From the Desk of Deborah Weinswig

Is Amazon a Threat to the Off-Pricers?

At Coresight Research, we’re often asked some variation of “Could Amazon put an end to the off-pricers’ strong run?” The top three US off-price retailers—TJX Companies (which owns T.J. Maxx and Marshalls, among other banners), Ross Stores (operator of Ross Dress for Less and dd’s Discounts) and Burlington Stores—have all enjoyed stellar growth in recent years: between 2013 and 2017, revenues grew by 31% at TJX US, by 38% at Ross Stores and by 37% at Burlington. But could Amazon grind their growth to a halt?

Amazon Is Already a de Facto Off-Pricer

We have long argued that Amazon effectively operates an off-price fashion site. Amazon.com has traditionally focused on third-party brands that offer some big product names mixed in with low-price “unknowns.” Major brands’ offerings on the site have tended to be patchy and to include subprime or previous-season stock. In some cases, unauthorized sellers offer “gray market” stock, and branded apparel items on the site are almost always priced below standard retail price.

The results of

our US consumer survey earlier this year back up our perception that Amazon operates as a

de facto off-pricer. Fully 48% of all Amazon apparel shoppers we surveyed told us that they expect to always pay less than full price on the site, and just 11.5% said that they buy apparel on Amazon because its ranges are up to date. Those figures compare with 32% who said that they buy apparel on Amazon because it offers the lowest prices and 49% who said that they buy apparel on the site because it offers good value for price paid.

In addition, Euromonitor International estimates that Amazon sold almost $25 billion of clothing and footwear in the US in 2017, versus TJX’s total US sales of $27 billion (including nonapparel goods). Those figures indicate that Amazon could already be one of America’s biggest off-price retailers.

But Amazon Is Moving Further Away from a Discount Fashion Proposition

However, we perceive that Amazon is now backing off from a cut-price, limited offering, rather than encroaching on the off-pricers’ territory. In the past year, Amazon has struck deals with brands such as Nike and Calvin Klein to sell their products on its site; in the case of Calvin Klein, this included some exclusivity, implying that Amazon is moving away from a discount position in fashion. Moreover, Amazon has grown its private-label offering substantially. Our exclusive research in June showed that Amazon’s own-brand apparel offerings span almost 5,000 products across dozens of brands. In total, some 66 of Amazon’s 74 private labels include an apparel offering. These changes to Amazon’s fashion offering further differentiate the company from the off-pricers, which focus on branded products acquired opportunistically from excess inventories.

