From the Desk of Deborah Weinswig

Amazon Is Helping Entrepreneurs Start Delivery Businesses to Expand Its Own Fulfillment Network

Amazon recently announced a new initiative called Amazon Delivery Service Partners, which aims to help entrepreneurs build small businesses while also expanding its own delivery network. Through the program, Amazon will provide entrepreneurs with access to its delivery technology, hands-on training, and discounts on assets and services, including vehicle leases and comprehensive insurance. Amazon believes that participating entrepreneurs can launch a business for as little as $10,000.

On behalf of participating entrepreneurs, the company has negotiated exclusive discounts on required resources, such as Amazon-branded vehicles customized for delivery, uniforms, fuel and comprehensive insurance coverage. The offering is even sweeter for US military veterans: qualified veterans who launch their own Amazon delivery business can receive a $10,000 reimbursement, and the company is setting aside $1 million to help cover their startup costs. Amazon estimates that a successful delivery service owner with a fleet of 40 delivery vehicles can earn up to $300,000 in annual operating profit.

Amazon sees this initiative as a continuation of its efforts to enable business owners around the world to participate in the wave of e-commerce, no matter the size of their business. Amazon’s Marketplace has already enabled more than 140,000 small and midsized businesses to each achieve more than $100,000 in annual sales on the site. The company claims that more than half of the products sold on Amazon.com are sold by third-party sellers. Moreover, Amazon provides technology tools such as Kindle Direct Publishing and Amazon Web Services that enable businesses of all sizes.

Under the Delivery Service Partners program, Amazon aims to launch hundreds of small businesses that will hire tens of thousands of workers. Drivers wearing blue shirts with the Amazon logo and black hats will pick up parcels at the beginning of each day at one of 75 Amazon stations. An algorithm will determine which parcels drivers pick up and which are sent on to other delivery companies, such as FedEx and UPS, for last-mile fulfillment.

Amazon has a strong incentive to build out its own fulfillment network. In 2017, the company spent $25.2 billion on fulfillment, up 43% from the prior year, with the increase outpacing the company’s 31% increase in reported revenue. This program enables Amazon to develop its delivery network while generating positive media buzz.

The program represents yet another step in Amazon’s strategy to expand its delivery methods in order to provide better customer service and reduce fulfillment costs. The company already has 7,000 of its own trucks and 40 airplanes, according to CNBC. It also has a $1.5 billion cargo hub currently under construction in northern Kentucky. By building out its own delivery network, Amazon also reduces its reliance on FedEx, UPS and other delivery companies, giving it more control over its entire fulfillment system, from purchase to delivery.

There is an existing model for this type of delivery network: Alibaba, China’s largest e-commerce company, manages a consortium of independent warehouses and delivery companies called Cainiao. The company was founded in 2013, and Alibaba owned a 47% stake in it as of the end of March 2017. Cainiao aims to a take collaborative approach to logistics. Its data platform drives efficiency by connecting e-commerce companies with players along the logistics chain to enable end-to-end solutions. Its scale is massive—Cainiao’s delivery network encompasses 90 partners in 224 global regions operating 200 warehouses in 250 cities. Those warehouses direct 230,000 vehicles that serve 180,000 delivery stations. Cainiao claims that its platform processes data for 70% of the packages delivered in China (estimated to hit 145 million in 2020) and sends 800 million status updates each day.

Amazon’s new delivery program allows it to “do good while doing well” by helping veterans and budding entrepreneurs start businesses while increasing its control of its delivery network and reducing costs. Given that Amazon is already a highly data-driven company, it is likely that it will tightly integrate data from participating delivery companies into its platform in order to increase efficiency and improve delivery times and customer satisfaction.

