albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

Holiday 2020 Won‘t Be the Same, or Will It?

This week, Walmart announced that its stores would be closed on Thanksgiving Day (November 26) this year, in addition to revealing a $428 million bonus payout to full-time associates, part-time associates, drivers, managers and other employees. This marks the first Thanksgiving since the late 1980s that Walmart will not be open. (The company’s Sam’s Club warehouse stores have traditionally remained closed on the holiday.)

Walmart’s decision is symbolic and highly significant, since remaining open on Thanksgiving offers an early start to holiday shopping, and most people do not work that day. Closing its stores also means that Walmart will not offer doorbuster deals, which started at 6:00 p.m. on Thanksgiving Day last year.

Even prior to Walmart’s announcement, many in the retail industry speculated about the survival of Black Friday. The uncertainty has been based on consumers’ reluctance to enter enclosed indoor spaces such as stores and malls, greater reliance on e-commerce and a blurring of the holiday shopping season due to other promotions in the fall, such as Amazon Prime Day (which we discuss further below) and Christmas in July.

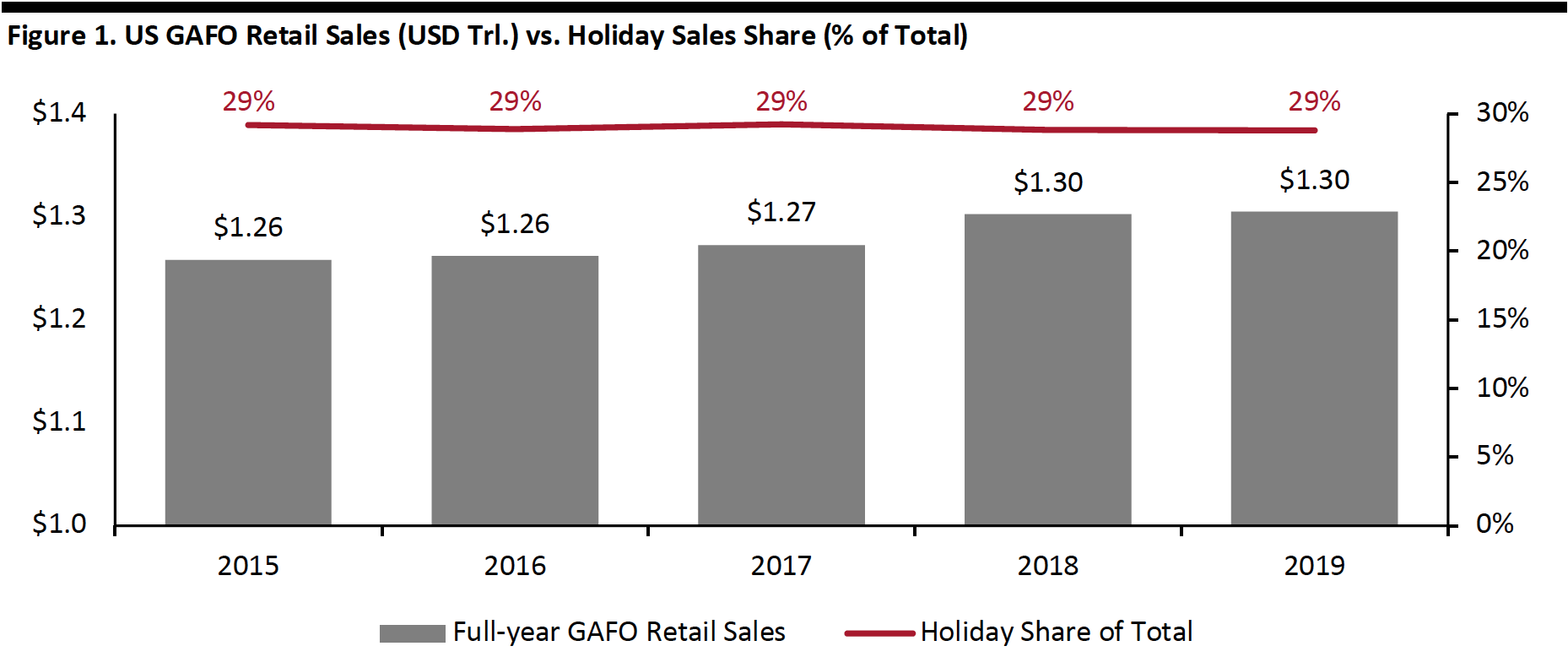

Holiday shopping in the US has typically been consistent: Figure 1 shows non-seasonally adjusted, total annual GAFO retail sales (general merchandise normally sold in department stores) and the share of holiday (October through December) sales, which account for a steady 29% over the past five years.

[caption id="attachment_113384" align="aligncenter" width="700"] Source: US Census Bureau/Coresight Research[/caption]

Source: US Census Bureau/Coresight Research[/caption]

However, with many things being different in 2020, it will be interesting to see if the holiday sales share trend changes this year. For one, retailers had to finalize their holiday plans at a time when many nonessential physical stores were forced to temporarily close due to Covid-19, with no clear opening date in sight. Since then, many stores and malls have reopened for curbside service or have reopened completely.