Further Strong Growth Predicted for Off-Pricers

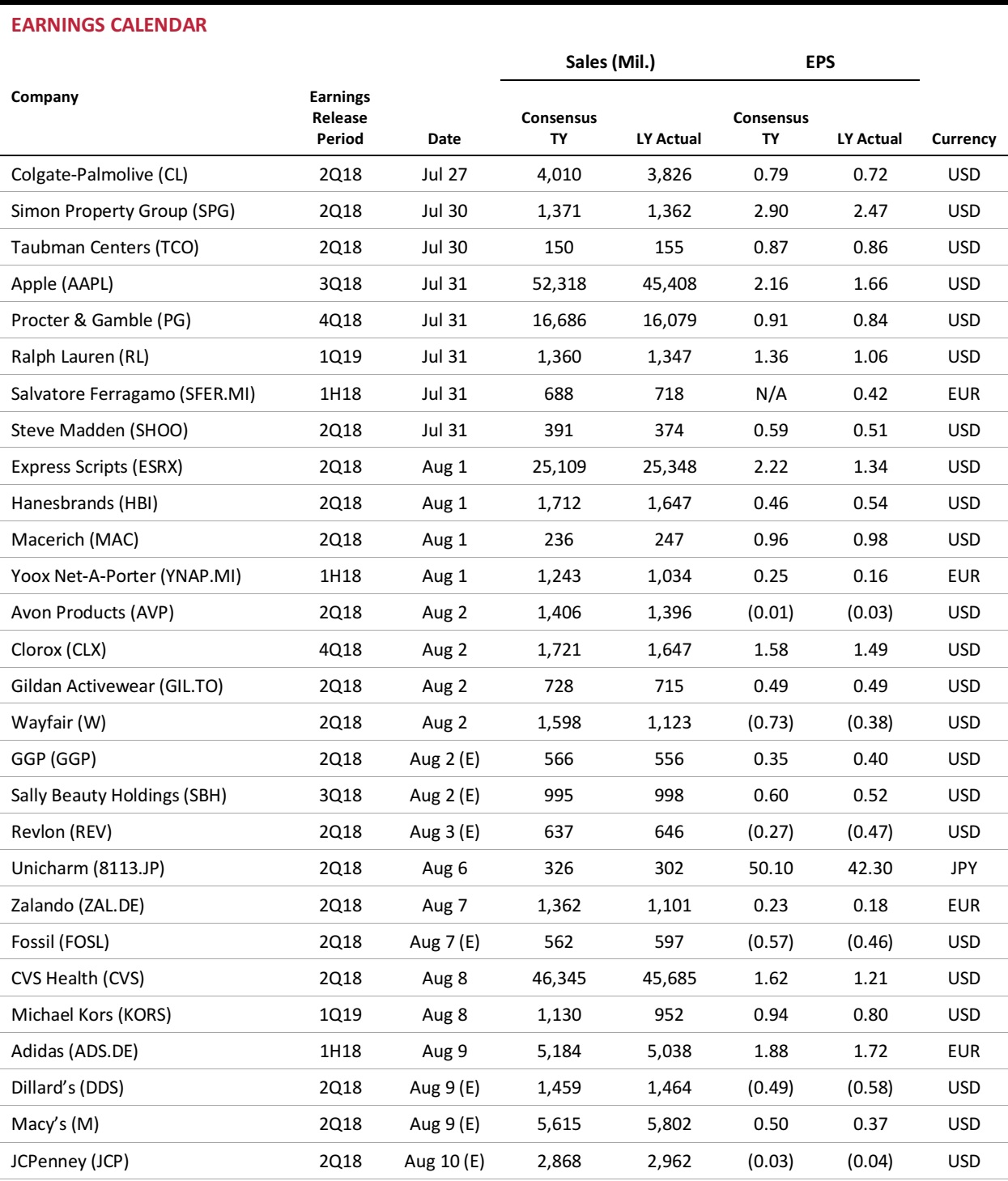

Wall Street analysts appear to be brushing aside any threat from Amazon, as they anticipate further strong performances from the top three off-pricers. Current consensus expectations call for TJX to grow total revenues by 26.5% between 2017 and 2021, for Ross Stores to grow total revenues by 26.4% over the same period and for Burlington to grow total revenues by 33.9%.

In the coming years, we see physical retail clustering around four functions that e-commerce either cannot serve at all or cannot serve as well as offline retail:

- Convenience, in the form of service demand for last-minute purchases.

- Collection of online orders.

- Discount, with shoppers swapping the convenience of multichannel propositions for cost savings.

- Destination, with high-quality stores serving leisure shoppers.

So, in our view, off-price retailers are a cornerstone of the discount segment, and we expect shoppers to continue to search them out even as they increasingly turn to sites such as Amazon.

- Keep an eye out for our forthcoming deep-dive report on off-price retailing.