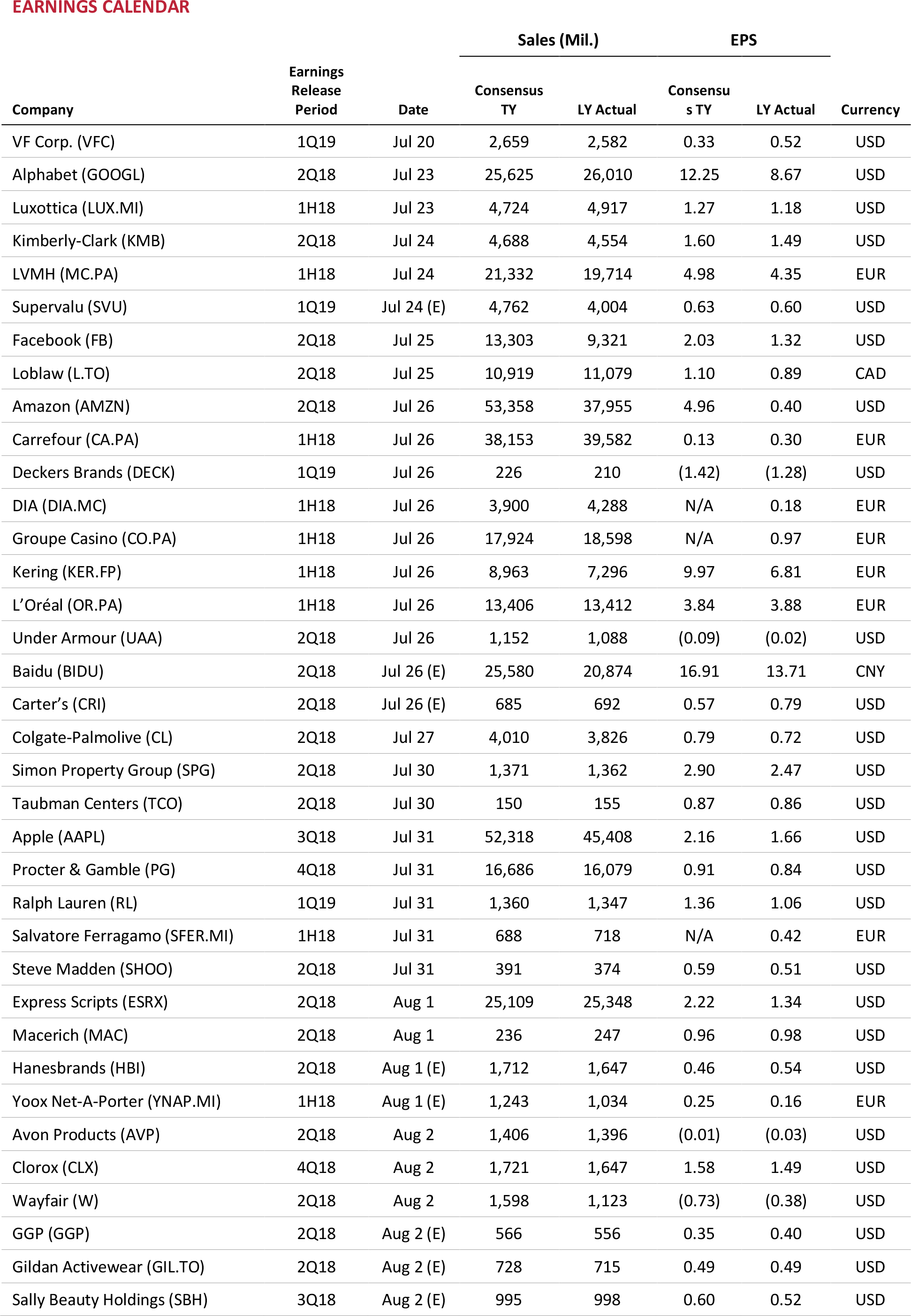

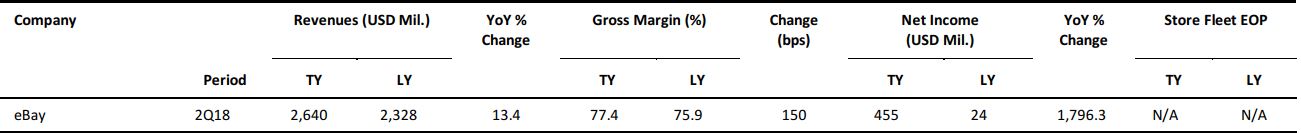

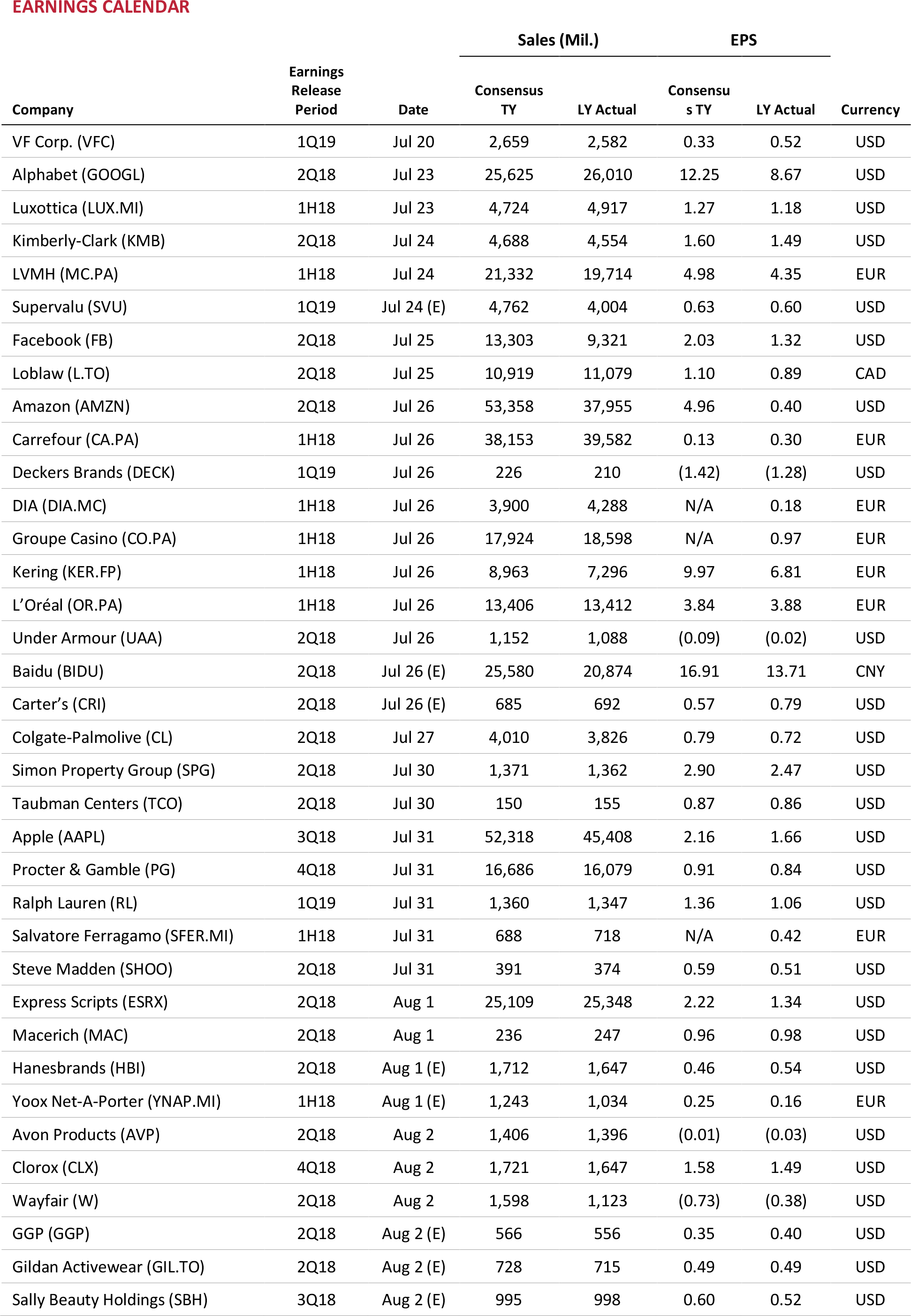

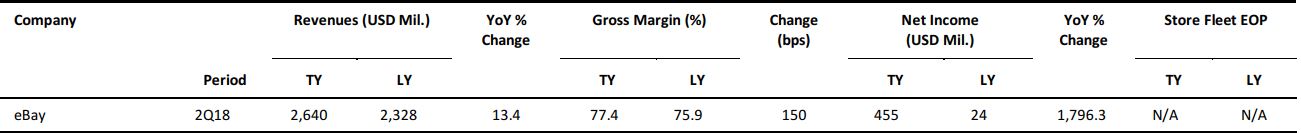

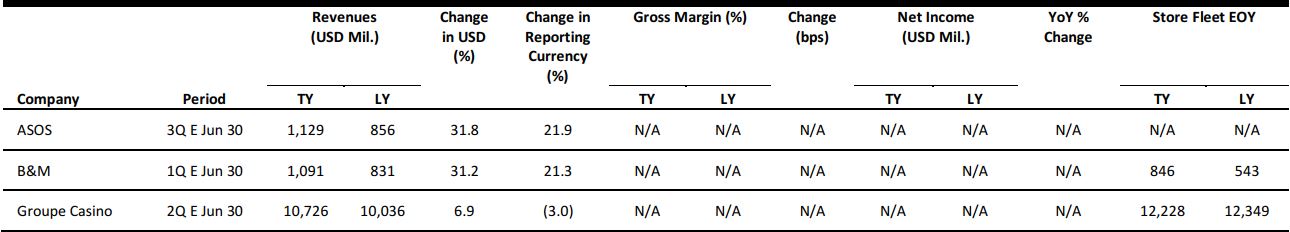

US RETAIL EARNINGS

Source: Company reports/Coresight Research

US RETAIL & TECH HEADLINES

With Amazon Leading the Way, E-Commerce Is Approaching 10% of All US Retail Sales

(July 17) Qz.com

With Amazon Leading the Way, E-Commerce Is Approaching 10% of All US Retail Sales

(July 17) Qz.com

- In the first quarter of 2018, of just over $1.2 trillion in total retail sales, e-commerce accounted for only $114 billion, or 9.3%. E-commerce sales grew from 8% of total sales in 2016 to 8.9% of total sales in 2017, a similar pace of growth as recorded in previous years.

- Given current trends, e-commerce sales are projected to surpass 10% of overall retail sales in the fourth quarter of 2018 (seasonally adjusted).

Walmart, Microsoft Team Up to Take on Amazon

(July 17) News.ABS-CBN.com

Walmart, Microsoft Team Up to Take on Amazon

(July 17) News.ABS-CBN.com

- Walmart said it was entering into a strategic partnership with Microsoft on “digital transformation” for the onetime retail industry leader. The move is aimed at helping Walmart compete better against Amazon, which is taking a growing share of retail sales in the US.

