From the Desk of Deborah Weinswig

What’s Going on in UK Retail? Reviewing Retail Difficulties and Consumer Demand

Readers of the international press might believe that the UK is in dire straits, with worried consumers retrenching their spending and Brexit-fearing businesses battening down the hatches. Adding fuel to this narrative, an unusually high number of British retailers have sought to close stores and renegotiate rents with their landlords so far this year. In this week’s note, we offer our own view of what is really going on in the UK economy and, specifically, in the country’s retail sector.

UK Retail Continues to Grow

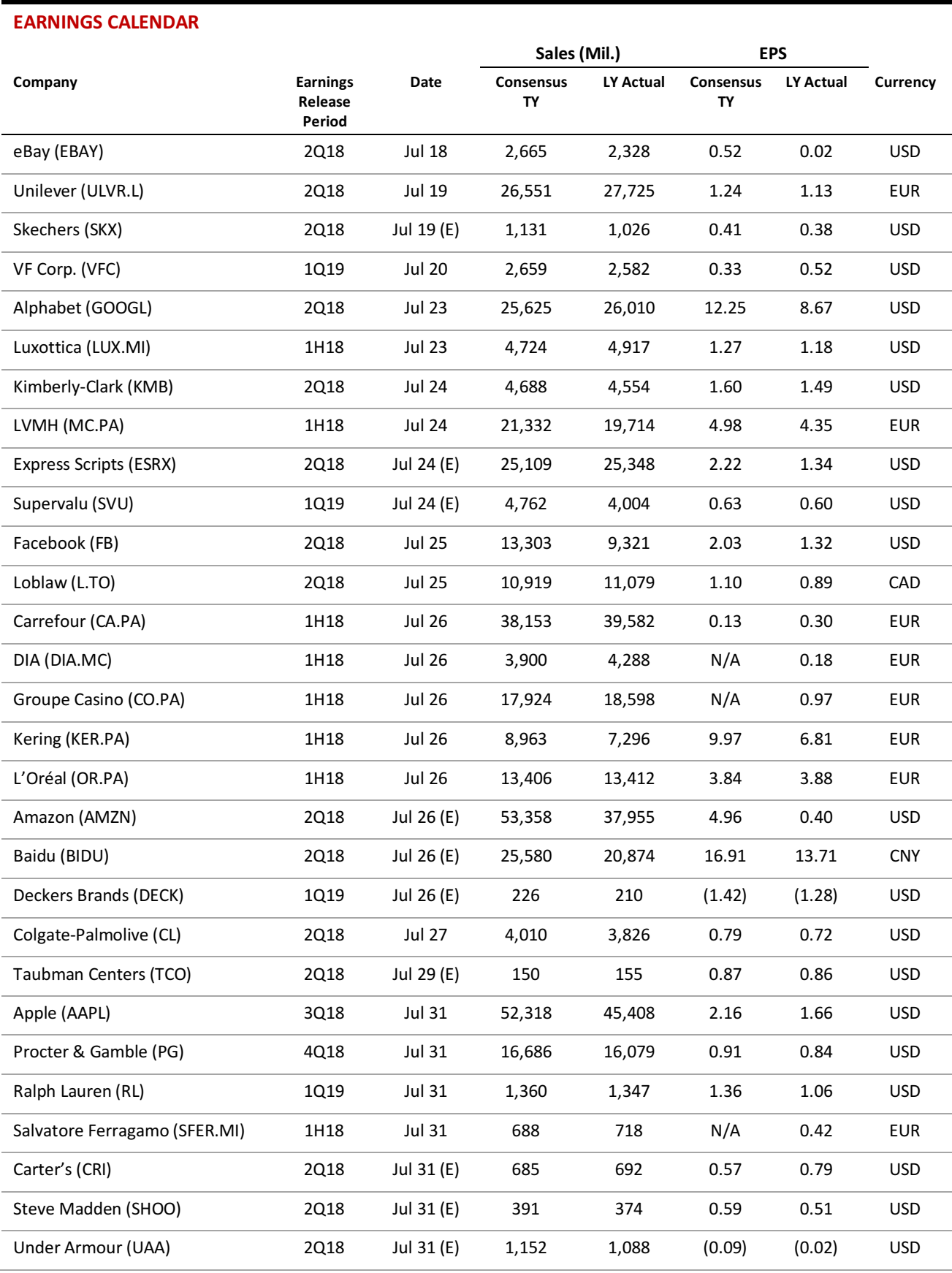

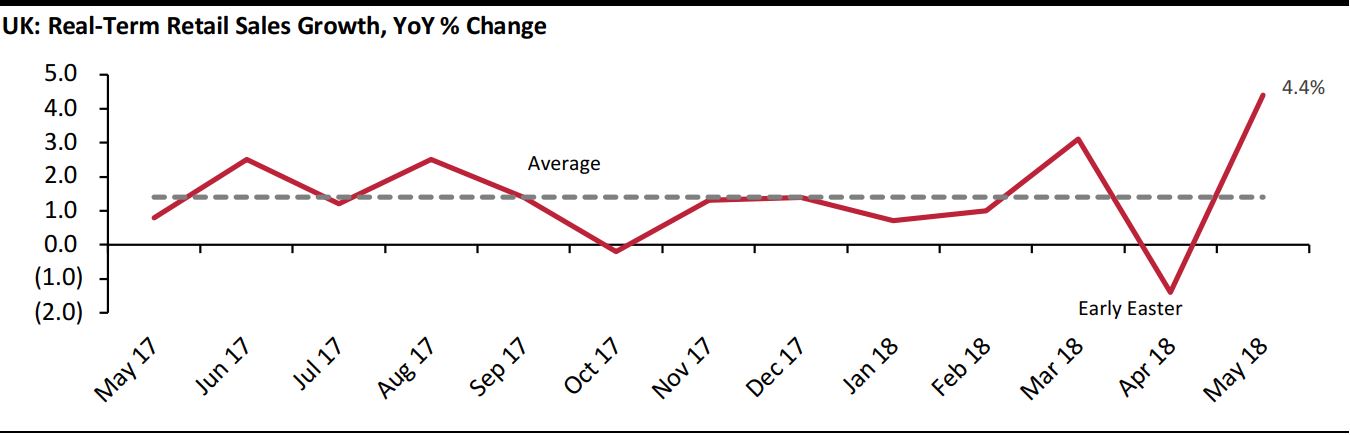

Brits are continuing to spend, supported by record employment levels and wages that are rising faster than inflation. So far this year, retail sales have continued to grow in real terms (i.e., adjusting for inflation), with sales in May jumping by an extraordinary 4.4%. The average real growth of 1.4% so far in 2018 is below that seen in recent years, but the sustained increase in real retail sales confirms that UK consumers have not cut back their retail spending in aggregate, even if some retailers are feeling the pinch.

Source: Office for National Statistics/Coresight Research

Source: Office for National Statistics/Coresight Research

The softening of retail growth in 2017 and into 2018 followed a squeeze of incomes, as inflation rose during 2017 and began to outstrip income growth. Consumers responded by growing their spending more slowly and fueling some of that spending by cutting how much they saved. The savings ratio fell to just 4.1% in the first quarter of this year, the third-lowest rate since the UK began keeping records in 1963.

However, inflation has been falling back in recent months, and average earnings growth has outstripped average price growth for the last five months. Grocery-price inflation, in particular, has been easing, which will free up cash for consumers to spend on discretionary categories. This suggests that the second half of the year will see stronger retail growth than the first half. The UK consumer economy is also being supported by a record employment rate: at 75.6% in April (latest), the proportion of working-age people who are employed is at its highest level since the government began keeping comparable records in 1971.

International readers should also not assume that UK consumer confidence is being dented by “Bregret” over Brexit. Two years after the referendum on EU membership, poll after poll finds that Brits’ views on leaving the EU have barely shifted—the UK is as divided as when it voted on Brexit in June 2016. Moreover, polls show that only a small minority of the UK public would now like to abandon the Brexit process and stay in the EU; instead, a large majority polled are reconciled to leaving. Supporting this perception of steadiness, Eurostat has recorded broadly consistent UK consumer confidence levels since the start of 2017.

