DIpil Das

FROM THE DESK OF DEBORAH WEINSWIG

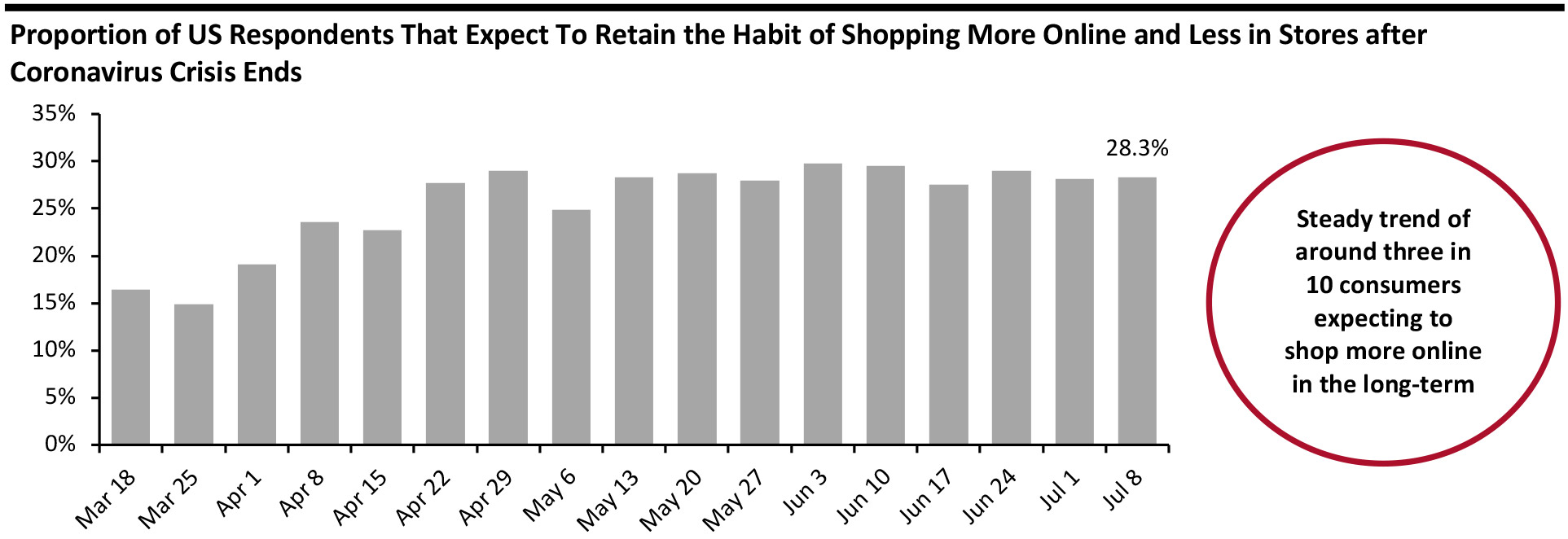

Heading Toward $1 Trillion in US E-Commerce, Fueled by Covid-19 Spending Trends The Covid-19 crisis has changed how people shop, and one of the most visible trends is the accelerated shift toward e-commerce. At Coresight Research, we see the current spike in online demand fueling a three-year climb toward approximately $1 trillion in total annual US online retail sales: We expect US e-commerce to hit that watershed in 2023. Our weekly survey of US shoppers confirms the strength of consumer expectations to shop more online, even after the crisis ends. Around three in 10 expect to do so, and that proportion has remained fairly steady since late April. [caption id="attachment_113032" align="aligncenter" width="700"] Base: US Internet users aged 18+