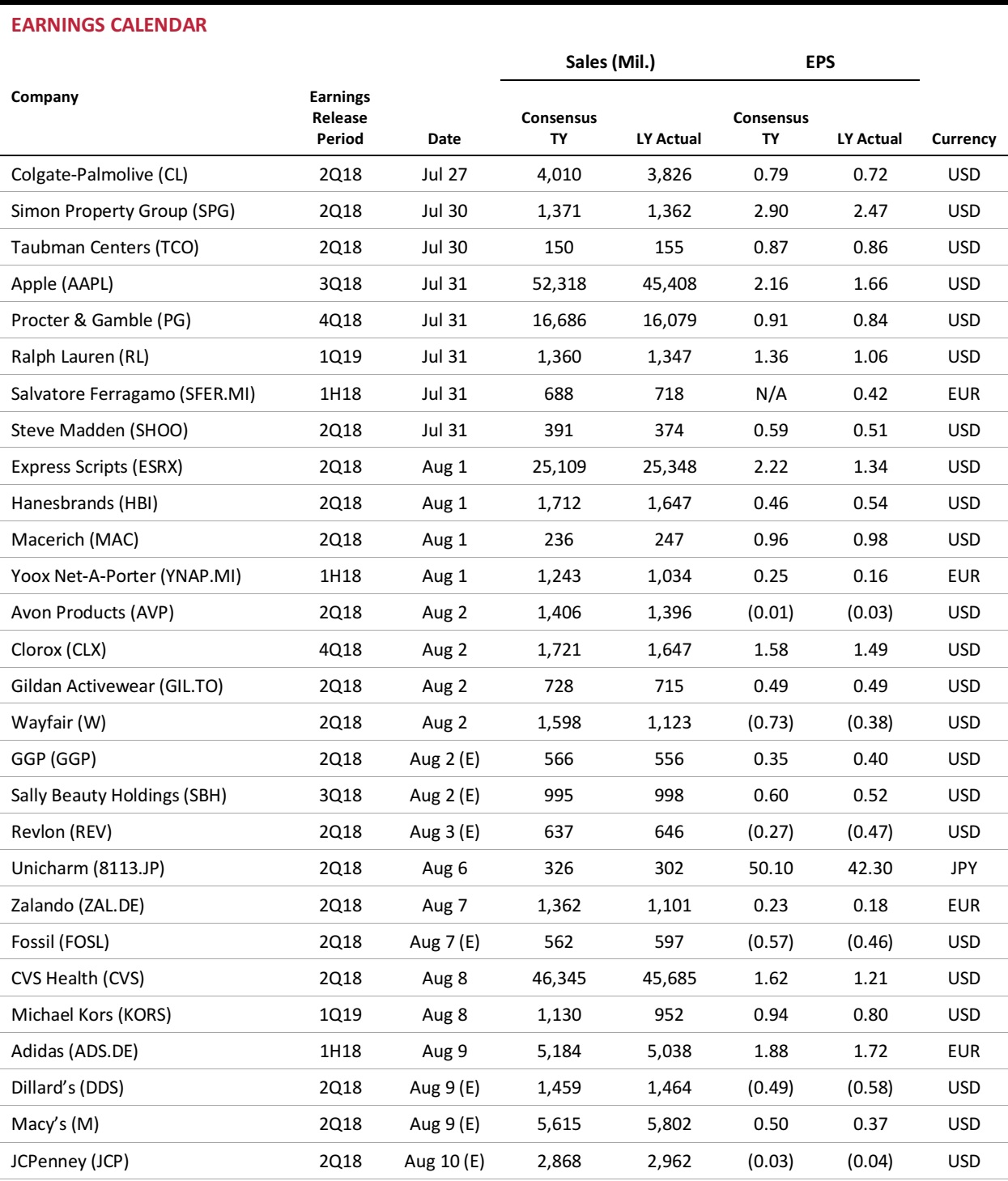

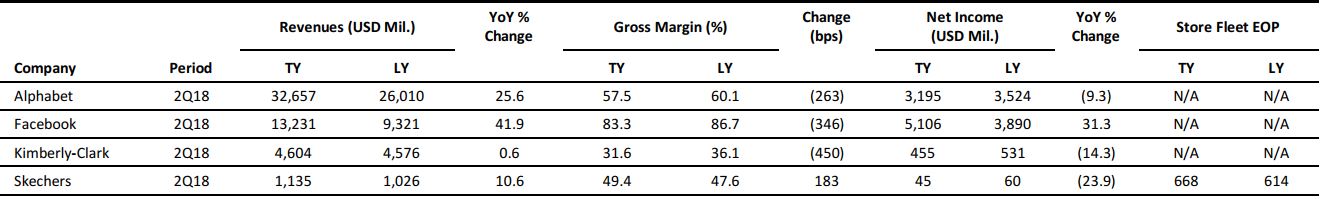

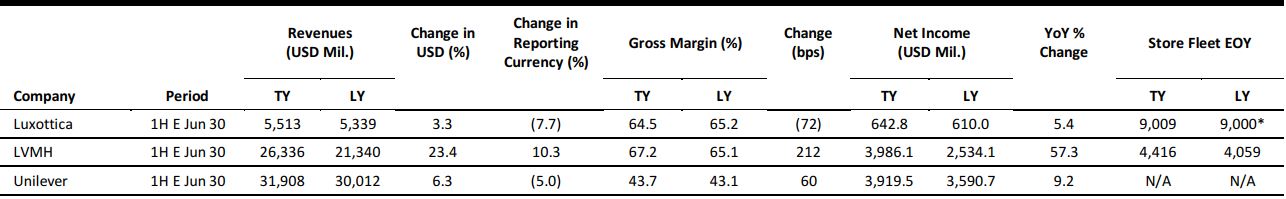

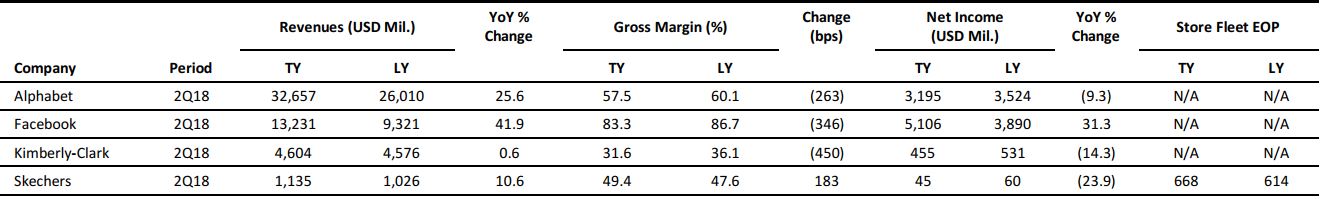

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

Pointy Fills Void for Local Retailers that E-Commerce Left Behind

(July 24) Pymnts.com

Pointy Fills Void for Local Retailers that E-Commerce Left Behind

(July 24) Pymnts.com

- While millions of consumers spend countless hours staring at their mobile devices, there are millions more who like to touch and feel goods at their neighborhood retail outlet.

- Startup retail technology firm Pointy serves thousands of small, local retailers that may not participate in the Amazon merchant program or sell online for regulatory reasons.

US Retailers Compete Early for Seasonal Workers amid Strong Job Market

(July 23) LATimes.com

US Retailers Compete Early for Seasonal Workers amid Strong Job Market

(July 23) LATimes.com

- Retailers such as JCPenney and Kohl’s already are posting help-wanted ads for their busy season, weeks or even months earlier than usual. That means Americans looking for a seasonal job with a retailer are enjoying their best prospects in years, thanks to the strong US economy and employment picture.

- That has put the onus on retailers to hire the best seasonal workers as early as possible, as those looking for work have considerable employment choices, analysts said.

Starbucks to Open US Signing Store

(July 23) InsideRetail.com.au

Starbucks to Open US Signing Store

(July 23) InsideRetail.com.au

- Starbucks is set to open its first “Signing Store” this October in Washington, DC. The initiative was led by a team of Deaf Starbucks employees and allies in an effort to create a distinct retail experience for all customers while promoting accessibility and offering employment and advancement opportunities for Deaf and hard of hearing people.