So, Why All the Store Closures?

A slew of UK retailers have closed stores this year: at midyear 2018 (June 29), the store closure total of 956 was already comparable to the 1,005 we recorded for 2017 as a whole. Major names such as House of Fraser, Carpetright, New Look and Mothercare have opted for company voluntary arrangements that allow them to close stores and reduce rents on remaining leases.

Some retailers have cited softening consumer demand, but we think that such softness is due in many cases to consumers opting to shop at rivals rather than to them cutting their spending altogether because, as the graph above shows, total retail demand has continued to grow. Instead, we see two specific challenges prompting store closures: cost pressures and structural changes.

First, retailers have seen labor costs rise due to the tight labor market, changes to the national living wage and new pension obligations. At the same time, high business rates have pinched retailers’ profits. Compounding these pressures is the migration of sales online—even when those sales move to a retailer’s own e-commerce site. The shift online deleverages the fixed costs of brick-and-mortar stores, including business rates, and that erodes store-level profitability.

Second, structural changes continue to squeeze legacy retailers hard. Major structural shifts in UK retail have enabled competitors to steal share from legacy retailers, while limiting those legacy retailers’ ability to pass on higher costs to shoppers. Consumer migration to e-commerce is one such shift, but the rise of discount retailers in grocery and adjacent categories (such as beauty) have had similar effects. Fierce competition has forced long-standing midmarket retailers to absorb cost pressures even while many of them face losing share in their market.

So, for international readers, an important part of the UK retail story is that consumer demand continues to grow, albeit at a slower pace than in recent years. The real bad news is that cost pressures and structural shifts are hitting established brick-and-mortar retailers and driving the high-profile struggles in UK retail.

US RETAIL & TECH HEADLINES

Walmart Plans Same-Day Grocery Push in New York with Jet.com

(July 10) CNBC.com

Walmart Plans Same-Day Grocery Push in New York with Jet.com

(July 10) CNBC.com

- Walmart is set to test same-day grocery delivery in New York through Jet.com as it dials up its efforts in the battle for online customers. The retailer announced Tuesday that it will open up a fulfillment center in the Bronx for Jet.com, which it acquired roughly two years ago.

- The move comes as Walmart has been investing heavily in its online grocery business. It previously announced plans to expand its online grocery delivery service to a fleet of roughly 800 stores by the end of the year.

