items, as well as new product and content launches. In addition, Prime members will enjoy special discounts at Whole Foods stores during Prime Day, in addition to the 10% discount they already receive at the grocery chain.

We’ll be following Prime Day developments leading up to the shopping holiday and all the way through the 36-hour event, as well as offering post–Prime Day coverage.

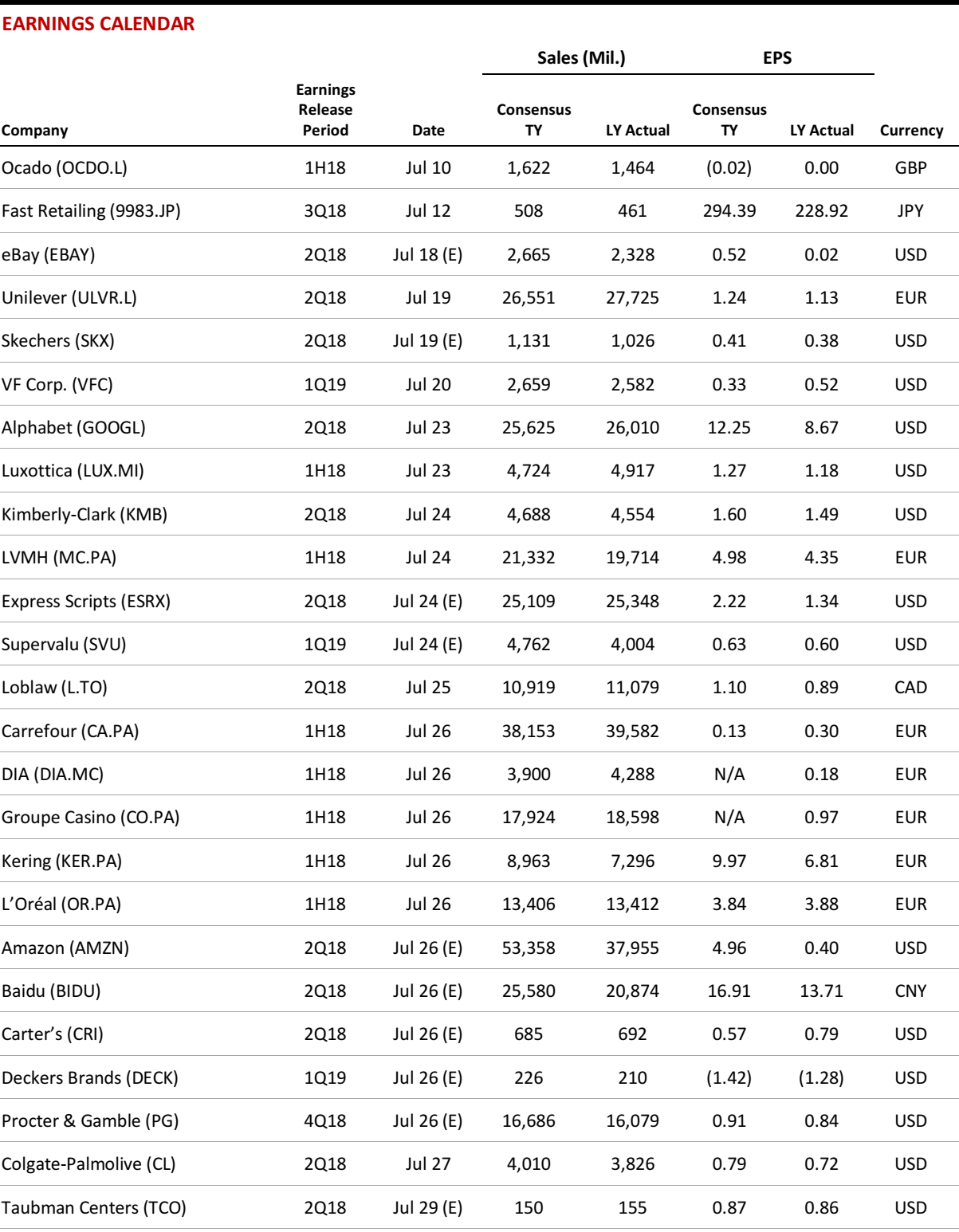

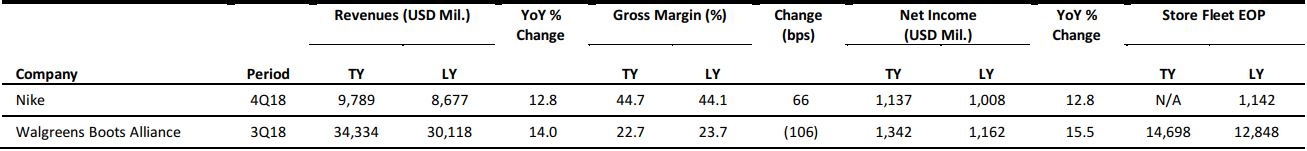

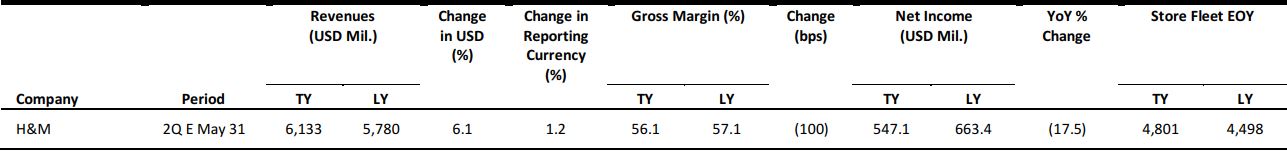

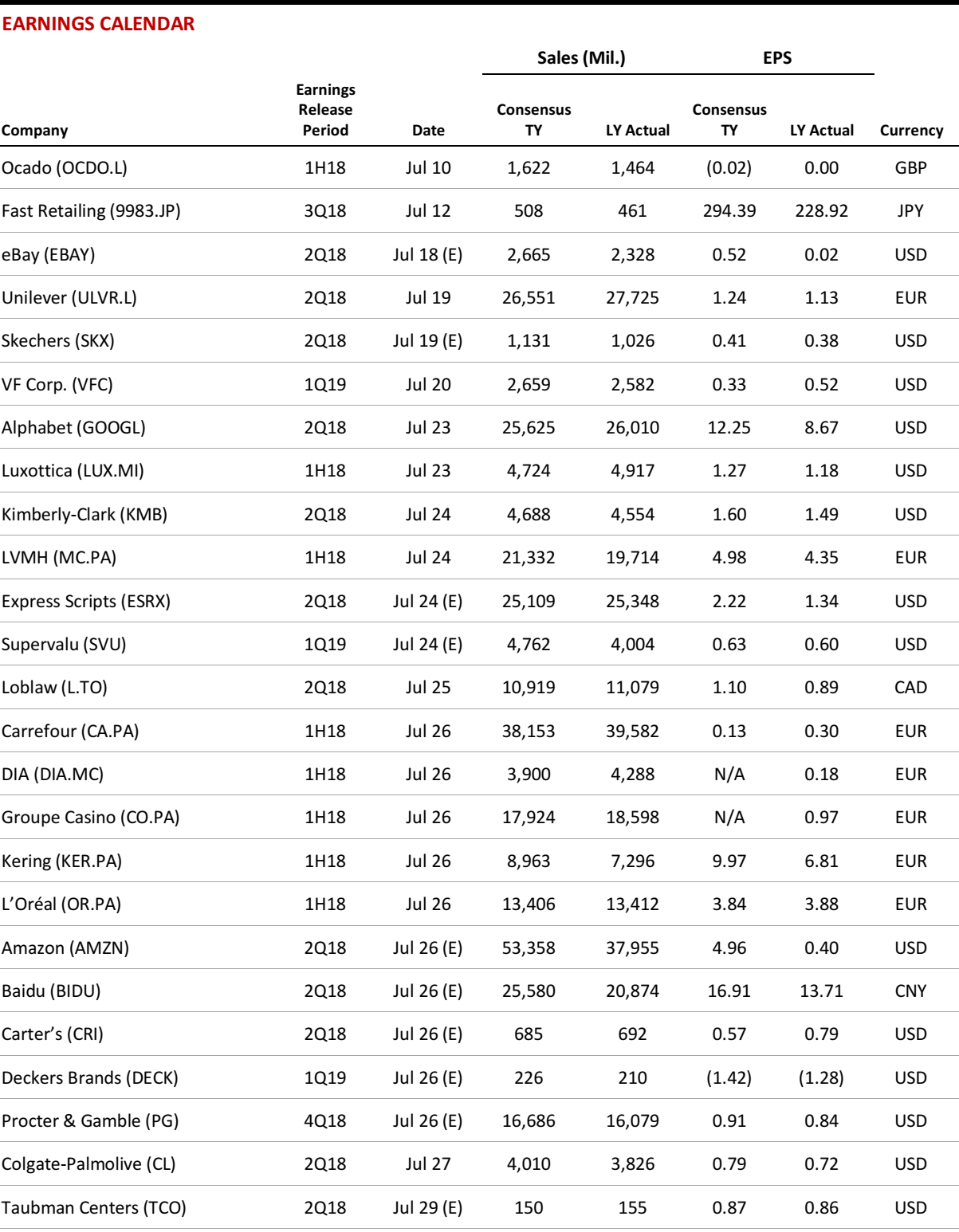

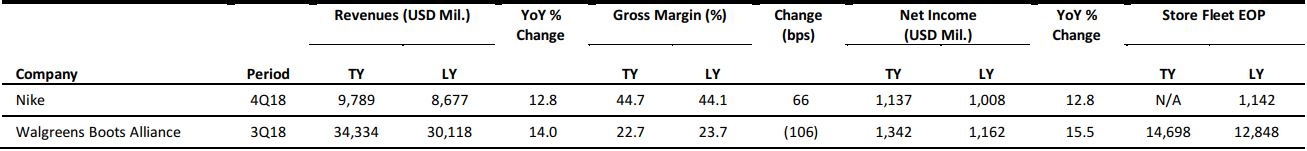

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

27% of Apparel Sales Are Now Online

(July 2) RetailDive.com

27% of Apparel Sales Are Now Online

(July 2) RetailDive.com

- Online apparel sales accounted for 27.4% of overall US apparel sales last year, up from 23.5% in 2016 and 20.7% in 2015, according to the most recent Internet Retailer Online Apparel Report, published last week.

