Nitheesh NH

FROM THE DESK OF DEBORAH WEINSWIG

Alibaba.com Makes a Grab for US Business Earlier this week, business-to-business e-commerce giant Alibaba.com opened to US businesses looking to sell to other businesses: us.alibaba.com will now allow US small and medium-sized businesses to access the platform’s buyers in the US and internationally, though initially not those in China. What Is Alibaba Doing? Alibaba.com now allows US business, such as manufacturers and wholesalers, to sell to other businesses. The company said it is creating an “ecosystem of participants” that includes “anchor sellers” and B2B service providers. Anchor sellers include Office Depot, with which Alibaba announced a strategic collaboration in March 2019. On July 23, Alibaba announced Robinson Fresh, a fresh-produce supplier, would be a new anchor seller on the platform. A number of B2B service providers will provide “offers, discounts and premium content” to customers on Alibaba.com. Alibaba.com will cosponsor a national tour of events with local chambers of commerce and B2B organizations. The tour will feature workshops, one-on-one training and consultation opportunities with Alibaba.com experts, along with support from other members of Alibaba’s ecosystem. The first event was held Brooklyn on July 23, to be followed by Los Angeles on July 26 and Chicago on July 30, with more planned throughout the year. What Else Has Alibaba Done to Attract US Businesses? This move follows Alibaba’s alliance with Office Depot announced in March. That partnership saw the launch of a new cobranded online destination, “Office Depot on Alibaba.com,” and leveraged the scale of the companies’ marketing touchpoints to drive awareness of sourcing options among small and medium companies in the US. In June, Alibaba’s Tmall Global, China’s largest business-to-consumer (B2C) cross-border online marketplace, launched its first English-language website. At the time, Tmall Global said it is committed to offering opportunities for small, medium-sized and niche brands to enter the China market. The new English-language website supports that goal: It outlines information on Tmall Global solutions, entry requirements, and merchant workflow, making it easier for merchants to join Tmall Global to enter the Chinese market. What It Means Let’s be clear: None of the ventures noted above are about Alibaba selling to US consumers via a B2C website. The company’s recent ventures focus on helping US companies sell to other companies (via Alibaba.com) or sell to consumers in China (via Tmall Global). So, the near-term competitive threat to US retailers, including e-commerce rivals, is limited. At the same time, it’s important to remember Amazon.com sells to business, too, and the company encourages this with its Amazon Business program. We think recruiting US sellers on the platform will boost Alibaba’s appeal among US buyers, because they can now buy domestically. This will increase competition among sellers with meaningful B2B sales, such as warehouse clubs and office-supplies stores. The counterpoint is the potential for retailers to sell to Chinese consumers via Alibaba’s Tmall Global. In the 12 months ended March 31, 2019, Alibaba saw 654 million active customers on its Tmall and Taobao marketplaces, up from 552 million in the same period of the prior year. And those marketplaces generated ¥5.7 trillion of sales in the year ended March 31, 2019, equivalent to around $832 billion at today’s exchange rates. By comparison, we estimate Amazon generated global gross merchandise volume of $277 billion in 2018. Unlike Amazon, Alibaba is a platform provider and not a retailer (in e-commerce). This means any extra competition for US retailers will come from B2B sellers that sell on Alibaba’s US platform — and that the company’s platforms provide options for retailers to offset heightened competition by tapping new markets.

US RETAIL & TECH HEADLINES

- GNC on Monday announced it will close 700-900 stores, part of its "2019 and 2020 cost- savings targets." Most of the closures will be in malls, as the 61% of its shops in strip centers "are relatively stable from a comparable sales perspective," according to management. More than a quarter (28%) of GNC shops are in malls.

- The news came as the supplements retailer reported that second quarter revenues in the US and Canada fell 8% to $476.1 million, mostly due to a 4.6% same-store sales decline.

- Google has debuted its new shopping platform to lure customers with personalized recommendations. The tool is now live in the US. It welcomes you by name and shows tailored suggestions if you're logged into your Google account.

- Search for an item, and the new site will point you to products for sale in Google's own store (for devices such as Google Home speakers), or from chosen third-party sellers. It may also point you in the direction of a physical bricks-and-mortar store.

- Walmart is making further organizational changes to integrate its store and digital operations and leadership. The changes bring the US supply chain teams together, led by Greg Smith, current executive vice president of Walmart US supply chain.

- Smith will jointly report to Greg Foran, who runs Walmart’s US stores, and Marc Lore, who runs Walmart’s US e-commerce business. Janey Whiteside, chief customer officer, will continue to report to both Foran and Lore. Finance will also be further integrated.