- The two firms said that the partnership was focused on using artificial intelligence and other technology tools to help manage costs, expand operations and innovate faster. Microsoft’s Azure platform will help Walmart manage operations and improve its supply chain.

Amazon Says US Prime Day Sales Reach Records Despite Early Outage

(July 17) MarketWatch.com

Amazon Says US Prime Day Sales Reach Records Despite Early Outage

(July 17) MarketWatch.com

- Amazon said that Prime Day sales in the US were “bigger than ever,” growing faster in the first 10 hours year over year, despite an early outage that kept many from shopping the event’s deals.

- At about 5pm, ET, on July 16, Amazon tweeted that “some customers are having difficulty shopping,” but that “many are shopping successfully—in the first hour of Prime Day in the US, customers have ordered more items compared with the first hour last year.”

Rival Retailers Try to Catch a Ride on Amazon Prime’s Tailwinds

(July 16) Bloomberg.com

Rival Retailers Try to Catch a Ride on Amazon Prime’s Tailwinds

(July 16) Bloomberg.com

- Retailers Target, Best Buy, Macy’s and Walmart all planned special promotions to coincide with Amazon’s Prime Day, which began at noon on July 16 in Seattle and was quickly engulfed in negative feedback about technical glitches.

- Nearly four out of 10 Americans planned to shop somewhere else besides Amazon on Prime Day—anumber that many speculated would increase if Amazon’s technical snafus lingered.

Back-to-School Shoppers Are Waiting for Deals

(July 13) RetailDive.com

Back-to-School Shoppers Are Waiting for Deals

(July 13) RetailDive.com

- Back-to-school shopping is in focus for retailers and consumers alike, but shoppers are holding out for the best promotions before actually buying. Household spending on clothing, supplies, computers and electronics for children in grades K–12 is expected to reach nearly $28 billion this year, according to Deloitte’s annual back-to-school survey.

- The wait-and-see approach is leaving 20% of back-to-school budgets, or some $5.5 billion, up for grabs at the moment, Deloitte said.

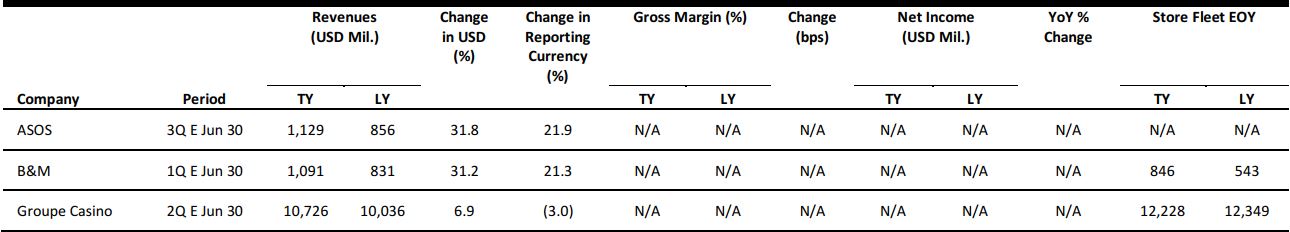

EUROPERETAIL EARNINGS

Source: Company reports/Coresight Research

EUROPE RETAIL & TECH HEADLINES

British Retail Footfall Down 0.9% in June

(July 16) TheRetailBulletin.com

British Retail Footfall Down 0.9% in June

(July 16) TheRetailBulletin.com

- British retail footfall fell by 0.9% in June, according to figures from Springboard and the British Retail Consortium (BRC). Shopping centers and retail parks saw footfall drop by 3.4% and 0.4%, respectively, in June, while high-street footfall slid 0.1%. Footfall grew in only four areas of the UK, the West Midlands (up 0.8%), North and Yorkshire (up 0.5%), Northern Ireland (up 3.6%) and Wales (up 0.3%).

- Diane Wehrle, Marketing and Insights Director at Springboard, said, “The drop in footfall in June, the seventh in as many months, means that we are now in the longest period of continued footfall decline since 2015.”

Sainsbury’s and WHSmith Announce a Trial Partnership

(July 16) RetailGazette.co.uk

Sainsbury’s and WHSmith Announce a Trial Partnership

(July 16) RetailGazette.co.uk

- British grocery retailer Sainsbury’s announced a deal that will see its food-to-go ranges sold across WHSmith travel stores.

- Sainsbury’s is due to supply nine WHSmith stores in airports, railway stations and hospitals with snacks and light meals. Sainsbury’s said that the partnership aligns with its strategy to expand its offerings and that it is working with new partners to cater to changing shopper needs.

Adidas Keen to Strengthen Bonds with Small Retailers

(July 16) RetailDetail.eu

Adidas Keen to Strengthen Bonds with Small Retailers

(July 16) RetailDetail.eu

- German sportswear retailer Adidas said that it wants to strengthen its relationships with small-scale retailers to negate their claims that it is favoring large international chains as it expands its web shop.