- Starbucks will hire 20–25 deaf, hard of hearing and hearing partners to work at the Signing Store, with a requirement that they be proficient in American Sign Language.

US Retailers Rush to Fill Shelves Before Trade War Tariffs Start to Bite

(July 19) TheLoadstar.co.uk

US Retailers Rush to Fill Shelves Before Trade War Tariffs Start to Bite

(July 19) TheLoadstar.co.uk

- As the transpacific trade war officially gets under way, US retailers are rushing to fill inventories before additional tariffs are put on Chinese goods. However, longer term, escalating tariffs could mean increased sourcing in South and Southeast Asia.

- The National Retail Federation’s Global Port Tracker estimates that June retail imports were up 6.8% year over year and equal to the record set in August 2017. Hackett Associates told Reuters that the June import spike was likely due to “preemptive buying in anticipation of the tariffs.”

Retailers Are Getting into the Media and Advertising Businesses

(July 18) Axios.com

Retailers Are Getting into the Media and Advertising Businesses

(July 18) Axios.com

- Move over, telecom and big tech: mass market retailers and grocers are developing their own content and advertising businesses to compete with legacy media. Ad-serving and video creation have become so democratized that any company with an audience is now able to steal advertising dollars or consumer attention away from traditional media companies.

- Walmart, for example, is considering launching an ad-supported subscription streaming video service that would target Middle America and undercut rivals Netflix and Amazon Prime Video.