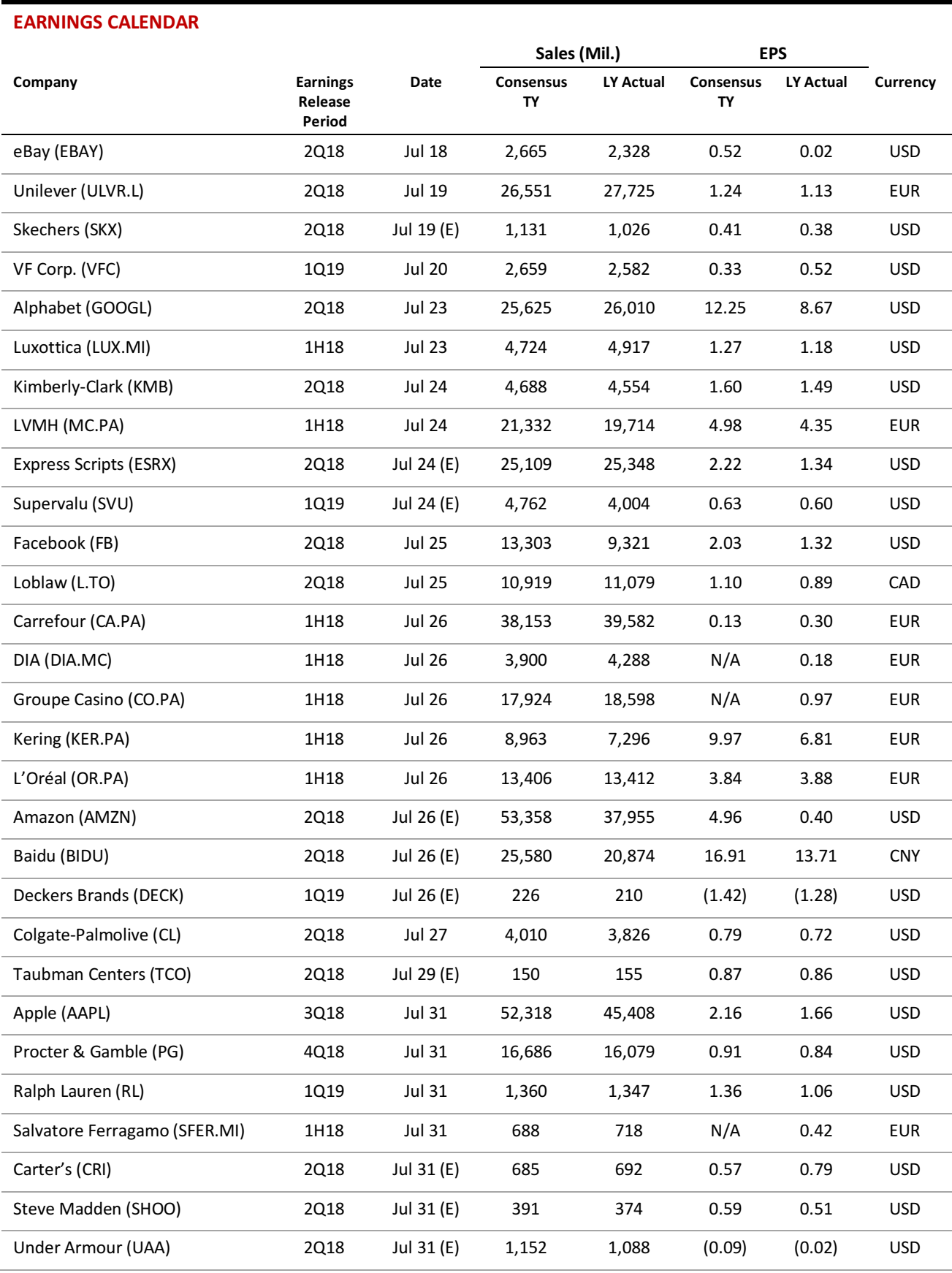

How Amazon Is Primed for Prime Day

(July 10) Pymnts.com

How Amazon Is Primed for Prime Day

(July 10) Pymnts.com

- In Amazon’s world, the days just keep getting longer. The next Prime Day is a week away, and the e-commerce operator’s annual sales and marketing frenzy will run 36 hours this year (starting at 3 pm, EST, on July 16), up from 30 hours last year.

- The changes to Prime Day this year show how Amazon is growing and changing. Perhaps the most notable news is that Prime Day will have a significant presence at Whole Foods, the upscale grocery chain that Amazon bought in 2017.

Nordstrom Local Expands Its Innovative, Inventory-Free Retail Hubs

(July 9) FastCompany.com

Nordstrom Local Expands Its Innovative, Inventory-Free Retail Hubs

(July 9) FastCompany.com

- What if your favorite fashion destination was also your local tailor, manicurist, bartender, juicer, cobbler, stylist—and even your WeWork?

- That’s the essential idea behind Nordstrom Local, the innovative “service hub” the retail giant launched last October in Los Angeles. The 3,000-square-foot atelier-like space that sits alongside millennial catnip boutiques like Glossier and Marc Jacobs on bustling Melrose Avenue combines a medley of Nordstrom’s popular amenities under one chic roof.

US Retail CEOs Expect M&A Activity to Drive Bullish Growth

(July 9) ChainStoreAge.com

US Retail CEOs Expect M&A Activity to Drive Bullish Growth

(July 9) ChainStoreAge.com

- In KPMG’s US CEO Outlook 2018 report, 83% of CEOs in the consumer and retail industry say they are confident about growth prospects during the next three years. Mergers and acquisitions (M&As) were cited as the top growth driver (38%), followed by strategic alliances (23%).

- M&A activity is expected to transform retailers’ business models faster than organic growth, as well as result in reduced costs, increased market share and the onboarding of new technologies, according to KPMG.

The Fall of Toys“R”Us Leads to Retailer Rush to Fill the Void

(July 9) Digiday.com

The Fall of Toys“R”Us Leads to Retailer Rush to Fill the Void

(July 9) Digiday.com

- When Toys“R”Us closed up its last US store at the end of June, it set off a retail free-for-all to fill the gap. Amazon is taking a page from the Toys“R”Us playbook and will reportedly mail out holiday catalogs to millions of homes and hand them out at Whole Foods locations.

- Target also aims to ramp up its toy strategy. The company plans to expand the toy aisles in 500 Target stores for the holiday season, to start stocking new toy categories, such as electric ride-ons and playhouses, and to make improvements to its online toy section.

