albert Chan

FROM THE DESK OF DEBORAH WEINSWIG

The Opportunities for Grocery Outlet, and Others, in the US Discount Grocery Market

On June 20, Grocery Outlet, which calls itself an “extreme value” retailer, launched its initial public offering (IPO). Grocery Outlet Holding calls itself an “extreme value” retailer that sells name-brand consumables and fresh produce through its 323 US stores. It has grown store numbers and revenue rapidly in recent years. In this week’s note, we review Grocery Outlet’s place in the US discount grocery landscape and look at activity from major rivals.

Grocery Outlet’s Proposition

Grocery Outlet stores offer branded grocery products and general merchandise at prices it says are approximately 40% lower than conventional grocers and approximately 20% lower than other leading discounters. The company buys cancelled orders of branded products, factory overruns, packaging changes and products approaching “sell-by” dates. It sources from approximately 1,500 suppliers annually, with no supplier representing more than 5% of sales.

Grocery Outlet stores have a small-box format: The average size is 15,000 to 20,000 square feet, compared to the average supermarket size of size over 60,000 square feet. Grocery Outlet stores are run by independent operators under franchise. Grocery Outlet plans to expand its store base by approximately 10% annually and believes the US could support a total of 4,800 locations.

Since 2015, Grocery Outlet has grown comparable sales at an average rate of 4.2%. However, comparable-store sales growth will have been flattened by its average annual 10.1% increase in store numbers: Grocery Outlet has confirmed that its stores take a number of years to reach maturity, but they will be included in the base for comparable sales just one year after opening.

Increasing Competition in the Discount Segment

Aldi is the eighth-biggest grocery retailer in the US by estimated 2018 revenues, according to Euromonitor International, whose data suggest privately owned Aldi has grown revenues at a CAGR of 12.7% over the past five years. Our Who Shops Where for Groceries report found Aldi ranked sixth in the grocery sector by number of respondents who had bought from the retailer in the past year.

Approximately 90% of products sold in Aldi stores are private label, differentiating it from Grocery Outlet’s branded offering. Aldi US stores average around 12,000 square feet. In June 2017, Aldi announced a $3.4 billion program of capital investment intended to grow its US presence by around 50%, expanding to 2,500 stores nationwide by the end of 2022 from its store base of “more than 1,600 stores” at the time of the announcement.

Save-a-Lot is the second largest grocery discounter in the US, behind Aldi, according to Euromonitor, whose analysts calculate Save-a-Lot’s share of the discount grocery segment slid from 28.1% in 2016 to 23.2% in 2018. Faced with increasing competition, Save-a-Lot plans to enhance its private label offering, remodel stores and convert itself from deep-discount to extreme-value retailer.

Lidl is jump-starting its US store-opening plans: In May, it announced it would open 25 new stores by spring 2020. This would take the still-nascent chain close to 100 US stores — well behind its initial plans for 100 stores by summer 2018, a target that Lidl now expects to hit by the end of 2020.

The major dollar-store chains are adding competitive pressure, too. In the current fiscal year, Dollar General plans to open 975 new stores, remodel 1,000 existing stores, and relocate a further 100 stores. “Consumables,” which effectively means grocery categories, accounted for fully 77.5% of Dollar General revenues in 2018. In March, Dollar Tree announced plans to open 350 new Dollar Tree stores and 200 new Family Dollar stores this year. The retailer also plans to close around 390 underperforming Family Dollar stores and renovate at least 1,000 Family Dollar stores.

Bucking the trend of discounters opening stores, discount chain Fred’s is closing stores — reflecting the increase in competition. Fred’s recently announced it will shut 49 stores in its third batch of store closures this year. The chain previously announced the closure of 264 stores. Following the completion of the latest round of closures, Fred’s will operate 244 stores.

Finally, we cannot discuss low-price grocery retailers without acknowledging Walmart, which has achieved US market leadership in grocery through its consistently strong focus on low prices — and so is a major competitor for all grocery discounters. Walmart held slightly over one-quarter of the overall grocery retailer sector in 2018, according to Euromonitor, having grown its share over each of the five prior years. Our Who Shops Where for Groceries report found 70% of US grocery shoppers had bought from Walmart (in store) in the past year.

