DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

US Silvers: Growing from 16% of the Population in 2018 to 20% in 2030 In the US and other major developed markets, the senior population is growing at a faster rate than younger age groups. According to the United Nations, the US 65+ population stood at 52 million in 2018 and will reach 72 million by 2030. This group accounted for 16% of the US population in 2018 and is expected to grow 40%, or 20 million, through 2030. This means it will account for over a fifth or 20% of the total US population in 2030. In comparison, the senior population in Western Europe and Southern Europe will account for more than one-quarter of the total population by 2030. People aged 75 and over were 7% of the total US population in 2018 and that demographic is expected to grow 59% to account for nearly 10% of the total population by 2030. Silver consumers contribute a fifth of all spending in the US. In 2017, total consumer spending in the US was $7.8 trillion, and seniors accounted for $1.6 trillion of that – up 10% year over year, based on data from the Bureau of Labor Statistics. In absolute terms, senior households tend to underindex in more categories than they overindex. Senior households underindex on spending on alcohol, entertainment, food and household furnishings – but still account for a fifth of all spending in these categories. US seniors’ spending on apparel is significantly lower than their 24% share of US households, but the group overindexes heavily on spending on healthcare and housekeeping supplies. When we last tracked US senior consumer spending in our report Mining Silver: Identifying Opportunities in the Senior Boom, we found that consumers aged 65 and over directed more of their spending toward shopping than other age groups did in 2015, and that trend continued through 2017 (the latest year for which data is available), with the share of senior households’ total expenditure directed toward retail increasing by 0.3 percentage points, to 22.5%. In absolute terms, senior households continue to spend less in total and less on retail categories, partly due to their smaller average household sizes. In 2017, seniors spent just 82% of the amount the average US household did. Seniors spend just 65% of what the typical US household spends on apparel and footwear, and while they also severely underindex in this category, this is up from 57% in 2015. For many older shoppers, clothing and footwear purchases appear to be more out of function than out of desire – but cost-saving is not a top priority when they do spend on clothing. Coresight Research survey data shows they care about the environment, are conscious about the way clothing is produced and are even willing pay more for clothing produced sustainably. In 2017, silver households spent 87% of the amount typical households spend on food, up from 85% in 2015, indicating incremental progress in seniors’ share of total consumer spending. An interesting attribute of senior consumers is that they are willing to spend more on healthier food, as wellness and fitness gains priority as consumers age: Coresight Research survey data shows 37% of older shoppers said they will pay more for healthier food — the same or a greater proportion than shoppers in other age groups. Senior consumers may be frugal spenders on many discretionary categories, but there are pockets of opportunity for brands and retailers where these consumers are willing to trade up to more premium products — these include apparel produced in a more environmentally friendly way and healthier food. Get more information from our report Silver Consumers in the US, 2019.

US RETAIL & TECH HEADLINES

Walmart Is Investing $1.2 Billion in China

(July 2) CNN Business

Walmart Is Investing $1.2 Billion in China

(July 2) CNN Business

- Walmart is pouring more than a billion dollars into its China business as it faces growing competition from local rivals and online retailers. The US retail giant plans to invest around ¥8 billion ($1.2 billion) in distribution centers in China over the next two decades.

- Walmart is planning to spend the money to boost grocery deliveries. Walmart has since grown its e-commerce operations in China and is testing smaller "smart supermarkets" that allow customers to use smartphones as scanners at checkout.

Taiwan's CyberLink Aims to Bring Facial Recognition to US Stores

(July 2) InsideRetail

Taiwan's CyberLink Aims to Bring Facial Recognition to US Stores

(July 2) InsideRetail

- Taiwan-based surveillance company CyberLink plans to bring its facial recognition technology to US stores – a market in which Chinese rivals are struggling to gain a foothold.