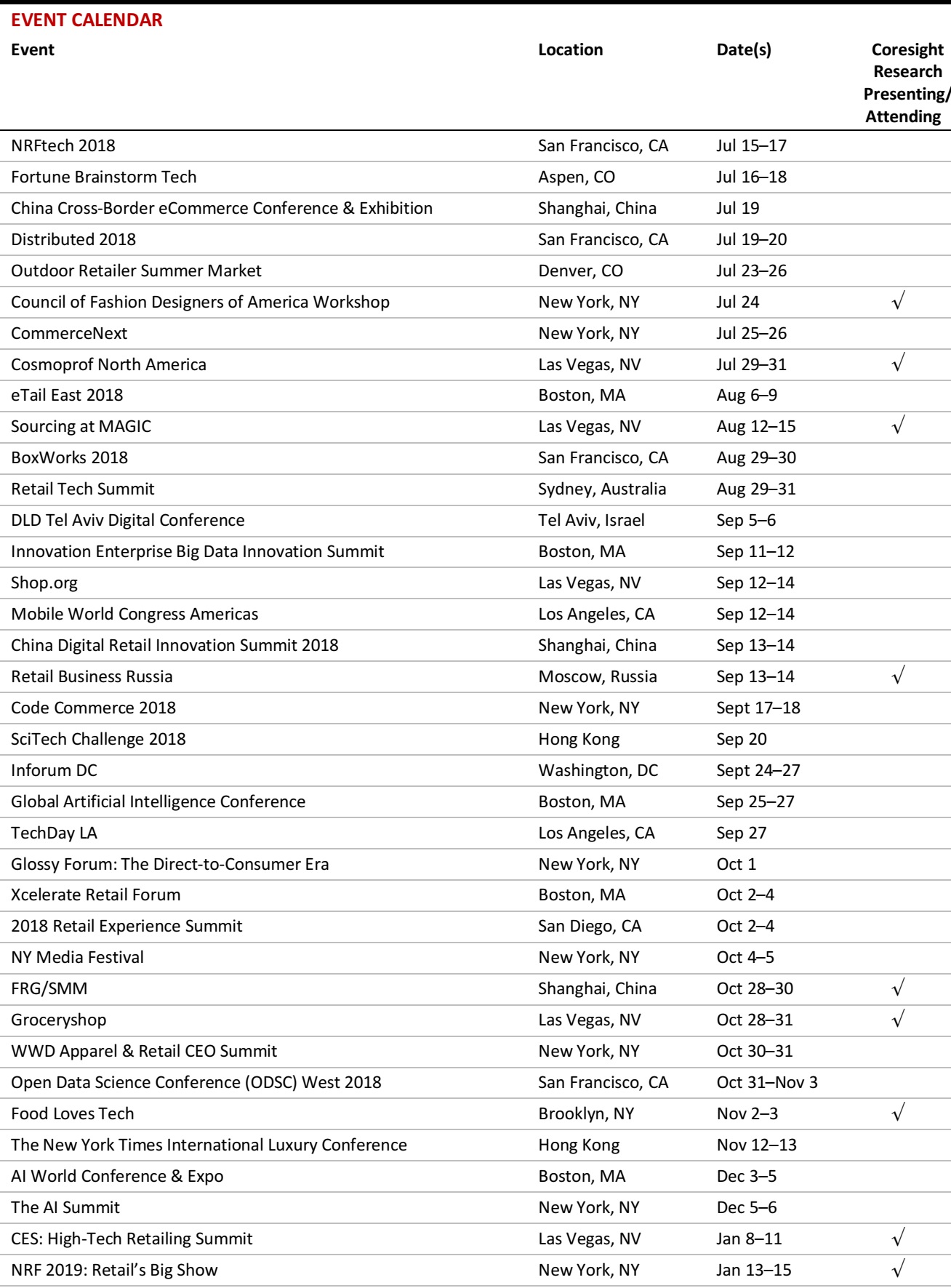

EUROPE RETAIL & TECH HEADLINES

UK Retail Sales Growth Proves Solid in June, Supported by Warm Weather and Sporting Fever

(July 10) BRC press release

UK Retail Sales Growth Proves Solid in June, Supported by Warm Weather and Sporting Fever

(July 10) BRC press release

- UK retail sales grew by 2.3% year over year in June, helped significantly by warm weather and the FIFA World Cup, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. The sales growth in June was above the three-month and 12-month averages of 1.2% and 1.5%, respectively. Comparable sales increased by 1.1% year over year.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended June, total food sales grew by 1.7% and total nonfood sales grew by 0.8%.

GaleriaKaufhof and Karstadt Likely to Form Joint Venture

(July 6) Reuters.com

GaleriaKaufhof and Karstadt Likely to Form Joint Venture

(July 6) Reuters.com

- European department store chains Galeria Kaufhof and Karstadt are likely to form a joint venture. Kaufhof’s Canadian owner, Hudson’s Bay Company (HBC), confirmed that it is in talks with Karstadt’s parent company, Signa, regarding the potential venture.

- Signa would hold a majority stake in the joint venture, for which it would pay HBC €1 billion ($1.17 billion). HBC said that the venture is subject to further review and approval by its board.

Marks & Spencer to Forgo First-Quarter Trading Update

(July 9) IrishTimes.com

Marks & Spencer to Forgo First-Quarter Trading Update

(July 9) IrishTimes.com

- British retailer Marks & Spencer (M&S) announced that, unlike in previous years, it will not release a first-quarter trading update at its annual general meeting later this month. It is not compulsory for the company to release quarterly figures.

- M&S said that it will publish only half-year, third-quarter and full-year results this year.

Poundworld’s Rescue Bid Rejected by Administrators, Poundland Founder Mulls Swoop

(July 10) RetailGazette.co.uk

Poundworld’s Rescue Bid Rejected by Administrators, Poundland Founder Mulls Swoop

(July 10) RetailGazette.co.uk

- Poundworld CEO Chris Edwards last week tabled a bid to acquire 180 Poundworld stores, which would have saved around 3,000 of the company’s 5,100 jobs. Deloitte, Poundworld’s administrator, rejected the bid, saying that it was inadequate.

- Steven Smith, the founder of rival discount retailer Poundland, is reportedly in talks to save a portion of Poundworld out of administration.