The Opportunities

Differentiated retailers such as Grocery Outlet and Aldi continue to see opportunities for growth, in part because the US grocery market remains unusually fragmented and regionalized. The opportunity for discount players such as Grocery Outlet is therefore not just attracting more shoppers to value formats, but in driving consolidation within the discount grocery segment.

US RETAIL & TECH HEADLINES

![]() Walmart Labs Acquires Two Startups to Bolster its Customer Service

Walmart Labs Acquires Two Startups to Bolster its Customer Service

(July 9) LiveMint

- Walmart Labs has bought two startups to strengthen its customer service. The technology arm of the US retail giant has acquired health tech startup FloCare and B2B wholesale trading platform BigTrade, for undisclosed amounts.

- This type of acquisition is typically made for the skills of the team, rather than for the product. As part of the latest transaction, some founders and team members of the two companies will join Walmart Labs in the customer and supply chain technology teams, respectively.

![]() Whole Foods Ramps Up Prime Day Grocery Deals

Whole Foods Ramps Up Prime Day Grocery Deals

(July 8) Supermarket News

- Whole Foods Market is serving up more exclusive savings and grocery deals for the annual Prime Day sales event. Whole Foods said Amazon Prime members who make an in-store purchase of $10 or more between July 3 and July 16 will get a $10 credit to their Amazon account that can be used to spend on Amazon.com during Prime Day.

- The same offer extends to those making a Whole Foods purchase of $10 or more via the Prime Now grocery delivery and pickup service.

US Consumers Step up Borrowing at a Healthy Pace in May

US Consumers Step up Borrowing at a Healthy Pace in May

(July 8) KIRO

- US consumers borrowed more on their credit cards in May and also took out more student and auto loans, a modest sign of economic health. The Federal Reserve said consumer borrowing increased 5% that month, just below April's 5.2% rise. Total outstanding consumer debt, which excludes mortgages, stood at nearly $4.1 trillion in May.

- Steady increases in consumer borrowing echo other recent data showing consumers remain confident in the economy and are willing to spend.

7-Eleven Parent Wants US Stores to Sell More Fresh and Fast Food 'Like Is Common in Japan'

7-Eleven Parent Wants US Stores to Sell More Fresh and Fast Food 'Like Is Common in Japan'

(July 5) Dallas Morning News

- 7-Eleven is getting some kudos from its Japanese parent company Seven & I and not-too-subtle encouragement to step up efforts to sell more fresh and fast food. While fresh food and the company's 7-Select private label products drove improved quarterly results, the parent sees more potential.

- Seven & I said in its first-quarter report that it considers the development and improvement of fast food items important and management plans to improve store cleanliness and customer service.

EUROPE RETAIL & TECH HEADLINES

![]() UK Retailers Experience Worst June on Record

UK Retailers Experience Worst June on Record

(July 9) BRC.org.uk

- UK retail sales dropped 1.3% year over year in June, according to the British Retail Consortium (BRC)-KPMG Retail Sales Monitor. Comparable sales decreased 1.6%. The BRC noted that alongside Brexit uncertainty, June sales could not match last year’s spending due to the 2018 heatwave and the World Cup, which combined led to the worst June on record.

- The BRC splits food and nonfood retail sales on a rolling three-month basis. In the three months ended June, total food sales grew 2.4% and total nonfood sales fell 2.1%.

![]() DigitalBridge Raises £3 Million for Its Home Design Platform

DigitalBridge Raises £3 Million for Its Home Design Platform

(July 8) TechCrunch.com

- UK-based home décor visualization startup DigitalBridge has received new funds of £3 million ($3.7 million) from Maven’s Venture Capital Trusts and NPIF Maven Equity Finance. The startup will use the funds to grow adoption of its product, enter new markets and develop new products.

- DigitalBridge, which is available on retailers’ apps and sites, uses augmented reality to help users design and buy bathrooms or kitchens. The tool is already available on home improvement retailer B&Q’s site and its app in the UK.