- Many consumers say that they like buying apparel online: 43.2% of respondents to a February survey of 2,535 US consumers by Pymnts.com said that they prefer to shop for clothing in stores, while 26.9% said that they prefer to shop only online and 29.9% said that they prefer to shop both.

How to Make Piles of Money Using Instagram

(July 2) Bloomberg.com

How to Make Piles of Money Using Instagram

(July 2) Bloomberg.com

- Once, Instagram was a simple photo-sharing app, a way for iPhone shutterbugs to show off their latest cool pics. Now, its visual nature and 1 billion active users have sellers salivating over its potential as a place to sell everything from dresses to furniture.

- Smaller businesses are the ones that have found creative ways to hawk their wares on social. Young entrepreneurs are starting online stores that use Instagram to funnel shoppers to their websites. Vintage clothing retailers post outfits and reward the first commenter with permission to buy each one-of-a-kind item, creating a mad dash for dresses and pumps. If you’re too slow, it’s gone forever.

Retail Reset: Sharpening the Sharper Image Brand

(July 2) Pymnts.com

Retail Reset: Sharpening the Sharper Image Brand

(July 2) Pymnts.com

- Anyone who shopped at a mall in the 1980s or 1990s—particularly with their dad (or, really, anyone’s dad)—likely enjoys a twinge of nostalgia anytime they hear the words “The Sharper Image.”

- ThreeSixty Group bought The Sharper Image brand in December 2016, at a time when the brand had been going through “some issues” adapting to a retail environment that saw fewer and fewer consumers heading to the mall. With the brand’s reset, its focus has moved to distributing its widening array of branded offerings through large-scale store channels, expanding its licensing agreements and thinking beyond the mall when it comes to serving up the old-school “Sharper Image experience.”

Amazon Prime Has Invaded Whole Foods Stores, but an Important Word Is Notably Absent

(June 30) BusinessInsider.com

Amazon Prime Has Invaded Whole Foods Stores, but an Important Word Is Notably Absent

(June 30) BusinessInsider.com

- Amazon has officially left its mark on Whole Foods stores—though not with its name. Discounts for Amazon Prime members have now rolled out to all Whole Foods stores across the country. The in-store signage is plentiful and immediately apparent.