- CyberLink says its FaceMe software program – which tracks shoppers' faces and analyzes their emotions – can help brick-and-mortar stores offer shoppers more personalized service without compromising privacy. CyberLink showed off this tech, which featured monitors equipped with a camera running FaceMe that analyzed visitors' faces as they approached.

Toys “R” Us Launches on eBay

(July 1) InsideRetail

Toys “R” Us Launches on eBay

(July 1) InsideRetail

- Less than a month after returning to Australian shores with a more focused, digital offering, Toys “R” Us has launched on eBay, adding more than 4,000 items to the marketplace. The move represents an important facet of its omnichannel approach moving forward.

- The launch follows an eight-year partnership between eBay and Hobby Warehouse, which is partnering with TRU Kids, the US-based owner of Toys “R” Us, on the toy store’s relaunch in Australia and New Zealand.

Struggling Beauty Giant Coty to Restructure Operations

(July 1) The Wall Street Journal

Struggling Beauty Giant Coty to Restructure Operations

(July 1) The Wall Street Journal

- Cosmetics maker Coty is taking a $3 billion write-down on CoverGirl, Max Factor and other brands it acquired a few years ago, becoming the latest consumer giant to reckon with mainstream labels that are losing their grip on American shoppers.

- The makeup and fragrance seller, which is controlled by European investment firm JAB, has struggled with weak sales and executive turnover. The company said it will restructure operations and cut jobs at brands Coty bought in 2016 from Procter & Gamble.

Luxury Reseller The RealReal Rises After $300 Million IPO

(June 27) Bloomberg

Luxury Reseller The RealReal Rises After $300 Million IPO

(June 27) Bloomberg

- Online luxury reseller The RealReal raised $300 million in its initial public offering, selling 15 million shares for $20 each after marketing them for $17 to $19. The shares closed at $28.90 in New York, giving the company a market value of about $2.39 billion, but have since shed value, closing at $25.22 on July 3.

- The company makes it easier sell and buy used luxury items such as clothing, accessories and jewelry on consignment by providing a platform for transactions and verifying that the goods are authentic.

EUROPE RETAIL & TECH HEADLINES

Klarna Expands Partnership with Abercrombie & Fitch

(July 2) FashionNetwork.com

Klarna Expands Partnership with Abercrombie & Fitch

(July 2) FashionNetwork.com

- Abercrombie & Fitch has announced the payment platform currently available to Abercrombie & Fitch shoppers in Germany via a partnership with Swedish global payment platform Klarna Bank will be introduced to the UK and US markets later this year.

- The retailer’s UK customers will be able to pay for purchases in three instalments over a period of two months. Customers in the US will be able to pay in four parts over the same time span.

Groupe Casino Concludes Sale of 38 Stores

(July 2) Company press release

Groupe Casino Concludes Sale of 38 Stores

(July 2) Company press release

- French retailer Groupe Casino completed the sale of 8 stores for €39 million ($44 million) on July 2. The deal included the sale of three hypermarkets to Leclerc and four Casino supermarkets and one Leader Price store to Lidl.

- Separately, the company completed the sale of one hypermarket to Leclerc, two hypermarkets to Groupement des Mousquetaires and 11 Casino supermarkets and 16 Leader Price stores to Lidl for €58 million ($65.5 million) on June 27.

Boots Announces 200 Store Closures

(June 27) Company press release

Boots Announces 200 Store Closures

(June 27) Company press release

- Walgreens Boots Alliance, the US parent of UK health and beauty retailer Boots, has announced plans to close around 200 Boots stores over the next 18 months. The stores include mainly local pharmacies in locations that have other stores nearby.

- The retailer has been struggling due to increased online competition, rising wages and property taxes.

New Look’s French Division Goes Into Liquidation

(June 28) RetailGazette.co.uk

New Look’s French Division Goes Into Liquidation

(June 28) RetailGazette.co.uk

- New Look’s operations in France will be liquidated as it has failed to find a credible buyer. The retailer will close most of its 30 stores as a part of the liquidation.