![]() Select Creditors Owed Over £53 Million

Select Creditors Owed Over £53 Million

(July 8) RetailGazette.co.uk

- Creditors of British womenswear retailer Select claim that they are owed over £53.1 million ($66.5 million) as part of the administration process.

- At the time of administration in May, the retailer had only £1 million ($1.25 million) in cash and held an additional £2.8 million ($3.5 million) worth of inventory.

![]() ASOS Prepares For 100 Job Cuts as Sales Drop

ASOS Prepares For 100 Job Cuts as Sales Drop

(July 8) TheTimes.co.uk

- British online retailer ASOS is consulting on a round of layoffs at its London head office, amid decelerating sales and issues at the new US warehouse it opened earlier this year. ASOS issued a profit warning in December then reported an 87% fall in pre-tax profits in its first fiscal half in March.

- Around 100 jobs are at risk and will mainly affect the marketing department, according to The Sunday Times.

M&G Real Estate Withdraws Debenhams CVA Legal Action

M&G Real Estate Withdraws Debenhams CVA Legal Action

(July 8) Company press release

- On Monday, British department store Debenhams announced that property investor M&G Real Estate has withdrawn its legal challenge to Debenhams’ restructuring plans after both parties completed negotiations.

- Debenhams Chairman Terry Duddy believes the outstanding challenges by Sports Direct and Combined Property Control to the retailer’s restructuring plans should also be dismissed.

Ermenegildo Zegna Buys a Majority Stake in Dondi

Ermenegildo Zegna Buys a Majority Stake in Dondi

(July 8) Company press release

- Italian luxury menswear retailer Ermenegildo Zegna has signed an agreement to acquire a 65% stake in Italian textile manufacturer Gruppo Dondi for an undisclosed sum.

- As part of the agreement, the Dondi family will retain 35% of the shares in the company. The family will also remain responsible for administering the company’s operations and its creative design.

ASIA RETAIL AND TECH HEADLINES

![]() Alibaba to Donate $145 Million to Chinese Women’s Soccer Team

Alibaba to Donate $145 Million to Chinese Women’s Soccer Team

(July 7) SCMP.com

- Alipay, the Alibaba-owned mobile and online payment platform, announced on July 5 plans to donate ¥1 billion ($145 million) to Chinese women’s soccer team Steel Roses over the next decade.

- The donation will be funded by the Alipay Foundation, the Jack Ma Foundation and the Joe Tsai Foundation. The initiative will focus on improving the national team’s performance and reaching out to young players.

![]() Lazada Announces its First Midyear Sale

Lazada Announces its First Midyear Sale

(July 6) GadgetPilipinas.net

- Southeast Asian e-commerce company Lazada Group is holding its first midyear sale on July 12 across six markets in Southeast Asia for 24 hours. The tagline of the sale is “millions of deals your heart desires.”

- Lazada will offer discounts, free shipping and vouchers during the sale. From July 1-12, customers can also earn rewards through Lazada’s live-streamed game show called “GUESS IT” available on its mobile app.

![]() Amazon India Plans to Open New Fulfilment Centers

Amazon India Plans to Open New Fulfilment Centers

(July 8) FashionNetwork.com

- Amazon India plans to add two new warehouses, in the cities of Patna and Guwahati, and will open new fulfilment centers (FCs) equipped with automated pick, pack and shipping processes in Mumbai and Delhi to improve its delivery capabilities across the country.

- Amazon India has grown its delivery network from 60 to about 80 delivery stations this year and has announced that the new FCs will increase storage capacity 80% to about nine million cubic feet.

Chanel to Launch Its Tmall Flagship Store in August

Chanel to Launch Its Tmall Flagship Store in August

(July 8) FashionNetwork.com

- French fashion company Chanel will launch an official store on Alibaba Group’s e-commerce platform Tmall on August 2 to sell its cosmetics, skin care and fragrance line in China. Chanel started a pre-sale on July 6.

- Tmall will be the first third party e-commerce platform on which Chanel will sell its products in China. The products were previously available only on the company’s official online site and physical stores.

Timberland Collaborates with Readymade to Launch New “Inverted Design” Boots

Timberland Collaborates with Readymade to Launch New “Inverted Design” Boots

(July 9) FashionNetwork.com

- US footwear manufacturing company Timberland has collaborated with Japanese fashion brand Readymade, founded by Yuta Hosokawa, to launch limited edition boots on July 20.