Then there is Amazon. In a typical year, Amazon Prime Day would already be behind us, as it usually takes place in mid-July. Thus far, the company has announced Prime Day in India to take place on August 6 and 7, but the dates of its US Prime Day have not yet been announced, with current predictions centering on early October. Holding Prime Day so late in the year could siphon off much of the spending earmarked for post Thanksgiving.

There are many key variables surrounding this year’s holiday season, including consumers’ willingness to go back into stores and malls and their ability to shop due to high unemployment rates, as well as income reductions from still-closed restaurants, gyms and entertainment venues. A recent Coresight Research survey of US consumers showed that 30.6% of respondents plan to spend “a lot less for the holiday season than last year.” However, the holidays are still several months away, and recent improvements in monthly retail sales suggest the beginning of a recovery in consumer interest in shopping and ability to spend.

US RETAIL AND TECH HEADLINES

Amazon Confirms Prime Day Delay in the US and Announces Dates for India

(July 21) TechCrunch.com

- Amazon has confirmed that Prime Day, its annual shopping holiday typically held in July, will be delayed this year due to disruptions caused by the coronavirus pandemic. The shopping holiday was initially held on the company’s US website only but has expanded over the years to occur simultaneously across several markets it serves, including the Asia, Europe and the UK.

- Although the event will be delayed in the US, Amazon has confirmed that it will be held on August 6 and 7 in India. This is the first time that the event will take place on different dates across its markets.

Nordstrom and Sephora Announce Job Cuts

(July 21) RetailDive.com

- Nordstrom is cutting 521 Seattle-based jobs as part of its non-store staff reductions, as per a notice filed at the Washington State Employment Security Department. These job cuts form a portion of the retailer’s planned 20% reduction in overhead expenses.

- Sephora is cutting 117 jobs, equating to 7% of its full-time staff. Several are corporate roles associated with the beauty retailer’s partnership with JCPenney and reflect changes linked to the latter’s store closures.

Zappos Starts Selling Single Shoes and Mixed-Size Pairs

(July 16) RetailDetail.eu

- Online apparel and footwear retailer Zappos has started selling single shoes and different-sized pairs. The company aims to cater to the needs of physically disabled customers and those with different-sized feet.

- Zappos began testing its new service on July 14. In the early stages, the company will buy shoes in pairs and will sell them individually or cross-paired. Currently, the offer includes brands such as Converse, New Balance and NIKE.

Best Buy Changes Pay Structure and Adds a Layer of Predictability in Compensating Employees

(July 21) Company press release

- Consumer electronics retailer Best Buy is changing its current pay structure to replace the short-term incentive compensation with a 4% increase in hourly wages that provides more predictability. In addition, the starting hourly wage of all domestic employees will be $15, effective August 2, 2020.

- Best Buy reported a 2.5% increase in total sales and a 255% jump in online sales, year over year, for the second fiscal quarter ended July 18. CEO Corie Barry stated, “Strong consumer demand, combined with shopping experiences that emphasize safety and convenience, have helped produce our sales results to date.”

Walgreens Partners with DoorDash for On-Demand Distribution

(July 16) Company press release

- Walgreens has partnered with last-mile delivery platform DoorDash to offer on-demand delivery to customers in Atlanta, Chicago and Denver in the US. Customers can order through the DoorDash app or website and choose from over 2,300 convenience, health and wellness products.

- By end of summer 2020, the partnership plans to include over 5,000 items for on-demand delivery and expand to major markets, starting with Cincinnati, Cleveland, Minneapolis, Oklahoma City, Phoenix, Sacramento and Seattle.

In an Unprecedented Move, L.L.Bean Enters into Wholesale Partnerships

(July 21) RetailDive.com

- Apparel and outdoor recreation equipment retailer L.L.Bean has announced entering wholesale collaborations for the first time in its existence. The aim of the partnerships is to “broaden the omnichannel approach and strategy,” according to the company.

- It will foray into wholesale by partnering with department store retailer Nordstrom, sporting goods retailer Scheels, and office supplies retailer Staples, allowing L.L.Bean to place its products in over 1,200 stores and online.

Google Launches Video Shopping Platform Shoploop

(July 16) Company press release

- Google has announced the launch of video-shopping platform Shoploop, which allows users to find, review and purchase goods. Google’s in-house research and development lab, Area 120, has created the platform.

- Shoploop is currently focused on content creators, publishers and online store owners in the beauty industry across categories such as hair and nails, makeup and skin care.

EUROPE RETAIL AND TECH HEADLINES

Kingfisher Provides Pre-Close Update on Second Quarter ahead of Its Half Year Results

(July 22) Company press release

- In a pre-close trading update for its quarter ending July 31, 2020, UK-based DIY retailer Kingfisher reported a 21.6% increase in comparable sales in the quarter to July 18, maintaining momentum from June, driven by strong e-commerce growth and a phased reopening of stores in France and the UK.