- But one thing is missing: the word “Amazon.” The new deals in Whole Foods are specifically called “Prime deals,” not “Amazon Prime deals.” None of the signage or materials mention Amazon, and there’s no orange—Amazon’s usual color—as Prime’s blue hue instead takes on a dominant role.

700 Empty Toys“R”Us Stores. Who’s Going to Fill Them?

(June 28) CNNMoney.com

700 Empty Toys“R”Us Stores. Who’s Going to Fill Them?

(June 28) CNNMoney.com

- Toys“R”Us will leave 700 empty stores across the US, but many of those will soon be occupied. Despite the flood of store closings in recent years and the growth of online shopping, many retailers are looking to add brick-and-mortar locations.

- Party City has already announced plans to lease 50 empty Toys“R”Us locations this fall for use as Halloween and Christmas stores. The company doesn’t plan to sign long-term leases. But some other retailers are looking for permanent homes.

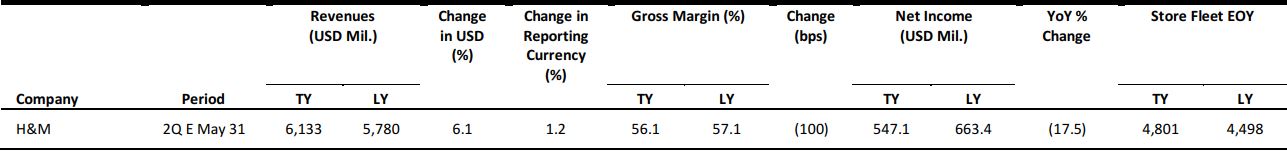

EUROPE RETAIL EARNINGS

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

Adam Crozier Appointed Chairman of ASOS

(July 3) Company press release

Adam Crozier Appointed Chairman of ASOS

(July 3) Company press release

- British online fashion retailer ASOS has announced that Adam Crozier will be its next Chairman. Crozier will step into the role on November 29, and will succeed Brian McBride, who led the company for six years.

- Crozier is currently a director of Whitbread, Vue International and Stage Entertainment and he previously served as a director at Saatchi & Saatchi, G4S, Royal Mail and, most recently, ITV, where he was also CEO.

Carrefour to Create Long-Term Strategic Alliance with Tesco

(July 2) Company press release

Carrefour to Create Long-Term Strategic Alliance with Tesco

(July 2) Company press release

- French retailer Carrefour has announced a strategic alliance with British grocery retailer Tesco. The alliance is expected to be formalized in the next two months and will be aimed at improving price competitiveness and product quality.

- The companies will work on jointly purchasing own-brand products and products not for resale from global suppliers.

Retailers Look to Cash in on New Look’s Retail Stores

(July 3) DrapersOnline.com

Retailers Look to Cash in on New Look’s Retail Stores

(July 3) DrapersOnline.com

- Retailers such as Sports Direct and Mountain Warehouse are keen on occupying New Look stores that are under threat of lower rents under the terms of New Look’s company voluntary arrangement (CVA). JD Sports and Iceland have already signed up to take over some of the fashion retailer’s stores.

- Under the terms of the CVA, landlords are subject to rent cuts of up to 60%, prompting them to negotiate with rival tenants to lease the stores and ease the impact of the cuts.

Groupe Casino Announces a Set of Next-Generation Purchasing Platforms Called Horizon

(June 28) Company press release

Groupe Casino Announces a Set of Next-Generation Purchasing Platforms Called Horizon

(June 28) Company press release

- French retailer Groupe Casino has concluded several agreements with Auchan Retail, Metro and Schiever Group to form a set of purchasing alliances called Horizon. The alliances will pave the way for negotiations that are not transactional, but rather collaborative and innovative.

- In France, the alliance members will jointly negotiate purchases with the main manufacturers of national brands and launch invitations to tender for their general expenses and basic private-label brands.