- The Timberland x Readymade collaboration premium boot is designed with an “inside out” concept wherein the parts of the boots typically on the inside are on the outside. It is available in one color, called Wheat Nubuck, and is priced at ¥55,000 ($505.64).

![]() Tesco Plans to Open 750 Stores in Thailand

Tesco Plans to Open 750 Stores in Thailand

(July 8) RetailGazette.co.uk

- UK retailer Tesco plans to open 750 convenience stores in Thailand over the next three years. This expansion will be the company’s first major expansion outside the UK.

- Tesco generated revenue of £4.1 billion ($5.1 billion) in Thailand in the year to February 23. Tesco has stated it sees potential for business expansion due to Thailand’s increasingly affluent population.

Giorgio Armani Launches 3D AR Makeup Try-Ons in China

Giorgio Armani Launches 3D AR Makeup Try-Ons in China

(July 9) LuxuryDaily.com

- L’Oréal’s augmented reality (AR) platform Modiface has developed a virtual makeup application for Italian fashion brand Giorgio Armani on China’s leading social media platform WeChat.

- Armani Beauty’s 3D AR try-on app allows the user to virtually sample the brand’s products via smartphone cameras. The app has a split screen mode so the user can compare screenshots of the try-on.

LATIN AMERICA RETAIL AND TECH HEADLINES

![]() Dpstreet Opens a New Store in Tabasco

Dpstreet Opens a New Store in Tabasco

(July 8) FashionNetwork.com

- Mexican clothing, footwear and sporting goods retailer Dpstreet has opened a new store at the Plaza Altabrisa shopping mall in Tabasco, Mexico. The store offers products from brands such as Adidas, Puma, Nike, Armani, Fila and Lacoste, among others.

- Dpstreet has over 50 stores across Mexico and has two other stores in Tabasco, one at the Galerias shopping mall and another at the Plaza Sendero shopping mall.

![]() Brazil Welcomes its First Healthy Supermarket

Brazil Welcomes its First Healthy Supermarket

(July 8) ESMMagazine.com

- Brazilian supermarket Super Saudavel has opened its first healthy supermarket in São Paulo, Brazil. It offers a range of healthy products chosen by a team of nutritionists.

- Super Saudavel offers an assortment of organic produce and has also labeled products that are free from preservatives, dyes, flavor enhancers, sweeteners and artificial flavors.

![]() Uterqüe Launches its Online Store in Mexico

Uterqüe Launches its Online Store in Mexico

(July 6) FashionNetwork.com

- Spanish fashion brand Uterqüe, owned by Inditex, has launched an online store in Mexico. Uterqüe has 15 stores in the country.

- The online shop exhibits a variety of deals, including its new collection of clothing, footwear, accessories and bags.

B2W Tests Drones

B2W Tests Drones

(July 5) Reuters.com

- Brazilian e-commerce retailer B2W, a subsidiary of Lojas Americanas, is testing drones to transfer merchandise from its distribution centers and hubs to its stores. B2W says it is the first Brazilian retailer to trial logistics with drones.

- The retailer plans to start using drones in its distribution by January 2021.

Forus Adds Vans to Its Portfolio

Forus Adds Vans to Its Portfolio

(July 8) America-retail.com

- Chilean shoe retailer Forus has announced it will take over management of US brand Vans in Chile. The retailer plans to open 20 stores by 2020 to strengthen the operation of Vans in its wholesale business and e-commerce platform.

- Vans, which was previously directly managed by its US parent company VF Corporation, has five stores in Chile and a presence in multi-brand stores.

![]() Liverpool to Invest Close to MXN 12 Billion in Mexico

Liverpool to Invest Close to MXN 12 Billion in Mexico

(July 8) America-retail.com

- According to brokerage firm Citibanamex, Mexican department store chain Liverpool has plans to invest nearly MXN 12 billion ($634 million) in its store and distribution network by 2022. The company’s investment includes the opening of its Arco Norte distribution center in the State of Mexico.