- Smaller retailers have expressed their discontent over Adidas frequently tying up with larger retailers, such as JD Sports in the UK and Footlocker in the US, to expand its web offering.

Annual General Meeting Warnings Indicate 351 Marks & Spencer Jobs at Risk

(July 16) TheGuardian.com

Annual General Meeting Warnings Indicate 351 Marks & Spencer Jobs at Risk

(July 16) TheGuardian.com

- British retailer Marks & Spencer (M&S) has proposed 351 job cuts in its stores, comprising 182 section manager, 115 operations manager and 54 visual manager positions.

- According to documents seen by The Guardian, M&S stated that increasing management costs and a 7.5% drop in sales in the last two years had “contributed to reducing store profitability, impacting on our ability to trade.” M&S CEO Steve Rowe hinted that further job cuts may result from a plan to cut costs by £350 million ($479.5 million) by 2021.

Pointy Raises Fresh Funds to Help Brick-and-Mortar Retailers

(July 12) TechCrunch.com

Pointy Raises Fresh Funds to Help Brick-and-Mortar Retailers

(July 12) TechCrunch.com

- Pointy, an Irish startup that helps offline retailers sell online, has raised $12 million from Polaris Partners and Vulcan Capital in its series B round of funding. Pointy CEO Mark Cummins said that the funds will be used to increase the number of covered retailers, which currently stands at 5,500.

- Cummins stated, “For all the hype around e-commerce and the media narrative of ‘Retail Apocalypse,’ people still make the vast majority of their purchases in local stores. But local retailers have lost out in not having their products visible online. We solve that problem for them.”

ASIA RETAIL & TECH HEADLINES

Ele.me to Expand Further in Food Delivery

(July 16) RetailNews.Asia

Ele.me to Expand Further in Food Delivery

(July 16) RetailNews.Asia

- me, a food delivery app recently acquired by Alibaba, announced that it would expand in the already competitive food delivery business in China. The company will compete with Meituan-Dianping, China’s on-demand-service provider.

- Meituan-Dianping controls the market, with a 59.1% market share as reported by iResearch, a market research company. Wang Lei, CEO of Ele.me, remarked, “Ele.me is not only going to win this summer’s battle, it will also take the crown in local services and the new retail sector.”

GS Retail Invests Equity in Thrive Market

(July 12) TheInvestor.co.kr

GS Retail Invests Equity in Thrive Market

(July 12) TheInvestor.co.kr

- South Korean retailer GS Retail has announced a KRW 33 billion ($29 million) equity investment in US e-commerce firm Thrive Market. This is GS Retail’s first overseas investment, and it comes in the context of an expanding US organic food market.

- Thrive has posted average annual sales growth of 40% since its inception in 2015. GS Retail aims to market Thrive products within a year through GS25 and GS, its branded retail chains.

Victoria’s Secret Opens a Flagship Store in Hong Kong

(July 16) RetailNews.Asia

Victoria’s Secret Opens a Flagship Store in Hong Kong

(July 16) RetailNews.Asia

- American lingerie brand Victoria’s Secret opened its first flagship store in Hong Kong on July 17. The store had been under construction for over a year.

- The store opening is part of the retailer’s global expansion strategy. Victoria’s Secret’s product offering includes lingerie collections, perfumes and body care products.

Cyberdyne Announces Establishment of Fund for Healthcare and AI Firms

(July 10) TechCrunch.com

Cyberdyne Announces Establishment of Fund for Healthcare and AI Firms

(July 10) TechCrunch.com

- Japanese robotics firm Cyberdyne announced an $82 million fund to invest in healthcare and cybernics—a new research vertical focusing on the integration of neuroscience, robotics, information technology and other disciplines.

- “Cyberdyne and its consolidated subsidiary, CEJ Capital Inc., have [established the] CEJ Fund in order to support and nurture venture companies aiming at solving social issues and creating a new cybernic industry,” the Japanese firm said. Cyberdyne said that the CEJ Fund had initially raised ¥9.2 billion ($81.8 million).

LATAM RETAIL AND TECH HEADLINES

Carrefour Introduces Automatic Checkout System at Atacadão Stores

(July 16) ESMMagazine.com

Carrefour Introduces Automatic Checkout System at Atacadão Stores

(July 16) ESMMagazine.com

- French supermarket group Carrefour has introduced an automatic checkout system at its Atacadão wholesale banner in Brazil. The new system allows shoppers to pay for their purchases faster than they could at a regular checkout register.

- The system uses 16 cameras to scan the sides of packages, boxes and loose items on an automatic conveyor belt. The system is able to register about 60 items per minute compared with 15 items per minute with a regular checkout system.

Brazilian Development Bank to Fund Accelerator Program

(July 11) ZDnet.com

Brazilian Development Bank to Fund Accelerator Program

(July 11) ZDnet.com

- Brazil’s national bank for economic and social development, BNDES, will provide R$10 million ($2.5 million) for a startup accelerator program in Rio de Janeiro.