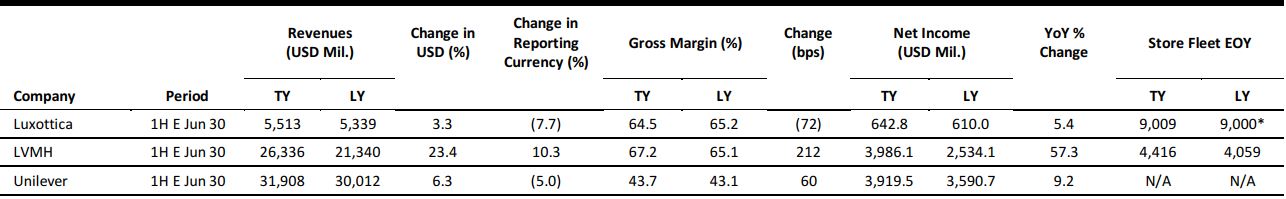

EUROPE RETAIL EARNINGS

*Luxottica store numbers for last year are approximate and as of closest year-end, due to the absence of reported store numbers in the company’s 1H17 statement. Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

UK Grocery Market Sales Grow at Fastest Rate This Year

(July 24) Kantar Worldpanel press release

UK Grocery Market Sales Grow at Fastest Rate This Year

(July 24) Kantar Worldpanel press release

- Grocery sales in the UK grew by 3.6% in the 12 weeks ended July 15, according to market-measurement firm Kantar Worldpanel.

- For the 12-week period, market leader Tesco posted sales growth of 2.3%, while Sainsbury’s registered moderate growth of 0.8%. Asda posted sales growth of 3.7%, its highest rate in five years, and Morrisons registered 2.9% growth. German cut-price retailers Aldi and Lidl posted strong sales numbers: Aldi’s sales were up 10.9% for the period and Lidl’s sales were up 9.7%. Aldi and Lidl are on the brink of achieving an unprecedented combined market share of 13%.

Marks & Spencer Partners with Founders Factory as Exclusive UK Retail Investor

(July 23) Company press release

Marks & Spencer Partners with Founders Factory as Exclusive UK Retail Investor

(July 23) Company press release

- British retailer Marks & Spencer (M&S) and Founders Factory, an incubator and business accelerator, announced the launch of Founders Factory Retail, a joint venture focused on discovering and developing startups.

- M&S CEO Steve Rowe said, “Partnering with Founders Factory as their exclusive retail partner gives M&S access to a global network of startups and entrepreneurs [that] will provide disruptive thinking and questioning to the way we work at a time of critical transformation within the business.”

Tesco to Launch New Discount Stores Chain

(July 23) FT.com

Tesco to Launch New Discount Stores Chain

(July 23) FT.com

- British retailer Tesco is reportedly planning to launch a new chain of discount stores across the UK to compete with German cut-price retail rivals Aldi and Lidl. According to the Financial Times, Tesco plans to set up 30 new stores this autumn. Aldi and Lidl have a combined share of nearly 13% of the UK grocery market, compared with less than 9% four years ago, according to Kantar Worldpanel.

- Bernstein analyst Bruno Monteyne stated, “If Tesco is doing such a thing, it won’t be a copy of hard discounters. It will target the same points and quality, but will bring unique ranges and services.”

Carrefour Introduces Personal Shopper Experience “ShipTo” in Belgium

(July 19) RetailDetail.eu

Carrefour Introduces Personal Shopper Experience “ShipTo” in Belgium

(July 19) RetailDetail.eu

- French supermarket group Carrefour has introduced a personal shopper service named ShipTo in its Knokke-Heist seaside store in Belgium. The company plans to expand the concept across Belgium depending on the service’s initial success.

- Through the service, customers are assigned a personal shopper who visits the store to collect products, suggests alternatives and home delivers within 90 minutes.

House of Fraser’s CVA Under Threat After Legal Filing by Landlords

(July 23) RetailGazette.co.uk

House of Fraser’s CVA Under Threat After Legal Filing by Landlords

(July 23) RetailGazette.co.uk

- A group of landlords associated with House of Fraser’s company voluntary arrangement (CVA) have filed a legal petition on the grounds of alleged prejudice against them and material irregularities in the CVA’s implementation.

- Begbies Traynor Partner Mark Fry and JLL Director Charlotte Coates, who are advising the landlords, said, “We strongly believe it to be unjust for the existing shareholders in House of Fraser to receive £70 million [$91 million] of value, the details of which were not communicated initially, while certain landlord creditors are shouldering the financial impact of the process.”