- C. Penney has hired advisers to explore debt restructuring options that would buy more time for the money-losing US retailer to forge a turnaround. The 117-year-old department store chain’s move represents a high-stakes attempt to get its financial house in order before its cash coffers dwindle and its debt, totaling roughly $4 billion, comes due.

- The Plano, Texas-based company faces fierce competition from discount retailers, and has struggled to boost the profile of its e-commerce business.

- This holiday season, some shoppers will once again be able to shop in a Toys “R” Us store. The retailer will open two permanent stores in November – at Simon Property Group’s Galleria mall in Houston and at Unibail-Rodamco-Westfield’s Garden State Plaza mall in New Jersey.

- The stores are product of a joint venture between software retailer b8ta and Tru Kids, the company that is helping manage the brand names left in the wake of the 2018 Toys “R” Us liquidation.

EUROPE RETAIL & TECH HEADLINES

- British fashion retailer River Island has announced it will launch a new womenswear brand Harpenne in September. The new clothing line aims to fill a gap in the market by targeting an older audience.

- The brand will offer about 120 pieces of ethically sourced clothing priced between £25 ($31) and £100 ($125). Harpenne will add new products each week, including some limited-edition lines.

Groupe Casino to Sell its Subsidiary Vindémia for €219 Million

(July 22) Company press release

Groupe Casino to Sell its Subsidiary Vindémia for €219 Million

(July 22) Company press release

- French retailer Groupe Casino has agreed to sell its subsidiary Vindémia to automotive distribution and retail group GBH for an enterprise value of €219 million ($246 million). Vindémia operates in Reunion (a department of France off the coast of Madagascar), Madagascar, Mauritius and Mayotte.

- The sale is subject to authorization of the French competition authority and consultation with representative bodies of the workforce. As a part of the deal, Vindémia will carry on operations within GBH’s retail division.

Sainsbury’s Partners with Deliveroo

(July 22) RetailGazetter.co.uk

Sainsbury’s Partners with Deliveroo

(July 22) RetailGazetter.co.uk

- British supermarket chain Sainsbury’s has partnered with online food delivery company Deliveroo to deliver hot takeaway food to its customers.

- Sainsbury’s has launched a two-month trial in five stores across Cambridge, Selly Oak, West Hove, Hornsey and London’s Pimlico. As part of the trial, freshly baked pizzas, sweets, snacks, sides and drinks will be delivered to customers’ homes, straight from the supermarket counter.

Sports Direct Withdraws Challenge to Debenhams Restructuring

(July 22) Reuters.com

Sports Direct Withdraws Challenge to Debenhams Restructuring

(July 22) Reuters.com

- British department store Debenhams has announced that former shareholder Sports Direct has withdrawn its challenge to Debenhams’ restructuring.

- Terry Duddy, Debenhams’ Chairman, stated that the firm was determined to defend its restructuring plan to preserve the jobs of nearly 25,000 individuals who worked at the firm.

- British retailer Marks & Spencer has appointed Harriet Hounsell to be its new HR Director, as part of the company’s leadership transformation plan.

- Hounsell is currently serving as McDonald’s Chief People Officer and will commence her new role with Marks & Spencer in October. She will replace David Guise who announced his resignation in May.

- German fashion retailer Gerry Weber has announced plans to close all its UK stores by the end of October. The announcement comes as part of its parent company’s restructuring plan initiated in January.

- In January, Gerry Weber had stated it would restructure the business by shutting 230 stores internationally, affecting nearly 900 workers.

ASIA RETAIL AND TECH HEADLINES

- Trax, a Singapore-based startup that provides computer vision technology and analytics for the retail industry, has raised $100 million in a Series D round led by Chinese asset management firm HOPU Investments.

- Trax will use the investment to support global expansion and accelerate mass-market deployment of its retail technology.

- Swedish furniture retailer Ikea plans to start selling in Mumbai, its second location in India in less than a year, after Hyderabad. Ikea will first offer online sales in Mumbai and later open small stores, pick up centers and customer service centers across the city.

- In addition to Mumbai, customers will be able to shop online in the coming months in Hyderabad and Pune, followed by other cities. The company’s aim is to have 25 stores by 2025 and expand to 49 cities by 2030.

- Taiwan’s beauty technology company Perfect Corp has announced the launch of its YouCam for Web service that will offer virtual makeup tools for online businesses.

- Subscribers get access to Perfect Console, a technology that allows them to set up and manage virtual makeup applications across e-commerce sites.

- Korea-based duty-free shopping retailer Lotte Duty Free (LDF) reported a 49% increase in online store sales to KRW 1.4 trillion ($1.85 billion) in its first fiscal half of 2019.