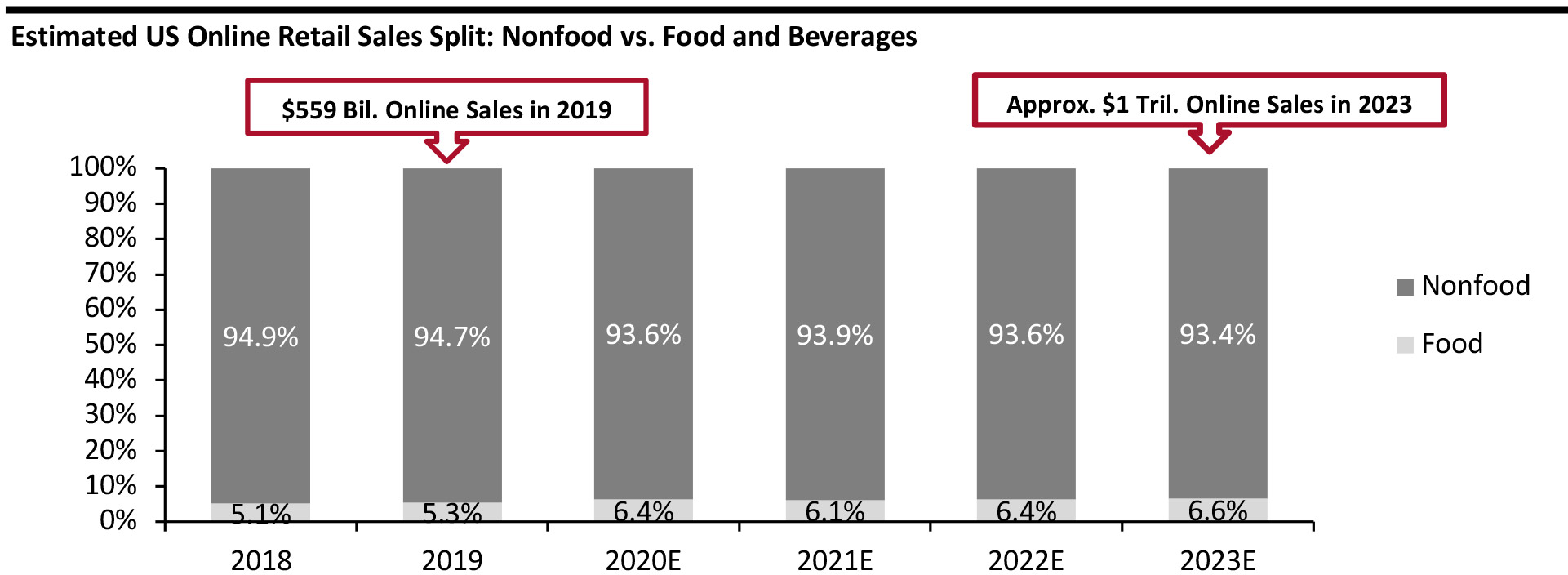

Base: US Internet users aged 18+ Source: Coresight Research [/caption] Consumers have flocked to e-commerce for groceries, which will support the drive toward a trillion-dollar e-commerce sector: We estimate that online food and beverage retail sales will rise by 45–50% over the course of 2020. However, this is from a still-small base, and even by 2023, food will account for a small share of total online sales. As we show below, the share of online channel sales accounted for by food and beverages is currently in the single digits, and—despite stronger growth for food than nonfood categories, including a jump in the share of channel sales in 2020—we expect this to remain the case through 2023. Major nonfood categories, especially apparel and electronics, will continue to account for much larger shares of total online sales. [caption id="attachment_113033" align="aligncenter" width="700"]

Source: Coresight Research[/caption]

What Does This Mean for Retailers?

In short, nonfood categories will continue to be by far the biggest driver of e-commerce expansion in the coming period. The funneling of an estimated hundreds of millions of dollars of nonfood sales to e-commerce in the coming years underscores the potential for store closures across many nonfood sectors. The short-term demands of the Covid-19 pandemic will fuel retail store closures as a result of retail failures, but accelerated structural shifts will drive a downsizing of nonfood retail space as retailers favor investments in e-commerce.

Source: Coresight Research[/caption]

What Does This Mean for Retailers?

In short, nonfood categories will continue to be by far the biggest driver of e-commerce expansion in the coming period. The funneling of an estimated hundreds of millions of dollars of nonfood sales to e-commerce in the coming years underscores the potential for store closures across many nonfood sectors. The short-term demands of the Covid-19 pandemic will fuel retail store closures as a result of retail failures, but accelerated structural shifts will drive a downsizing of nonfood retail space as retailers favor investments in e-commerce.

US RETAIL AND TECH HEADLINES

Amazon Plans Neighborhood Health Center Pilot Program in Collaboration with Crossover Health (July 14) Amazon Blog- As part of a pilot program, Amazon plans to open neighborhood health centers near its fulfillment centers and operations facilities in collaboration with health-care firm Crossover Health. The program aims to improve access to quality primary health care for its employees and their families.

- Starting with its first health center in Dallas-Fort Worth, Texas, Amazon plans to open a total of 20 centers in five cities across the US as part of the program.

- Outdoor clothing and equipment retailer REI has laid off 400 retail employees, equating to roughly 5% of its retail staff, as the pandemic continues to impact its revenues. The company furloughed 90% of its retail employees and laid off 300 employees at its head office in April.

- The retailer closed stores on March 15 when lockdown restrictions were announced and began reopening some stores mid-May, but the recovery has been slow. In addition to REI, companies including Casper, Gap Inc, Sephora and Tapestry have also announced layoffs.

- Amazon plans to launch new automated shopping carts in a service called Dash Cart at its grocery store in Woodland Hills, California this year. Customers can activate a cart by scanning a QR code through the Amazon app, which is linked to their account.

- The shopping carts are embedded with cameras, weight sensors and a smart display. They can track items as shoppers place grocery bags in the cart. The cart charges them automatically when the grocery bags are removed, allowing them to skip the checkout line.

- Wear-to-work retailer RTW Retailwinds, along with its affiliates, has filed for Chapter 11 bankruptcy protection in the Bankruptcy Court for the District of New Jersey. The company has launched a store-closing and liquidation process, with nearly 92% of its brick-and-mortar locations reopened following coronavirus-related closures.

- RTW Retailwinds also plans to sell its e-commerce operations and related intellectual property in bankruptcy proceedings. The company expects to entirely repay the approximate $12.7 million outstanding balance under a loan agreement with Wells Fargo Bank by August 31, 2020.

- Gift and stationery retailer Paper Source has launched subscription box services for children and adults. The Kids Club subscription is available for two age groups (eight years and below; nine years and above) and includes instructional videos and craft supplies, priced at $125 per month.