ASIA RETAIL & TECH HEADLINES

Chinese Sales Drive Hermès’ Business in Asia

(July 23) RetailNews.Asia

Chinese Sales Drive Hermès’ Business in Asia

(July 23) RetailNews.Asia

- French luxury goods manufacturer Hermès reported 15% sales growth in Asia (excluding Japan) versus 11% growth globally (excluding Asia) in the first half of 2018.

- The company’s Asian sales have benefited from new store openings in Changsha, China, and at Landmark Prince’s in Hong Kong.

Innisfree Partners with Tmall to Open a New Smart Store in Hangzhou

(July 19) TheInvestor.co.kr

Innisfree Partners with Tmall to Open a New Smart Store in Hangzhou

(July 19) TheInvestor.co.kr

- South Korean budget cosmetics retailer Innisfree has announced a joint store opening with Alibaba’s Tmall B2C marketplace. The store, located in Hangzhou, China, offers features such as a smart skin analyzer, smart shelving and vending machines.

- The partnership comes in the context of Alibaba’s support of Korean cosmetics companies. Tmall stated that it will collect consumer data from Innisfree’s 61 existing stores in Shanghai and Hangzhou to bolster Innisfree’s marketing strategy.

SoftBank Vision Fund Seeks to Invest in SenseTime

(July 20) SCMP.com

SoftBank Vision Fund Seeks to Invest in SenseTime

(July 20) SCMP.com

- SoftBank Vision Fund is seeking to invest $1 billion in Chinese artificial intelligence (AI) company SenseTime, which aims to be the world’s most valuable AI startup. The company has raised more than $1.2 billion to date.

- SenseTime specializes in facial recognition and is venturing into autonomous driving and augmented reality. It contributes to China’s surveillance system and competes directly with Alibaba-backed Megvii.

Chinese Retail Sales Growth Strengthens in June

(July 16) XinhuaNet.com

Chinese Retail Sales Growth Strengthens in June

(July 16) XinhuaNet.com

- Chinese retail sales of consumer goods grew by 9% year over year in June, according to the National Bureau of Statistics of China. The later arrival of the Duanwu (Dragon Boat) Festival this year accelerated growth in June.

- In the first half of 2018, retail sales grew by 9.4% year over year, versus 9.8% in the first quarter. In the second quarter, consumer spending played a pivotal role in China’s economic growth, contributing 78.5% of total growth. According to the National Bureau of Statistics, China’s GDP increased by 6.7% year over year in the second quarter.

LATAM RETAIL & TECH HEADLINES

Carrefour Launches New Project to Help Retailers Develop Zero-Waste Recipes

(July 20) ESMMagazine.com

Carrefour Launches New Project to Help Retailers Develop Zero-Waste Recipes

(July 20) ESMMagazine.com

- Supermarket group Carrefour has launched a new initiative to develop zero-waste recipes in conjunction with Gastromotiva, a Brazilian nonprofit that focuses on cooking as a means of social change. The effort includes the establishment of a lab in Rio de Janeiro dedicated to the study and development of such recipes.

- The company announced a dedicated investment of €300,000 ($350,000). Carrefour also plans to develop an exclusive product line to sell in its stores to represent the work undertaken in its laboratory.

Tech Investments Gain Momentum in Latin America

(July 23) TechCrunch.com

Tech Investments Gain Momentum in Latin America

(July 23) TechCrunch.com

- Tech investments from venture capitalists have surged in Latin America, reaching $1.1 billion in 2017. In the previous five years, funding had remained steady at $500–$600 million per year. The trend is continuing, and $600 million was raised in the first quarter of 2018.

- Government and institutional support to develop local ecosystems—such as Start-Up Chile, Mexico’s funds of funds and Brazil’s BNDES, as well as an entrepreneurs bill passed in Argentina—have reinforced the tech startup ecosystem in Latin America.

Baidu Halts Its Brazil Operations

(July 17) TechCrunch.com

Baidu Halts Its Brazil Operations

(July 17) TechCrunch.com

- Baidu, a technology company and Internet service provider, announced that it will shutter its operations in Brazil. The decision comes in the context of the company’s changing global strategy. Baidu plans to channel its focus on AI by ending operations in verticals such as financial services and mobile advertising.