Administrators Hit Back at Poundworld Founder’s Accusations

(July 3) RetailGazette.co.uk

Administrators Hit Back at Poundworld Founder’s Accusations

(July 3) RetailGazette.co.uk

- Administrators of Poundworld have hit back at accusations by the retailer’s founder, Chris Edwards, that the process to save the British retailer “has been handled badly.” Edwards stated that his team was allowed access to Poundworld’s headquarters only in the last few days, despite having contacted administrators from Deloitte four weeks ago.

- Deloitte responded that it has yet to receive suitable bids and that it is still looking for a buyer “of all or parts of the business.” Some 5,100 jobs are expected to be at risk. Edwards believes that 3,000 can be saved if the administration process is carried out promptly.

ASIA RETAIL & TECH HEADLINES

India’s Cashify Raises $12 Million for Its Secondhand Smartphone Business

(June 29) TechCrunch.com

India’s Cashify Raises $12 Million for Its Secondhand Smartphone Business

(June 29) TechCrunch.com

- Cashify, a company that buys and sells used smartphones, is the latest Indian startup to raise capital from Chinese investors. The company announced a $12 million series C round led by Chinese funds CDH Investments and Morningside. Cashify gives consumers a fast way to sell their electronics; it deals mainly in smartphones, but also takes laptops, consoles, TVs and tablets.

- Sellers fill out some details online about their device, then Cashify dispatches a representative to the seller’s home to perform diagnostic checks and pay cash for the device that day. The startup also offers an app that automatically carries out the checks. Cashify offers a higher cash payment for sellers that use the app since it requires fewer of the company’s resources.

HTC Is Firing 25% of Its Staff to Cut Costs Once Again

(July 2) TechCrunch.com

HTC Is Firing 25% of Its Staff to Cut Costs Once Again

(July 2) TechCrunch.com

- Smartphone maker HTC continues to struggle. After offloading 2,000 engineers to Google as part of a $1.1 billion deal with the search giant, HTC is now laying off 1,500 staff, or nearly one-quarter of its total headcount, to cut more costs, according to Reuters.

- The cuts will be completed before October and they are said to be part of a move to centralize the leadership of HTC’s smartphone and Vive VR business. The layoffs follow another poor quarter for the company: in its first-quarter results, HTC posted a NT$5.2 billion ($170 million) operating loss as revenue dropped by 40% year over year, to NT$8.8 billion ($290 million), during the three-month period.

Chinese E-Commerce Player Pinduoduo Files for $1 Billion US Initial Public Offering

(July 2) SCMP.com

Chinese E-Commerce Player Pinduoduo Files for $1 Billion US Initial Public Offering

(July 2) SCMP.com

- Chinese e-commerce service provider Pinduoduo (PDD) is planning to raise at least $1 billion in a US IPO as it fights for market share against giants such as Alibaba. The company was founded by former Google engineer Colin Huang and counts Tencent and Sequoia Capital China as backers.

- PDD has become one of the fastest-growing startups in China by creating a sort of Facebook-Groupon mash-up, where people spot deals on products such as fruit, clothes or toilet paper, and then recruit friends to buy the items at a discount. It offers merchandise at up to 20% less than market price by letting consumers buy directly from manufacturers, cutting out middlemen, advertising and acquisition costs.

Tencent’s WeChat Widens Service Fee for Users of “Card Repay” Feature in Digital Wallet

(July 2) SCMP.com

Tencent’s WeChat Widens Service Fee for Users of “Card Repay” Feature in Digital Wallet

(July 2) SCMP.com

- WeChat, China’s largest social platform, which has around 1 billion users, will expand fees for users who pay their credit card bills via the “card repay” service within WeChat Wallet, bringing the era of free services for mobile payments closer to an end.

- WeChat, which is operated by Chinese Internet giant Tencent, will begin charging a fee of 0.1% on credit card repayment amounts beginning August 1. However, the service will remain free for customers with platinum and gold credit cards and for those who save a monthly fixed amount above ¥500 ($75) in the “Love Investment Plan,” a finance product offered by Tencent.

LATAM RETAIL & TECH HEADLINES

AWS Hires New Country Director for Brazil

(June 25) ZDNet.com

AWS Hires New Country Director for Brazil

(June 25) ZDNet.com

- Amazon Web Services (AWS) has hired Cleber Morais as the new Country Director for its Brazil operations. Morais previously led Schneider Electric’s Brazil operations, and he has held other senior roles at Avaya and Bematech during his 30-year career.