- Liverpool also plans to transform Suburbia, a brand it acquired from Walmart three years ago, to an improved format. The retailer intends to operate at least 250 Suburbia stores in Mexico in the next five years.

MACRO UPDATE

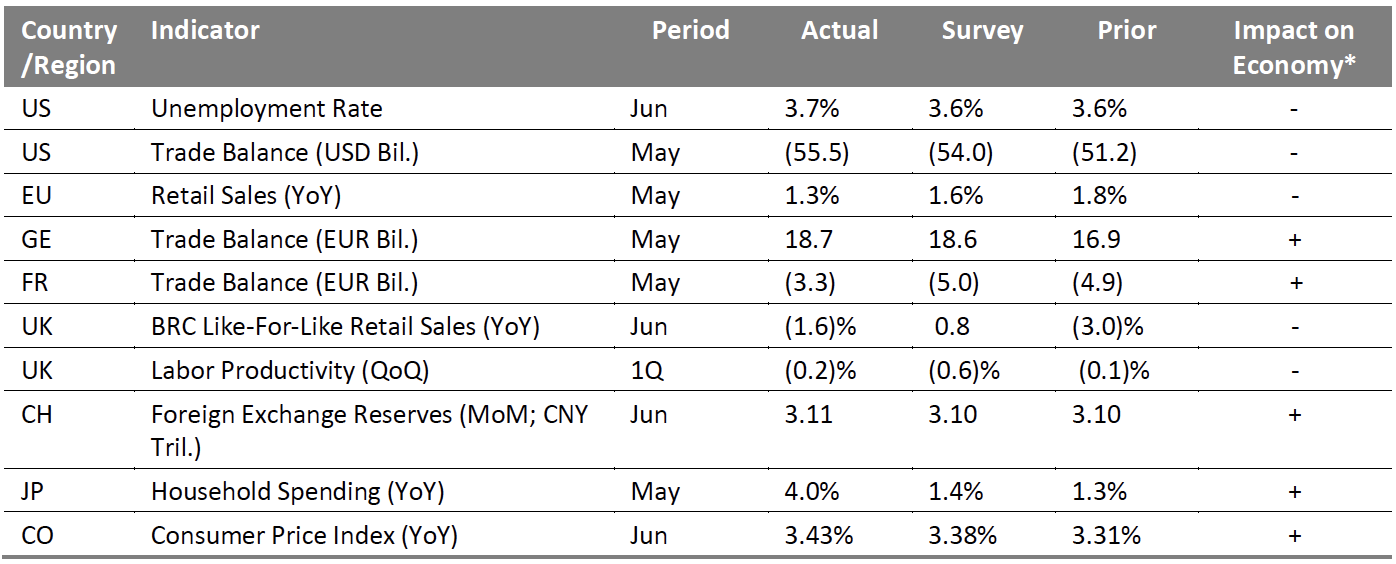

Key points from global macro indicators released July 3-9, 2019:

US: The unemployment rate increased to 3.7% in June, from 3.6% in May and above the consensus estimate of 3.6%. The trade deficit widened to $55.5 billion in May from $51.2 billion in April. Europe: In the eurozone, retail sales growth slowed to 1.3% year over year in May from 1.8% in April and above the consensus estimate of 1.6%. In the UK, comparable retail sales were down 1.6% year over year in June compared to a 3.0% fall in May, as recorded by the British Retail Consortium (BRC), and below the consensus estimate of 0.8%. Asia Pacific: In China, foreign exchange reserves increased to ¥3.11 trillion in June from ¥3.10 trillion in May, above the consensus estimate of ¥3.10 trillion. In Japan, household spending increased 4.0% year over year in May, versus 1.3% in April and the consensus estimate of 1.4%. Latin America: In Colombia, the consumer price index increased 3.43% year over year in June, versus 3.31% in May, and above the consensus estimate of 3.38%. [caption id="attachment_92748" align="aligncenter" width="700"] *Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.