- New Look’s Polish division has also filed for bankruptcy and the retailer has completely withdrawn from China and Belgium.

Lamoda Partners with X5 Store to Open 500 Pick-Up Points

(June 28) ESMMagazine.com

Lamoda Partners with X5 Store to Open 500 Pick-Up Points

(June 28) ESMMagazine.com

- Russian food retailer X5 has announced a strategic partnership between its subsidiary X5 Omni and Russian online fashion retailer Lamoda. The contract will see Lamoda launch 500 pickup points at X5 stores by the end of 2020, while X5 Omni will make its parcel pick-up network available to Lamoda customers.

- Lamoda plans to offer its customers a “try-before-you-buy” experience with fitting rooms at the pickup points. The points will also allow payment by cash, card or instalments and merchandise returns, and offer rapid delivery options

ASIA RETAIL AND TECH HEADLINES

Shiseido Launches Skincare Service Brand Optune

(July 1) Company press release

Shiseido Launches Skincare Service Brand Optune

(July 1) Company press release

- Shiseido has announced the full-scale launch of its skincare service brand Optune that uses IoT technology. Customers can sign up to the service on Shiseido’s official website for a monthly charge of ¥10,000 ($92.26), excluding tax.

- The Optune app measures users’ changing skin conditions and collects data on external environmental factors each day, then sends personalized skincare products to the user.

Jacobs Douwe Egberts Launches Store on Tmall Global Platform

(June 28) Company press release

Jacobs Douwe Egberts Launches Store on Tmall Global Platform

(June 28) Company press release

- Beverages group Jacobs Douwe Egberts (JDE) has launched its coffee and tea flagship store on Alibaba’s Tmall Global. JDE’s aim is to offer high-quality coffee and tea to the 654 million active users on Alibaba’s marketplaces.

- JDE will initially offer brands Moccona, L’OR, Kenco and Maxwell House, and will expand its range in the coming months.

Lazada Joins Alibaba’s IP Protection Platform

(July 1) Retailtechinnovationhub.com

Lazada Joins Alibaba’s IP Protection Platform

(July 1) Retailtechinnovationhub.com

- Southeast Asian e-commerce company Lazada Group, owned by Alibaba Group, has joined Alibaba’s Intellectual Property Protection (IPP) Platform.

- The IPP platform is an online infringement claims processing system which allows brands to request the removal of infringing products on shopping websites. Before, infringement claims were processed by email.

DFS Partners with Parfums Christian Dior To Launch Pop-Up Concept Store

(June 28) insideretail.asia

DFS Partners with Parfums Christian Dior To Launch Pop-Up Concept Store

(June 28) insideretail.asia

- LVMH-owned travel retailer DFS Group has partnered with Parfums Christian Dior, the perfumery and cosmetics line of French luxury brand Christian Dior, to launch a pop-up store called DFS x Dior Summer Party in Macau from July 1-31.

- The pop-up store will offer exclusive products designed for travelers.

Zara India Posts 13.4% Dip in Profits in Fiscal Year 2018-19

(July 1) indianretailer.com

Zara India Posts 13.4% Dip in Profits in Fiscal Year 2018-19

(July 1) indianretailer.com

- Inditex Trent Retail India, the company that operates Spanish fashion brands Zara and Massimo Dutti stores in India, has reported a 13.4% drop in Zara’s profit after tax (PAT) to INR 714.9 million ($10.4 million) in fiscal year 2018-19, weaker than the INR 825.9 million ($11.99 million) PAT recorded in the previous fiscal year.

- During the year, Inditex Trent Retail India reported a 17.7% increase in revenues to INR 14.37 trillion ($208.7 million), stronger than the INR 12.21 trillion ($177.3 million) revenue generated in the previous fiscal year.