Mothercare Seeks to Close 60 Stores and Raise £32.5 Million in Equity amid Restructuring Plans

(July 9) Reuters.com

Mothercare Seeks to Close 60 Stores and Raise £32.5 Million in Equity amid Restructuring Plans

(July 9) Reuters.com

- Baby apparel and equipment retailer Mothercare is seeking to close 60 stores by June 2019, instead of the 50 that it previously announced. The company also plans to raise £32.5 million ($43.2 million) in equity by the end of July 2018.

- The new shares will be issued at 19 pence apiece, well below last Friday’s already deteriorated closing price of 28.6 pence. The fresh funds will be used to reduce debt.

The Original Factory Shop CVA Approved, 32 Stores Up for Closure

(July 9) DrapersOnline.com

The Original Factory Shop CVA Approved, 32 Stores Up for Closure

(July 9) DrapersOnline.com

- Creditors have approved a proposed company voluntary arrangement (CVA) for British discount retailer The Original Factory Shop (TOFS) that will see it close 32 stores and a distribution center. The CVA is an insolvency process that will include TOFS moving to monthly rents, with rent reductions beginning on August 1.

- The company stated, “The business has been under per forming for some time, but this has been more marked in the past 12 months. The decline in performance has been the result of both the macroeconomic factors and business-specific issues affecting the company.”

ASIA RETAIL & TECH HEADLINES

Alibaba Partners with Chinese VC Ganesh Ventures for India-Focused Fund

(July 10) Tech.EconomicTimes.IndiaTimes.com

Alibaba Partners with Chinese VC Ganesh Ventures for India-Focused Fund

(July 10) Tech.EconomicTimes.IndiaTimes.com

- Alibaba founder Jack Ma has formed a strategic alliance with $250 million Chinese venture capital fund Ganesh Ventures. The India-focused fund seeks to use all of its funds in domestic startups over the next five years, in verticals such as media, technology, consumer products, and health and financial technology. “We want to engage not just at the early stage, but also at growth stage,” said Jessica Wong, Managing Partner of Ganesh Ventures.

- Alibaba’s India portfolio includes domestic market leaders Paytm, a digital payments platform, and BigBasket, an online grocery store.

Secoo to Create Alliance with Italy’s Richard Ginori

(July 10) RetailNews.Asia

Secoo to Create Alliance with Italy’s Richard Ginori

(July 10) RetailNews.Asia

- Luxury retailer Secoo has announced a partnership with Italian porcelain manufacturer Richard Ginori that will focus solely on the Chinese market.

- The alliance will bolster Secoo’s strategy of tapping into China’s robust luxury consumer market, according to Secoo Founder and CEO Li Rixue. The move is expected to strengthen Secoo’s foothold as a luxury e-commerce website.

Xiaomi Struggles in Hong Kong’s Fundraising Round

(July 9) SCMP.com

Xiaomi Struggles in Hong Kong’s Fundraising Round

(July 9) SCMP.com

- Chinese smartphone maker Xiaomi saw its stock sales perform far below anticipated levels when it debuted on the Hong Kong Stock Exchange on July 9, owing to tensions amid a US-China trade war.

- Xiaomi’s fundraising fell short considerably, with proceeds amounting to $3.1 billion, less than a third of the expected $10 billion. Edmond Hui, CEO of Bright Smart Securities, remarked that “investors are no longer that crazy about so-called new economy IPOs, as many of them have quickly fallen below their offer prices.”

Grab Goes Beyond Rides to “Grab” Southeast Asia’s One-Stop App Title

(July 10) TechCrunch.com

Grab Goes Beyond Rides to “Grab” Southeast Asia’s One-Stop App Title

(July 10) TechCrunch.com

- Ride-hailing firm Grab announced that it will allow third parties to become part of its service through an initiative called “Grab Platform.” The initiative will allow partner firms to leverage Grab’s scale to reach new customers.

- HappyFresh, an online grocer, is the first to integrate itself into the Grab app. Grab Cofounder Hooi Ling Tan said that the company plans to introduce APIs to enhance the partner sign-up process.

Tmall and Eurovet Collaborate to Help Industry Players Sell Lingerie in China

(July 10) Alizila.com

Tmall and Eurovet Collaborate to Help Industry Players Sell Lingerie in China

(July 10) Alizila.com

- Alibaba’s Tmall B2C marketplace and trade show organizer Eurovet have teamed up to help industry players sell lingerie, swimwear and activewear in China.

- The partnership will include educating Eurovet trade show participants on the characteristics and preferences of Chinese shoppers. Participants will also have access to “Tmall’s insights to better engage with Chinese consumers, streamline the shipping and logistics process, improve supply-chain management and communicate with their local partners,” the companies stated.

LATAM RETAIL & TECH HEADLINES

Brazilian Manufacturing Sector Set to Embrace Industry 4.0

(July 9) ZDNet.com

Brazilian Manufacturing Sector Set to Embrace Industry 4.0

(July 9) ZDNet.com

- Manufacturing firms’ investments in technologies linked to automation and data exchange have been growing in Brazil, a new survey has found. Brazil’s National Confederation of Industry (CNI) reports that 48% of the 632 firms it polled are keen on investing in technologies related to Industry 4.0.

- CNI reported a 10% increase in manufacturers using technologies such as digital automation and integrated engineering systems between 2016 and 2018. Renato da Fonseca, CNI’s Executive Manager of Research and Competitiveness, said that the survey results indicate that companies are in the early stage of digitalization and will implement newer technologies.

Google in Quest for Startups for Acceleration Program in Brazil

(July 7) ZDNet.com

Google in Quest for Startups for Acceleration Program in Brazil

(July 7) ZDNet.com

- Google is seeking specialist startups focused on advanced technologies such as machine learning, artificial intelligence and the Google Cloud Platform for the second cohort of its Launchpad Accelerator program in Brazil.