*Coresight Research’s evaluation of the actual figure’s impact on the economy relative to historical benchmarks and the current macroeconomic environment: + indicates a positive signal for the country’s economy, – indicates a negative signal and = indicates a negligible or mixed impact.Source: US Bureau of Labor Statistics/Bureau of Economic Analysis/Eurostat/Destatis/Ministry of the Economy and Finance, France/British Retail Consortium/Office for National Statistics/People’s Bank of China/Statistics Bureau of Japan/Banco de la Republica/Coresight Research[/caption]

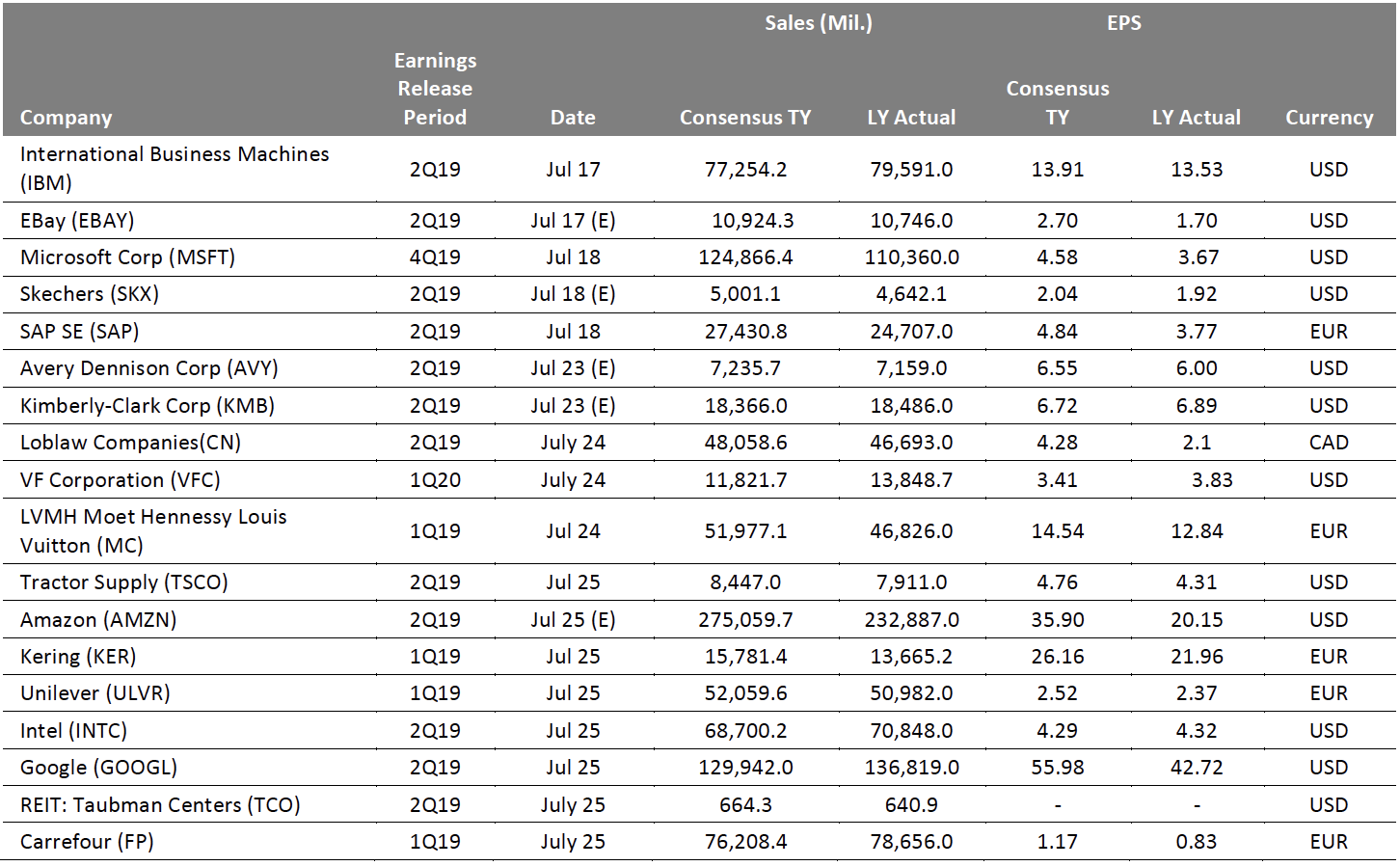

EARNINGS CALENDAR

[caption id="attachment_92749" align="aligncenter" width="700"] Source: Bloomberg[/caption]