LATIN AMERICA RETAIL AND TECH HEADLINES

Guess Plans to Open First Accessories Store in Peru

(June 28) america-retail.com

Guess Plans to Open First Accessories Store in Peru

(June 28) america-retail.com

- US clothing retailer Guess has plans to open its first store exclusively for accessories in Peru. The store, which opens in August, will be located at the Real Plaza Salaverry shopping center in the capital Lima.

- The new store will offer all lines of accessories such as footwear, handbags, glasses, costume jewelry and watches.

Ikea Plans 10-Year Expansion in Mexico

(June 27) fashionnetwork.com

Ikea Plans 10-Year Expansion in Mexico

(June 27) fashionnetwork.com

- Swedish furniture retailer Ikea is looking to open stores outside Mexico City as part of its 10-year expansion plan for Mexico. This announcement comes a month after Ikea confirmed that it will open its first store in Mexico City in 2020.

- Ikea aims to produce at least 8% of its merchandise locally for its operations in Mexico.

New Era and J.Crew Launch in Peru

(July 1) fashionnetwork.com

New Era and J.Crew Launch in Peru

(July 1) fashionnetwork.com

- In separate moves, US-based headwear retailer New Era and specialty retailer J.Crew have launched their products in the Peruvian market.

- New Era products will be available at all Ripley stores and its own store in the Plaza Norte Shopping center in Lima. J.Crew’s men’s collection will be available at Falabella stores in Peru.

GPA Partners with Microsoft to Test “Scan & Go” Concept

(June 28) Reuters.com

GPA Partners with Microsoft to Test “Scan & Go” Concept

(June 28) Reuters.com

- Brazilian food retailer Grupo Pao de Açúcar (GPA) has partnered with Microsoft to launch a “scan and go” cashier-less concept and facial recognition technology at its stores by end of this year.

- The concept will be tested at its new Minuto Pão de Açúcar banner to be opened in December. The store will have Amazon-style lockers from which shoppers can collect items ordered online.

Cencosud Launches Largest-Ever IPO on Santiago Exchange

(June 28) Reuters.com

Cencosud Launches Largest-Ever IPO on Santiago Exchange

(June 28) Reuters.com

- On June 28, Chilean retailer Cencosud launched an initial public offering (IPO) for its shopping center division. It was the largest ever IPO on Santiago’s stock exchange, netting nearly $1.1 billion.

- Cencosud placed almost 474 million shares, representing 28% of its shopping division on the exchange. The cash raised will be used to pay debts owed to its parent company Cencosud.

France’s Groupe Casino to Simplify Latam Holdings

(June 27) Company press release

France’s Groupe Casino to Simplify Latam Holdings

(June 27) Company press release

- On June 27, Brazilian food retailer Grupo Pao de Açúcar (GPA), a subsidiary of French retailer Groupe Casino, revealed its plan to simplify the shareholding arrangement for its Latin American operations.

- The reorganization will see Groupe Casino holding a 41.4% stake in GPA which will acquire all shares in Colombian retailer Exito

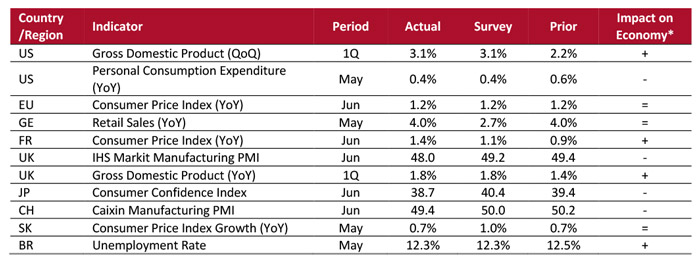

MACRO UPDATE

Key points from global macro indicators released June 26–July 2, 2019:- US: Gross domestic product was up 3.1% quarter over quarter in the first Growth in personal consumption expenditure fell to 0.4% year over year in May from 0.6% in April.