- The company plans to phase its selection across the next three months for its program beginning on September 24, 2018. The selected startups will be based in São Paulo and will be mentored by Google experts until November.

Data Protection Efforts to Protect Businesses and Individuals in Brazil

(July 5) ZDNet.com

Data Protection Efforts to Protect Businesses and Individuals in Brazil

(July 5) ZDNet.com

- The Brazilian government has passed a new GDPR-style bill that aims to create a better data protection environment on the Internet. The draft legislation includes the creation of a federal body called the National Data Protection Authority, which will be dedicated to monitoring, law enforcement and sanctions related to data protection.

- The bill is directed at protecting consumers and businesses and establishing symmetric information between them. The entity holding data will be directly responsible in case of a data leak, and a fine of up to 4% of company revenue will be imposed in case of noncompliance.

Ant Financial Services Expects Mobile Wallet Applications to Gain Traction in South America

(July 10) SCMP.com

Ant Financial Services Expects Mobile Wallet Applications to Gain Traction in South America

(July 10) SCMP.com

- Ant Financial Services, Alibaba’s fintech affiliate and one of China’s largest online payment operators, believes that mobile wallet applications will gain traction in South America and Africa in the coming years. Ant Financial’s Head of International Investment, Kenny Man, said that countries in South America and Africa will be a priority for the company’s global partnerships.

- Over the last three years, Ant Financial has forged nine partnerships with companies across the world, including in South Korea, Pakistan, Bangladesh and Hong Kong.