- As a part of its strategy, Baidu sold Peixe Urbano—a group buying company that it acquired to leverage a user base of 25 million—to venture capital firm Mountain Nazca.

IBM Appoints First Woman as Latin America Head

(July 23) ZDNet.com

IBM Appoints First Woman as Latin America Head

(July 23) ZDNet.com

- IBM has appointed Ana Paula Assis as General Manager of IBM Latin America, making her the first female executive to take up the senior-most role in the region.

- Assis served as a director of financial services at IBM’s global technology services unit and as strategic outsourcing director at IBM Brazil over the last decade. Most recently, she served as a VP in the software business unit at IBM’s Greater China unit.

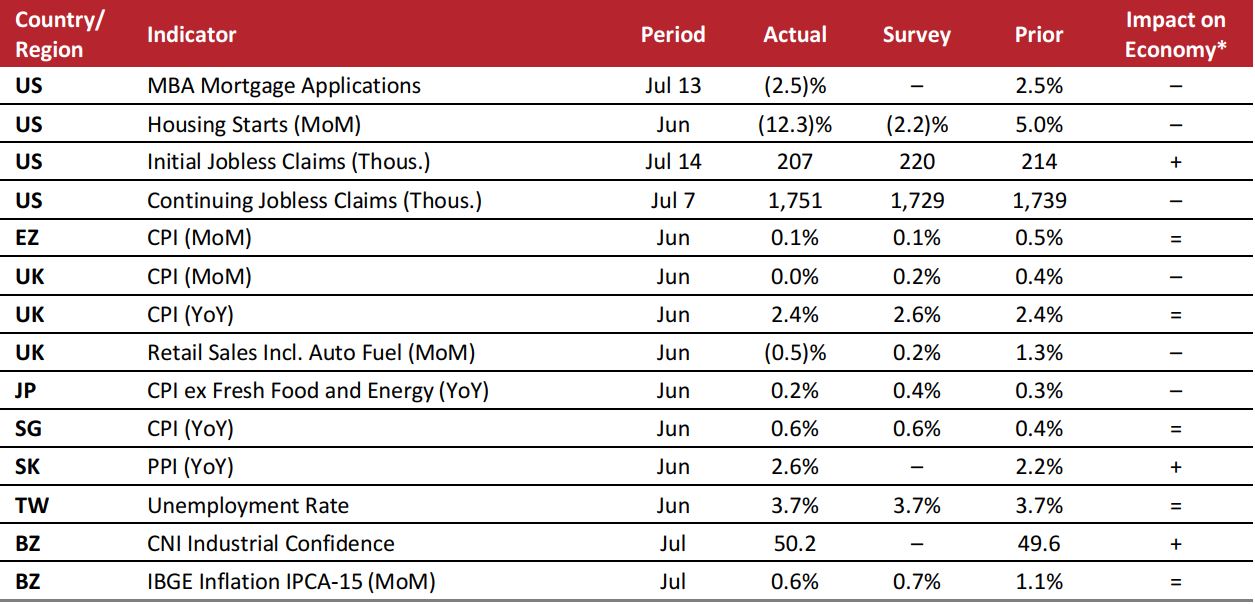

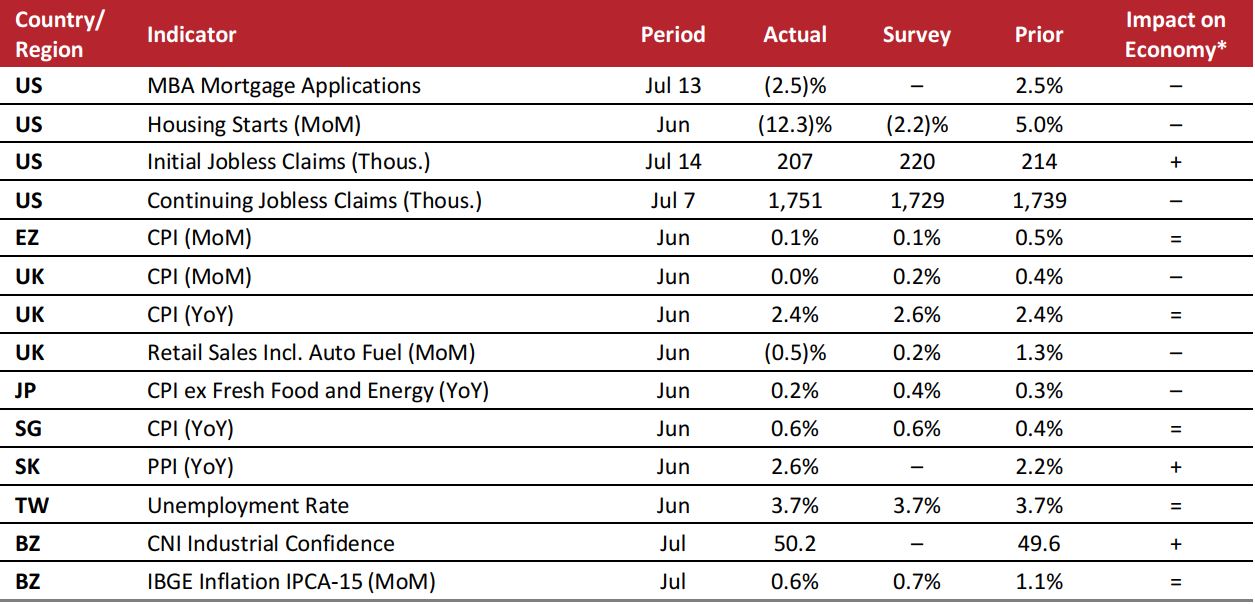

MACRO UPDATE

Key points from global macro indicators released July 18–25, 2018:

- US: According to the Mortgage Bankers Association’s (MBA’s) weekly survey, mortgage applications decreased by 2.5% in the week ended July 13, versus a 2.5% increase the previous week. Housing starts fell by more than analysts anticipated in June, declining by 12.3% month over month. Initial jobless claims decreased to 207,000 in the week ended July 14.

- Europe: In the eurozone, the Consumer Price Index (CPI) increased by 0.1% month over month in June, in line with the consensus estimate. In the UK, the CPI increased by less than analysts expected in June, rising by 2.4% year over year. UK retail sales including auto fuel fell by 0.5% month over month in June, versus the consensus estimate of a 0.2% increase.

- Asia-Pacific: In Japan, the CPI excluding fresh food and energy increased by 0.2% year over year in June; the increase was below analysts’ expectations. In Singapore, the CPI increased by 0.6% year over year in June, in line with the consensus estimate. In South Korea, the Producer Price Index (PPI) rose by 2.6% year over year in June, versus 2.2% in May. In Taiwan, the unemployment rate stood at 3.7% in June, in line with the consensus estimate.