- The program, called BNDES Garagem, will beginin November 2018 and include 60 startups in its first cohort. Participating startups will receive accounting, legal, technology, public relations and digital marketing services, and have access to spaces for events and training.

Total Retail Sales in Brazil Drop 17% on World Cup Match Day

(July 16) RioTimesOnline.com

Total Retail Sales in Brazil Drop 17% on World Cup Match Day

(July 16) RioTimesOnline.com

- Retailers in Brazil saw sales drop 17% on July 6, when Brazil was eliminated from the 2018 World Cup, according to a survey of retailers across categories by Cielo, a credit and debit card operator. Cielo compared retail performance on the Friday that Brazil lost the match to performance on regular Fridays before the World Cup.

- Apparel retailers were most affected. On the day Brazil lost to Belgium and fell out of the running for the World Cup, clothing retailers saw sales fall by 43%, Cielo said.

Credz Signs Agreement with TAS Group for a Digital Wallet App Pilot Project

(July 16) BobsGuide.com

Credz Signs Agreement with TAS Group for a Digital Wallet App Pilot Project

(July 16) BobsGuide.com

- Brazilian card issuer Credz and European fintech firm TAS Group have signed a deal to work on a proof of concept for a digital wallet app for the Credz retailer partner network.

- Credz has 50 partners in Brazil. The digital wallet app is being trialed at selected merchants in São Paulo, and Credz plans to subsequently roll out the app to its retailer partner network throughout the country.