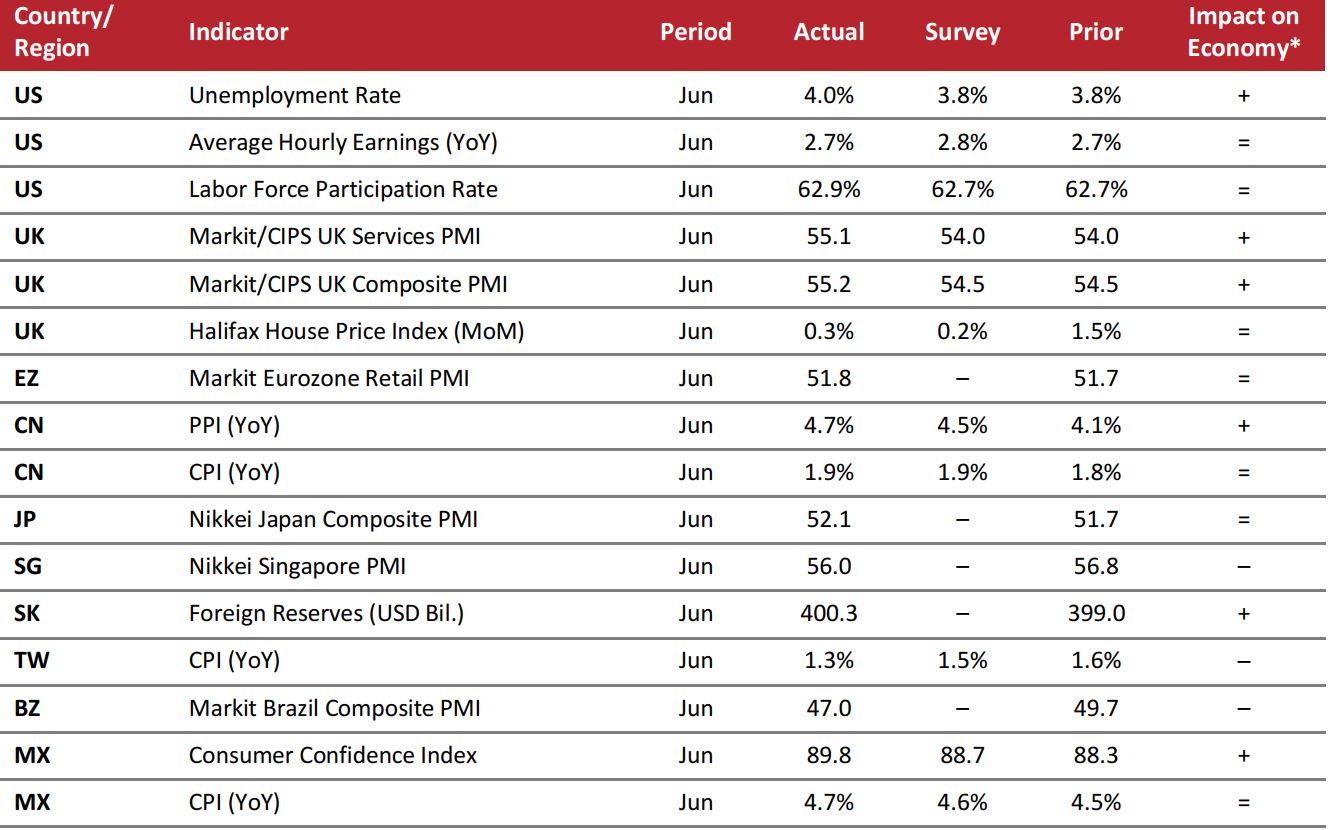

MACRO UPDATE

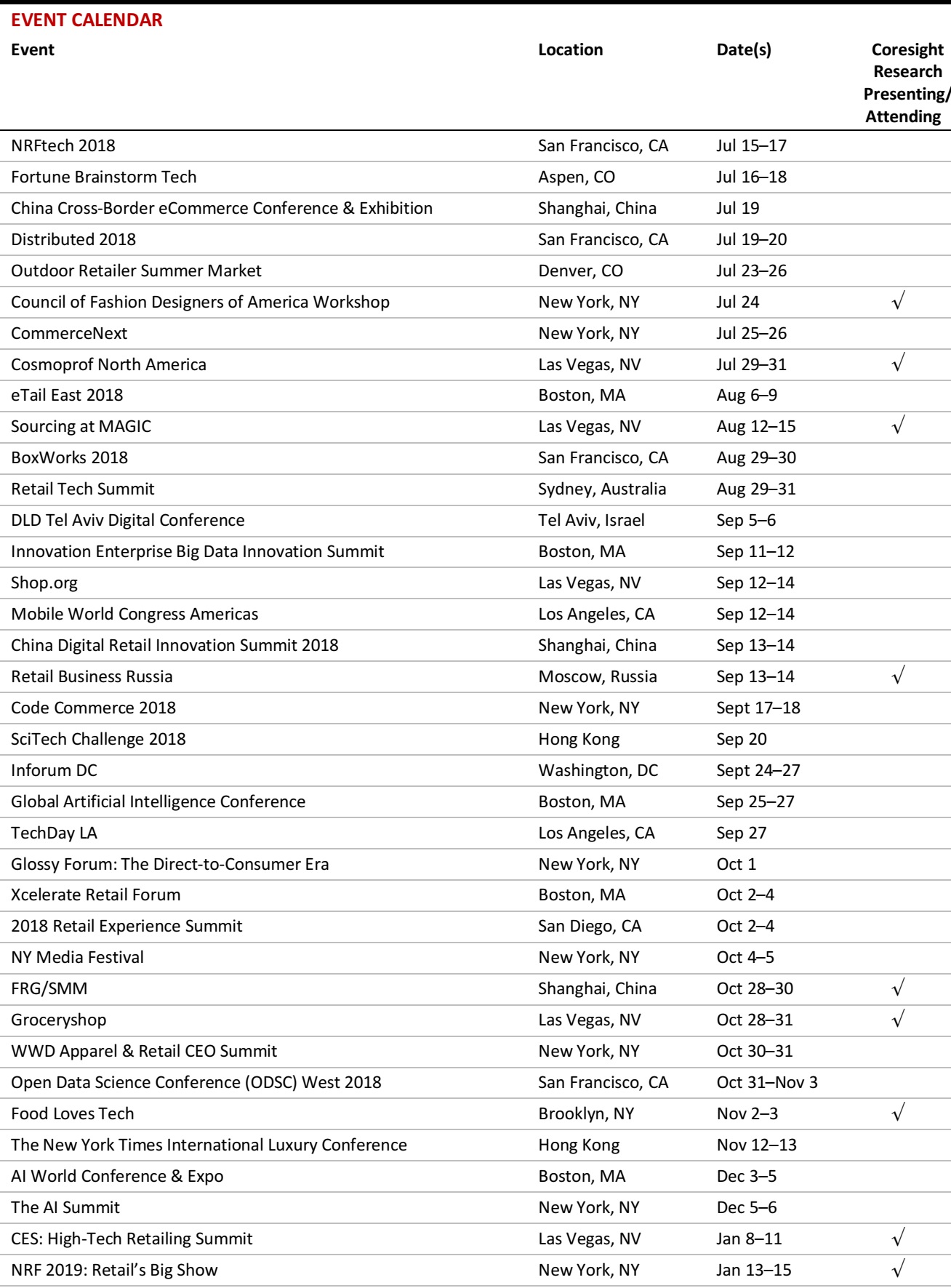

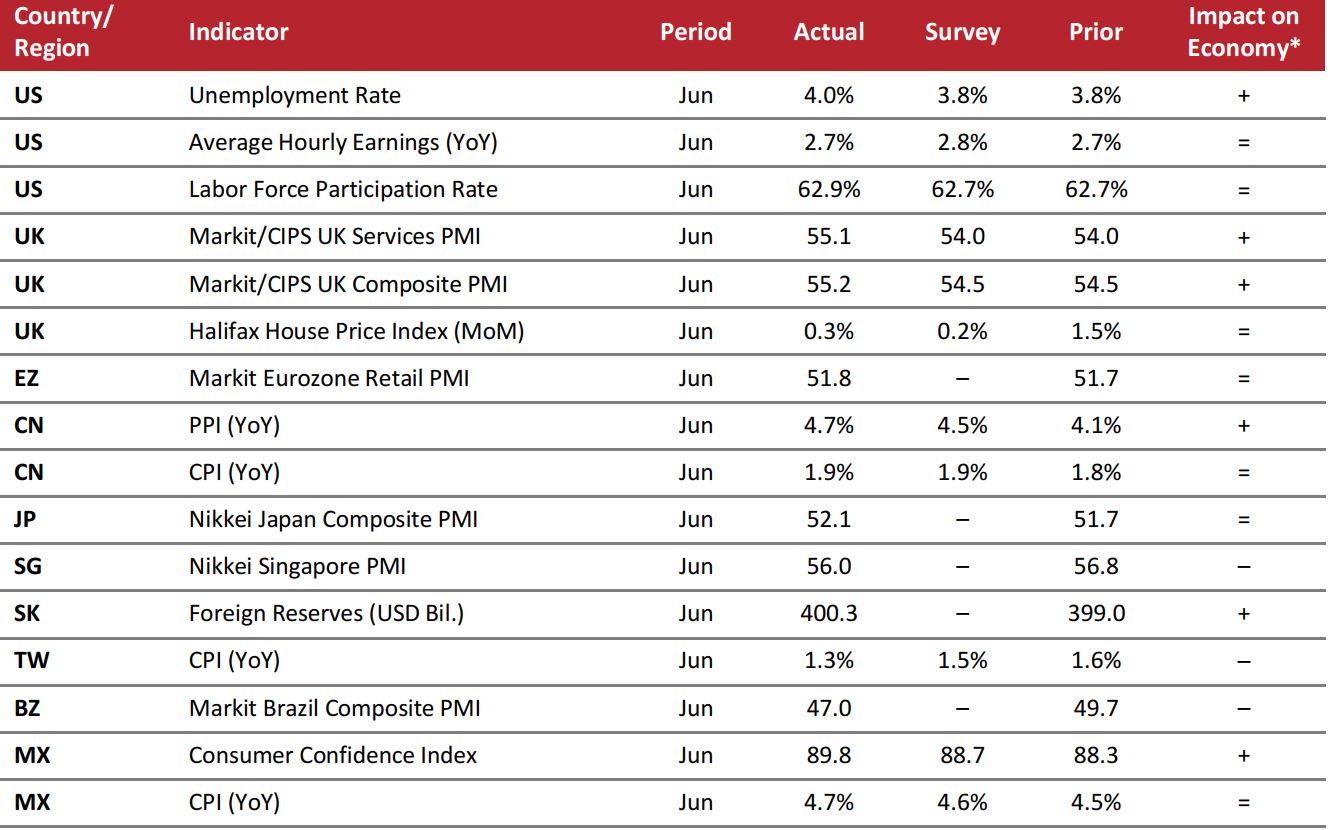

Key points from global macro indicators released July 4–July 11, 2018:

- US: The US unemployment rate increased to 4.0% in June. Average hourly earnings grew by 2.7% year over year in June; the increase was slightly below the consensus estimate of 2.8%. The labor force participation rate increased to 62.9% in June.

- Europe: In the UK, the Markit/UCIPS Composite Purchasing Managers’ Index (PMI) remained above the expansion threshold in June, rising to 55.2, which was higher than the consensus estimate. The Halifax House Price Index increased by slightly more than analysts had expected in June, rising by 0.3% month over month. In the eurozone, the Markit Retail PMI increased to 51.8 in June.

- Asia-Pacific: In China, the Producer Price Index (PPI) increased by 4.7% year over year in June, versus the consensus estimate of 4.5%. The Nikkei Japan Composite PMI stood at 52.1 in June, while the Nikkei Singapore PMI stood at 56.0. In Taiwan, the Consumer Price Index (CPI) rose by 1.3% year over year in June; the increase was slightly below the consensus estimate of 1.5%.

- Latin America: In Brazil, the Markit Composite PMI remained below the expansion threshold in June, falling to 47.0 from 49.7 in May. In Mexico, the CPI increased by 4.7% year over year in June, rising by slightly more than analysts had estimated.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Markit/Halifax/National Bureau of Statistics of China/Bank of Korea/Taiwan Directorate General of Budget, Accounting and Statistics/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Markit/Halifax/National Bureau of Statistics of China/Bank of Korea/Taiwan Directorate General of Budget, Accounting and Statistics/Instituto Nacional de Estadística y Geografía/Coresight Research

Source: Office for National Statistics/Coresight Research

Source: Office for National Statistics/Coresight Research

Walmart Plans Same-Day Grocery Push in New York with Jet.com

(July 10) CNBC.com

Walmart Plans Same-Day Grocery Push in New York with Jet.com

(July 10) CNBC.com

How Amazon Is Primed for Prime Day

(July 10) Pymnts.com

How Amazon Is Primed for Prime Day

(July 10) Pymnts.com

US Retail CEOs Expect M&A Activity to Drive Bullish Growth

(July 9) ChainStoreAge.com