- Morais has taken over the role from José Nilo Cruz Martins, who now leads Strategy and Operations for AWS in Latin America.

Tablet Market Sees Revenue Growth in Brazil

(July 2) ZDNet.com

Tablet Market Sees Revenue Growth in Brazil

(July 2) ZDNet.com

- According to figures from market intelligence firm IDC, tablet device revenue in Brazil increased in the first quarter of 2018. Revenue from tablet sales reached R$403 million ($103 million) in the first quarter of 2018, versus R$363 million ($92 million) in the prior-year quarter. The average ticket rose to R$525 ($134) from R$473 ($120) over the 12-month period.

- Some 768,000 tablets were sold in the country during the quarter. While that figure represents only a 0.1% year-over-year increase in the number of units sold, manufacturers earned much more in the quarter because the devices have become pricier, according to IDC.

Users Ages 35–44 Account for the Largest Share of Online Pharmacy Purchases in Brazil

(July 2) ECommerceNews.com.br

Users Ages 35–44 Account for the Largest Share of Online Pharmacy Purchases in Brazil

(July 2) ECommerceNews.com.br

- Brazil’s Farmácias APP researched purchases made on its platform in the first quarter of 2018, and found that the Brazilian consumers who are most willing to purchase medications, toiletries, beauty products and perfumes over the Internet do not tend to be the youngest.

- The company found that people ages 35–44 were responsible for 62% of the transactions, while those ages 25–34 were responsible for just 21%, a dynamic that differs from most digital platforms, where younger consumers tend to account for more purchases.

E-Commerce Should Generate R$37.9 Billion in the Second Half of the Year in Brazil

(July 2) ECommerceNews.com.br

E-Commerce Should Generate R$37.9 Billion in the Second Half of the Year in Brazil

(July 2) ECommerceNews.com.br

- E-commerce should generate R$37.9 billion ($9.74 billion) in the second half of the year in Brazil, according to estimates from the Brazilian Association of Electronic Commerce (ABComm). If the forecast materializes, it will represent 15% year over year growth.

- ABComm estimates that the average ticket in the second half will reach R$310.00 ($80) and that e-commerce orders will total 122 million. The second semester tends to be busier in Brazil because of seasonally important retail dates such as Black Friday, Christmas and Father’s Day.