- LDF has a target of total online sales of KRW 2.9 trillion ($2.46 billion) by the end of 2019. LDF’s online store offers about 87,000 products from around 2,000 brands.

Michael Kors Launches on Tmall

(July 18) Alizila.com

Michael Kors Launches on Tmall

(July 18) Alizila.com

- US luxury fashion brand Michael Kors has launched its flagship store on Tmall Luxury Pavilion, the online platform for luxury and premium products on Alibaba’s Tmall.

- The store will offer the entire range of Michael Kors men’s and women’s products to customers in China as well as special access to products launched exclusively on Tmall.

Reliance to Reportedly Launch Tiffany & Co And Tory Burch In India

(July 17) EconomicTimes.IndiaTimes.com

Reliance to Reportedly Launch Tiffany & Co And Tory Burch In India

(July 17) EconomicTimes.IndiaTimes.com

- Reliance Brands, the retail subsidiary of India’s Reliance Industries, has reportedly signed a deal to launch US luxury jewelry retailer Tiffany & Co and US lifestyle brand Tory Burch in India.

- The stores will be in the Jio World Center Mall scheduled to open in April 2020 in Mumbai.

LATIN AMERICA RETAIL AND TECH HEADLINES

Grupo Axo Acquires Privalia Mexico

(July 18) Themds.com

Grupo Axo Acquires Privalia Mexico

(July 18) Themds.com

- Mexican multi-brand firm Grupo Axo has acquired e-commerce retailer Privalia Mexico, owned by French company Veepee (formerly Vente-Privee.com), for an undisclosed amount.

- The acquisition is yet to be approved by Mexico’s federal agency Comisión Federal de Competencia Económica (Cofece). If approved, Grupo Axo will become owner of all Privalia Mexico shares.

- Italian luxury fashion brand Dolce & Gabbana will expand in Mexico with the opening of its first boutique store in the Mexican state of Veracruz.

- The Dolce & Gabbana boutique will be inside department store El Palacio de Hierro at the Andamar Lifestyle Center shopping mall to open in September.

- Ikea plans to invest about $150 million to expand in Mexico. Ikea has already invested nearly $500 million in the country.

- Malcolm Pruys, Retail Manager and Director of Ikea, Mexico, said the new investment will be used to develop infrastructure and enhance energy efficiency at the first Ikea store in Mexico set to open by fall of 2020.

- American sportswear company Under Armour plans to open its third store in Lima later this month. The new large-format store, covering an area of 1,615 square feet, will be situated at the Larcomar shopping center in the district of Miraflores, Lima.

- Under Armour also opened three new stores in Buenos Aires, Bolivia and Medellín in the last 30 days. According to the newspaper Gestión, Under Armour expects to grow in the Peruvian market with two or three openings annually in Lima and enter other provinces from 2021.

- US pet retailer Petco plans to expand to 100 branches in Mexico by the end of 2020 and launch a mobile app this year. Petco currently runs 74 stores and expects to open 16 new stores in 2019.

- Petco will invest $20 million this year on store openings, logistics and technology. The new mobile app will allow customers to make purchases, book appointments for pet services and receive updates on promotions.

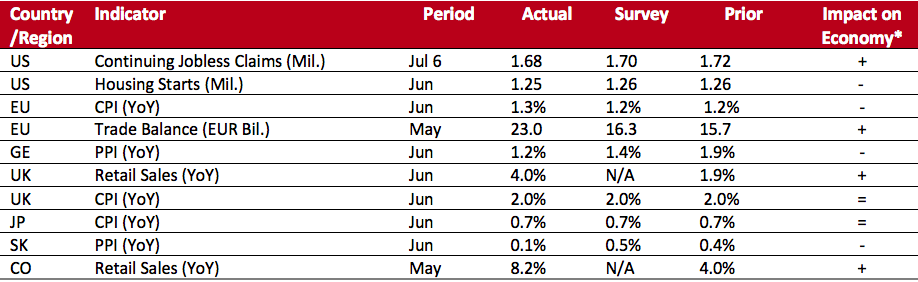

- US: Continuing jobless claims fell to 1.68 million in the week ended July 6 from 1.72 million in the previous week. Housing starts fell to 1.25 million in June from 1.26 million in May.

- Europe: In the eurozone, the consumer price index (CPI) was up 1.3% year over year in June, a slight increase from the 1.2% year over year growth in May, and above the consensus estimate of 1.2%. In Germany, the producer price index (PPI) was up 1.2% year over year in June, a drop from the 1.9% year over year growth in May, and below the consensus estimate of 1.4%.