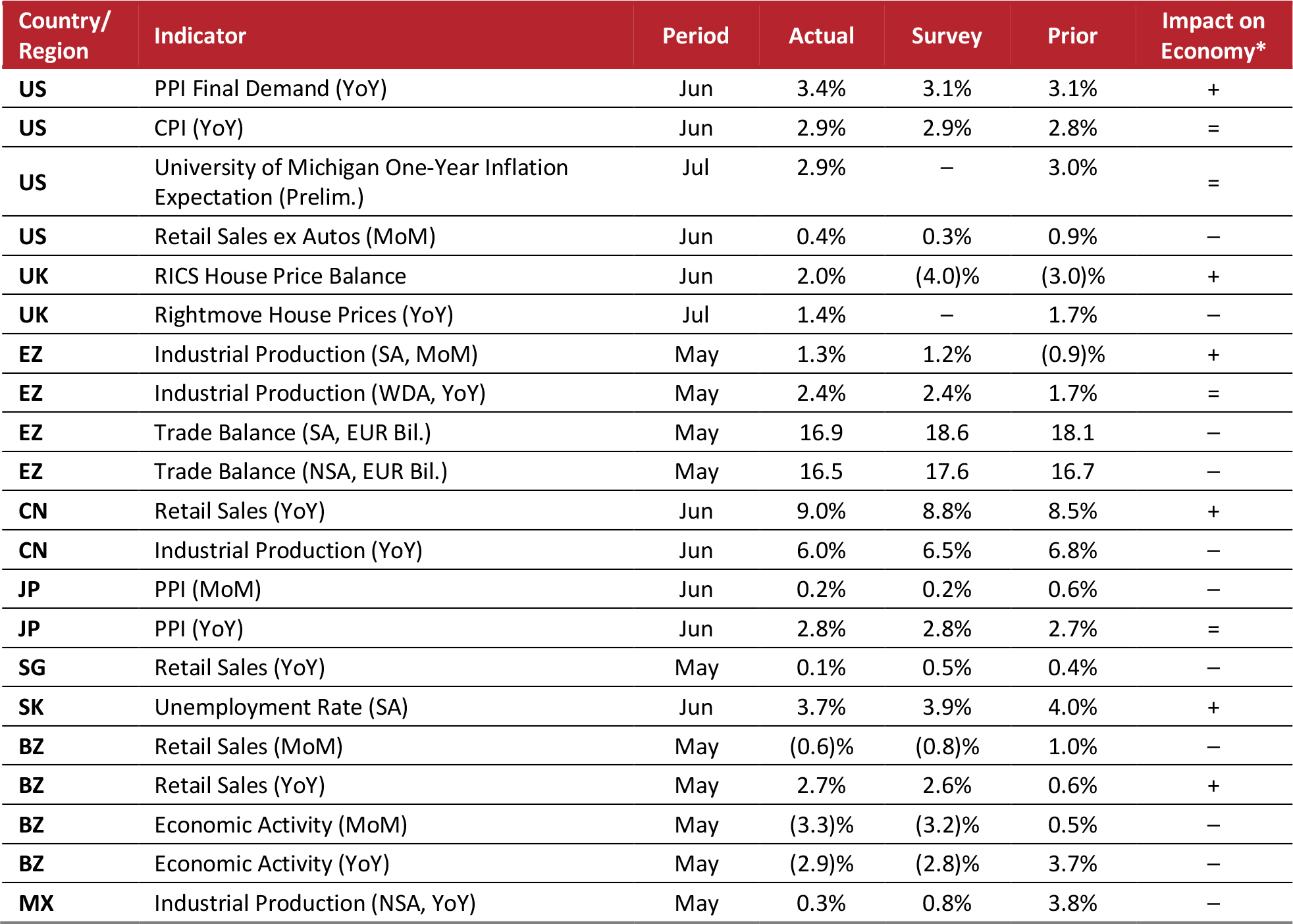

MACRO UPDATE

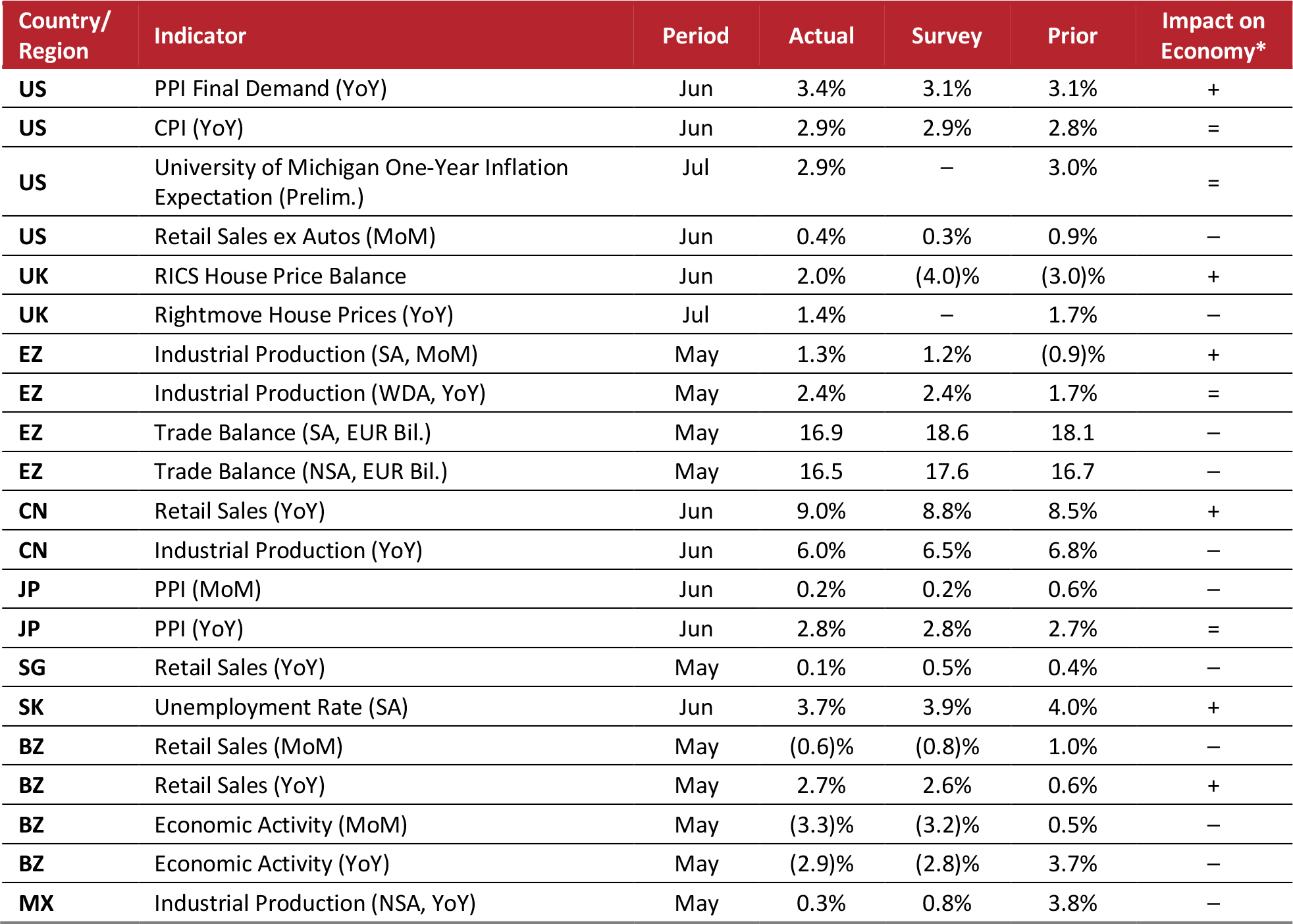

Key points from global macro indicators released July 11–18, 2018:

- US: In June, the Producer Price Index (PPI) for final demand increased by more than analysts had expected, rising by 3.4% year over year. The Consumer Price Index (CPI) rose by 2.9% year over year in June, in line with the consensus estimate. The University of Michigan One-Year Inflation Expectation stood at 2.9% in July.

- Europe: In the UK, the RICS House Price Balance rose in June to 2.0%, well above the consensus estimate. In the eurozone, industrial production increased by a seasonally adjusted 1.3% month over month in May, coming in slightly higher than the consensus estimate.