- Europe: In the eurozone, the consumer price index was 2% year over year in June and in line with the consensus estimate. In the UK, the IHS Markit Manufacturing Purchasing Managers’ Index (PMI) decreased to 48.0 in June from 49.4 in May and below the consensus estimate of 49.2; the low manufacturing PMI reflects a stockpiling prior to the original March 29 Brexit date.

- Asia Pacific: In Japan, the consumer confidence index fell to 38.7 in June from 39.4 in May, below the consensus estimate of 40.4. In China, the Caixin Manufacturing Purchasing Managers’ Index (PMI) decreased to 49.4 in June from 50.2 in May and below the consensus estimate of 50.0.

- Latin America: In Brazil, the unemployment rate fell to 12.3% in May, from 12.5% in April and in line with the consensus estimate of 12.3%.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact. Source: Bureau of Economic Analysis/Eurostat/Destatis/INSEE/Office for National Statistics/Cabinet Office, Japan/IHS Markit/Statistics Korea/IBGE, Brazil/Coresight Research [/caption]

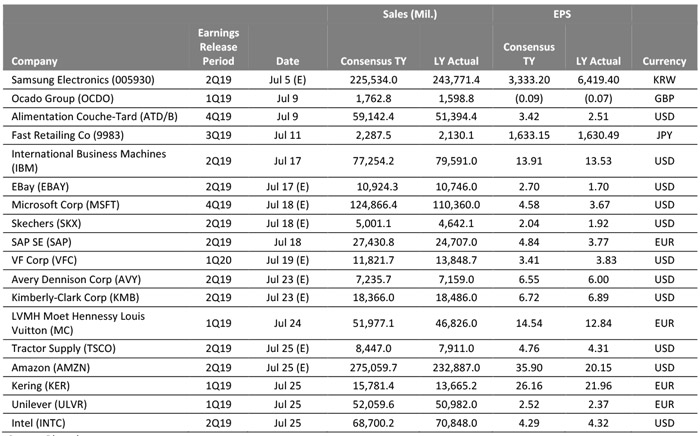

EARNINGS CALENDAR

[caption id="attachment_92382" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

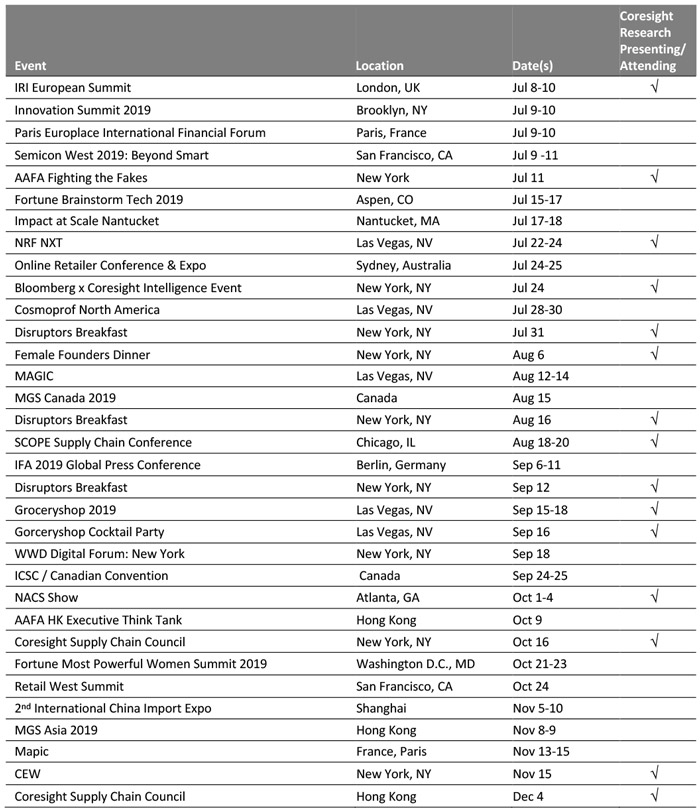

EVENT CALENDAR