Source: Bloomberg[/caption]

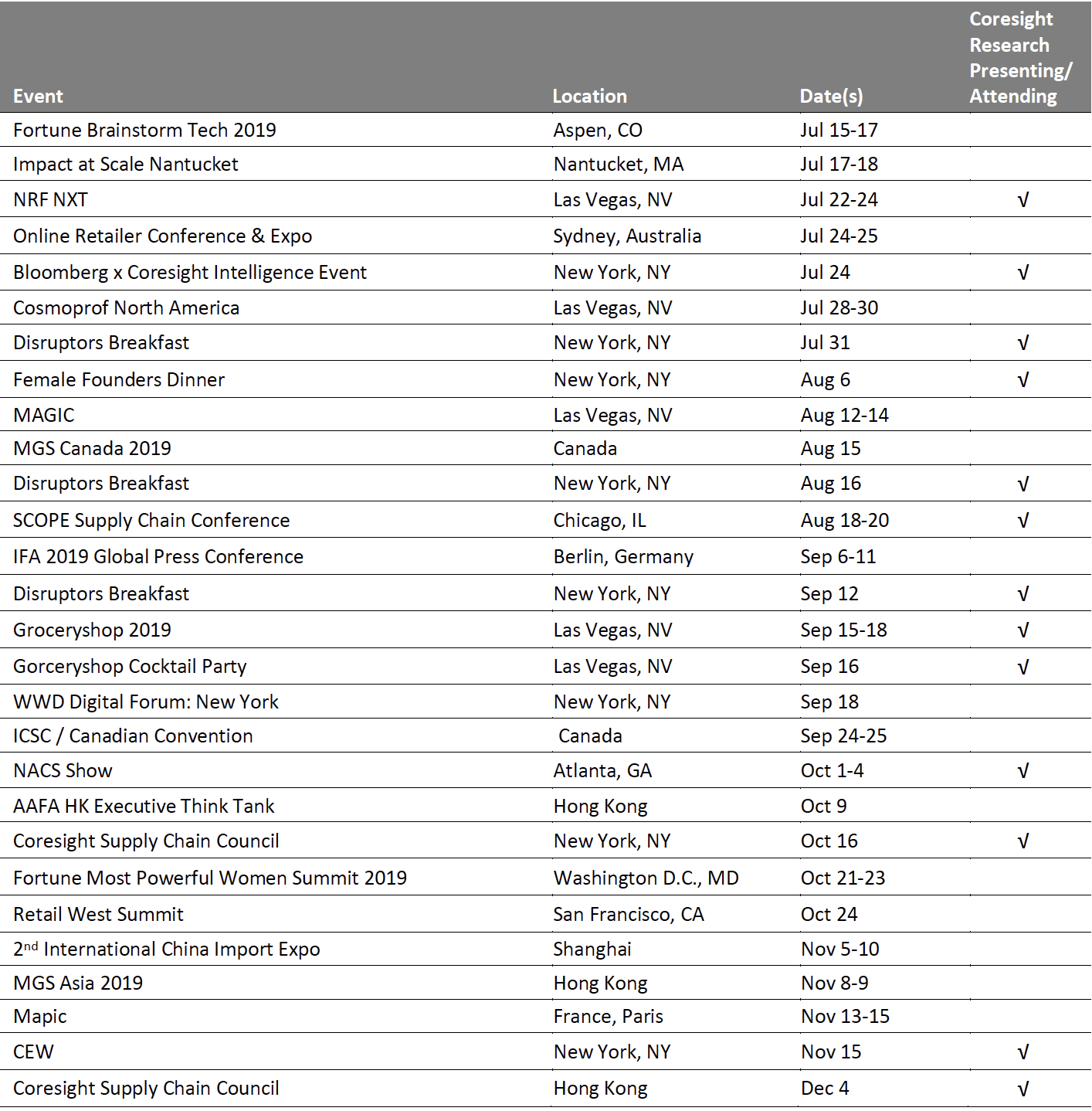

EVENT CALENDAR