- Asia-Pacific: In China, retail sales growth exceeded the consensus estimate in June, coming in at 9.0% year over year. In Japan, the PPI increased by 2.8% year over year in June, in line with the consensus estimate. In Singapore, May retail sales increased by 0.1% year over year in May, versus the 0.5% consensus estimate. In South Korea, the unemployment rate fell to 3.7% in June.

- Latin America: In Brazil, May retail sales grew by slightly more than analysts had expected, rising by 2.7% year over year. Economic activity in Brazil decreased by 2.9% year over year in May, falling by more than had been anticipated. In Mexico, industrial production increased by a non-seasonally adjusted 0.3% year over year in May, versus the 0.8% consensus estimate.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/University of Michigan/US Census Bureau/RICS/Rightmove/Eurostat/National Bureau of Statistics of China/Bank of Japan/Singapore Department of Statistics/Statistics Korea Instituto Brasileiro de Geografia e Estatística /Banco Central do Brasil/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/University of Michigan/US Census Bureau/RICS/Rightmove/Eurostat/National Bureau of Statistics of China/Bank of Japan/Singapore Department of Statistics/Statistics Korea Instituto Brasileiro de Geografia e Estatística /Banco Central do Brasil/Instituto Nacional de Estadística y Geografía/Coresight Research

With Amazon Leading the Way, E-Commerce Is Approaching 10% of All US Retail Sales

(July 17) Qz.com

With Amazon Leading the Way, E-Commerce Is Approaching 10% of All US Retail Sales

(July 17) Qz.com

Amazon Says US Prime Day Sales Reach Records Despite Early Outage

(July 17) MarketWatch.com

Amazon Says US Prime Day Sales Reach Records Despite Early Outage

(July 17) MarketWatch.com

Rival Retailers Try to Catch a Ride on Amazon Prime’s Tailwinds

(July 16) Bloomberg.com

Rival Retailers Try to Catch a Ride on Amazon Prime’s Tailwinds

(July 16) Bloomberg.com

Back-to-School Shoppers Are Waiting for Deals

(July 13) RetailDive.com

Back-to-School Shoppers Are Waiting for Deals

(July 13) RetailDive.com

British Retail Footfall Down 0.9% in June

(July 16) TheRetailBulletin.com

British Retail Footfall Down 0.9% in June

(July 16) TheRetailBulletin.com

Sainsbury’s and WHSmith Announce a Trial Partnership

(July 16) RetailGazette.co.uk

Sainsbury’s and WHSmith Announce a Trial Partnership

(July 16) RetailGazette.co.uk

Adidas Keen to Strengthen Bonds with Small Retailers

(July 16) RetailDetail.eu

Adidas Keen to Strengthen Bonds with Small Retailers

(July 16) RetailDetail.eu

Annual General Meeting Warnings Indicate 351 Marks & Spencer Jobs at Risk

(July 16) TheGuardian.com

Annual General Meeting Warnings Indicate 351 Marks & Spencer Jobs at Risk

(July 16) TheGuardian.com

Pointy Raises Fresh Funds to Help Brick-and-Mortar Retailers

(July 12) TechCrunch.com

Pointy Raises Fresh Funds to Help Brick-and-Mortar Retailers

(July 12) TechCrunch.com

GS Retail Invests Equity in Thrive Market

(July 12) TheInvestor.co.kr

GS Retail Invests Equity in Thrive Market

(July 12) TheInvestor.co.kr

Victoria’s Secret Opens a Flagship Store in Hong Kong

(July 16) RetailNews.Asia

Victoria’s Secret Opens a Flagship Store in Hong Kong

(July 16) RetailNews.Asia

Cyberdyne Announces Establishment of Fund for Healthcare and AI Firms

(July 10) TechCrunch.com

Cyberdyne Announces Establishment of Fund for Healthcare and AI Firms

(July 10) TechCrunch.com

Carrefour Introduces Automatic Checkout System at Atacadão Stores

(July 16) ESMMagazine.com

Carrefour Introduces Automatic Checkout System at Atacadão Stores

(July 16) ESMMagazine.com

Total Retail Sales in Brazil Drop 17% on World Cup Match Day

(July 16) RioTimesOnline.com

Total Retail Sales in Brazil Drop 17% on World Cup Match Day

(July 16) RioTimesOnline.com

Credz Signs Agreement with TAS Group for a Digital Wallet App Pilot Project

(July 16) BobsGuide.com

Credz Signs Agreement with TAS Group for a Digital Wallet App Pilot Project

(July 16) BobsGuide.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/University of Michigan/US Census Bureau/RICS/Rightmove/Eurostat/National Bureau of Statistics of China/Bank of Japan/Singapore Department of Statistics/Statistics Korea Instituto Brasileiro de Geografia e Estatística /Banco Central do Brasil/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/University of Michigan/US Census Bureau/RICS/Rightmove/Eurostat/National Bureau of Statistics of China/Bank of Japan/Singapore Department of Statistics/Statistics Korea Instituto Brasileiro de Geografia e Estatística /Banco Central do Brasil/Instituto Nacional de Estadística y Geografía/Coresight Research