- Comparable e-commerce sales were up 225% in June 2020 and 202% in May. Kingfisher expects to better last year’s half-year adjusted pre-tax profit due to strong sales growth and cost reductions but has not provided full-year fiscal guidance due to uncertainty surrounding the pandemic and wider economy. It will report half-year results on September 22.

Missguided Partners with InPost To Offer Customers Access to Self-Serve Lockers

(July 22) uk.fashionnetwork.com

- Fashion retailer Missguided has partnered with parcel-delivery lockers company InPost to provide shoppers access to InPost’s self-serve parcel lockers across the UK. The self-serve lockers will offer a contact-free collect and return service to Missguided’s shoppers.

- Missguided Head of Distribution Karl Harwood said, “Partnering with InPost puts us in a unique position with a delivery service that is open around the clock, with the added benefits of being contact-free and also more environmentally friendly than home delivery.”

Hermes Plans To Hire 10,500 People as Online Shopping Grows in the UK

(July 20) BBC.com

- Hamburg-headquartered logistics company Hermes has announced it will create 10,500 jobs in the UK due to a surge in online shopping. The openings include 1,500 full-time roles across its delivery network and head office, in addition to 9,000 freelance couriers.

- Hermes currently has a network of more than 15,000 self-employed couriers in the UK. The company has announced an investment of £100 million ($127 million) toward its expansion and has launched 90 new sub-depots since the beginning of this year.

Gatemore Capital Management Acquires a 3.4% Stake in Superdry; Exceeds Disclosure Threshold

(July 21) Drapersonline.com

- Investment firm Gatemore Capital Management has crossed the 3% disclosure threshold in clothing company Superdry after building its stake in the company over the past 12 months. The investment firm sees potential for growth in Superdry’s business owing to the return of Co-Founder Julian Dunkerton and its performance during the coronavirus lockdown.

- Gatemore Capital Management is supportive of Dunkerton’s plans to return the brand to its design-led roots and the company’s dedication to sustainability, it announced in a statement.

Zalando To Give Strategic Support to Brands on Its Platform

(July 20) Globenewswire.com

- Berlin-based online fashion retailer Zalando is leveraging analytics company GoodData’s technology to provide brands with data-driven insights to help them better understand their target market and customize their offering.

- Using GoodData’s technology, Zalando launched “ZMS Insights”—an analytics platform leveraging data from its digital marketing segment ZMS—to help its brand partners with their plans and strategies related to product, marketing and merchandising. More than 1,000 brands are currently using this tool to their advantage.

ASIA RETAIL AND TECH HEADLINES

Amazon India’s SMB Exports Exceed $2 Billion

(July 20) Reuters.com

- Total exports from small to medium-sized businesses (SMBs) under Amazon’s Global Selling program have crossed the $2 billion milestone, according to the company. The program was launched in India in 2015 and has helped more than 60,000 Indian sellers to export products to approximately 15 countries.

- It took the company over three years to hit the first billion dollars and just 18 months to add another billion to the total exports under the program, according to Amazon Seller Services VP Gopal Pillai.

Alibaba’s Ant Group Seeks $200 Billion; Plans Concurrent IPO

(July 21) Techcrunch.com

- Alibaba’s financial services arm Ant Group has started the process of a simultaneous initial public offering (IPO) on the Hong Kong Stock Exchange and the Shanghai Stock Exchange’s Star Market, seeking $200 billion.

- The proceeds from the public listing will enable Ant Group to digitize China’s service industry in remote regions, increase domestic demand as a digital channel to access government-issued bonds, expand globally through its e-wallet partners and introduce new technologies.

Didi Chuxing Launches Cheaper Ride-Hailing Service for Younger Customers

(July 22) ChannelNewsAsia.com

- Chinese ride-hailing company Didi Chuxing has launched a cheaper, standalone service in a move to target younger customers, with booked rides starting from as low as ¥5.50 ($0.79).

- The new service is called “Huaxiaozhu,” and its app is separate to Didi Chuxing’s. The new service is already operational in some cities in China’s southwestern province of Guizhou and the eastern province of Shandong.

Don Don Donki Enters Malaysia

(July 22) Retailnews.asia

- Japanese discounter Don Don Donki is set to launch its first Malaysian store early next year in Kuala Lumpur’s renowned shopping district Bukit Bintang. It plans to offer a wide range of Japanese goods and globally sourced products.

- The store layout will span three floors of Lot 10 shopping center, which is set to open in the last quarter of 2020. The retailer currently has seven stores in Singapore, three in Hong Kong and two in Bangkok.

Mobile Muji Store Aims To Connect with Consumers in Japan’s Mountains

(July 21) Insideretail.asia

- Japanese retailer Muji has turned a tourist coach into a mobile store, to be more accessible to consumers in the remote mountainous regions of Japan, particularly older shoppers who cannot conveniently visit city stores.

- Muji will trial the mobile store from August, initially offering clothing, stationery and daily-use supplies. The retailer has plans for a full launch in September, after Muji has met the target shoppers and learned more about their specific needs.