- Latin America: In Brazil, industrial confidence increased to 50.2 in July, according to the National Confederation of Industry (CNI); the reading was 3.9 points below the average of 54.1. The IBGE inflation forecast for Brazil increased by 0.6% month over month in July, versus the consensus estimate of 0.7%.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: Mortgage Bankers Association/US Census Bureau/US Department of Labor/Eurostat/UK Office for National Statistics/Japan Ministry of Internal Affairs and Communications/Singapore Department of Statistics/Bank of Korea/Taiwan Directorate General of Budget, Accounting and Statistics/Brazil Confederação Nacional da Indústria/Instituto Brasileiro de Geografia e Estatística/Brazil Ministry of Labor and Employment/Coresight Research

Pointy Fills Void for Local Retailers that E-Commerce Left Behind

(July 24) Pymnts.com

Pointy Fills Void for Local Retailers that E-Commerce Left Behind

(July 24) Pymnts.com

Starbucks to Open US Signing Store

(July 23) InsideRetail.com.au

Starbucks to Open US Signing Store

(July 23) InsideRetail.com.au

Carrefour Introduces Personal Shopper Experience “ShipTo” in Belgium

(July 19) RetailDetail.eu

Carrefour Introduces Personal Shopper Experience “ShipTo” in Belgium

(July 19) RetailDetail.eu

Chinese Sales Drive Hermès’ Business in Asia

(July 23) RetailNews.Asia

Chinese Sales Drive Hermès’ Business in Asia

(July 23) RetailNews.Asia

Carrefour Launches New Project to Help Retailers Develop Zero-Waste Recipes

(July 20) ESMMagazine.com

Carrefour Launches New Project to Help Retailers Develop Zero-Waste Recipes

(July 20) ESMMagazine.com