US Retail CEOs Expect M&A Activity to Drive Bullish Growth

(July 9) ChainStoreAge.com

UK Retail Sales Growth Proves Solid in June, Supported by Warm Weather and Sporting Fever

(July 10) BRC press release

UK Retail Sales Growth Proves Solid in June, Supported by Warm Weather and Sporting Fever

(July 10) BRC press release

GaleriaKaufhof and Karstadt Likely to Form Joint Venture

(July 6) Reuters.com

GaleriaKaufhof and Karstadt Likely to Form Joint Venture

(July 6) Reuters.com

Marks & Spencer to Forgo First-Quarter Trading Update

(July 9) IrishTimes.com

Marks & Spencer to Forgo First-Quarter Trading Update

(July 9) IrishTimes.com

Poundworld’s Rescue Bid Rejected by Administrators, Poundland Founder Mulls Swoop

(July 10) RetailGazette.co.uk

Poundworld’s Rescue Bid Rejected by Administrators, Poundland Founder Mulls Swoop

(July 10) RetailGazette.co.uk

The Original Factory Shop CVA Approved, 32 Stores Up for Closure

(July 9) DrapersOnline.com

The Original Factory Shop CVA Approved, 32 Stores Up for Closure

(July 9) DrapersOnline.com

Alibaba Partners with Chinese VC Ganesh Ventures for India-Focused Fund

(July 10) Tech.EconomicTimes.IndiaTimes.com

Alibaba Partners with Chinese VC Ganesh Ventures for India-Focused Fund

(July 10) Tech.EconomicTimes.IndiaTimes.com

Brazilian Manufacturing Sector Set to Embrace Industry 4.0

(July 9) ZDNet.com

Brazilian Manufacturing Sector Set to Embrace Industry 4.0

(July 9) ZDNet.com

Data Protection Efforts to Protect Businesses and Individuals in Brazil

(July 5) ZDNet.com

Data Protection Efforts to Protect Businesses and Individuals in Brazil

(July 5) ZDNet.com

Ant Financial Services Expects Mobile Wallet Applications to Gain Traction in South America

(July 10) SCMP.com

Ant Financial Services Expects Mobile Wallet Applications to Gain Traction in South America

(July 10) SCMP.com

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Markit/Halifax/National Bureau of Statistics of China/Bank of Korea/Taiwan Directorate General of Budget, Accounting and Statistics/Instituto Nacional de Estadística y Geografía/Coresight Research

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

Source: US Bureau of Labor Statistics/Markit/Halifax/National Bureau of Statistics of China/Bank of Korea/Taiwan Directorate General of Budget, Accounting and Statistics/Instituto Nacional de Estadística y Geografía/Coresight Research