- Asia Pacific: In Japan, the CPI was up 0.7% year over year in June and in line with the level in May. In Korea, the PPI was up 0.1% year over year in June, a decrease from the 0.4% year over year growth in May, and below the consensus estimate of 0.5%.

- Latin America: Retail sales in Colombia were up 8.2% year over year in May, an increase from the 4.0% year over year growth in April.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Department of Labor/US Census Bureau/Eurostat/Destatis/Office for National Statistics/Statistics Bureau Of Japan/Bank of Korea/Dane/Coresight Research[/caption]

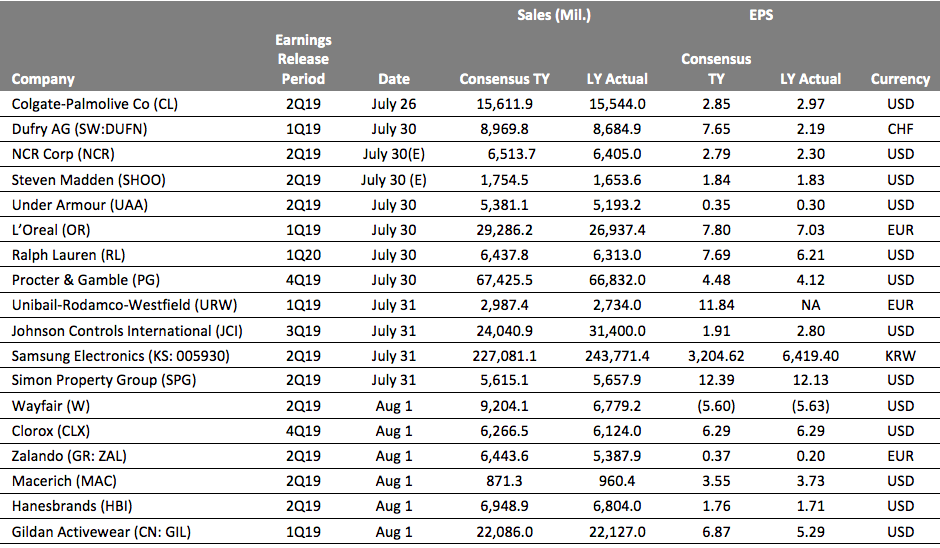

EARNINGS CALENDAR

[caption id="attachment_93553" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

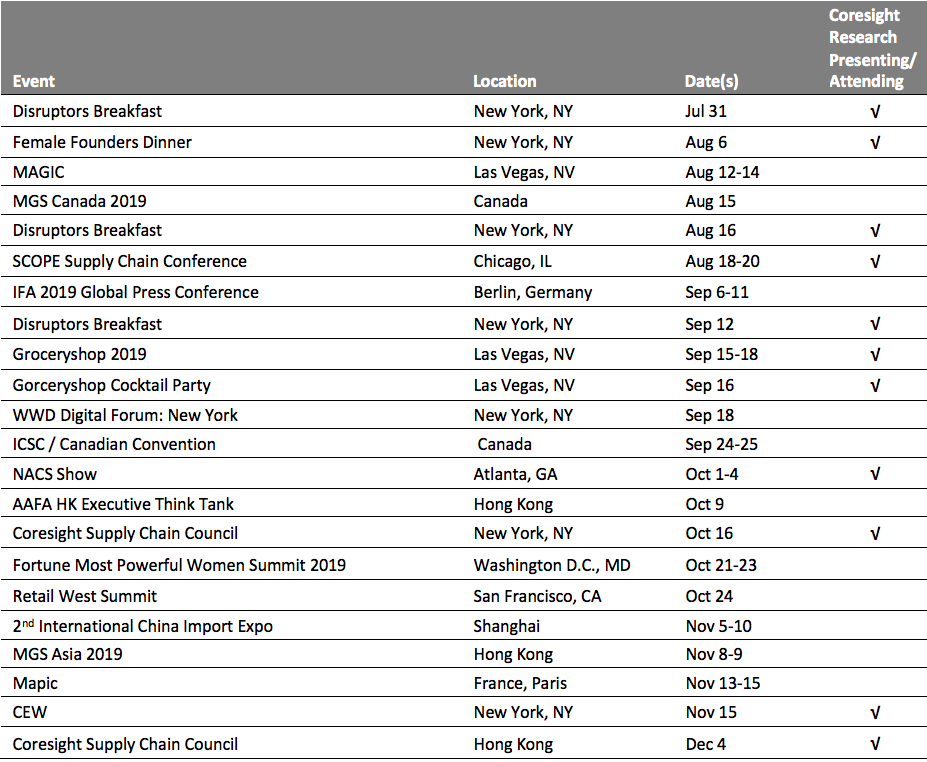

EVENT CALENDAR