- The subscription service for adults is priced at $49.95 per box of curated stationery and includes four boxes per year, delivered quarterly. The company has also launched virtual creative learning workshops for children and adults, which are delivered via video-conferencing tool Zoom twice a week.

EUROPE RETAIL AND TECH HEADLINES

ASOS Reports 10% Increase in Sales (July 15) Company press release- British pure-play fashion retailer ASOS recorded a 10% increase in group revenues to £1 billion ($1.26 billion) during the four months to June 30 and said that it expects to grow profits throughout the financial year.

- Its international markets drove growth as retail sales increased by 17% to £654 million ($827 million) across the quarter. Its EU revenues spiked 22% to £328 million ($415 million).

- Kurt Geiger-owned online footwear retailer Shoeaholics will open its first pop-up stores on the UK’s high streets later this month after it experienced a jump in online sales during lockdown. Shoeaholics sells brands including Aldo, Carvela, Steve Madden and others at 30% –40% below the recommended retail price.

- Shoeaholics reported average daily sales of 400 pairs of trainers—its bestselling category—during the lockdown, which is more than twice the amount from the same period last year.

- Following a strong first quarter, German meal-kit delivery firm HelloFresh saw strong demand for meal boxes in the second quarter and expects sales to have exceeded market expectations and reach between €965 million ($1.09 billion) and €975 million ($1.11 billion). Strict lockdowns and social distancing measures drove demand for food delivery, particularly in the US, HelloFresh reported.

- Due to this strength and continued growth momentum early in the third quarter, HelloFresh now expects fiscal-year revenues to grow 55–70% on a constant-currency basis, versus the previous guidance for 40–55% growth. Approximately 2 million of the company’s 4.2 million active customers are in the US. The company will report its financial statements for the second quarter on August 11, 2020.

- British online grocery retailer and technology provider Ocado has reported 27.2% year-over-year growth in retail revenue for the half year ended May 31, 2020. Total group revenue, including its technology division, increased 23.2% year-over-year for the period.

- The company posted a loss before tax of £40.6 million ($51.2 million) for the period, in comparison to a loss of £147.4 million ($186 million) for the same period last year. Ocado stated that fees invoiced to foreign development partners rose 58.2% as its international rollout accelerated with the launch of its first robotic distribution warehouses for Groupe Casino in Paris and Sobeys in Toronto.

- Mixed-goods retailer Wilko has appointed Karen Mackay as its CFO, effective September 2020. Mackay joins Wilko from health-care firm Optegra, where she has served as CFO for the last five years.

- Mackay will replace Alex Russo, who joined rival variety retailer B&M in March.

- Sweet Fit, a France-based, interactive virtual-mirror startup, has partnered with Israel-based online fitting-technology firm MySizeID. Under the partnership, Sweet Fit will integrate MySizeID into its technology platform.

- MySizeID’s technology allows users to scan their body with their smartphone camera and receive accurate, real-time measurements. With the integration, customers can select the right clothing size from specific brands after trying on items virtually.

ASIA RETAIL AND TECH HEADLINES

Bukalapak Partners with HappyFresh (July 14) KR-Asia.com- Bukalapak, an Indonesian e-commerce platform, has partnered with grocery-delivery platform HappyFresh to enable more than 50 million users to fulfill their daily needs.

- Shoppers can choose the HappyFresh Groceries feature on the Bukalapak platform to buy products from over 150 supermarkets across major Indonesian cities.

- Indian conglomerate Tata Group and British grocery chain Tesco have invested ₹670 million ($8.8 million) each into their joint venture Trent Hypermarket, with plans to expand their food and grocery retailing business in India.

- According to filings submitted to the Registrar of Companies, equity shares were issued to both companies in March and June 2020. Trent Hypermarket operates 51 Star food and grocery stores, including 12 hypermarkets and 39 supermarkets in cities across India, including Bengaluru, Hyderabad, Mumbai and Pune.

- Tencent has launched a mini program on social media platform WeChat called WeChat Minishop, allowing businesses and self-employed individuals with a business operations license to open online stores. The feature is now available to businesses for testing and will be open to individuals later.

- A single WeChat account can only operate one mini-shop, and products for sale should be in consumer categories including home appliances, smartphones, apparel and pet care.

- New apparel brand Wein will launch in India through an online platform this August. Wein is promoting itself as an alternative to the Chinese e-commerce platform Shein, which is banned in India along with 58 other Chinese apps.

- The Wein platform will offer “100% Made in India” ethnic and western wear. It will also feature a “Shein” section for womenswear, a “Hein” section for menswear and a plus-sized section called “Plus for Us.”

- South Korean beauty products company Amorepacific has launched its luxury beauty brand Sulwhasoo in India, exclusively with beauty and fashion products retailer Nykaa. The Sulwhasoo range of products will include its star products—including First Care Activating Serum and the Concentrated Ginseng Renewing Cream.

- Prior to the launch of Sulwhasoo, Amorepacific has launched other beauty brands in India, including Etude in 2019, Laneige in 2018 and Innisfree in 2013.