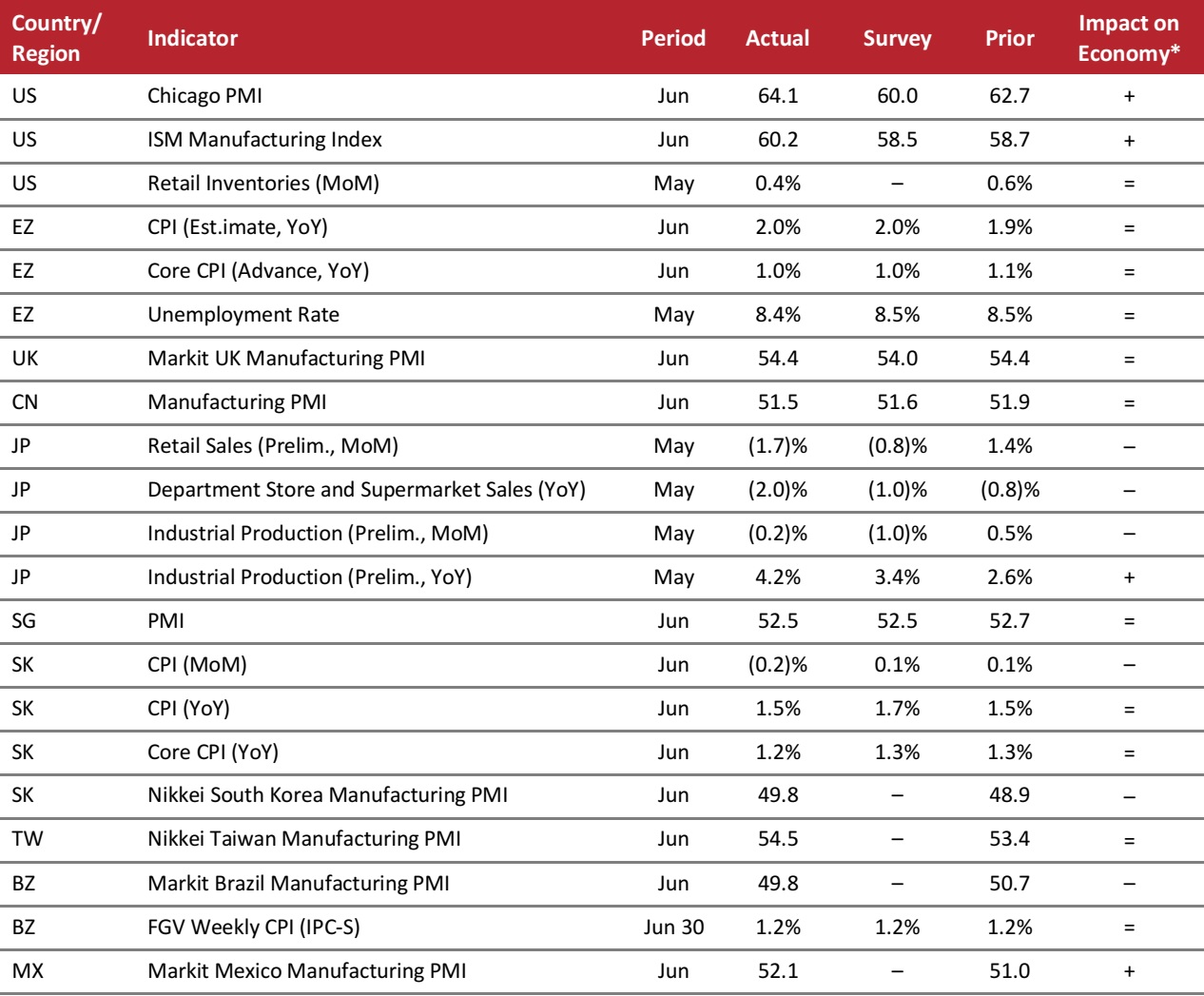

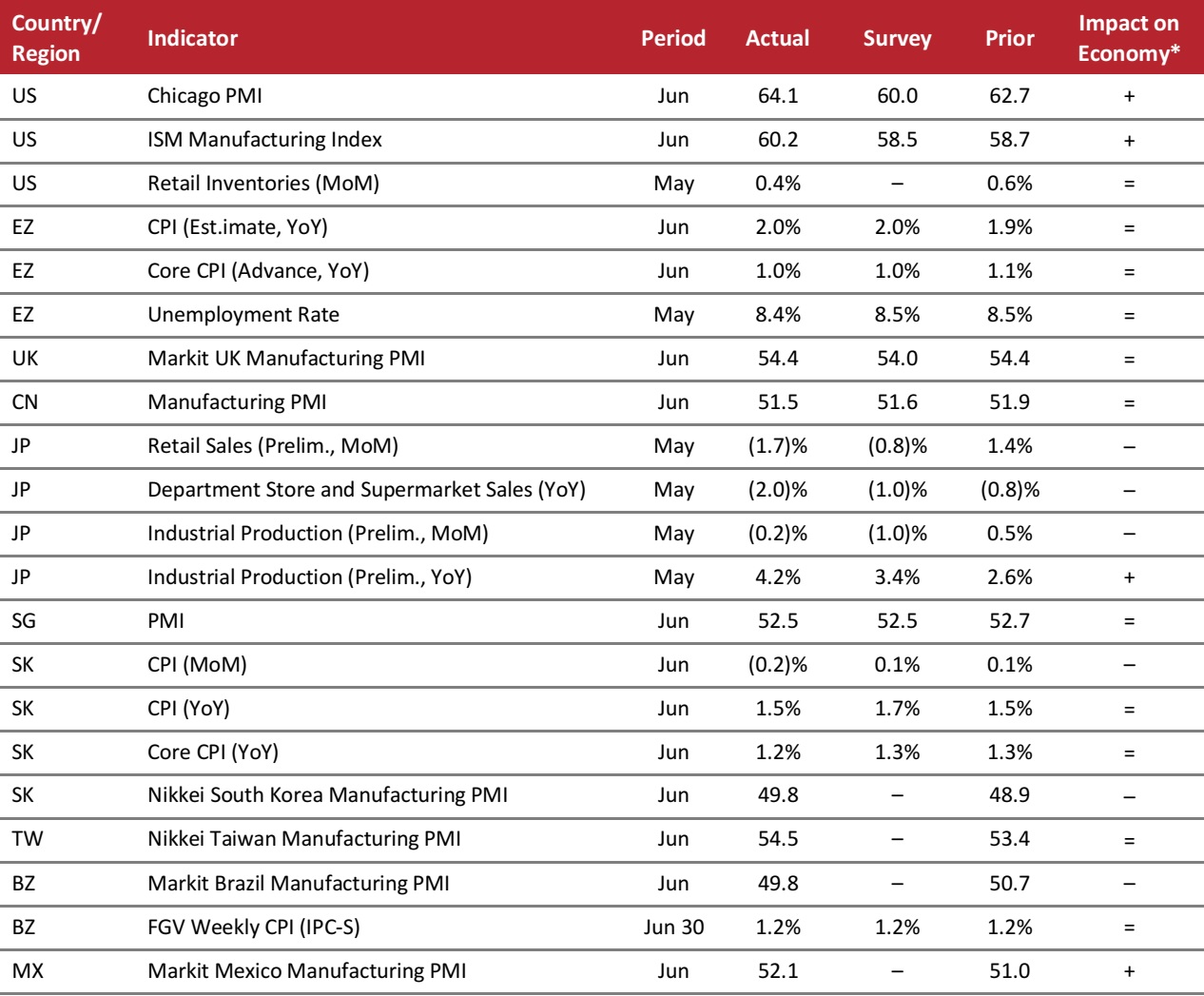

MACRO UPDATE

Key points from global macro indicators released June 27–July 4, 2018:

- US: In June, the Chicago Purchasing Managers’ Index (PMI) increased to 64.1; the reading exceeded the consensus estimate of 60.0. The ISM Manufacturing Index also exceeded analysts’ expectations, rising to 60.2 in June versus the 58.5 consensus estimate.

- Europe: In the eurozone, the Core Consumer Price Index (CPI) increased by 1.0% year over year in June, in line with the consensus estimate. Unemployment in the eurozone ticked down to 8.4% in May from 8.5% in April. In the UK, the Markit Manufacturing PMI stood at 54.4 in June, unchanged from May.

- Asia-Pacific: In China, the official Manufacturing PMI edged down to 51.5 in June. In Japan, retail sales decreased by 1.7% month over month in May, missing the consensus estimate, which had called for a 0.8% decrease. In South Korea, the CPI rose by 1.5% year over year in June.

- Latin America: In Brazil, the Markit Manufacturing PMI fell into contractionary territory in June, decreasing to 49.8. In Mexico, the Market Manufacturing PMI increased to 52.1 in June from 51.0 in May

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Census Bureau/MNI/Institute for Supply Management/Eurostat/UK Office for National Statistics/Markit/Japan Ministry of Economy, Trade and Industry/Singapore Institute of Purchasing and Materials Management/Statistics Korea/Fundação Getúlio Vargas/Coresight Research

27% of Apparel Sales Are Now Online

(July 2) RetailDive.com

27% of Apparel Sales Are Now Online

(July 2) RetailDive.com

How to Make Piles of Money Using Instagram

(July 2) Bloomberg.com

How to Make Piles of Money Using Instagram

(July 2) Bloomberg.com

Retail Reset: Sharpening the Sharper Image Brand

(July 2) Pymnts.com

Retail Reset: Sharpening the Sharper Image Brand

(July 2) Pymnts.com

Tablet Market Sees Revenue Growth in Brazil

(July 2) ZDNet.com

Tablet Market Sees Revenue Growth in Brazil

(July 2) ZDNet.com

E-Commerce Should Generate R$37.9 Billion in the Second Half of the Year in Brazil

(July 2) ECommerceNews.com.br

E-Commerce Should Generate R$37.9 Billion in the Second Half of the Year in Brazil

(July 2) ECommerceNews.com.br